The 5 best Forex Brokers in Nepal – Comparisons and reviews

Table of Contents

Thanks to the internet, forex trading is becoming a widespread investment in Nepal. The Nepalese regulatory authority allows forex trading, leaving traders with many options of brokers to choose from. We have tested various brokers accepting Nepalese traders, reviewing platforms and trading conditions. This article introduces the most suitable regulated brokers to trade within Nepal.

See the list of the best Forex Brokers in Nepal:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 5 best forex brokers in Nepal includes the following:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

Here is an overview of each broker:

1. Capital.com

Capital.com is an online forex and CFD broker, offering access to trade over 135 forex pairs and hundreds of CFDs.

Capital.com has its headquarters in the United Kingdom, with offices in Poland, Seychelles, Gibraltar, and Belarus. The broker’s regulators are FCA, ASIC, CySEC, and the NBRB.

Nepalese traders can choose from two account types, both of which are zero commission accounts. Trading services are provided on the MT4 and Capital.com app. The broker also offers social trading services through the Tradingview platform.

As for trading costs, Capital.com charges an average spread of 0.8 pips on its commission-free accounts. Deposits and withdrawals are at zero costs. There is no charge on dormant accounts. So the broker’s trading fees are extremely competitive. Its trading services are top-notch, with outstanding support for traders in the form of education and customer service.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

Blackbull Markets is an online forex brokerage company providing access to trade over 70 currency pairs and various other assets. Blackbull Markets is based in New Zealand and operates different branch offices around Asia and other parts, including Hong Kong, the United Kingdom, Japan, and the US.

BlackBull Markets hold licenses from its home country’s top regulator, the Financial Markets Authority FMA. The broker is also registered in Seychelles with the Financial Service Authority FSA.

BlackBull Markets offer Nepalese traders a choice of two retail account types. A standard commission-free account and a raw ECN (Prime) commission-based account. Nepalese can use the MT4, MT5, or the broker’s mobile app for trading. Social trading is available through Zulutrade and MyFxbook.

BlackBull Markets’ fee structure depends on the account type. The average spread of 0.8 pips is charged on the standard account, while the prime account attracts an average spread of 0.4 pips, with a $3 commission per lot side. Nepalese can enjoy direct access to the market to get the best price on the ECN account. Its education and support service are among the best.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is a financial technology company offering online trading services on various assets like forex, indices, commodities, and CFDs. RoboForex’s head office is in Belize, with other centers in New Zealand, Cyprus, and the United Kingdom.

RoboForex operates with licenses from well-known Belize’s International Financial Service Commission IFSC.

Nepalese traders can choose from four account types that suit different trading styles and objectives. Several platforms are also available to trade with, including the cTrader, MT5, MT4, and RTrader. Social trading is available through the broker’s partners, CopyFx.

RoboForex fee models depend on the account type. But the costs are reasonable, with an average of 0.8 pips on the standard commission-free account. Its raw ECN account attracts an average spread of 0.4 pips and a $2 charge on commission per side. RoboForex offers great trading services at reduced costs, especially considering its various bonus programs. Traders also enjoy several choices of assets, account types, and platforms.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is a global online forex and CFD broker, offering ECN access to trade various financial instruments like CFDs, commodities, forex, metals, and energies. Pepperstone has its home office in Australia, and other licensed offices around Europe, Asia, and Africa, including China, Kenya, Germany, the Bahamas, the United Kingdom, and the UAE.

Pepperstone operates with several licenses from different regions, including CySEC Cyprus, FCA UK, CMA Kenya, SCB the Bahamas, and its home base license ASIC.

Nepalese traders can choose a standard no-commission account or a raw spread (ECN) account and trade with the MT5, MT4, or cTrader. Automated trading is fully supported. Social and copy trading is available through the broker’s partnerships with Zulutrade, Duplitrade, and MyFxbook.

Pepperstone offers competitive trading fees, with an average spread of 0.8 pips on its standard no-commission account. The raw spread (razor ECN) account attracts a 0.4 pips average spread, with a $3 commission fee per side. Pepperstone offers world-class trading services, top-quality research and education, and award-winning customer service.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a European online binary options (only for professional traders and outside EAA countries) and forex broker. It is offering trading services for options, forex, indices, energies, and metals. IQ Option’s head office is in Cyprus, and it operates a branch office in Seychelles.

IQ Option’s regulators are the Cyprus-based CySEC and Seychelles’ FSA.

Nepalese traders can access online options and forex trading on the broker’s proprietary platform, the IQ Option app. Social trading services are offered on this platform through the Community Live Deals feature.

The average spread on its account offering is 0.8 pips spread, with a $0 commission fee. Nepalese can expect a user-friendly trading environment with unique assets and full traders’ support services.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Nepal?

Nepal is a federal democratic republic nation in south Asia, bordering China and India. Agriculture is a major aspect of its economy, making up over 30% of its GDP.

The country has only recently come out of its rough times. So its economy and finances are still struggling. The introduction of democracy is opening doors for expansion and investment. Online forex trading is part of its growing financial sector.

The Securities Board of Nepal SEBON regulates capital market activities, including forex trading. The body is charged with protecting investors and issuing licenses to financial companies, such as brokerages, investment firms, etc. Brokers are not mandated to have a SEBON license before accepting Nepalese traders, but they must obtain their authorization to do business within Nepal. Although, as of now, there is no forex broker with a local office in Nepal.

SEBON ensures investors’ safety by making regulations to fight and prevent insider trading. The body ensures its capital market is free of malpractices that harm investors and destabilizes the free flow of business. Leverage for the retail forex trader is restricted to 1:30. Nepalese should note that this regulator does not require negative balance protection and compensation fund scheme from brokers.

Securities for traders in Nepal

SEBON allows forex trading with any broker of your choice. Being a densely populated nation, Nepal shows a great potential market for forex brokers. Many types of brokers accept traders from this region. That’s why a trader has to be careful with their choice. Regulated brokers are the safest choice for Nepalese traders and everyone.

It is best if the broker’s regulator is globally-recognized and offers adequate customer protection. Regulators in regions such as Europe, the United Kingdom, and some parts of Asia and Africa require strict standards and investor protection from brokers.

So their license proves the broker’s credibility. CySEC, ASIC, FMA, DFSA, and FCA are examples of these well-known regulators. Regulatory bodies within Asia can also offer the Nepalese trader some protection. These regulators are its own SEBON, India’s SEBI, and Dubai’s DFSA.

Other notable regulatory bodies to look out for are FSCA, SCB, FSA, CMA, and BaFIN (Germany). Brokers operating with any combination of these licenses are reputable and safe for Nepalese traders.

(Risk warning: 78.1% of retail CFD accounts lose money)

Is it legal to trade Forex in Nepal?

Yes, forex trading is permitted in Nepal. SEBON allows citizens to trade with any broker from around the world. Therefore, forex trading is legal. Note that profits from trading may incur taxes. It is best to seek details from the authorities or the regulator’s website. That way, you can trade safely within the country’s laws.

How to trade Forex in Nepal – Tutorial

The internet has made forex trading easy and accessible to all.

Venturing into this investment only requires basic things like:

- Stable and secure internet connection

- A smart device

- A reputable broker

Fortunately, online forex trading does not require the world’s fastest internet and complex computer systems. A mobile phone, tablet, or laptop will do just fine. Although, it has to be connected to a stable internet service. The internet is your gateway to the international market. Frequent disruptions in service mean rough trading experience and possible loss of funds. Therefore, ensure the internet connection is strong and stable.

Once you have the basic physical tools in place, you need a good broker to participate in the international market. The broker links you to the big players who provide liquidity and quotes for market assets. The ideal broker provides access to the best deals for your asset and charges reasonable fees for the service.

Here’s how to identify the ideal broker:

- The broker’s regulator

The ideal broker operates with one or more licenses from acclaimed financial entities. We have listed most of the above. The broker usually includes all license information on its website below the webpage. The trader can confirm the genuineness of the details on the regulatory body’s website. They can contact the regulator for clarification if necessary.

- The spreads and commissions

These terms are the fees that the broker charges for the trading services. The spread is a differential of the ask and bid price. Depending on the broker’s fee structure or account type, they may charge a commission with a minute spread amount. Some charge only the spread, with zero commission. The trader should compute and compare these fees among brokers so that they don’t end up with an expensive service.

- A free demo

Reputable brokers provide customers and site visitors with a means of testing their service. The free demo simulates the broker’s real platforms and services. Traders use it to see the offerings and platform’s features. Access is usually allowed for 30 days or more.

- 24 hours customer service

The ideal broker ensures support services are easily accessible while trading, no matter the time of day. You should be able to reach customer service if you encounter any issues while trading. Some reputable brokers provide multilingual support that includes Nepali.

- Simple and common payment methods

A good broker ensures that deposits and withdrawals are easy to do on its platforms. They provide common payment services available in the region to make this possible. Traders can avoid stress while funding their accounts, especially by moving money out of the platform. The most common payment options are

These points are basic requirements every reputable broker must meet.

Follow these steps to start trading:

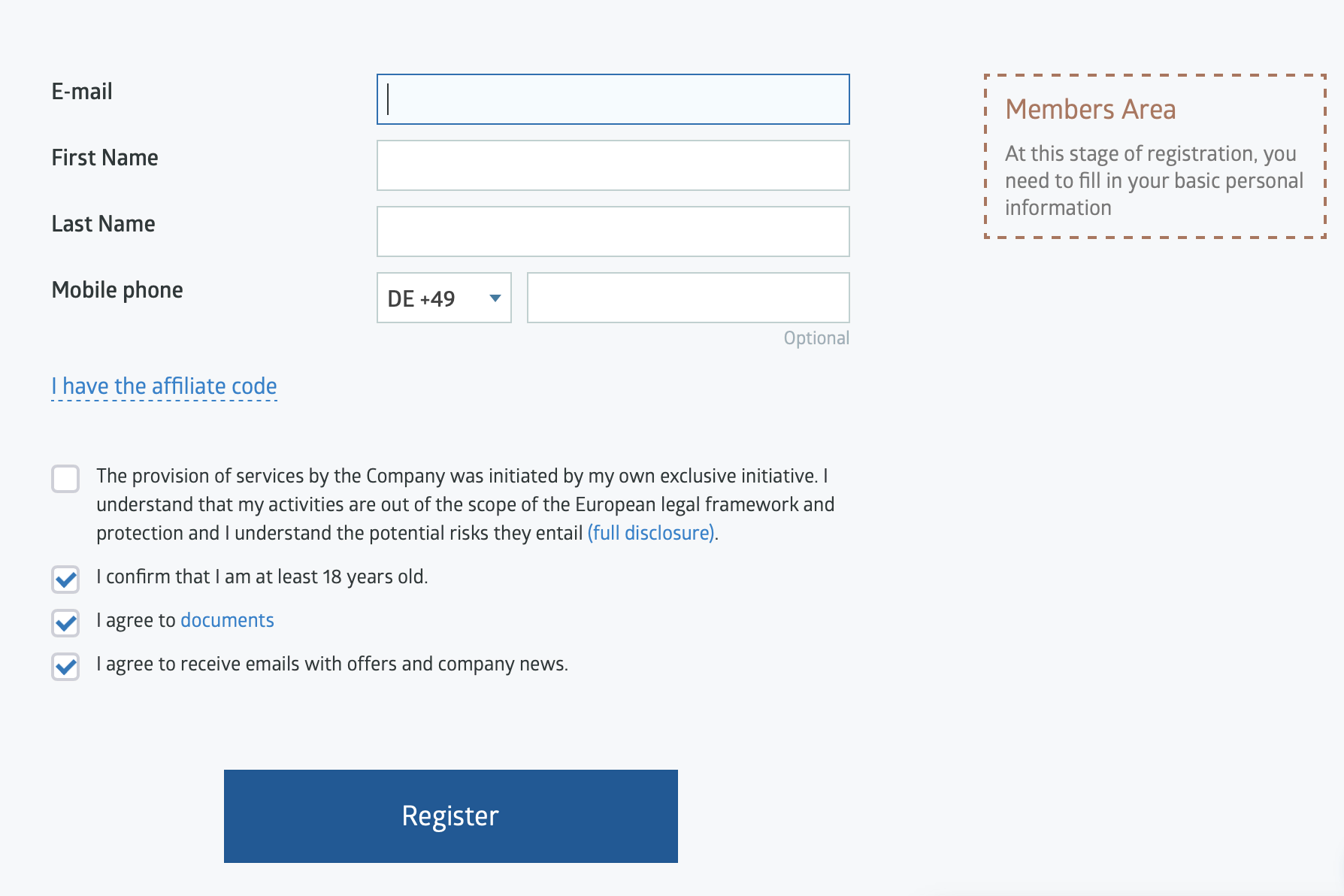

1. Open account for Nepal traders

Enter the broker’s website to start the signup process. If you’re in Nepal, the webpage designed for Nepalese will load with auto-translated text to Nepali if the broker supports the language.

The create account button is often the boldest at the top of the page or center. Click on the button and type in the required information. It should be your email address and perhaps your given name.

Once you click on OK, the system pushes a confirmation message to the email you entered. Open your inbox, promotion, or spam folder to see the message. Click on the link in the message’s body to verify the email, and continue filling the complete registration form that loads.

The broker should request a government-issued ID card and a utility bill showing your address. The regulations in most regions require these KYC documents for records. Follow the broker’s instructions to send them these documents.

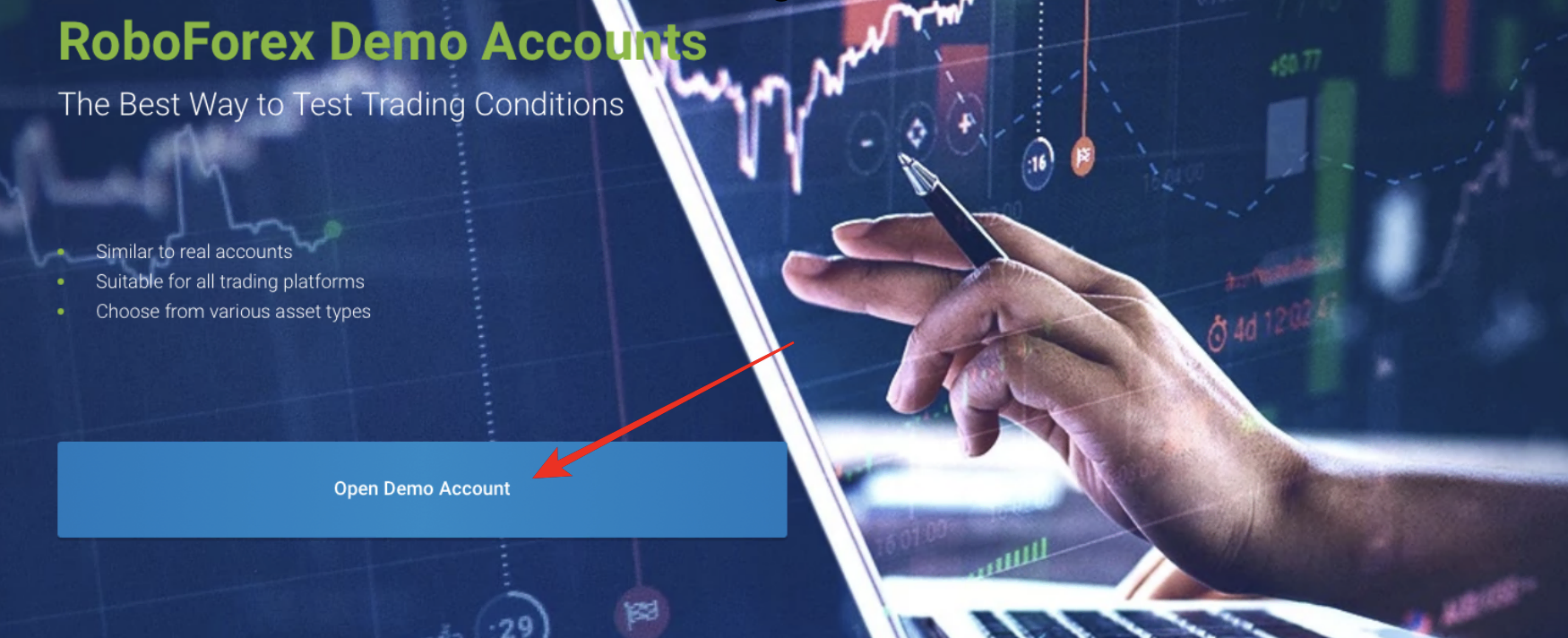

2. Start with a demo or real account

Once the broker receives all necessary information from you, they process the registration and set up a trading account within two days.

The account will be ready for trading. But it is best to use the broker’s demo first. It allows you to see the platform features and become familiar with the broker’s trading environment beforehand.

New forex traders should practice with the demo as much as possible before trading on a real account. Getting familiar with the forex market is helpful and increases confidence and clear-headedness while trading.

Many traders also find the demo quite useful for testing forex strategies before using them for actual trading. However, some prefer a live account for practice or testing. Many brokers offer cent or micro accounts that allow users to trade with minute cash. We recommend such accounts for these tests to reduce the financial risks.

3. Deposit money

Trading on a real account requires real cash. So the next step is to deposit money in the trading account. The broker will have different easy payment methods with which you can do this.

The funding tab will be somewhere at the top of the page. Click on that tab and select the deposit option from the menu. The payment methods will appear for you to choose your preferred one. Fill out the request form and click on OK. The payment service processes the transfer and funds the account within a short period, usually within an hour.

Deposit service is free with reputable brokers. But the payment service might charge a small fee. Although, this amount is often deducted separately. So the money you transferred should appear in full amount on your trading balance.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

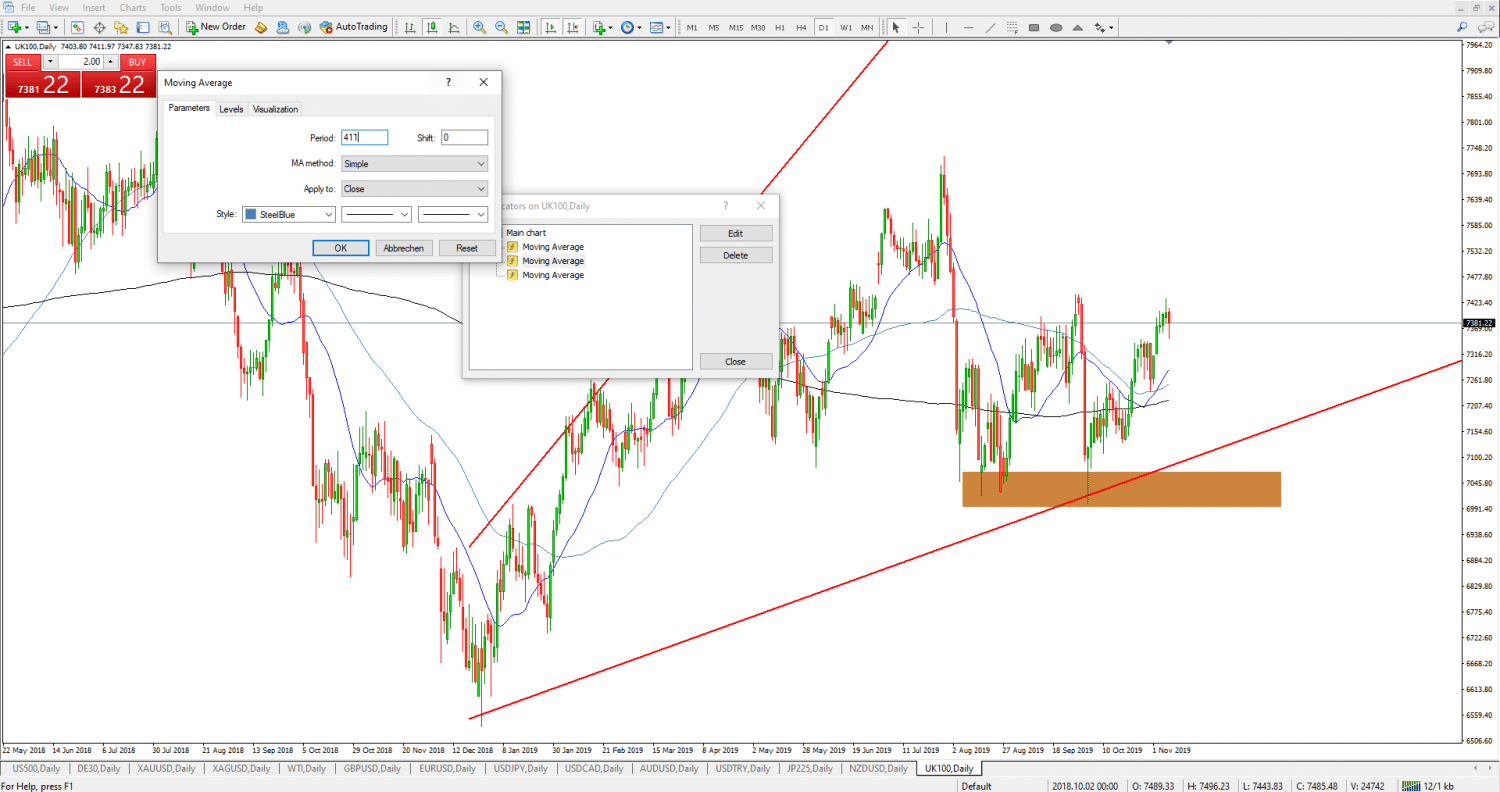

4. Use analysis and strategies

Now that your account is funded, the next step before trading is market analysis. Analyzing the currency pair is necessary for profitable trading. Market analyses give you important knowledge about the asset you wish to trade. You gain insights into past price movements and the factors that influence the moves.

Market analysis shows you the best entry and exit approach for your trade forex pairs. You can choose the best forex strategies after understanding the currencies and their price behaviors.

The two important analyses in forex are:

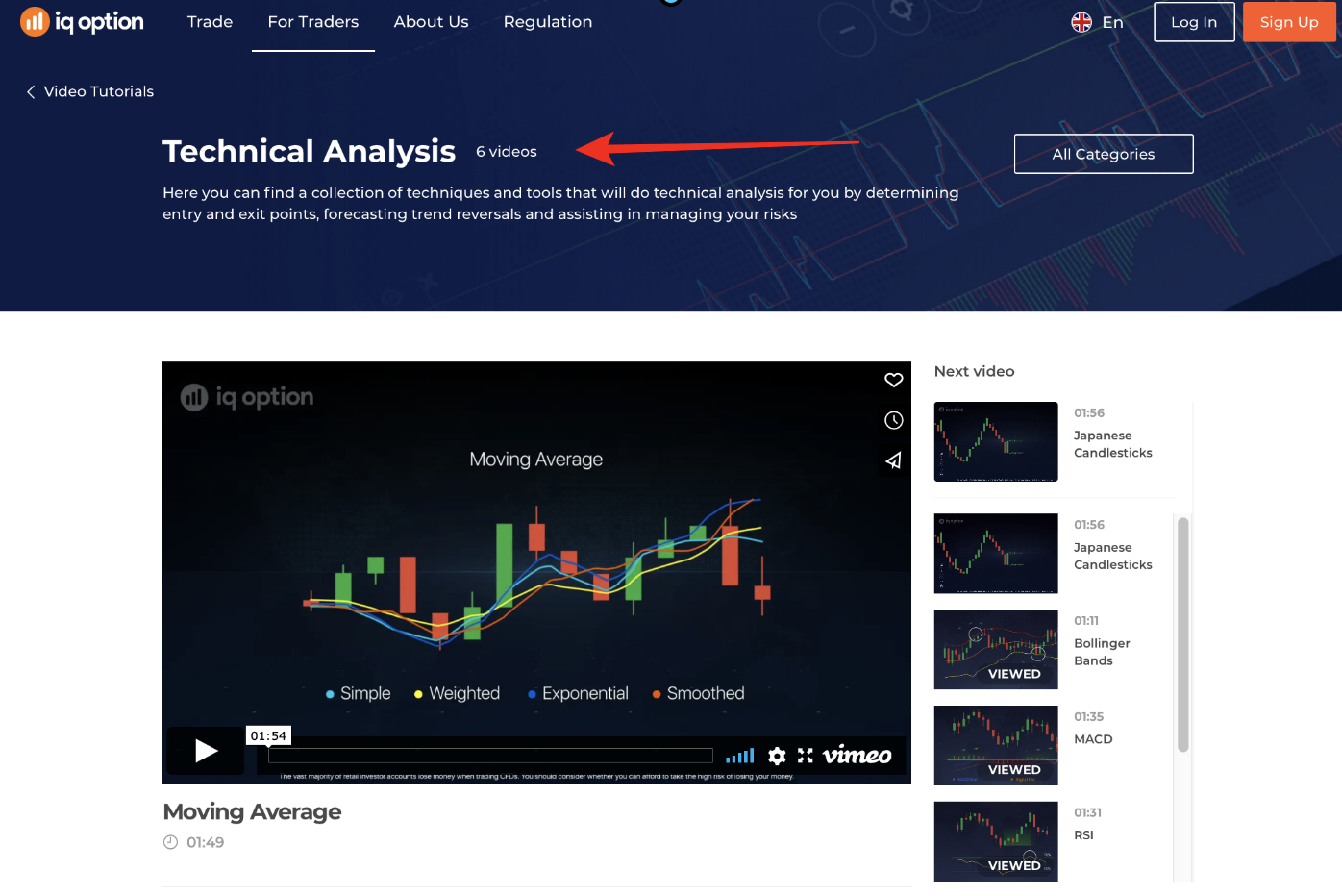

- Technical analysis

- Fundamental analysis

Forex technical analysis has to do with studying historical prices in the chart to find patterns that show the best trading opportunities. This analysis is popularly used, and many tools are embedded in all trading platforms to simplify the process. Charts, indicators, trade signals, etc., are all technical analysis tools on trading platforms. Learning their uses and correctly interpreting patterns are the keys to successful technical analysis.

Forex fundamental analysis has to do with studying the economies that influence the currencies’ exchange rates. Every national currency is backed by its nation’s economy, which determines its value in the international market. The trader studies the economic elements of the countries to understand past price movements and anticipate future moves. There are tools for this analysis on trading platforms. But the most important ones to study forex fundamentals are market research materials, providing information on the country’s GDP, inflation rate, interest rate, trade surplus or deficits, etc.

Both analyses are crucial to successful forex trading. They help you choose the best trading strategy for your chosen assets.

The most popular forex trading strategies:

- Trend trading

- Trading breakouts

- News release trading strategy

- Range trading

- Price action

- Etc.

5. Make a profit

The proper analysis will lead to the most suitable forex strategy, which results in making profits. Once you start to make a profit, you can withdraw the earnings using the same methods as the deposits.

Click on the funds’ tab again and select the withdrawal option. Choose the payment method and fill out the request form. Once you click on OK, the broker processes the withdrawal and sends the money to your receiving account. Note that withdrawals take longer to process than deposits. Expect the funds to settle within two days. Depending on the payment option used and the broker, it can take longer or lesser time.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Nepal

Many brokers welcome Nepalese on their platforms. Choosing the most suitable one for your trading goals is the first step to profitable forex trading.

FAQ – The most asked questions about Forex Broker Nepal:

How can I know the Nepal forex broker’s trading strategies?

For trading currencies, many of the same methods used for stocks can be applied, but it’s crucial to comprehend how different asset classes differ from one another. Currency fluctuations are possible, as was when the British pound fell in value relative to other important currencies after England decided to exit the European Union. However, currency movements won’t generally be as pronounced, and you’ll need a trained eye to spot trends. You should become familiar with the following forex trading tactics:

– Momentum trading

– Trend following

– Range trading

Which forex broker in Nepal is the best for trading?

Most foreign brokers welcome Nepali traders and frequently provide more favorable trading terms than regional brokers. The Nepal Stock Exchange (NEPSE) has over 50 brokers listed, allowing Nepalese traders to compare the market to those of competitors worldwide to make the best decision. Finding the finest broker will still mostly depend on personal preferences.

How can I obtain a forex broker ID in Nepal?

The online application provided by brokers should just take a few seconds to complete. Account verification is required, and brokers will request papers, such as a current ID and a document showing residency no older than three months.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)