Four best Forex Brokers and platforms in the Republic of Congo – Comparison and reviews

Table of Contents

Forex brokers are now available to forex brokers from wherever they are due to advanced trading tools developed every year. However, forex traders have to be careful about where they open a trading account since many forex frauds exist. Four regulated and credible forex brokers accept forex brokers from the Republic of Congo.

See the list of the best Forex Brokers in Congo:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

The list of the four best forex brokers in the Republic of Congo:

1. RoboForex

It got launched in 2009 and has over one million trading accounts registered. Trading instruments include stocks, forex, commodities, ETFs, cryptocurrencies, indices, and metals.

Financial Services Commission regulates it. A forex broker offers numerous accounts like the Pro, Pro-cent, Prime, and ECN account with an initial deposit of $10, while the R-stocks trader requires $100.

Fees-Pro and Pro-cent accounts have forex spreads from 1.3 pips, the ECN and Prime account from 0.0 pips, and the R-stocks trader has forex spreads from $0.01 pips. The Prime account has $15 for all $1 million, $20 per $1 million for the ECN account, R-stocks trader from $1.5, and the Pro and Pro cent have no commissions.

Overview

- Minimum deposit-$10

- License-FSC

- Platform-R-stocks trader, c Trader, MT4 and MT5

- Spreads-0.0 pips

- Support-24/7

- Free demo-yes

- Leverage-1:2000

It offers a variety of trading platforms allowing traders to select their preferences. It is also a low-cost forex broker with tight spreads and low commissions. This forex broker also has the CopyFX platform for copy trading.

It is available as a mobile application and has a desktop version available for \windows and MAC. It has bonuses and promotions such as the welcome bonus offered to forex traders.

Disadvantages of RoboForex

- RoboForex has limited trading instruments. It has trading instruments, although it only covers around eight categories.

(Risk Warning: Your capital can be at risk)

2. Capital.com

It was established in 2016 and had been operating for more than five years, with over five million registered traders. It offers Shares, stocks, indices, cryptocurrencies, and commodities.

It has trading licenses from the Financial Conduct Authority, Cyprus Securities Exchange Commission, and Australian Securities and Investment Commission.

Traders can choose between three accounts that it offers the Standard account with $20, the Plus account has $2000, and the Premier account with $10,000. Its forex spreads start from 0.8 pips, and it charges no commission.

Overview

- Minimum deposit-$20

- Licenses-FCA, ASIC, CySEC

- Platforms-MT4, web-trader

- Spreads from 0.8 pips on major pairs

- Support-24/5

- Free demo-yes

- Leverage-1:30

Capital.com Users can access various trading features using the MT4, and web trading is supported. It is a secure trading broker and complies with strict regulations from multiple regulatory institutions.

It also offers tight spreads and low trading costs. Its users can access its trading platform, a mobile application; it also has desktop and website versions. It accepts payments through credit/debit cards, bank accounts, Multibanko, Trustly, Sofort, Giropay, iDeal, Astropay, and Apple Pay.

Disadvantages of Capital.com

- It has high rollover costs. Its rollover cost is high, which is a limiting factor for forex brokers that prefer keeping a position open for several nights or even weeks.

(Risk warning: 78.1% of retail CFD accounts lose money)

3. Pepperstone

Since 2010 when it was founded, thousands of forex brokers have registered trading accounts on its platform. It offers commodities, indices, forex, ETFs, and shares. It has trading licenses from the Financial Conduct Authority and Australian Securities and Investment Commission.

It offers the Razor and Standard accounts an initial deposit of $200. The Razor account has forex spreads from 0.0 pips, and the Standard account with 1.3 pips. It also has low commissions, where the standard account is commission-free, but the razor account has a commission of $7 per $100,000.

Overview

- Minimum deposit-$200

- Licenses-ASIC, FCA

- Platform-MT4, MT5,c Trader

- Spreads-0.0 pips on the Razor account

- Support-24/5

- Free Demo-no

- Leverage-1:400

Pepperstone traders have access to various trading instruments and a quality trading platform. It has regulations from tier-one jurisdictions, which means it offers a secure trading environment for its traders.

Traders who prefer trading using automated platforms can use the MT4, MT5, and cTrader trading platforms. It has co[py trading and social trading platforms for traders to interact and share trading ideas.

Disadvantages of Pepperstone

- Pepperstone has limited educational materials. It has educational resources, although they are not as comprehensive to enable a trader to; learn how to trade.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. BlackBull Markets

Since 2014 when it was established, it has had thousands of traders registered. It has trading instruments starting from CFDs, metals, indexes, commodities, energies, shares, and metals. It has regulations from Financial Services Authority.

It offers three types of accounts, ECN Standard account with an initial deposit of $200, ECN Prime requires $2000, and the ECN Institutional account needs $20,000. Forex spreads on the ECN standard start at 0.8 pips, ECN Prime at 0.1 pips, and ECN Institutional at 0.0 pips.

ECN Prime has a commission of $6 for every $100,000. The ECN Institutional account varies with the trading instruments, and the ECN Standard account has no commissions. Other trading costs include deposits and withdrawals, which are free, overnight costs vary with time, and it has no inactivity costs.

Overview

- Minimum deposit-$200

- License-FSA

- Platforms-MT4, MT5

- Spreads-0.0 pips

- Support-24/5

- Free demo-yes

- Leverage-1:30

This forex broker offers low trading costs, tight spreads, and low commissions. Additionally, traders can access industry-standard trading resources and fast execution speeds from the ECN accounts.

It has the Copy trading features such as MyFXAutotrade and ZuluTrade platforms. Its platform is user-friendly, and it supports the MT4 and MT5 trading platforms. It also accepts payment methods such as Bank transfers, credit/debit cards, Fasa Pay, Neteller, and Union Pay.

Disadvantages of BlackBull Markets

- It has limited educational materials. Educational materials available in this forex broker are limited, and forex traders have to rely on resources from other sources to supplement the resources they need.

(Risk Warning: Your capital can be at risk)

What are the financial regulations in Congo?

The Capital markets in the Republic of Congo are undeveloped due to its weak economy that is still recovering from war, political instability, and corruption the country has gone through. The country has large mineral and natural resources but is controlled by the informal sector.

Therefore, the capital market is characterized by commercial banks that buy and sell bonds from the Central bank of Congo (BCC). Individuals and institutions that want to buy and sell bonds have to do it through commercial banks.

The securities and exchange markets remain highly underdeveloped in the country’s financial sector. Still, forex traders can access securities using international forex brokers that now accept traders from Congo.

The BCC regulates forex brokers and other financial intermediaries, including authorized banks, which can register trading accounts for residents and non-resident traders.

Any financial intermediary that wants to engage in foreign exchange operations in the Republic of Congo as the main activity has to seek authorization from the BCC. The BCC issues the conditions that market participants require to meet to be authorized to conduct their operations.

Security for traders from Congo

The BCC has laws regarding investor protection for forex brokers, like ensuring that financial institutions offering trading instruments based in the Republic of Congo are authorized to operate. Forex traders can ensure the protection of their funds by registering trading accounts from legalized banks by the BCC.

It ensures that funds are protected through supervising and monitoring the activities carried out by the market participants. Ensuring operations carried out by the financial intermediaries are transparent and fair.

Traders also open trading accounts on offshore forex brokers with regulations from accredited Regulatory Agencies. The offshore regulatory institutions ensure forex brokers comply with investor protection guidelines such as negative balance protection and compensation funds.

(Risk warning: 78.1% of retail CFD accounts lose money)

Can you trade Forex legally in Congo?

Forex traders in the Congo can trade forex through international forex brokers as no forex brokers are based in the Congo. It requires a stable internet connection and sufficient capital to get started.

The Central bank of Congo is the main regulatory institution for forex. Since the securities and exchange markets are still underdeveloped in Congo, forex traders can rely on other regulatory institutions outside the Republic of Congo.

How to trade Forex in the Republic of Congo

Open account for Congolese traders

Get a reliable forex broker you can open a trading account. There are no Congolese forex brokers, and forex traders rely on banks to trade, but international forex brokers now accept Congolese traders.

Traders need to be careful when registering for a forex broker, as there are many forex scams in the forex market. We recommend looking for forex brokers licensed with well-known regulatory institutions. Ensure that the forex brokers offer trading features compatible with your trading objectives.

Register a trading account with the forex broker you have selected. Registration is online for most forex brokers, and the registration form is on most forex brokers’ websites. Identify the trading account suitable for your trading objectives and fill in the registration form with your details.

The registration form requires your name, age, email, nationality, date of birth, account type, and password. Some forex brokers that comply with strict regulations require them to provide their employment status and trading background to know the trader’s risk tolerance.

Download a trading platform compatible with your forex broker and trading account. There are many trading platforms that most international forex brokers support, which offer different trading features.

The forex broker you are registered under should guide you in downloading and installing. The trading platform helps traders to access the financial markets.

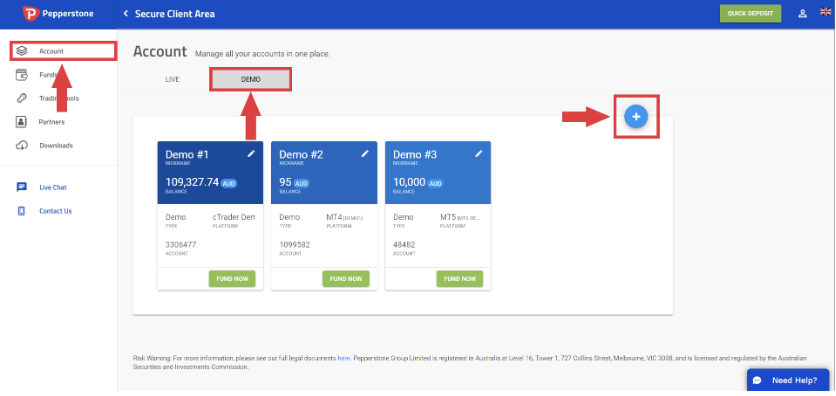

Start with a demo or real account

The Demo account helps traders practice their trading strategies, and new traders can learn how to trade without risking their real funds. It has virtual funds that forex traders use to open and close positions as they practice trading.

The demo account is crucial for new traders as they can learn forex trading before trading with real funds. Traders are recommended to start with the demo account to correct the mistakes they might make trading on real accounts and reduce the risk of losing the trade.

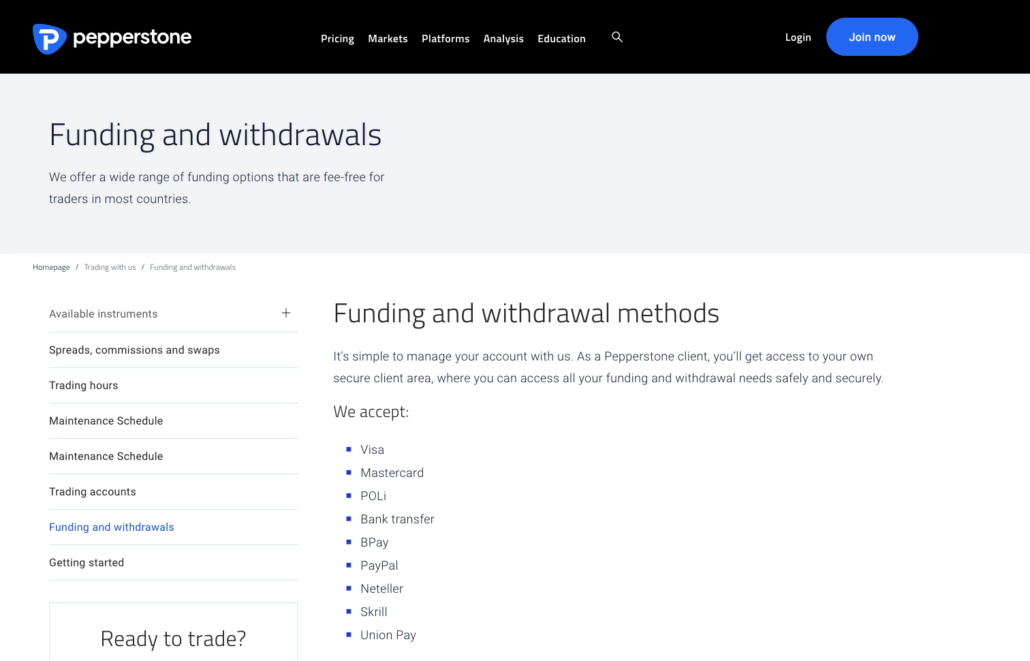

Deposit money

Forex brokers support a wide range of payment methods, such as bank transfers, credit/ debit cards, and Digital wallets that many forex traders use. You can look at the deposit options offered and use one available in your region, and deposit funds to start trading.

Ensure that you have enough practice with the trading instrument before trading. Have a plan on how to enter or exit the market and follow a trading strategy to avoid getting influenced by emotions when making trading decisions.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

Use analysis and strategies

Analysis

Analysis of financial markets allows traders to know the market movement and plan. Traders who want to start trading need to know how to analyze the underlying market comprehensively or the trading instrument before opening trading positions.

You can apply two different trading analyses, technical or Fundamental.

Technical analysis works by analyzing the price charts and using technical analysis tools to understand the market conditions. Forex traders can apply technical indicators that help to know the trend, momentum, and liquidity of trading instruments and make insightful trading decisions.

Fundamental analysis is also crucial as the trader has to know the factors influencing the price movements of many trading instruments, the interest rates, trade relations between countries, the political climate between countries concerning the trading instrument, and the economic status.

Traders should monitor these factors to get trading opportunities and know when to enter or exit trading positions.

Trading strategies

Forex traders have to apply trading strategies when entering a trading position that guides them during their trades.

Some trading strategies include:

Position trading – forex traders apply this trading strategy when they anticipate the prices of an asset to increase. It works by buying an asset at a low price when you expect its value to increase within a period. It requires a trader to be patient and wait out the temporary volatility until the prices of the asset increase, and they can sell it at a high price and profit from the difference.

Trend trading is a trading strategy that needs traders to know how to use technical and fundamental analysis to predict the trend and the trend’s momentum. If the trend is a strong uptrend, traders can go long, while they go short if it’s a downtrend.

Swing trading – this trading strategy requires the trader to find an asset or a volatile currency pair with well-defined swing highs and swing lows. They can then identify a trend and trade the swings. It needs the trader to be fast and keen when trading to avoid misinterpretation of the price action.

Trading a reversal – is a trading strategy in which a forex trader has to identify if the trend is changing the trend. If the prices are moving towards a downtrend, traders go short. At the same time, if they are headed to an uptrend, they go long. This trading strategy is important as traders can identify the right positions to exit or enter the market.

Make a profit

Make profits by following your trading strategy without improvising other trading strategies during the trade. Ensure you have practice using trading with different strategies before opening a trading account.

Ensure that you use technical and fundamental analysis before and during the trade to find the best opportunities to enter or exit the financial markets. Limit the leverage you are using if the trading instrument is volatile or if you are a new trader to limit the risk.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Congo

Congolese forex traders need to be cautious when choosing a forex broker to prevent losing their investments to forex scammers. They have to find a licensed forex broker that offers a variety of trading features to give them an equal opportunity with other traders in other regions.

It is imperative to choose a forex broker that offers low trading costs, a wide range of trading instruments, and a wide selection of payment methods accepted in Congo. Besides that, forex traders should invest in learning how to apply analysis and choose a trading strategy suitable to their trading instrument and trading objectives.

FAQ – The most asked questions about Forex Broker Republic of Congo :

Can I know the detailed information from which to choose a forex broker in the Republic of Congo?

Before choosing a broker in the Republic of Congo, examine each of the following elements.

– An authorized broker needs to have a current license.

– Should offer a phony account so that users can test the software.

– It should provide you access to all of the resources.

– Should provide you with a reliable trading platform for mobile devices,

– Should provide simple deposit and withdrawal procedures.

– It should provide you with hassle-free customer service.

How can I check if a Republic of Congo forex broker has a genuine license?

By consulting the “Registered Entities” registries on the official websites of regulatory agencies like the CySEC, ASIC, FINRA, FCA, or BaFin, you can determine whether a broker or trading platform has an active license.

You can contact the Central African Banking Commission at +237 223 4030 to find out if they oversee and regulate your broker or trading platform if they have operations in the Republic of the Congo.

How much money should I fund while trading as a forex broker in the Republic of Congo?

When opening an account with a foreign broker in the Republic of the Congo, you should deposit a minimum amount in your wallet. This is usually around $50.

Last Updated on March 3, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)