Five best Forex Brokers and platforms in Oman – Comparison and reviews

Table of Contents

If you are looking to open a trading account in Oman, you can look at this list of five forex brokers we recommend that have experience and a good reputation from forex traders.

See the list of the best Forex Brokers in Oman:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 67% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 67% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 67% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

They offer industry Standard trading resources, fast execution speeds, and a wide range of trading instruments.

Five best forex brokers in Oman

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

It has been in the markets since 2016 and has registered over five million forex traders. It has trading instruments such as commodities, cryptocurrencies, forex, shares, and stocks.

Its regulation is from the Cyprus Securities and Exchange Commission and the Australian Securities and Investment Commission. It has three accounts the Plus account has $2000, the standard account requires $20, and the Premier account offers $10,000.

Trading costs vary with the account types, but forex spreads start at 0.8 pips. Capital.com I have known as a commission-free forex broker. Overnight charges vary with the open position, and it has no inactivity cost. The deposits and withdrawals are free.

Overview

- Minimum deposit-$20

- Licenses-FCA, ASIC, CySEC

- Platforms-MT4, web-trader

- Spreads from 0.8 pips on major pairs

- Support-24/5

- Free demo-yes

- Leverage-1:30

Capital.com is an award-winning forex broker regulated in multiple jurisdictions, which has made it one of the most reliable forex brokers. It offers negative balance protection to traders, ensuring that their funds are secure.

It also has an award-winning AI interface, making it easy to navigate the trading platform. Its traders can deposit or withdraw funds using Multibanko, Apple pay, Sofort, Trustly, GiroPay, iDeal, Trustly,2C2P, bank transfers, and credit/debit cards.

Disadvantages of Capital.com

- Capital.com has limited trading instruments. It has about six categories of trading instruments that are available for forex traders to use. 3. 2.

(Risk warning: 67% of retail CFD accounts lose money)

2. BlackBull Markets

Since its establishment in 2014, it has registered thousands of forex traders. It has Trading instruments such as energies, metals, forex, commodities, indexes, shares, and CFDs. Regulation is from the Financial Services Authority in Seychelles.

It has the ECN standard account, which requires an initial deposit of $200, the ECN Prime with $2000, and the ECN Institutional with $20,000. Forex spreads vary with the account. The ECN Standard account offers forex spreads from 0.8 pips, the ECN Prime has 0.1 pips, and the ECN Institutional offers 0.0 pips.

Overview

- Minimum deposit-$200

- License-FSA

- Platforms-MT4, MT5

- Spreads-0.0 pips

- Support-24/5

- Free demo-yes

- Leverage-1:30

It also has low trading costs for most of the activities traders do on the platform, the ECN Institutional has varying commissions, and the ECN Standard has no commissions. The ECN prime charges $6 for every $100,000 traded. It has no inactivity fees, the rollover costs apply, and the deposits/ withdrawals are free.

BlackBull Markets is a forex broker that offers industry-standard trading conditions for its traders. It has fast order processing speeds and offers copy trading through third-party firms like MyFXbook and Zulutrade.

It also has various trading tools, technical indicators, charting software, and a watchlist. The MT4 and MT5 trading platforms are available, and it has a mobile application. It has a desktop and a website version.

Disadvantages of BlackBull Markets

- It has limited educational resources. BlackBull Markets has few educational materials on its trading platform. Forex traders often offer training, webinars, and tutorials to new traders who register, which helps them understand different aspects of trading.

(Risk Warning: Your capital can be at risk)

3. RoboForex

It has been offering brokerage services for a decade and has registered over one million traders since 2014 when it got launched. Indices, forex, metals, ETFs, stocks, cryptocurrency, and CFDs. International Financial Services Commission regulates it.

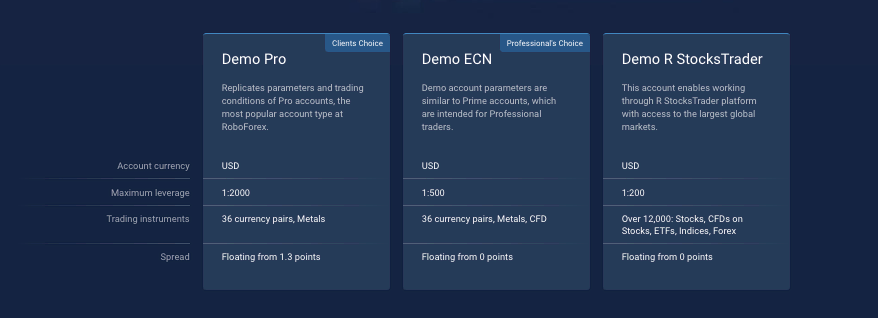

Traders can select to open accounts from the five types offered, the Pro, Pro-cent, Prime, and ECN account with a minimum deposit of $10, and the R-stocks trader requires $100. Forex spreads are based on the account you open. The Pro and Pro-cent forex spreads start at 1.3 pips, Prime and ECN from 0.0 pips, and $0.001 for the R-stocks trader.

The Prime account has commissions of $15 for every 1 million traded, the ECN charges $20 for every 1 million of volume traded, and the R-stocks trader with commissions from $1.5, and the Pro and Pro-cent have no commission.

Overview

- Minimum deposit-$10

- License-FSC

- Platform-R-stocks trader, c Trader, MT4 and MT5

- Spreads-0.0 pips

- Support-24/7

- Free demo-yes

- Leverage-1:2000

RoboForex offers multiple accounts which have low trading costs. It also has the CopyFX platform for copy trading or social trading. Its users have their account balances secured by the Negative balance protection, and traders can take advantage of its many bonuses and promotions to make more profits.

Dormant accounts for ten months have an inactivity cost of $10; overnight costs vary with the size of the trade and leverage used. The deposit and withdrawal costs are free using bank transfer, credit/debit cards Neteller, AstroPay, Skrill, Perfect Money, NganLuong wallet, and AdvCash.

Disadvantages of RoboForex

RoboForex is regulated in tier three jurisdiction. It has regulation from the IFSC, which is considered not as strict as other regulatory agencies located within the EU.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Since 2010 when it started its operations, it has had thousands of registered accounts on its trading platform. It offers trading instruments such as ETFs, indices, commodities, ETFs, stocks, and shares.

It has regulations from Finacial Conduct Authority and Australian Securities and Investment Commission. The Standard and Razor accounts are present, both with initial deposits of $200. Forex spreads on the Razor account start from 0.0 pips and the Standard account from 1.3 pips.

Pepperstone is a forex broker with multiple regulations, ensuring that it adheres to industry standards when offering services. It also has quality trading tools and offers negative balance protection for traders’ accounts.

Overview

- Minimum deposit-$200

- Licenses-ASIC, FCA

- Platform-MT4, MT5,c Trader

- Spreads-0.0 pips on the Razor account

- Support-24/5

- Free Demo-yes

- Leverage-1:400

The Razor account has $7 for every $100,000, but the Standard account has no commissions. Deposits and withdrawals are free, and it has no inactivity costs. The rollover costs get charged based on the leverage and position.

Traders can access the trading platform through the mobile app; it also has desktop versions for desktops and laptops compatible with IOS windows and IOS. Traders can transfer funds through Neteller, PayPal, B pay, POLi, UnionPay, POLi, Skrill, debit/ credit cards, and bank transfers.

Disadvantages of Pepperstone

- It has limited learning resources. The learning resources available in Pepperstone are fewer than other platforms that offer brokerage services. It is crucial to offer comprehensive learning resources such that new traders can learn how to trade when they register accounts.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

Over 40 million registered traders had used this platform since 2013 when it started its operations. Trading instruments offered include cryptocurrencies, forex, options, CFDs, Options, commodities, and ETFs.

It has a trading license from Cyprus Securities Exchange Commission. It has the VIP account with an initial deposit that varies starting with $1900 and the Standard account with a minimum of $10.

Forex spreads change with the liquidity of the asset and volatility, but for the major pairs, it starts from 0.8 pips. Cryptocurrency on its platform has 2.9%, but other trading instruments have no commissions.

Overview

- Minimum deposit-$10

- License-CySEC

- Platform-IQ Option trading platform

- Spreads-from 0.8 pips

- Support-24/7

- Free demo-yes

- Leverage-1:500

Rollover costs range from 0.1 to 0.5%, and inactivity costs of $10 for accounts inactive for over three months. Deposits and withdrawals are free, but withdrawals through bank transfers have a $31 fee.

IQ Option has a proprietary platform with quality trading resources and complies with investor protection rights. Its traders can use the fast order processing speeds to trade using different strategies.

Disadvantages of IQ Option

- It does not support MT4 and MT5. Most forex traders use the MT4 and MT5 platforms when trading as it offers competitive trading features and is popular among forex traders. IQ option does not support these platforms and can be a drawback for forex brokers that prefer them.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Oman?

Oman is a country with a low population but with vast resources, such as oil which has been the source of its strong economy. The forex trading industry in Oman is active due to the technological advancement and regulations that ensure the effective running of operations in the Muscat Securities markets.

The securities and stocks trading officially began in 1988 when the Muscat Securities Market was established. Since then, it has developed and has seen a rise in the volume of Oman traders joining the forex industry.

The securities and exchange markets have also led to the growth of the economy of Oman. The development of the capital markets in Oman was due to the easing of regulation which attracted more investors and financial intermediaries to start their operations in Oman.

The Central bank of Oman, together with the CMA, plays a role in ensuring the regulation of the financial sectors. It oversees licensing the financial institutions that apply for regulation within Oman and qualifying the CMA standards.

For the company to get registered by the CMA, it must comply with the CMA’s requirements. Together with the central bank of Oman, the CMA has the authority to establish the laws that govern the securities and stocks and ensure implementation by the entities involved.

Security for traders from Oman

The CMA of Oman has ensured investor protection by ensuring that financial dealers in the Oman securities and exchange markets have a trading license. Forex brokers are required to offer industry-standard services for forex traders.

Brokers need to have a separate account for investor funds to protect the investments of forex traders. Market participants have to comply with the Anti-money laundering regulations and laws limiting the use of capital markets for funding terrorism activities to ensure the security of the Oman capital markets.

(Risk warning: 67% of retail CFD accounts lose money)

Is it legal to trade Forex in Oman?

It is legal to trade forex in Oman. The central bank of Oman, the Capital Markets Authority, and the finance ministry are mandated to regulate and ensure Oman’s financial sector’s stability.

Forex traders can open trading accounts with forex brokers based in Oman or offshore forex brokers regulated in other jurisdictions. Forex brokers regulated in Oman have to ensure they provide high standards according to the financial legislation of Oman.

How to trade forex in Oman – Tutorial for traders

Open account for Omani traders

Search for a forex broker regulated in Oman by the CMA or an offshore forex broker regulated by tier one or two jurisdictions that accept Oman forex traders. Ensure to verify the license of the forex brokers since there are forex scams claiming to be regulated with fake license numbers and documents.

You should check the trading features: trading instruments, trading tools, low trading costs, order processing speeds, payment methods, and responsive customer care. These features will enable you to have a smooth trading experience.

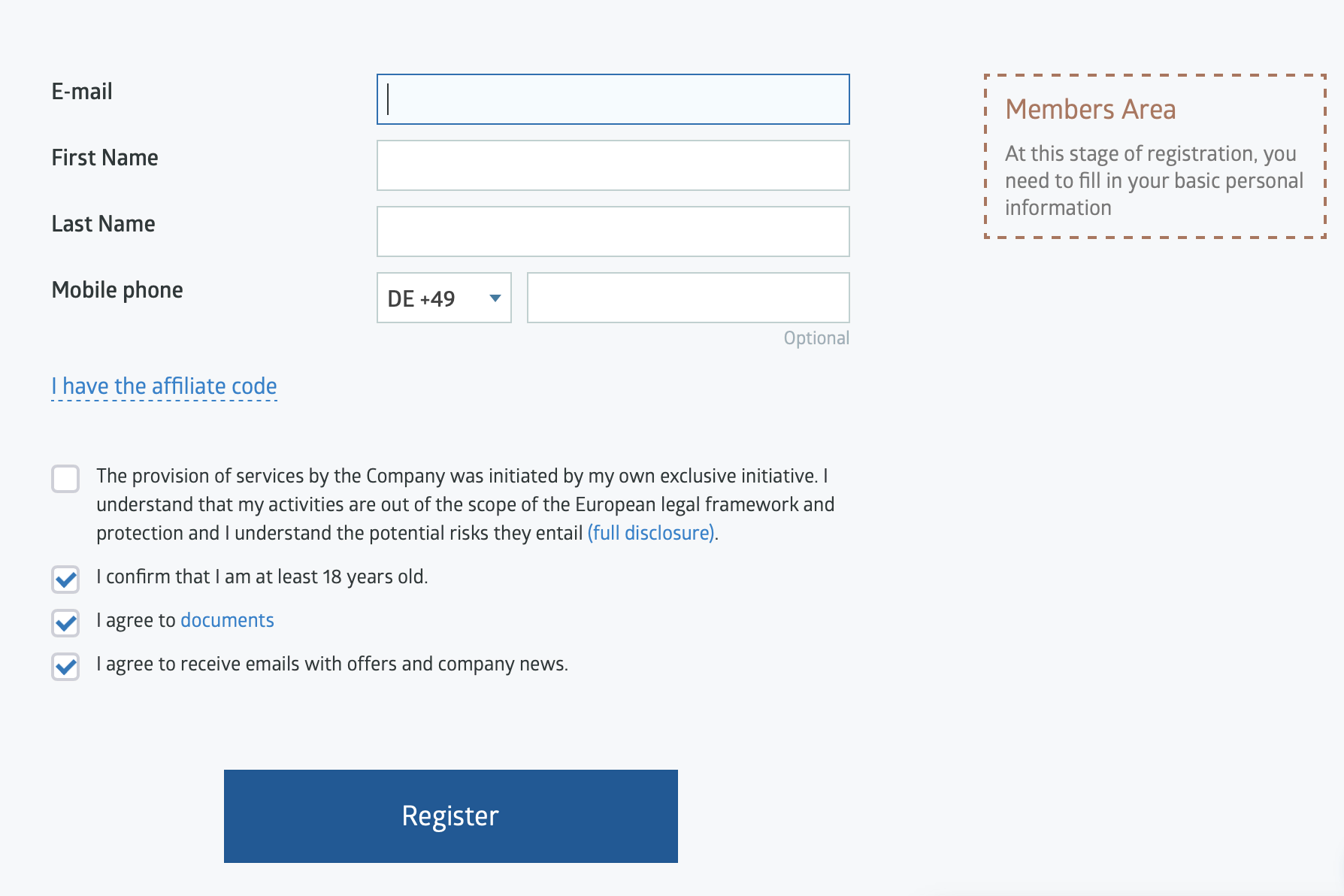

Open a trading account on the forex broker you have chosen; the registration form is on their website. The registration form needs you to submit your name, email address, nationality, date of birth, account type, telephone number, and address if the forex broker complies with the AML regulation.

Forex brokers also require your financial status and trading experience for risk assessment purposes. You will also require to submit a softcopy of your national identification card or utility statement to verify the information submitted.

Download a trading platform based on the guidelines of your forex broker. Some forex brokers support a variety of trading platforms, while others have their proprietary trading platforms. If your forex broker offers a variety, you can research which one you are comfortable with before downloading.

The process of downloading and installing takes a few minutes, after which you can use it to access financial markets. Navigate on the trading platforms interface and use the tools offered to enable you to trade effectively.

Start with the demo or real account

Start trading using the real account, or you can start by testing out the trading tools and instruments on the demo account. A demo account is also a useful tool for new traders since they can use it to learn how to trade.

The demo account uses virtual funds and offers the same trading conditions as the real trading account. Practice your trading strategies to ensure they are effective, offer consistent returns, and reduce the mistakes you might make while using your real funds.

Deposit money

Deposit the funds using your trading broker’s payment methods supported in your region. You can deposit through bank transfers, credit or debit cards, or electronic wallets like PayPal.

Before trading, ensure you have a trading strategy with consistent results by practicing on the demo account and adjusting the trading strategy. Forex traders should conduct a qualitative analysis of financial markets to know the best opportunity to enter or exit a trade.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Analysis

Forex traders must know how to conduct technical and fundamental analysis before starting. Analysis helps the trader know the financial markets’ status before investing. Using analysis is one of the most efficient methods traders use to prepare for a trade.

Fundamental analysis uses financial events, news, interest rates, and the economic and political status of the country to predict price movements. These factors contribute to the volatility of market prices of related countries; for example, if a country is politically unstable, its currency can experience some volatility.

Technical analysis this method works by evaluating the prices of a market through technical tools such as indicators and price charts. You can predict the price movement by looking at the volatility, liquidity, and momentum. Some forex traders also use price patterns to predict the trend.

Strategies

There are many trading strategies that Oman forex traders can apply to the financial markets. Some of the popularly used by many traders are;

Day trading-Day trading strategy requires the forex trader to open and close trading positions within the day. Day trading involves short-term trades during the day and needs the forex broker to have fast order execution speeds to make more profits than losses.

Trend trading –is a trading strategy in which the trader has to identify a trend using technical and fundamental analysis. Open a trading position by going long on an uptrend or short on a downtrend. You have to ensure you monitor the market since the trend can change and make you lose your trade.

Swing trading requires identifying a trend. The trader needs to find a trading instrument with some volatility, and you can see the swing highs and swing lows. When trading the swing highs and swing lows, monitor the financial markets while trading.

Trading a momentum-you can use the momentum of a bear or bull market to trade. You have to apply technical tools to know the trend’s momentum. If the momentum is strong, open a trading position and exit when it becomes weak.

Make profit

Make a profit by following your trading strategy when trading. Limit losses using risk management tools such as stop-loss, take profit, limit orders, and guaranteed stop loss. New traders should limit the amount of leverage they use to reduce their risk exposure.

Practice trading on the demo account before trading on the real account to reduce the mistakes you might make on the real account. Limit your losses by using the one percent rule, and ensure to track the market conditions when trading.

(Risk warning: 67% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Oman

Forex traders based in Oman can register a trading account from forex brokers based in Oman, banks, or from regulated offshore forex traders. Many forex brokers now accept forex traders from Omani traders.

When choosing a forex broker that accepts Oman traders, make sure you check the regulation of the forex broker. Many forex scams pretend to offer traders high returns on their investments.

Find a forex broker that offers trading features such as low trading costs, fast execution speeds, and industry-standard trading features. Check the forex brokers we have recommended to simplify the searching process.

FAQ – The most asked questions about Forex Broker Oman :

What aspects should I look at while selecting a forex broker in Oman?

Choosing a broker whose activities are closely monitored by a strong regulator who follows strict standards of security, openness, and fairness is crucial. It is also crucial to look into how user-friendly the broker’s platform is. An overly complex user interface might result in trading errors and be difficult to use.

Additionally, a top-notch brokerage would accept Oman’s most popular payment options, including Visa, Mastercard, PayPal, STICPAY, CashU, and others. Despite the fact that many Omanis speak English well, having the Arabic language available is preferred.

As an Oman Forex Broker, can I open swap-free accounts?

Yes, they can. All reputable brokers who do business with Oman adhere to the Shariah law’s prohibition on generating and paying interest. Money is just used as a means of exchange and is not considered to have any intrinsic value. Swap-free Islamic accounts come in various forms, including regular, micro, small, and VIP accounts, to accommodate both professional and retail users.

Can I use copy trading as an Oman forex broker?

Well, that varies entirely on the platform that each brokerage uses. This type of trading is supported by platforms like ZuluTrade, which is especially helpful for beginners who still have trouble making wise trading decisions.

Last Updated on March 2, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)