The 5 best Forex Brokers and platforms in Papua New Guinea – Comparisons and reviews

Table of Contents

Forex trading is not so popular in Papua New Guinea, though many brokers welcome clients from the country. Many seek ways to increase their income to meet living costs, and forex trading is one legit avenue.

See the list of the best Forex Brokers in Papua New Guinea:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

If you have considered this venture, you must realize you require a cost-effective licensed broker offering quality service.

We introduce to you the list of the 5 best brokers accepting Papua New Guinea traders:

- Capital.com

- Blackbull Markets

- RoboForex

- Pepperstone

- IQ Option

Below, we summarize their offerings:

1. Capital.com

Capital.com is known for its quality educational materials and user-friendly proprietary platform, making them appeal to traders of all levels.

At a glance:

- Regulations – CySEC

- Minimum deposit- $20

- Platforms – MetaTrader 4, Capital.com app

- Spreads and fees – 0.8 pips on average for major pairs. Zero commission.

- Free Demo account – Yes

- Support – 24 hours, Mon – Fri.

- Headquarters – United Kingdom

Capital.com offers top-rate educational and research materials for beginners and skilled traders. The broker is among the world-class forex online brokers, providing services at low fees.

Papua New Guinean traders can access thousands of instruments, including over 130 forex pairs and other assets. The company came into being in 2016 and holds top-tier licenses in several jurisdictions, including:

A major disadvantage of Capital.com is its lack of the MetaTrader 5 platform. Traders who wish to use the platform’s unique tool must choose another broker.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

Blackbull Markets is the standard regulated broker with a growing portfolio of tradeable assets. The broker is considered one of the best because of its order execution speed, competitive fees, and support for several copy trading platforms.

Summary:

- Regulations – FMA, FSA.

- Minimum deposit – $200

- Platforms – MetaTrader 4, MetaTrader 5, Mobile app.

- Spreads and fees – from 0.1 pip for raw ECN account. Commission: $3 per trade.

- Free Demo account – Yes

- Support – 24 hours, Mon – Fri.

- Headquarters – New Zealand

Though not regulated in Europe, the broker has built a strong reputation as a credible and authentic ECN broker. Blackbull Markets came into existence in 2014 and now has a presence in several top-tier jurisdictions, including the United Kingdom, Japan, and New York.

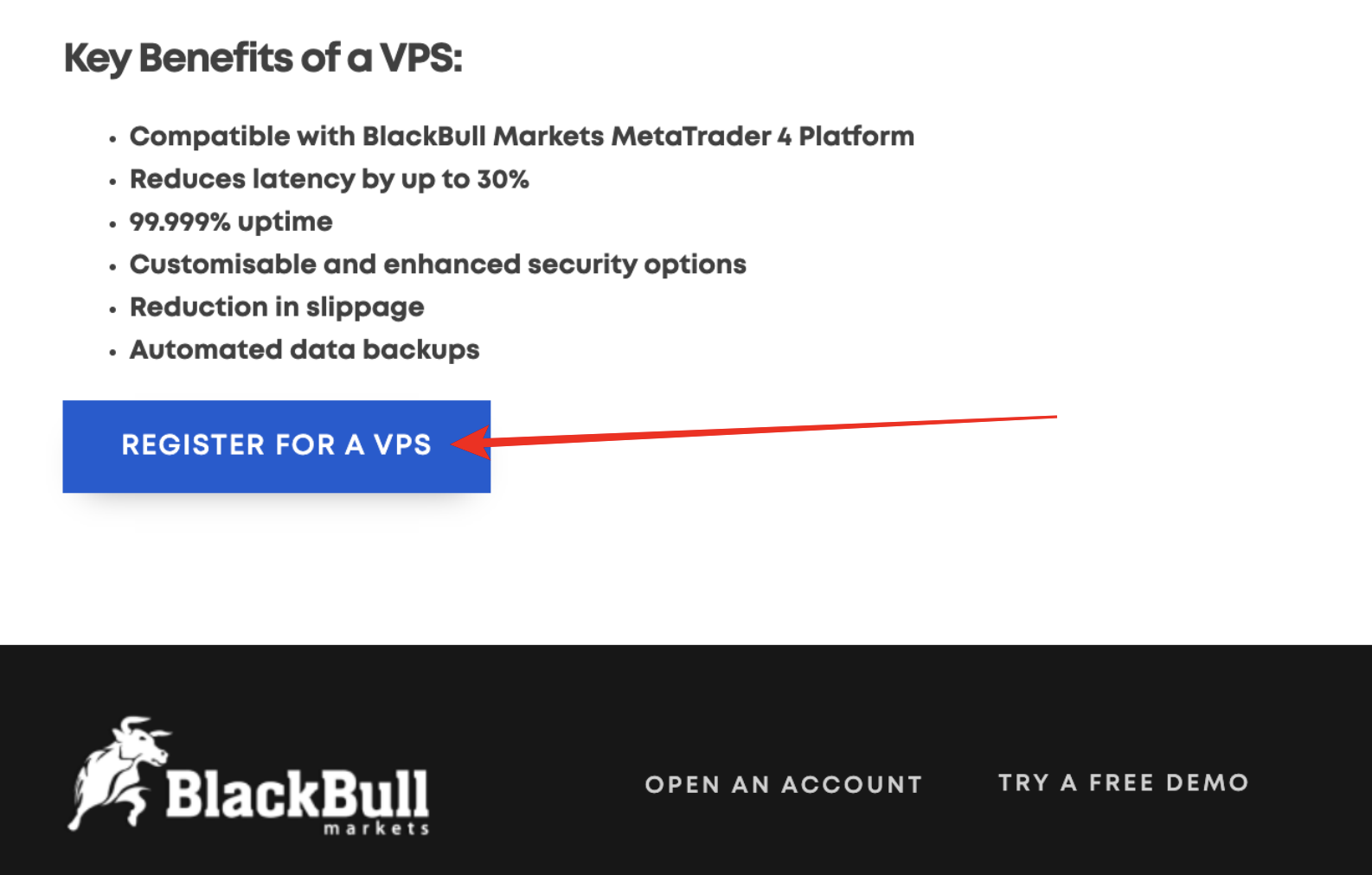

The broker provides access to various markets on the MT4, MT5, and mobile trading apps. The products available are forex, CFD, energies, metals, and ETFs. These platforms support social and copy trading through third parties like Myfxbook and Zulutrade. Algorithm traders also get full support through the broker’s VPS hosting from BeeksFX monthly. Although, monthly fees apply for the VPS.

One major demerit with this broker is its comparably high minimum deposit. $200 might be too much, especially if you only wish to test the broker. Competitors allow trading with a much lower minimum amount.

(Risk Warning: Your capital can be at risk)

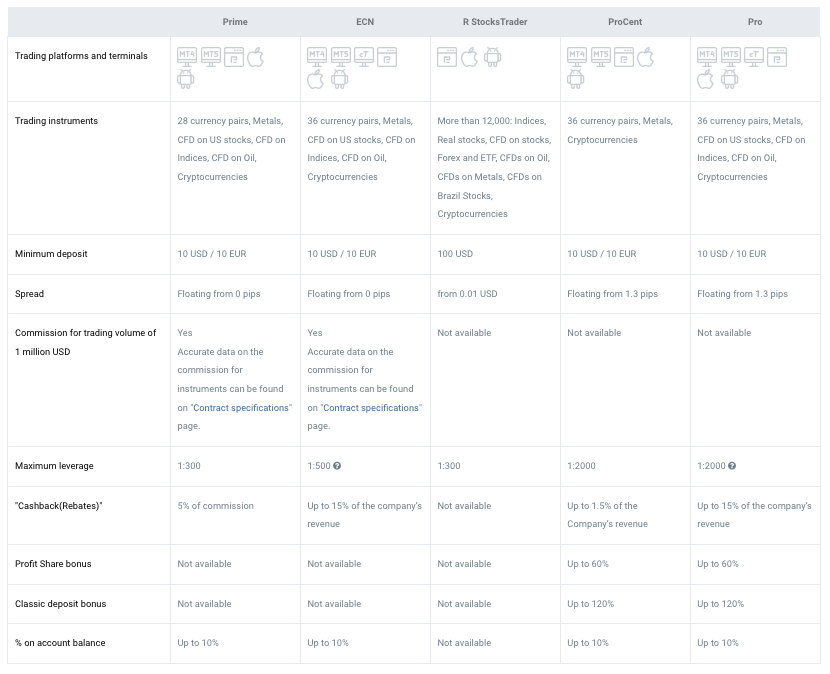

3. RoboForex

RoboForex is a multiple asset online broker based in Belize and established in 2009. The broker offers one of the largest variety of asset options to trade at low costs.

Summary:

- Regulations – IFSC.

- Minimum deposit – $10

- Platforms – MT4, MT5, cTrader, RTrader.

- Spreads and fees – from 0.1 pip for raw ECN account. Commission: $2 per side.

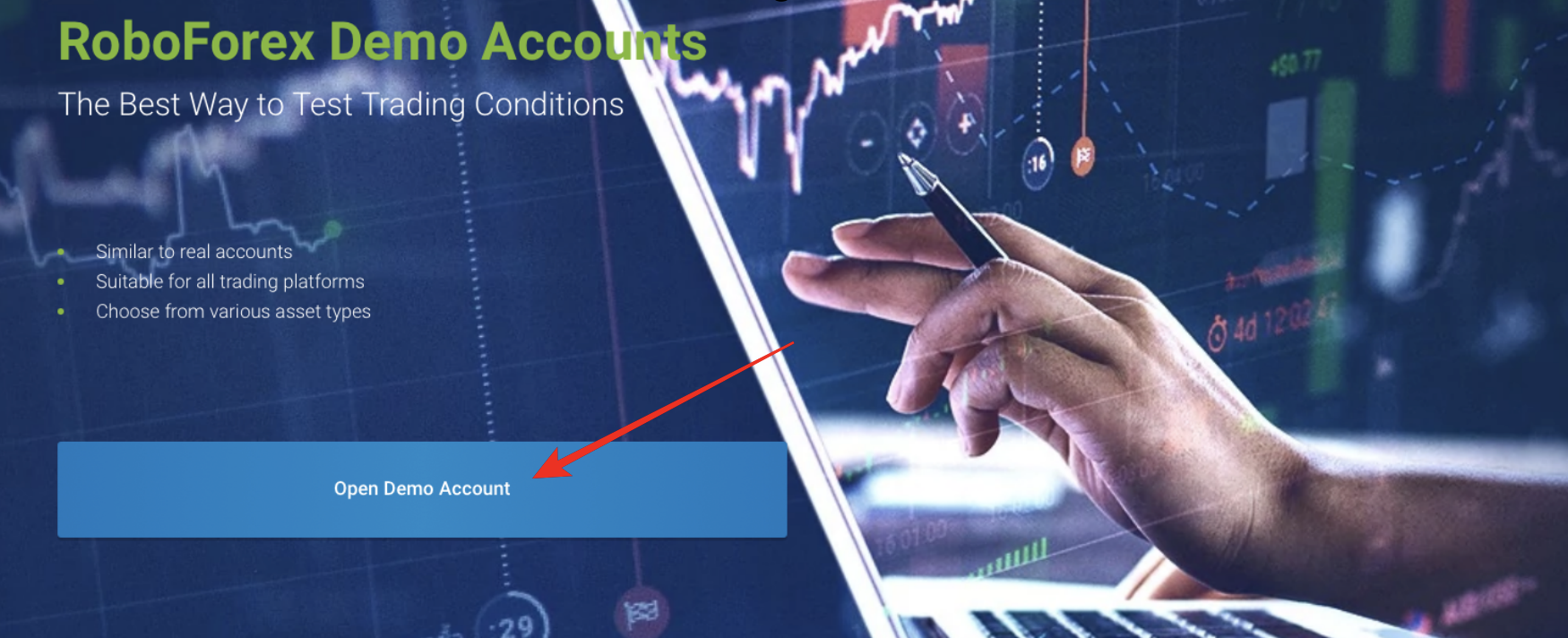

- Free Demo account – Yes

- Support – 24 hours, Mon – Fri.

- Headquarters – Belize.

RoboForex proprietary trading platform is among the most intuitive and packed with useful tools for the trader. The platform supports algorithm trading that allows users to customize it to use their trading strategy. Coding knowledge is not required for this.

Traders can choose between a commission-free and commission-based account. All offer significantly competitive trading costs. Customers can also benefit from its bonus and rebate programs, lowering the trading fees further.

A major disadvantage of RoboForex is the withdrawal fees that customers have to pay when withdrawing funds. Many reputable brokers do not charge a dime for this service.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is among the safest online global broker. The company offers an increasing range of financial instruments, top-quality educational and research content, and full support for social trading.

Traders can use the MetaTrader or cTrader platforms with a selection of the broker’s exclusive third-party add-ons that increases the platforms’ usability and efficiency.

Quick glance:

- Regulations – CySEC, ASIC, FCA, DFSA, FSA.

- Minimum deposit – $0 ($200 recommended)

- Platforms – MT4, MT5, and cTrader.

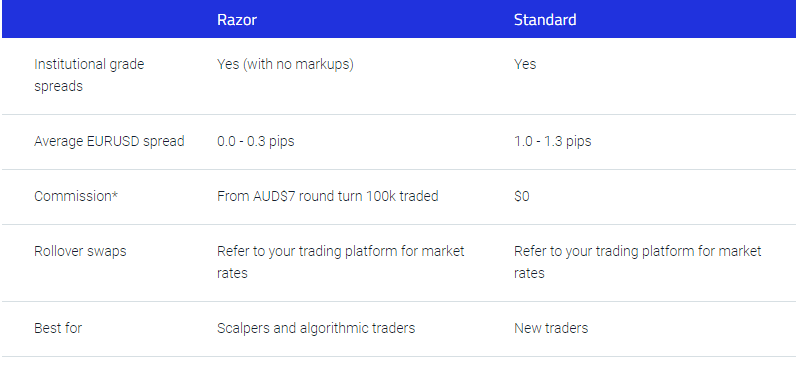

- Spreads and fees – from 0.1 pip for the razor account. Commission: $3 per lot traded.

- Free Demo account – Yes

- Support – 24 hours, Mon – Fri.

- Headquarter – Australia

Pepperstone offers traders a rich trading experience through the MetaTrader and cTrader. Traders can access different markets, including forex and CFDs. These platforms include plugins that enable automated trading, copy, and social trading. An active trader program is available for high-volume razor account holders. The program offers several benefits, including rebates, free VPS, etc.

The broker is also a genuine ECN broker, offering one of the fastest trade executions and the best deals. Social and copy trading is provided on its three platforms through MirrorTrader, RoboX, MyFxbook, and DupliTrade. So traders have various options here.

Pepperstone offers top-quality educational materials for beginners and skilled traders. Although, its education offering lacks progress reports as it does not include quizzes and tests.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a Europe-based binary option and online forex dealer. The broker allows trading various assets, including forex pairs, indices, binary options (for professional traders and outside EAA countries only), and digital options.

The low minimum trading amount and deposit make it easy to join this broker. Its easy-to-use trading app makes IQ Option an appealing choice for all.

Summary:

- Regulations – CySEC

- Minimum deposit – $10

- Platforms – IQ Option app

- Spreads and fees – 0.8 pips average on major crosses during active hours.

- Free Demo account – Yes

- Support – 24 hours, Mon – Fri.

- Headquarter – Cyprus

IQ Option offers zero commission account type with competitive spreads. A minimum deposit of $10 gets you started with binary options (for professional traders and outside EAA countries only) trading. Other products are also available to trade at tight spreads. A deposit of $1900 elevates the trader to VIP status. This account type comes with various benefits, including lower trading fees.

The broker offers trading services on its in-house app. Mobile trading is also available with all the necessary features and tools. MetaTrader platforms are not available with this broker. That means traders cannot access some competitive tools in the MetaTraders. Automated trading support is not available here.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Papua New Guinea?

Forex trading has only started to take off in Papua New Guinea. Many do not yet know what the sector is all about. The activity is hardly regulated in the country.

Papua New Guinean financial regulations are basic and do not make online forex and CFD trading provisions.

The country’s apex financial body is the Bank of Papua New Guinea (BPNG). This central bank is responsible for financial institutions, such as banking, insurance, savings and loans, and other related services.

The Papua New Guinean financial sector remains less developed than other Oceanic nations. Brokers do not need a license from BPNG to accept PNG traders. They do not need any form of authorization.

Many brokers see a market here, and they lure people into forex trading. The government does not concern itself with online forex traders here.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for Papua New Guinean traders – Good to know

As there are no laws against forex trading, all kinds of bad actors can find this market appealing. Papua New Guinean traders must take responsibility for themselves and screen the brokers they deal with.

It is safer to deal only with well-known regulated brokers. The license must be from a globally-recognized entity, such as:

- ASIC, Australia.

- FCA, United Kingdom.

- CySEC, Cyprus.

- SVG FSA, Saint Vincent, and the Grenadines

- FSCA, South Africa.

Other well-respected regulatory bodies exist in the Oceania regions, Europe, Africa, and Asia. Although, some of them are tier-2 regulators and may not provide compensation funds.

The trader must double-check and confirm the genuineness of the license before trading with a broker.

Is it legal to trade Forex in Papua New Guinea?

There is no law against forex trading in Papua New Guinea. Therefore, forex trading is permitted in the country.

The trader must choose a regulated broker with an encrypted trading platform to trade safely.

How to trade Forex in Papua New Guinea – Tutorial

Trading forex requires these three basic items:

- Reliable internet service

- Mobile phone, tablet, or computer

- A good broker

To trade the forex market, you need to connect to reliable internet. Timing is very important. Poor internet service can cause you to miss profitable trades. Disruptions in the connection can lead to loss of money.

The broker partly determines the profitability of your forex trading ventures. One whose service is substandard will cause you to lose your capital. You also want to avoid overpriced brokers so that you can keep the better part of the profit from trading.

Look out for these requirements before choosing a broker:

- Regulations

We have stressed the importance of choosing a licensed broker. These brokers adhere to strict trading regulations that ensure the safety of your funds and personal data. There’s no worrying about scams when dealing with a regulated broker. Confirm that the broker is legit by investigating their license and customer feedback online.

- Low fees

The forex trading industry is competitive. There are many reputable brokers, and they willingly lower the spreads to attract customers. Make sure your chosen broker offers among the most competitive fees. You can compare prices before choosing the broker.

- Free demo

Reputable brokers often offer a free demo that allows new customers to test their platforms before depositing money to trade. You might want to avoid a broker that does not offer a free demo.

- 24 hours customer service

A good broker will ensure support is ever available during trading hours. The customer service should be reachable all day throughout the weekdays. Many brokers have phone, email, and live chat support. But they respond faster on live chat. So ensure the broker’s support is also reachable via this medium.

- Easy deposit and withdrawal

Good brokers provide simple payment methods to ease the account funding and withdrawal process. The common payment options in Papua New Guinea are MasterCard and Visa. So ensure the broker provides this option.

Follow these steps to start trading:

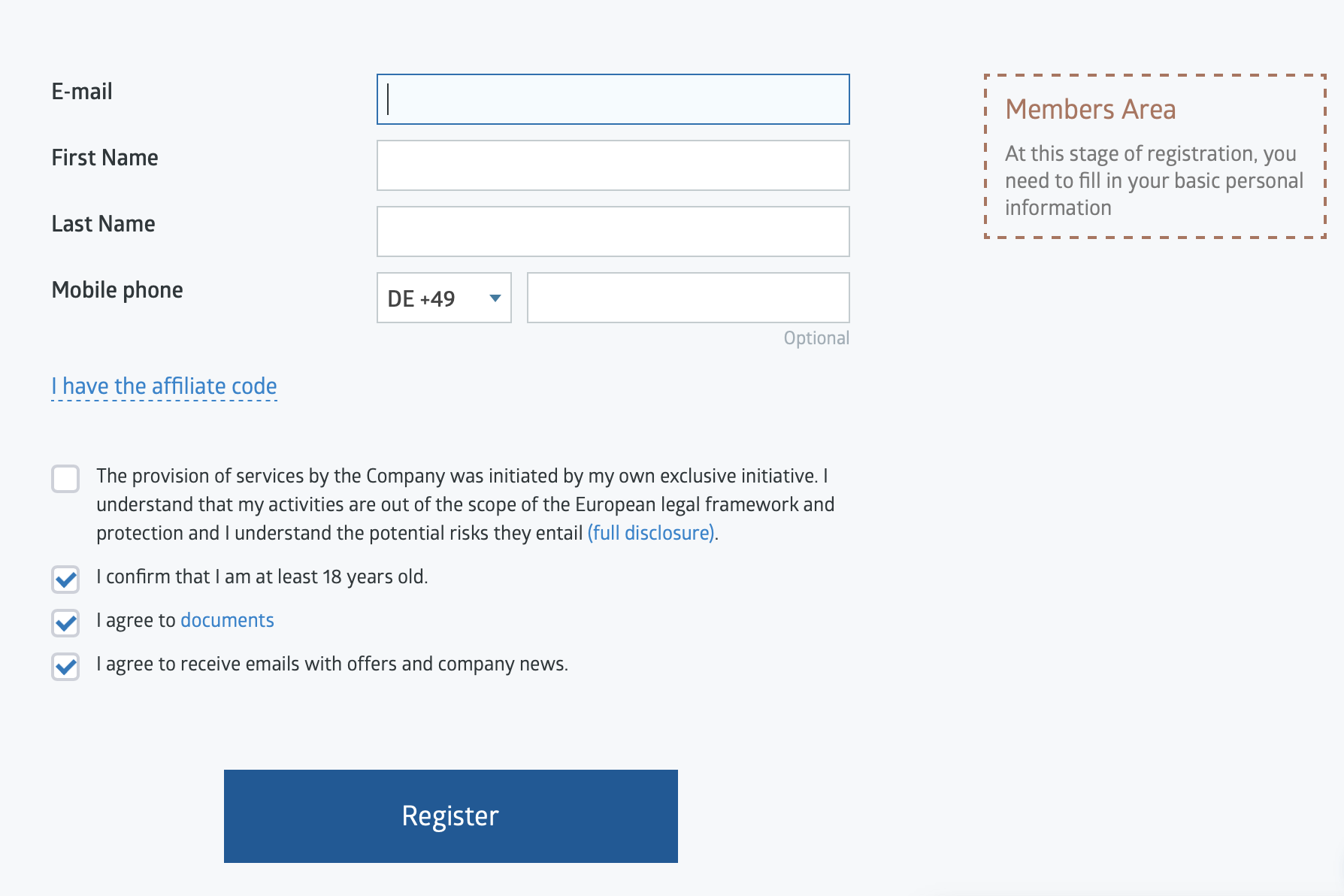

1. Open account for Papua New Guinea traders

Enter the broker’s web address on your browser to proceed. The register button is often displayed boldly at the top or middle of the homepage.

Clicking on that brings a form for entering your name, email, and maybe phone number. Once you enter these and click register, the broker sends a verification link to the email address provided.

Open your inbox and click on the link. This verifies the information you gave and takes you to the page where you continue the registration.

Follow the instructions and prepare to scan and send a valid ID and proof of address to complete the signup.

2. Start with a demo or real account

The next step is to test the broker’s trading platform using the free demo. This account usually comes already funded with sufficient virtual money. Brokers usually provide virtual funds of up to $10000, and the trader can request more if they exhaust it.

This allows the user to carry out many test transactions without risking their money. New traders can use it to get acquainted with the foreign exchange trading environment.

Traders who are switching brokers can see the company’s environment before they trade live with them. People sometimes use demo accounts to test new strategies they’ve just learned.

Demo accounts are highly useful, and we recommend newcomers use them to build confidence before trading the real market.

3. Deposit money to trade

After the demo practice comes real trading, you require real funds, so you need to deposit money to trade.

Click on the FUNDS tab on the trading platform to find the deposit option. The broker will provide several easy payment methods to make it hassle-free for users.

In some cases, the broker assigns an assistant to guide you through the early stages of starting forex trading with them. So it should be simple to deposit money.

The transfer should take a few minutes, and your forex account gets the fund almost as soon as you send the cash. Most brokers do not charge deposit fees. Any deductions you see will be from the third-party(payment) company. You will be duly notified of the charges.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Before placing your first trade, you need to conduct an analysis of the forex pair you wish to trade. It would be best if you also researched several proven trading strategies.

The analysis will show you what trading strategies are suited to the asset. Market analyses help you understand the currencies and the elements that cause their exchange to rise or drop.

Here are two crucial analyses for forex trading:

- Technical analysis

- Fundamental analysis

Technical analysis involves using a forex price chart to analyze the market and find opportunities. The trader examines the chart and the price patterns from market movements. These patterns show the best entry and exit points in the market. But the trader has to identify and interpret them before using them accurately. Trading platforms come with many indicators and charts to help traders conduct successful technical analyzes.

Fundamental analysis refers to looking into the economic factors that directly affect the currency rates. These factors are called forex fundamentals, and they include the gross domestic product (GDP), import and export, inflation, interest rate, etc.

The trader examines the states of these elements to understand the asset’s price history. They can then anticipate future price moves.

These two analyses are essential to trade forex successfully. Profitability in forex results from proper analysis and the right strategy.

Popular forex trading strategies:

Day trading

Day trading strategy involves completing all transactions before the trading day’s close. That means the trader ensures they close all trades before the end of the day. Many forex traders use this strategy. It saves costs and limits the risks in the trades. Several other strategies fall under day trading. We briefly explain them below.

Scalping

Scalping is a strategy whereby the trader conducts their trades within a few minutes. They hold trade positions only for a few minutes, not longer than 15 minutes. Many scalpers use a one-minute time frame or five. The goal is to profit from small price moves in the market. The gains are minimal for each trade. But the trader conducts many transactions before the end of the day, and the profits accumulate to a good amount, as long as the trades are successful.

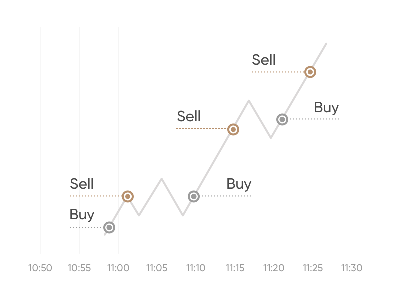

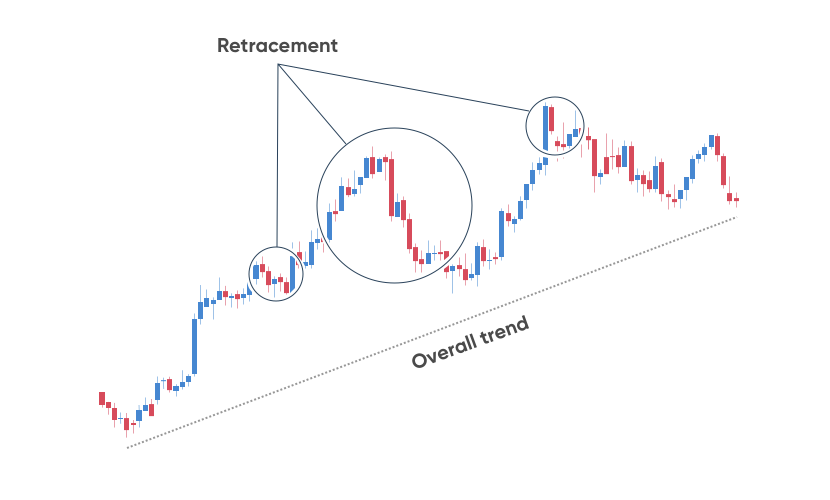

Trend trading

Trading the market trend means placing trades in the current price direction. That means if the market is experiencing an uptrend, the trader places more BUY trades. If it is a downtrend, SELL positions are more appropriate for trend trading. The trader must first identify the momentum before using this strategy.

5. Make profit

If you have done the necessary analyses and applied a winning strategy, your trades will start to generate profits soon.

You can withdraw the gains by clicking on the FUNDS tab on the platform. Select withdrawal and fill out the form to request the service.

The broker starts to process the request once you click on submit. The funds may not hit your account as quickly as the deposit. Withdrawals take longer to process, usually 48 hours on average. Depending on the broker and the payment method, it can take longer than this.

(Risk warning: 78.1% of retail CFD accounts lose money)

Final conclusion: The best Forex Brokers are available in Papua New Guinea

There are hardly any forex laws in Papua New Guinea. Therefore, many global brokers accept traders from the country. Not all brokers operate with an acceptable license. There are also scammers posing as online forex dealers. With this guide and our recommended brokers’ list, you can avoid dubious players and signup with one of the bests.

FAQ – The most asked questions about Forex Broker Papua New Guinea:

Which forex broker in Papua New Guinea offers traders high liquidity?

Trading will leave you with a tremendous amount of funds only when you choose a broker that offers you high liquidity. Faster execution of trades and quick monetary convertibility make trading worth it for any trader. So, traders in Papua New Guinea should choose a broker that offers them the best liquidity. Five Papua New Guinea forex brokers offer you high liquidity. These include:

BlackBull Markets

Pepperstone

IQ Option

Capital.com

RoboForex

How can traders in Papua New Guinea earn more money by trading?

Traders in Papua New Guinea can earn more money by trading forex. However, they should choose a forex broker in Papua New Guinea that offers them many underlying assets. Besides, they should also research before they place their forex trades.

How can a trader in Papua New Guinea research before trading forex?

Traders can include several kinds of strategies when trading forex. For instance, they can use the news trading strategy. Besides, trend analysis is also an important trading strategy for traders in Papua New Guinea. Apart from this, they can include several tools and technical indicators in their technical analysis for trading forex.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)