The 5 best Forex Brokers and platforms in Mexico – Comparison and reviews

Table of Contents

Foreign exchange, sometimes known as Forex, is the world’s largest financial market. There are several advantages to having a marketplace for all of the world’s currencies.

See the list of the best Forex Brokers in Mexico:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Mexico is one of Latin America’s most active developing markets. As a result of the Mexican peso’s stability and liquidity and the government’s investor-friendly policies, the forex business continues to flourish in the country. Learn the fundamentals of forex trading in Mexico with the best five brokers in the market. They are;

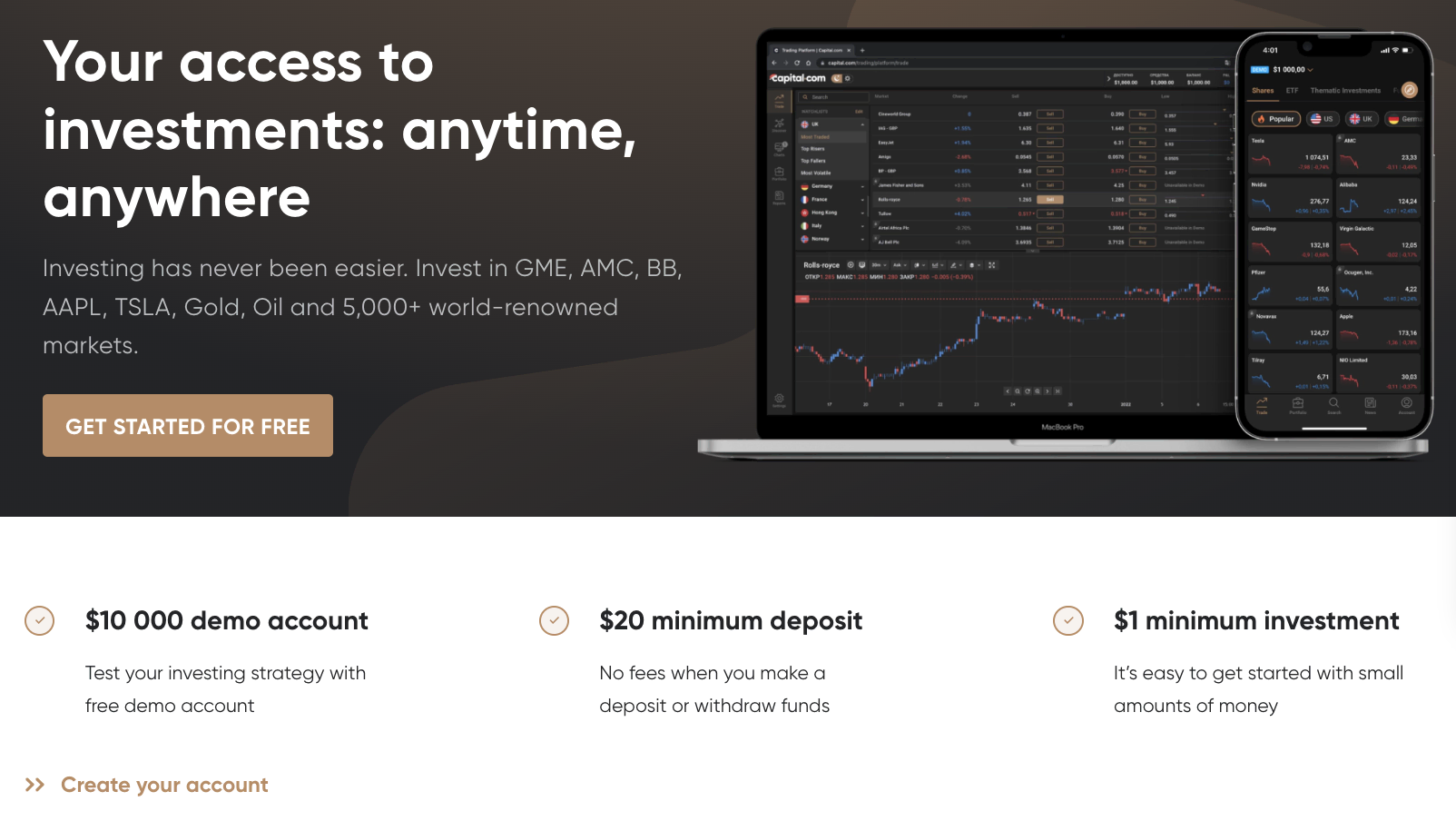

1. Capital.com

Capital.com was created in 2016 and currently has over 500,000 users. The Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, the Australia Securities and Investment Commission (ASIC) in Australia, and the National Bank of Belarus in Belarus all regulate the company.

Capital.com has a solid range of teaching tools for novices, including articles, videos, and a comprehensive training program. This course comprises 28 lectures separated into five sessions, with a final test to measure your progress and financial knowledge.

Traders may pick from a wide choice of assets on Capital.com, allowing them to make well-informed decisions. Stocks, indexes, cryptocurrencies, commodities, and FX are among the alternatives. Customers of Capital.com are well-protected by law, making it a well-regulated and well-liked trading platform.

Capital.com is one of the best brokers due to its technology platform. Traders can utilize the firm’s bespoke trading platform to make educated investment selections since it delivers essential data.

Capital.com provides low-cost CFD and Forex trading. The process of establishing a new account is straightforward. However, the minimum deposit is hefty, at $3000, compared to other brokers. The business gives exceptional customer service, but it also responds promptly.

Capital.com also offers an artificial intelligence-powered smartphone app. Artificial intelligence is also included in the platform, which improves the trading experience. The broker is one of the few that uses technology to help its customers.

Advantages of Capital.com

- Tools for risk management and hedging mode are available

- Live chat and other forms of customer service are available in 24 languages, 24 hours a day, 7 days a week.

- Traders have access to video content which helps with market analysis

- Every trader is assigned an account manager who helps with their trading activities.

Disadvantages of Capital.com

- The desktop trading platform doesn’t have a two-factor authentication system, and the design is obsolete.

- For new traders, the platform is not quite easy to navigate.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a forex and CFD broker fully regulated by the Financial Service Providers Register of New Zealand (FSPR). More than 20 foreign currency pairings, six leading stock indices, and the prominent commodities gold, silver, and WTI & Brent oil are among the trading instruments available, which may be traded on the original MetaTrader 4 (MT4) or the newer MetaTrader 5 (MT5) platforms.

BlackBull Markets was created in 2014 by a consortium of fintech developers, FX traders, and data security experts. This platform is a fantastic location to start trading metals, commodities, indices, energy, and CFDs.

When you initially start trading with BlackBull Markets, you’ll find that the broker offers a modest price structure and excellent trade execution.

A trader can conduct lucrative trading without pain or regret by selecting an enormous asset. BlackBull Markets is a premier broker for seasoned traders, offering a secure and highly risk-free trading environment.

API is the most significant feature offered by this broker. It links sophisticated trading platforms with algorithmic traders. This broker also offers a free VPS hosting option for ECN Prime accounts with a trading volume of more than 20 lots.

They are a dependable Electronic Communication Network (ECN) broker with a No-Dealing Desk (NDD) and Straight-Through Processing (STP) technique (STP). Global partners’ prime liquidity providers offer deeper poo liquidity and more market depth.

Merits of BlackBull Markets

- Free virtual private servers (VPS) and API trading are available.

- Deposits at BlackBull Markets are free of charge.

- Traders have direct access to trade on MetaTrader 4 and MetaTrader 5

Demerits of BlackBull Markets

- The broker does not provide investor protection.

- The customer service team is not available 24/7

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex has been focused on offering the most acceptable trading conditions utilizing new technology and many years of expertise since its inception. RoboForex is a global broker with over 12,000 trading products and eight asset classes.

They pride themselves on the range of services they provide their clients and partners, all of which are of the same high quality, regardless of their level of expertise or investment.

Around 800,000 consumers from 170 countries use RoboForex. Due to the broker’s assistance in 18 languages, the language barrier is significantly reduced.

RoboForex has made every effort to break through any barriers between clients, regardless of whether they are from outside or inside the nation, whether they are new to trading or have years of expertise.

RoboForex offers a variety of educational opportunities and the opportunity to refine your skills and engage in trading contests, all of which will help you increase your level and abilities. Members get access to market analysis, technical analysis, professional trading analytics, and several tools in the Members section.

Trading platforms such as MT4, MT5, and cTrader are available from RoboForex. MT4 is a well-known, multi-functional trading platform used by millions of traders every year. Despite its superior features, MT5 is less widely used than MT4.

Both platforms provide excellent trading features. The most popular ECN platform still trades.

RoboForex’s MT5 platform is less popular than MT4 since it lacks backward compatibility and does not allow for hedging. With a variety of new features, this platform has been extensively improved. However, it still falls short of the MT4 platform.

Minimum deposits vary by region, but RoboForex also provides several choices to assist traders in better comprehending the RoboForex trading idea.

RoboForex strives to provide its platform with a risk-free investment environment for all users. They’re demonstrating that they’re a trustworthy individual. In the last several years, their popularity has soared to unprecedented heights.

Advantages RoboForex

- Negative balance protection is used to protect your deposits from losses.

- RoboForex has a 0% commission policy for deposits and many withdrawals, which means that all costs are covered.

- They offer very tight spreads starting at 0 pips

- All orders are executed fast

Disadvantages RoboForex

- A minimum deposit of $10 is required.

- Only a small number of cryptocurrencies are available.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone makes market access simple, letting clients focus on the more difficult task of profitably trading the markets. Pepperstone is an excellent choice for traders who want a limited number of low-cost alternatives, a range of user interfaces and account kinds, and prompt customer support.

Since its start in 2010, Pepperstone Group has become a top-tier participant in the online brokerage sector, having established a highly competitive and feature-rich trading platform that focuses on forex, stocks, indices, metals, commodities, and even cryptocurrencies.

The FCA, ASIC, CMA, BaFin, SCB, and DMSA regulate the broker. Market data and insights from Pepperstone are up to date according to industry standards, and they assist traders in connecting with the market and supplementing instructional resources.

The broker outperforms the great majority of global forex brokers with its lightning-fast execution methods, different account types, competitive pricing, and multiple platforms (MT4 and MT5, as well as comprehensive cTrader functionality).

Pepperstone offers some of the most competitive commission rates in the online brokerage industry. The “Standard” account, which has minimum FX spreads starting at one pip, but no commission, and the “Razor” account, which has minimum FX applies starting at zero pips but commission, are available to new clients. On Pepperstone’s other instruments, the spreads are either straight or a combination of distance and commission.

Pros of Pepperstone

- Pepperstone’s dual offering of MetaTrader and cTrader is ideal for automated traders and copy traders.

- Pepperstone offers a variety of platform add-ons to improve the MetaTrader experience.

- They provide effective customer service to traders

- The withdrawal and deposit process is seamless

Cons of Pepperstone

- There is a high withdrawal cost for clients outside the EU/Australia.

- There isn’t any basic information provided for research

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a multi-award-winning trading platform that has been praised and recognized by industry leaders. It offers a flexible platform that allows you to adjust anything from the chart type to the color scheme to match your specific requirements.

Using a variety of payment methods, instant withdrawals are available. Furthermore, you will always have access to a team of fluent specialists in your native tongue.

The trading platform IQ Option is well-known. It has a simple and intuitive user interface that caters to the needs of even the most discriminating traders. On the IQ Option platform, clients may trade over 500 assets, including currencies, indexes, commodities, and stocks.

To assist investors on their way to prosperity, the company developed a trading tool called IQ Option trade pattern. A tool, which you may access through the website, has the potential to have a substantial influence on the result of your investment.

IQ Option trading patterns provide video tutorials for almost every trade pattern accessible. In a short length of time, everything you need to know about employing such practices can be learned from the device. The device is easy to locate because it is next to the trading platform.

Despite being a relatively new player in the Binary Options business (only for professional traders and outside EEA countries), IQ Option is known for always searching out new binary options technologies to improve. The platform offers both a desktop solution and a mobile app to aid investors in evaluating markets and benefitting from them. It prides itself on its ease of use, making binary options trading a joy.

Merits of IQ Option

- The Real Account has a low minimum deposit requirement.

- A VIP account comes with unique advantages such as increased profitability, dedication to the account officer/manager, private tutoring, exclusive training materials, and much more.

- Traders have access to customer support 24/7

- High-profit potential when trading binary options (only for professional traders and outside EEA countries)

Demerits of IQ Option

- Traders from outside the EU can participate in trading competitions.

- Only the in-house IQ Option trading platform is available.

(Risk warning: Your capital might be at risk.)

Is it legal to trade Forex in Mexico?

Trading Forex pairs are legal in Mexico. Thus investors may readily enter the foreign exchange market. On the other hand, most local brokers focus on providing their clients with access to the stock markets rather than offering Forex trading.

Mexican traders can also register with overseas FX and CFD brokerage businesses, which do not require other authorization from local regulators to operate freely in the country. Nonetheless, numerous agencies, notably the Central Bank, oversee the Forex market in Mexico.

Import and export, as well as international investment, necessitate the use of foreign currency. When trading Forex, it’s crucial to use a licensed, safe, and well-known broker. Forex trading is permitted in Mexico, and several foreign online brokers provide appealing trading conditions.

When trading, you should be aware of the notion of leverage. Brokers dealing in high-leverage transactions in Mexico might make a lot of money. However, this has the potential to result in significant losses.

Negative balance protection and stop-loss accounts are two forms of protection offered by some Mexican brokers.

Colombians allow forex trading because it is necessary for doing business and exchanging currency. Import and export, as well as international investment, necessitate the use of foreign currency. When trading Forex, it’s crucial to use a licensed, safe, and well-known broker.

What are the financial regulations in Mexico?

Banks, financial institutions, mortgage financing institutions, finance lease institutions, credit reference bureaus, and bureau de change are all regulated and supervised by the Bank of Mexico.

Consumers are protected by financial regulation. Inadequate broker regulation leads to poor service and the possibility of financial loss. To prevent fraud, Iran’s brokers are regulated.

Working capital for the agency and a customer-funded account must be maintained separately. When client funds are used to do business, fraud happens. To prevent this from happening, legislation is essential.

The purpose of these Financial Regulations is to offer direction to those in charge of the Authority’s finances, including authorization, approval, receipts, custody, and payments, whether income or capital.

The government created these financial standards to help keep your money and assets safe and secure. There is the opportunity for transparency, freedom of choice when picking a broker, and understanding the financial industry’s dos and don’ts as a new broker in the forex market.

Bank laws and regulations are government laws and regulations that, among other things, bind banks to specified standards, restrictions, and norms to maintain market openness between banking institutions and the individuals and enterprises with which they do business (intending to preserve the integrity of the financial system).

Security for Mexican traders

As more people take charge of their own investments or interact with brokers remotely rather than in person or over the phone, online trading is becoming more popular. At the same time, cyber-attacks are on the rise as hackers attempt to exploit system flaws in order to steal identities and even money.

You can secure your trading account with the following steps;

Do not give anyone your online account’s login ID and password. Keep a watch on your online account and keep a tight eye on any transaction paperwork. To review all transactions swiftly, log into your online account on a regular basis or when you receive an e-statement alert from your broker.

Be wary of any transactions that appear to be suspicious or unapproved. Create a strong password that has at least 8 alphanumeric characters. Change it on a frequent basis to avoid using the same password twice.

When an unexpected pop-up screen or window appears, when your computer responds slowly, or when unexpected actions or information are requested, don’t log in to your online account. Don’t utilize a public computer or an unfamiliar and insecure network connection to access your online account.

Activate the auto-lock feature on your computer or mobile device; install reliable anti-virus, anti-spyware, and anti-malware programs, keep them up to date as new versions are released, and set up a personal firewall. Make sure your operating system, apps, software, and browser are all up to date. Ensure that your software is up to date.

How to trade Forex in Mexico – An overview

Open account for Mexican trader

On the forex broker’s website, you may create a new account. To open an account with some forex brokers, you must make a minimum deposit. These brokers also provide several different account types, each with its minimum deposit and spread width. Choose the one that is most relevant for you.

Open a trading account for spread betting or contract for difference (CFD) trading. You may open a real or demo account to trade the price variations of currency pairings.

(Risk warning: 78.1% of retail CFD accounts lose money)

Start with a demo account or real account

Traders can use a demo account to replicate a natural trading environment without risking their actual money. It will assist traders in getting started with free online trading and practicing before investing real money.

On the forex broker’s website, you may create a new account. To open an account with some forex brokers, you must make a minimum deposit. These brokers also provide several different account types, each with its minimum deposit and spread width. Choose the one that is most relevant for you.

Deposit money

After you’ve opened an account, you’ll need to transfer money to begin trading forex. Depending on the broker you pick, you may choose your currency and fund your account in various ways. Wire transfers, debit cards, and electronic payment systems like Paypal and Skrill are popular ways to fill your account.

Simply enter their credit card information into their FX accounts, and the monies will be available within one working day. Investors can utilize an existing bank account, a wire transfer, or an online check to finance their trading accounts.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Retail forex traders take advantage of forex analysis to determine whether to buy or sell currency pairs. It might be complicated, needing the use of charting software. It can be fundamental, depending on current events and economic statistics.

Some of the strategies used are;

Swing Trading

Swing trading is a trend-following approach that seeks to profit on short-term price momentum spikes. When it comes to swing trading, traders try to capture profits from short-term profits to medium-term profits. This takes place within a couple of days or some weeks, as the case may be.

Scalping

Scalping is an intraday trading method in which traders buy and sell currencies with the intention of squeezing modest profits out of each transaction. Scalping tactics in forex are typically based on a continuous analysis of price movement and an understanding of the spread.

Day Trading

Day traders earn their designation by concentrating primarily on intraday price swings and profiting from the volatility.

Retracement Trading

A retracement occurs when the price reverses course for a brief period before continuing in the dominating trend’s direction. Traders use technical analysis to spot prospective retracements and separate them from reversals.

Make Profit

With the help of a broker, make a foreign exchange contract. Make forex transactions according to your plan, with predetermined entry and exit locations. When trading, remember to use risk management conditions such as a take-profit or stop-loss order.

Close your shop and give it some thought. Stick to your trading plan and exit the market when your predetermined stops have been achieved. Think about how you performed so you may improve with each trade you make.

Conclusion: The best Forex Brokers are available in Mexico

Forex trading is the way of the future worldwide, and you can get started in Mexico with a variety of firms and platforms. Before jumping into the forex market as a newbie, it’s always a good idea to investigate the finest brokers to deal with and adequately analyze the forex market.

However, you should continue with caution and ensure that you are well-versed in the fundamental and technical research of the currency market. In addition, you should have a well-thought-out and tested trading strategy. Find out everything you can about risk management.

You can make a solid living in the foreign exchange market if you practice and follow excellent risk management when it comes to forex trading.

FAQ – The most asked questions about Forex Broker Mexico :

How can I go for a reliable forex broker in Mexico?

Mexican citizens should choose a broker that accepts deposits made in pesos from Mexico and has a Spanish-language website and phone support.

The top online brokerage companies will also include the following attributes for your convenience:

1 Trading in all significant and minor currency pairs

2 An excellent track record with customers

3 An established track record with clients

4 A reasonable deposit amount

5 The maximum leverage ratio that is compatible with your trading strategy and risk tolerance

6 Easy methods for depositing and withdrawing money

7 Protection from negative balance

8 Customers can expect a smooth investment portfolio owing to competitive processing fees and dealing spreads.

Which trading instruments can I use in forex broker Mexico?

Nearly all trade goods can be bought or sold in Mexico. Options and contracts for difference (CFDs), which are tightly regulated in Europe and the US, are permitted to be traded freely there. Investors can trade stocks, bonds, and other kinds of securities, as well as test their skills in the derivatives market.

What do financial regulators in forex broker Mexico do?

The Central Bank of Mexico (Banxico) is in charge of, among other things, managing and preserving the stability of the Mexican peso, which is the nation’s official currency. Another regulatory body oversees Mexico’s financial sector, the National Banking and Securities Commission or CNBV.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)