The 5 best Forex Brokers & platforms in Madagascar – Comparison & reviews

Table of Contents

Finding the best forex broker that accepts Malagasy traders can be challenging. Successful traders frequently carry out their due diligence on reputable trading platforms in order to increase their earnings. We’ve simplified your search by compiling a list of the best 5 forex brokers in Madagascar.

See the list of the best Forex Brokers in Madagascar:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

5 best Forex Brokers & platforms in Madagascar

1. Capital.com

3. RoboForex

4. Pepperstone

5. IQ Option

1. Capital.com

Capital.com was established in 2016 as an international CFD broker. The company has branches in the UK, Cyprus, Australia, Seychelles, and Gibraltar.

Traders worldwide can safely deposit and withdraw their funds safely on Capital.com, thanks to top-tier regulations. Such regulations include:

- The UK’s FCA (Financial Conduct Authority),

- The EU’s Cyprus Securities and Exchange Commission,

- Australia’s Australian Securities and Investments Commission

- The Financial Services Authority (FSA) in Seychelles.

The top forex brokerage has two major trading applications:

- Investmate app,

- It’s learning-app

- MetaTrader 4.

Android and Apple users can find these apps on the Apple Store and Play Store, respectively.

Capital.com’s commission and fees are in accordance with industry norms. Commissions are only present when you execute a trade, while the average spread is 0.6 pips.

The minimum deposit on Capital.com is only $20, €20, or £20, according to the base currency selected for your account. You can deposit with Madagascar-approved credit cards, debit cards, bank transfers, electronic transfers, and wire transfers.

While deposits are instant, the withdrawal process often requires roughly two days.

Pros

- Provides all major currency pairs, cryptocurrency, indices, stocks, and EFTs.

- Access to forex trading articles and courses of excellent educational value.

- The game-like nature of the exclusive Investmate educational software makes studying enjoyable.

- Provides a wide selection of cryptocurrency CFDs (not available in the UK except to professional traders).

Cons

- Unavailability of MetaTrader 5

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets started operations as an international forex brokerage firm in 2014.

The company currently has regulatory licenses from:

Malagasy traders have access to three different account options on BlackBull Markets. The ECN-based accounts provide very competitive trading opportunities via the No Dealing Desk (NDD) model.

You may employ high leverage ratios up to 1:500 on the BlackBull Markets trading platform. Thanks to the Seychelles regulations, this option is available for both expert and retail investors in Madagascar.

There is no proprietary smartphone app available from the FX broker. Instead, traders can use third-party platforms like MT5 and MT4, which are downloadable on the Play Store and Apple Store.

The minimum deposit on the ECN Basic account is $200, while clients choosing the ECN Prime account can only start trading with a $2000 deposit. So, deposit and start your trading journey with BlackBull Markets using bank transfers or credit cards.

BlackBull Markets charge zero deposit fees, although third-party apps may require processing fees. However, the forex broker charges 5′ base currency’ as a withdrawal fee. So, if you choose dollars as your base currency, the withdrawal fee will be $5.

New traders can set up a demo account and get $100,000 in virtual funds. The brokerage firm also provides a learning section known as ‘Learn To Trade’ for new traders to educate themselves while practicing on the demo account.

Contacting BlackBull Markets’ customer support from Madagascar is easy via the 24/7 Live Chat. Alternatively, Malagasy clients can use international phone lines to contact customer support for concerns and questions about their accounts.

Pros

- Access to more than 50 currency pairs.

- Provides access to Myfxbook, ZuluTrade, and other copy trading platforms.

- Integration with MetaTrader apps and TradingView.

Cons

- The ECN Prime Account has a high deposit requirement.

- Dealing with digital currencies and stocks is not possible.

- There are no MetaTrader app plug-ins available.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is a trustworthy brokerage firm that began operations in 2009. It offers financial market activities in 169 countries, including Madagascar. RoboForex has a user base of over 3.5 million people.

Regulatory bodies like the FSC in Belize authorize trading activities on RoboForex. RoboForex is also a certified member of Hong Kong’s Financial Commission, the World’s EDR, for resolving forex issues.

RoboForex excels brightest in commission-based trading, as it is one of the most affordable brokers. The trading platform’s ECN account has a minimum spread of 1.3 pips, while the minimum lot starts from 0.01.

A minimum of $10 is required to start trading on RoboForex. Deposits are free of charge on RoboForex, although there may be bank or third-party merchant charges. The withdrawal charges required on RoboForex vary based on your payment mode.

RoboForex accommodates Madagascar traders of all levels, whether seasoned or novice. If you don’t want to start with a real account, you can open a RoboForex demo account which provides similar trading pairs in a real account.

The company’s excellent qualities are its bonus packages. Traders can get a 120 percent bonus on their investment after subsequent deposits. Market participants who join a brokerage firm receive a 15% payback on their profits under the RoboForex Cashback scheme.

Pro

- Access to 36 FX pairs, four crypto pairings, multiple index CFDs, stock CFDs, and ETFs.

- Unique copy trading platform, known as CopyFx

- High affiliate fees, which start at $5 per lot.

- Fast withdrawal.

Cons

- Low cryptocurrency trading opportunities

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is an Australian-based forex broker founded in 2010. It became an international brokerage firm in 2015 after opening its office in London.

The top forex broker has regulatory licenses from major financial regulators like:

- UK’s Financial Conduct Authority.

- Germany’s Federal Financial Supervisory Authority, also known as BaFin

- Australia’s Australian Securities and Investments Commission.

Although the company does not offer a unique trading platform, users can use various third-party trading platforms. Pepperstone-integrated trading mobile platforms include the cTrader mobile app and MetaTrader apps.

The competitive pricing offered on the Pepperstone Razor account makes the broker a good agency execution broker. Pepperstone also provides a standard account for new traders, a traditional kind with no commissions.

Using the Razor account, high-volume traders in Madagascar can participate in the broker’s Active Trader program. The program provides traders with discounts for every traded lot once they fulfill monthly volume requirements.

Pepperstone’s Malagasy clients can contact the support team for help using the live chat and phone customer service accessible 24 hours a day. There is also online training and a plethora of trading manuals for both experienced and novice traders.

Pros

- Access to over 70 currency pairs and an expanding list of crypto assets, indices, and stocks.

- Competitive pricing for aggressive traders.

- There are a variety of social copy trading sites to choose from.

Cons

- Sustaining trading positions overnight comes at a high price.

- The MetaTrader framework is simple.

- High minimum deposit

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option started offering its services in 2013 under its company of IQ Option Ltd., a Cyprus-based firm licensed by CySec. Traders from more than 200 countries, including Madagascar, can trade safely on IQ Option.

The company began as a binary options brokerage firm. (Binary Options are for professional traders and for that outside of EAA countries only).

Today, it offers multiple CFDs on ETFs, Forex, Cryptocurrencies, Stocks, and Indices.

Users have access to IQ Option’s unique trading platform, which has won several awards. The trading app is simple to use and navigate. Trading forex is easier on IQ Option thanks to multi-chart designs, advanced analytics, economic forecasts, asset screeners, historical quotations, volatility notifications, and trading updates.

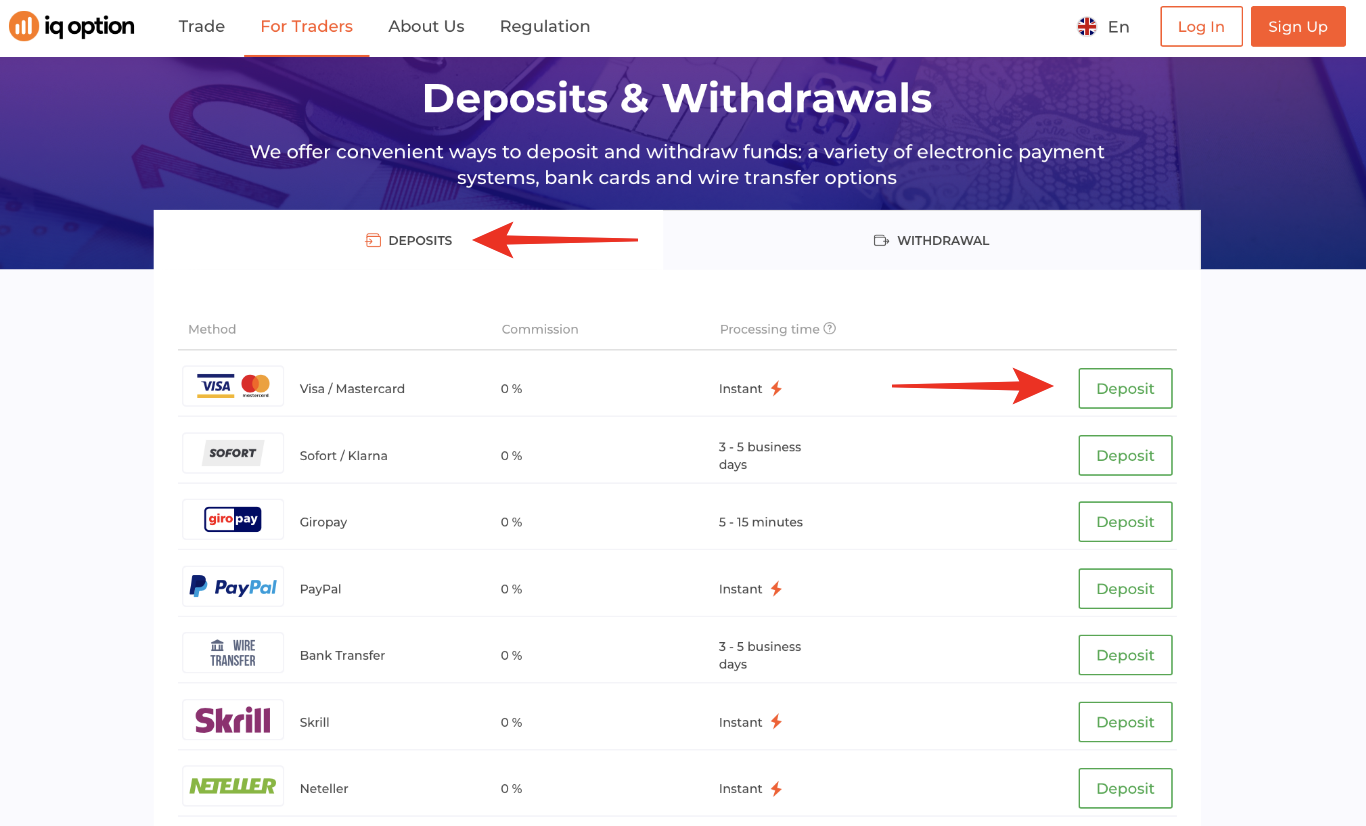

There are two kinds of trading accounts available at IQ Option. Standard trading accounts require a $10 minimum deposit, while VIP accounts must deposit large sums of money, often changing with time.

VIP accounts come with a private account advisor, monthly assessments on your market activity, and a 3% bonus.

Like other forex brokers, IQ Option provides a $10,000 demo account. Individuals can open a real account by depositing funds via wire transfers and credit cards.

There are no processing costs when depositing money with this broker. However, the FX trading platform charges $2 to withdraw funds.

Pros

- More than 90 trading assets

- Low minimum deposit.

- Access to a beginner-friendly trading platform available on Android and Apple devices

Cons

- No cTrader or MetaTrader platforms

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Madagascar?

Madagascar, the island country across the Mozambique Channel in the Indian Ocean, is home to more than 27 million residents. Yet, there are no locally authorized forex brokers at the moment.

Forex trading is becoming increasingly popular in Madagascar as new investors seek to take part in one of the biggest financial markets in the world. In addition, forex trading has been more available and less expensive due to improvements in internet technologies, and increasing broadband coverage in Madagascar.

With the growing need to participate in forex in Madagascar, traders are advised to choose only regulated brokers. Forex brokerage firms regulated by international bodies help to reduce the risk of losing investments to fraudulent brokers.

Regulation protects traders. A lack of broker regulation might result in subpar services and even financial loss.

One major rule is that the operating capital of the broker and the facilities funded by the customers must be kept separate. If customer funds are used to do business, this is considered fraud. Legislation is essential to prevent this from happening.

Although there are no regulated brokers in the country, prospective forex traders can rely on brokers regulated by international bodies. Such bodies include:

- The Financial Conduct Authority in the UK

- The Cyprus Securities and Exchange Commission

- The Australian Securities and Investments Commission

Security for traders from Madagascar

The digitalization of financial transactions in Madagascar has paved the way for online scammers to defraud naïve investors. As such, traders should ensure that the brokers they are dealing with are licensed.

Several key variables are considered when choosing a regulated online trading platform in Madagascar.

- Ensure the broker has at least a two-year track record.

- Ensure the broker has at least a 15-person customer service team.

- Ensure a top-tier regulatory body regulates it.

- Ensure the broker provides fast withdrawals within two to three days

- If you are using an international broker, ensure it accepts traders globally.

- If you decide to use a local broker, ensure the Central Bank of Madagascar regulates it.

Interestingly, the best five forex brokers reviewed above meet these key criteria. However, you should research as much as possible and, if required, create a demo account before opening a real trading account.

When trading, you should be aware of the concept of leverage. Significant leverage transactions offered by Malagasy brokers can result in large profit margins. However, this works in both directions and can result in significant losses.

A good and reputable broker should offer some protection to help you manage your funds. Examples of these protections are negative balance guarantees as well as stop-loss accounts.

Is it legal to trade Forex in Madagascar?

Yes, forex trading is legal in Madagascar. Foreign exchange is an integral part of business in the country, which explains why trading currency pairs is allowed.

Importation and exportation of goods, as well as foreign investment, all need the use of forex. The essential thing to remember while trading forex is to choose a licensed, safe, and reputed broker.

(Risk warning: 78.1% of retail CFD accounts lose money)

How to trade Forex in Madagascar – Tutorial

Currency trading is both risky and complicated. While it is not exactly difficult, trading forex is a unique enterprise that needs specialized understanding.

The foreign exchange industry (frequently referred to as FX or Forex) is a worldwide trading market for fiat currencies. As the world’s biggest market in daily trading activity, forex provides high volatility and liquidity.

Forex is active 24/5 (24 hours each day from Monday to Friday). This is because exchange rate pairings are used for trading assets (fiat currencies) against one another.

Understanding how to trade forex is essential to avoid losing funds. Here are some steps to help you start trading profitably.

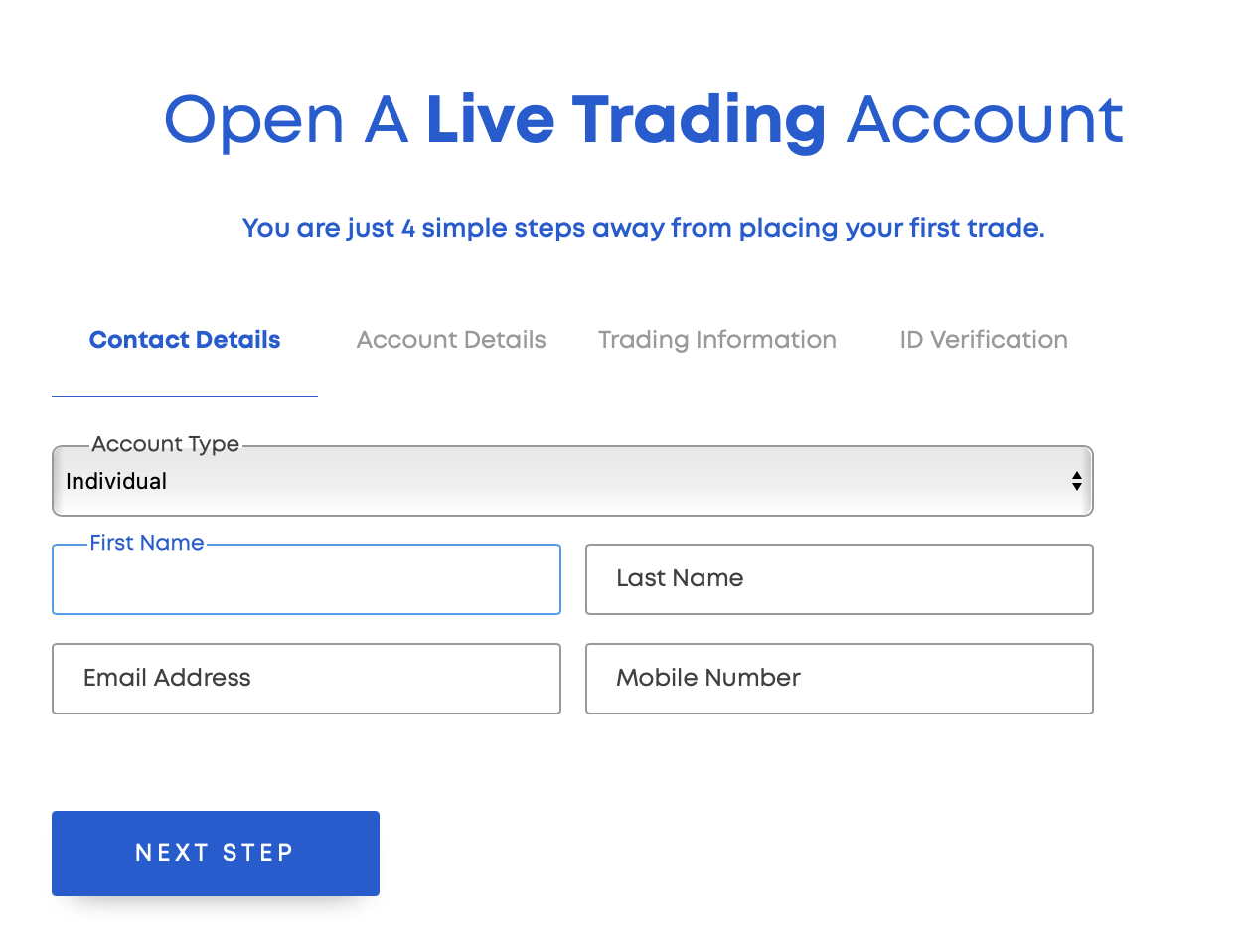

1. Open account for Madagascar traders

Once you decide on the forex broker you want to trade with, you must create an account with the broker using your valid Madagascan ID and inputting basic personal information. Online forex brokers allow you to upload all necessary documents using your smartphone camera.

After successfully uploading the necessary documents, your broker will send an email containing activation instructions. Click on the activation link to confirm your registration, and you may start trading the forex markets right away.

2. Start with a demo account or real account

Using a demo account before depositing funds into your real account is important for new traders and expert traders new to a forex broker.

Demo accounts provide “genuine” market situations for learning and experimenting. For example, forex brokers in Madagascar provide virtual money, which you can use to trade currency pairs like a real account.

Before financing your genuine account, use the demo to examine the broker’s interface and experiment with some investing methods.

3. Deposit money

Funding your account is the first step when trading forex for real profits. Most brokers offer different payment methods, such as credit cards and bank transfers.

Although deposit fees are often free, some third-party financial providers like PayPal and Neteller charge a small fee for processing your payments. In addition, some online brokers accept cryptocurrency payments for traders who have Bitcoin or Ethereum wallets.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

After funding a real account, you need to understand how forex works so that you can create a trading strategy.

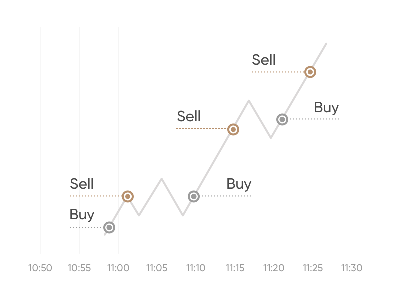

Forex is always traded in pairs. For instance, a forex pair like EUR/USD consists of the base currency, i.e. EUR (European Euro), and the quote currency, i.e. USD (US Dollar).

The FX pair compares one currency (base) against another (quote). If you purchase the EUR/USD pair, you purchase the Euro and sell the Dollar. On the other hand, if you sell the EUR/USD pair, you sell the Euro and buy the Dollar.

Reading and evaluating the currency pairs and their value is a basic but vital skill for every new trader. With this skill, analyzing real-time data from financial websites will become easy.

Traders can hone their trading skills by employing technical analysis tools like candlesticks, moving average, or the stochastic oscillator. These tools will further increase your chances of making profits if you understand major trading strategies like:

- Day trading

- Scalp trading

- Swing trading

- Position trading

5. Make profits

The major goal of trading forex is to make profits and reduce losses. Any trader can achieve their aim by studying and practicing consistently.

New traders that want to earn without investing much time in reading charts and practicing with demo accounts can use forex brokers offering copy trading services. With copy or social trading, you can profit by taking positions on forex pairs selected by expert traders.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Madagascar

Forex trading provides a great opportunity for making consistent profits. Fortunately, prospective traders in Madagascar can trade legally as no law prohibits their trading activities.

However, Malagasy traders should choose only regulated brokers to avoid losing their funds to online frauds. It is also important to master basic forex skills to help reduce losses involved in trading forex.

1. Capital.com

2. BlackBull Markets

3. RoboForex

4. Pepperstone

5. IQ Option

FAQ – The most asked questions about Forex Broker Madagascar :

How can I trade with a forex broker in Madagascar?

It is risky and challenging to trade currencies. Forex trading is a unique business that requires specific knowledge, even though it is relatively easy.

The foreign exchange market, sometimes known as FX or Forex, is a global market for trading fiat currencies. Forex offers tremendous volatility and liquidity, the world’s largest daily trading market.

To minimize financial loss, it is imperative to understand how to trade forex. The following steps will assist you, in the beginning, to trade profitably.

First, create an account for Madagascar traders.

Start with a real or trial account.

Add funds to your account.

Design new plans and strategies.

Earn profits and start withdrawal.

How can I choose the best forex broker in Madagascar?

You must consider or check a few things while opting for a forex broker in Madagascar.

Check for a valid and regulated forex broker.

The broker should offer you a fake or demo account.

It should cover asset types.

Should offer trading through the mobile platform.

It should provide an easy deposit and withdrawal process.

Should offer effective and dedicated customer service.

How can I know the reliable forex brokers in Madagascar?

For your convenience, we list the few reliable forex brokers in Madagascar. Have a look over them.

Robo Forex – Best trading platform for experienced investors and traders.

Exness – Trusted broker with all the relevant terms.

Tickmill – Best platform for experienced and professional traders.

Capital.com – It offers different and interesting investing options for both newbies and experienced.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)