4 best Forex Brokers and platforms in Romania – Comparison and reviews

Table of Contents

Since its inception in Amsterdam approximately 500 years ago, forex trading has grown in leaps and bounds. Forex trading has made sure people very wealthy, and chances are, if you are reading this article, you intend to make money from trading in Forex.

See the list of the 4 best Forex Brokers in Romania:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 67% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 67% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Suppose you are a citizen of Romania and do not know the proper procedures to trade in Forex or what broker to choose from.

Here is a list of five of the top forex brokers in Romania:

- Capital.com

- Blackbull Markets

- Pepperstone

- IQ Option

1. Capital.com

Capital.com is a multinational broker firm. It boasts of a solid user base numbering 500,000 people and growing. Capital.com offers a global portfolio of Forex to pick from, with access to 6,100 markets and where its clients can trade with a 0% commission fee.

Clients under Capital.com can invest in global stocks and ETFs (exchange-traded funds) or trade in CFDs (A contract for differences).

In terms of popularity, Capital.com ranks very high in 2021. It was voted “Most Innovative Tech 2021” by TradingView.

Capital.com is accessible on both mobile and laptop or computer devices, and you can fund your wallet and carry out all trade within its website or app.

Traders may make better-informed decisions on Capital.com by selecting from various assets. Some alternatives include stocks, indexes, cryptocurrencies, commodities, and foreign exchange. Users of Capital.com are properly protected by law.

Another critical thing Capital.com provides to all new clients is education. They have a range of courses that can help people get started on financial education, which allows them to make better investment and trading decisions.

Capital.com has a comprehensive training program for novices, including articles, videos, and a full training curriculum.

This course consists of 28 lectures separated into five sessions and a test to measure your progress and financial knowledge.

The firm operates under the regulation of:

- The Financial Conduct Authority (FCA) in the United Kingdom

- The Australia Securities and Investment Commission (ASIC) in Australia

- The Cyprus Securities and Exchange Commission (CySEC) in Cyprus

- The National Bank of Belarus (NBRB) in Belarus

Merits of Capital.com

- It boasts an impressive portfolio of courses to educate new clients on best practices for trading.

- There is a free demo account from which you can explore, which never expires.

- A robust website and app to trade with

- Traders have access to excellent customer service 24/7

Demerits of Capital.com

- Citizens of the USA are denied from trading on the platform.

- The trading options are limited when considered with other trading platforms.

(Risk warning: 67% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets was founded in Auckland, the capital of New Zealand. The founders were a mix of data security professionals, developers, and forex traders, who operate in more than 180 countries. They work in the equities retail space to provide all their clients with the best trading exposure.

The platform is a registered financial services provider (FSP403326) and typically holds a financial Derivative Issuer License.

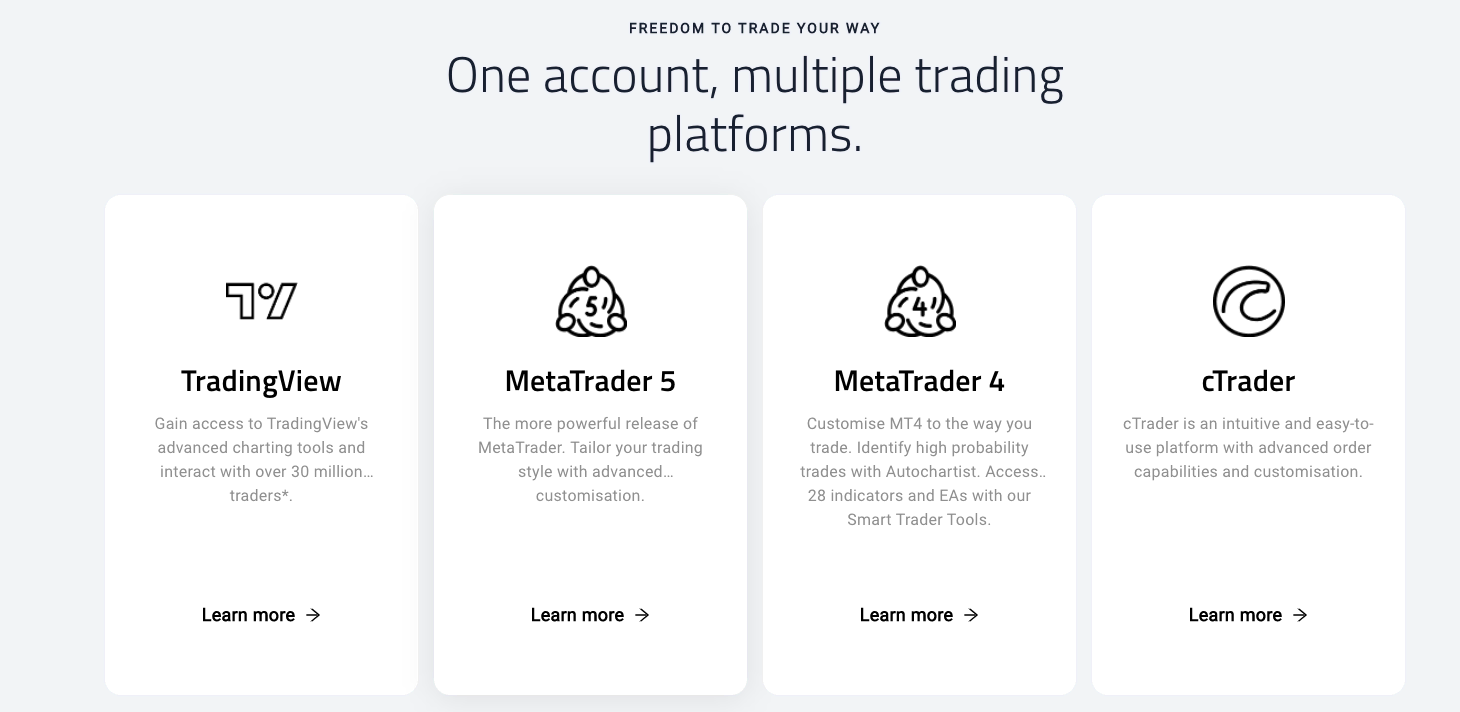

The firm offers trading access to more than 300 tradable instruments, and this consists of Equities, Forex, CFDs ( A contract for differences), and commodities on MetaTrader 4, MetaTrader 5, and WebTrader.

When you first start trading with BlackBull Markets, you’ll find that they provide a reasonable price structure and excellent transaction performance.

BlackBull Market’s technology is top-notch. They provide their clients with high trade execution speed with complete support on MetaTrader 4, MetaTrader 5, and the Web Trader. This greatly improves the speed at which clients can trade due to the speed of data collection that BlackBull Markets can make and process.

The platform is constantly introducing new features, one of which is social trading. Social trading is an investment that allows investors to examine the trading conduct of their peers and professional traders.

They are a reputable Electronic Communication Network (ECN) broker with a No-Dealing Desk (NDD) and Straight-Through Processing (STP) methodology (STP).

Pros of Blackbull Markets

- When you trade on BlackBull Markets, you pay no deposit fees

- Clients have access to fast-paced trading technology like MetaTrader suite, which includes MT4 and MT5

- Traders are provided with helpful videos and other forex-related educational materials to help boost their trading knowledge.

Cons of Blackbull Markets

- There is no 24/7 customer support

- Making a Withdrawal attracts a fee

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone was created in 2010 in Melbourne, Australia. A team of experienced traders started it with a mission to improve online trading from the traditional problems that plague other services, such as poor customer support, slow trade times, etc.

Pepperstone makes trading very simple. This, in turn, makes clients focus much more on making profits from market trades. Pepperstone profers competitive rates in the digital brokerage industry.

The Financial Conduct Authority and the Australian Securities and Investment Securities Commission regulate Pepperstone.

Pepperstone’s commission rates are among the lowest in the online brokerage sector. New traders are allowed to choose between the Standard account, which offers minimum forex spreads that starts at just one pip and no fee, and the Razor account, which provides minimum forex spreads that start at zero pips.

They operate in markets such as Forex, shares, exchange-traded funds, indices, commodities, and currency indices, all of which are available for new clients to trade with.

Pepperstone operates some top social trading strategies that are backed by in-house technology. They include Myfxbook, MetaTrader Signals, and DupliTrade.

Advantages of using Pepperstone

- They are enough social copy trading to choose from

- They are enough educational items on the platform to get the basics of trading

- Fast response time from the customer service team

- Traders are provided with a demo account with which they can practice trading.

Disadvantages of using Pepperstone

- Its customer support does not work on weekends

- Payments take a day or two to process

- In many cases, traders are offered CFDs

- The brokerage firm does not provide any facility to track your progress as a trader.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option is one of the newer online brokerage firms. They have a tradition of constantly updating their services to match new and innovative online brokerage services. The platform boasts about 46,000,000 investors worldwide and counting.

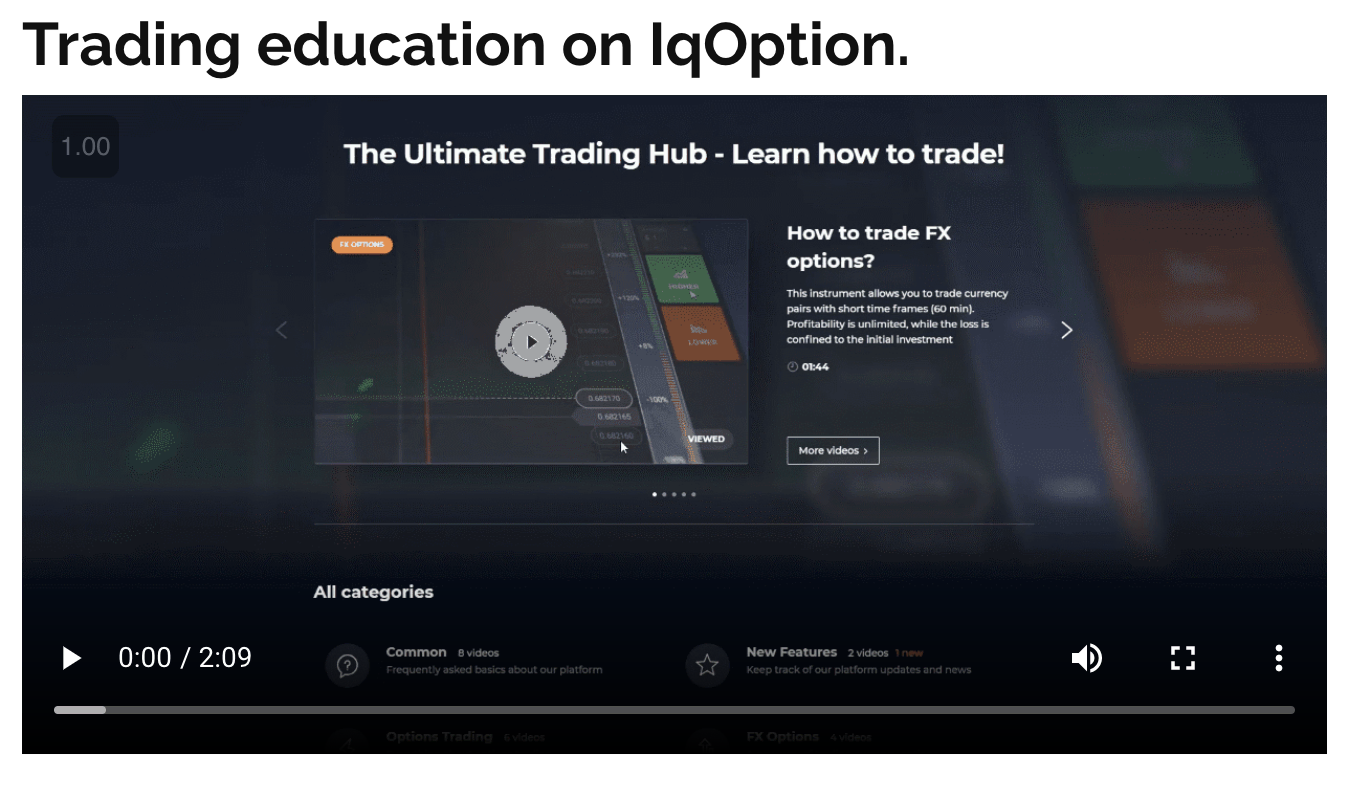

IQ Option trading patterns offer video instruction for practically every available trade pattern. It will teach you all you need to know about applying such tactics in a short period.

The platform is easily identifiable due to its proximity to the trading platform.

They are big on digital services, offering a very active mobile and desktop site to allow trading, making the platform more straightforward and more convenient.

IQ Option allows customization of the user interface to fit the needs of every client, and clients can change their chart type, color, etc., right on the platform, making IQ Option more personal to use.

Due to the heavy use of its technology, the platform has a behemoth of features that can make trading very easy to carry out.

Features like intelligent newsfeed help curate news that can help in better investment or trading options. There is also a robust online community, so it’s much easier to get answers to your probing questions.

Advantages of IQ Option

- Extensive Payment support, which involves a lot of other third payment APIs

- Vast and active community that can help you

- Traders can use their demo account funded with $10,000 virtual money

- Access to a wide range of trading assets.

Disadvantages of IQ Option

- It takes longer to carry out a withdrawal

- Withdrawal from a bank comes with a fee

(Risk warning: Your capital might be at risk.)

Is it legal to trade Forex in Romania?

Yes, it is very legal to trade in Romania. Although before you can get started, you’ll need to open a personal account with a forex broker to trade on your behalf.

Romania operates under the financial regulation of the European Union. This allows EU-licensed forex brokers to work within the country.

Romania follows the strict financial rules laid down by the European Union. This makes it possible for EU-licensed stockbrokers to make trades within the country. Brokers that are CySEC-regulated and licensed are widely accepted.

However, it is prudent to note that the ASF (Autoritatea de Supraveghere Financiara) is its major financial regulatory organization. Also, the Romanian National Bank handles the country’s national currency, which is the new Romanian Leu (RON) (BNR).

Unregulated brokers are not permitted to operate in Romania, and the Romanian government has been known to take tangible actions to prevent such unscrupulous individuals from entering the country.

Forex and CFD trading services are still available to Romanians through businesses having an EU license.

What are the financial regulations in Romania?

Being a member of the European Union, Romania abides by all EU financial regulatory rules and the European MiFID financial harmonization statute.

This implies that Romania permits registered and licensed brokers in another EU nation to conduct business there.

Brokers regulated by the Cyprus Securities and Exchange Commission (CySEC) or the Financial Conduct Authority (FCA) in the United Kingdom, for example, can lawfully provide services to Romanian traders.

(Risk warning: 67% of retail CFD accounts lose money)

How to trade Forex in Romania

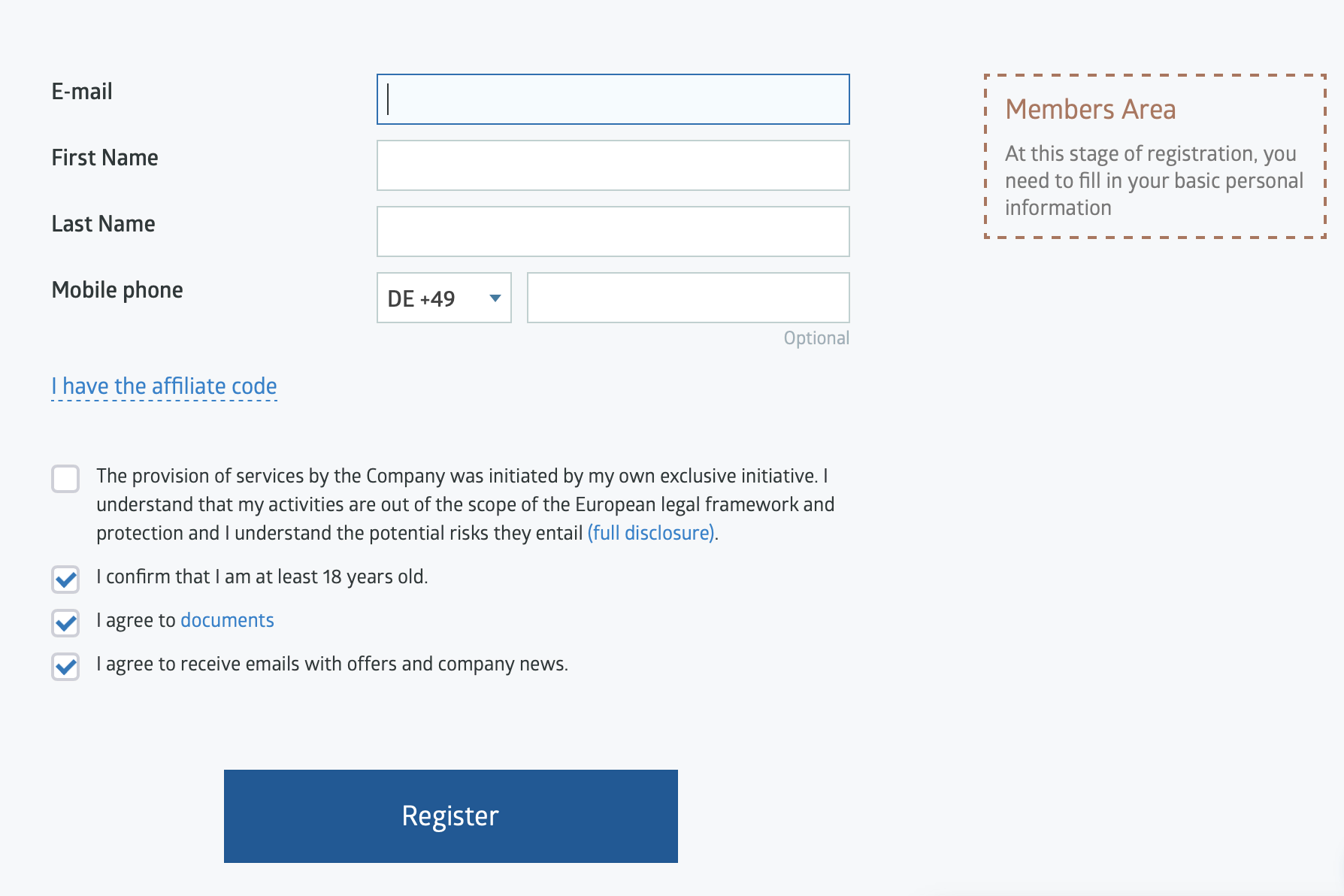

Open an account for Forex traders

The first step to take when starting as a forex trader is opening up a forex account. As a trader in Romania, choose a broker in your country. Ensure you have the required documents for opening a forex account, including proof of residency and a valid identity card. You can use a recent utility bill or your bank statement as recent as three months ago for proof of residence.

Start with a demo account or real account

When you start as a forex trader, it is safer to start out using a demo account rather than a real account. This is because, with a demo account, you can practice trading without losing actual money. When you are confident that you have understood the techniques of trading, you can fund your live account.

Deposit money

Once you have decided on the trading platform you want to go with; the next step is actually to deposit money in your live account. Different trading platforms have their minimum deposits. You can find that in the reviews above.

The method you will use in making this deposit depends on the trading platform you use. You can fund your live trading account through credit cards, PayPal, bank transfer, Skrill, and many others.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Retail forex traders make use of forex analysis and methods in deciding whether to sell or buy a currency pair. These are the strategies:

Position trading

This trading strategy is used by traders who hold positions for a long time, from a few weeks to a few years.

This approach demands traders adopt a macro perspective of the market and accept small market movements that contradict their stance as a long-term trading strategy.

Position trading is a strategy where traders maintain their holdings for an extended period, ranging from weeks to years.

As a long-term trading plan, this technique requires traders to have a comprehensive picture of the market and resist tiny market fluctuations that contradict their stance.

Scalping

This method entails opening many transactions to make a tiny profit on each one.

As a result, scalpers try to maximize profits by amassing many little wins. This tactic is the polar opposite of holding a position for hours, days, or weeks.

Scalping is quite popular in the Forex market because of its liquidity and volatility. Investors prefer markets with constantly shifting price movements so that they may profit from minor variations.

Day trading

Unlike scalping, which involves buying or selling a particular currency pair or currency pairs and then holding for a short period of time, trading from minutes to hours. Day trading has to do with buying or selling a currency pair and holding it for a day. This is on the same trade day. The trade ends when the market closes.

Make profit

Truth be told, every trader seeks to make a profit when they trade. However, it is helpful to bear in mind that for every trade you place, you are risking part of your funds. In the end, this can result in profit or loss.

For traders to make a profit, it is important to master trading techniques. Understand how the market works and everything that pertains to forex training. Increased knowledge and constant practice will make you a more profitable trader.

(Risk warning: 67% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Romania

Forex trading is not rocket science. Although it takes a while to master, the journey is worth it, as you learn how to make sound financial decisions not only on how to trade with Forex but also on better financial practices that you can apply to your life.

Forex can be pretty tricky, so it is vital to learn the basics of Forex to ensure proper research is done. This also covers risk assessment and management, so you are fully aware of the risk of trading in Forex.

FAQ – The most asked questions about Forex Broker Romania :

How to trade forex in Romania?

Traders can trade forex in Romania just like in any other nation. To begin trading, traders in Romania just choose a forex broker. Several forex brokers are operating in Romania. You can choose one of the best forex brokers and begin forex trading. The broker will allow you to fund your trading account and place your trade. Finally, after winning your forex trade, you can withdraw your funds.

What payment methods can a trader in Romania use for trading forex?

Romanian traders can access all the leading payment methods. However, it also depends upon the type of forex broker traders in Romania choose. Mostly, the leading brokers, such as IQ Option, RoboForex, Capital.com, etc., offer bank transfers, cryptocurrency, cards, and electronic wallet transactions. These payment methods are widely accessible to all forex traders in Romania.

Which forex broker should I choose in Romania to access most underlying assets?

The trading experience of the traders will be fun if they choose the broker that offers them maximum underlying assets. Forex trading is the best for traders when they indulge in trade diversification. Brokers in Romania, such as IQ Option, BlackBull Markets, capital.com, etc., offer more than 50 underlying assets to traders. So, if you wish to trade forex, you can choose one of the five reviewed brokers.

Last Updated on June 1, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)