The 5 best Forex Brokers and platforms in Panama – Comparison and reviews

Table of Contents

Forex trading is popular among the youths of today because of the evolution of technology. Forex involves currency exchange online using different assets that a forex broker provides on their platform.

See the list of the best Forex Brokers in Panama:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Individuals interested in trading forex can choose any of the five best forex brokers that we will mention below. The brokers are all regulated by one or more international financial organizations.

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

The brokerage firm is well-known globally and offers assets like CFDs, Commodities, and Gold. Capital.com, as a broker company, started in the year 2016 and has offices situated in the UK, Australia, Cyprus, Seychelles, and Gibraltar. Financial organizations in the area regulate these branches. Consequently, this makes Capital.com a reliable broker to their clients.

Capital.com offers clients on their platform a good trading experience on the forum. One is that the broker provides traders with educational courses and articles. The good thing about this is that it improves a trader’s knowledge about forex and trading forex.

The platform does not stop there. It offers traders low trading fees. Capital.com provides two account types from which traders can choose. There is a standard account with the lowest deposit amount of $20 and a plus account with a minimum deposit of $3000. Both traders of the standard account and the account do not get any commission.

Capital.com offers a very realistic demo account. Traders that are new to forex trading can quickly use this to catch up in learning how to trade and how to place positions whenever the primary market is open. The broker even has a MetaTrader platform that gives traders a beautiful trading experience.

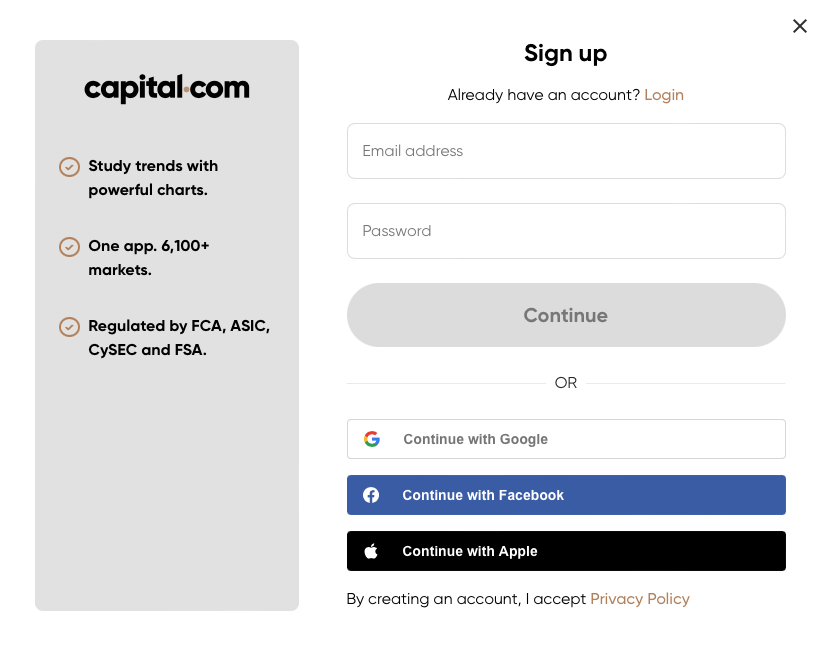

Opening an account is easy for traders. You need to provide the necessary documents for proof of identity and identification to start trading on Capital.com. Their account is easy to open whether you are using a phone or the web version on your computer.

Advantages of Capital.com

- A minimum deposit of $20 into the standard account

- The broker is commission-free

- No deposit fee on Capital.com

- Withdrawal of funds does not attract any fee

Disadvantages of Capital.com

- There is a high stock index fee

- There are no more minor currencies on the broker platform

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a globally known forex broker in the forex broker business. The company was created in 2014 in New Zealand. Two international financial organizations regulate the forex broker. The FMA in New Zealand and FSA in Seychelles provide the financial regulations by which the broker operates. The regulation offers traders security trading on the platform.

The broker platform is known for providing a reliable source of market information. The in-house market resource helps traders understand how to approach trading on the primary market. The broker offers traders assets to trade with from CFDs, Forex, and stocks. With the market resources provided, traders can know which assets are best to trade with at a particular time.

MetaTrader platform is available on the broker platform. Both the MetaTrader 4 and MetaTrader 5 are available on the MetaTrader platform. Traders even enjoy a quick transaction experience on the MetaTrader because of the Wall Street server connection. Transactions happen in a matter of milliseconds – say 3-8 milliseconds.

Traders can use either the Standard account or Prime account to trade. There are differences between these two accounts. The Standard account has a minimum deposit of $200, a spread that the pip starts from 1.1, and no commission at the end of trading.

If you consider the Prime or ECN prime account as most people know it, you have a minimum deposit of $2000, a spread with the pip starting from 0, and you get a percentage commission at the end of every trade.

Opening an account here is relatively straightforward. You will be required to provide a necessary document for identification and residency. It takes one day before you can start trading with your real account. There is a demo account available for traders to trade with.

Advantages of BlackBull Markets

- Offers great market resources to clients

- An interactive platform that allows traders to customize charts and workplace

- BlackBull Markets is available on both phones and desktop

- There is a MetaTrader platform available for traders

Disadvantages of BlackBull Markets

- Prime account owners’ minimum deposit is $2000

- There is a fee for making withdrawals when traders want to withdraw funds from their accounts.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex was founded in 2009 to provide assets like Forex, Stocks, and Indices to forex traders worldwide. The broker has well over two million traders worldwide and has offices in up to 169 countries across the globe. RoboForex traders have security because of the financial regulatory organizations from Belize that oversee the company.

RoboForex is a technologically improved broker. RoboForex is available on the phone with RMobileTrader and an RWebTrader on the web version. Whether you are trading on your mobile app or desktop, you can be sure of a good trading experience.

RoboForex’s other trading terminals are the MetaTrader platform and the cTrader. The MT4 is the most used of the MetaTrader, even though it isn’t as advanced as the MT5. You will find that the cTrader platform is used more than the MetaTrader on RoboForex. These trading terminals allow traders to perform multiple functions on the broker platform.

There are different account types on RoboForex that can be used for trading. The standard account is most commonly used because it offers traders the ability to deposit funds as low as $10 into the account. The accounts have the same spread that starts from 0 pip.

RoboForex provides educational resources to traders on their platform, and these resources can come in courses, literature, and webinars. Traders can learn a lot about the forex market with the educational resources that the company provides. Market resources from within are also offered to traders.

Advantages of RoboForex

- Traders withdraw funds from their accounts without worrying about fees

- MetaTrader and cTrader platforms that give traders a great experience

- Equal spread across all the accounts

- For a standard account, traders are required to pay a minimum of $10 as a deposit

Disadvantages of RoboForex

- Trading fees can be slightly high.

- The customer support does not operate 24/7

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone was established in 2010 to offer assets like Forex and CFDs to clients worldwide. The company is an Australian-based forex company with an office in London. The office in London was established in 2015 to improve client services in Europe.

Forex traders on the broker platform have security. Pepperstone is one of those companies with more than two licenses from financial organizations. Financial Conduct Authority regulates the broker in the UK, BaFin in Germany, and Australia’s very own ASIC (Australian Securities and Investments Commission).

Pepperstone offers two account types that traders can use to trade these are the Standard account and Razor account. Both account types offer a different experience to traders. The Standard account starts with a deposit amount of $200, while the Razor account deposit starts from $2000. The accounts also have different spreads and commission rates.

Traders get free, reliable educational articles and courses. This helps traders on their platform have good knowledge about the forex market. It gives them knowledge about strategies they can use and generally how the forex market operates.

Traders that use Pepperstone can trade on either their mobile phone or desktop’s web version. This allows the trading experience of clients to be smooth. Opening an account on either the phone or the web is effortless. Opening your account is entirely digital.

Advantages of Pepperstone

- MetaTrader is available on the broker platform

- Plug-in is provided for you as a trader.

- Good customer support is given to clients

- The broker platform offers security to its traders

Disadvantages of Pepper

- The demo account expires

- It offers CFDs primarily to clients

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option was created as a company to offer binary options (only for professional traders and outside EAA countries) before some improvements were made in its technology, and it now offers Forex and CFDs. The improvement made even more people start using the platform to trade. The Cyprus Securities and Exchange Commission regulates the broker. It even has its HQ in Cyprus.

The broker platform offers its traders a demo account that will not expire. It has two account types that traders can pick from, depending on how the trader is. There is a standard account in which traders can make the minimum deposit of $10. The standard account operates on a different FX spread from the other account, which traders can use to start trading on IQ Option.

VIP account is the other account type that traders can use to perform trade. The FX spread operates on a different pip from the standard account. Traders who use this account type need to make at least a deposit of $1000 before trading with the account.

Trading on IQ Option allows you to learn more about forex because they give clients top-notch educational resources. These resources come in educational courses, literature, and videos that the clients can use to inform themselves about forex. Forums are active within the platform. Traders can also get information about the market on the platform.

The forex platform is available for those with phones, and there is a web version. They both have the same interface, and traders can even manipulate the chart to suit them. This allows trading on the platform to be enjoyable and user-friendly.

Advantages of IQ Option

- A demo account is available on IQ Option

- Traders can change the look of the interface to suit them

- Opening a statement with the broker is easy

- The minimum deposit of $10 into your standard account

Disadvantages of IQ Option

- US Clients cannot trade on IQ Option

- Withdrawing through direct bank transfer takes time

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Panama?

In Panama, there is the Superintendency of Banks of Panama (SBP). This SBP serves as the country’s central bank and is charged with the duty of regulating the banks and banking groups that are authorized to function in the country.

The main function of the SBP is to ensure that all the banks in Panama are operating smoothly to improve the efficiency of the banking system in the country. It makes sure that it checks every activity in other financial institutions by providing banking laws that they must follow.

The SBP carries out two supervision methods to ensure that the laws are followed. The macroprudential supervision and the macroprudential supervision are the two types of control.

Macro supervision ensures that financial instability is prevented in the banking system. It has to deal with the soundness of Panama’s general financial system. On the other hand, micromanagement focuses on the well-being of each financial institution. Micro means taking every individual and ensuring that they are functioning correctly.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Panama

Trader’s security is essential in Forex trading. Maybe this is so because Forex trading is an online trading platform and does not have regulations in many countries. People think forex is fraud and that a broker can decide to close up any day, so most people do not trade forex. There is that fear of losing money and everything you worked for if you fall into the hands of the wrong forex brokerage companies.

Suppose forex is not regulated in your country. It is best to trade with companies with international financial regulators that govern and make sure that such companies obey a law. Trading with regulated forex broker platforms is the best form of security a trader can give themselves.

The brokers mentioned above are well regulated by one financial institution. They ensure that the broker platform offers transparent trading policies to the traders.

Is it legal to trade Forex in Panama?

Panama does not have a body that regulates forex activities. No organization or law governs forex activities in the country. This is why many fear that forex is not legal in Panama. You must know that it is legal to trade forex in Panama, and forex trading is not a crime as long as you are trading on a licensed platform.

Trading on a licensed broker shows more credibility and trusteeship to traders. Forex brokers are regulated as a framework that guides their existence, and therefore, it is legal to trade on such platforms.

How to trade Forex in Panama – A step-by-step tutorial

Open account for Panama trader

Open an account as a trader in your country. This is just the first step you need to take to trade forex in Panama after selecting the broker you want to trade on. The broker will need to verify your account first, and so you will need to show proof of identity and residency. You can tender documents such as a National ID card, Drivers’ license, and National passport for proof of identity. For residents, you can tender a utility bill, for example.

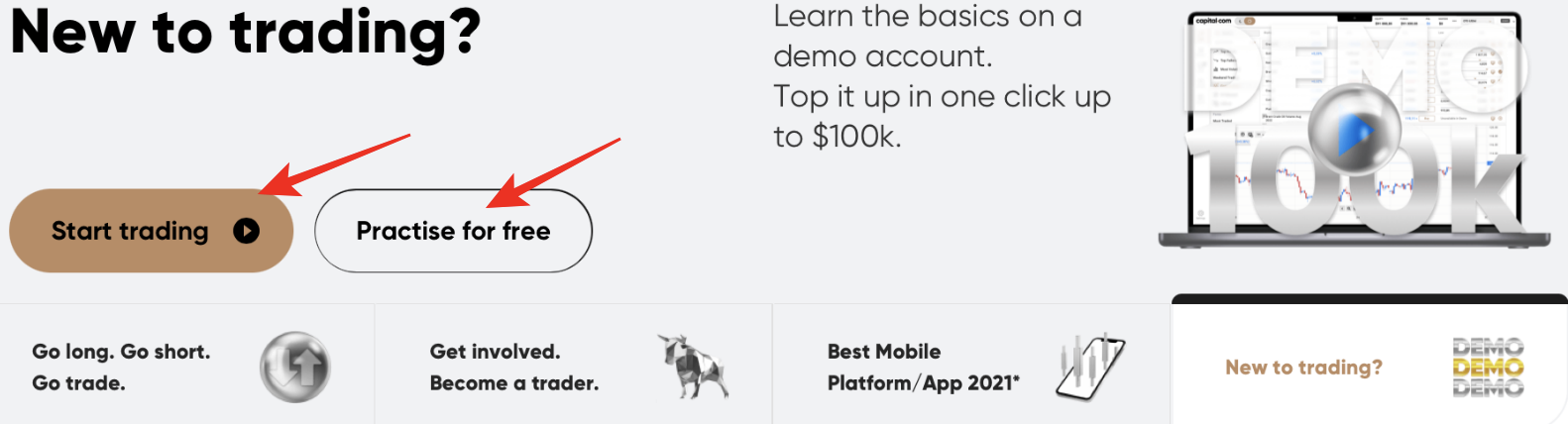

Start with a demo account or real account

Next is to start trading with your real account, if you like, or the demo account. It is good, to begin with, your demo account as a new trader. Trading with your demo account helps you know how to trade forex just like it is a live account you are using. You don’t need to deposit money into your demo account because it is already loaded with an amount by the broker platform.

You will need to deposit an amount into your real account before you can trade on it.

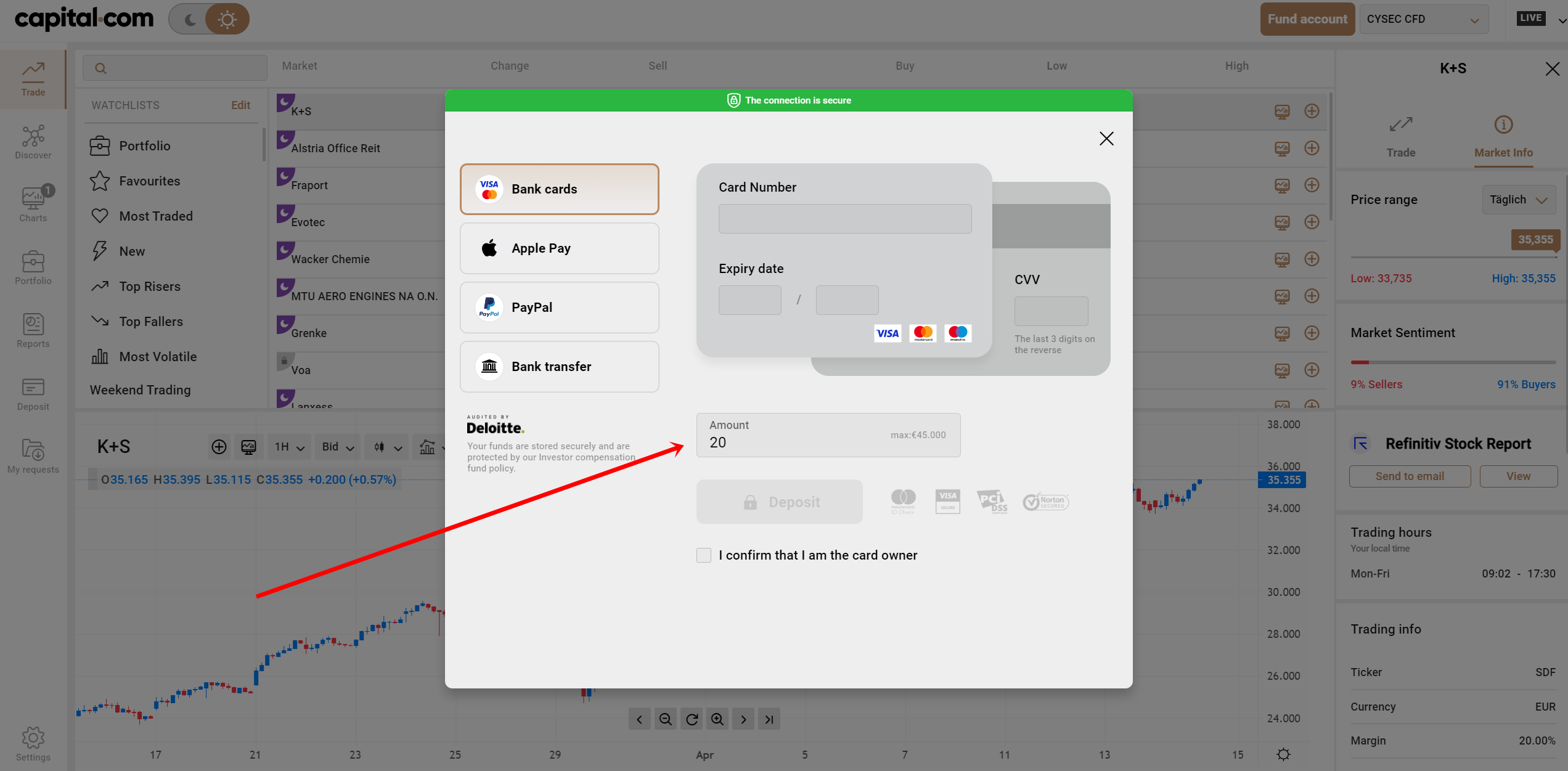

Deposit money

Trading with your real account will require you to deposit money into the count. The platform will provide you with more than one payment method that you can use to pay money into your account. Every broker has a minimum amount that traders can deposit into their accounts.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

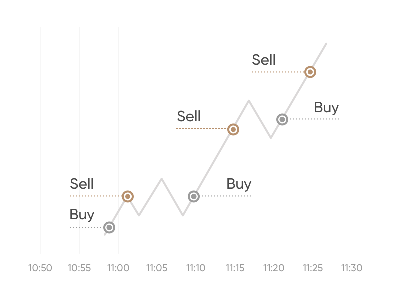

Use analysis and strategies

Traders usually have a particular strategy that they use while trading. They use strategies to analyze changes in the market. Adopting a specific approach will help you trade carefully because forex involves many risks, and only the careful traders make the profit most.

Strategies that you can adopt are listed below.

Scalping

Scalping in forex trading is one of the best strategies a client adopts. It usually involves opening more than one trade in the market for a short while. The trader aims to gain a small profit from all of their trade.

Day trading

This method involves opening trade on a single position for a whole day. The traders wait for a new day before opening another trading position.

Position trading

Position trading involves opening a trading position on the chart for a long time. The trading position can be the same for more than weeks and sometimes span into years.

Make profit

As far as you have a good trading strategy, it is more likely that you would make a profit from forex trading. Profit-making depends on the position you are in when the market closes.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Panama

Registration on a broker platform is easy. The process is done digitally, which means that signing up is done on your phone or your computer—whichever of these devices you have.

Forex brokers have different trading policies. It is always best to go for something that suits you. Trading on a licensed broker is the best thing you can do for yourself as a trader.

FAQ – The most asked questions about Forex Broker Panama:

How do the trading and spreads cost affect a forex broker in Panama?

Commission, spreads (currency’s buy and sell rates), and interest rate swaps are common charges of a forex broker in Panama. The professional forex brokers in Panama keep their fees in the following manner:

1. They keep the spreads and commissions to a minimum.

2. Inactivity or account maintenance costs are zero.

3. Deposits and withdrawal fees are nothing or a minimum.

Why compare forex brokers in Panama?

Comparing the different available forex brokers in Panama is an intelligent move. This evaluation ensures you and your money are in the right hands, and you won’t get scammed. Ensuring that the forex broker is regulated and abides by the rules tells their reputation. Further, a forex broker can make or break your entire forex trading experience.

Why should I participate in forex trading through a forex broker in Panama?

Appointing a forex broker in Panama to handle your forex trading can help you set a strong foothold. The forex broker doesn’t require a lot of money to begin. Forex brokers can help you trade over 100 currency pairs available in the market. Further, automated tools and trading signals make it streamlined and easy to trade.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)