4 Best Forex Brokers & platforms in Pakistan – Comparisons and reviews

Table of Contents

You need a low-fee user-friendly broker to profit from forex trading in Pakistan.

See the list of the best Forex Brokers in Pakistan:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | Not regulated | Starting 0.1 pips variable & low commission | 300+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Low spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Researching brokers can be exhausting and consume time. We have done the hard part and now bring you a list of Pakistan’s best and most affordable brokers.

4 Best forex brokers in Pakistan

1. RoboForex

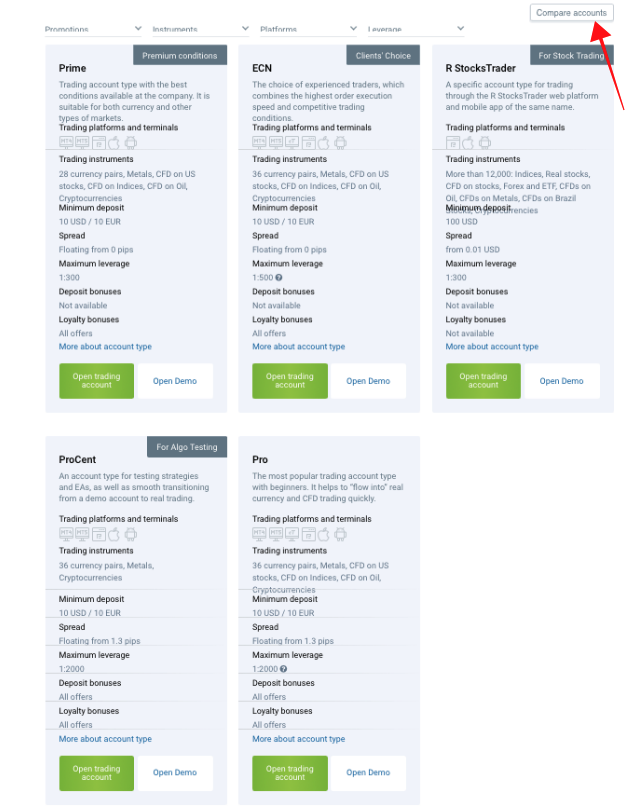

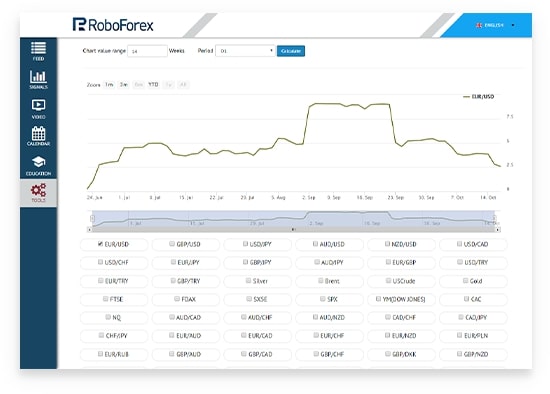

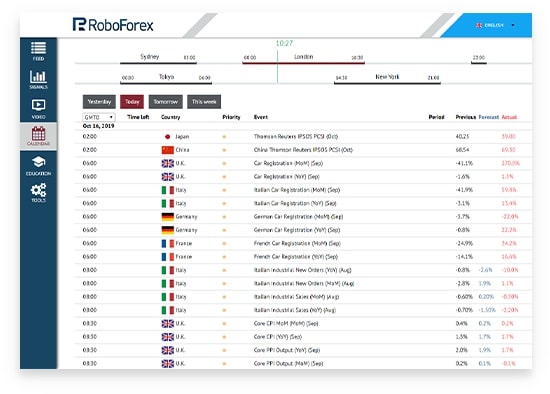

RoboForex is an international brokerage company founded in 2009. The broker is headquartered in Belize and offers global customers forex and CFD trading services.

RoboForex operates with a license from the International Financial Service Commission (IFSC).

The broker boasts over 1 million active accounts worldwide. These clients use its range of account types that cater to all levels of traders. Pakistanis can choose from MT4, MT5, cTrader, and RStocksTrader. All offer low trading fees, with spreads starting from 0.1 pip on their ECN account.

Apart from low trading costs, RoboForex is also known for its bonus and rebate programs. Newly registered customers get a $30 bonus to trade with. Existing customers get deposit bonuses at intervals, and active traders enjoy rebates. All of these further reduce trading costs for the customer. $10 is the minimum required amount to start trading.

RoboForex offers a free demo account to test its platforms. An Islamic account is also provided.

The broker provides 24-5 customer support and valuable education materials for traders. Popular funding methods are also available. But the broker charges a high fee for withdrawals.

RoboForex demerit

The withdrawal fee is a major disadvantage of trading with this broker. Its competitors do not place a fee on withdrawals.

(Risk Warning: Your capital can be at risk)

2. BlackBull Markets

BlackBull Markets is an international forex and CFD broker based in New Zealand. The Financial Markets Authority of New Zealand (FMA) and the Financial Service Authority of Seychelles (FSA) are the broker’s regulators. The company is also a member of New Zealand’s Financial Service Provider Register (FSPR). A reputable financial body in charge of preventing fraud and money laundering.

The brokerage firm was created in 2013 and has built a strong reputation as an authentic ECN/non-dealing-desk broker.

Pakistani traders can enjoy low fees and ECN trade executions with this broker. But the required minimum deposit is $200. But customers trade at an average spread of 0.3 pips on its commission-based account.

The broker offers trading services on the MT4 and the BlackBull Markets app. These are accessible on mobile phones, with functional trading tools and news updates. A free demo account is provided, and there is an interest-free Islamic account for Sharia-compliant traders.

Traders can reach its support service any time of the day from Monday to Friday (24-5 support). The broker offers dedicated support staff to its customers to make customer service more easily reachable. Pakistanis can contact its customer service via live chat, email, or phone support.

Common payment methods are provided for easy deposits and withdrawals. These methods include the basic ones, such as bank wire, credit card, debit card, Skrill, and Neteller.

BlackBull Markets drawbacks

The minimum deposit is higher than its competitors. Many reputable brokers allow trading on their platforms with much lower minimum deposits.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone is an established forex and CFD broker based in Australia. The company came into being in 2010 and now has offices worldwide, in Asia, Africa, Europe, and the United Kingdom.

Apart from Australia (ASIC), the broker is registered in several jurisdictions, including:

- The United Kingdom, FCA.

- The United Arab Emirates, DFSA.

- Cyprus, CySEC.

- South Africa, FSCA.

- Seychelles, FSA.

The broker offers genuine STP and ECN trade executions in its Standard and Razor accounts, respectively. Pakistanis can trade on reasonably low fees, with spreads as low as 0.1 pips on its Razor account. The standard account is totally free of commission charges and spreads start from 0.6 pips here.

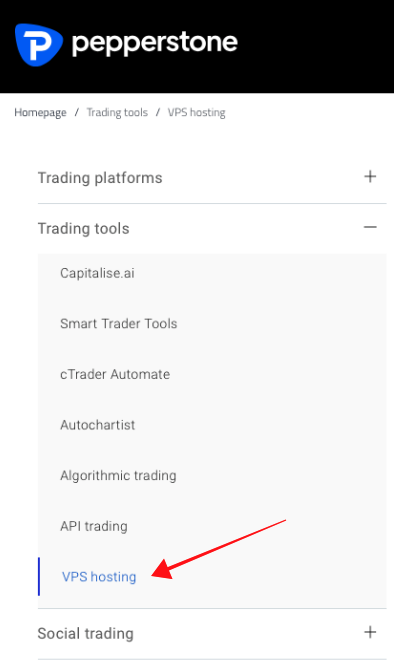

Pepperstone offers the MT4, MT5, and cTrader with unique add-ons, including free VPS for active and volume traders. Algorithm trading is fully supported, and copy trading is available. New Pakistani traders can use its 30-day free demo account for practice. Islamic swap-free account is also offered.

The broker provides useful research and education content in video tutorials and texts. Traders of all levels can find helpful information to improve their trading decisions.

Support service is available 24-5 by phone, email, live chat, and social media. Deposits and withdrawals are also made easy with the common payment methods that the broker provides. These include Visa, Mastercard, bank wire, Qiwi, Neteller, and Skrill.

Pepperstone disadvantage

The free demo period might be too short for some users. Many reputable brokers offer longer periods to access their free demo.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option is a forex and binary brokerage company established in 2013 and based in Saint Vincent and the Grenadines.

If you live in Pakistan and are looking to trade binary options, IQ Option is among the best broker for this service.

The broker offers a unique, intuitive, and user-friendly trading platform for binary options and forex trading.

With $10, you can start trading with this broker. Pakistani traders can access various financial instruments, including currencies, CFDs, cryptocurrencies, binary options, digital options, ETFs, and commodities.

IQ Option trading platform is an award-winning, user-friendly platform suitable for beginners and advanced traders. A free demo is available, so traders can test both forex and binary options trading before starting.

Deposit and withdrawal methods for IQ Option include credit cards, debit cards, maestro, bank transfers, and bitcoin.

IQ Option cons

The broker offers trading services only on its proprietary app. The MetaTrader platforms are not available to trade with. The absence of the MetaTrader platforms could mean some popular features, such as algo-trading, might not be available.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Pakistan?

Pakistan’s Securities and Exchange Commission (SECP) regulates financial market activities. This body is situated in Islamabad and oversees securities and futures trading in the financial markets.

The body regulates other financial sectors, such as the banking and insurance industry, mortgage, REITS, etc.

Forex trading in the country is not as restricted as many would think. Many Pakistanis engage in this activity in its dynamic and growing economy, although cryptocurrency trading is banned.

The Securities and Exchange Commission of Pakistan (SECP) introduced the ban to curb money laundering and fraud. This regulatory authority continues to introduce regulations to discourage forex scams.

Despite its regulations, many brokerage firms in the country operate without its license. There have been reports of scams by unlicensed fraudulent brokers within Pakistan. So Pakistanis are advised to deal with only licensed or internationally known brokers.

Security for Pakistani forex traders

As we mentioned, a few Pakistanis have reportedly been defrauded by scam forex dealers.

Pakistani traders should deal with the right brokerage companies to be safe and avoid falling victim. These consist of licensed international brokers outside Pakistan or brokers registered with SECP inside the country.

Pakistani traders should confirm the broker’s license by checking its website and the regulatory authority. They can contact the licensing body for further clarification.

Is it legal to trade forex in Pakistan?

Yes, forex trading is legal in Pakistan. Many Pakistanis trade in the financial markets, though not all brokers accept clients from the country.

Pakistani traders can sign up with international brokers outside the country, holding a globally recognized license. Or they can trade with the one registered with the Securities and Exchange Commission of Pakistan.

How to trade forex in Pakistan – An overview

Trading forex in Pakistan requires the same basic stuff as in other parts of the world.

These basic requirements include:

- Good internet connection

- A smartphone or computer

- A reputable broker.

They probably already have the first two in place.

A reputable broker offering quality trading services at competitive fees is crucial to forex trading success in Pakistan.

Each of the recommended brokers above fits this bill. But if you are not satisfied with what they offer, you can find many other credible online brokers.

Check these boxes below to ensure you have the right broker:

- Regulated by the appropriate financial bodies.

- Competitive spreads and commissions.

- Free demo account.

- 24-5 multilingual customer service.

- Trading platform compatible with IOS and Android.

- Accessible payment methods

- Easy and fast withdrawal

The broker you choose should meet these above requirements for peace of mind trading experience.

Follow the steps below to trade forex:

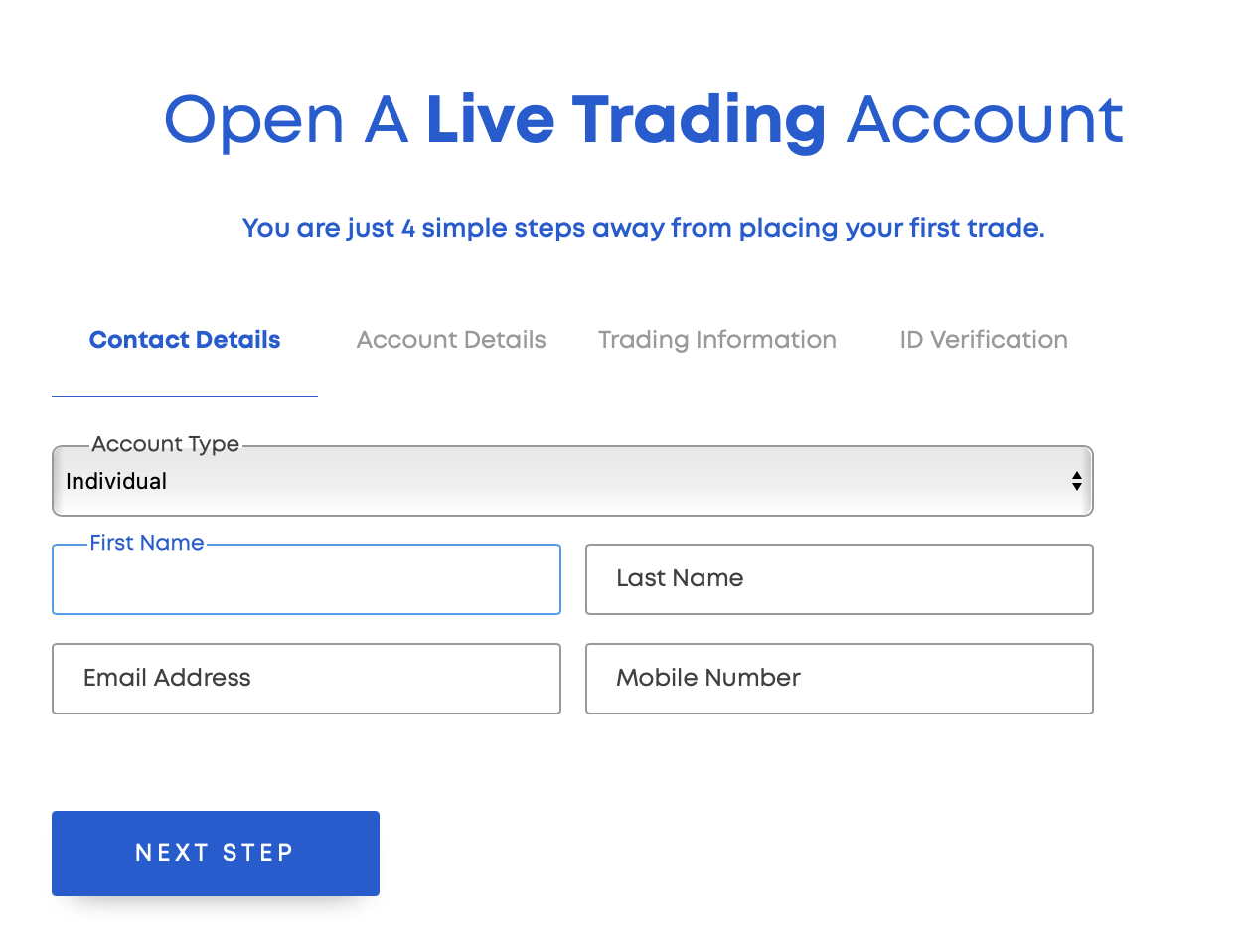

1. Open an account for Pakistani traders

Enter the broker’s web address on your browser. The landing page appears with a visible signup tab. Click on this and enter the required details. The required details might be your official name, email, and phone number.

Once you fill out the form, the broker sends a link to the email you provided. This link verifies the email and name of the broker. So, you need to open the message and click on the link.

Clicking on the link might also load the page for registration continuation. You might have to scan and send your ID card and proof of house address to complete the signup process.

Once this is done, the broker activates your account and makes it ready for trading.

2. Start with a demo or real account

Once you’ve completed the signup, you may first practice trading with the broker’s free demo or start trading for real.

We advise new or inexperienced traders to always use the free demo before going live.

It helps you understand the broker’s platform and trading environment before carrying out trades.

New traders can also use it to familiarize themselves with the market environment without risking their funds.

Traders who are changing brokers can also test with free demos to see what trading is like with this new choice of broker.

Many skilled traders prefer to test with a real account instead of a demo. The reason is that the demo usually does not show ALL the features available in the live trading platforms.

It is not a bad idea to test with a live account. But we recommend trading with the minimum required amount in this case. That way, you can run your tests with minimal financial risks.

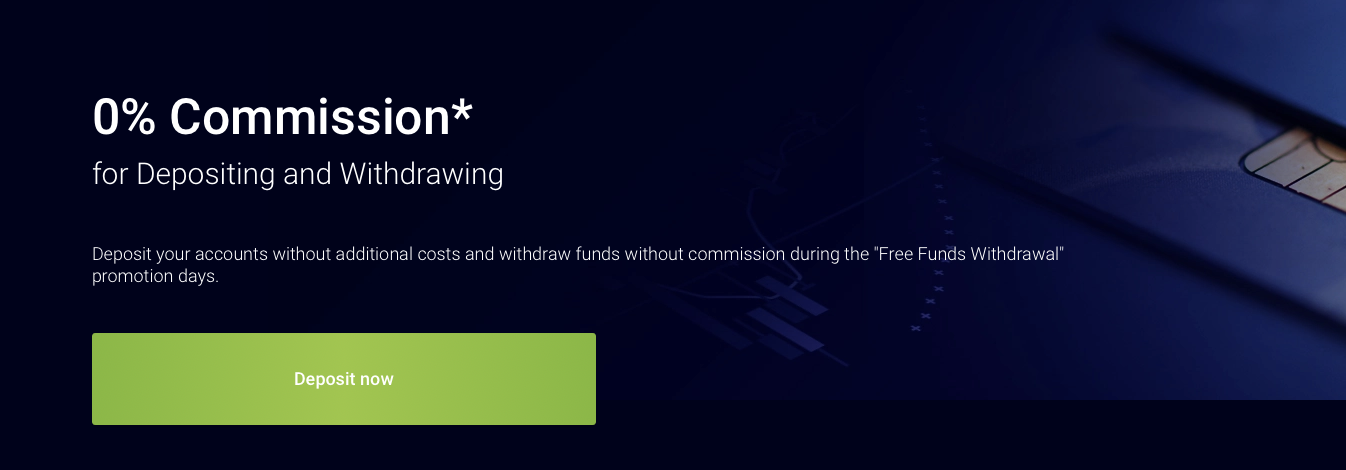

3. Deposit money to trade

Once you are ready to trade on a real account, you must deposit money first.

The broker usually assigns a staff to help with this process. But it should not be complicated if the payment methods are widely used.

That is why we recommend brokers that offer multiple common payment methods. The trader can have different easy options to fund or withdraw cash from the trading account.

These popular payment methods can include Visa, Mastercard, bank transfer, Skrill, and Neteller.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

4. Use analysis and strategies

An analysis is an essential part of forex trading. That and using a functional strategy.

The trader must first analyze the instrument and the price movement before placing trades.

Analysis helps one understand the asset’s price conditions, how it moves, past trends, current trends, and influencing factors.

Two important market analyses to carry out are:

- Fundamental

- Technical analysis

The fundamental analysis gives the trader insight into the currency’s fundamental factors. These factors are made up of elements of the country’s economy, including GDP, inflation rates, trade surplus or deficits, the country’s politics, etc. The trader needs to investigate these and understand their effect on the exchange rates.

Technical analysis involves forex indicators in a price chart. These indicators show past and current price patterns that the trader studies to find opportunities. Technical analysis provides valuable data, such as the asset’s average price in a given period, the current trend, possible price breakouts or retracements, etc. Brokers usually provide important tools to view these patterns. But the trader needs to learn to interpret them. Accurate interpretation of patterns helps you place successful trades.

Both analyses are vital for forex trading. Many skilled traders use these to devise an effective strategy to make profits. We share some common strategies below.

Common forex trading strategies:

Trend trading

These are three market trends: uptrend, downtrend, and ranging market.

An uptrend indicates a market condition where the price keeps trending higher. A downtrend market means the asset’s price is experiencing decreases and reaching new lows. A ranging market is a condition where prices move within specific ranges. It neither climbs high nor falls below the range.

These conditions present trading opportunities. The trader needs to identify the trend and then enter their trades in the price direction. Trend trading strategy can be used in any time frame, whether the trend is long-term or short.

Day trading strategy

This trading approach involves closing all trades before the trading day ends. The trader avoids overnight risks that come with sudden price moves. Fees that accrue from leaving positions open overnight are also avoided.

Swing trading

Swing trading involves holding your trade positions for a few days to a few months. This strategy is tricky, and the trader must have carried out proper necessary analysis before using it. These types of trades are exposed to more risks since the position stays open for many nights. Prices can make sudden turns overnight or at the start of the business day. Swap fees would also accrue.

Final remark: The best Forex Brokers are available in Pakistan

Forex trading in Pakistan is legal and has few restrictions. Traders must seek the right broker, conduct the necessary analysis, and use a working strategy to trade successfully. We hope this article helps you lay a solid foundation in your forex trading venture.

FAQ – The most asked questions about Forex Broker Pakistan :

As a trader in Pakistan, how can one develop the best forex trading strategies?

There are plenty of ways that a trader can employ to develop the best forex trading strategies. Whether a trader is based in Pakistan or any other nation, accommodating news in the trading analysis is highly important. Traders in Pakistan must also watch out for trends in the forex market. Besides, they should also use several trading tools, and techniques brokers offer them.

Can traders in Pakistan signup for a forex trading account?

Yes, traders in Pakistan can sign up for a forex trading account. However, to do so, you would need a reputed forex broker. Though there might be several forex brokers in Pakistan, the services of BlackBulls Markets, Pepperstone, IQ Option, RoboForex are the best.

Can Pakistani traders use a forex demo account?

Yes, Pakistan traders can use a forex demo account. All brokers that operate in Pakistan allow traders to sign up for a forex demo account. The demo account features are the best of the five trading platforms we discussed. Their demo trading accounts are lookalikes of the real trading account. So they can enjoy learning how to trade just as they would on their real trading account.

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)