3 best Forex Brokers & platforms in Portugal – Comparison & reviews

Table of Contents

The forex trading community in Portugal continues to grow as time goes by. If you are looking to join this community, this review will help you pick out the best broker for you.

See the list of the best 3 Forex Brokers in Portugal:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 67% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 67% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

3 best forex brokers in Portugal:

- Capital.com

- BlackBull Markets

- Pepperstone

We have reviewed and gathered important information on each of the forex brokers mentioned above. This should help you decide which broker best suits your trading needs.

1. Capital.com

Capital.com was established in 2016, and its main office is located in England. Other offices are located in Gibraltar, Seychelles, Cyprus, and Australia. This broker’s team consists of both bankers and software developers. They are well known for having low fees when it comes to trading forex.

Traders can rest assured that Capital.com is safe and can be trusted. It is regulated by the Financial Conduct Authority, the Cyprus Securities and Exchange Commission, and the Australian Securities and Investments Commission.

There is only one account type offered at Capital.com. This is known as the Standard Account. It takes less than five minutes to open an account for this broker. You need to provide some basic information about yourself and present a valid ID to verify your account.

Depending on the base currency that you choose, the minimum deposit is $20, £20, or €20. However, if you decide to add via bank transfer, a minimum deposit of $250 is required by the broker. There are five base currencies for you to choose from. These are AUD, PLN, EUR, USD, and GBP.

The website of the broker features numerous educational courses and videos for newbie forex traders. It also offers a free-to-use demo account where clients gain access to the trading platform and are given virtual funds to practice trading.

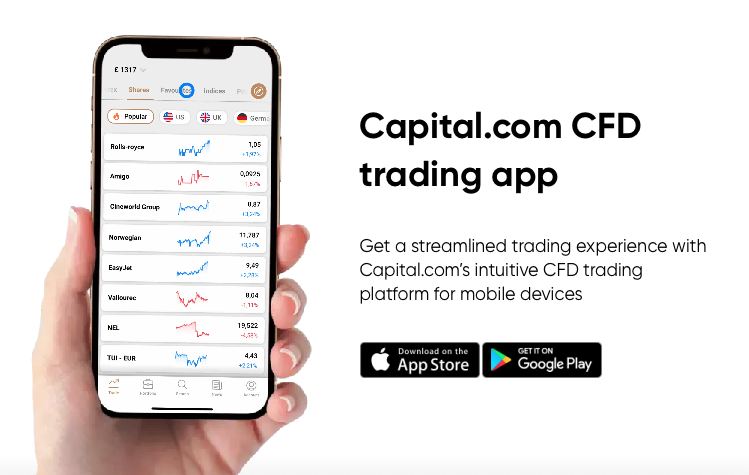

For those who prefer to trade on the go, Capital.com’s trading platform also comes in a mobile form. This allows clients to trade from their mobile phones or tablets. For ease of use, you can view the trading platform in more than 25 languages, including Portuguese, Russian, Thai, Arabic, Finnish, Polish, and many more.

Customer support is available 24/7, and you can reach out to them via email, phone, and live chat via the trading platform.

Summary:

- The minimum deposit required is $20 by credit card.

- The broker holds licenses issued by CySEC, ASIC, and FCA.

- The broker doesn’t charge a commission, inactivity, or withdrawal fee.

- Spreads can be as low as 0.6 pips.

- The broker accepts payments made via iDeal, Neteller, Skrill, Qiwi, WebMoney, MasterCard, Visa, and Bank transfers.

Disadvantages of trading with Capital.com

One disadvantage of trading with Capital.com is there are only five account currencies to choose from. However, this might only be a problem for a handful of traders.

Another is the verification process may be easy, but you have to do it within 15 days. If you fail to present a valid ID within that time frame, Capital.com will terminate your account.

(Risk warning: 67% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets was established in 2014 and is well known in the forex trading community. Although its main office is located in New Zealand, you will find other branches in the United Kingdom, Malaysia, New York City, and Indonesia.

The Financial Services Authority of Seychelles and the Financial Markets Authority of New Zealand both regulate this specific broker. Many brokers choose BlackBull because of its low fees and user-friendly trading platform.

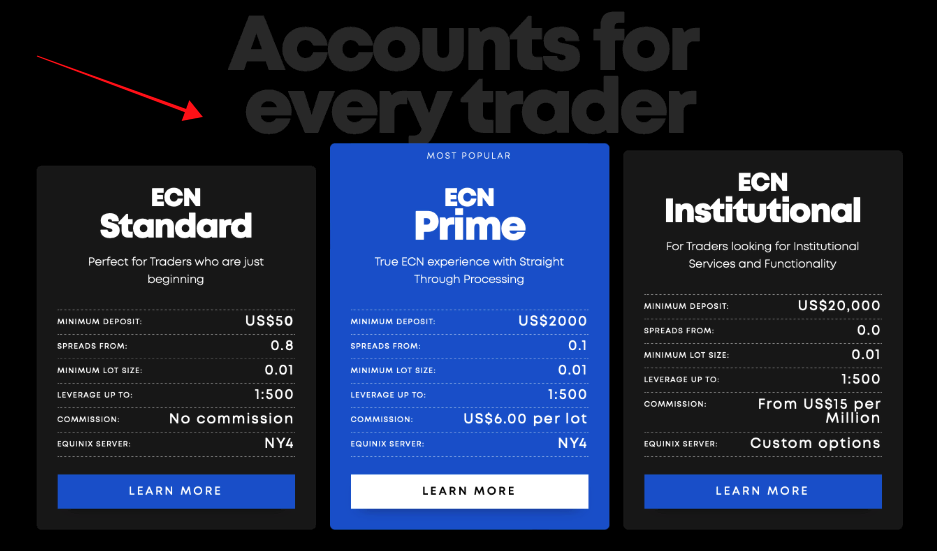

With BlackBull Markets, clients can choose to open either a Standard Account or a Prime Account. The difference between these two accounts is the spreads, minimum deposit, and commission rate.

For Standard Account, the minimum deposit is $200, while Prime Account holders need to put in $2,000. Prime Accounts are entitled to as low as 0.01 spreads when it comes to spreads, while Standard Account spreads start at 0.8. Lastly, the broker does not charge a commission fee for Standard Accounts, but there is a $6 fee per lot for Prime Accounts.

In total, there are nine base currencies to choose from. These are ZAR, JPY, CAD, SGD, NZD, AUD, GBP, EUR, and USD. When withdrawing your funds, BlackBull Markets charges a $5 fee. However, if you are withdrawing via an international bank, the fee is bumped up to $20.

The web trading platform is also available as a mobile version, so you can trade wherever you go. It supports more than 40 languages, including Portuguese, Spanish, Ukrainian, Uzbek, Thai, Serbian, and many more.

There are multiple educational videos and articles featured on the website. There is even a trading platform tutorial video to help guide you through BlackBull Market’s platform. The demo account is free to use and comes with virtual funds provided by the broker.

You can contact the broker’s customer service via phone, live chat, or email. However, they are not available around the clock. Instead, it is only available 24/5.

Summary:

- The minimum deposit required is $200.

- The broker holds licenses issued by the FSA and FMA.

- The broker does not charge a commission fee for Standard Account users.

- Spreads start from 0.8 pips.

- The broker accepts payments made via debit card, credit card, China Union Pay, FasaPay, Neteller, Skrill, and Bank transfer.

Disadvantages of trading with BlackBull Markets

The withdrawal fee of $20 is a bit much. There are also only a few research tools that the client can use. Lastly, Prime Accounts require a huge deposit of $2,000.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone was founded in 2010 and is located in Australia. In 2015, they expanded their office to London to cater to European traders.

The Financial Conduct Authority and the Australian Securities and Investments Commission regulate and oversee Pepperstone. They also implement a negative balance protection system for most of their clients.

There is only one live account type in Pepperstone, and they do not require a minimum deposit. Additionally, the broker does not charge an inactivity and withdrawal fee. If you are not ready for live trading yet, you can open a free demo account to hone your skills.

You can access the trading platform via any device. It also has a web-based platform for those who don’t want to download the software. It is also available in multiple languages.

Customer service is only available 24/5, and you can contact them via phone and live chat. The broker boasts of their customer support’s quick response time, so you can rest assured that they will address your concerns ASAP.

Summary:

- The minimum deposit required is $0.

- The broker holds licenses issued by ASIC and FCA.

- The broker charges a commission fee that starts at $3.

- Spreads start from 0.0 pip.

- The broker accepts payments made via Union Pay, Neteller, Skrill, Bpay, Poli, PayPal, credit cards, debit cards, and bank transfers.

Disadvantages of Trading with Pepperstone

The only downside to Pepperstone is customer support is not available 24/7.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

What are the financial regulations in Portugal?

The Euro is one of the most traded currencies in the forex trading market. It is also one of the seven major currencies, which include USD, JPY, GBP, and more.

Additionally, forex brokers don’t necessarily have to be regulated by the CMVM or the Comissão de Mercado de Valores Mobiliários. It is no surprise that forex trading is popular among the Portuguese community.

The Comissão de Mercado de Valores Mobiliários, also known as the Portuguese Securities Market Commission, was founded in 1991. The company is responsible for overseeing the financial market and regulating forex brokers.

Other responsibilities of the company include:

- Mediating or helping resolve conflicts between financial bodies.

- Ensuring that the financial market is stable.

- Assist in the improvement of the various instruments in financial markets.

- Handle complaints and provide information to investors.

Security for traders

Although the Comissão de Mercado de Valores Mobiliários oversees the forex trading market in Portugal, there are still some risks when it comes to trading Forex. This depends on the broker you choose to partner with. There are some factors to consider.

Although it is not required, the forex broker that you choose should be regulated by the Comissão de Mercado de Valores Mobiliários. This ensures that you can trust the broker.

Check to see if the broker offers additional protection. Some companies have a system that shields your funds from hitting 0 when trading. Some even offer insurance as well. Also, make sure that your funds are held in a segregated account. This ensures that the broker or anybody else won’t be able to touch your funds.

Keep in mind that trading, in general, is risky. Taking time to research and learn different risk strategies can go a long way when it comes to the forex trading world.

(Risk warning: 67% of retail CFD accounts lose money)

Is it legal to trade Forex in Portugal?

Yes, it is legal to trade forex in Portugal. Since the currency used in this country is the Euro, this gives Portugal-based traders an advantage if they want to trade that specific currency.

How to trade Forex in Portugal – A comprehensive overview

1. Open an account for Portuguese traders

To open an account, all you have to do is fill out the registration form and present the documents that your broker requires. Typically, the form asks for your complete name, country of residence, phone number, and other basic information.

Depending on the broker, they will ask you to present a valid ID to verify your account.

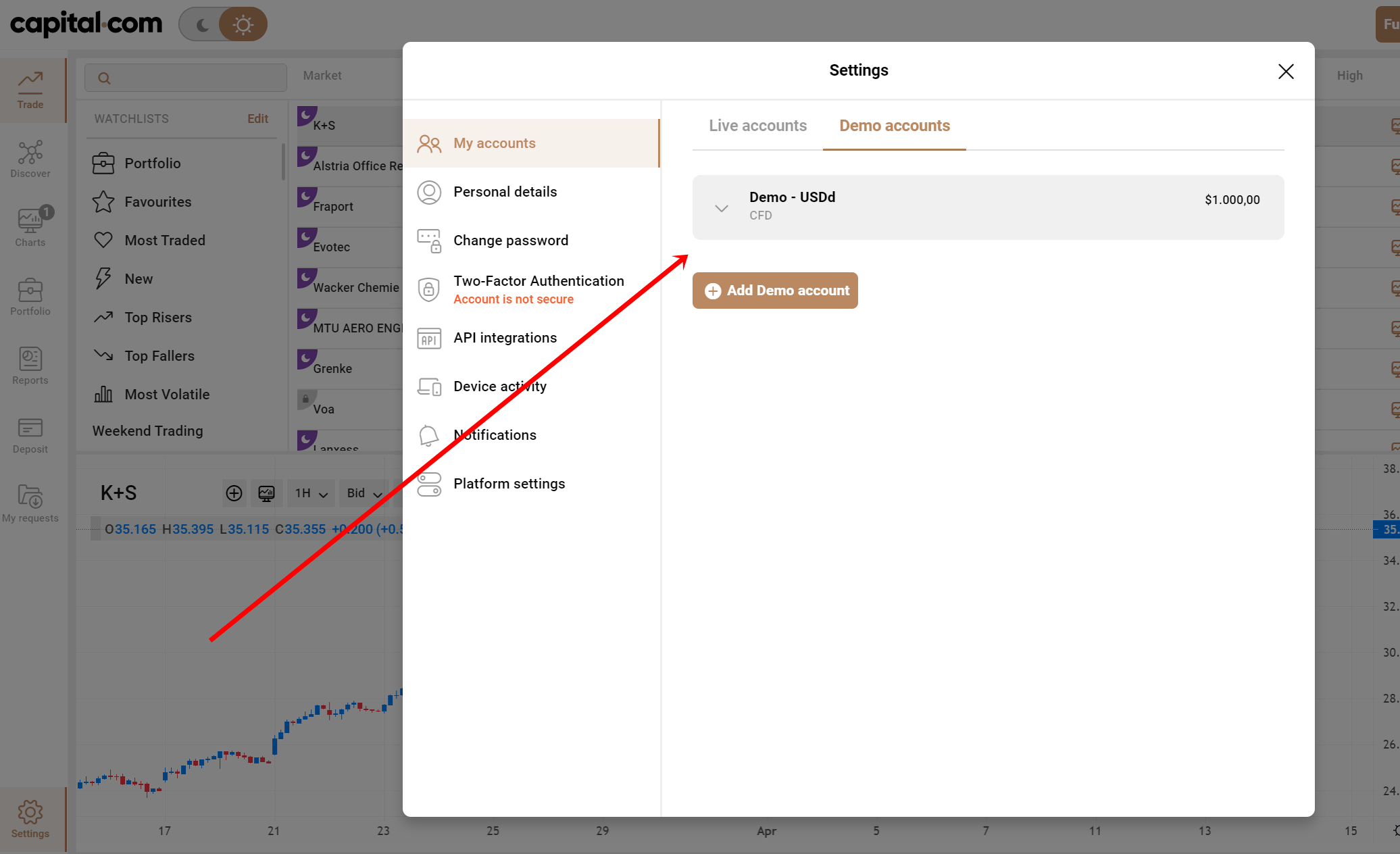

2. Start with a demo account or “real” account

Before you decide to invest your hard-earned funds in forex, it’s a great idea to test the platform using a demo account. All the brokers mentioned above offer a free demo account to their clients.

Take advantage of this. Demo accounts come with virtual cash that you can use to either hone your trading skills or test the capabilities of the broker’s trading platform.

3. Deposit money

Once you have finished taking advantage of the free demo account and have decided to create a real account, the first thing you have to do is deposit funds.

Most brokers support debit cards, credit cards, and bank wire transfers. However, they also support some online platforms like PayPal, Skrill, Neteller, and more.

4. Use analysis and strategies

When it comes to trading forex, you can’t just jump in with both feet without familiarizing yourself with the different strategies implemented by professional forex traders.

One of the most common trading strategies is trend trading. This long-term trading strategy includes monitoring the market’s directional movement or current trend for a certain currency pair. This involves selling in downtrends and buying in uptrends.

Analyzing the market also plays a huge role in risk management. Typically, the broker will assign a dedicated staff member to guide you through the forex trading world if you are new. However, analyzing the market on your own can go a long way.

5. Make a profit

Take the time to study the market and implement the right trading strategies. It will be easier for you to turn a profit when trading forex pairs. Make sure to familiarize yourself with risk management as well to increase your chances of gaining.

(Risk warning: 67% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Portugal

Keep in mind that trading comes with risk. You must implement a risk management system and take the time to analyze the market before you execute your trades thoroughly. Practicing on a demo account will also help you hone your skills to prepare you for live market trading better.

FAQ – The most asked questions about Forex Broker Portugal :

How can traders in Portugal trade forex?

Forex trading in Portugal is possible when a trader chooses a broker. If a trader chooses a well-established forex broker and signs up for a live trading account with that broker, he will succeed in trading forex. A trader can choose an account type that the broker offers. Then, he can fund it and place the forex trade.

Which forex brokers in Portugal are worth signing up with?

Traders can choose one of the below-mentioned brokers for forex trading in Portugal.

BlackBull Markets

Capital.com

IQ Option

These brokers have an ultimate trading platform with all top-class features. In addition, traders can also find assets other than ones for forex trading. Thus, trade diversification is also possible with these brokers.

Can a trader in Portugal use a demo account?

The services offered by Roboforex are the best when considering a low minimum deposit amount. Therefore, traders in Belgium who trade with Roboforex can start trading by funding their accounts with only $10. Apart from this, they can make the lowest trade amounting to $1.

Last Updated on June 1, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)