The 5 best Forex Brokers in Mauritius – Comparisons and reviews

Table of Contents

Choosing the best forex broker among too many can be tedious. This is especially true if you live in Mauritius, where many online brokers welcome traders from there. That is why we have reviewed and analyzed several platforms to create this list of the industry’s best.

See the list of the best Forex Brokers in Mauritius:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

5 best forex brokers for Mauritians:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

Below, we give an overview of each’s services:

1. Capital.com

Capital.com is a well-known online broker based in London. Capital.com came into the market in 2016 and now has customers worldwide, including Mauritius.

Capital.com holds licenses in its regulated offices around Europe, including:

Capital.com provides access to various markets, such as forex, CFD, stocks, cryptocurrencies, and indices. Mauritians can begin trading with a minimum deposit of $20. A free demo is offered, and 24 hours customer service on weekdays.

Mauritians can use the MT4 or the Capital.com app to trade in the international market. Tradingview is also available for social trading. Capital.com provides common payment methods for easy deposit and withdrawal. These methods include bank transfer, credit card, and debit card.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets was established in New Zealand in 2013 as an online forex trading broker. BlackBull Markets has offices in the United Kingdom, Japan, Seychelles, and Hong Kong.

BlackBull Markets operates with licenses from:

The company provides genuine ECN trading services through its raw ECN accounts for retailers and institutions. Mauritians can trade assets such as forex, CFDs, cryptocurrencies, ETFs, commodities, metals, and energies. The minimum deposit to trade on its platforms is $200. The broker provides a free demo account for tests and practice.

BlackBull Markets trading services are offered on the MT4, MT5, and the mobile app. The Zulutrade and MyFxbook are accessible for social and copy trading. Mauritians can deposit and withdraw on its platform through bank transfer, Fasapay, and credit and debit cards.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is a global forex broker headquartered in Belize. RoboForex has operating offices in New Zealand, Cyprus, and the United Kingdom. The broker accepts traders from many parts of the world, including Mauritius.

RoboForex holds licenses from:

- IFSC, Belize.

The broker is also a member of Hong Kong’s Financial Commission, an entity that handles arbitration matters between traders and brokers. The organization also provides additional investor protection through a €20000 compensation scheme.

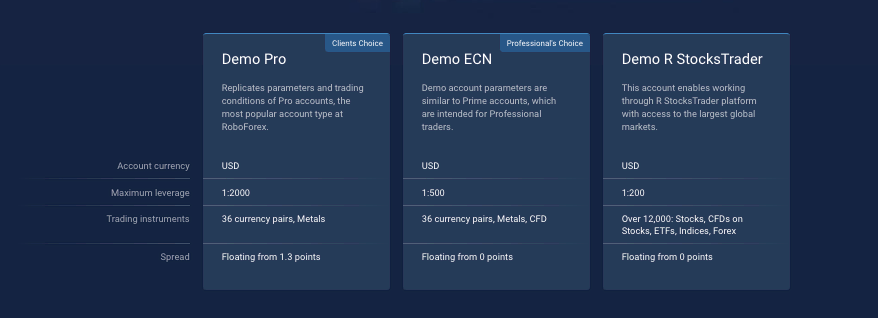

RoboForex offers market access to a wide selection of assets, including thousands of CFDs, stocks, forex, and commodities. The minimum deposit required is $10. A free demo account is available for tests.

RoboForex platform options are MT4, MT5, cTrader, and RTrader. Automated trading is available, and copy trading services are provided through CopyFx. Simple payment methods are available, such as credit cards, debit cards, and bank transfers.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is a popular online forex broker with its head office in Australia. The broker began operations in 2010 and has since spread to many parts of the world. Pepperstone now has offices in Cyprus, Kenya, the United Kingdom, the Bahamas, and Germany.

Pepperstone operates under licenses from these bodies:

- ASIC, Australia.

- CMA, Kenya.

- SCB, the Bahamas.

- FCA, the United Kingdom.

- CySEC, Cyprus.

- BaFIN, Germany.

Pepperstone provides true access to the ECN markets to trade CFDs, forex, stocks, indices, and commodities. The broker does not impose a minimum deposit to use its platform. But $200 is recommended for a rich platform experience. Some traders start with a higher minimum deposit. Others trade with a lesser amount. A free demo account is available with 30 days of access.

Pepperstone provides trading services on the MT4, MT5, and cTrader. The broker supports automated trading. Also, social and copy trading is offered through Duplitrade, Zulutrade, and MyFxbook. Several easy payment methods are provided, including Visa, MasterCard, and bank transfer.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is an online binary option and forex broker based in Cyprus. IQ Option started operations in 2013 as a binary options (only for professional traders and outside EAA countries) broker but has expanded its business. The company has offices in Seychelles and the United Kingdom.

IQ Option operates with licenses from:

IQ Option’s tradeable products now include forex, ETFs, index CFDs, commodities, and metals. The minimum deposit to trade with the broker is $10. The broker offers a free demo to check out its services before signing up.

IQ Option offers its brokerage services on its proprietary platform, the IQ Option app. Social trading is provided through the Community Live Deals feature. Deposits and withdrawals are made easy through Visa, MasterCard, and bank transfer payment methods.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Mauritius?

Even though Mauritius is not one of the economic powerhouses in Africa, many brokers have offices in the country, and many Mauritians are active forex traders.

The Financial Service Commission FSC is the body created by its government to oversee the financial sector. The FSC regulates all financial institutions in the country, except the banking sector.

Forex brokers must obtain the FSC license to operate within the country’s borders. However, the FSC is considered more lenient than other regulators in Africa, Europe, and America. For instance, non-professional traders in Mauritius are allowed leverage up to 1:2000. Whereas Kenya’s CMA allows 1:100, and only 1:30 leverage is permitted in Europe.

The FSC’s license also does not mandate brokers to provide negative balance protection and a compensation scheme. So traders may not enjoy much protection compared to dealing with brokers regulated in Europe or America.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders in Mauritius – Good to know

Brokers operating inside the country must hold an FSC license. Traders looking to deal with a local broker should first check that the broker is FSC-regulated.

However, as we said, the FSC license does not require strict standards and consumer protection. Therefore, its regulation is not enough to prove a broker’s credibility.

Mauritians should use brokers having additional licenses from a top-tier regulator. Financial entities like the FCA, ASIC, and CySEC are top-rated bodies requiring strict standards and investor protection.

Mauritians will be safe dealing with international brokers operating with these licenses. Regulated domestic brokers having any of these licenses are also safe.

Traders can confirm the license validity by checking the regulators’ websites. High-leverage traders should go for brokers that provide negative balance protection.

Is it legal to trade forex in Mauritius?

Yes, forex trading is legal in Mauritius. The FSC regulates the forex sector and issues licenses to brokers operating in the country. Traders using local brokers should check that the broker holds the country’s license.

How to trade Forex in Mauritius – Tutorial

Forex trading in Mauritius, like in every other place, requires three basic tools:

- Internet-enabled device

- Reliable internet service

- A reputable broker

The internet-enabled device can be a mobile phone, tablet, or computer. You should then subscribe to a good internet service provider offering an uninterrupted internet connection. So that trading will go smoothly.

Profitable trading partly depends on the broker too. A good trading service increases the trader’s chance of success. Therefore, it is essential to choose the broker carefully.

Here’s how to spot a good broker:

- License

The broker should hold the proper operating licenses in their regions. Many international brokers have their headquarters in Europe. Check that the broker is regulated there. If the broker has an office in Mauritius, check that they are FSC-licensed in addition to another top-tier regulation.

- Reasonable trading fees

Brokers charge fees for their services in the form of spreads and commissions. Compare these fees and ensure the broker you choose is not charging above the industry average. Trading at high costs reduces your earnings. Consider other non-trading fees, too, and stick with a broker who is fair in their charges.

- A free demo

A free demo account lets you see the broker’s services before depositing money in their platform. Reputable brokers make sure customers and site visitors can test their services before making a commitment.

- Accessible customer service

Good brokers ensure customer service is ever reachable during trading hours. Check that the broker provides 24 hours support service through easily accessible mediums, such as live chat, phone, and email. Email support is sometimes slower. So many brokers also make social media chat support available.

- Simple payment methods

Confirm the payment methods that the broker provides. Ensure it is accessible in the country. Deposits and withdrawals should not be complicated. Good brokers make certain of this by providing easy and common payment methods in the location.

These basic requirements show that a broker is worth dealing with. Check that the broker meets ALL the above before signing up to trade with them.

Follow the steps below to begin forex trading:

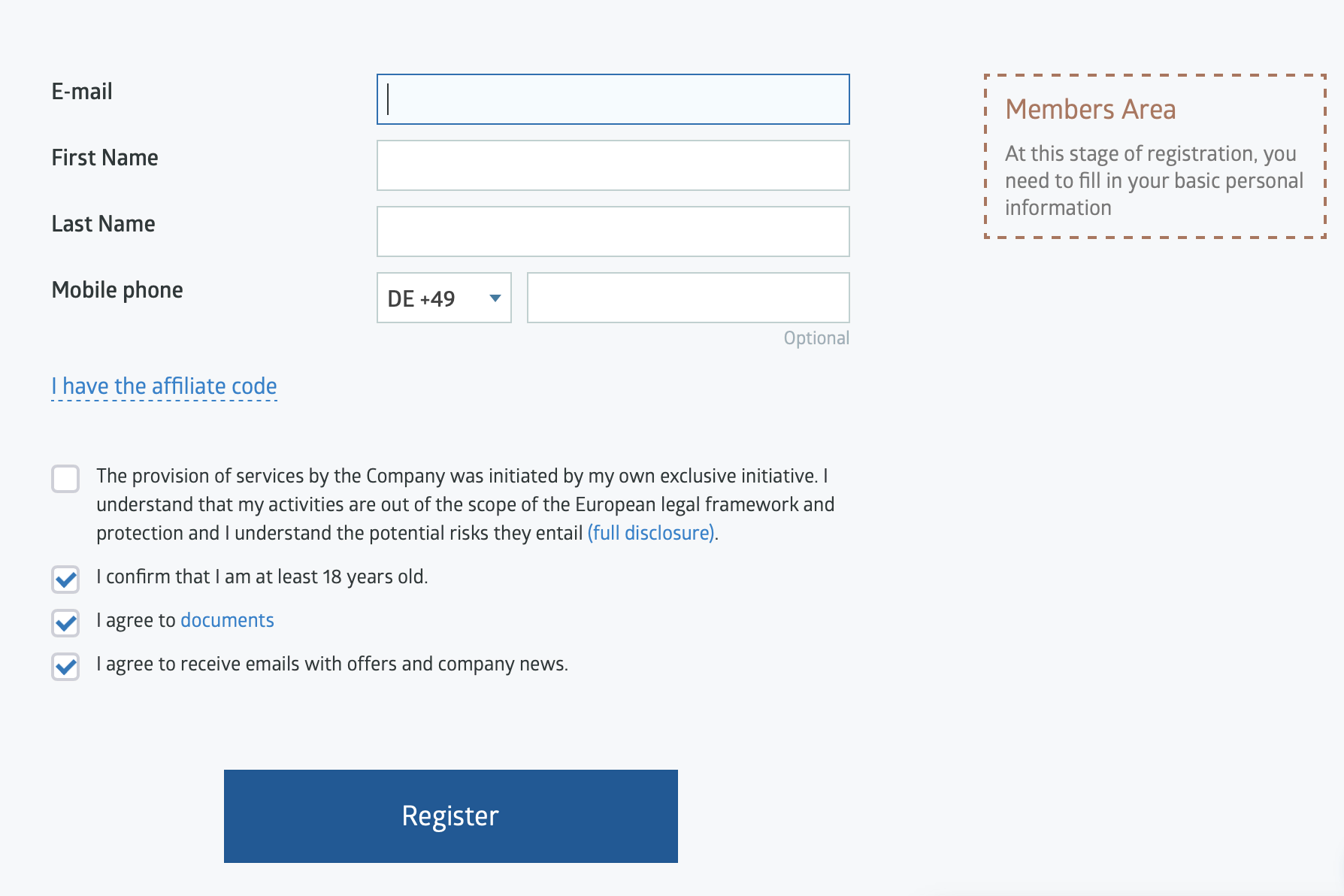

1. Open account for Mauritius traders

Go to the broker’s website to start the signup process. You will get redirected to the website designed for your country as service and offerings differ according to region.

The create account button will be on bold display at the top right side of the page or the center. Click on the button, and the create account box appears.

The broker may only request your email and perhaps, your full name at this stage. Enter the information and click the OK button to proceed.

An automated message goes to the email you provided. This is meant to verify the details you gave before continuing the signup. Open the message in your mailbox and click on the verification link.

The action verifies the details and loads the full signup page so you can complete the registration. Brokers usually request copies of a government-issued ID card and a utility bill showing your address. It is part of the regulation to keep these KYC documents in their records. So be prepared to scan and send these.

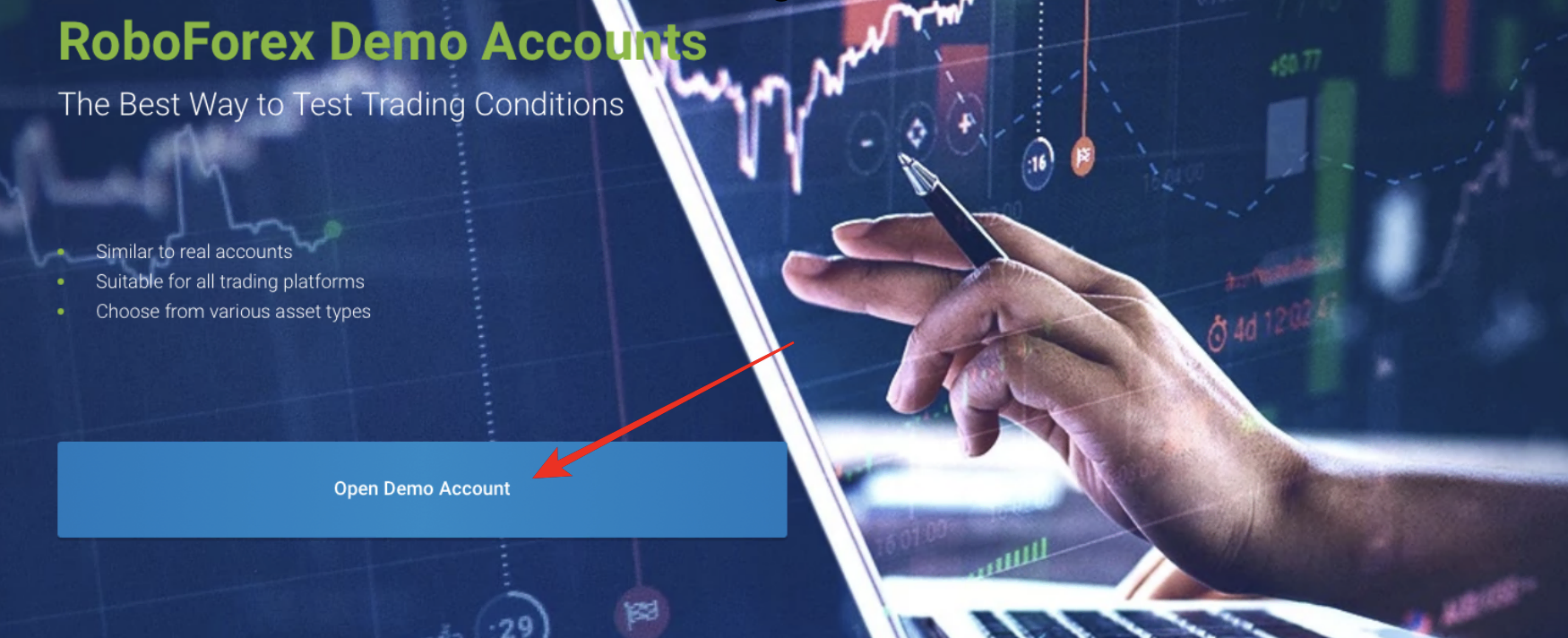

2. Start with a demo or real account

The next step is the test or practice. If you are new to the market, you need to practice trading before doing it for real. The free demo lets you do this as much as you should. Brokers often load the account with sufficient fake money to conduct many transactions.

The free demo account access is granted for no less than 30 days. This is enough time to acquaint yourself with the forex market.

Traders switching brokerage companies also use demo accounts to test a broker before joining them. A free demo is also useful for testing forex strategies you wish to trade with.

3. Deposit money to trade

The third step is to trade on the real account. For this, you need to deposit money. As we mentioned, this process should be uncomplicated if the broker provides common payment methods in the region.

Click on the funding tab on the platform and select the deposit options to see the available methods. Choose your preference and fill out the required details.

Deposits are processed quickly and are often free on the broker’s side. So the funds should reflect in your balance within minutes. Some brokers usually assign a support rep to new customers in the first few weeks. So seeking assistance will be easy if you encounter any difficulty.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

After funding the trading account, the next step is trading. But you have to conduct market analyses before placing a trade. The analysis is necessary to trade the market successfully.

Market analyses show you where the asset’s price has been and its possible future moves. It helps you see the factors influencing the currencies’ values. Trading with market analyses is trading blind and leads to many losses.

These are the two important market analyses in forex:

- Technical analysis

- Fundamental analysis

Technical analysis in forex looks at the past price movements of the currency pairs. Patterns emerge from these movement, showing the trader the best buy and sell opportunities in the market. The forex price chart is a basic requirement in this analysis, and trading platforms always come with it. Many tools are also included in trading platforms that help with technical analysis. That is why it is popularly used in forex. A new trader can easily learn to use these tools by taking advantage of the educational materials on the internet and the trading platforms.

Fundamental analysis in forex is about examining the economy that powers the currencies. Every exchange rates depend on the countries’ economies. Therefore, the trader must examine factors like the interest rate, trade surplus or deficits, gross domestic product (GDP), etc., to gain insight into the currencies’ worth. It helps the trader make informed trading decisions and succeed in the market.

Both analyses are essential to profitable forex trading. The trader can choose the appropriate forex strategies for their assets with these.

Popular forex trading strategies:

- Day trading strategy

Day trading refers to conducting all transactions within the day. The trader exits all positions before the day’s end to avoid overnight risks and fees. Day trading strategy is a popular approach among forex traders. Many find it easier to manage positions daily or in shorter-term time frames.

- Swing trading

Swing trading strategy refers to a longer-term approach where positions are held for longer than a few days. The trader must first identify a trend that will last a specified period before using the strategy. Swing trades are often held for a few days to a few weeks, depending on the duration of the medium-term trend.

- News report trading

Trading the news is a popular strategy in forex. The trader bases all their decision on economic reports. They have to stay updated on forex fundamentals. The strategy requires experience in market behaviors and how the economic news report influences price movements. The trader must study hard before using this strategy effectively.

Many more techniques exist, and they all require effective risk management. The trader must have a good understanding of the strategy they choose to apply it correctly.

5. Make a profit

Trade the forex market using the most suitable strategy after analyzing the forex pair. You should start to see some profits before long.

Once you start making profits, you want to check the broker’s withdrawal processing to see how smooth the service is.

Click on the funding tab once again and choose the withdrawal option. Select the preferred payment method for the receiving account. We recommend using the same method for deposits to avoid complications.

Fill out the request form and submit it. The broker receives this and starts to process the withdrawal. The service takes longer, so don’t expect immediate processing.

The average time length is 48 hours. Some take more time, and others take less. It all depends on the broker and the payment method.

(Risk warning: 78.1% of retail CFD accounts lose money)

Final thoughts: The best Forex Brokers are available in Mauritius

Trading the foreign exchange market in Mauritius is legal and simple if you follow the guide in this article. Choosing a broker might be tough with too many options. But the brief list above should lessen the burden. These brokers meet all the requirements and provide easy and quick registration processes.

FAQ – The most asked questions about Forex Broker Mauritius:

Is forex trading taxable through a forex broker in Mauritius?

Yes, when you trade through a forex broker in Mauritius, you will have to pay taxes on profits. The tax rate can fluctuate over the years; therefore, it is wise to speak with a tax expert before you make an investment and realize benefits.

How does the forex broker in Mauritius gets verified for meeting regulatory requirements?

When you look for a registered forex broker in Mauritius, check the official website of FSC. On their website, look for the register of the firms and type the company/ broker name in the search space. This information lets you know about the broker and their current status. The bottom of the homepage is also where you can find the business name. Further, check any other regulations that your broker might be registered at as follows:

Firms register at FCA (UK)

ASIC (AU) register of firms

ESMA (EU) register of firms

How to begin with a forex broker in Mauritius as a beginner?

As a novice, you ought to pick a brokerage that provides you with a demo account. Getting quality trading experience is crucial to trading on leverage due to higher availability. Demo accounts function just like the real ones for practice without risking your money.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)