The five best Forex Brokers and platforms in Morocco

Table of Contents

Forex trading requires the trader to have experience trading and be disciplined and patient. Besides that, it also needs you to have a good forex broker with industry-standard trading resources, credibility, and low trading costs. Here are five of the best forex brokers you can work with if you are a trader in Morocco.

See the list of the best Forex Brokers in Morocco:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The five best forex brokers in Angola:

1. Capital.com

Capital.com has been operating since 2016, and since then, it has registered over 5 million trading accounts.

Trading instruments – traders can access Indices, stocks, commodities, cryptocurrency, and forex.

Regulation – it has trading licenses from CySEC, ASIC, FCA, and NBRB.

Account types -The Premier has an initial deposit of $10,000, Plus with $2000and Standard account with $20.

Fees – forex spreads start at 0.8 pips.

Trading costs – it has no commissions regarding inactivity costs. The deposits and withdrawals are also free, and the overnight costs apply based on the size of the open position and the number of nights.

Leverage – EU clients have a limit of 1:30, while the other regions can access 1:500.

The demo account – it is unlimited and has $10,000 virtual funds.

The trading platforms – it has a web trader and the MT4.

Payment methods – clients can select from ideal, Trustly, 2c2p, Giropay, Sofort, credit/debit cards, and bank transfers.

Customer care – the support team is available 24/7 through telephone, live chat, and emails. It supports 13 languages.

Pros

- Low trading costs

- Quality trading tools

- Fast order processing speeds

- The fast account registration process

- Negative balance protection

Cons

- Limited learning and research resources

- High initial deposit for the premier account

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets has thousands of forex traders registered since it launched in 2014.

Trading instruments – traders can access energies, indexes, commodities, metals, CFDs, shares, and forex.

Regulation – it has regulation from the Financial Services Authority.

Account types – it has three types the ECN standard with an initial deposit of $200, ECN Prime has $2000 while the ECN Institutional has $20,000.

Fees – the ECN institutional has forex spreads from 0.0 pips, ECN Standard starts from 0.8 pips, and the ECN Prime from 0.1 pips.

Trading costs – the ECN standard has no commissions; the ECN Institutional also has variable commissions. The overnight costs apply, and deposits and withdrawals are free.

Leverage – the maximum leverage is 1:500.

Demo account – it has an unlimited demo account.

Trading platforms – it offers MT4 and MT5.

Payment methods – it supports Fasa Pay, Neteller, bank transfers, credit cards, UnionPay, and Skrill.

Customer support – the support team is available 24/6 through live chat, emails, and telephone.

Pros

- Low trading cost

- High leverage rates

- A Fast account registration process

- Fast deposits and withdrawals

- Industry-standard trading resources

Cons

- Limited educational and trading resources

- Customer care is only present 24/6

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex has been in the industry since 2009 and has registered one million trading accounts.

Trading instruments – it offers stocks, forex, CFDs, commodities, energies, ETFs, metals, and cryptocurrencies.

Regulation – it has regulated by the Financial Service Commission.

Account types – it offers five types, Prime, ECN, Pro, and Pro-cent, with an initial deposit of $10, while the R-stocks trader has a minimum deposit of $100.

Fees – the Pro and Pro-cent have forex spreads from 1.3 pips while the R-stocks trader starts at 0.01 dollars, and the Prime and ECN accounts start from 0.0 pips.

Trading costs – An inactivity cost of $10 for inactive accounts of more than ten months; the commission is low. The deposit and withdrawals are free, and overnight charges apply.

Leverage – the highest leverage is 1:2000 for the Pro and Pro-cent; the ECN account has a limit of 1:500 while the R-stocks trader and the Prime account have 1:300.

Demo account – the demo account is unrestricted.

Trading platforms – it has four types: the r-stocks trader, c Trader MT4, and MT5.

Payment methods – it accepts Skrill, Neteller, Perfect Money, bank transfers, debit or credit cards, AdvCash, AstroPay, and NganLuong wallet.

Customer support – it supports 11 languages and is available 24/7 through live chat, email, and telephone.

Pros

- Fats account registration

- Fast deposits and withdrawals

- Low trading costs

- Low initial deposits

- Negative balance protection

- Quality trading resources

Cons

- Limited trading instruments

- It is not available in some regions

(Risk Warning: Your capital can be at risk)

4. IQ Option

IQ Option started its operations in 2013 and has registered over 40 million forex traders.

Trading instruments – It has Binary Options (Only for professional traders and outside EAA countries), CFDs, Cryptocurrencies, commodities, stocks, and forex.

Regulation – it has regulations from the Cyprus Securities and Exchange Commission.

Account types – It has two the Standard and the VIP account; the Standard has $10 as the initial deposits and varies on the VIP account.

Fees – the forex spreads vary with the liquidity of the trading instrument.

Trading costs – it has overnight rates ranging from 0.1-0.5%, the commissions are low for other treading instruments, but cryptocurrencies have 2.9%. Deposits and withdrawals are free, while the inactivity fee of $10 is charged when a trading account remains g=dormant for more than three months.

Leverage – the highest leverage is 1:500

Demo account – its demo account is unrestricted and has $10,000 virtual funds.

Trading platforms – it uses its proprietary trading platform.

Payment methods – traders, can transfer funds through bank transfer, Web Money, Neteller, Skrill, Cash U, and Money Bookers.

Customer Support – Customer support is available through emails and live chat.

Pros

- Low trading costs

- Fast order processing rates

- Fast deposits and withdrawals

- Fast order processing speeds

Cons

- Limited research materials

- Limited trading instruments

(Risk warning: Your capital might be at risk.)

5. Pepperstone

Pepperstone has been in the market since 2010 and has registered thousands of trading accounts.

Trading instruments – forex, ETFs, Indices, stocks, shares, and commodities.

Regulation – it has regulations from the ASIC and the FCA.

Account types – traders can select from the Razor or the standard account with $200.

Fees – the Standard account has forex spreads from 1.3 pips, while the Razor account is from 0.0 pips.

Trading costs – the standard account has no commission, while the razor account charges $7 for every $100,000. It has no inactivity costs but the rollover costs apply for overnight trades. Deposits and withdrawals are also free.

Leverage – the highest leverage is 1:400

The demo account – Pepperstone has a limited demo account of thirty days after registration but has virtual funds worth $50,000.

Trading platforms – traders can select from the MT4, MT5, or the cTrader.

Payment methods – it accepts UnionPay, PayPal, Neteller, Skrill, bank transfers, and credit and debit cards.

Customer care – customer support is available 24/5 via live chat, emails, and phone calls.

Pros

- Fast Order processing speeds

- Fast deposits and withdrawals

- Industry-standard trading resources

- Risk management tools

Cons

- Limited learning resources

- Customer care is only present 24/5

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Forex trading in Morocco – What you need to know

The economy of Morocco is among the leading in Africa, ranking 5th. Its forex industry is also growing at a rapid rate. The main economic activity in Morocco is Agriculture, tourism, and mineral resources. The capital market in Morocco has been active since the 1980s.

In 1993, Morocco began modernizing the securities and stocks exchange sector. They set up new firms such as brokerage firms and stock exchange markets. As the capital markets grew in the following years, so was the need to increase regulation.

Like the forex industry in the rest of the world, morocco also has its fair share of frauds that operate like legitimate forex brokers. Morocco created the Capital Markets Authority, also known as the (CDVM) an agency that helps regulate market participants.

The CDVM had major changes in 2004 when it gave it more control over the capital markets. In 2013, CDVM was given more Authority and began its change into the Moroccan Capital Market Authority (AMMC) and given control over more trading instruments and other market participants.

CDVM entirely changed to the AMMC in 2016 and has been regulating the securities and exchange markets since.

Is it legal to trade Forex in Morocco?

Yes, it is legal to trade in the capital market if you are a resident of Morocco. Traders can choose from a local forex broker regulated with the AMMC or an offshore broker regulated by one of the reputable forex regulatory organizations outside Morocco.

Choosing a regulated broker when trading forex in any country is important. We recommend having an offshore broker with regulations from tier-one, two, or three jurisdictions that ensure the security of funds and investor protection.

What are the financial regulations in Morocco?

The AMMC is an independent organization that the government of Morocco has given the Authority to regulate the securities and exchange markets.

Dahir launched it according to Moroccan laws of forex and has a mission to:

- Protect investments done in trading instruments.

- Ensure fairness and transparency in the forex market.

- Make sure that the forex market is running efficiently.

- Prevent money laundering through the financial markets by monitoring activities and ensuring compliance with laws created to regulate financial markets.

- Generate awareness and educate individual prospects interested in forex trading.

- Work with the government to regulate the financial sector in Morocco.

- Some regulations created and implemented to meet its functions include;

- Ensuring that the market participants such as traders, financial advisors, and financial dealers maintain an ethical code of conduct when trading any asset through circulars according to international standards.

- It states that the forex brokers, financial advisors, and other financial dealers must meet to get licensed and operate in Morocco.

- It ensures the organization’s standards looking for licensing approval are per the international standards. These include the agency’s technical, financial, and experience that meets the industrial standards to be approved by the finance ministry to operate in Morocco.

- Ensuring that forex traders or investors in the financial markets get enough relevant information through controlling the information provided to the public by financial dealers and brokerage firms.

- It also ensures that forex investors have adequate information from financial issuers about an investment to help them make informed decisions. It does this by ensuring the consistent release of information to investors.

- Ensuring quality of services provided by forex brokers, stock exchange operators, traders, and financial companies. A thorough inspection of the company and ensuring they collect relevant documents and present them to the AMMC for audit.

- Investigate complaints from traders about suspicious trading activities and verifies the wrongdoing before acting, such as imposing penalties and sanctions.

Security for traders from Morocco

The AMMC has placed the necessary guidelines against infringement of investor rights. By ensuring the proper service provisions for financial firms, including forex brokers, through frequent audits and inspections.

It has maintained strict regulation by ensuring that forex brokers that operate in Morocco are licensed. Forex traders and other investors in the securities markets also have enough information from their forex brokers before making any trading decisions.

(Risk warning: 78.1% of retail CFD accounts lose money)

Analysis and strategies to use when Forex trading in Morocco

Forex traders trade forex for different objectives, but the main goal is to profit. It implies that you have to plan how you intend to trade to make profits. The primary principles of making a profit are applying trading strategies and understanding the market through analysis.

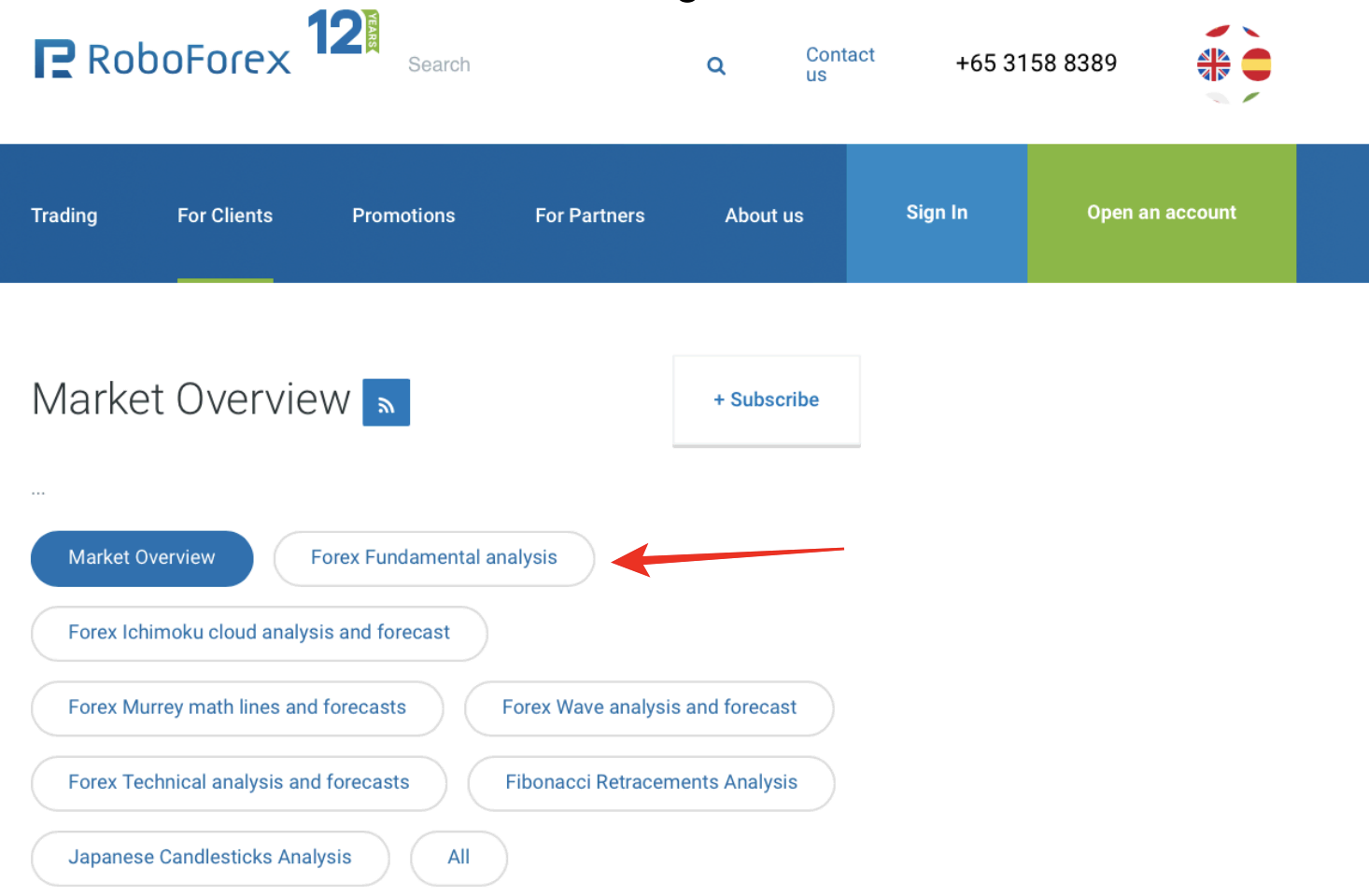

Analysis

You can analyze the market using two methods technical and fundamental analysis.

Technical analysis requires you to utilize trading tools such as technical indicators to evaluate the market trends, volatility, and liquidity. You can also study the previous activity of the price action by looking at the previous price charts to know how it moves in particular influence.

Fundamental analysis studies the factors that influence the price actions, such as the economy of a country, GDP, employment to unemployment ratio, trade, and political and economic status. These factors influence the price movements of financial assets, especially currency pairs.

Trading strategies

Some trading strategies you can apply when trading forex includes;

News trading consists of waiting for a major financial announcement that will cause volatility and go short or long depending on how you expect the price action to move.

Trend trading – is finding a trend in the price action, such as a downtrend and shorting to profit. You can also find an uptrend and go long, and it is a trading strategy that many traders use.

Scalping – this trading strategy is mostly used by experienced traders and involves trading the small movements that appear in price action. It requires a trader to be fast and keen since it needs more wins than losses if you want to profit from trading.

How to trade Forex in Morocco – A quick tutorial

Find a regulated Forex broker

If you want a reliable forex broker, you need to research forex brokers available in Morocco. Based on your conditions, you can choose from local forex brokers and international brokers. Some features to consider include the regulation, customer support, trading costs, trading features, and trading platforms.

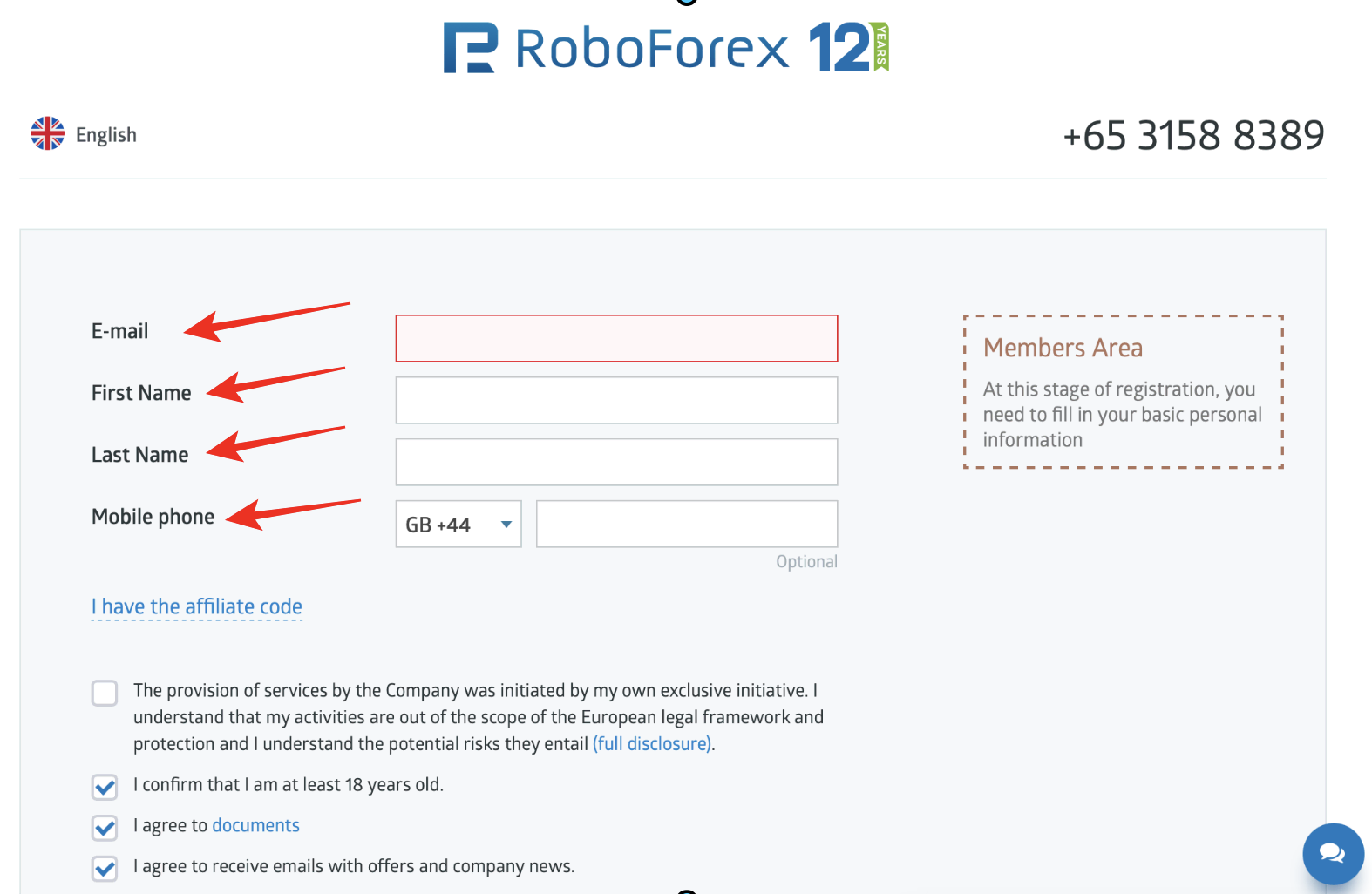

Register a trading account

If you found a forex broker you prefer, register a trading account with the registration form provided on its website. The registration process should be simple and fast, taking about three to five minutes. It requires you to submit information about yourself to create a trading account.

Registering a trading account includes name, email, citizenship, phone number, account type, and password. They may need you to submit a copy of your national ID and a utility statement for verification purposes.

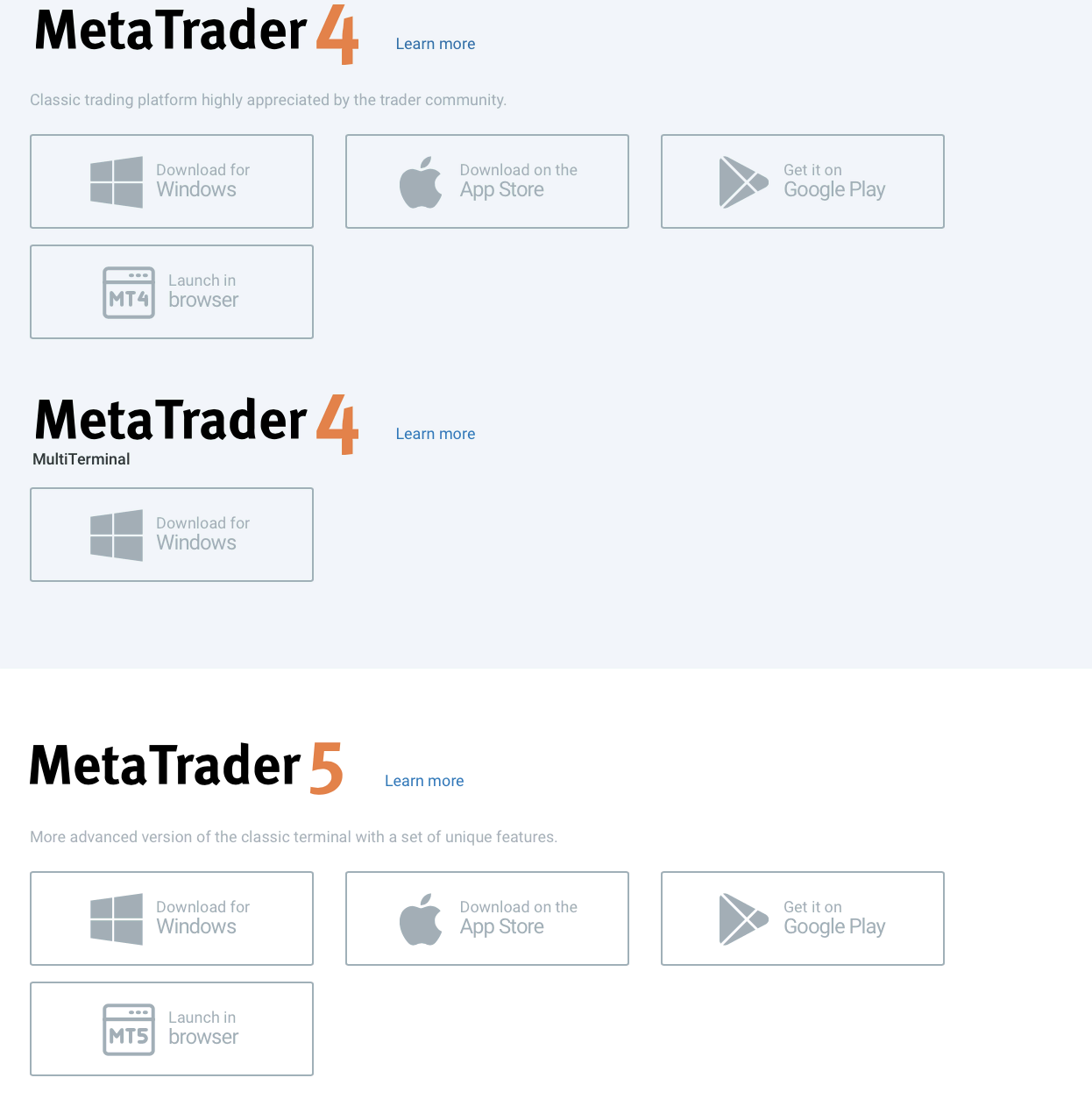

Download a trading platform

Forex brokers work with various trading platforms, and once you register a trading account, you have to download a platform you prefer. Some forex brokers have their proprietary platforms, but most of them will need you to download one that they support and is compatible with your trading account.

After downloading, look at the trading features and familiarize yourself with the trading platform. You can also try and customize features according to your liking when trading.

Start with a demo account

Forex brokers emphasize using a demo account to practice trading to minimize making mistakes that lead to losing your capital. Instead, you can practice trading different financial assets and applying different trading tools and assets.

It is imperative, especially for new traders, to learn to trade before moving to a real account. The demo account gives them experience trading and helps them know the tricks and tips to use when forex trading.

Deposit funds and start trading

If you have enough confidence in your trading skills, link a trading account with your preferred payment method and deposit funds to your trading account. Start trading using the trading strategies you have practiced, and apply risk management tools.

Conclusion: The best Forex Brokers are available in Morocco

The forex trading industry in Morocco has kept growing over the years. We recommend forex traders ensure they choose regulated forex brokers to ensure the security of their funds. Traders should also learn how to trade before risking their capital.

Forex trading information is accessible for forex traders who are willing to take the time to learn. Forex trading is lucrative if you can get enough knowledge about trading and practice frequently. Ensure to research the trading instrument or a currency pair before trading.

(Risk warning: 78.1% of retail CFD accounts lose money)

1. Capital.com

2. BlackBull Markets

3. RoboForex

4. Pepperstone

5. IQ Option

FAQ – The most asked questions about Forex Broker Morocco:

Is the Moroccan Dirham available in Forex?

Yes, it is available in forex, growing stronger with time. However, not all forex brokers offer it, but Moroccan traders can pair it with the EUR or the USD. Its currency code is MAD, the current exchange rate for the USD/MAD is 10.02, and the EUR/MAD is 10.57.

How is Forex trading taxed in Morocco?

If you trade forexes in morocco, whether with a local or offshore broker, your income is considered taxable under capital gains tax. Forex traders are liable to pay 10% of the total they make trading forex in Morocco.

Which brokers in Morocco offer the best forex trading services?

Many forex brokers in Morocco help traders in accessing top-class features. However, a trader must keep several things in mind while choosing a forex broker. For instance, a trader must check whether the forex broker he signs up with is regulated. A regulated broker offers safe trading practices. So, a trader must choose one of Morocco’s forex brokers.

BlackBull Markets

Pepperstone

IQ Option

Capital.com

RoboForex

What should I do to trade forex in Morocco?

If you wish to trade forex in Morocco, you can pick a broker and signup for a trading account. Then, you can choose the underlying forex asset you wish to trade. Finally, you can fund your forex trading account and place your trade.

After you make profits on your trades, you can withdraw those profits by submitting a withdrawal request with the broker.

Is a forex demo account available for traders in Morocco?

Yes, a demo account is available for all traders. The location of a trader’s residence does not matter. They can always use the demo trading account with the brokers that offer one. The five brokers reviewed here offer great demo trading accounts to traders. You can use their forex demo account without paying any charge for 30 days.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)