The 5 best Forex Brokers and platforms in Niger – Comparison and reviews

Table of Contents

Forex trading is one of the biggest marketplaces on the globe today. As of 2019, a report was released by the Bank for International Settlement (BIS), which stated a day-to-day trading count of 6.6 trillion in forex.

See the list of the best Forex Brokers in Niger:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 67% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 67% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 67% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Starting in forex can be tough, especially for you as someone just beginning in the forex trade. This article consists of vital information that needs to be known as a broker in Niger and the best five brokers you can choose from.

The list of the top 5 forex brokers in Niger includes the following:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

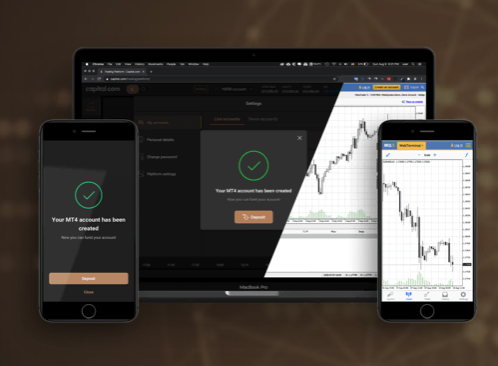

1. Capital.com

Formed in the year 2016, Capital.com already has 500,000 traders worldwide that use it.

The establishment is under proper regulation with some important monetary bodies such as:

- The Financial Conduct Authority, United Kingdom

- The Australia Securities and Investment Commission, Australia

- The Cyprus Securities and Exchange Commission, Cyprus

- The National Bank of Belarus, Belarus

Capital.com, no doubt, is one of the best brokers out there, so if you’re a beginner, you have nothing to worry about because they provide you with extensive articles, explanatory videos, live forums where you can ask questions, and training. The training has 28 courses sectioned in 5 sessions. After, you are assessed with an exam to see your development.

When it comes to technology, Capital.com has a good platform here. Traders can easily navigate through its trading interface, which allows them to make wise investments since it gives unique data.

Capital.com offers an extensive range of trading assets from which traders can pick. Some of the assets you can choose include – Stocks, crypto, indices, forex, and commodities. Trader’s on this platform are well-secured under the law, making it a well-checked and trusted platform.

CFDs, along with forex trading, are offered at moderate costs. Its method of signing up is easy with a minimum deposit of $3000. The company presents excellent customer service and quick responses to questions.

Pros on trading in Capital.com

- High-quality training and educational tips

- Availability of a demo account that allows new traders to practice, plus it never expires.

- Offers a wide variety of assets

- It has a competitive marketplace

Cons of trading in Capital.com

- Clients that are in the USA are not allowed on the platform

- There is a high fee for stock Index

(Risk warning: 67% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets was founded in 2014 by a small group of professionals in FX trading, data security, and developers in Fintech. Suppose you are starting trading metals, indices, and CFDs. Then this platform is a good start for you.

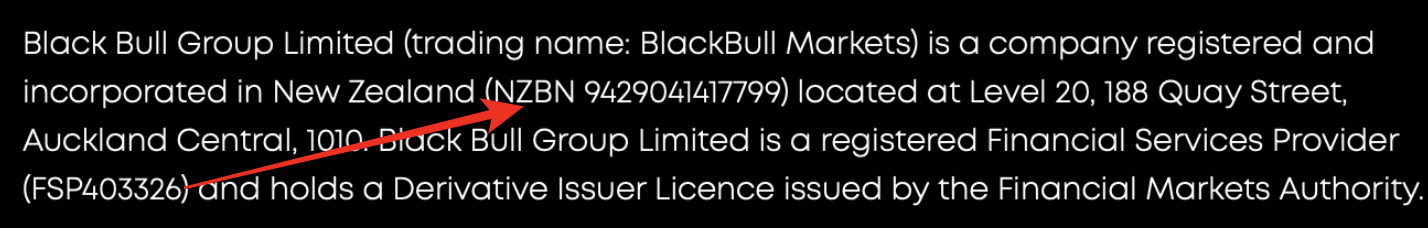

The Black Bull company is regulated by FSP403326, which therefore means that it has a Financial Markets Authority Issuer License. BlackBull Markets is also great for you if you like to invest with small assets.

Newly opened account owners will notice that the platform has a logical pricing structure and transaction execution. Free virtual private servers (VPS) and APIs are also commodities that can be traded on BlackBull Markets.

BlackBull Markets has an MT4 platform that automatically connects with the Equinix NY4 server that belongs to Wall Street. When it comes to quick transaction rates, BlackBull is indeed a quick one, as it measures up to 2 to 5 milliseconds. Being a trader on this platform means that you have many servers to trade in exchange with the available liquidity competitors who give very aggressive buy/sell prices, slight slippage, and thin spreads.

Pros of trading in BlackBull Markets

- Has MT4 and MT5 platform

- Virtual private servers (VPS) and APIs are available on the platform

- Deposit is free on BlackBull

- You can have a Tradeview on the web

Cons of trading in BlackBull Markets

- The withdrawal process has an attraction of fee

- Customer service has a slow response to clients

(Risk Warning: Your capital can be at risk)

3. RoboForex

With over 800,000 users from 170 countries around the globe, RoboForex makes it to number 3 on the spot. This platform has brokers/traders support numbering up to 18 languages. This helps the platform break any barrier between them and their clients.

RoboForex group was created in 2009 with two different bodies but the same, i.e., RoboForex and Robomarkets Lte. RoboForex presents services around the globe, while Robomarkets was created explicitly for traders in the EU and EEA. The IFSC regulates the company.

RoboForex offers MetaTrader suite (MT4 and MT5) and cTrader. Many users trade with MT4 since it is popular and multi-functional for trades; MT5 is still the most used trade site. Both offer quality opportunities.

There is no standard minimum deposit amount, as it varies from country to country. RoboForex provides its traders with various options to learn how trading is done correctly on the platform.

They are also working on the risks involved in investment. This means it gives them a good reputation and a trustworthy platform to trade in. All of which still makes RoboForex relevant in the Forex trade world.

They also have a members section to provide their members with market review, technical review, expert trading examinations, and various other tools.

Pros of trading in RoboForex

- Traders can perform flexible transactions.

- Low traders fees and enough freedom.

- It has a broad marketplace that allows traders to have a variety of selections.

- Availability of Demo accounts.

Cons of trading in RoboForex

- Customer support response and attendance are not so excellent.

- Traders only have access to a limited number of currency pairs.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Founded as far back as 2010, Pepperstone has gathered quite a reputation for itself in the broker’s line. The platform is well organized and thought out well in trading forex, metals, crypto, and stocks.

Pepperstone is a simple platform that focuses more on making its users have a leisurely experience and pin on the point of making money on the platform. Traders have the opportunity to have different accounts and enjoy minimal costs in trading. They also provide clients with quality customer service.

This broker also has regulatory bodies that supervise it. The Financial Conduct Authority, Australian Securities and Investment Commission (ASIC), Competition and Market Authority (CMA), Federal Financial Supervisory Authority (BaFin), Standard Chartered Bank (SCB), and DMSA supervise the activities of the broker. They are also excellent at giving the most recent market data and insight into trading activities. Pepperstone connects with reliable market resources.

The platform provides its marketplace with one of the most aggressive commission rates in online broker’s business. Has a Standard account that has a starting FX spread using one pip but without commission, while their Razor account starts at zero pip, plus commission from which new users can pick to start their trade

Pepperstone has other instruments such as the spreads that can be straight or be a combination of distance plus commission.

Pros of trading in Pepperstone

- Competitive pricing for traders who are using Razor account

- Pepperstone provides the opportunity for growing tradable market.

- Range of variety to choose from their social copy marketing platform.

- Pepperstone carries out proper research for its users.

Cons of trading in Pepperstone

- Customer service works only on weekdays, excluding weekends.

- There is no good work in trying to work on the development of its users through examination or interactive courses.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

Founded in 2013, IQ Option is number five on the list because of how efficient it is. Though it is not as old as some existing platforms in binary options occupation, they have continued to update its system with better binary options (only for professional traders and outside EAA countries) to maximize the best for its clients.

Unlike some platforms, this one offers traders both mobile and desktop experiences. This makes for ease of use and flexibility when it comes to using the broker’s platform.

The broker is very much popular, as it is already not only a one-time winner of awards and is recognized by industry top traders. It has a unique feature that allows traders to adjust the chart to the theme to fit their specific needs.

They developed a tool named IQ Option trading patterns which will aid traders on their way to wealth. The tool is accessible on the broker’s website and can have a substantial impact on the result of a trader’s investment.

This tool also provides the traders with informative videos that help clients learn the trading patterns. The videos are so educational that you will know all about employing all that you have learned in them in a short time. As a result of where it is located, this device is easy to operate just by the trading platform.

IQ Option is terrific because of its easy-to-navigate interface and how they treat every trader on their platform.

Pros of trading in IQ Option

- Opening an account on the platform is very easy, and it is online

- Interactive webinars are made available for all traders

- They have an outstanding customer service support team that is available 24/7

- There are no deposit or withdrawal fees

Cons of trading in IQ Option

- Withdrawing via bank transfer takes a long time.

- Does not provide MetaTrader platforms

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Niger?

Niger is one of the eight countries that belong to the Banque Centrale des Etats (BCEAO), and this bank is responsible for the financial regulation in Niger and the seven other states. This body is essential because it controls the other banks that operate in Niger.

Niger’s trade openness is fair, according to the 2015 Index Of Economic freedom, which follows the international average. According to the World Bank, Niger’s trade system is comparable to other low-income nations. Niger is also a member of the

West African Economic and Monetary Union (UEMOA). Affiliation implies joining a customs union with significant de facto protectionism and state rules.

The banking sector is governed by the Central Bank of West African States (BCEAO). The banking system in Niger is highly concentrated, with only four banks holding 90% of all deposits. The CFA franc is pegged to the euro due to Niger’s membership in the CFA region. This makes it almost impossible for Niger to pursue its monetary strategy.

Niger’s affiliation with these committees plays a significant role in the financial regulations.

(Risk warning: 67% of retail CFD accounts lose money)

Security for traders from Niger – Important facts

As a result of how the world is being transformed into a global village, online trading is now fast a popular thing. As a result of how much the world is changing, especially economies in the world, many individuals have decided to take matters into their own hands and be their financial providers.

The marketplace has become remote, and thereby, traders and brokers can perform financial transactions more accessible, faster, and much more efficiently. Just from your fingertips, investors can now trade with their smartphones or from their laptops.

It is essential to check the historical spread of the forex broker you want to go for. Most times, you want to go with minimal spread. Spread is the difference between the sell and buy rate. Excellent customer service is also a top priority.

You may as well keep your eyes pilled for Bucket retailers. Bucket retailers are known to trade on behalf of the investor and offer a non-changing price assurance. Keep in mind that they wait for the market price to change before going ahead to keep the difference for themselves.

Is it legal to trade Forex in Niger?

Niger, unlike some of the countries that have banned forex trading in their country, the government of Niger did not ban forex trading in the country, and its citizens are free as they wish to trade in the forex marketplace without any fear.

With a population of more than 20 million people and the country’s economic structure is low, the government encourages its citizens to begin forex trading.

Niger merchants can deal in international currency conversion markets from the comfort of their own homes. Through a Niger forex broker, you can invest in Niger Currency trading online.

How to trade Forex in Niger – Overview

Open an account for Niger traders

First, any trader that wants to start forex in their country must first open a trading account that belongs to it. After which, they will be asked to provide means of identification such as a passport or a National Identity card or driver’s license, and proof of residency, which can come as providing either a utility bill or bank statement. It’s always best to go for that which you can give quickly.

Start with a demo account or real account

Demo accounts are a great start if you are a beginner in the game. Forex trading is not a child’s play, so you should never just begin with a real account if you are a beginner. Starting with the broker’s demo account, if it has, will help you as a beginner know how the market works. Start a demo account with your chosen broker. If you are a professional in forex, you can deposit funds into your live account.

Deposit money

Immediately after deciding on your preferred broker and opening an account with them, you may proceed to deposit money into the live account and start trading currencies in real-time.

After this, you would want to choose your preferred payment method to deposit your money. Payment methods are usually through bank transfer, a master card, or a visa card. After this, you may fully begin trading currencies on your broker platform.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

You should note that as a forex trader, there are analytic strategies that you can use to know if you should buy/sell currency. Your plan should not be too complex, and you should keep an eye on the chart movement. You can also consider the current world market economies and essential people predictions, as these can also be vital.

Below are some of the strategies traders use:

Scalping

In forex, what scalping simply means is focusing on minute market changes. Traders usually open an enormous amount of trades to make tiny profits from each.

Day trading

Exchanging currencies in a single day is what is called day trading. Day trading is not only familiar in forex as it can be applied in any market, but the term is usually associated with forex trading. It simply means that you open and shut all trades in one day.

Position trading

This strategy involves holding a particular position for an amount of time, usually a few weeks to even a few years. Thus, traders embrace a comprehensive view of the market and tolerate minute market changes that may conflict with their position.

Make profit

To make a profit, you must close the trade that you started. Your profit or loss depends on the movement of the currency set you placed in the marketplace.

(Risk warning: 67% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Niger

As a trader in forex, you must familiarize yourself with the whole dos and don’ts of the system to be on the safe side. Traders must know that forex Trading should not be seen as a child’s game. At the same time, knowing how it works makes it much more manageable.

Also, trading on the best broker platform out there is very important. This will let you know that you and your money invested is secure and that the whole process is legit. Brokers with international regulatory bodies are still the best to trade with.

FAQ – The most asked questions about Forex Broker Niger:

Can you suggest leading forex brokers in Niger?

Since forex trading in Niger is picking pace, several brokers have emerged that offer traders the best trading services. However, other factors, such as the broker’s reputation, features offered, etc., also hold significance for traders. So, the best choice for Nigerian traders would be to pick one of the following forex brokers.

BlackBull Markets

Pepperstone

Capital.com

IQ Option

RoboForex

What should a Nigerian trader consider before choosing a forex broker in Niger?

A trader must keep a few things in mind while choosing a forex broker in Niger. First, the broker extending services should be reputed. It should have an advisory body overseeing its functions. Second, you must ensure that the broker should offer you an innovative trading platform that keeps you engaged. Apart from this, the platform should have outstanding features for trading.

What is the use of a forex demo account that brokers offer for traders in Niger?

If you are about to begin forex trading, a demo trading account will greatly help you. It will help forex traders immeasurably if they understand the basics of trading. In addition, forex brokers in Niger, such as the ones listed above, offer you a virtual currency of $10,000 in your trading account for demo trading. You can use this virtual currency to learn to trade. Or you can also enjoy building your trading strategies on the demo trading account.

Last Updated on April 14, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)