The 5 best Forex Brokers and platforms in Qatar – Comparison and reviews

Table of Contents

Forex trading has become one of the most popular ways to invest and grow your money. Forex traders can use various strategies to trade the market, including technical analysis and fundamental analysis. There are quite a lot of brokers you can choose from as a forex trader. This article will highlight the best five forex trading platforms in Qatar.

See the list of the best Forex Brokers in Qatar:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

Capital.com is a forex trading platform with over 1 million users from over 180 countries. It has a simple and easy-to-use interface that enables traders to make quick decisions and trade in multiple markets. The company offers 24/7 customer support and features, including stop losses, guaranteed safeguards against negative balances, and risk-free transactions.

Capital.com is a forex and CFD broker regulated in the EU by the Cyprus Securities and Exchange Commission (CySEC)and the Financial Conduct Authority (FCA) in the UK. The company is headquartered in Limassol, Cyprus. Capital.com offers trading on over 2,000 financial instruments, including Forex, stocks, commodities, indices, and ETFs.

The Capital.com trading platform is web-based and provides users with many features, such as real-time quotes, technical indicators and charting tools, advanced order types, and more.

The benefits Capital.com

- Wide range of assets: The platform offers many assets to trade, including stocks, indices, commodities, and Forex. This gives investors various options to choose from and allows them to diversify their portfolios.

- Low spreads: The spreads on the platform are low, which means that investors can make more profits on their trades.

- Fast execution: The platform has a short execution time, ensuring that orders are filled quickly and accurately.

- Cpaital.com offers a user-friendly platform that is easy to use.

Disadvantages of Capital.com

- You cannot use Capital.com to trade stocks

- The research and analysis tools are fundamental

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

As a trader, there are several platforms you can choose from to trade forex. Each platform has its unique benefits and drawbacks. BlackBull Markets is a forex trading platform that offers investors the opportunity to trade in the foreign exchange market. The company was founded in 2014 and is headquartered in Auckland, New Zealand. BlackBull Markets offers its clients a wide variety of features, including an extensive range of forex pairs, a customizable trading platform, and 24/7 customer support.

The BlackBull Markets trading platform is easy to use and navigate. It offers a wide range of features, including an economic calendar, market news, and a variety of charting tools. The platform supports various currencies and allows traders to place orders in both manual and automated modes.

The advantages of using BlackBull Markets

- BlackBull Markets is an award-winning and regulated platform

- 24/5 customer support

- Wide range of features and instruments

- Excellent liquidity and execution

- Commission-free trading

- Easy-to-use platform

The disadvantages of using BlackBull Markets

- BlackBull Markets offers a high spread on its products compared to other brokers in the market.

- The trading platform provided by BlackBull Markets is not very user-friendly and can be

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is an online broker that provides traders with access to various trading instruments and services, including Forex, CFDs, and metals. The RoboForex trading platform is web-based and easy to use, making it a popular choice for those new to online trading.

Offering a wide range of trading accounts, RoboForex users can open Cent, Mini, Standard, ECN Zero, and Crypto accounts. The company also provides a variety of trading platforms, including the popular MetaTrader 4 and MetaTrader 5 platforms. The platform offers a wide range of trading tools and features, including advanced charting tools, technical indicators, and automated trading strategies.

Merits of using RoboForex

- Wide range of financial instruments to trade – Forex, CFDs, metals, oil, indices, etc.

- Extremely low spreads and commissions

- Over 60 technical indicators and 24 analytical objects

- Availability of expert advisors and traders’ community

- Free educational materials

Demerits of using RoboForex

- Lack of human interaction and emotional support

- Limited investment options- RoboForex offers a limited range of investment options compared to what is available through human brokers.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is an online Forex and CFDs broker that provides traders access to the global financial markets. Leveraging cutting-edge technology, Pepperstone allows FX and CFD traders to trade on institutional grade liquidity from the world’s tier-1 banks and hedge funds.

Starting out in 2010, this broker has fast become one of the biggest forex brokers worldwide. With over $11 billion in total trading volume and over 100,000 active clients, Pepperstone continues to lead the industry by ensuring forex trading is available to everyone. Headquartered in Melbourne, Australia, the company has offices in London, Shanghai, and Tokyo.

Advantages of Pepperstone

- A wide range of trading instruments, including currency pairs, CFDs, and metals

- Access to world-class liquidity and tight spreads

- No commission is charged on trades

- A user-friendly platform that is easy to navigate

- 24/5 customer support

Disadvantages of Pepperstone

- There are several disadvantages of using the Pepperstone forex trading platform, which traders should know before signing up.

- Customer support is often unhelpful and slow to respond, which can be frustrating for traders who need help with their accounts or technical issues.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a leading forex and CFD broker. They offer a user-friendly platform with a wide range of features, perfect for both novice and experienced traders. The IQ Option platform has been designed with the latest technologies, making it easy to use and navigate. It offers a wide range of assets to trade, including Forex, stocks, indices, and commodities. It also offers a wide range of trading tools and features, including indicators, charts, and analysis tools. It is also mobile-friendly, so you can trade on the go. There is a wide range of trading tools and features available, as well as an extensive education center to help you learn about Forex and CFD trading.

Benefits of IQ Option

- A wide variety of assets to trade: You can trade a wide variety of assets on IQ Option, including stocks, Forex, commodities, and indices. This gives you a lot of flexibility when choosing which trades to make.

- Low minimum deposit: You can start trading with as little as $10 on IQ Option. This makes it accessible to traders of all levels of experience.

- User-friendly platform: The IQ Option platform is easy to use and navigate.

- A wide range of tradable assets

Disadvantages of IQ Option

- The first disadvantage is that not all countries can access IQ Option. The company is currently available in over 100 countries, but some traders in other countries don’t have access to it.

- No MT4: IQ Option does not offer the popular MT4 platform, which many traders are used to.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Qatar?

The Qatar Financial Centre (QFC) / Regulatory Authority (QFCRA) is the independent regulator of the QFC. The QFCRA is responsible for the regulation and supervision of the financial and professional services sector in the QFC. The QFCRA’s mission is to develop and regulate the QFC into a world-class financial center, which inspires confidence, attracts high-quality business, and supports the growth of Qatar’s economy.

The QFC is an onshore jurisdiction with its legal system and regulatory framework. The QFC Regulations provide a comprehensive and flexible regime that enables companies to thrive with minimal impact.

Qatar is one of the wealthiest countries in the world and has a robust economy. The country has been working hard to develop its financial sector and attract foreign investors. To develop the economy, Qatar has put in place several regulations to protect investors and ensure the stability of the financial industry.

Some of the key regulations in Qatar include the anti-money laundering law, which was introduced in 2002. Also, the foreign investment law was introduced in 2004. These laws help protect investors and ensure that the financial sector is stable.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Qatar

The forex market constitutes the world’s largest and most liquid market, with a daily trading volume of $5 trillion. Because of this, it offers traders several advantages, including 24-hour trading, high liquidity, and the opportunity to profit off both rising and falling prices.

The forex market is unique because it doesn’t have a physical location like a stock exchange. Currencies are traded all over the world through a variety of different platforms. If you want to trade currencies successfully, it’s essential to understand how the forex market works and the factors that influence currency prices.

Several security measures are available for forex traders in Qatar. The most crucial step that traders can take to protect themselves is to choose a regulated and reputable broker. Several brokers are registered with the Qatar Financial Centre and meet the required security standards.

QFC-registered brokers must meet some regulatory requirements, including maintaining segregated client funds accounts and adhering to strict anti-money laundering procedures. They are also required to have comprehensive risk management policies in place.

Is it legal to trade Forex in Qatar?

There is no specific answer to this question. The legality of forex trading in Qatar will depend on several factors, including the type of forex trading you are engaged in and your nationality.

Qatar has several financial regulations in place to protect its citizens and investors. Forex trading is permitted in Qatar, but there are some restrictions.

In Qatar, forex trading is legal as long as it is done through licensed brokers. The Qatar Financial Centre (QFC) is one of the most popular venues for forex trading in the region, and many of the world’s leading brokers have a presence there.

How to trade Forex in Qatar – Quick tutorial

Forex trading is a form of investment that is open to anyone with an internet connection. In Qatar, as in most countries, it is essential to be aware of the risks involved in Forex trading before starting.

The Forex market is the largest and most liquid market in the world. It is open 24 hours a day, five days a week, and currencies are traded worldwide. Because the market is so big, it offers traders a variety of opportunities to profit from both rising and falling prices.

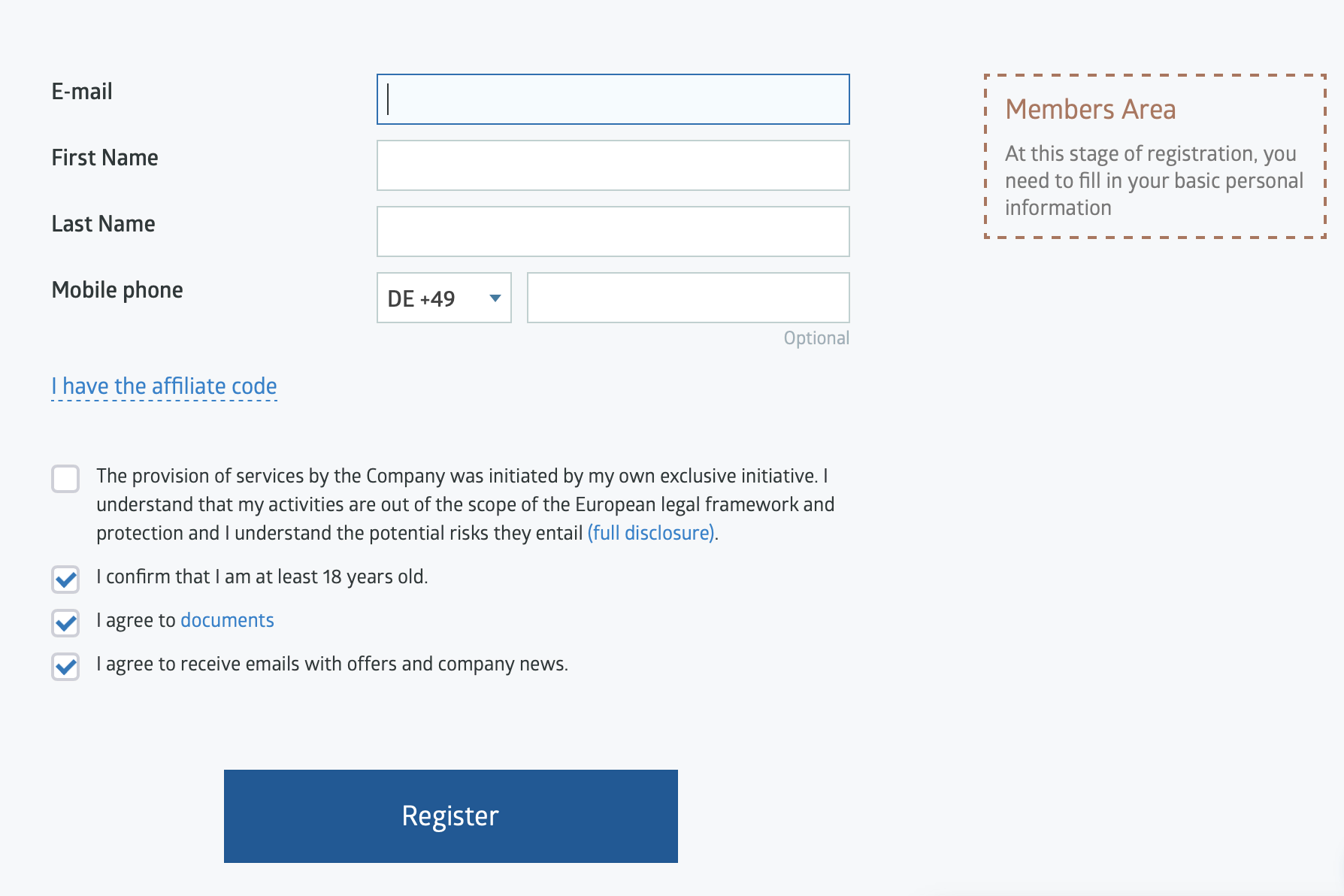

1. Open an account for Qatar traders

Opening a forex trading account in Qatar is a relatively simple process. However, there are a few things that you should keep in mind before you get started.

The first step is to find a reputable broker. There are many brokers to choose from, but not all are reputable. Do your research and ensure that the broker you choose is licensed and regulated by the Qatar Financial Centre (QFC).

The next step is to complete the account application. To complete your account opening process, you must provide your personal information, such as your name and address and your financial information. Be sure to provide accurate information during the account opening process.

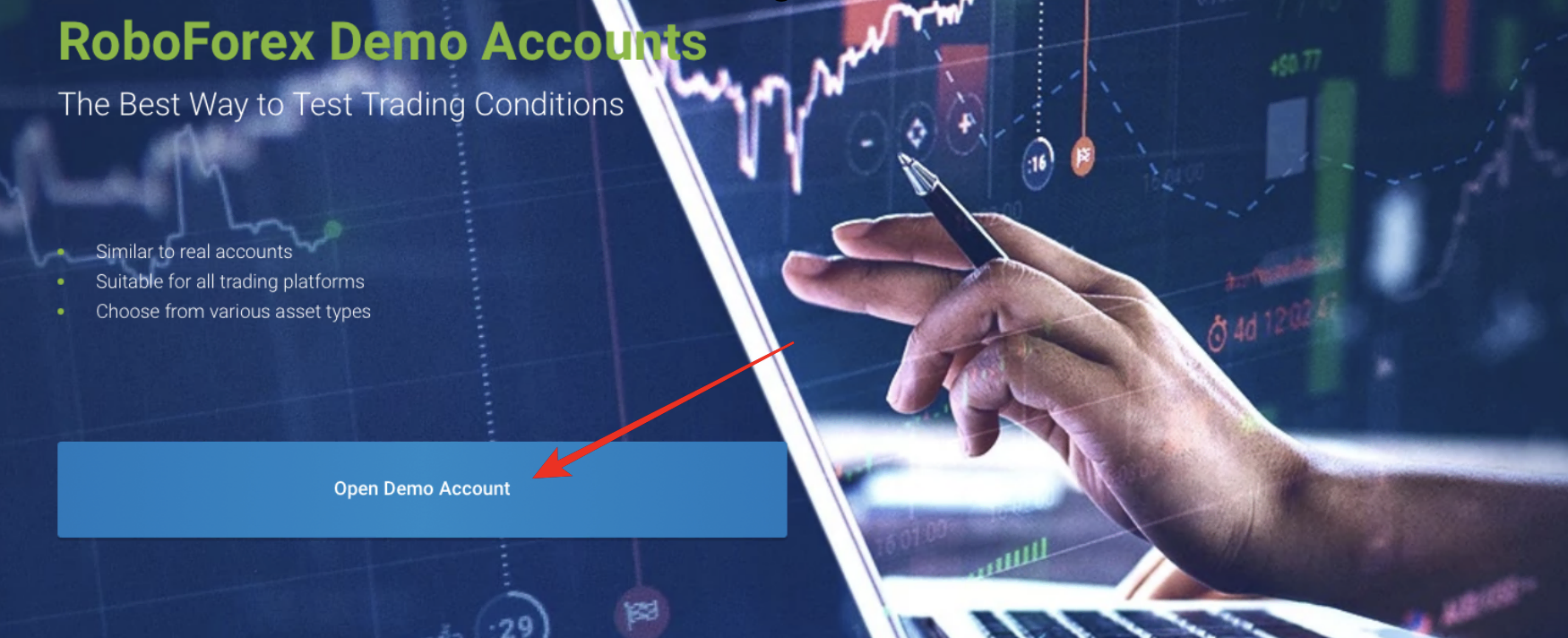

2. Start with a demo account or real account

When you start trading Forex, you have two choices: a demo account or a real account. Most people think that demo accounts are only for beginners, but that’s not true. Demo accounts are for everyone, regardless of your experience level.

Demo accounts allow you to trade in a simulated environment. A demo account is an account you can trade without using real money and without risking any losses. Using a demo account is a great way to learn the ropes of forex trading without taking risks.

Real accounts, on the other hand, allow you to trade with real money. This means that you can make a profit with the real account after familiarizing yourself with the broker platform.

3. Deposit money

When you first open a forex trading account, you will need to deposit money into it to buy and sell currencies. The process of doing this is relatively simple.

Here is a step-by-step guide on how to deposit money into your forex trading account:

- Go to the website or app of the forex broker you are using.

- Log in to your account.

- Click on the “Deposit” or “Add Funds” button.

- Select the method you want to make use of. The following methods can be; Master card, wire transfer, bank deposits, or other methods provided by the platform.

- Select the currency you want to deposit (e.g., USD, EUR, GBP).

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Before you start trading, it’s essential to understand the basics of forex trading. Learn about supply and demand, economic indicators, and technical analysis. Study different strategies and find one that works for you. Be patient and stay disciplined—over time, you will see results.

Position trading

Forex position trading is a long-term strategy that aims to take advantage of small, consistent price movements. It differs from day trading, which focuses on taking advantage of short-term price fluctuations. Forex position traders hold their positions for weeks or months, and sometimes even years.

There are many advantages of using strategy:

1. It allows traders to profit from both up and down markets.

2. it reduces the amount of stress typically associated with trading.

3. It will enable traders to enter and exit the market.

4. it can be used to generate a consistent income.

Scalping

Forex scalping is a trading strategy that allows traders to make quick profits by buying and selling currencies. The idea is to take advantage of small price movements in the market and exit positions before the currency prices move back in the opposite direction.

Forex scalping strategies involve buying and selling currencies at very short intervals. Many forex scalpers use a combination of technical and fundamental analysis to make trading decisions.

Day trading

Day trading is one of the riskiest types of investment there is. It is possible to earn an impressive income through day trading, but it is quite possible to lose a lot of money. This is why day traders must be very knowledgeable about the markets in which they are trading and must be able to make quick decisions.

Day trading is a form of active investing where shares or other securities are bought and sold within the same day. Traders aim to take advantage of short-term price fluctuations to generate profits. There is no one-size-fits-all day trading strategy.

Make profit

There is no doubt that Forex trading is a profitable way of making money. However, this does not mean that it is easy to make money in Forex. It is quite the opposite. It takes a lot of hard work, dedication, and skill to succeed in Forex trading.

There are a few things that you can do to increase your chances of making a profit in Forex. First, you need to learn as much about Forex trading. This includes learning about the different currencies, understanding market trends, and mastering the art of technical analysis.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Qatar

Forex trading can be a great way to make money if you know what you’re doing. This article explained the basics of forex trading and gave some tips for beginners and expert traders. If you’re interested in learning more, please read through to learn more about forex trading in Qatar.

This article lists the five best forex brokers and platforms in Qatar. If you are looking for a reliable and reputable broker to help you trade Forex, this article is for you. Choose one of the brokers listed above in this article and start making profits today.

FAQ – The most asked questions about Forex Broker Qatar:

What are the commissions and spreads charged by a forex broker in Qatar?

The forex brokers in Qatar charge commissions on trading Contracts of Difference (CFDs). Spreads are charged on regular currency pairs. The most liquid currency pairs have spreads starting typically at 0.5 pips.

What are the account types offered by a forex broker in Qatar?

A forex broker in Qatar offers the following account types even if the naming process is different:

1. Starter/ Mini/ Bronze accounts

2. Gold accounts

3. VIP/ Executive/ Premium Accounts

Some accounts reflect the different needs and statuses of the varying clientele.

How are the customer and additional services offered by a forex broker in Qatar?

A forex broker in Qatar must have full customer service. Usually, they offer support to customers in English or Arabic language. Traders should judge how the customer team handles queries to ensure support when required. Additional services by these brokers include the forex VPS service. The banks in retail forex brokerage also provide trading in forex contracts like FX swaps and FX futures.

Where does the forex trading procedure through a forex broker in Qatar begin?

When you choose the forex broker Qatar, you follow up with the signing process for personal information and verification of identity through related documents.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)