The 5 best Forex Brokers and platforms in Namibia – Comparison and reviews

Table of Contents

Namibia is a country in Africa with a financial sector dominated by four large conglomerates. These businesses are all closely-owned, and they have funding ties to South Africa.

In the last ten years, the trading of Forex in Namibia has become easier to get involved in, which has helped the country’s economy grow and led to higher incomes for many citizens.

Searching for the best Forex brokers can be difficult, especially if you look for reputable brokers that accept Namibian traders. It can also be tough to find a broker that allows you to invest in the Namibian dollar. It is essential to do your research before investing in the Forex market. This article will give detailed information about the five best brokers in Namibia.

See the list of the best Forex Brokers in Namibia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 5 best brokers in Namibia includes:

- Capital.com

- Blackbull Markets

- Roboforex

- Pepperstone

- IQ Option

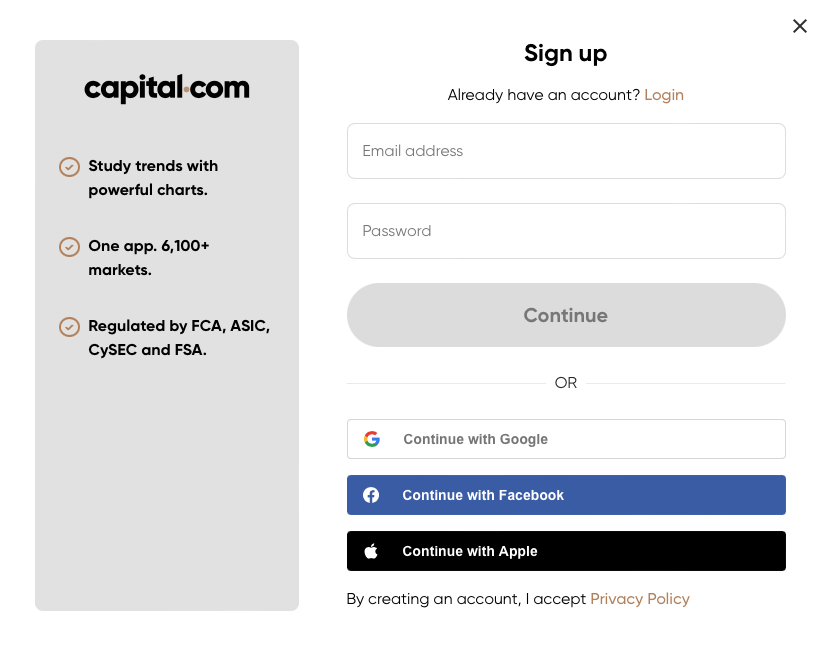

1. Capital.com

Capital.com is a CFD and Forex broker that has been in the industry for less than a decade. The company is based in Cyprus and is registered and regulated by the CySEC in Cyprus. There, Capital.com holds license number 247/14.

Capital.com is also a binary options (only for professional traders and outside EAA countries) broker that offers a wide range of products, including stocks, commodities, indices, and currencies. They also offer a wide range of expiry times, making them an excellent choice for traders.

It also offers a variety of tradable assets, making it a good choice for traders who want to diversify their portfolios. The company offers competitive spreads and quick execution times.

Capital.com provides an excellent training program for beginner traders that includes 28 lectures, divided into five sessions and an exam to check your progress and financial understanding.

One thing that makes Capital.com stand out among other trading platforms is its customer service. They offer 24/7 support in a variety of languages. They have a very user-friendly platform.

Benefits of Capital.com

- Capital.com offers its traders low CFD fees.

- On the Capital.com trading platform, opening an account is seamless.

- Capital.com provides its traders with Email and chat support.

- Traders are provided with educational tools.

Drawbacks of Capital.com

- Capital.com does not accept traders in the United States.

- Capital.com provides several trading symbols for its traders, but the number of symbols is lesser than the industry standards.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a CFD and Forex broker that offers traders access to global markets. The company was founded in 2014 and, since then, has strived to provide an outstanding trading experience for its clients.

BlackBull Markets is one of the leading online brokers globally, with its headquarters located in Auckland, New Zealand. BlackBull Markets serves retail and institutional investors from over 170 countries worldwide.

BlackBull Markets offers a wide variety of tradable products, including Forex, indices, commodities, and shares. In addition, the company provides several features that make trading easy and convenient for its clients. These features include leverage up to 500:1 and negative balance protection.

BlackBull Markets is regulated by New Zealand’s Financial Markets Authority (FMA) and (FSA) Seychelles’ Financial Services Authority.

As a trader on BlackBull Markets, you can deposit funds into your account with different currencies, including USD, EUR, and GBP. The method of depositing funds into your account include Union Pay, credit cards, bank transfer, FasaPay, Neteller, and Skrill. The process of funding your account on BlackBull Markets is processed immediately except for the bank transfer method. The bank transfer method takes between 1 and 3 working days.

Merits of Blackbull Markets

- BlackBull Markets provides its traders with cross-platform trading.

- Commission-free trading is available for traders on BlackBull Markets.

- Traders on BlackBull Markets have access to copy trading platforms such as HokoCloud, ZuluTrade, and Myfxbook

- BlackBull Markets offers its traders free virtual private servers (VPS) and API trading.

Demerits of Blackbull Markets

- BlackBull Markets provide its traders with a scanty education and research materials.

- The platform charges their traders a withdrawal fee.

- The research tools available on BlackBull Markets are basic.

(Risk Warning: Your capital can be at risk)

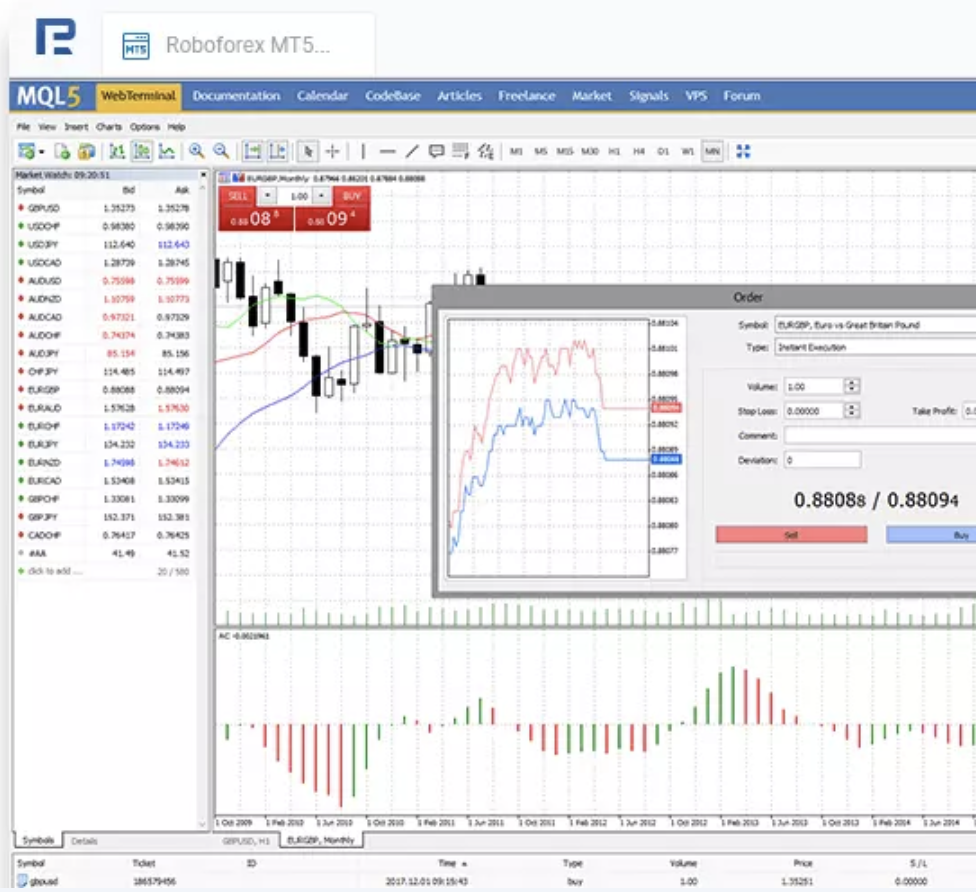

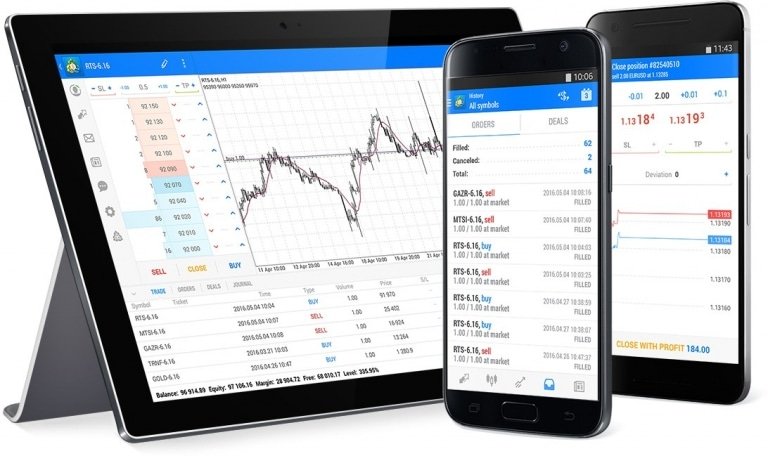

3. RoboForex

RoboForex is a registered forex trading platform that is recognized worldwide. RoboForex provides services for trading on the online financial markets. It provides its traders with seven asset types; stocks, ETFs, metals, currency pairs, indices, energies, and metals. The gross total of trading tools available on the RoboForex trading platform is about 12,000.

As a trader on RoboForex, there are five types of trading accounts available on the platform. Each account has a minimum deposit of 10 USD.

RoboForex provides its traders with popular trading platforms such as MetaTrader 5, MetaTrader 4, and cTrade. RoboForex also has the R StocksTrade terminal, which has a built-in trading strategy builder. This inbuilt trading strategy builder allows the trader to test automated strategies without undergoing the coding process.

RoboForex provides its services to retail traders and organizations. RoboForex provides services to traders in about 169 countries with 3.5 million traders.

Benefits of RoboForex

- Demo accounts are available for traders on the RoboForex trading platform. A demo account allows Forex traders to get familiar with the trading environment.

- RoboForex supports its traders, and the live support is available round the clock in about 11 languages.

- RoboForex provides a unique investment program such as CopyFx.

- Withdrawal of your funds does not take time on the RoboForex trading platform. You get your funds immediately.

Drawbacks of RoboForex

- RoboForex does not have cryptocurrency tools.

- A minimum deposit of $10 is required when you open an account on RoboForex.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is an Australian online Forex broker. The company provides Forex trading, as well as CFDs and indexes, to retail and institutional investors. Pepperstone offers its services to traders in over 180 countries and boasts over 15,000 clients.

The company aims to offer a fair and transparent trading environment and excellent customer service. Pepperstone is one of the fastest-growing Forex brokers globally and has been awarded multiple honors. Pepperstone also offers a wide range of educational resources to help traders learn about forex trading and expand their skills.

Pepperstone is regulated by three financial authorities which are the Financial Conduct Authority of the United Kingdom (FCA), the Australian Securities and Investments Commission (ASIC), and Germany’s BaFin.

Opening an account on the Pepperstone trading platform is very fast and easy. Pepperstone provides top-notch customer care to its traders. Deposit and withdrawal processes are user-friendly and, in most cases, free of charge.

Advantages of Pepperstone

- Award-winning customer service

- No commission trading

- There are over 70 currency pairs available to traders on Pepperstone.

- Access to over 16,000 markets.

- The trading process is fast and reliable.

Disadvantages of Pepperstone.

- On the Pepperstone trading platform, you can only trade Forex and CFDs.

- Customer service is not available during the weekend.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

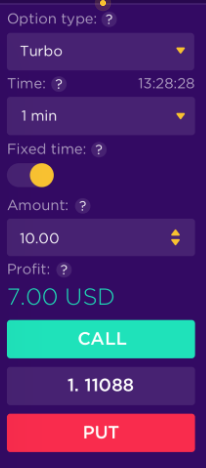

5. IQ Option

IQ Option is a forex trading platform established under the European company IQ Option, and its headquarters is located in Cyprus. The Cyprus Securities and Exchange Commission CySEC licensed this company in Cyprus with license number 247/14. This license allows IQ Option to provide its services to traders within the European Economic Area Zone.

IQ Options offers services of binary options (only for professional traders and outside EAA countries), shares, currencies, ETF trading, and shares. Presently, IQ Options has grown to have over 25 million clients that trade on their platform. They also offer their services to traders all around the world.

IQ Option offers services to traders in about 170 countries, but still, they do not have access to some countries such as Canada, Turkey, Australia, Japan, Iran, Syria, and Israel.

Merits of IQ Option

- IQ Option allows traders to trade in currencies of their choice. The currencies available include EUR, GBP, USD, MUR, Yuan, EUR, and IDR.

- Both the IQ Option trading platform and the website are made available to traders in 13 different languages, allowing traders to trade in the language they understand best.

- The method of opening an account on IQ Option is straightforward.

- IQ Option provides its trades with varieties of trading tools.

Demerits of IQ Option

- MT4 and MT5 trading platforms are not available on IQ Option.

- IQ Option does not provide service to traders in the United States and some other countries.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Namibia?

Namibia is a landlocked country located in southern Africa. The country has around 2.5 million people, and its economy is based mainly on agriculture, tourism, and mining. Namibia has been plagued with economic instability in recent years, which has led to significant financial regulation changes.

The Bank of Namib serves as the central bank of the country and oversees all financial institutions. Several Acts regulate different aspects of the financial services industry in Namibia. These include the Banks and Trust Companies Act, the Insurance Act, and the Pension Funds Act, among others.

In Namibia, the Act of Parliament that oversees the banking industry is the Banking Institutions Act of 1998. It consists of the primary laws that involve the authorization of people to carry out banking business. It also serves as the structure used to regulate Banks in Namibia to protect the investors and depositors.

The Central Bank of Namibia is responsible for issuing currency, regulating the banking sector, and promoting financial inclusion. The government also plays a role in financial regulation through the Ministry of Finance, which is responsible for issuing licenses to financial institutions and promulgating rules.

The banking sector in Namibia is relatively developed, with over 20 banks and 25 microfinance institutions. The industry has grown rapidly in recent years, with total assets increasing from N$80 billion in 2009 to N$236 billion in 2016.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders in Namibia

Namibia has long been an attractive destination for traders because of its stability and lack of red tape. However, as the country has begun to prosper, it has also become a target for criminals.

The police and other security forces are doing their best to combat crime, but traders need to take some responsibility for their security.

There are a few key things that Namibian forex traders need to keep in mind regarding security. Cybercrime is on the rise, and traders are often targeted by criminals who want to steal from them.

First of all, it’s essential to make sure that you’re using a trustworthy and reliable forex broker. There are many scams, so it’s crucial to do your research and only invest with a broker that you trust. Also, ensure the broker you are trading with is recognized outside of Namibia and is registered by reputable bodies.

Second, protect your computer with antivirus software and a firewall. Ensure that your passwords are strong and unique, and never share them with anyone.

It is also vital you keep your trading information confidential.

Given the importance of the trading industry to Namibia, traders must have access to secure trading platforms that enable them to conduct their business safely and efficiently.

Is it legal to trade Forex in Namibia?

Forex trading is legal in Namibia, and there are no restrictions on who can trade. The Namibia Central Bank is not responsible for the regulation or supervision of forex trading. The Namibian Securities Commission has the responsibility of overseeing the forex market.

Brokers who offer their services to Namibian traders must be registered with the commission and must comply with several regulations. These include submitting financial reports, keeping client funds separate from company funds, and adhering to anti-money laundering measures.

As a trader in Namibia, ensure you do adequate research about the forex trading platform you want to trade with before starting trading with them. When you carry out your research, it will help you avoid illegal brokers that are out to reap traders of their money.

How to trade Forex in Namibia – Tutorial

Forex trading can be a great way to make some extra money, but it’s important to remember that it can also be a risky investment. Before you start trading, it’s essential to educate yourself on the basics of forex trading and how to stay safe while doing it.

It would be best if you started small as a beginner in forex trading. You don’t want to risk too much money when you’re creating. Try trading a small amount at first to get used to the process.

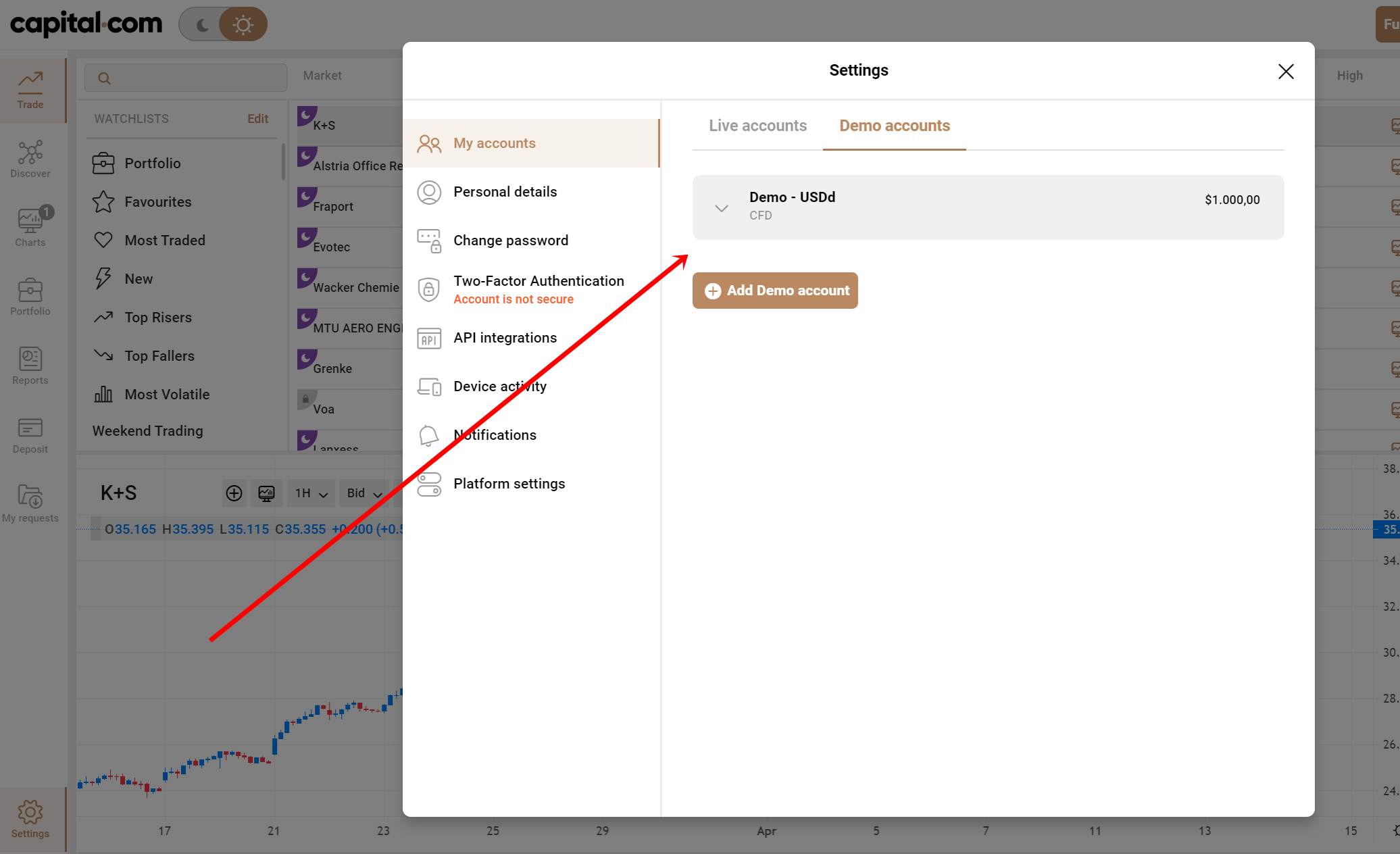

Do not trade directly on a live account when starting on any trading platform. Ensure you use a demo account first. Using a demo account will help you familiarize yourself with the trading platform.

Open account for Namibia traders

The first thing you need to do after you have decided on the trading platform you want to trade. You open a forex account in Namibia. You will be asked to present two documents; a valid identification card and your proof of residency.

Start with a demo account or real account

If you are new to the forex market, you should trade with a demo account before dealing with a real account. Demo accounts are accounts that are just like a real account, but you are not trading with real money on the demo account.

Trading with a demo account will save you from losing money. It will also help you get familiar with the trading environment and get to know how the platform functions.

Trading with a demo account also allows you to study which of the strategies works best for you. After which, you can now decide if you want to trade with real money or not.

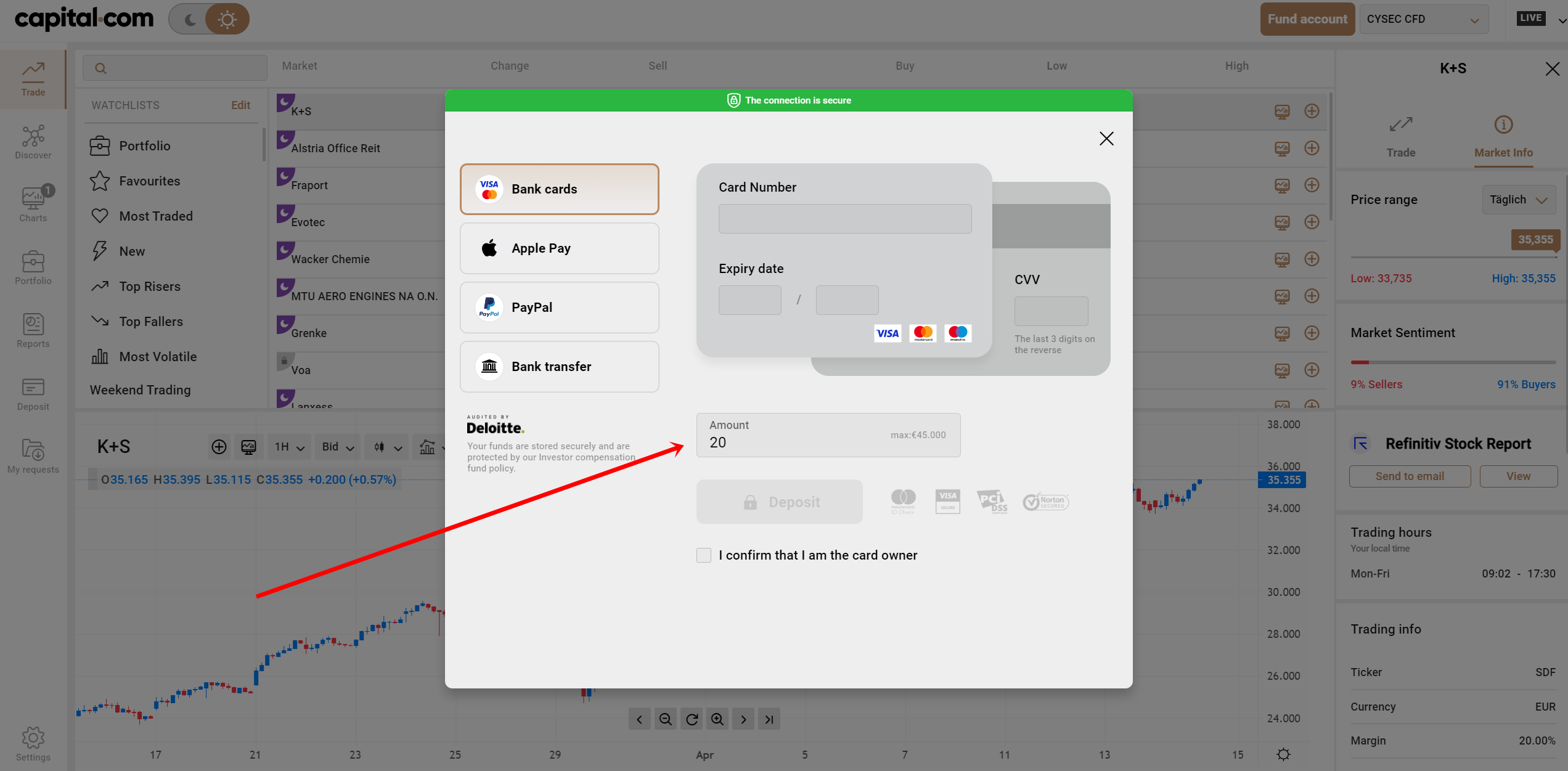

Deposit money

After you have gone through the account opening process, the next thing is to deposit money into your account.

The method you will use to deposit money into your account is dependent on the trading platform. The methods that are popularly used include Payment methods such as PayPal or Skrill, the use of credit cards, and bank transfers.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Before you start trading on any forex trading platform, ensure you know which trading strategy works best. The most common techniques are explained below.

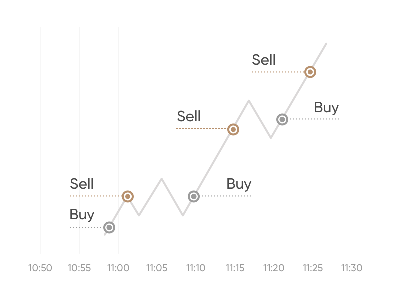

Scalping

Scalping is a well-known trading strategy among Forex traders. Scalping involves trades opening many trades to earn small profits.

Position trading

Traders who use the position trading strategy hold their positions for a long time ranging from a couple of weeks to a year or more. Position trading is a long-term trading strategy.

Traders that use this strategy take note of every change that occurs in the forex market and make sure the changes do not affect their position.

Day trading

Forex day trading is a popular strategy employed by many forex traders. This type of trading involves opening and closing trades within the same day, with the aim of To make small profits from each transaction. While this approach carries a higher level of risk, it also offers the potential for greater rewards. Forex day traders typically use technical analysis to identify trading opportunities and use a variety of orders to enter and exit positions.

Make profit

Forex trading is one of the most popular ways to make money online. It is a form of investment where you buy and sell currencies intending to make a profit.

The forex market is open 24 hours a day, so you can trade at any time that suits you. To be successful in forex trading, you need to understand how the market works and be able to make calculated decisions about when to buy and sell currencies.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Namibia

Do not allow the fear of losing money to stop you from trading Forex. As a forex trader, your aim is to make a profit. Hence you need a well-thought-out plan and also know the strategy that works best for you.

This article provides an overview of how to make a profit from forex trading. Forex trading can be profitable if you have the right skills and knowledge.

FAQ – The most asked questions about Forex Broker Namibia:

What are the pros of forex trading in Namibia through a Forex Broker Namibia?

You can gain the following merits of forex trading through a forex broker in Namibia:

1. Most accessible financial market

2. Trading platforms available for online trading

3. Retail traders use Forex leverage to enhance exposure and profit margins

4. Daily trading volumes present quick money-making opportunities

5. The abundance of short-selling opportunities

6. Most liquid financial forex market

7. Detailed technical analysis is possible for forex trading in Namibia

8. Fewer fees and commissions

9. Lower tax burden

10. Automated forex trading

Describe some beginners’ tips for forex trading with a forex broker in Namibia?

You can implement the following beginners’ level tips to begin forex trading with a forex broker in Namibia:

1. Gather knowledge about forex trading, the basic terminology, etc.

2. Register a demo account with a registered, reputed, and regulated broker

3. Know the risks of forex trading

4. Learn the various forex trading strategies

5. Craft a robust trading plan

6. Practice trading without risk through the demo account

7. When ready, get a real account

8. Select a trading platform of your choice

9. Submit funds in that account and begin trading

Which are the best currency pairs for forex broker Namibia?

Although the market is volatile, the forex broker Namibia can suggest any of the following pairs:

EUR/USD

GBP/USD

USD/CHF

USD/CAD

GBP/JPY

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)