The 4 best Forex Brokers and platforms in New Zealand – Comparisons and reviews

Table of Contents

If you reside in New Zealand and are looking for a tight-spread forex broker to trade with, you have visited the right page.

We reviewed several New Zealand brokers and brought you this list of the best brokers with low fees.

See the list of the best Forex Brokers in New Zealand:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | Not regulated | Starting 0.1 pips variable & low commission | 300+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Low spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

4 best forex brokers in New Zealand

We provide a brief review for each below:

1. RoboForex

At a glance:

- Minimum deposit – $10

- Regulations – IFSC.

- Execution type – STP, ECN.

- Year founded & HQ – 2009, Belize.

- Assets – 36 currency pairs, 4 cryptocurrencies, 12000 equities, 1000+ ETFs, 100+ commodities.

- Fees – Spreads from 0.1 pips. Commission from $2.

- Payment methods – credit card, debit, wire transfer, Skrill, Neteller.

RoboForex offers one of the best and most intuitive proprietary platforms. Its trader appeals to algorithm traders because of the embedded “strategy builder.” A feature that allows the trader to customize auto trading solutions, even without knowledge of coding.

RoboForex offers several account types on multiple trading platforms, including its own. These platforms are MT4, MT5, cTrader, and Trader.

The account types are:

- Pro

- ProCent

- Prime

- ECN

- RStocksTrader

The Pro and ProCents are commission-free accounts but attract higher fees on spreads. The average is 1.4 pips, which is highly competitive with zero commission.

The other three enjoy very tight spreads, starting from 0.0 pips. With commission ranging from $2 – $6, according to the trade size.

The broker is a trusted and well-regulated company offering high-tech forex trading solutions at low costs. Traders enjoy lots of bonuses and rebates here, which further lowers the broker’s trading costs.

The award-winning brokerage firm has offices in the UK, Belize, Cyprus, and even New Zealand. So Kiwi traders can seek in-person support from the broker in its Auckland office.

Cons of trading with RoboForex:

1. Not enough cryptocurrency assets

Traders who wish to speculate on a variety of cryptocurrency assets might be disappointed with the limited selections here.

(Risk Warning: Your capital can be at risk)

2. BlackBull Markets

Overview:

- Minimum deposit – $200

- Regulations – FMA, FCA.

- Execution type – STP, ECN.

- Year founded & HQ – 2014, New Zealand.

- Assets – Forex, indices, oil and gas, equities, stocks.

- Fees – spreads from 0.0 pips. Commission on raw account: $6 per round-turn.

- Payment methods – MasterCard/Visa, BPay, Bank transfer, Union pay, Neteller, Skrill.

BlackBull Markets is among the few brokers established in New Zealand. This award-winning broker offers two types of accounts that give traders access to various assets.

Its offerings are:

- 30+ forex pairs

- 6 index CFDs

- Oil and gas

- Gold and silver

- Equity indices

- 350+ stocks

The broker is regulated by the Financial Markets Authority of New Zealand and the FCA.

Kiwi traders have access to the forex liquidity pool through BlackBull’s ECN account. Its liquidity providers are HSBC, Bank of America, and Credit Suisse. And the broker has an aggregation system in place that encourages high competition among providers. Leading to the tightest spreads for traders.

New Zealand traders can choose between the standard or raw account. Both runs on Metatrader 4 and 5. The minimum deposit for a Standard account is $200, and the Raw account requires at least $2000 to trade.

Traders enjoy commission-free trading on the Standard account, though the floating spread is higher than the Raw account. But it remains among the most competitive spreads in the market, starting from 0.8 pips. The Raw account attracts a commission of $6 per round-turn of 100000 lots. Floating spreads start from 0.0 pips. This means zero spreads on trades sometimes.

The broker also offers an ECN institutional account that requires a $20000 minimum deposit. But the account comes with many benefits, including a bespoke experience, negotiable fees, rebates, and more.

Social trading is available through its partnership with Zulutrade and MyFxbook.

Its customer support is among the best and has received an award for its exceptional support service. There are customer service offices in New Zealand and Malaysia, giving clients around Asia-Pacific easy access to face-to-face support. Traders can comfortably call on support through BlackBull’s toll-free line, email, or live web chat on its site.

The drawback of trading with BlackBull Markets

1. No EU license

The broker is not regulated in the EU zones. However, BlackBull is undoubtedly legit and highly trustworthy. But people from such zones may prefer brokers with an EU license to enjoy full investor protection.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Summary:

- Minimum deposit – $200

- Regulations – FCA, ASIC, CySEC, BaFin

- Execution type – STP, ECN.

- Year founded & HQ – 2010, Australia.

- Assets – Forex, metal, cryptocurrencies, indices, stocks.

- Fees – Commission on razor account: $3.5 per traded lot size. Spreads from 0.0 pip.

- Payment methods – Bank wire, credit card, debit card, local deposit, Paypal, Neteller, BPay, Union pay, MPesa.

Pepperstone is a part of the Pepperstone Group of companies based in Australia and founded in 2010.

Pepperstone is now an internationally acclaimed broker with offices in Nairobi, Dubai, the UK, Limassol, and other parts of the world.

The broker has licenses in over seven jurisdictions and is among the world’s most trusted forex brokers.

Pepperstone is regulated by the following bodies:

Pepperstone offers two types of accounts called Standard account and Razor. The Razor account is a raw spread commission-based account that gives traders direct access to the liquidity pool. The spreads vary and start from 0.0 pips on this account. The commission is $3.5 per lot. The Standard account is an STP type with spreads starting from 0.6 pips and zero commission.

The broker also offers an active trader program for high-volume customers. Traders enjoy many benefits here, such as VPS hosting, zero spreads, and more.

Forex traders can access over 70 currency pairs on the MT4, and MT5, cTrader. Tradingview is also offered for social trading. Other assets available are cryptocurrencies, metals, commodities, and indices.

Pepperstone’s award-winning customer service is available 24-5 and very responsive. Traders can reach them via live chat on its trading platforms, emails, and phone.

Disadvantages of the Pepperstone trading platform

1. No educational quiz

Its educational content is comparably non-interactive as it lacks progress tracking through quizzes or tests.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

Overview:

- Minimum deposit – $10

- Fees – spreads start from 0.6 pips. Low commission charges. An inactivity fee may apply.

- Payment methods – Credit card, debit card, skrill, Maestro, wire transfer, web money.

IQ Option is among the leading forex and binary options brokerage firms in the global financial market.

Though established relatively recently (2013), IQ Option is a fast-growing brokerage with over 48 million customers worldwide.

The broker provides access to various markets, including forex, binary options, ETFs, commodities, stocks, and cryptocurrencies.

IQ Option is based in Saint Vincent and the Grenadines but welcomes clients from nearly all parts of the world, including New Zealand.

Traders can choose from their Standard account or VIP and enjoy competitive trading costs in a conducive environment. Clients whose initial deposit reaches $1800 are automatically VIP account holders. The holder gets a dedicated manager and enjoys a 3% rebate, among other benefits.

The disadvantage of trading with IQ Option

- No MetaTrader platforms

The broker does not offer the popular Meta trader platforms. Though IQ Option’s proprietary app is rich with essential indicators and trading tools, many traders find Metatrader suites easier to use and richer.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in New Zealand?

The foreign exchange market is a global financial marketplace, as you know. Due to its tremendous size, it requires jurisdictional regulations, as a single organization can not control its global activities.

This is why there are many forex regulatory bodies spread across the world. Each region is responsible for setting up its own regulatory body. In the same way, each country is responsible for its government.

The SEC, CFTC, and NFA oversee brokers’ activities in the United States. The United Kingdom has the Financial Conduct Authority FCA to regulate forex activities in its jurisdiction. While in some Euro zones and Australia, there is CySEC and ASIC, respectively. Other European countries have their regulators.

New Zealand’s forex regulatory organization is the Financial Market Authority. This body was created in 2011 after the previous one was dissolved. The former regulatory body was disbanded due to allegations of incompetence and failure to clamp down on fraudulent activities.

Investors at the time claimed to have lost their funds due to price manipulation and insider trading. This led to the dissolution of the Securities Commission of New Zealand, the then financial body responsible for the NZ market.

Because of this history, the FMA is a no-nonsense organization with tight regulations, requiring strict compliance with its policies.

The organization revoked licenses from several brokers who did not meet its standard then. New brokers coming into the New Zealand market have to adhere to the laid down rules and regulations.

Part of the requirements for brokers is to agree to frequent account auditing and make known any information the organization requires. Forex trading in New Zealand is now extremely safe because of this.

Is forex trading legal in New Zealand?

Yes. Forex trading is totally legal in Aotearoa, the Land of the Long White Cloud. The Financial Markets Authority is the country’s regulator and has made forex trading safe here.

How to trade forex in New Zealand – A quick guide

It is difficult or near impossible for an unregulated broker to operate in the NZ market. Nevertheless, the trader should check that the choice broker operates under the FMA license before trading.

Follow the steps below to trade forex in New Zealand:

1. Open a New Zealand forex trading account

Visit your choice broker’s website and type in your name and email on the registration page. Wait for the authenticated link that goes to your email within minutes.

Click on the link in the message to confirm the email address you entered. Fill out the rest of the required information on the page that pops up.

You might be required to scan and send the broker your national ID and proof of address. Or only your IRD number will be required to verify your identity.

2. Start with a demo or ‘real’ account

Most reputable brokers offer a free demo account that allows the client to test its platform before trading live.

If you are new to forex, we recommend you take full advantage of this demo to get familiar with the forex market environment before starting.

It’s alright to start with a real account if you wish. Most traders prefer this as it gives a complete market experience. Some features, such as take-profit, may not be available for demo accounts. Traders can not fully test a strategy that requires it in such cases. So a live account is preferable here. But we always recommend new and inexperienced traders to start with the minimum deposit.

3. Deposit money to trade

Once you complete the registration, in most cases, the broker assigns a dedicated staff to assist you in the initial stage.

This consultant will put you through making your first deposit. But the process should be pretty straightforward.

Many payment methods are available in New Zealand, so it should be easy enough to fund the account.

Brokers often use popular channels: Visa, Mastercard, Bank wire, Paypal, Webmoney, and others. Many brokers will not charge for depositing funds, but the bank or third-party company may request very small fees.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

4. Use Analysis and Strategies

For you to profit from forex trading, you need one or more effective strategies. Market analysis is also a must to help you understand the condition of the currency you wish to trade.

Most Kiwis trade the country’s national currency alongside the US dollar, Euro, Pound, Japanese Yen, or Swiss Franc. The strategy you choose to work with should match the pair you trade.

Here are some analyses and strategies that are effective with the NZD:

1. Fundamental analysis

This analysis is extremely crucial, especially if you wish to trade a pair that includes the kiwi (NZD). It means you must have a basic understanding of the factors that affect the currency’s value and the other pair. Exports, commodity prices, and political events are all vital areas to keep an eye on.

2. Support and resistance trading strategy

Since the NZD is relatively stable, this trading approach can be effective. It involves looking at the price chart to find the points where the price of your chosen pair is refusing to climb higher (resistance) or drop lower (support). These are opportunity areas to trade and earn. When prices stop rising, it means they’re about to fall. We enter a SELL position in this case. When the price halts in its downward spiral, we expect it’s about to rise. So we enter a BUY trade. The trick is to accurately identify these points.

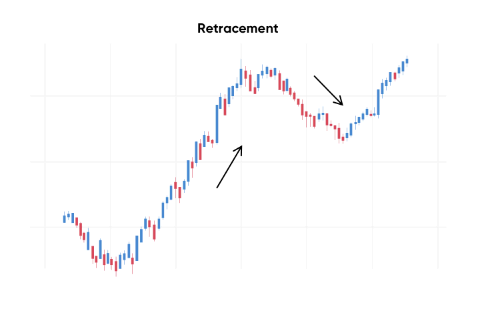

3. Trend trading approach

This is among the commonest strategies with major currencies, such as the NZD. It’s also fairly easy to trade. But you must make sure you identify an actual trend to trade this successfully. So if the asset is experiencing a downtrend, you stick to short (SELL) trades. Long (BUY) positions will yield profits if it’s an uptrend.

But these trading strategies require some study. Brokers offer technical indicators and other tools to help traders identify opportunities in the market.

Conclusion: The best Forex Brokers are available in New Zealand

If you’re in New Zealand and new to forex trading, the FMA provides some helpful educational content to guide you in the trade.

You can also reach out to your chosen broker for inquiries and clarifications. We recommend trading with ONLY FMA-approved brokers. This guarantees your protection and peace of mind while trading.

FAQ – The most asked questions about Forex Broker New Zealand :

What is the best form of trading for traders in New Zealand?

Traders in New Zealand can indulge in forex trading. Forex trading has a high scope and allows traders to make quick money. Once a trader learns to tap the opportunity with currency fluctuations, they can earn more money. Thus, forex trading is the best for traders in New Zealand and elsewhere as it allows you to make maximum profits.

Which strategy should I try to build while trading NZD?

While trading NZD, a trader should try to keep an eye on the market. A trader’s ears should always be open to hearing about the New Zealand trading market changes. It will allow you to ascertain whether the currency will assume a higher price or downgrade in the future. Also, you should never miss out on conducting a perfect technical analysis. It will let you know the currency’s resistance and support levels in the market.

Which broker offers the best services in New Zealand?

The brokers that offer the best services in New Zealand include the following.

BlackBull Markets

Pepperstone

RoboForex

IQ Option

Can I know the most popular currency pair among the New Zealand forex broker traders?

According to Chris Weston of the prominent New Zealand brokerage IG Markets, the country’s IG consumers are not as interested in trading their local currency, the NZD, versus the USD as one might assume. Instead, most Kiwi traders favor big currency pairs like EUR/USD, GBP/USD, and AUD/USD.

Is a license required for New Zealand forex brokers offering CFDs and spot forex trading?

Yes, New Zealand brokers can provide leveraged derivatives under the new regulations specified by the local regulator, the Financial Markets Authority, but only if they have an FMA license. This applies whether the issuer is based in New Zealand or elsewhere. Kiwi traders can consult the regulator’s official website, www.fma.govt.nz, for a list of authorized derivative issuers.

What instruments are available for trading by New Zealand forex brokers?

In addition to currency pairs, commodity markets, contracts for differences, equities, and binary options, New Zealanders have access to various other financial instruments.

However, because binary options and CFDs carry a higher risk of financial loss, most new traders from the Land of the Long White Cloud prefer spot forex to more sophisticated instruments like binary options and CFDs.

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)