4 best Forex Brokers in Luxembourg – Comparisons and reviews

Table of Contents

Trading and investing in the financial market are becoming more popular among individuals. While the market is easily accessible due to the internet, people worry about safety and the risks of falling into a scam. Our recommendations are for you if you reside in Luxembourg and are looking for a safe and reliable broker.

See the list of the best 4 Forex Brokers in Luxembourg:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 76% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 76% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 4 best forex brokers for Luxembourgers:

- Capital.com

- BlackBull Markets

- Pepperstone

- IQ Option

Here’s an overview of each broker:

1. Capital.com

Capital.com offers access to trade various financial instruments in the international market. The assets to trade are stocks, commodities, CFDs, forex, and indices.

Capital.com is registered with several top-rated financial entities, including the FCA, CySEC, ASIC, and Belarus’ Central bank, NBRB. The broker is based in London and came into existence in 2016.

Traders can use the MT4 and Capital.com app to access the forex market. Tradingview is also available for social trading. The minimum deposit to use the platforms is $20. A free demo account is provided.

As for the fees, Capital.com charges a 0.8 pips average spread on major forex pairs. The account types are all $0 commission accounts. There are no charges on withdrawal and deposits. Dormant accounts do not get fined. Swap fees are charged on the leveraged amount.

Luxembourg traders can expect high-standard trading services, with outstanding trader support through quality educational tools and 24 hours customer service. Capital.com offers these services at competitive rates.

(Risk warning: 76% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets offer direct market access to trade financial assets such as forex, commodities, metals, CFDs, and energies.

BlackBull Markets operates with licenses from the Financial Markets Authority of New Zealand FMA. They are also registered with the Financial Service Authority of Seychelles FSA. BlackBull Markets joined the industry in 2013.

BlackBull Markets offers its trading services on MT4, MT5, and its mobile app. Zulutrade and MyFxbook are also provided for social trading. The minimum deposit to trade with the broker is $200. Free demo accounts are available for tests.

BlackBull Markets offer an ECN-type account with floating spreads from 0.1 pip. The commission on this account is $3. Its STP no-commission account attracts an average spread of 0.8 pips. Withdrawal fees may apply. Dormant accounts attract charges after 90 days of no activity. Overnight charges also apply.

Traders can expect fast execution and quality support at reasonable trading costs.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone started its operations in 2010 and offers access to ECN trading of various market instruments, such as forex, commodities, metals, equities, and indices.

Pepperstone is headquartered in Australia and has several regulated offices in Europe, Africa, and the Caribbean.

Pepperstone has licenses from:

Pepperstone offers first-rate trading services on the cTrader, MT5, and MT4. The broker does not impose a minimum deposit to use its services, though $200 is recommended. Many European traders begin with much more than this amount, other trade with much less and raise their investment later. A free demo account is provided.

Pepperstone fees are within the industry average. Its ECN account attracts a minimum floating spread of 0.1 pip, with a $3 commission. The standard account average spread is 0.8 pips, with no commission fee. There are no charges on deposits, withdrawals, or dormant accounts.

Luxembourgers can expect a rich trading experience, with the fastest order execution at competitive trading costs.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option provides access to exciting market instruments, such as binary options (only for professional traders and outside EAA countries), FX options, forex, digital options, and ETFs.

IQ Option is based in Cyprus and started operations in 2013. The company operates with a CySEC license and is also registered with the FSA Seychelles.

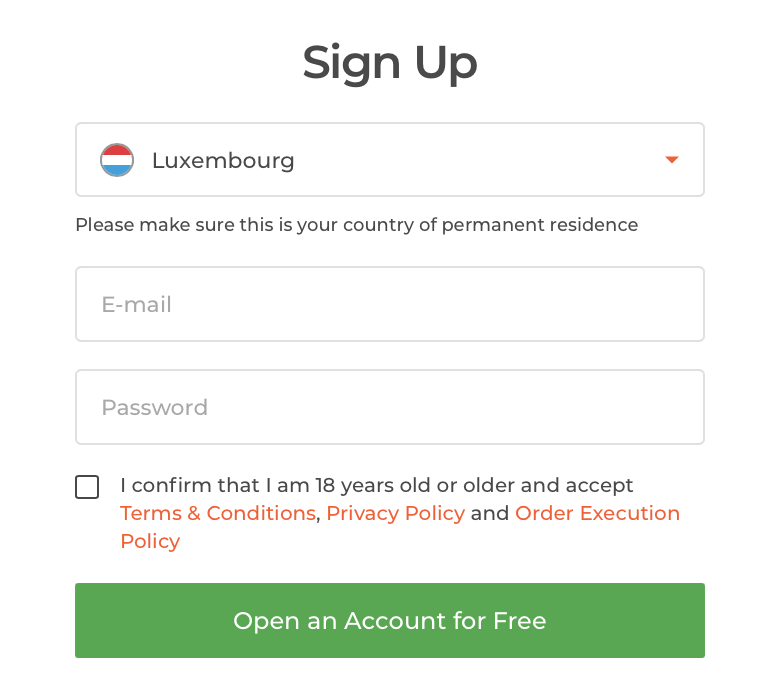

Traders can use the IQ Option app to access the financial market. The minimum deposit allowed is $10. A free demo account is provided for test trading before real transactions.

IQ Option operates a no-commission-fees account, with an average spread of 0.8 pips on major currency pairs during active hours. A dormant account attracts a €10 fee after 90 days of inactive account. Withdrawal charges apply for bank transfers.

IQ Option remains one of the acclaimed binary options (only for professional traders and outside EAA countries) brokers in Europe. Its service costs are competitive, and traders receive quality support.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Luxembourg?

Forex and CFD trading is a strictly regulated sector in Luxembourg. The sector is under the supervision of the Commission de Surveillance du Secteur Financier (The Commission for Financial Sector Supervision).

The CSSF was established in 1998 by Luxembourg’s government. Its responsibilities include regulating and overseeing non-banking institutions, such as the security markets, investment firms, and pension funds. Part of the CSSF’s duties is monitoring and controlling market operations, improving risk management qualities, and ensuring the environment is safe for investors.

The body also serves as the country’s dispute resolution entity in these sectors. The CSSF can exact penalties on organizations that fail to comply with its regulations. Brokers operating within Luxembourg must hold a CSSF license.

These brokers must provide negative balance protection and insurance compensation scheme in case of business failure. As an EU member country, the CSSF does not allow leverage trading above 1:30.

(Risk warning: 76% of retail CFD accounts lose money)

Security for traders in Luxembourg – Some important facts

Luxembourg traders are fortunate because the CSSF ensures a safe environment for all investors. But the trader must bear part responsibility of choosing the right broker.

A domestic broker must hold a CSSF license to be considered safe for the Luxembourg trader. If you choose to trade with an international broker, let it be one operating within Europe. Or a broker having a license issued within Europe or the United Kingdom.

These are safe options for Luxembourg traders. Licenses issued in Germany, Cyprus, or Australia prove the broker’s standards and credibility. Brokers operating with European licenses all follow MiFID regulations. These brokers can offer you their services, and they are safe to deal with.

Is it legal to trade Forex in Luxembourg?

Yes, it is. Forex trading is allowed and quite popular in Luxembourg. Fortunately, the CSSF works hard to ensure the environment is safe and investors have protection while trading the financial market.

How to trade Forex in Luxembourg – Tutorial

Online forex trading requires a smart device connected to a dependable internet service. Thankfully, internet connectivity in Luxembourg is great. A smartphone, tablet, or laptop will be good enough to start with.

The next important basic requirement for forex trading is a reputable broker. The broker provides access to the international market through the trading account. First, you have to sign up with them.

Trading services differ among brokers. You will need a broker whose services match your objectives. But first, you need to be sure the broker’s service is up to the required standards.

Here’s how to identify a good broker:

- License

Confirm that they have a CSSF license if operating within Luxembourg. If not, check that they hold a license from CySEC, BaFIN, FCA, ASIC, or any other regions whose regulations align with MiFID. Check the regulator’s website to be sure the license is genuine.

- Competitive trading costs

Check on the average spreads and commissions charged on popular trading platforms. Ensure the broker you’re interested in charges within the range. You want to avoid high trading costs. Compare fees to see that the broker is not overpriced.

- Free demo account

Reputable brokers must provide a free demo for checking their services. Ensure the broker offers this free account before considering them.

- Customer service

The ideal customer service in the forex trading industry is available 24 hours a day, Monday to Friday at least. Check that the broker provides such service and is easily reachable through live chat, phone, social media, and email. Many brokers offer multiple language customer service. So if this is important to you, check that support is provided in German and French.

- Payment options

The payment methods provided indicate how smooth or rough the trading experience will be with the broker. Popular and easy-to-use payment methods mean smooth trading with no hanging deposits and withdrawals. If the payment service is not accessible in your country, there will be difficulties causing stress sometimes.

These are ALL standard requirements of a reputable broker.

Follow these steps to trade forex:

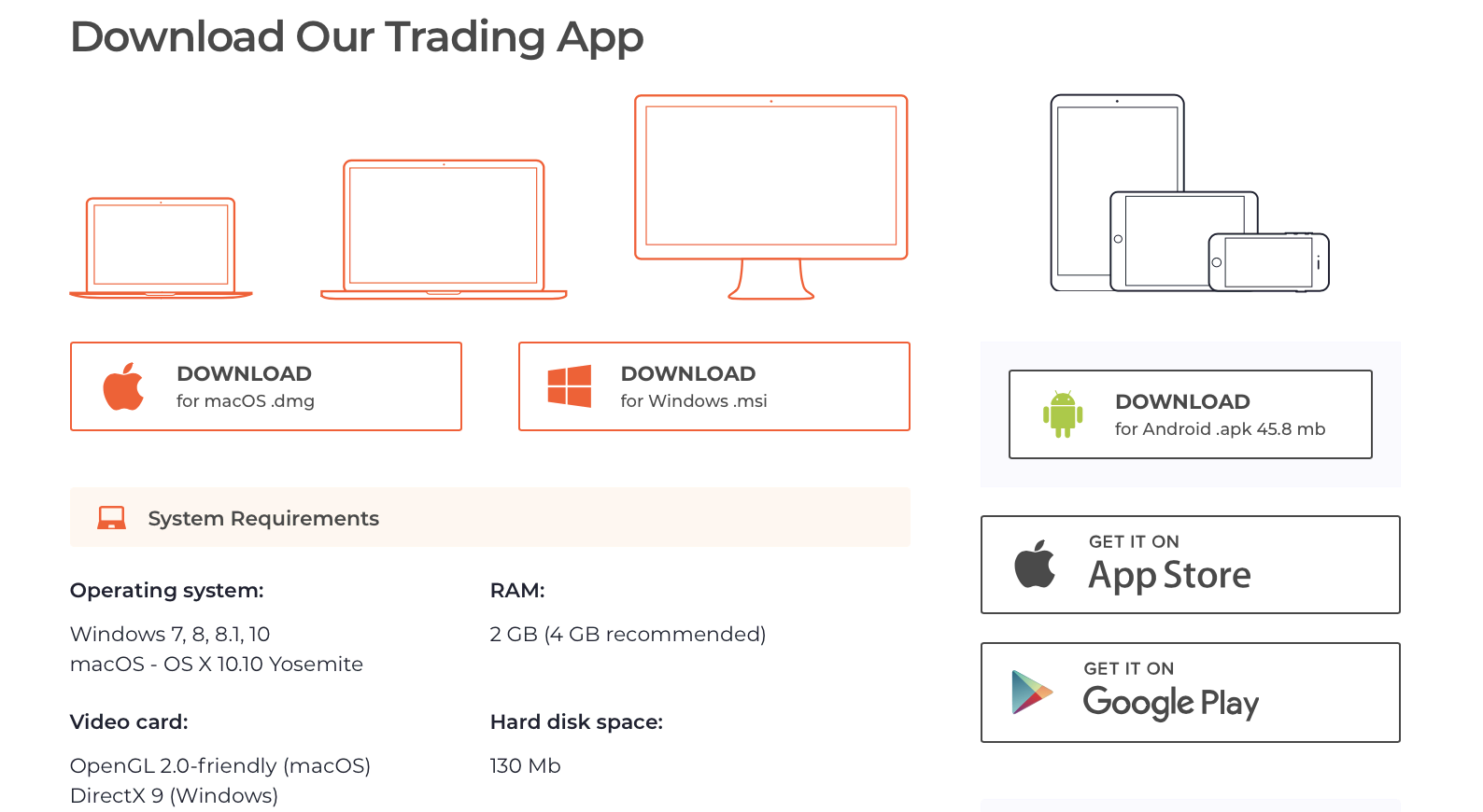

1. Open account for Luxembourg traders

Visit the broker’s website to get a trading account. The webpage will probably load in your national language if the broker supports it. The website will be for Luxembourg traders, offering trading services according to the regulations.

Click on create an account, which should be displayed at the top of the middle of the page. Enter the required detail in the form. This should be your full name and email address.

Once you click on submit, the broker sends a message to the email you typed into the form. Open the message and click on the link in the body. This verifies the information provided and takes you to the full signup page to complete the registration.

Be prepared to provide your social security number or a copy of a government-issued ID card. Identity confirmation is part of the regulations in most EU countries and other parts of the world.

2. Start with a demo or real account

Next is to trade using the free demo. You want to experience the broker’s trading environment before committing your cash. A free demo is the best way to do this. You can see the platform’s features and test them without risking your funds.

Newcomers can practice trading on this account before the real thing. You need to be familiar with the forex environment before starting live trades.

The free demo also lets you test your trading styles and strategies on the broker’s platforms before fully accepting their services.

The broker will fund the account with enough virtual money to conduct many transactions. Some brokers offer additional funds if you exhaust the initial balance.

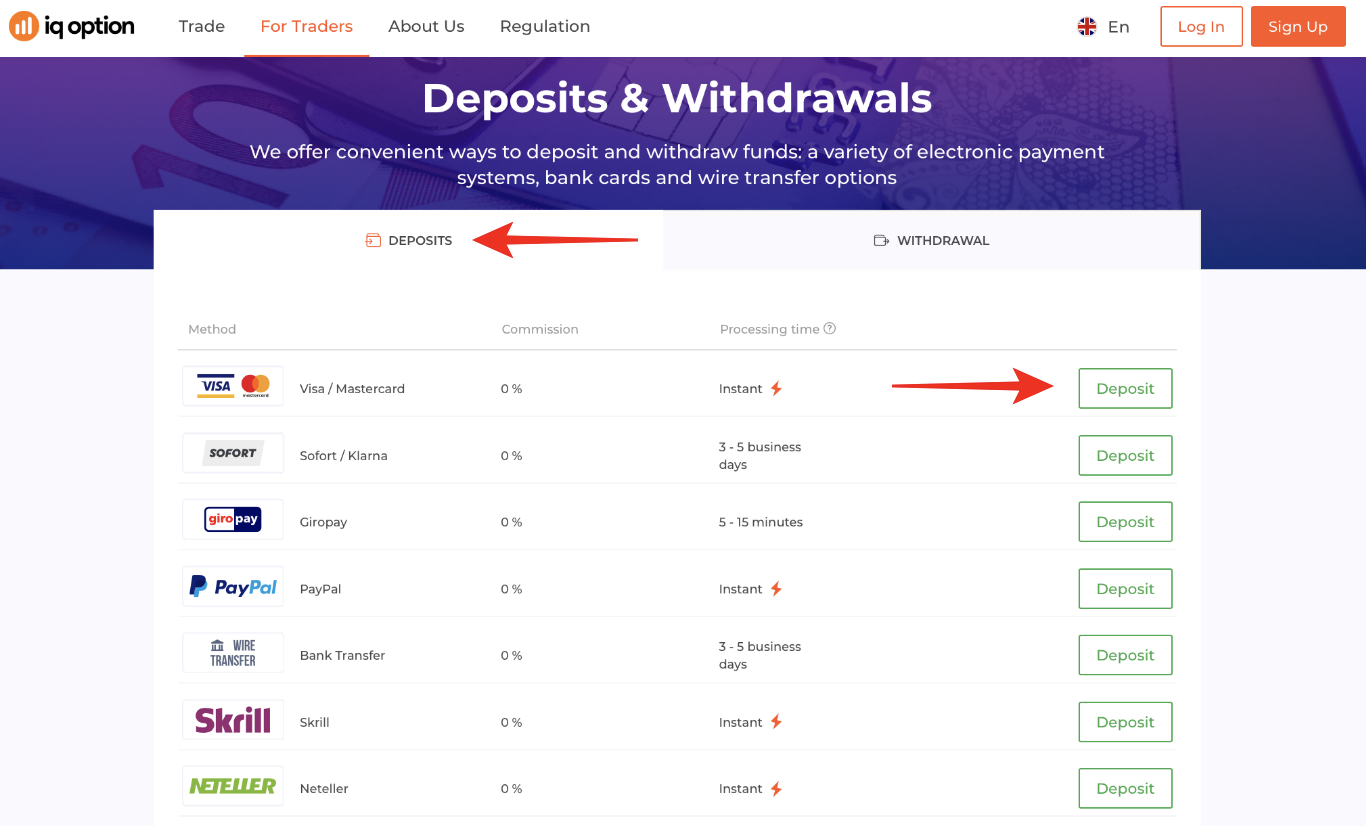

3. Deposit money

The next step after the demo sessions is trading on a live account. This account requires real cash, so you’ll need to deposit money.

The broker should simplify this process by providing simple and common payment options. Click on the funds tab on the platform and select the deposit option to see the payment methods.

Choose the easiest one you prefer and fill out the form to initiate a transfer. Once this is done, the money should appear in the account within minutes since deposits are processed very quickly.

Brokers do not charge for deposits. But the payment platform might charge a small amount for this service. It is often deducted separately, not from the actual funds transferred. If this is the case, the money should appear in full in the trading account.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Forex market analysis is necessary before placing any trades. First, you need to examine the currencies’ past exchange rates and influencing factors. It will give you valuable insights into the price movements.

Market analyses let you see where the prices have been and where it is likely to go. This knowledge guides you in choosing the most suitable trading strategy for the forex pair.

There are three important analyses in forex:

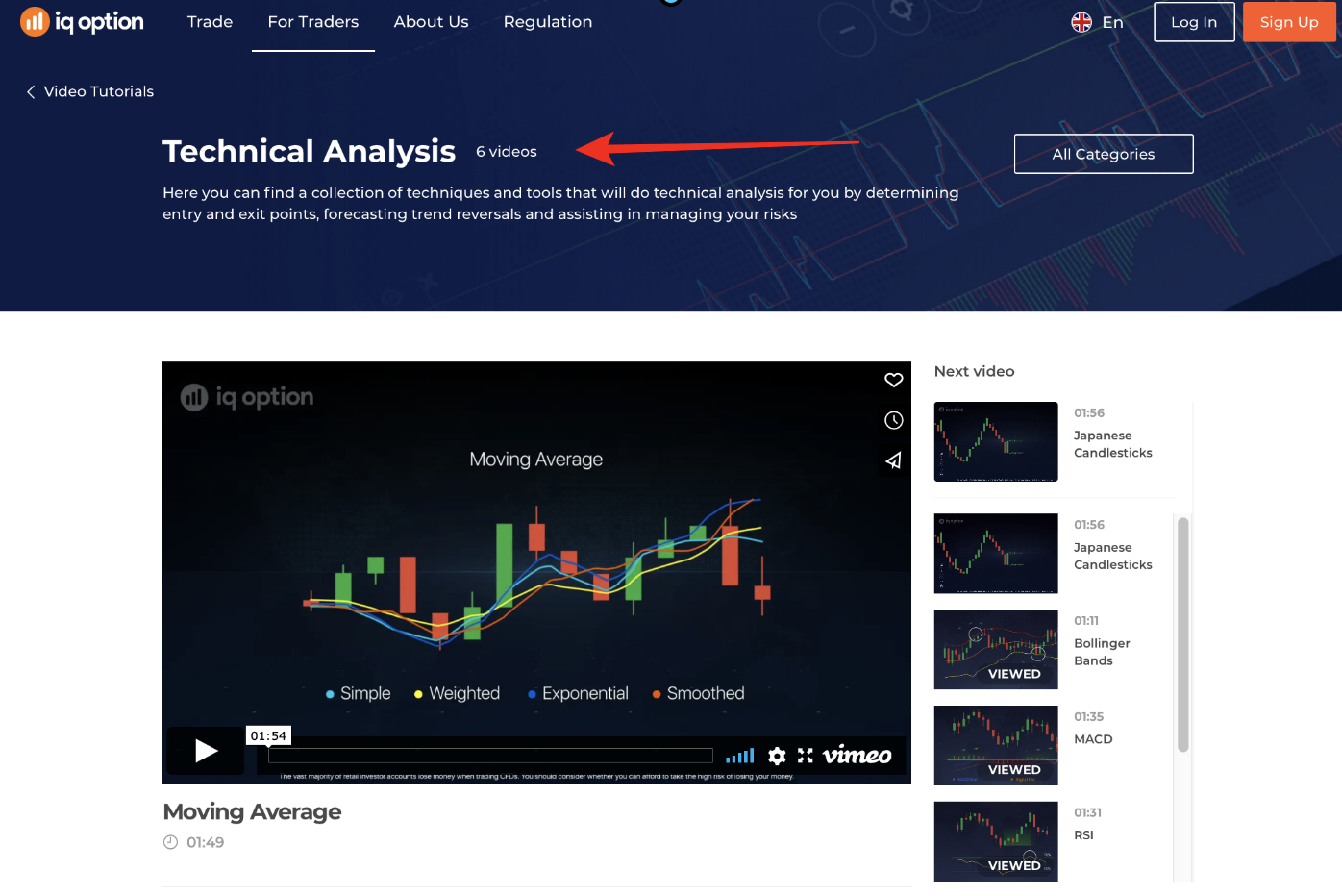

- Technical analysis

- Fundamental analysis

- Sentiment analysis

Technical analysis has to do with studying past price movements in the forex chart. The movements show patterns that indicate the best trading opportunities. But the trader has to identify and correctly interpret these patterns. Technical analysis is more popularly used in forex trading. Brokers’ platforms come with various tools for technical analysis, including charts, indicators, trade signals, etc. Many trading strategies are also based on this.

Fundamental analysis has to do with examining the economies that drive the currencies. The stronger the economy, the bigger its currency’s value in the financial market. So traders look at economic factors such as inflation, GDP, exports, interest rates, etc., to analyze the country’s economy. Knowing the currencies’ strengths help you make good trading decisions. Trading platforms often come with market analyses and educational materials that help traders conduct fundamental analyses.

Sentiment analysis involves looking into market participants’ responses and behaviors. Higher demand for an asset indicates that participants expect prices to increase. Sentiment analysis is not as simple as black and white. The current price movement on a naked chart is not always enough to analyze market reactions. Some tools on trading platforms help confirm the market’s expectations. The volatility index (VIX) and the relative strength index (RSI) are good examples of such tools.

These analyses are all vital to profitably trading the forex market. The trader can safely choose a suitable strategy after properly conducting these.

Many Luxembourgers stick to their national currency while trading in the foreign exchange market. That is because the Euro is among the top three strongest base currencies in the financial market. It provides great opportunities for traders to earn significant profits speculating on this currency.

The most popular forex strategies for the Euro:

- Scalping

- Price action trading

- Breakout strategy

- Swing trading

- Range trading

- Momentum strategy

- Carry trade strategy

5. Make a profit

Trade the forex market after properly analyzing the market and choosing the best strategy. These are the two basic ingredients for profitable trading.

Once you start making a profit, you can add it to your investment or withdraw it from the platform.

Withdrawals are usually as easy as deposits, although they take longer to settle in the receiving account.

Click on the same funding tab and select the withdrawal option. Choose the same payment method used for the deposit and fill out the request form.

The broker receives this request once you click on submit. The withdrawal gets processed and hits the receiving account within 1 to 48 hours. Sometimes, it takes longer than this to process. It all depends on the payment option selected and the broker.

(Risk warning: 76% of retail CFD accounts lose money)

Final remark: The best Forex Brokers are available in Luxembourg

Fortunately, Luxembourg traders can trade forex in a safe and liberal environment. It all comes down to choosing the most suitable trader for your style and trading goals. We hope that this article will simplify your choices. Good luck and happy trading!

FAQ – The most asked questions about Forex Broker Luxembourg:

What factors are considered while selecting the best forex broker in Luxembourg?

While choosing the best forex broker in Luxembourg, look for the following factors:

1. Check whether a trusted regulatory body regulates the broker

2. Comparison of fees and features like spreads, withdrawal fees, commissions, etc.

3. The number of currency pairs offered by the broker.

4. Minimum deposit requirements with the platform.

5. Usability, customer service, and more while opening the account and testing the platform.

Thorough research helps ensure safety and access to the best broker.

How to verify the authenticity of a forex broker in Luxembourg?

ESMA is the European Union Authority that protects the financial system’s stability by safeguarding investors and maintaining order and discipline in the market. It provides the registration details of different brokers for you to verify. Only compliant brokers get the recognition. The forex broker Luxembourg is overseen by the Commission de Surveillance du Secteur Financier (CSSF).

Who is the best scalping forex broker in Luxembourg?

Taking advantage of minor changes in currency prices is known as scalping. The best scalping forex broker in Luxembourg is Pepperstone. Scalping is a trading strategy where establishing and liquidating a position within minutes or seconds is crucial. This strategy is rising in popularity among traders and brokers.

Last Updated on June 1, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)