3 best Forex Brokers in Malta – Comparisons and reviews

Table of Contents

Profiting from forex trading is not certain. But you can personally increase your success chance by choosing a good broker. We have conducted many tests and made a list of the best brokers for traders in Malta.

See the list of the 3 best Forex Brokers in Malta:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

3. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 3 best forex brokers for the Maltese includes:

- BlackBull Markets

- Pepperstone

- IQ Option

The brokers’ overview:

1. BlackBull Markets

BlackBull Markets is a popular ECN broker headquartered in New Zealand. BlackBull Markets has branch offices around Asia and the United Kingdom.

The broker’s regulators are New Zealand’s Financial Markets Authority FMA and Seychelles’ Financial Service Authority FSA.

Traders can choose between the MT4, the broker’s app, and the MT5 to trade different assets, such as forex, stocks, indices, metals, and energies. The broker offers a free demo that lets you test its platforms before signing up. A $200 minimum deposit is required to trade with BlackBull Markets.

BlackBull Markets’ minimum spread on its raw account (ECN execution) is 0.1 pip, with a $3 charge on commission. Its standard account’s minimum spread is 0.6 pips, with zero commission fee. Withdrawal fees may apply, but no inactivity fee. The broker offers true ECN fast executions with low spreads. Social and copy trading is available through Zulutrade and MyFxbook.

(Risk Warning: Your capital can be at risk)

2. Pepperstone

Pepperstone is a popular ECN broker based in Australia. Pepperstone has several regulated offices around Europe, Africa, and Asia, including Germany, Cyprus, Kenya, Dubai, and the United Kingdom.

Pepperstone’s regulatory bodies are:

- Germany’s BaFIN

- Cyprus-based CySEC

- United Kingdom’s FCA

- Kenya’s CMA

- UAE’s DFSA

- and its home country’s ASIC.

Pepperstone offers world-class trading services on the cTrader, MT5, and MT4. Traders can access various markets, starting with any amount. Pepperstone recommends a $200 minimum deposit. Social and copy trading services are offered through the broker’s partnerships with Zulutrade, Duplitrade, and MyFxbook. Automated trading tools are fully provided. Customers can also test the platforms using the free demo.

Pepperstone’s minimum spread on its razor (raw ECN) account is 0.1 pip. A $3 commission charge applies. The minimum spreads on the standard account are 0.6 pips, with no commission charges. Expect top-quality customer support and rich educational content with the fastest trade execution.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

3. IQ Option

IQ Option is an online broker dealing in forex, binary options (only for professional traders and outside EAA countries), and digital options. The broker is based in Cyprus and has offices in the United Kingdom and Seychelles.

IQ Option’s regulators are the Cyprus Securities and Exchange Commission CySEC and the Financial Service Authority of Seychelles FSA.

The broker provides its trading services on the IQ Option app, a proprietary platform that is uniquely designed for forex and options trading. Traders have to deposit a minimum of $10 before accessing the broker’s services. A free demo is provided for tests and practice. The broker also offers social trading through its platform’s Community Live Deal feature.

IQ Option’s minimum spread is 0.6 pips, and its account offerings are all commission-free. Maltese traders may not have access to binary options (only for professional traders and outside EAA countries). IQ Option is an online broker dealing in forex, binary options, and digital options. But the FX option is a unique instrument designed for EU citizens and offers the same earning potential.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Malta?

Malta is a South European archipelago nation located between Italy and North Africa. The country’s economy is considered advanced and mostly based on communication, tourism, and transport.

Malta has seen reasonable growth in its forex market these last few years. The reason for this is the country’s favorable living costs compared to other European nations. Its tax model is beneficial for businesses and encourages investment and expansion.

The Malta Financial Service Authority MFSA is the country’s financial market regulator. As Malta is an EU member country, the MFSA policies are derived from Europe’s Markets in Financial Instruments Directive (MiFID) framework.

The implication is a secure forex environment for traders. There is ample provision for investor protection, including negative balance protection and compensation schemes. However, traders are not allowed leverage above 1:30 under these regulations.

Malta operates a business-friendly economy that attracts brokers from many parts of the world. Forex and CFD brokers must hold an MFSA license or one issued within an EU member country to transact business with a Maltese trader.

Security for traders in Malta – Good to know

A European Union member, Maltese traders, enjoy investor protection while trading the financial markets. The MFSA ensures a safe forex trading environment by conducting periodic audits on its licensed brokers.

Traders in Malta are safe to deal with any broker operating with a license issued in an EU member country. As these brokers follow the MiFID regulations, they can “passport” trading services to any EU member state.

Maltese traders can deal with local or international brokers regulated within the European Union states. The trader should confirm the broker’s license by checking the regulator’s website.

Is it legal to trade Forex in Malta?

Yes. Forex trading is legal and well regulated in Malta. The Maltese are free to signup with any broker having a license issued within an EU country. This includes MFSA-licensed brokers.

How to trade Forex in Malta – A detailed guideline

Before starting, you need to ensure the basic requirements are in place.

These are:

- Stable internet service with a good device.

- A trusted broker.

Stable and fast internet service is a necessity to trade forex online. A good connection ensures a smooth trading experience. Many brokers’ platforms are compatible with smartphones. Therefore, a mobile phone, computer, or tablet should be used.

Another essential requirement is a good broker offering quality trading services. Poor brokerage service can lead to loss of funds and discourage the trader from the market.

Here’s how to find a good broker:

- Regulations

The broker must be regulated by the MFSA or a well-known financial body in an EU member country and the United Kingdom. Examples of such bodies are CySEC, FCA, and BaFIN.

- Competitive spreads

The brokers’ spreads and fees should be reasonable and fall within the average market range. Some brokers have account types without mark-up but with commission fees. The rates fall between $6 to $7 per lot round turn.

- Free demo account

The broker must offer a free demo account with at least 30 days’ access. Potential customers can see their services before committing with cash.

- 24 customer service

The broker must provide 24-hour support that is easily accessible. Support must be constantly available during trading hours, from Monday to Friday. Many brokers offer multiple language support services that might include the option to switch between Maltese and English.

- Available payment methods

The broker must also provide easy means to deposit funds and withdraw profits from a trading account. Check that the payment options offered are easily accessible in your country. Easy funding and withdrawal are part of a smooth trading experience.

All these requirements indicate that the broker is a standard, reputable broker worth considering.

Follow the steps below to trade forex:

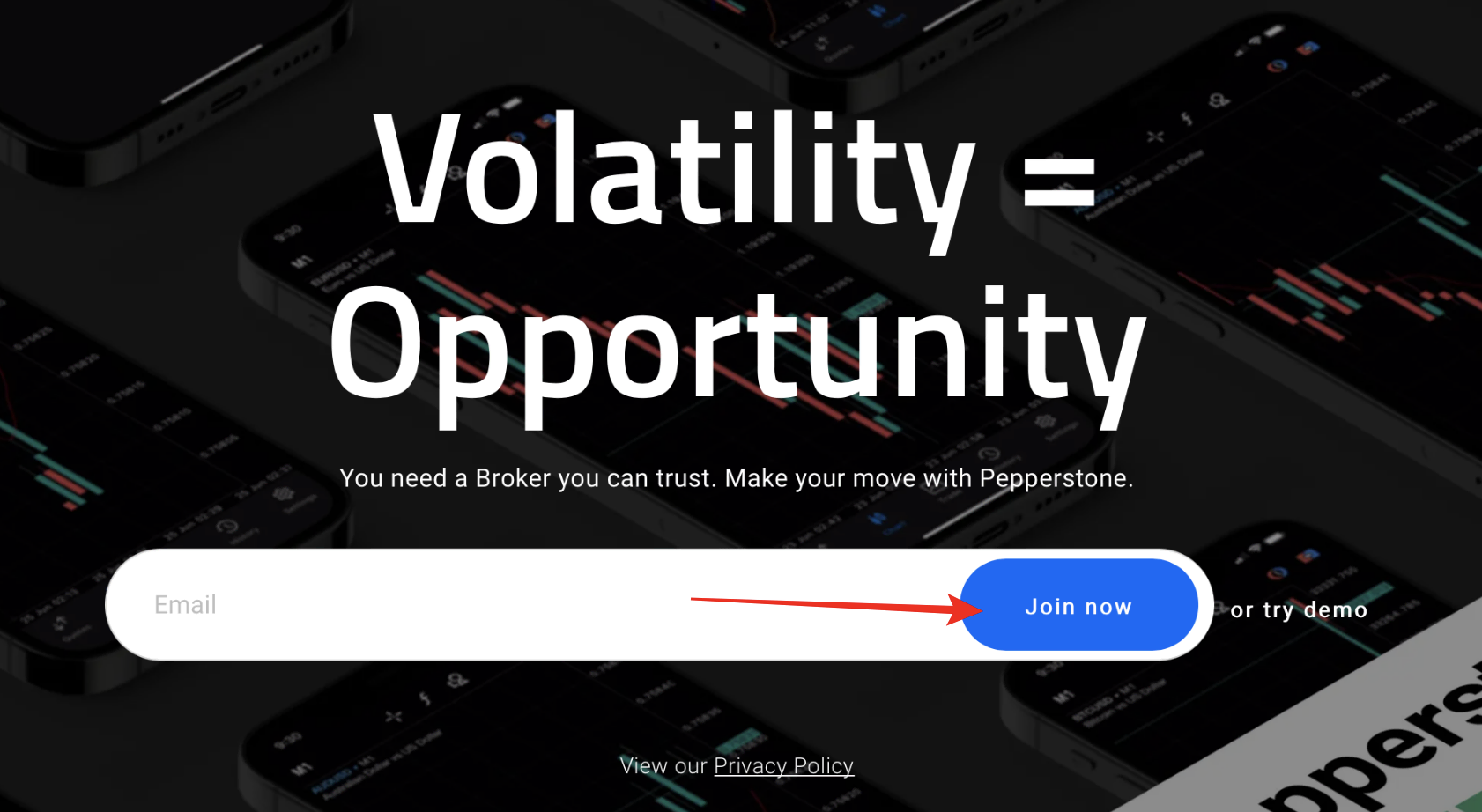

1. Open account for Malta traders

The broker’s website should take you to the webpage meant for Malta. The site will contain services specific to Maltese traders. The signup button will be on an eye-catching display at the top of the page.

Click on the button and enter the required information. This should be your email address and, in some cases, your full name. Once you type in the information and click on signup, the system forwards a message to the email address.

Open your mailbox and click on the link in the message body to verify the details you provided. The detail gets confirmed, and the create account page loads so that you can continue the process.

The broker may request that you scan and upload some KYC documents, such as the Maltese ID card and a utility bill. It is part of the regulations to request and document these details from customers.

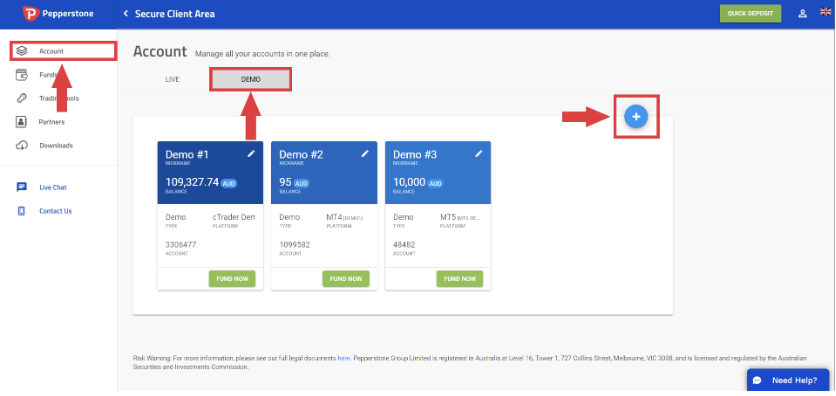

2. Start with a demo or real account

A free demo account should be available to you, which allows you to check out the broker’s services before trading live.

If you’re new in the forex industry, we highly recommend using a demo account first before a real one. It lets you familiarize yourself with the foreign exchange market beforehand.

Before beginning live transactions, you can also get acquainted with the broker’s platform features in a risk-free setting.

The demo account is highly useful for checking out a broker’s services if you wish to change your broker. You can test your trading styles and different strategies without any financial risk.

Some traders prefer to have these tests and practice on a real account instead. Many brokers offer a cent account that allows trading the market with a small amount. We recommend such accounts for tests and practice if you would rather skip the demo.

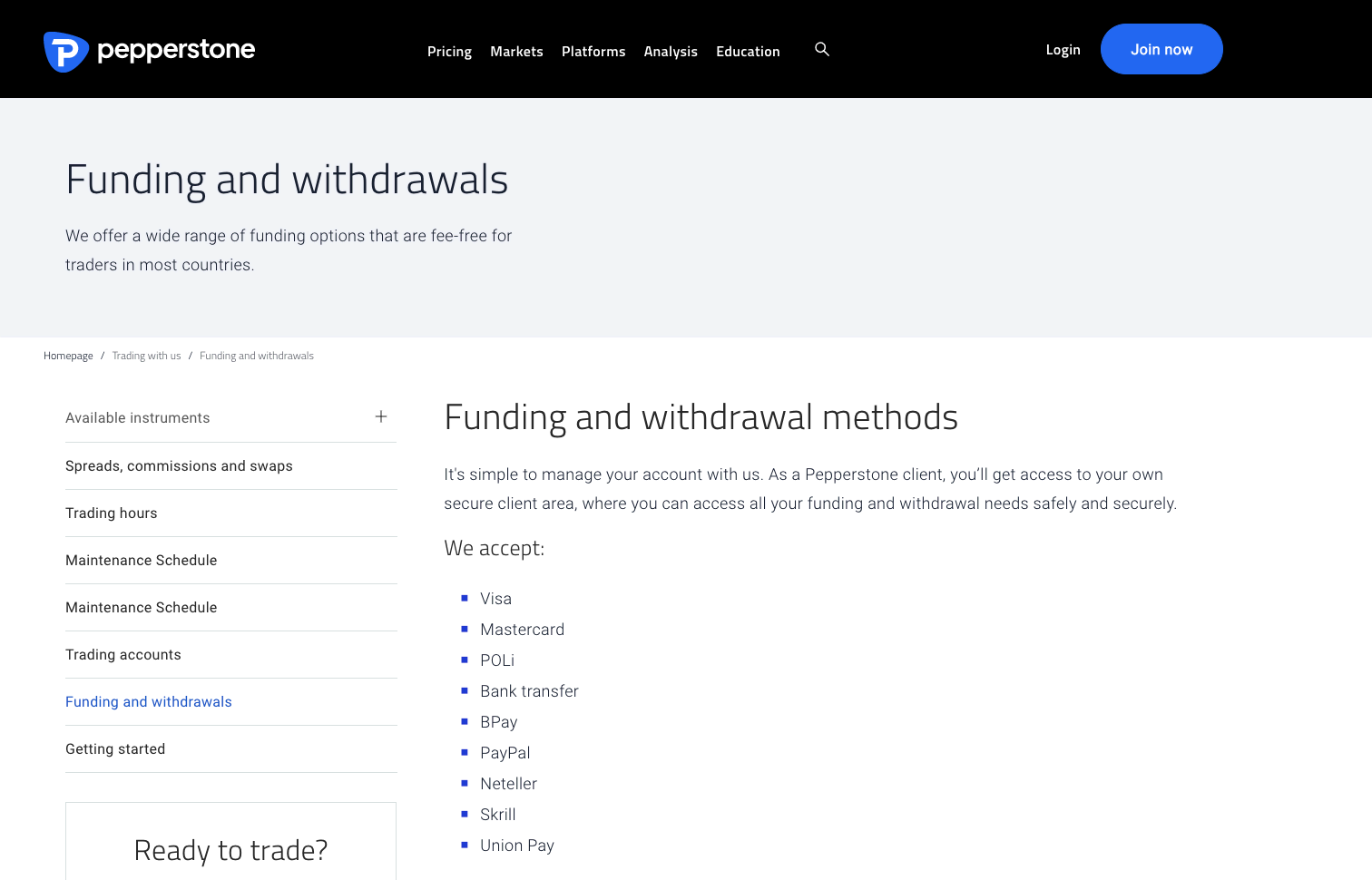

3. Deposit money to trade

If you wish to run tests on a real account or are satisfied with the demo and ready to trade, you should deposit money in the live account.

The broker should offer several common payment methods to make this easy. Click on the funding tab on the platform and select the deposit option to see the methods provided.

Choose the easiest one for you and follow the instructions to fund the account. Once completed, the money should appear on the trading balance within a few minutes.

Many brokers often assign a support rep that assists new customers in the beginning stages of the platform. If necessary, the rep will be on hand to guide you through this process.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Successful trading requires proper market analyses. So before you place a trade, ensure you have perfectly analyzed the currencies’ exchange rates.

Market analyses give you valuable information about the asset and help you make the best predictions about price movements. You will gain insights into past price moves, factors that caused the moves, and the repeated patterns that often take shape in the market.

Here are the three important market analyses in forex trading:

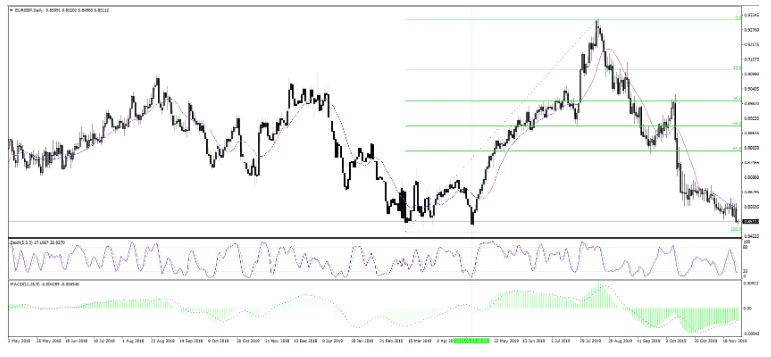

- Technical analysis

- Fundamental analysis

- Sentiment analysis

Technical analysis is about examining past prices to find patterns, which often contain buy and sell opportunities. The trader uses the forex price charts for this study. Many tools are embedded in trading platforms that help with proper technical analysis, including charts, research tools, indicators, etc. The trader learns to use these tools and interpret the patterns they find for a successful technical analysis.

Fundamental analysis is about studying the economies that backs the currencies. The trader has to analyze economic factors such as interest rates, GDP, exports, inflation rate, etc. These factors make up a country’s economy, and a thriving economy equals a strong currency. The trader determines the exchange rate’s movements by analyzing the economy. They can then make good trading decisions based on the analysis result. Platforms often come with tools, including market analysis reports, economic news updates, etc.

Sentiment analysis is about examining the market participants’ behavior and reactions to an asset’s price moves. The trend informs the trader of the current market sentiment. But the trader can anticipate price direction by understanding the participants’ behaviors and how they react to every market move. Brokers’ platform comes with tools that help analyze market sentiment accurately, including the RSI and VIX. Understanding their uses is key to effective sentiment analysis.

These analyses are important to trading the forex market successfully. The trader can determine the best entry and exit points in the market only after analyzing the assets.

The most popular forex trading strategies:

- Price action strategy

Price action trading is among the simplest strategy and does not involve the use of complicated indicators. The trader examines the naked price chart and bases their trade decisions on the information it presents. The trader should know how to interpret candlesticks’ movements since they represent the price directions. Important details to note in price action trading are the price high, low, opening, and closing within a specified period.

- Range trading

Range trading strategies only work in a ranging market and can be ideal for trading the Euro. A ranging market is a condition in which the asset price is neither trending high nor low. The price instead moves within two specific points or a range. The trader needs to identify these points and capitalize on them. The appropriate limit orders must be placed at both points to complete the strategy.

Other effective strategies are:

- Breakout trading

- Fibonacci retracements

- ABCD pattern in forex

- Momentum strategy

- Etc.

The effectiveness of these approaches greatly depends on correctly applying them to trades.

5. Make a profit

Choose the most suitable strategy after conducting the proper analyses. The trades will be successful, and you will be making profits before long.

You can raise your trading amount or move the earnings out of the account. Withdrawing profits should be as easy as depositing funds if the broker makes provision for this. Although, withdrawals take longer to complete processing.

Click on the funding tab again, and this time, select the withdraw option to move funds out. Choose the preferred payment method. Let it be the same one you used for deposits to avoid complications.

Fill out the request form and click on submit. The processing begins, and the funds hit your account within 48 hours from the request time. Depending on the broker, it can take a much lesser time or longer. The payment methods, too, can determine the time length.

Final thoughts: The best Forex Brokers are available in Malta

The Maltese are fortunate to have many well-regulated brokers to choose from. These brokers’ services are basically the same. But small differences in trading conditions and service quality may exist. The brokers recommended herein are among the best and can be trusted for high-quality service.

FAQ – The most asked questions about Forex Broker Malta :

Which forex brokers in Malta offer traders the best trading services?

Several forex brokers in Malta excel in offering quality services to traders. These brokers offer top-class and innovative trading platforms to traders. Traders who wish to access the best of all trading services can sign up with one of the forex trading

platforms.

BlackBull Markets

Pepperstone

IQ Option

What trading platforms do forex brokers in Malta offer traders?

Traders can use all the leading platforms that make their trading experience fun and innovative. The forex brokers in Malta, such as IQ Option, Pepperstone, RoboForex, etc., allow traders to use platforms such as MT4 and MT5. Traders can easily customize these trading platforms to fit their trading needs. Thus, traders can enjoy trading forex with these brokers.

Which currency pairs do forex brokers in Malta offer to traders?

Forex brokers in Malta offer all the leading currency pairs to traders. Thus, traders can trade those forex pairs that they think will make their profit.

The leading currency pairs include the following.

USD/GBP

USD/JPY

USD/EUR

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)