The 4 best Forex Brokers and platforms in Puerto Rico – Comparison and reviews

Table of Contents

Getting the right forex broker can be pretty sticky for many people that want to start a forex trade. Some spend time thinking if forex is legit and it is not just a game to try and swindle people off money.

In this article, we will be showing you the five best forex brokers that are out there in business. You will also get to know whether forex is legit and see how you as a trader can ensure security for yourself trading forex.

See the list of the best Forex Brokers in Puerto Rico:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The 4 best forex brokers are listed below.

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. BlackBull Markets

BlackBull Markets is a well-known forex company, primarily because of its server speed. The platform offers enough trading instruments to traders. Traders have a variety of these instruments to trade with. The company started in 2014, having its main office in New Zealand. The company is well-regulated by the FMA and FSA.

Traders have access to reliable market resources. Even though the company does not provide educational resources, the market resources from within are trustworthy. Traders can use the information to know how the forex market is.

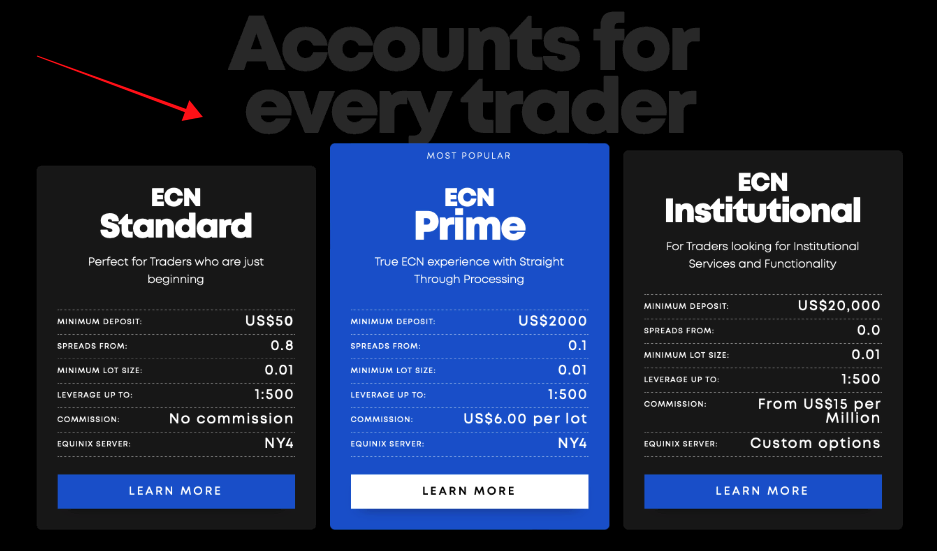

BlackBull Markets has a demo account that traders can use to practice strategies and understand the trading interface. The platform has two account types: a standard account and an ECN prime account.

Standard account traders can deposit $200. The spread is at 1.1 pips, and the trader will not get any commission. At the same time, the ECN prime account traders make an initial deposit of $2000 before they can trade with the account. The FX spread floats from 0 pip, and traders get a percentage commission at the end of every trade.

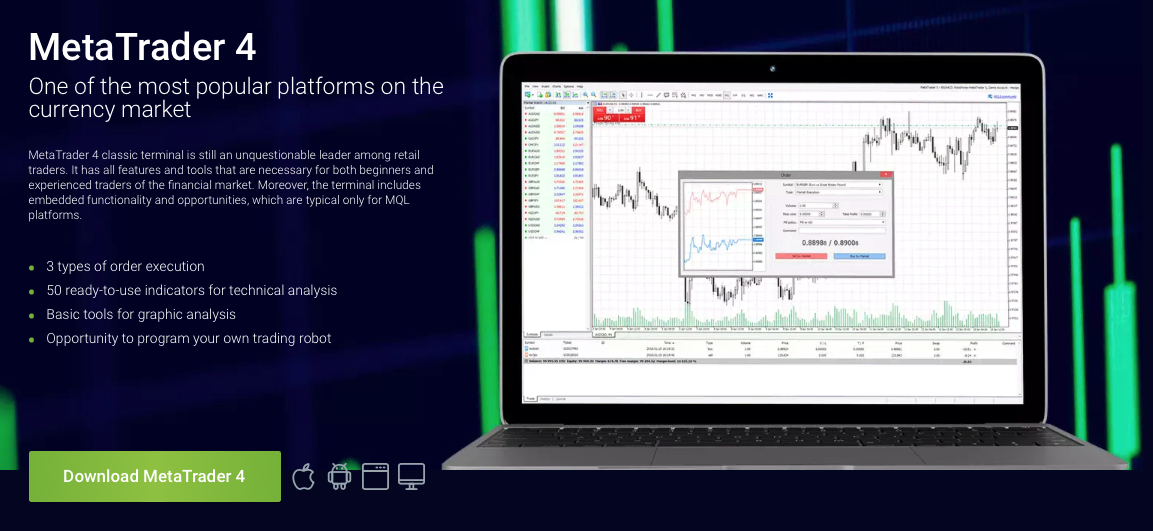

The MetaTrader platforms on the broker are MT4 and MT5. The MetaTrader platform makes the broker platform to be multi-functional. Its MetaTrader is connected to one of the fastest servers on Wall Street. This implies that transactions can be done in a matter of milliseconds. Trading on BlackBull is very swift.

Merits of BlackBull Markets

- MT4 and MT5 are both available on the broker’s platform

- Excellent and reliable market research

- Transactions are carried out swiftly on the platform

- Traders can customize the chart of the platform

Demerits of BlackBull Markets

- Withdrawal fees

- There are no educational resources and quizzes provided for traders

(Risk Warning: Your capital can be at risk)

2. RoboForex

RoboForex is a well-known forex trading platform that started in 2009. The broker is regulated by the IFSC. Traders’ trading rights are protected under these regulators. They make sure that RoboForex functions according to the laws of the organizations.

RoboForex is a good platform for new traders because they offer educational resources that are very helpful to them. You can learn how to trade better and how forex trading works from the resources. RoboForex’s in-house market resources are also reliable and can be trusted by traders on their platform.

Not only is MetaTrader (MT4 and 5) available on RoboForex. Traders also have access to the cTrader platform, which is even better and more technologically advanced than the MetaTrader. The MetaTrader platform is also good on the broker platform. Trading forex on RoboForex is an enjoyable experience.

The account type allows you to deposit a minimum of $10, except if you’re using the R Stock Trader account, which offers traders the minimum deposit of $100. Opening any of the accounts is straightforward for traders. The opening account process is entirely digital.

Merits of RoboForex

- The minimum deposit of $10 for standard account users

- It has both MetaTrader and cTrader platforms available

- There are no withdrawal fees

- There are reliable educational resources on the platform

Demerits of RoboForex

- The customer support does not work round the clock

- High trading fees are on the platform

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone was formed in 2010 in Australia. The ASIC in Australia regulates the broker. The Australian Securities and Investment Commission provides security for traders on the platform. Pepperstone offers good trading conditions to its customers. The company has other regulatory institutions from Germany and United Kingdom.

Pepperstone customer support is top-notch, and it even won the award for the best customer support broker recently. It provides good services to its clients. The quick response provided by the customer service makes it easy for people to get answers to questions they want to ask.

The platform offers assets to traders ranging from Stocks, Commodities, and Groceries. This makes traders have multiple choices in determining the asset they wish to trade on the platform.

Both desktop and mobile versions of the broker platform are user-friendly. The MetaTrader platforms are very much interactive. The MetaTrader even offers plugins that help traders strategize their market moves. A bot is available with the plugin that allows traders to position themselves better when they want to trade.

Pepperstone has two account types – a standard account and a razor account. The brokers’ standard account is set with a minimum deposit of $200, an FX spread of 1 pip, and no added percentage at the end of a trade.

While the razor account users have a minimum deposit of $2000 and a commission at the end of a trade, the FX spread operated on the platform starts from 0 pip.

A mobile application and web version are available, which makes forex trading flexible. Traders get to have the same kind of trading experience on both devices. The mobile application is provided with the web version’s same plugin.

Merits of Pepperstone

- Plugins have a bot that can help traders strategize their chart position.

- The platform provides unique courses that help clients know more about forex trading

- The customer support is a very reliable one

- Razor account owners enjoy a special commission after trading.

Demerits of Pepperstone

- The demo account provided expires after a month

- Limited number of assets on the broker platform

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option started in 2013 in Cyprus as a binary options company. (Binary Options are only for professional traders and outside EAA countries). In later years after some improvement in their services, the company set out to offer more assets to traders on their platform. IQ Option is under the regulation of the Cyprus Securities and Exchange Commission. This makes the broker reliable to the traders.

The broker is available on the phone and web. This means that traders can trade on multiple devices instead of being restricted to a particular device. The good thing is that the devices offer the same experience and interface. So, there is no difference in trading experience.

Traders can easily open accounts because the process is completely digitalized. After registration, you can start with either the demo account or the real account. The demo account is loaded with $10000, which traders can use to practice their strategies. The real account has two account types available – the Standard account and the VIP account.

The standard account traders can deposit as low as $10 into their accounts to trade. Traders can even place trades as low as $1 on the platform. Trading with the standard account offers you a spread of 1.2 pip with no commission when you end a trade.

On the other hand, the VIP trader’s lowest amount of deposit is $1000. The spread offered is 0 pip, and traders can get a commission at the end of every trade. The VIP account is usually used by professionals because of the market competition involved.

The broker platform offers educational materials to traders. There are well-researched materials that are on IQ Option. They help one to know more about forex trading. There are forums for different market types on the platform. Webinars are even sometimes organized.

Merits of IQ Option

- Minimum deposit of $10

- The broker offers educational courses

- Opening an account is effortless

- There is no deposit fee

Demerits of IQ Option

- It takes time for funds to be withdrawn into your bank account

- Clients from the United States are not allowed.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Puerto Rico?

The body responsible for financial regulation in Puerto Rico is the Commissioner of financial institutions. The Commissioner of financial institutions is known as the Commissioner. The office is charged with regulating financial institutions in the country and dispensing cash to other banks in Puerto Rico.

The nine commercial banks, two-state dev. Banks, 78 mortgage banks, 32 IBM, and other financial institutions in the country are licensed by the Commissioner. The office of the Commissioner states rules that every bank should follow in the country.

Security for traders from Puerto Rico

The internet is fast-growing, making it easier for people to get information about many things. People can make money through forex trading from their homes.

Forex trading involves currency exchange with a broker’s platform. It should be known that not many broker platforms are being regulated and are just set up by some individuals who want to swindle traders of their money. This is a form of the activities carried out because of the internet. Forex is an online business.

Traders can ensure security for themselves by trading with regulated forex brokers. Such brokers offer their traders favorable trading conditions. This is because of the regulation, and the broker will be transparent and not try to defraud their clients. Such broker platforms offer the best kind of security for traders.

Is it legal to trade Forex in Puerto Rico?

Forex trading in Puerto Rico is very much legal. Some Puerto Rican forex traders patronize the forex brokers listed above.

The country does not have any regulations for forex brokers because there are not so many people who know about forex trading in the country, and there is no local forex brokerage company in it.

If you want to trade forex legally as a Puerto Rican, it is advised that you do so with forex companies that have regulations and licenses from international financial bodies. Such brokers have a framework that guides their existence and a form of superior body that they are subject to.

International regulatory bodies of forex brokerage companies are:

They go on and on. The critical thing to note is that you must ensure that the broker platform you want to trade on is regulated.

How to trade Forex in Puerto Rico – Tutorial

Open account for Puerto Rican trader

Opening an account for a Puerto Rican trader is the first step you must take if you stay in the country. You cannot trade on any brokers’ platform except if you open an account with them. Opening an account with any broker is digital. You can open the account on any of your digital devices.

The broker will need you to show proof of identity and residency. Once you have directed any of the documents for identity and residence, it will take 24 hours for your account to be verified.

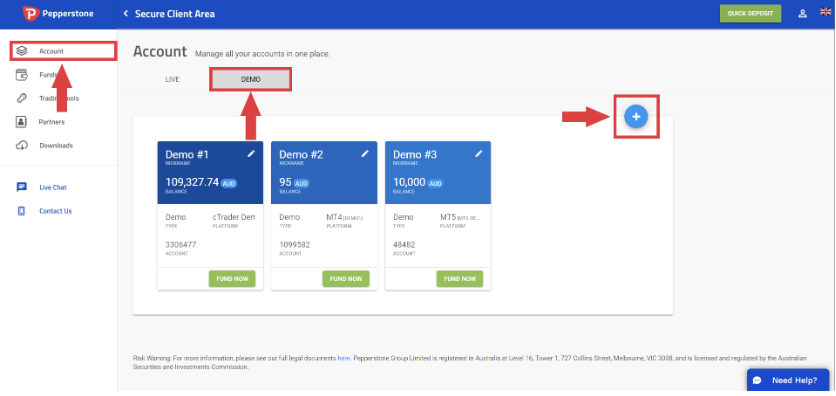

Start with a demo account or real account

After your account has been verified, you will have access to your real account and a demo account if the broker you are trading on has a demo account. The broker platforms we listed above have a demo account.

A demo account is valuable and can help you as a new trader know how the interface, spread, and chart of the broker platform works. Starting with your real account will require you to deposit money into it.

Deposit money

Once you are ready to start with your real account, you will need to deposit money into it. There is usually more than one payment method through which you can do this. The generally available payment methods are direct Bank Transfer, debit card, and Credit card.

The minimum deposit amount depends on the broker you are trading.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use of analysis and strategies

To lower the risks involved in forex trading, it is good for you to have a strategy that you will use as a broker. Strategy and analysis help you as a trader to be careful while trading. Traders have thought out plans before placing a trading position on the chart.

Scalping

Scalping is a trading technique whereby the forex trader only opens more than three trading positions on the chart for a short time. The trader does not even wait for a whole day before closing the trade.

The aim is to make little profit from the trades opened.

Day trading

Day trading is not just a strategy used in forex. But it is commonly used in forex. It involves opening a trading position in one day and then closing it at the end of the day. The aim is to monitor the market movement for a day.

Position trading

Position trading involves staying in the same position on the chart for a whole day. The trader ignores short-term changes. The trader can maintain the position for weeks and even some years.

Make profit

The goal of every forex trader is to make a profit at the end of every market. Your gain is dependent on your position when the general forex market comes to an end. You can ever withdraw the profit made from your trading into your bank account.

Conclusion: The best Forex Brokers are available in Puerto Rico

Individuals should get themselves acquainted with what forex is all about and if it’s the right thing. Forex trading is for the careful and watchful ones. It is not always right to make haste to open trade on the spread. Traders should have a specific or more than one technique in trading.

Forex is legit, and it is an excellent way to earn money, and forex trading is growing globally. But keep in mind that there might be some unaccredited forex brokers I

n the brokerage business. And they look just as legit as those that are licensed. Traders must do the proper findings to ensure that their chosen broker is under some regulation.

FAQ – The most asked questions about Forex Broker Puerto Rico:

How can the forex trading market in Puerto Rico be accessed through a forex broker in Puerto Rico?

The forest trading market accessible through a forex broker in Puerto Rico has been exploding recently. The base currency (US) and advantageous tax laws have caused a rise in the past 5 years. The volume traded every single day is significant compared to other sectors. Online technology advancement, extensive internet coverage, and enhanced competition among brokers have made Forex trading in Puerto Rico popular and accessible.

What are forex trading strategies preferred by a forex broker in Puerto Rico?

Since Puerto Rico takes USD as the base currency, the popular forex trading strategies implemented through a forex broker in Puerto Rico are as follows:

1. Fundamental analysis considers long-term considerations with GDP reports, non-farm payroll data, trade balance sheets, etc., reviewed.

2. Technical analysis doesn’t consider the political and economic statuses of the trade countries. Charting patterns and volume changes are included in the decision-making.

How to keep yourself safe while working with a forex broker in Puerto Rico?

The safety practices while working with a forex broker in Puerto Rico include:

1. Ensure the broker is licensed and well-regulated.

2. Do not fall into debt by keeping a little margin while trading.

3. Practice on a demo account first.

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)