The 4 best Forex Brokers in Libya – Comparisons and reviews

Table of Contents

More online brokers accept traders from Libya, and more people add forex trading to their income stream. You have visited the right page if you’re in Libya and seeking the best broker to trade with.

See the list of the best Forex Brokers in Libya:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

We have compiled a list of the best forex brokers with excellent trading conditions.

4 best forex brokers for Libyans:

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

Here’s the overview of each broker’s services:

1. BlackBull Markets

Blackbull Markets is a global ECN forex broker, providing direct market access to traders in different parts of the world. Blackbull Markets operate with licenses from these entities:

Traders have options between its standard STP, raw ECN, and Institutional ECN accounts. The minimum deposit to trade on the broker’s platforms is $200. The floating spread on the raw account starts from 0.1 pip, with a $3 commission charge.

Libyans can access over 40 forex pairs and other assets, such as ETFs, CFDs, energies, commodities, and indices. The platforms come with several indicators, charts, and education materials for users to succeed in the market. The broker offers trading services on MT4, MT5, and the mobile app. Social trading and Islamic accounts are available.

The broker is a good choice for Libyans willing to start with its relatively high minimum deposit. Otherwise, many reputable brokers allow trading with a much lower amount.

(Risk Warning: Your capital can be at risk)

2. RoboForex

RoboForex is a global brokerage company providing forex and other markets’ trading services. RoboForex’s headquarter is in Belize.

The company came into being in 2009 and operates with licenses from:

RoboForex requires a $10 minimum deposit to use its services. The platforms provided are MT4, MT5, cTrader, and RTrader. Libyans can trade in various markets, including forex, stocks, indices, metals, and CFDs. The broker provides varied account types to accommodate all levels of traders.

The average spread on its standard account is 0.8 pips. Starting spread on the raw account is 0.1 pip, with a $2 commission fee. A $30 bonus awaits new customers once they sign up and fund their accounts. Existing clients also get rewarded with bonuses and discounts.

RoboForex disadvantage is the withdrawal fee that the broker charges. The service is free with many other competitors.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone is an international CFD and forex broker, offering traders direct market access to trade various market assets. Pepperstone is based in Australia and began operations in 2010.

The company holds several licenses from top regulators, including:

- Australia Securities and Investments Commission, ASIC

- Cyprus Securities and Exchange Commission, CySEC

- Dubai Financial Service Authority, DFSA

- Financial Conduct Authority, FCA

- Capital Markets Authority of Kenya, CMA

Pepperstone recommends a minimum deposit of $200 for trading. But Libyans can start with any amount below this. The broker provides trading services on MT4, MT5, and cTrader. Its account types are STP and ECN order execution types. Islamic accounts are available for strictly Sharia-approved trading. Social, automated, and copy trading are fully supported through the broker’s several partnerships like Duplitrade, Zulutrade, and MyFxbook.

The minimum spread on the raw account (razor) is 0.1 pip. A $3 commission applies. The average spread on its standard commission-free account is 0.8 pips on majors during active trading periods. Rich education, market analyses, and research content are available.

However, Pepperstone’s education does not come with quizzes. So, it is tough to monitor learning progress.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option is a Cyprus-based forex and binary options broker founded in 2013. IQ Option is registered with CySEC and is considered one of the safest binary options dealers.

Libyans can trade several assets with this broker, including binary options (only for professional traders and outside EAA countries) and digital options, forex, energies, metals, and indices. The minimum deposit required is $10. Its VIP account requires a $1900 minimum deposit. The average spread is 0.8 pips, with zero commission fees.

Trading services are accessible on the IQ Option app. Video tutorials on the platform contain helpful content for trading. The app is accessible on mobile phones, and Islamic accounts are available.

A major drawback of IQ Option is the lack of availability of the meta trader platforms.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Libya?

Libya is a wealthy oil-producing nation in the north of Africa. The country’s economy relies heavily on profits from oil exportation.

The country’s finance sector operates a relatively new financial Market. The Libyan Capital Markets Authority was established in 2007 and oversees the financial market activities in the country. Stocks and securities trading occur in this capital market, and the organization is responsible for ensuring a stable financial market sector.

The LCMA oversees all non-banking financial activity and performs the following duties:

- Traders and investors protection in its financial market.

- Devise regulations that ensure transparency and fair business practice in non-banking finance sectors.

- Ensures continuous growth and development of its capital markets.

However, the Central Bank of Libya, the country’s top financial body, also shares a major responsibility for its financial market, as seen in 2018, when it banned cryptocurrency trading in the country.

The bank or the LCMA does not issue licenses to forex brokers from our investigations. The body is more concerned with stocks and securities trading and Investments within its capital market for now. We found little to no domestic forex brokers in the country. But there are no regulations against online forex trading.

But the sector is growing, and the body continues to create regulations to stabilize its financial markets.

Security for traders in Libya

Despite the lack of forex regulations, some Libyans engage in the activity online. More people are joining the forex market due to easy access brought on by the worldwide web.

Libyans can trade safely by dealing with only well-regulated brokers. The traders can verify the license on the regulatory body’s website.

Brokers holding licenses from FCA, CySEC, DFSA, CMA, ASIC, and FSA are all safe ones to deal with. The trader should also read customers’ feedback before trading with a broker.

Is it legal to trade Forex in Libya?

Yes, forex trading is permitted in Libya. There are no known regulations against it. Therefore, it is legal to trade forex in the country. But the trader must consult the country’s laws on taxes and Islamic investments, if necessary, to trade within its national laws.

How to trade Forex in Libya – An overview

Trading forex in Libya, like all other places, requires these three basic steps:

Step 1 – Get a smart device and subscribe to a reliable internet service

A smart device can be a tablet, mobile phone, or computer that allows strong internet connectivity. The internet service should be reliable, without frequent service disruptions. If service disruptions occur frequently or the quality is too poor (slow internet), the trader can lose money.

Step 2 – Find a credible broker

The success of this venture partly depends on the broker you deal with. Therefore, you should choose the broker carefully. It would be best if you avoided overpriced or poor service brokers.

Here’s how to recognize a credible broker:

- Licensed by a well-respected financial entity

Reputable brokers operate under one or more licenses from top-rated regulators. Check the broker’s regulation number. Confirm this on the regulator’s website to be sure. Any of the bodies listed above are well-known regulators. Other financial bodies are Germany’s BaFIN, New Zealand’s FMA, South Africa’s FSCA, Bahamas’ SCB, and Belize’s IFSC. Some offer more protection than others. The trader should investigate the broker’s license thoroughly.

- Low trading costs

The broker’s fees should be reasonable. This means the spreads and commission should fall within the industry average, if not below. The trader should make price comparisons to educate themselves on the acceptable fees for the specific asset they wish to trade.

- 24 hours customer service

Check that the broker provides easily reachable 24 hours support. Support services need to be accessible during trading hours. It is even better the broker offers the service in several languages, including Arabic.

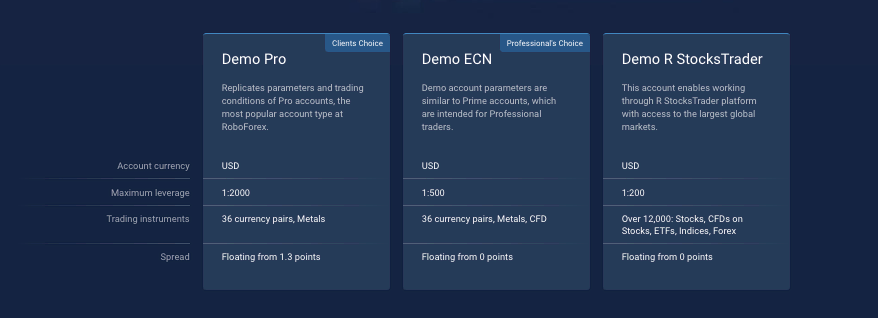

- Free demo for testing

The broker should also offer a free demo account that allows potential customers to check out its platforms without risks. The demo account should have enough virtual cash in the balance to conduct many practice trades. Access to demo accounts should be available for at least 30 days. Some brokers offer longer access time.

- Easy options for deposits and withdrawals

The withdrawal and deposit process should be uncomplicated and take as little time as possible. The broker ensures this by providing easy and popular payment methods in the region. This is an essential point to consider. You must be able to fund and withdraw profits from the trading account easily.

The broker checks out if they meet the above requirements.

Step 3 – Follow these steps below to trade forex:

1. Open account for Libyan traders

Go to the broker’s website to start the signup process. The link should take you to the webpage meant for Libyan customers. The page will load in Arabic if the broker site supports the language.

Click on the signup option and enter to fill out the form that appears. It will be a short one at this stage, requiring only email and maybe your full name and phone number.

The broker sends a verification link to the email you entered. Open the inbox, promotion, or spam folder of the mailbox and click on the link. It confirms your details and loads the complete signup page to continue the process.

Be ready to scan and send the broker a national ID and proof of address if requested. These are mandatory KYC documents in most regions. If applicable to your country, the signup process is incomplete without it.

2. Start with a demo or real account

The next stage is testing with the free demo. As said earlier, this account will come with sufficient credit to do many tests. So if you’re new to the market, it’s an opportunity to get fully accustomed to the forex trading environment before trading live.

Many other traders use the demo for different purposes. Testing a new strategy without financial risks is one. Some traders switching forex dealers often use it to see what trading with a broker would be like.

We recommend taking advantage of this free test account before trading in a real one with a broker.

3. Deposit money

After the test, next is real trading. For this, you need actual cash in the live account. So, you should deposit money to trade.

The broker will offer easy means by ensuring popular payment methods are available on its platforms.

Click on the fund tab on the platform to select the appropriate option for funds transferred into the account. The available payment methods will appear. Select the one you prefer and follow the instructions to deposit money.

The process is as simple as that, and most brokers assign a dedicated service rep to newly signed clients. These reps often guide customers through this stage and their first few trades.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Market analysis is necessary for every asset. So, before your first transaction, you need to analyze the asset’s price by looking into its past trends and the elements that affect the price movements.

The research gives you valuable insight into the forex pair you wish to trade. It helps you make the best trade decisions and place winning bets.

There are three types of market analysis in forex:

- Fundamental

- Technical

- Sentiment analysis

Forex fundamentals are the elements causing the exchange rate to move up or down. Fundamental analysis studies these economic factors influencing the currency’s value. The factors include the gross domestic product (GDP), inflation rate, interest rate, trade surplus or deficit, etc. The country’s political state also affects its economy and is part of the fundamentals. Traders examine the nation’s economy to better forecast its currency value.

Technical analysis involves studying the past prices of the forex pair on the chart. The goal is to spot patterns in the price movements. These patterns indicate the best entry and exit points. Brokers provide several tools that help the trader with proper technical analysis. Learning to use these indicators and interpret price patterns are key to accurately analyzing the asset.

Sentiment analysis examines the price movements to determine market participants’ feelings and expectations. When more market players are SELLING an asset, the market sentiment is toward falling prices. Trading platforms provide several AI software programs to identify the market sentiment accurately. These tools are valuable because things aren’t always what they seem. False trends are common and can mislead traders. Combining several indicators will show accurate data about the prevailing market sentiment.

These analyses are all crucial to forex trading, and fortunately, many tools are available to simplify the process. The trader only needs to learn their use according to their objectives.

Successful trades result from thorough analyses and correctly applying an effective strategy.

Here are some popular forex trading strategies:

- Price action strategy

Price action trading involves studying the forex chart and making decisions based on the price movements. In this case, the trader does not use any complex technical indicators. Instead, they examine the candlesticks to see the forex pair’s opening, closing, highs, and lows. The trader then enters a position based on this information.

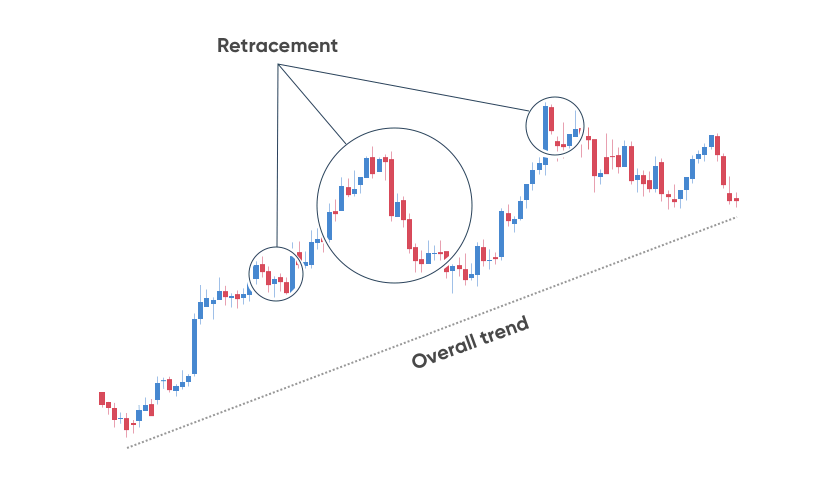

- Trend trading

Trading the trend refers to placing trades in the same direction of the ongoing trend. Most times, trend trading is employed as a medium or long-term strategy. The trader leaves the position open as long as the trend continues. Correctly identifying the trend is essential to profit from this trading technique.

Many strategies exist, and all are equally effective if the trader combines the right indicators and applies them correctly.

5. Make a profit

A suitable strategy and proper analysis will result in profitable trades. Once you start making a profit, you can withdraw using the same payment methods for depositing money.

It should be accessible through the funds tab and easy as deposits. However, the processing time is usually longer. The average time to receive the withdrawals is 48 hours. Depending on the broker and payment method, it can take a lesser or longer time than this.

Conclusion: The best Forex Brokers are available in Libya

Many online forex brokers welcome Libyan traders. We have outlined ways to identify the best ones. Our recommendations are among these industry’s bests. Testing the broker’s demo and reading customers’ feedback will help you determine the most suitable one

FAQ – The most asked questions about Forex Broker Libya :

What does a trader in Libya need for forex trading?

A trader wanting to trade in Libya needs a forex platform that offers him the best trading services. Besides, he would also need a working internet connection that helps him connect with the trading platform. You must develop perfect trading strategies to win forex traders at the platforms that forex brokers in Libya offer.

Can traders in Libya use demo trading accounts?

Yes, traders in Libya can use a demo trading account. The brokers operating in Libya offer traders the services of the demo trading account. If you wish to access the best demo trading accounts, you can signup with IQ Option, RoboForex, or BlackBull Markets. Their demo trading account is similar to the live trading account. Besides, you can also enjoy trading forex with a virtual currency of up to $10,000.

Which forex brokers in Libya offer the best trading services?

The five brokers mentioned are the best forex brokers in Libya. Their trading platforms are full of features that ease forex trading for any trader. In addition, these five brokers also offer excellent customer support. They excel in enhancing any forex trader’s trading experience.

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)