The 5 best Forex Brokers and platforms Malawi – Comparison and reviews

Table of Contents

It’s an age of innovation and technology. The world is now called a global village thanks to the internet. Even the world’s economies are dependent on the internet for growth and development.

See the list of the best Forex Brokers in Malawi:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Forex trade is one of the ways through which the world’s and personal economies are built today. If you’re looking to start forex, this article is what you need.

Here is the list of the 5 best brokers you can begin trading on without further delay:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

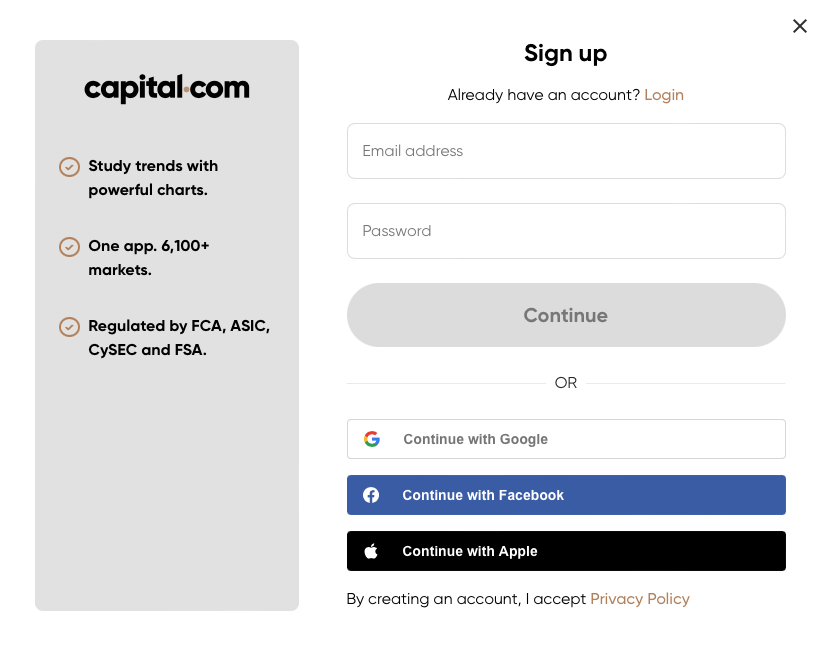

1. Capital.com

One beautiful thing about trading with Capital.com is that the broker’s platform has a variety of assets from which you can trade. Their assets range from Commodities, cryptocurrencies, metals, etc. All of these help traders on their platform choose the asset they prefer instead of just being stuck to one.

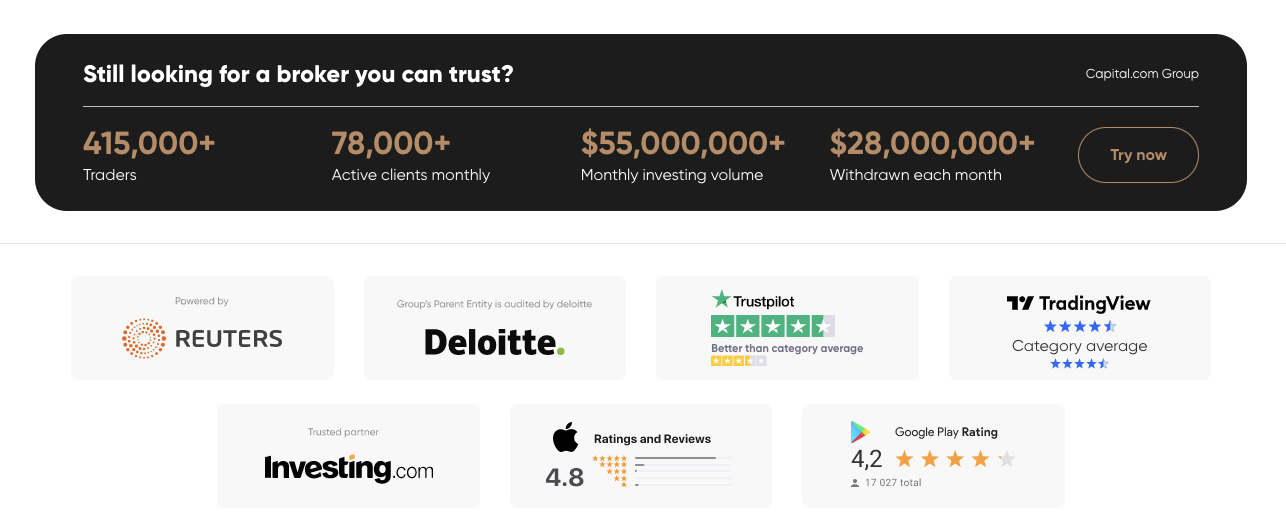

Capital.com was founded in 2016; it is one of the newest broker platforms established. And with already over 480,000 people from across the world, this makes the firm popular and well-known.

Aside from that, Capital.com is also regulated by international bodies from different countries, making them secure and trustworthy to their traders. These regulatory bodies include – CySEC, FCA, NBRB, and ASIC.

The platform also offers training and knowledge to traders. They have available articles, recordings, and courses that traders can take to improve their Forex trading skills and knowledge. They also have exercises that prove that what you’ve learned is gained and understood.

A minimum deposit of $20 has to be made before starting trade on it. If you ever need customer support, it’s easy to get a hold of their customer care.

Advantages when you trade with Capital.com

- Available courses and exercises which improve trader’s skill

- You can use the demo account, which replenishes every time

- The market is very competitive and engaging

- Availability of a demo account.

Disadvantages when you trade with Capital.com

- There is a restriction for clients in the US on the platform

- The minimum deposit is high compared to other competitors in the broker’s business.

(Risk warning: 78.1% of retail CFD accounts lose money)

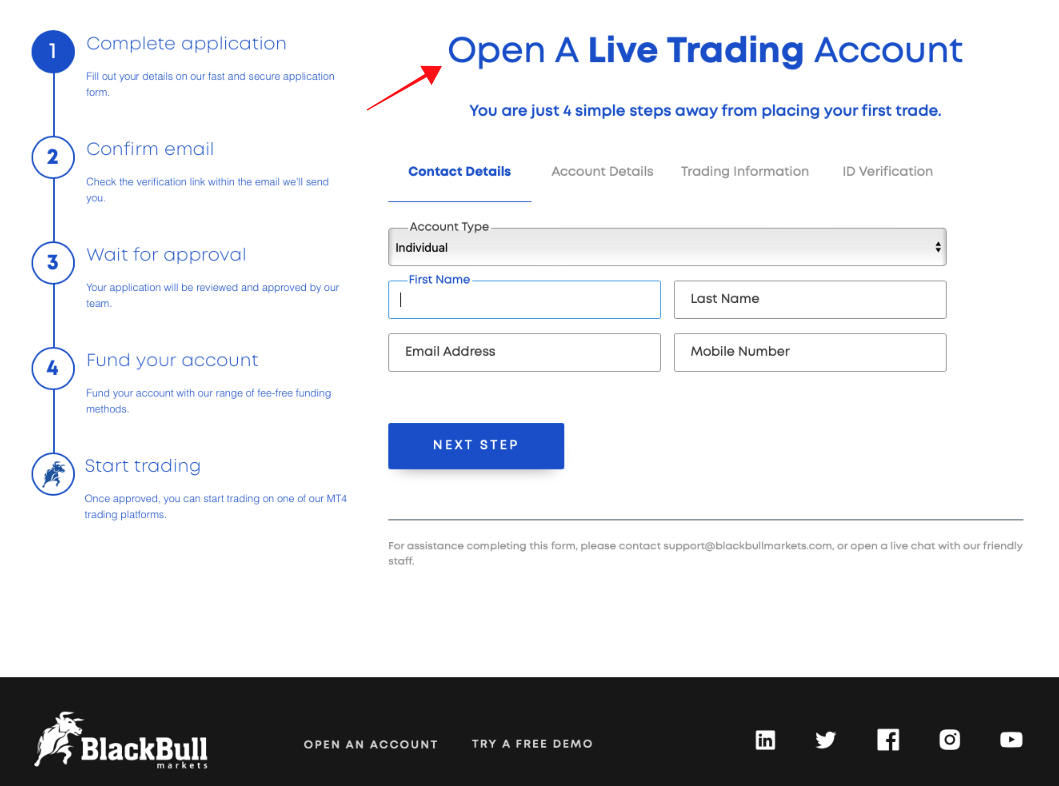

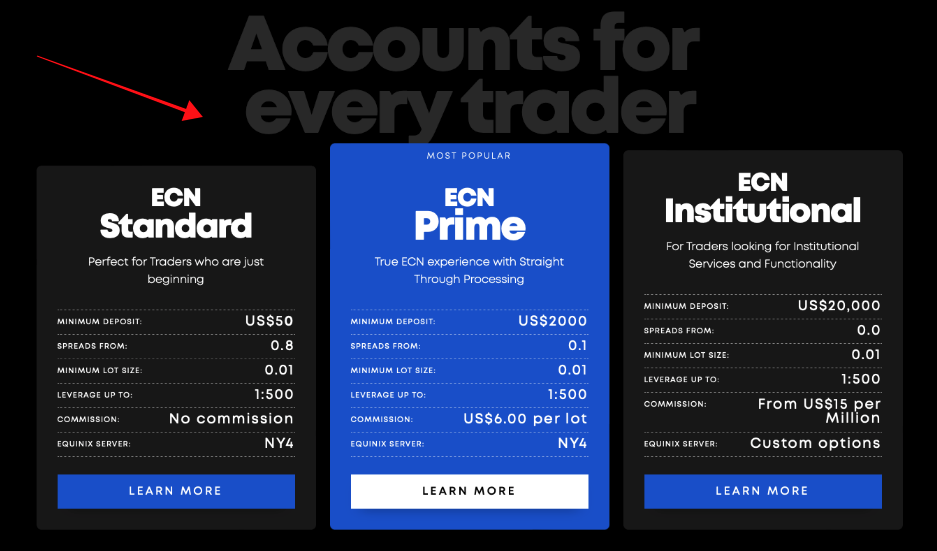

2. BlackBull Markets

With one of the fastest servers in the broker’s business. Traders with MT4 on BlackBull Market can make transactions very fast. This is so because the platform’s server is directly connected to WallStreet’s Equinix NY4 server, which moves 2 to 8 milliseconds.

If you’re looking to trade assets but not on a large scale, then BlackBull Market is what you need. You can trade the following assets – commodities, indices, metals, etc. The plate form is under the regulation of the Financial Services Provider. Thus, this is another broker’s platform that you can trust.

As a new user of the BlackBull Market, you will notice that the price structure is reasonable, plus the quick form of market transactions. The platform is client-friendly and respects the traders’ privacy because it gives Virtual Private Servers (VPS) and APIs, which helps you connect with a third-party trading platform.

Initially, the firm was formed in 2014 by some individuals from Fintech and experts in Forex from New Zealand who wanted to build their Forex trading platform. Unlike most of its competitors, BlackBull Market is not provided with sources such as articles or quizzes that can help traders on their platform improve in Forex trading.

Although there is the provision of in-house research on market strategies, which helps traders gain insight into market activities, there are proper means of market insight.

The platform provides two different deposit options, depending on the kind of account you choose. Owners of the standard account can make a deposit of 200 USD. While those with an ECN prime account can start with a deposit of 2000 USD before they can begin trading with the account.

Advantages when you trade with BlackBull Markets

- You don’t have to worry about deposit fees

- One can quickly create an account on the platform

- BlackBull encourages flexibility for its traders because you can trade both on mobile devices and computers.

Disadvantages when you trade with BlackBull Markets

- The customer service has a closing hour, and thus, they may be unavailable sometimes.

- Sadly, when a withdrawal is to be made, there is an attraction of fee.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex has well established itself in more than 100 countries globally, allowing it to have quite an amount of popularity among Forex traders in the world. The company is patronized by many traders worldwide, making them have customer support in more than 11 languages to respond to customers in native ways.

The minimum deposit into your account depends on your location. But be sure that they provide their traders with a wide range of options to make the navigation through the platform understandable and straightforward.

Like most other brokers out there, RoboForex provides a method or means through which its traders can expand their trading skills. It has within it trading competitions and quizzes, which will enhance the skills of its traders.

The platform was founded in 2009 under two companies, RoboForex and Robomarkets enterprise, which later formed the RoboForex Group. RoboForex deals with offering services to clients worldwide, while Robomarkets only provides services for clients in the European Union.

MT4 and MT5 (MetaTrader platforms) are available on RoboForex. MT4 is popular because it performs many functions. MT5 has a poorer standard than MT4, but cTrader is better because it offers Electronic Communication Network. The beautiful thing about Forex brokers with MetaTrader platforms is that they ensure more security to their traders, and it’s a great way to show that the platform is technologically developed.

Customers can also trust that the platform is well secured and regulated by the Internation Financial Services Commission. So there is assurance that traders’ money and activities are in the safe hands of an international body.

Advantages when you Trade with RoboForex

- Withdrawing money from your account is very easy

- You can learn how to trade with its demo account

- The minimum deposit amount is straightforward

- It has more than one software you can select.

Disadvantages when you Trade with RoboForex

- Customer service response is relatively slow.

- There is not enough currency pair available to choose from.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

When it comes to the safety of traders on the platform, Pepperstone is top at its game. It is highly regulated by SCB (Standard Chartered Bank), FCA (Financial Conduct Authority), CMA, ASIC (Australian Security and Investment Commission), and BaFin. These bodies are international, and they regulate the activities of the broker platform.

Pepperstone begins with a minimum deposit of 200 dollars which some traders might consider high, but it is also relatively low considering some other Forex brokers. The platform also has MetaTrading platforms (MT4 and MT5) and cTrader, which traders can choose. Plug-ins are available that help you maximize your trading experience with them.

A variety of assets are also available for traders to trade. Traders can choose from crypto, metals, commodities, and stocks. It was established in the year 2010 by Pepperstone Group.

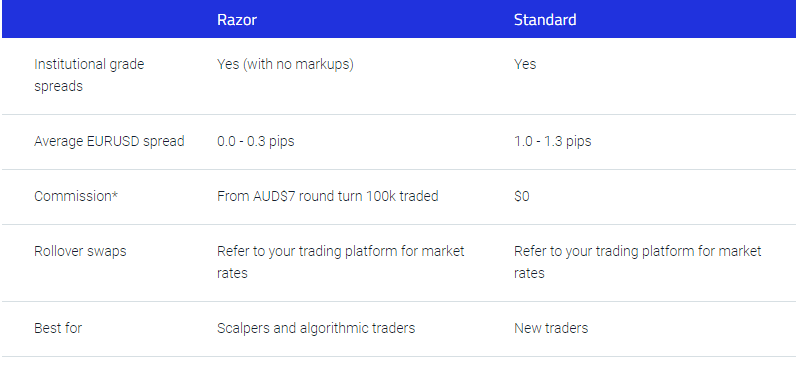

One of the first broker’s platforms to have two accounts from which clients can choose. A Standard account and Razor account. Their Standard account has an FX spread that starts from 1 pip and has zero commissions. At the same time, their Razor account has an FX spread that starts from 0 pip and has commissions attached to it for the traders that choose this account type. The very pleasant thing about the ability to select an account type that suits you is that you get to have your own space, understanding, and market competition. People with the same account type get to trade in the same kind of spread.

Pepperstone’s market strategy is straightforward for traders to use and understand, allowing them to focus appropriately on making a profit. Their customer service is of a good standard, and they are responsible to their clients.

Advantages when you trade with Pepperstone

- Razor account owners have a very competitive space.

- Plug-ins that come on the platform help trading much more accessible for their clients

- Social copy marketing spaces are numerous

Disadvantages when you trade with Pepperstone

- There is no means by which traders can know that they are improving their marketing skills.

- Their customer service is not available on weekends

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option was formed in 2013 and had its HQ in Cyprus. The platform is regulated by Cyprus Securities and Exchange Commission in Cyprus there. It is also relatively easy when you want to open an account with IQ Option. All required of a trader who wishes to start trading are forms of identity. The platform is also excellent because it allows flexibility for the traders.

IQ Option can be done on your mobile devices and desktop. Depending on which is more available to you. They provide clients with courses, conduct webinars, and have discussion forums for traders to connect and understand market strategies from other top traders worldwide. There is also a demo account that new traders can use to learn how to trade before delving into the real market with their real account.

It is well known to have various financial instruments that traders can use to trade. These instruments can come in the following forms: ETF, Stocks, and FX. IQ Option is very trusted and has one of the highest amounts of traders on its platform. IQ Option allows their clients to trade with as low as 1 dollar. This makes the platform a user-friendly one for their clients.

To prove this, they have won so many awards over the years. And this alone should give an insight into how good this trading platform is for FX traders.

Advantages when you trade with IQ Option

- It has an easy to use a demo account

- A deposit fee does not exist on the platform

- The platform can be used on either a phone or desktop

- Different chart kinds, from histograms to candles.

Disadvantages when you trade with IQ Option

- The withdrawal process through the bank takes time.

- The platform is not open to all traders as it has a restriction in some countries.

- MT4 is not available on the platform

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Malawi?

A variety of issues determine financial regulation in Malawi. The country’s finance is controlled by several bodies, including the government policies, the Reserved Bank of Malawi, non-governmental organizations, and a couple more. These are put in place to secure the country’s financial situation.

All banking institutions, especially financial ones, are controlled in Malawi by the Registrar of Financial institutions, and this Registrar is also the Governor of the Reserve Bank of Malawi.

By doing this, the government in Malawi aims to have a single regulator for all financial institutions. They can take advantage of financial resources, knowledge, skills, and a well-structured information network for financial institution regulation and supervision.

The Reserve Bank of Malawi oversees 19 Savings and Credit Co-operative Societies (SACCOs). These SACCOs’ overall assets, loans, and deposits contribute to 70% to 80% of all SACCO movements.

Under MOU, the Malawi Union of Savings and Credit Cooperatives (MUSCCO) oversees all the SACCOs. Also, Since the Registrar has ultimate responsibility for regulating these smaller SACCOs, they conjoin with MUSCCO, particularly when it comes to law and regulation enforcement.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Malawi – Some important facts

There are some misconceptions that there is no security for traders who trade on Forex broker platforms. But this is not so, well, only if you as a trader just go ahead and trade with just any broker.

Not all brokers are legit as they seem. This is why the government of any country where Forex trade is made advises its citizens to go for those brokers online with international regulatory bodies. This way security and privacy of the citizens are protected.

With the online Forex trading system, it is your duty as a trader to check if the platform you have decided on has the necessary regulatory body to avoid fraud or cyber theft.

Is it legal to trade Forex in Malawi?

There is a common notion that trading Forex on the Malawian financial market is risky. This is not the reality; forex trading is active in the country.

Malawi allows forex trading because currency exchange is required to carry out business. Import and export, as well as foreign investment, all require the use of forex.

One important thing to remember while trading Forex is to choose a licensed, safe, and reputable broker. Forex trading is not prohibited in Malawi, and numerous international online firms offer enjoyable trading circumstances.

How to trade Forex in Malawi – Tutorial

Open account for Malawian trader

To begin your forex trading journey as a trader from Malawi, you must first open an account with your preferred broker platform. In opening an account, you must make ready documents that you will request for identification, such as a National identity card, driver’s license, or passport photograph. They also ask for utility bills of any kind.

Start with a demo account or real account

After providing them with the necessary documents, you can start trading. However, it is advisable to start with a demo account if you are new to the Forex world to enable you to understand how it works before going into the game with your real account.

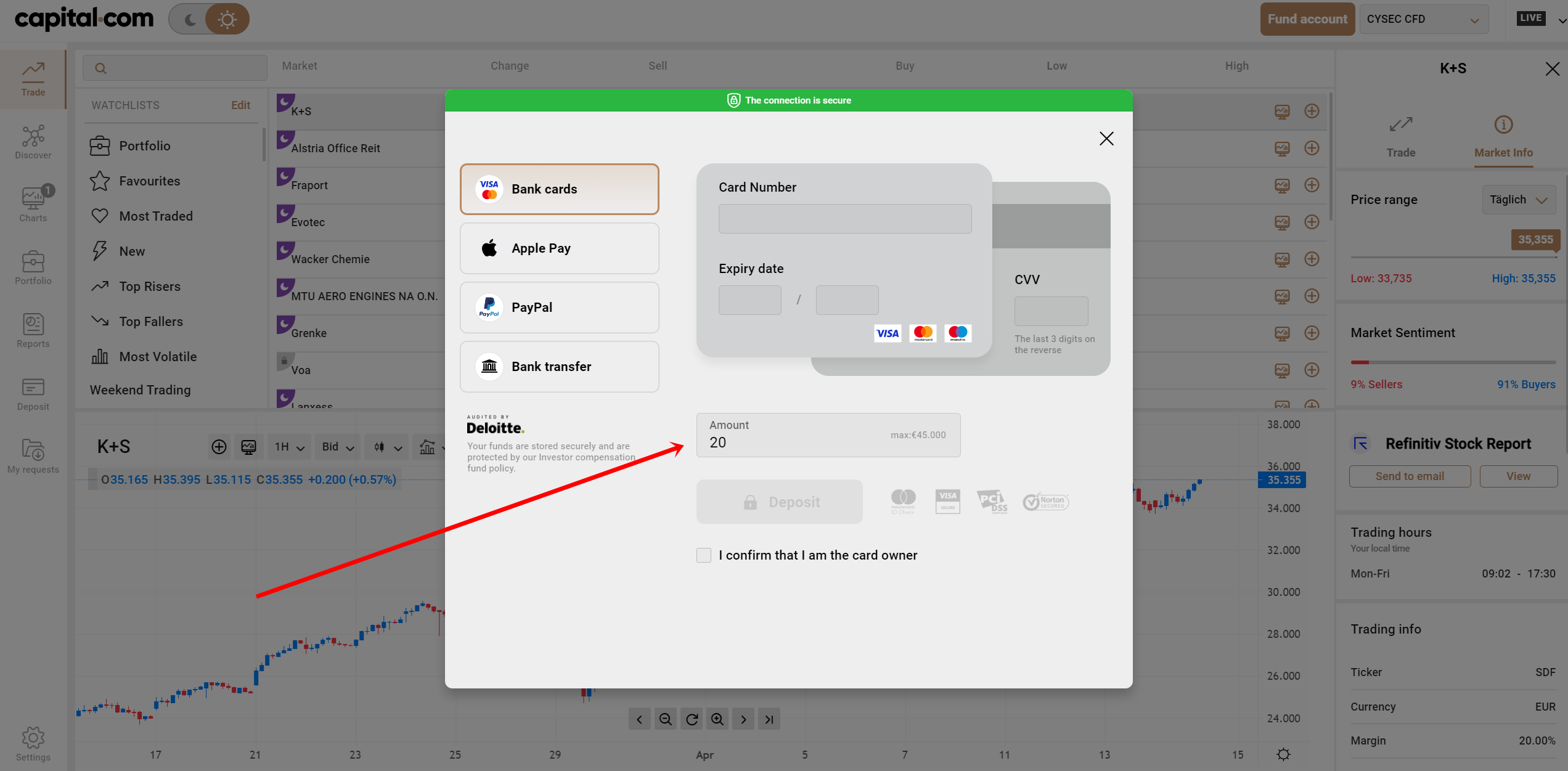

Deposit money

Be sure to check the payment method available in your country and choose the one that suits you most. Some payment methods might attract fees. Before trading, you must deposit an amount of money into your account. The amount varies depending on the broker’s platform.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

There are various means that a trader can use to be one of the best out there and be able to monitor market movement before making choices to buy or sell. This strategy will allow you to avoid some mistakes.

These strategies are as follows;

Scalping

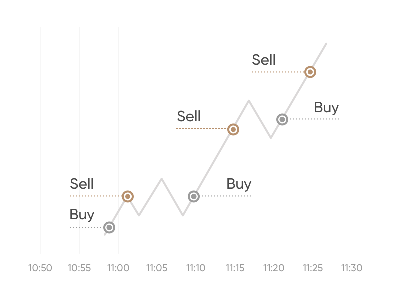

A day trading strategy in which forex traders decide to make exchange rates with a short holding period to achieve a string of fast profits.

Day trading

A trading strategy in which trades are opened and closed on the same day. The day trader capitalizes on minor price changes throughout the day or session.

Position trading

Simply the lengthiest trading, with trades lasting months to even years. Position traders ignore short-term market swings in place of identifying and benefitting from longer-term trends.

Make profit

This is the most exciting part for most traders in Forex. Carefully plan and take decisions before making a stake in the FX market. Following the strategies above will help you make it easier for you to make a profit in FX trading.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Malawi

Know that it’s not easy to kick off on a great start and that most times, you will get nervous before starting you begin trading. It is crucial that if you feel anxious in any way, you should go back to your demo account and keep practicing and growing till you become confident enough.

The forex market can be very competitive, and most times, the patient and watchful benefit from it. Don’t forget to be tactical and careful with your every move.

FAQ – The most asked questions about Forex Broker Malawi :

Which forex brokers in Malawi allow traders to sign up for a free forex trading account?

If you research, you might find several brokers that allow you to sign up for a forex trading account in Malawi. However, the best brokers that offer you a free trading account include the following:

RoboForex

Pepperstone

Capital.com

IQ Option

BlackBull Markets

Apart from offering you a free forex trading account, these brokers also offer you low fees and commissions. Their forex trading platforms are the best in Malawi.

Do forex brokers in Malawi charge inactivity fees from traders?

Yes, traders will have to pay an inactivity fee if they keep unused trading accounts. If you sign up for a trading account, you will have to use it regardless of the volume of trades you make. Otherwise, your forex broker might charge you an inactivity fee. However, the brokers mentioned here charge a very minute inactivity fee from traders. For instance, IQ Option charges only $10.

Can traders in Malawi trade forex?

Yes. Traders in Malawi can trade forex as their regulating authorities permit them to do so. However, they might find it challenging to choose the right forex broker. However, if a trader in Malawi chooses one of the five brokers mentioned here, he might make the right decision. It is because these forex brokers are the best and also offer traders the best features.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)