The best 5 Forex Brokers and platforms in North Macedonia – Comparison and reviews

Table of Contents

The forex market is a comprehensive market and a free market too. Many people are beginning to trade Forex because it is an essentially free market. Joining a forex broker platform is easy because traders can register online.

In this article, we will be showing you the best five brokers you can trade on in North Macedonia. You will also learn how to start an account on the broker platform if you do not know how to, and you will see if it is legal to trade ForexForex in your country.

See the list of the best Forex Brokers in North Macedonia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The best five forex brokers’ platforms include

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

Capital.com is known as a technologically improved brokers platform that started in 2016. It has its main branch in the United Kingdom, London. Other offices exist in other European countries.

Capital.com offers various assets to traders on their platform. Traders have assets to trade with, like CFDs, commodities, and stocks. Capital.com does not provide a commission for traders, so it is considered a commission-free platform.

The broker platform offers a demo account to traders, which means that traders can access a demo account on the platform. The good thing about Capital.com’s demo account is that it can be used consecutively. Aside from the demo account, the platform has two real accounts that traders can pick whichever suits them best.

The real or live accounts are the Standard account and the Plus account. Traders who open the standard account will have to deposit at least $30 into their account before trading with it. Owners of the Plus account will have to deposit at least $3000 before they can trade with their account.

Advantages of Capital.com

- No commission on the broker platform

- You can use the demo account for a long time

- The interface is customizable

- Easy withdrawing of fund

Disadvantages of Capital.com

- The least amount that can be deposited into the Plus account is $3000

- The MetaTrader 5 is not accessible on the platform

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets began its brokerage journey in 2014, and they offer broker services to clients worldwide.

They are under the license of FSA, which is a Seychelles financial monitoring organization. Traders enjoy security in trading on the broker platform because BlackBull Markets is regulated.

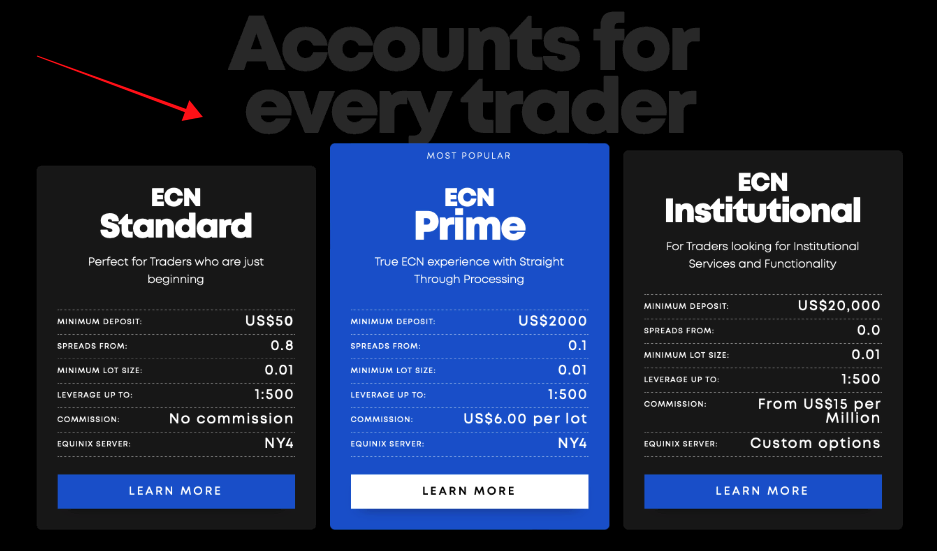

After registering with BlackBull Markets, traders can start with the demo or live account. The demo account is helpful for new traders. You can learn how the platform works and keep using it. The company offers three live accounts.

The standard account is usually owned by traders who want to start trading on the platform. Trader of this account must at least fund their accounts with $200 before they can trade with it. The spread is not so tight, and there is no commission for these account traders.

BlackBull Markets has what is called the Prime account. The initial deposit is different and higher than that of the standard account. The initial deposit is $2000, but traders at least get a commission when they trade with this account. The spread is tighter than that of the standard account.

The last account type on the brokers’ platform is the institutional account. This account’s minimum deposit is greater than the standard and prime account. The initial deposit starts from $20000. The commission is negotiable.

Whether using the standard account, the prime account, or the institutional account, you have a range of assets to place trades. The platform is a MetaTrader and has a unique platform for web traders called the WebTrader. You can trade anywhere with your phone or your computer.

Pros of BlackBull Markets

- Three different account types to choose from

- Market resources are provided for traders

- MT platforms and Specific WebTrader platform for Web users

- The server allows for fast transaction

Cons of BlackBull Markets

- 24/6 Customer support

- Withdrawing money will cost you a certain fee

(Risk Warning: Your capital can be at risk)

3. RoboForex

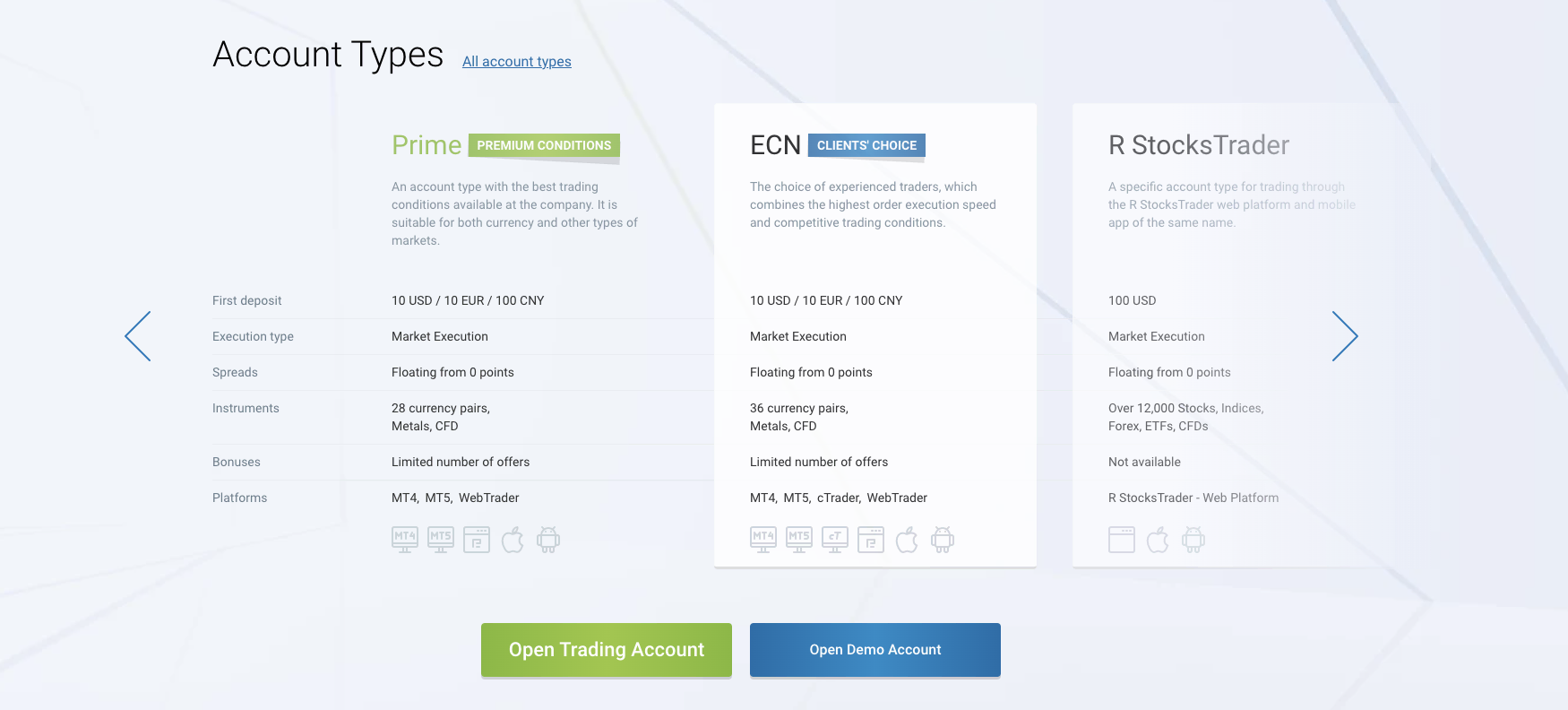

RoboForex offers many assets to traders, including ETFs, commodities, and CFDs. The first company was built in 2009 when RoboForex began. The broker is under the license number 000138/333 with FSC. It is a technologically improved broker that keeps growing even today. It has traders from countries in the world.

RoboForex is one of those platforms that offer both the MetaTrader 4 and MetaTrader 5 to clients. This is one of its kind because traders have access to the MT4, which is already an excellent trading platform, and then the MT5, which is more improved than the MT4. These platforms can be used whether you are using a phone or laptop.

Opening a trader account on the platform is very easy. After opening your account, you will access the demo account provided. The demo account is helpful, and it can be used and on by traders on the platform. The live accounts available on the platform are four. Traders can choose any that favors them most.

RoboForex offers traders a minimum deposit of $10. Although, this $10 deposit is exceeded for traders on the R StocksTrader account. Users of R StocksTrader need to deposit at least $100 into their account before trading with it. The spread of the R StocksTrader is also different from the other account types.

RoboForex is known to provide suitable educational materials to traders on the platform. The educational material helps traders to learn more about forex trading. Aside from the educational materials, internal market research is carried out and given to traders to help them have favorable trading conditions.

Merits of RoboForex

- There is the initial deposit of just $10

- Withdrawing money is easy

- Customers support is available 24hours to 7 days

- You get forex educative materials

Demerits of RoboForex

- Clients from some countries like Canada cannot trade on their platform

- RoboForex assets have a high trading amount

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone began in 2010 with its first office in Australia. The brokerage company is known to have many licenses and is, therefore, a secure platform for traders. Pepperstone is technologically advanced. Along with the security traders trading on the platform and its technology, it is not a surprise that the broker keeps having more traders on their platforms.

Pepperstone offers traders four different platforms that they can use to trade and have a unique trading experience. These platforms include TradingView, MT4, MT5, and cTrader. Out of all the platforms, the cTrader is used most. This is because of how advanced it is and how it helps traders trade quickly with its interface.

Traders usually use the MetaTrader platforms because it is made with plugins. The plugins have bots that can help a trader to strategize better. The plugin provided on the MT platform can be used on the phone and the computer. This is a fantastic feature for the traders on the platform.

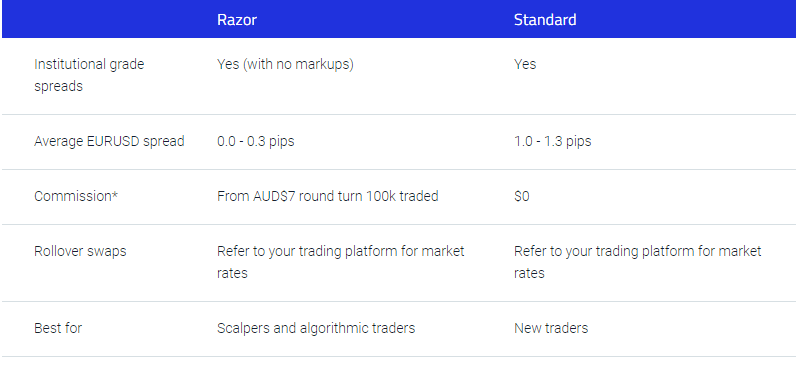

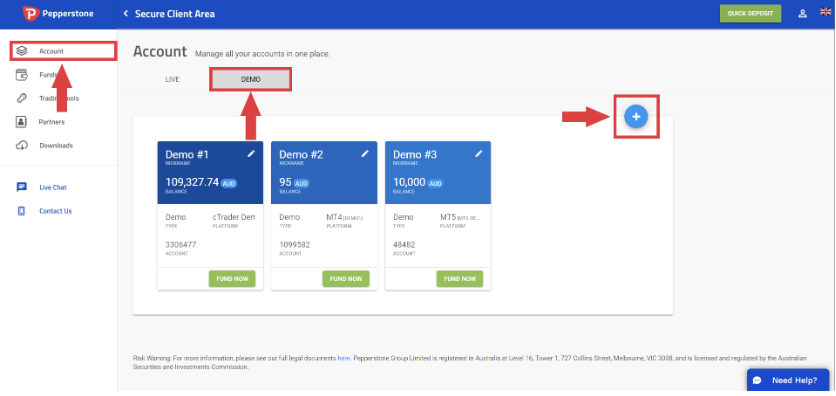

Opening an account with Pepperstone is easy. After opening your account, you can go ahead to use the demo account or the live accounts. The live accounts are two, and they offer different features to traders.

The standard account is made with the smallest deposit of $200. The account type does not offer traders commission, and the spread is not so tight. The other account is known as the Razor account. The razor account is made with a minimum deposit of $2000. Traders of this account get a commission after the trade and a competitive spread.

Benefits of Pepperstone

- Different trader platforms, especially the cTrader

- MetaTrader platform has plugins

- The company offers a trustworthy market resource

- Razor account owners have a competitive market spread

Disadvantages of Pepperstone

- A demo account that expires

- Pepperstone does not have many tradable assets

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

Cyprus is home to this forex brokerage company. The first office was built in 2013, and good enough, it is under the regulation of the CySEC. The company was only a binary option (only for professional traders and outside EAA countries) company when it started, but this is not the case today. ETFs, Metals, Stocks, and FX pairs are readily available to trade on the platform.

Opening an account is online, and it is easy. After opening your account, you have a demo account that has $10000 in it. You can use this amount to trade on the demo account platform. The money cannot be withdrawn because it is just demo cash. If you want to trade with your real account, you can choose any two accounts.

A standard account is present, and traders with this account type can deposit $10. But they do not get a commission as traders with this account type, and their spread is not so competitive. A VIP account is also available with a minimum deposit of $1000. You enjoy commission as a trader with this account and a tighter spread.

The customer support is responsive and offers some languages to respond to clients. IQ Option keeps building its clients around the world. The platform is also helpful to traders because it provides educational and market resources.

There is also an interactive forum for traders. Some webinars are organized for traders. Both new and old traders can come together in the forum and on the webinar to discuss.

Pros of IQ Option

- Customer support has a variety of languages

- A minimum deposit of $10

- Interactive webinar and chat rooms

Cons of IQ Option

- Clients from Canada are not allowed on the platform

- The VIP account’s minimum deposit is $1000

(Risk warning: Your capital might be at risk.)

What are the financial regulations in North Macedonia?

The National Bank makes the financial regulation in North Macedonia of the Republic of North Macedonia. The economic system consists of the National Bank, some commercial banks, pension funds, insurance companies, and some other financial institutions existing in the country.

The National Bank of the Republic of North Macedonia is the only independent financial institution in the country. All other financial institutions are dependent on the NBRNM. This National bank is responsible for regulating the country’s financial institutions. It issues licenses, rules, and penalties to all other monetary institutions in North Macedonia.

As regards Forex in the country, there is no restriction on Forex. The Securities and Exchange Commission for the Republic of North Macedonia is the body that supervises securities in the country and regulates the capital market.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from North Macedonia

Traders’ only source of security traders can give to themselves in North Macedonia is trading on forex brokers with regulatory bodies. North Macedonia does not have a local body that controls forex trade. This is why most traders get scared to trade Forex in North Macedonia.

Trading on forex broker platforms that are not under the regulation is not very trusted. It might be a fraud. It is advised that traders should not trade on any local broker platform because there is no regulatory body in North Macedonia.

International forex brokers that international financial regulators regulate make sure that broker platforms are secure and offer mild trading conditions to the traders. It prevents fraud and any other form of financial abuse.

Is it legal to trade Forex in North Macedonia?

North Macedonia is a country that appreciates free trade and a productive population. For this, it is legal to trade Forex in the country. North Macedonia does not have a particular body that regulates local forex brokers, and no law starts the role of forex brokers in the country.

For this reason, it might be thought that Forex is not legal in the country. North Macedonians can trade Forex as long as it is with a brokerage organization licensed by international regulatory bodies.

If you trade on a regulated platform, you will have more security and assurance dealing on that broker’s platform. Trading on the regulated broker platform is legal because such a body holds it accountable.

How to trade Forex in North Macedonia – Tutorial

Open account for North Macedonian trader

You must, first, open an account as a North Macedonian trader on the broker platform you have decided to trade on. The registration process on broker platforms is straightforward because it is online. You do not need to leave your home or office to register your forex trading account.

The broker platform will require that you upload a means of identification and address. You will be required to snap either your identity card or national passport for proof of identity. While for your residency, a utility bill or bank statement is alright.

Start with a demo account or a real account

After 24 hours, your account should have been verified and should be able to trade on the platform. Starting with a demo account is better if you are new to forex trading. The demo account will help you learn how to trade better as a trader. Professionals also use the demo account to practice one or two strategies they want to try out in their real account.

If you are new and want to trade with your real account, you will need to deposit money into your forex trader account on the broker platform. It is impossible to trade Forex with an empty account.

Deposit money

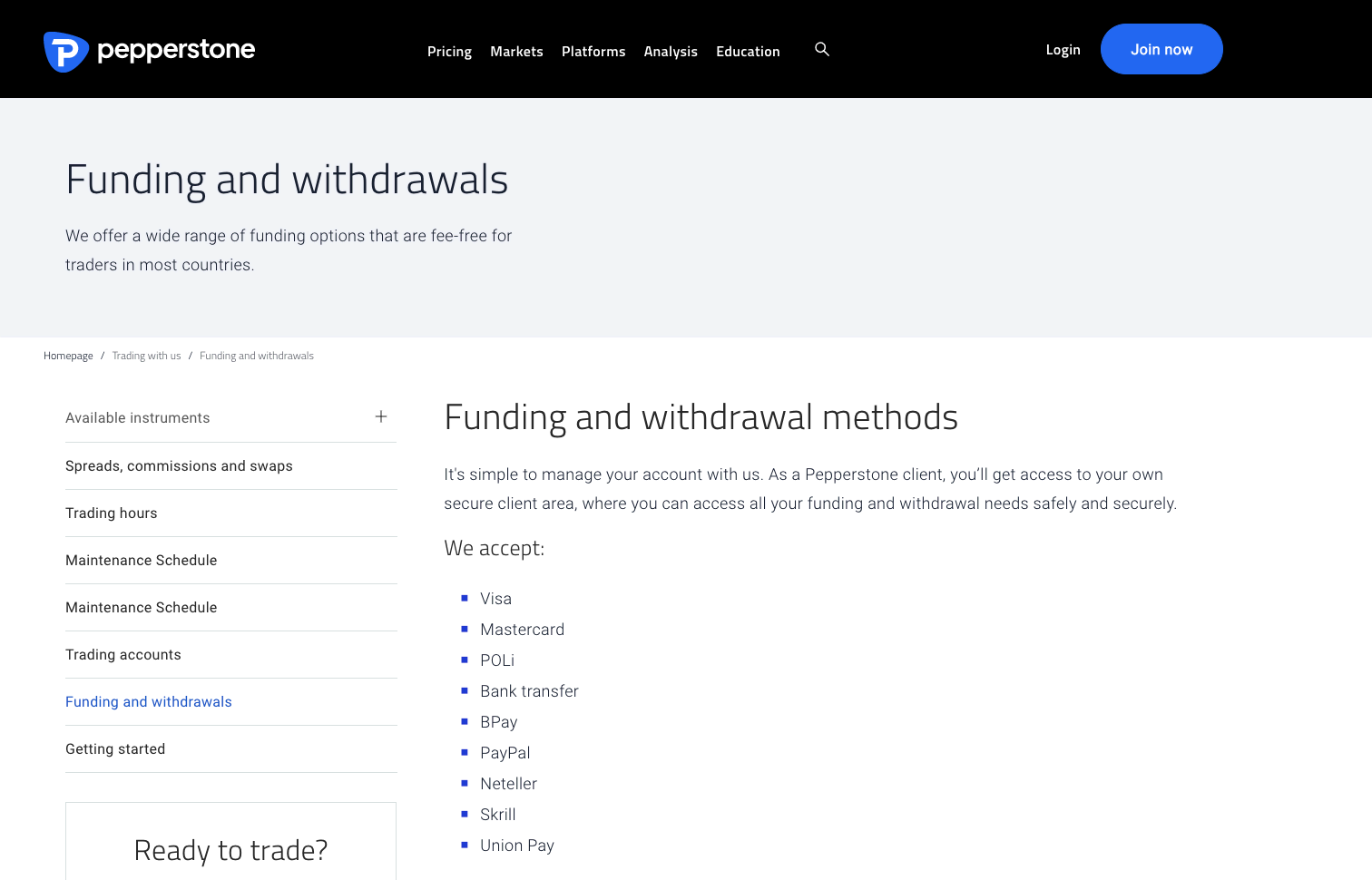

Deposit money into your real account to use it to trade. Every broker platform has the least amount a trader can deposit into their account before trading on the platform. The broker also offers a payment method with which the account can be funded.

Payment method can be through your MasterCard, Visa Card, Direct bank transfer, or Apply Pay. Choose the one that is most favorable to you.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Traders must analyze and strategize to make a profit in Forex. Forex trade is risk involved, and reckless trading is not the approach to the forex market, except if you want to run at a loss. Some standard forex strategies that traders use include the following.

Scalping

Scalping is a technique that involves opening many trading positions in the market for a short while to gain little profits from the trades. Scalping usually takes place for just a few minutes. Traders that typically use this method do not want to go through high risk. Scalping involves low risks.

Day trading

Day trading involves opening a trade for a whole day. The day trader must reduce the risk of using this strategy, not place trades at night. The trader waits patiently for a new day before opening a trading position on the chart.

Position trading

Position trading can be said to be the extreme opposite of day trading. The position trader can assume the same trading position for more than a year. The trader aims to notice how market changes happen eventually. The position trader ignores any sudden change in the market.

Make profit

Traders can make a profit by staying in the correct position. Making a profit or loss depends on your position on the forex chart when the market ends.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in North Macedonia

Forex trading is relatively straightforward. It only involves opening an account on the broker platform you have chosen. After that, you can start trading on the platform. Trading is the challenging part. It is not elementary, but as a trader with strategies in mind and analysis, you can trade well and profit.

You need to trade on regulated platforms because it creates more security for you as a trader on the platform. There are so many broker platforms out there that are not regulated. To avoid falling victim to fraudulent brokers, make sure you do your research and know that it has licensed.

FAQ – The most asked questions about Forex Broker North Macedonia:

What are the forest trading and forex broker north Macedonia situation like?

Forex trading through a forex broker in north Macedonia is on the rise in popularity, with a consistent increase in volume over the past years. Compared to other financial market sectors, it is pretty high. Forex trading has become more accessible and convenient in the area through advancements in online technology, a rise in internet coverage, and a competitive broker market.

What is the tax situation like in forex trading through a forex broker in North Macedonia?

A forest trader in Macedonia must pay taxes when their income reaches a specific level through a forex broker in north Macedonia. They must also ensure to file taxes when they suffer losses in trading. Taxes should get filed to the respective government agency in North Macedonia.

What features should be noticed in a forex broker in North Macedonia?

Look for the following characteristics while selecting the best forex broker in North Macedonia:

Minimum deposit requirements for opening an account

Funding methods to operate the account

Trading ability with each brokerage

Platforms of trading provided by these brokers

If applicable, the spread type offered by the brokers

The customer support offered by the brokers

These features can provide in-depth insights into how forex brokers in north Macedonia work.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)