4 best Forex Brokers in Latvia – Comparisons and reviews

Table of Contents

Forex trading does not guarantee a return on investments. This financial market is risky, and the risks increase if you deal with an ill-suited broker.

We have reviewed several brokers and tested their platforms. We recommend the best brokers with the most conducive trading environment below based on these tests.

See the list of the best Forex Brokers in Latvia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 76% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 76% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 4 best forex brokers for Latvians:

- Capital.com

- BlackBull Markets

- Pepperstone

- IQ Option

Here is an overview of each broker:

1. Capital.com

- License: FCA, CySEC.

- Headquarters: United Kingdom.

- Instruments: Forex, stocks CFDs, cryptocurrencies, index CFDS, and commodities.

- Minimum deposit: $20

- Spreads: from 0.8 pips (major pairs).

- Commission: 0

- Payment methods: Maestro, bank wire, Visa, Apple Pay, and Mastercard.

Capital.com is a famous low-fees broker in Europe.

Capital.com offers comfortable trading conditions with a range of instruments at low trading costs. The broker recently introduced a new account type called the Invest account. Latvians can trade stocks at zero cost on this account. Europeans and clients in the United Kingdom can also trade stocks at zero commission.

Traders can use the MT4 or Capital.com app to trade. Novice and experienced traders can comfortably use the services. Capital.com allows different trading styles, including hedging strategy and forex scalping. Mobile trading is also available. Traders get full support while using the broker through its 24 hours customer service and rich educational materials.

(Risk warning: 76% of retail CFD accounts lose money)

2. BlackBull Markets

- Regulators: FSA, FMA.

- Based in: New Zealand

- Instruments: Forex, CFDs, indices, energies, ETFs, etc.

- Minimum deposit: $200

- Commissions and spreads: 0.0 pips on raw ECN account plus $3 commission. 0.8 pips on the standard.

- Payment methods – WebMoney, Skrill, Neteller, debit card, credit card.

BlackBull Markets is an ECN broker based in New Zealand. The company started operations in 2014. BlackBull Markets appeal to traders seeking ECN execution at reasonable costs. Traders enjoy speedy order executions at the best deals.

BlackBull Markets do not yet have a European license. But they have built a strong reputation, and many now consider them highly reputable ECN brokers. BlackBull Markets trading services are offered on the MT4, MT5, and the mobile app. Copy and social trading are available with full support for traders.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

- License: DFSA, CySEC, BaFIN, SCB, FCA.

- Based in: Australia

- Tradable Products: CFDs. Forex, indices, commodities, etc.

- Minimum deposit – $0 ($200 is recommended).

- Spreads: 0.1 pip on razor account, 0.8 pips average on the standard.

- Commission – $0 on standard and $3 on razor (ECN) account.

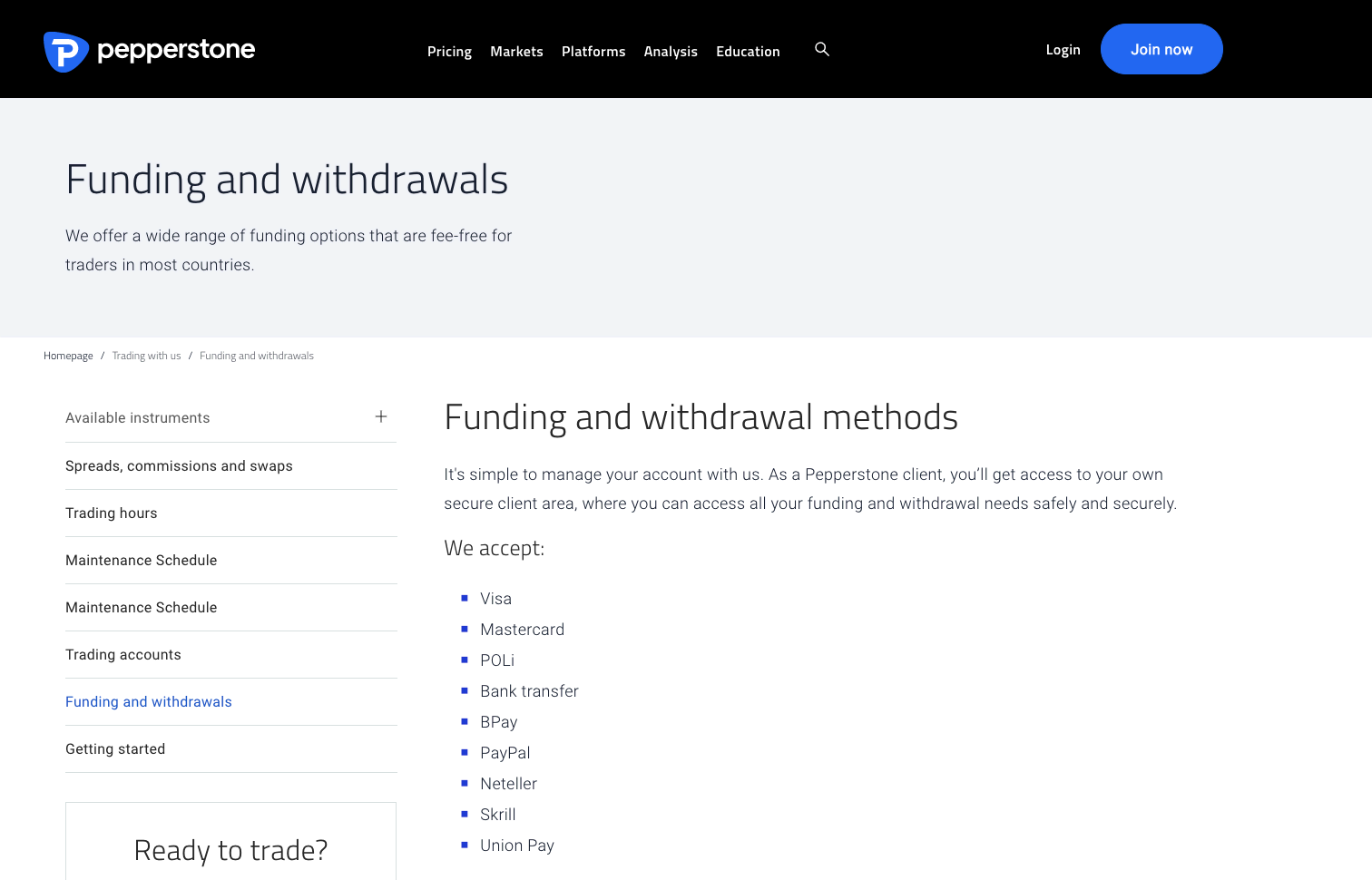

- Payment options – Mastercard, Wire transfer, PayPal, Visa, BPay, POLi

Pepperstone is among the best and most trusted ECN brokers. Pepperstone operates in several regions and holds several licenses from European financial bodies.

Its trading services are world-class, offered on the MT4, MT5, and cTrader. Numerous valuable tools and features are included in these platforms, including automated trading support, free VPS for active users, and multiple social trading platforms. Latvian traders can expect superfast order execution and competitive spreads and fees. Top-quality education and research materials are also available to help traders succeed.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

- Regulator: CySEC.

- Based in: Cyprus

- Assets: CFDs, forex, energies, metals, commodities, etc.

- Minimum deposit: $10

- Spreads: 0.8 pips average on major crosses.

- Commission: $0

- Payment options: Wire transfer, Visa, Skrill, Mastercard, and Neteller.

IQ Option is a Cyprus-based online broker providing binary options (only for professional traders and outside EAA countries) and forex trading services. The broker remains a great choice for European forex traders because of its competitive fees and credibility.

IQ Option offers trading services on its user-friendly app accessible on mobile phones and computers. The highly intuitive app comes with great support features for traders, including a community live deal option that links traders to others of their kind. Video tutorials are also provided that help novice traders quickly learn about the market.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Latvia?

Latvia is among the Balto-Slavonic countries with strong forex regulations. The country joined the European Union in 2014 and has since experienced growth in its financial sector. Many investors have taken great interest in its economy due to the country’s stability and growth.

The country’s financial markets regulator is the Financial and Capital Markets Commission FCMC. This financial body oversees the country’s finance sector and reports to the government. Banks, pension funds, investment firms, insurance, and all other institutions are under the supervision of the FCMC.

As a European Union member country, its regulatory framework follows MiFID guidelines. These guidelines allow brokers licensed within the EU to offer services to member countries.

Brokers that wish to operate within Latvia must obtain an FCMC license and adhere strictly to MiFID guidelines. Some FCMC regulations are the leverage limit of 30:1 and negative balance protection for non-professional forex traders.

(Risk warning: 76% of retail CFD accounts lose money)

Security for traders in Latvian traders – Good to know

Latvian traders are fortunate that forex trading is well regulated in the country. The FCMC ensures that investors are safe from fraudsters and unregulated brokers.

Latvians can safely trade forex and CFD with any licensed broker within the country. Licensed brokers within the Euro zones are also safe as they follow the same MiFID standards.

Latvians can confirm a broker’s regulation by checking their website for the details. They can directly contact the regulator also to check that the license is valid.

Is it legal to trade Forex in Latvia?

Yes, forex trading is legal and safe in Latvia. The sector is strictly regulated so that unscrupulous brokers can not operate in the country. Traders should deal with FCMC-regulated brokers within the country or other international brokers regulated under MiFID.

How to trade Forex in Latvia – Tutorial

Latvia is a safe place to trade forex. But the trader is responsible for ensuring they use the right basic tools and dealing with the appropriate company.

The trader must use a good internet connection and choose the broker best suited for their trading goals.

If convenience is important to you, choosing a trading platform available on mobile should be better. Many brokers offer platforms compatible with mobiles. So a smartphone, tablet, or computer is good enough.

Fortunately, Latvia’s internet speed has increased over the years. Internet connectivity is reliable, but we recommend avoiding the internet that allows public access. You want to be sure your personal data is protected. Ensure the internet service is fast and reliable.

The broker you choose also plays a huge role in the success of this venture. The broker has to provide conducive trading conditions at reasonable costs. Overpriced brokers will leave you with insignificant profits that can discourage you from investing.

Here’s how to choose the most suitable broker:

- Check the regulation

Ensure the broker holds the proper license and verify this license by doing the necessary checks. A domestic broker must be registered with FCMC. If it is a foreign broker, it should be regulated in Europe and follow the MiFID business structure.

- Compare fees

Brokers have different fee models and different account types. Some brokers charge only the spread, which is the mark-up. Others charge zero or very little spreads and commission. The trader must compare account types and prices before choosing a broker.

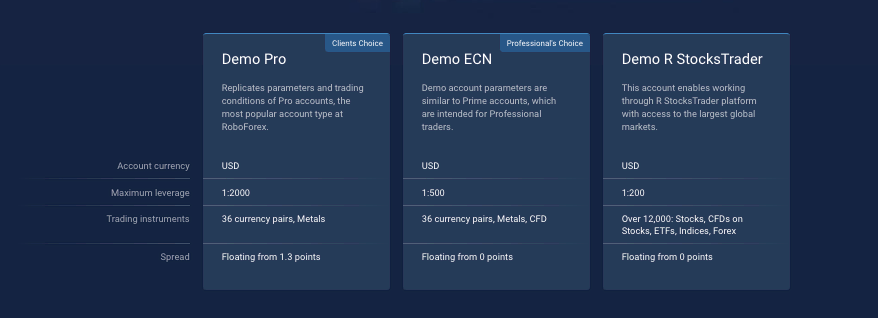

- Access to a free demo account

Credible brokers offer a free demo to allow site visitors and potential customers to test their services. The access period is usually 30 days at least. A broker without a free demo should be avoided.

- Available support service

Reputable brokers make sure customer service is available 24 hours during trading hours. The service must be easily accessible through phone, live chat, or email. Many brokers offer social media chat support.

- Popular payment method for easy funding

Popular payment methods indicate an easy deposits and withdrawals process. This is important for a smooth trading experience. Ensure that the payment options provided are available in your country.

The broker should meet all these requirements before you consider joining their platform.

Trade forex using the steps below:

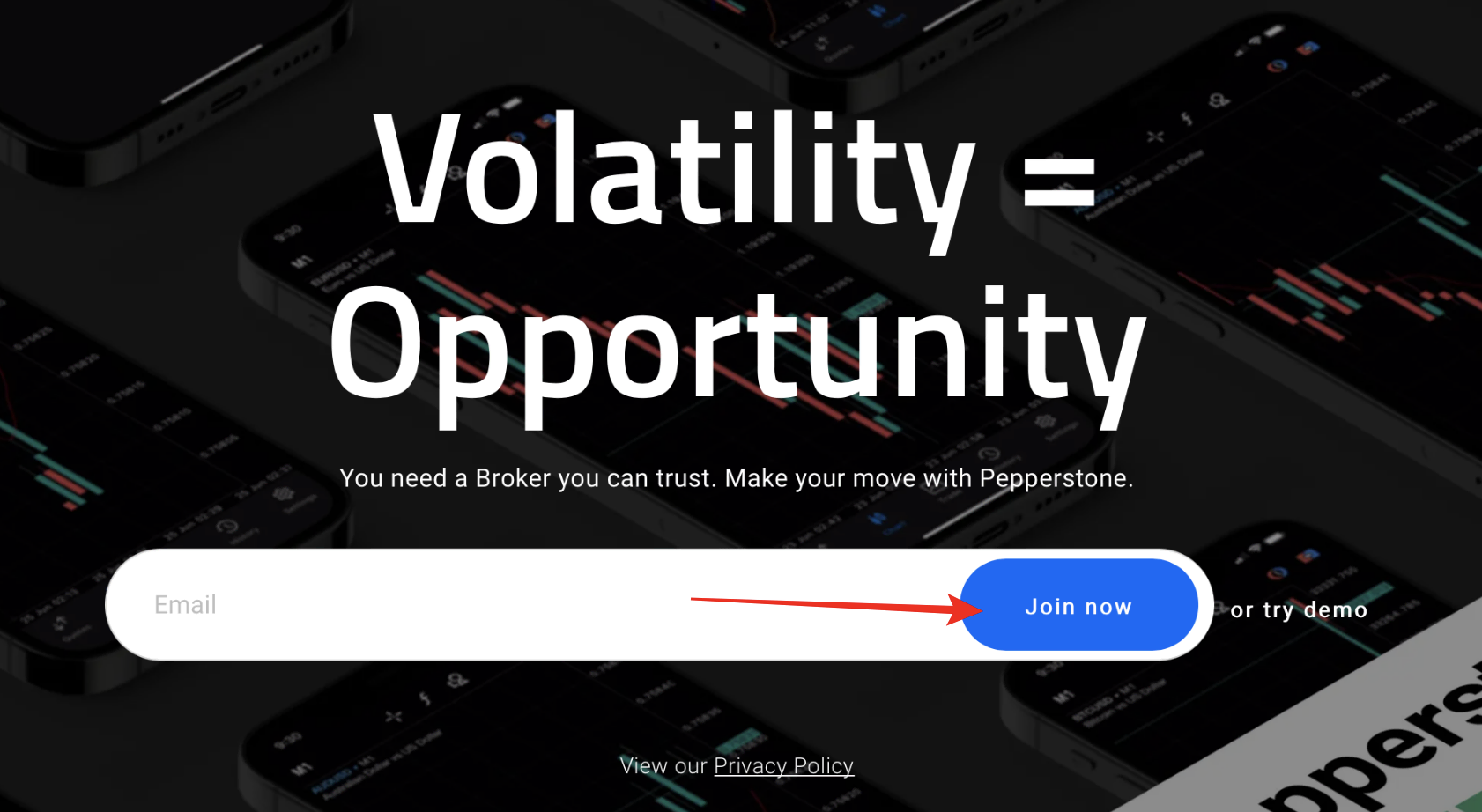

1. Open account for Latvia traders

Visit the broker’s website to signup to trade. The site should automatically redirect you to your country-specific webpage.

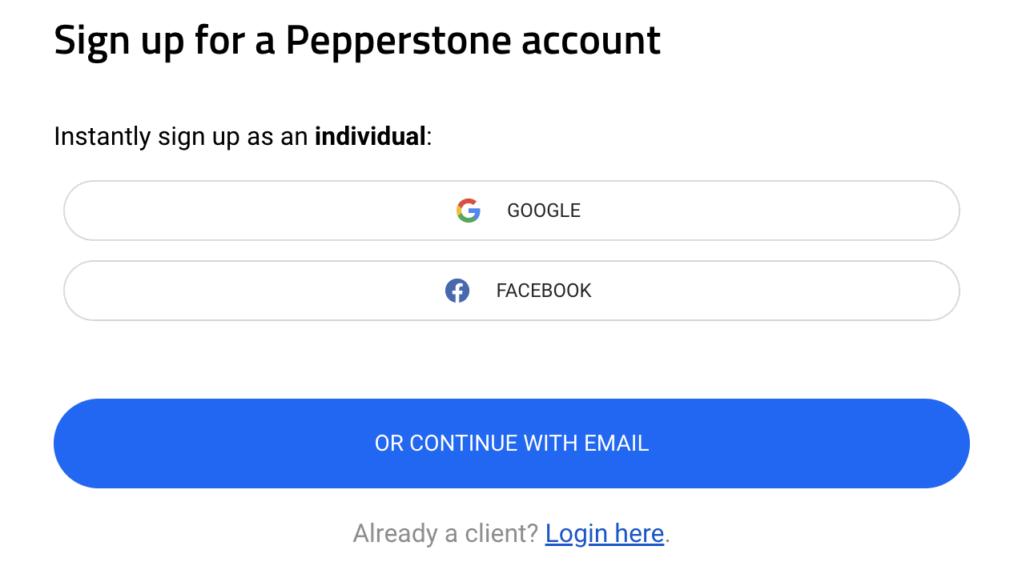

Click the signup button, which should be at the top right or center of the page. The form that appears will require only one or two details: your email and perhaps your full name.

Enter the information and click on submit. The system sends a message to the email you entered. Open your inbox or promotions folder to view the message. Click on the authentication link in the email to confirm the registration. This should redirect you to the full signup page, where you’ll complete the process.

The broker may request that you confirm your identity by uploading an ID issued by the government and utility bill.

2. Start with a demo or real account

The next thing is testing. The broker provides a free demo for this, as we said. The account will come with sufficient virtual money to conduct several trades. Some brokers let you request more virtual cash if you exhaust the balance before completing the test.

New traders should use the demo to practice trading. It lets them familiarize themselves with the market environment before conducting real trades.

The free demo is also useful for testing trading strategies before applying them to real transactions.

Many traders prefer to test forex trading with real accounts. If you seek a real trading experience before full commitment to the broker’s platform, we recommend a cent or micro account. Many brokers offer these types of accounts requiring very little trading amount. It lessens the financial risk and gives you the real market experience that you seek.

3. Deposit money

After the test stage comes real trading on a live account, actual fiat money is required for this. The broker should provide easy means to do this.

Click on the funds’ tab on the trading platform. Select the deposit option on the menu to access the payment methods provided.

Choose the method you prefer and follow the instructions. The process should be easy enough with a popular payment method. But If you encounter any trouble, a service rep should be available to resolve it quickly.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Before placing any trades, you should first analyze the currencies you wish to trade. Look into the price history to see the past trends and the price behaviors. This knowledge is indispensable in foreign exchange trading.

Market analysis gives you insight into the asset and the factors influencing its price movements in different directions.

The 2 crucial market analyses in forex are:

- Technical analysis

- Fundamental analysis

Technical analysis in forex looks at the forex chart, which contains past price movements. The trader studies the chart to find patterns that indicate the best trading opportunities. Forex trading platforms come with various tools used for this analysis. The charts show the price history, and indicators provide signals where there are opportunities. The trader needs to learn the uses of these tools. They should know how to interpret patterns and trade signals on the platform.

Fundamental analysis in forex trading examines the economic factors directly affecting the currencies’ values. These factors include inflation, interest rate, GDP, trade deficit, etc. These factors cause a rise or fall in the exchange rate. The trader examines them to understand the price direction and make better trading decisions.

Both analyses are essential for successful forex trading. They help the trader determine the most suitable strategy for the currency they wish to trade.

Common forex trading strategies:

- Price action trading

Price action trading strategy does not require much technical analysis. But fundamental analysis is useful in this approach. The trader examines the naked price chart, studying the price movements. The trading decision is based on the current information on the chart. The newsworthy information is the highs, the lows, and opening and closing prices for a specified period. Price action is simpler than most technical strategies. But the trader must understand candlesticks’ movement to get it right. The strategy yields profit if applied correctly. Several indicators might be used to confirm the results.

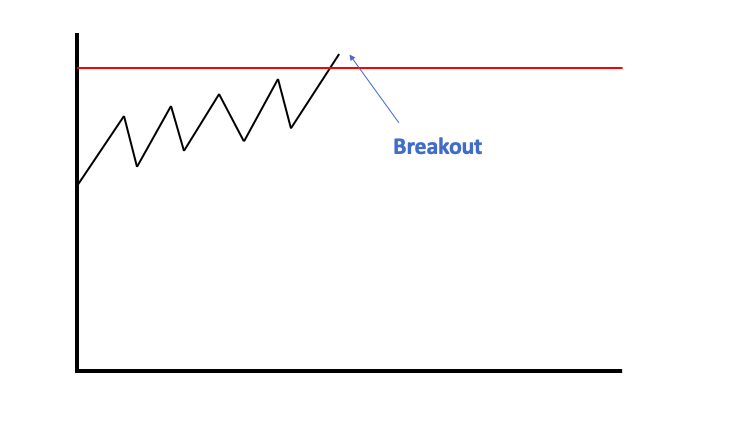

- Breakout trading strategy

Breakout trading requires using several indicators to spot the possible break points. Breakouts refer to a price break where the price direction changes. It is sometimes the start of a new trend. Other times, it is a reversal or a temporary interruption. A price can break out in a downtrend by rising slightly above its current level and continuing in that direction for some time. Traders need to foresee this move using analysis and appropriate tools. Risk management is a big part of this strategy. Limit orders are essential to ensuring the trade does not move against you unexpectedly.

- Scalping

Scalping is a popular strategy among day traders. It involves holding trades for no longer than 10 to 15 minutes. Scalping is a short-term approach, and the goal is to make small pips profit from tiny price movements. The strategy requires reasonable screen time since you need to keep your eyes on the trade. That is why it is most common with full-time forex traders. If the trades are successful, the small pip profits tend to add up to a good sum at the day’s end. Some scalpers hold their trades for one to two minutes.

5. Make a profit

A combination of the proper analyses and an effective strategy always leads to profit. Place your trades to make a profit after doing the needful analysis.

Once you start to earn, you can raise the trading capital or withdraw the profit.

Follow the same methods for deposits to move funds out of the account. Click on the funds’ tab and select the option to withdraw.

Choose the preferred payment option and fill out the withdrawal order. Once you submit the form, the broker starts to process the withdrawal.

The funds should hit your receiving account within two days or less. Depending on the payment method and the broker, it can take more than two days.

(Risk warning: 76% of retail CFD accounts lose money)

Final thoughts: The best Forex Brokers are available in Latvia

Latvians are fortunate to have many options of well-regulated brokers to choose from. The FCMC ensures traders’ protection and maintains a safe environment for all. It is up to the trader to choose the most suitable broker and use the best trading approaches to succeed in the market.

FAQ – The most asked questions about Forex Broker Latvia:

Does a forex broker in Latvia operate legally?

Yes, a forex broker in Latvia operates legally. Forex trading is fully permissible for traders. They can take pleasure in trading with the ideal trading approach. Besides, the rules in Latvia support forex trading. It takes place within a regulated environment in Latvia. So, a trader can trade without any hindrance and make immense wealth.

Is a demo account available with a forex broker in Latvia?

Yes, a forex broker in Latvia offers a demo account to a trader. You can use the demo account to trade if unaware of the forex trading basics. Your forex broker’s demo account will have similar characteristics to a live trading account. Besides, you can learn to trade without using your funds. Trading on a demo account, therefore, carries no financial risk.

Which forex broker is the best in Latvia?

Depending on his trading requirements, a trader can find the best forex broker in Latvia. Usually, all brokers offer traders the top features. However, other services, such as the brokers’ customer support, also matter.

So, a trader should pick a forex broker wisely. The following five brokers can be your best bet while trading forex in Latvia.

BlackBull Markets

Pepperstone

IQ Option

Capital.com

Last Updated on June 1, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)