The 5 best Forex Brokers in Nicaragua – Comparisons and reviews

Table of Contents

Finding the best forex broker in Nicaragua can be tough because forex trading is not common here. Many online brokers accept Nicaraguan traders and try to lure them to their platforms.

See the list of the best Forex Brokers in Nicaragua:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

This article helps you avoid the confusion that comes with too many options. We reviewed many of these brokers and have selected a handful offering the best trading conditions.

The list of the 5 best forex traders for Nicaraguans includes the following:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

Read on to see a summary of their offerings.

1. Capital.com

- Minimum deposit: $20

- Free demo: Yes

- Spread and commission: 0.6 pips minimum, with a $0 commission fee.

- Support – 24 hours, weekdays.

- Payment options – Visa, MasterCard, wire transfer.

Capital.com’s regulators are:

The platform started its operations in 2016 as an online forex and CFD broker. The broker is a global company, accepting traders from many parts, including Nicaragua.

Nowadays, Capital.com is regulated in Europe, the United Kingdom, Australia, and Belarus. The broker has offices in these places, including Seychelles, Gibraltar, and Poland.

Nicaraguan traders will gain access to thousands of markets, such as forex, CFDs of stocks, indices, commodities, and cryptocurrencies. The MT4 is provided for trading, making the overall user experience great.

Rich educational support and social trading are available, with a free demo and educational app. Nicaraguans can expect top-quality trading conditions at competitive fees with Capital.com.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

Not available in Nicaragua.

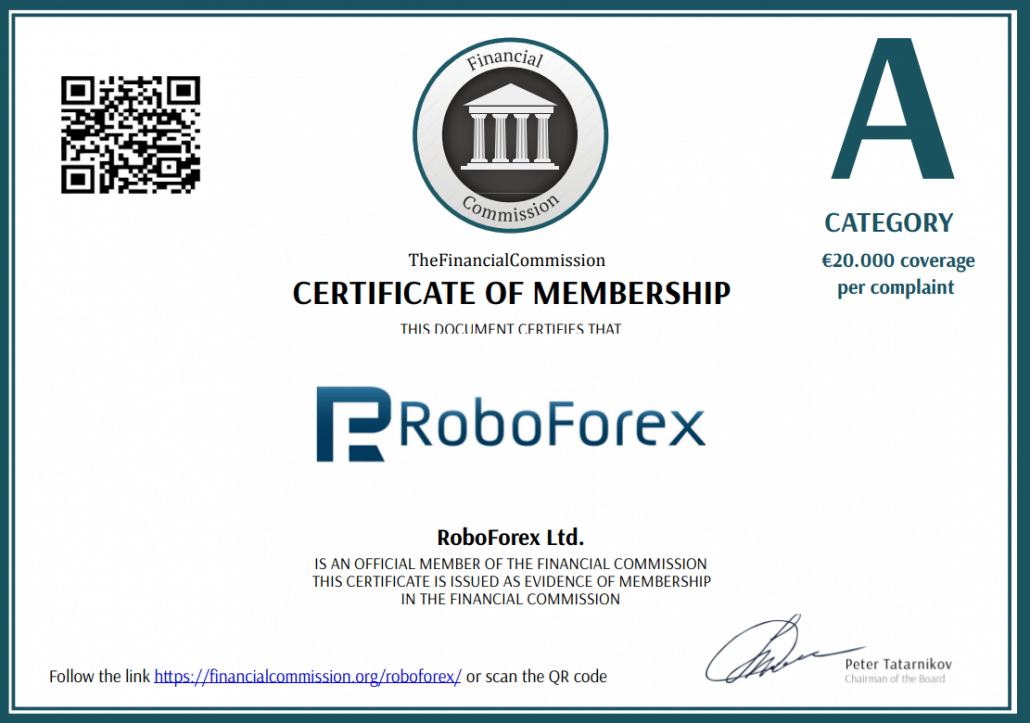

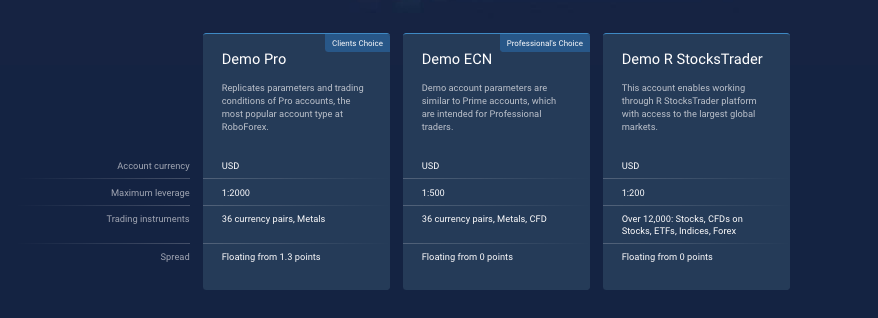

3. RoboForex

- Minimum deposit: $10

- License: IFSC.

- Free demo: Yes

- Spread and commission: 0.1 pip minimum on ECN accounts, with a $2 commission fee.

- Support – 24 hours, weekdays.

- Payment options – Visa, MasterCard, bank wire.

RoboForex began operations in 2009 as a financial service provider, offering forex brokerage services. RoboForex is headquartered in Belize and has other offices in New Zealand, Cyprus, and the United Kingdom.

RoboForex provides ECN as well as STP trading on its several account types. Traders can use the MT4, MT5, cTrader, and the company’s RTrader to access 12000+ market instruments.

RoboForex’s low trading fees and range of options appeal to Nicaraguan traders. Several bonus packages await new and existing customers, and traders of all levels can find the account that suits them.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

- Minimum deposit: $0 ($200 recommended).

- License: CySEC, SCB, FCA, ASIC.

- Free demo: Yes

- Spread and commission: 0.1 pip minimum on ECN accounts, with a $3 commission fee.

- Support – 24 hours, weekdays.

- Payment options – MasterCard, bank transfer, and Visa.

Pepperstone provides direct market access to the financial market through its forex brokerage services. Pepperstone is based in Australia and started operations in 2010. The broker has offices in the United Kingdom, Kenya, the Bahamas, Dubai, Cyprus, and Germany.

Traders can use the MT4, MT5, and cTrader to trade various assets, including forex pairs, CFDs, commodities, shares, and indices. The trader can connect to forex communities for social and copy trading through these platforms. Automated trading is also supported.

Nicaraguan traders choose Pepperstone for its ultrafast order execution, low fees, and first-rate services. An active trader program is available that rewards volume traders with exciting benefits.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

- Minimum deposit: $10

- License: CySEC.

- Free demo: Yes

- Spread and commission: 0.8 pips average on major pairs, with a $0 commission fee.

- Support – 24 hours, weekdays.

- Payment options – MasterCard, Visa, and bank transfer.

IQ Option is a Europe-based forex and binary options (only for professional traders and outside EAA countries) broker that started operations in 2013. IQ Option’s headquarters are in Cyprus, and it has operating offices in Seychelles and St. Vincent, and the Grenadines.

Traders can use its unique trading platform to access different instruments, such as forex, binary and digital options, ETFs, index CFDs, and commodities. The platform comes with various helpful tools that boost the users’ trading skills. The Community Live Deal features allow social trading where traders share strategies and learn from each other. New traders can easily find their way with the comprehensible video tutorials provided.

IQ Option appeals to Nicaraguan traders because of its easy-to-use platform, low fees, and good support for traders.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Nicaragua?

Forex trading is an uncommon investment in Nicaragua. Many do not get involved in it. Perhaps this is due to the country’s lack of regulations in the sector. Nicaragua’s economy is highly dependent on tourism. There is little focus on investments in the global financial market.

The Superindentendecia de Bancos y de Otras Institutiones Financieras de Nicaragua (SUDEBAN) is the country’s finance sector regulator. Translated in English as the Superintendency of Banks and other financial institutions. This body is responsible for its capital market, the Bolsa de Valores de Nicaragua. The market is mainly concerned with stocks and other securities.

SUDEBAN oversees all financial industries’ activities in the country. But the body has not reformed its regulatory framework to include forex trading, even though the activity is gaining traction. Its official website is in Spanish and does not include an option to switch to English. The brokers based in Nicaragua are not licensed by the country’s authority since this sector has no regulations.

However, many brokers welcome traders from Nicaragua, and the country’s authorities have not prohibited the activity.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for Nicaraguan traders

Nicaraguan traders can safely deal with brokers operating with a genuine license from a well-known financial body.

The country’s government does not forbid or restrict forex trading. So many brokers accept traders from here. Unscrupulous brokers can overrun such a market that has no restrictions or regulations.

Therefore, the trader should choose their broker carefully. Brokers with one or more licenses from Europe, the United Kingdom, North America, and Asia are safe. The trader should check the license validity on the regulator’s website before signing up.

Is Forex trading legal in Nicaragua?

Yes, forex trading is allowed in Nicaragua. The country’s finance sector regulator, SUDEBAN, has not made any laws against it. So trading the forex market is a legal activity in the country. The trader should endeavor to choose internationally licensed brokers for their safety.

How to trade Forex in Nicaragua

There are three basic requirements to start forex trading:

- Subscribe to fast internet service

- Get a smart device

- Find a trustworthy broker

An internet-enabled device connected to fast and stable internet is the basic tool for forex trading. The device can be a tab, smartphone, or laptop. But the internet has to be reliable, with no frequent disruption. Unstable internet can lead to loss of opportunities and money if the connection cuts off while placing or trying to close a trade.

A trustworthy broker is the next crucial requirement. The broker provides access to the financial market through a brokerage account. The customer obtains this access once they sign up with the broker. There are good brokers and bad ones. The quality of the service offered tells you what type of broker you’re dealing with.

Here’s how to find a trustworthy broker:

- License

Investigate the broker’s license to find out who regulates their activity. The regulator should be globally recognized and have an internet presence so you can learn about them. It would be best if you avoided a broker without a license.

- Trading fees

The spreads are a major transaction fee that brokers charge for their services. Commissions are also part of it. Compare these fees among brokers to ensure the broker you choose charges competitive fees. Look into the non-trading costs too.

- Demo account

A reputable broker must provide a FREE demo account to allow potential clients to test their services. The free demo should be accessible for at least 30 days.

- Support service

Credible brokers ensure support service is accessible throughout the day, night, and on weekdays (24 hours). Traders must be able to contact support whenever they need to easily.

- Deposit and withdrawal

A trustworthy broker ensures it is easy for traders to move funds in and out of their platforms. The company integrates simple popular payment methods into the trading platforms to make it so.

These are standard requirements for a reputable broker. Any broker missing any one of these listed items should be avoided.

Trade forex using the steps below:

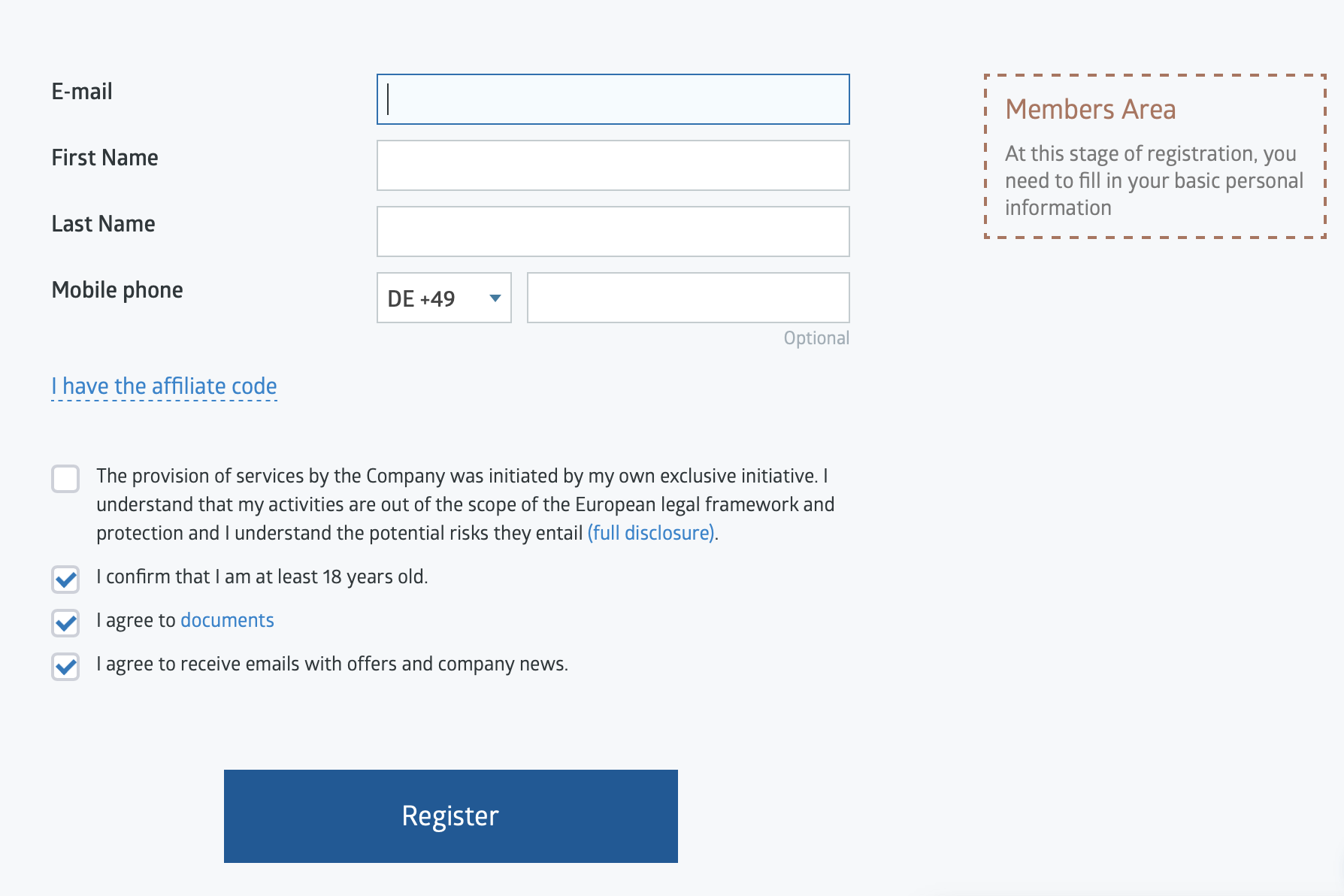

1. Open an account for Nicaraguan traders

Visit the broker’s website to begin the account signup process. For Nicaraguans, the webpage will probably load in Spanish, and it will be customized for traders from this region.

Click on the create account button visible on the page and type in the requested information. Only your email address and full name might be required at this stage.

Once you click submit, the system sends a verification message to the email you gave. Open the mailbox and click on the link in the message body. It verifies the details you entered and loads a page for you to continue the signup.

The broker might request a government-issued ID and utility bill showing your address. Be prepared to scan and upload these documents.

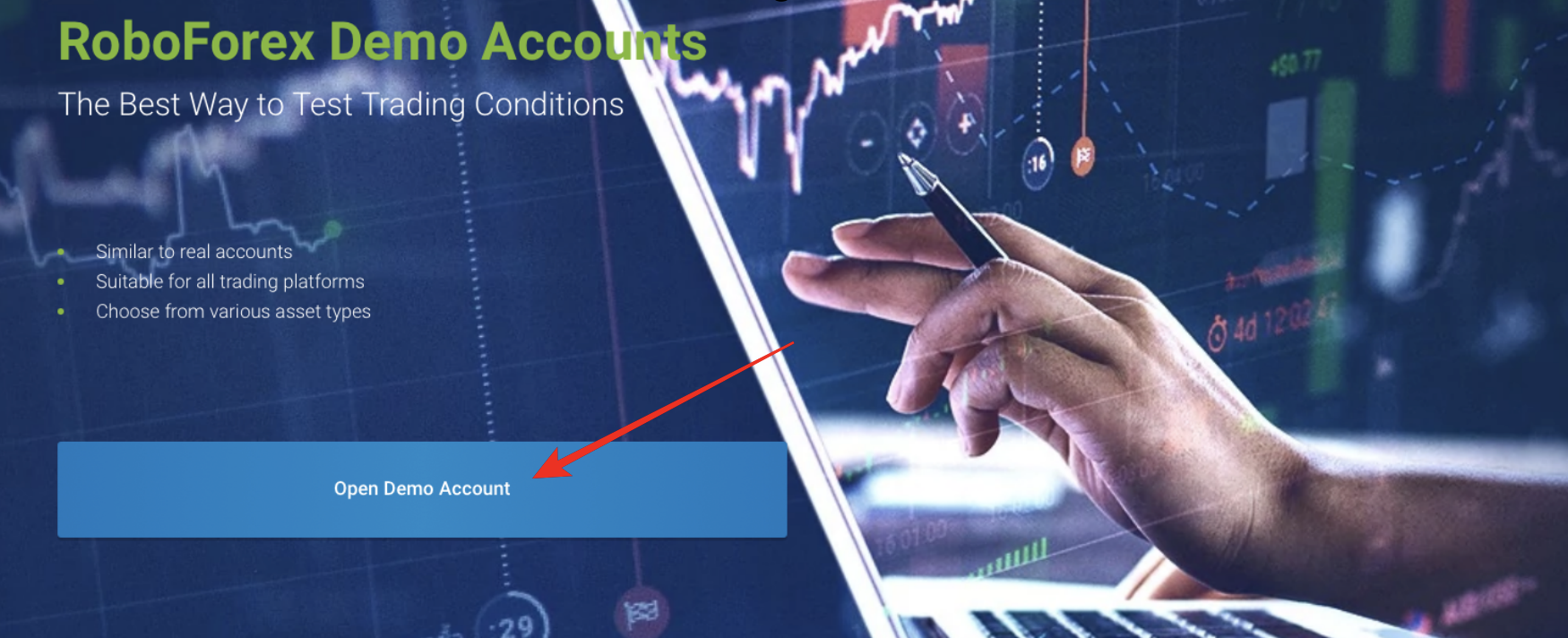

2. Start with a demo or real account

After signing up, use the broker’s free demo to practice trading or test their platform. The account should have sufficient virtual cash to conduct several test transactions.

If you’re new, it’s an opportunity to see the forex trading environment. You can get accustomed to the market without risking your funds.

Existing traders use them to test the broker’s platform features and trading strategies. Other accounts exist that traders can use to conduct tests. These are micro or cents accounts, and they require real money, though a small amount.

3. Deposit money

If you feel like testing the broker with a real account, you have to deposit money in the account for this.

Or, if you’re satisfied with the demo and ready for live trading, funding the real account is necessary.

This process should be easy if the broker provides simple payment methods in your region.

Click on the funding manager tab on the trading platform and select the option to deposit money in the trading account. Choose the payment method you want from the options offered. Follow the instructions to fund the account.

Brokers often assign dedicated support reps to newly signed customers. So the staff will be on hand if you encounter any issues.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Before your first trade, you should analyze the currencies you wish to invest in. It is crucial to trade the forex market profitably. The strategy shows the best time and points to enter and exit the market.

The analysis gives you valuable knowledge on what influences the exchange rate. It helps you make good trading decisions that result in gains.

There are three important forex analyses:

- Fundamental analysis

- Technical analysis

- Sentiment analysis

Fundamental analysis in foreign exchange looks into the factors directly causing the exchange rate’s rise and fall. These influencing factors make up the nation’s economy. They include the country’s interest rate, inflation rate, gross domestic product (GDP), etc. The trader examines these to guess the next price moves correctly.

Technical analysis in forex is the most common analysis. Traders study the price chart, looking at historical moves and finding patterns that indicate the best trading opportunities. Many tools are included on trading platforms that help with this analysis. The trader learns to use them and make the best trading moves to earn profits. Learning to interpret patterns and understanding the tools’ uses are keys to successful technical analysis.

Sentiment analysis in foreign exchange refers to studying market participants’ behaviors to determine how they feel. Market sentiment determines price direction. If the market feels the asset’s price will fall, there will be more SELL trades. If they expect a price rise, more BUY trades will happen. Brokers’ platforms offer tools that show market sentiments. The trader needs to learn to use them for proper sentiment analysis.

These market analyses are then combined with the most suitable strategy for the currency pair.

Here are some popular trading strategies:

- News release strategy

Trading the news in forex means paying attention to economic reports to place trades. A nation’s economy influences its currency’s value. Therefore, some traders make trading decisions based on news reports on forex fundamentals. This strategy requires knowledge and experience in the market. Sentiment analysis is also necessary to use it effectively.

- Scalping

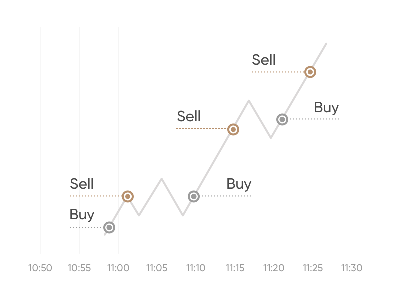

The scalping strategy is among the shortest term trading techniques. The trader opens and closes positions within a minute or two, at most, 15 minutes. The goal is to make small gains from tiny price movements. It results in several trades in a day. If these are successful, the trader’s profit adds up to a good sum. Scalping requires constant monitoring of the trade since positions are held only for a moment.

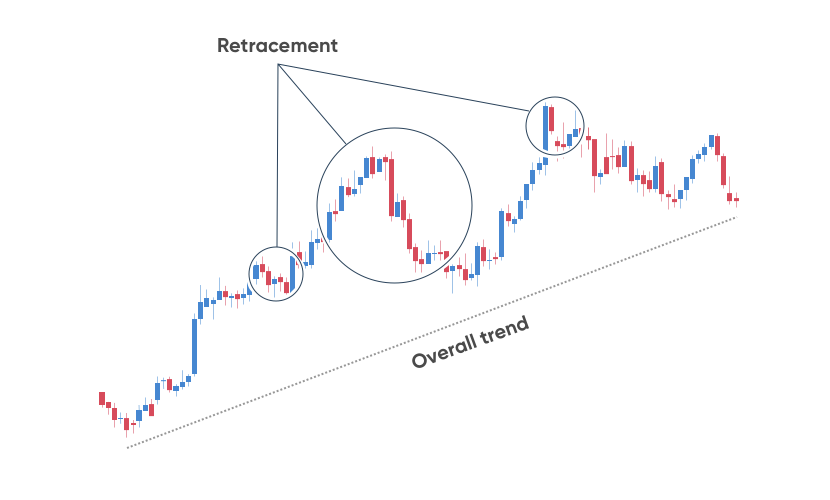

- Trend trading

Prices move in different trends, and many traders take advantage of this. It can be an uptrend, a condition where the asset’s price is trending high. A downtrend is a market condition in which the price is falling. A ranging market is a situation where prices move within specific ranges. These different conditions present trading opportunities. But it is necessary that the trader properly identifies the condition. False trends can cause losing trades. So traders use different indicators to be certain of the trend before placing trades.

- Price action strategy

Price action strategy involves looking at the naked forex price chart and placing trades based on the price move you see. Complex technical analysis is not required in this strategy. That is why it is very common in forex. The trader needs to understand how to interpret candlesticks’ movements to use this strategy correctly.

Many other strategies exist, and some are more effective than others. But the trader has to apply them to make a profit correctly.

5. Make a profit

As we said, the correct application of an effective strategy plus proper market analysis will result in winning trades.

Before long, you will start to earn from trading. You can withdraw the profits or raise your investment.

Withdrawing funds from the platform should be as hassle-free as depositing. Click on the same funds’ tab to see the withdraw option. Select that option and choose your preferred payment method.

Fill out the withdrawal request form and click on OK. The broker starts to process the request immediately.

Note that processing time for withdrawal is much longer than deposits. Sometimes, it can take as much as three days, sometimes less. It depends on the broker and the payment method used.

(Risk warning: 78.1% of retail CFD accounts lose money)

Final remark: The best Forex Brokers are available in Nicaragua

Many online forex brokers exist, and Nicaraguan traders can sign up with most of them. The trader should choose a regulated broker with conducive trading conditions and quality support. Our recommended brokers meet these requirements, and the narrow list simplifies your choice.

FAQ – The most asked questions about Forex Broker Nicaragua :

Is forex trading in Nicaragua possible?

Yes, traders who wish to mint money with forex trading can choose a forex broker in Nicaragua. Traders in Nicaragua can trade forex as they can enjoy the best benefits. The trading market in Nicaragua offers a great share to traders wishing to trade forex. Besides, the laws and regulations in Nicaragua support forex trading. So, you can trade forex in Nicaragua just like in any other country.

Which forex brokers in Nicaragua are regulated?

Several forex brokers in Nicaragua are highly regulated. For instance, you can choose IQ Option, RoboForex, Capital.com, Pepperstone, and BlackBull Markets. These brokers offer highly efficient services to traders. Besides, these five brokers fall under the purview of various regulating agencies, which makes trading possible for them. These five forex brokers in Nicaragua follow safe trading practices. Apart from this, they have a very big clientele.

How can I trade forex in Nicaragua?

Any trader must sign up for a trading account to trade forex in Nicaragua. Then, they would have to add funds to their live trading account for forex trading. Finally, traders can fund their trading accounts with brokers in Nicaragua and place their trades.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)