The 5 best Forex Brokers and platforms in Senegal – Comparison and reviews

Table of Contents

Every featured broker on forex platforms has its benefits as well as pitfalls. In deciding the forex broker you intend to work with, you must consider the services they render, security features they offer, fees they require, and others. We have organized them for you based on their outstanding features to help you pinpoint the five best forex brokers in Senegal. These brokers and trading platforms are recognized outside Senegal. They are also regulated by reputable bodies.

See the list of the best Forex Brokers in Senegal:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

List of the 5 top Forex Brokers in Senegal:

Searching for the leading forex company in Senegal can be a tasking process. To make the job easy for you, we have narrowed them down to the following:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

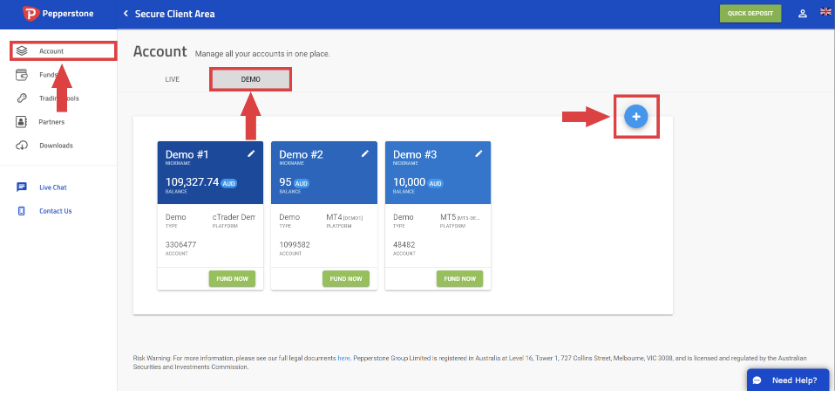

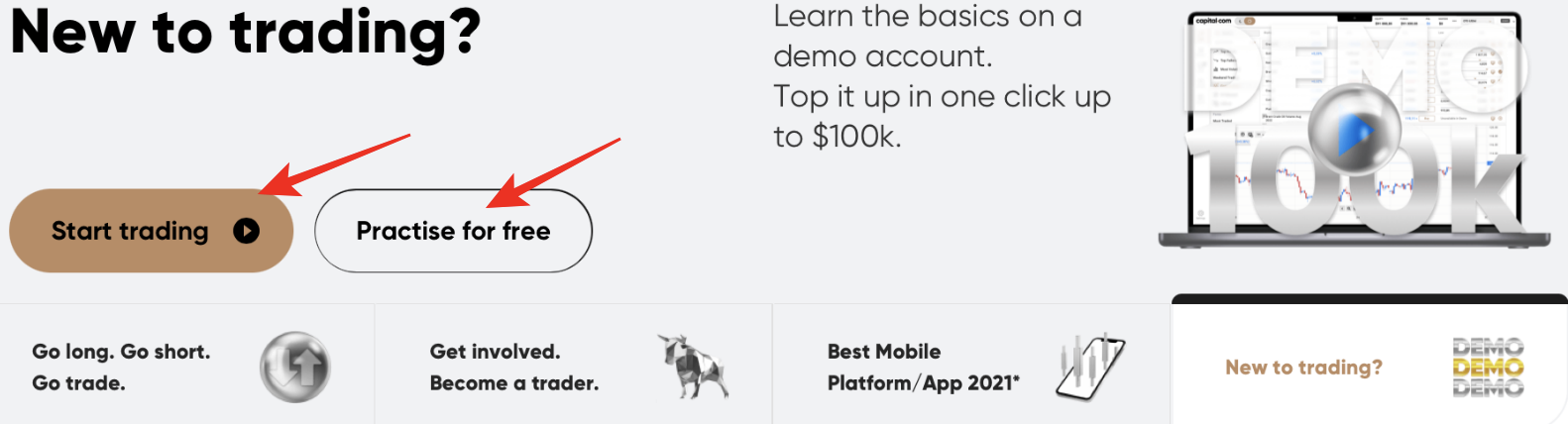

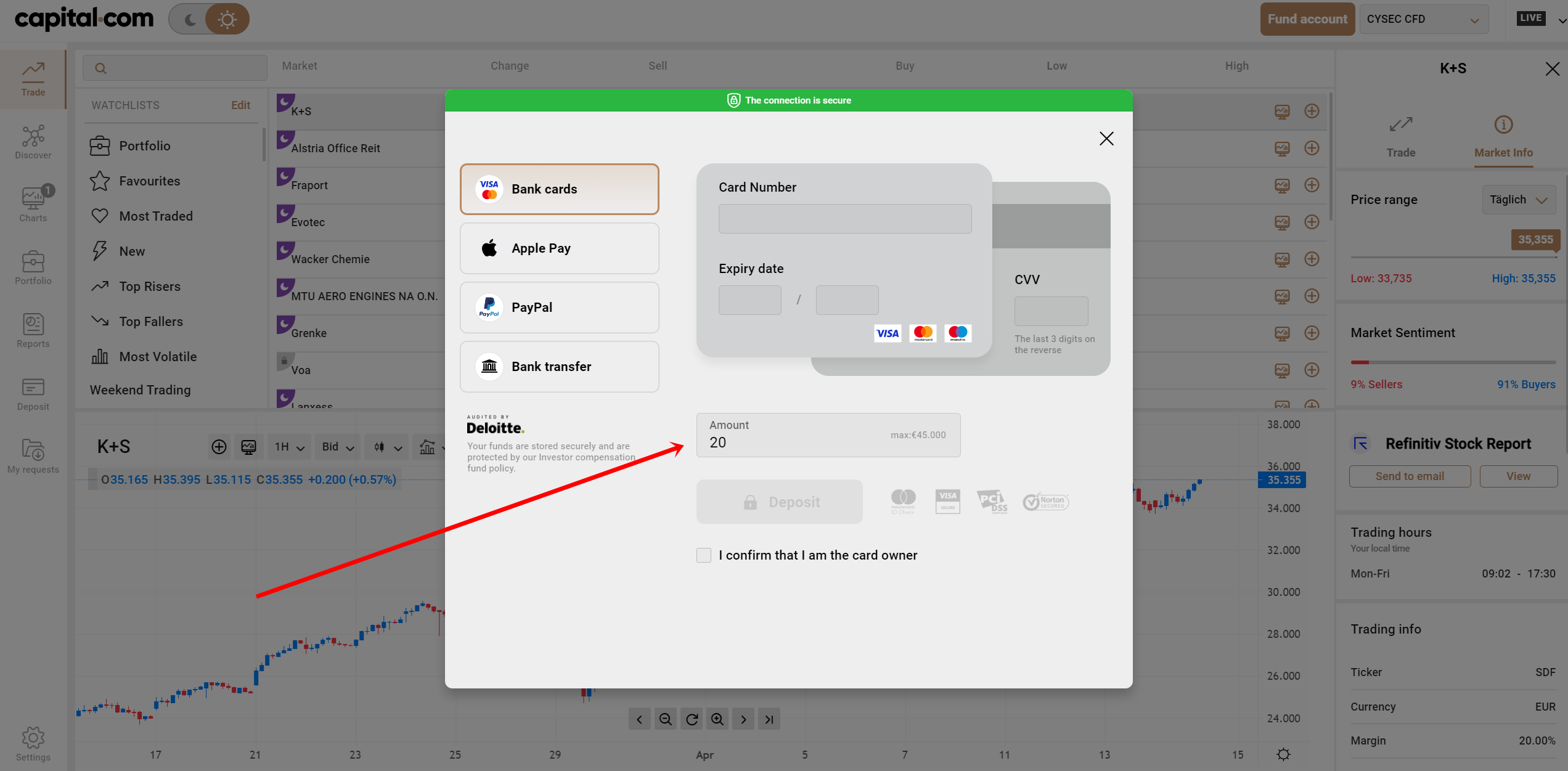

1. Capital.com

Capital.com had its first appearance in 2016. It was brought into operation by a group of AI specialists and bankers. Capital.com carries out its dealings and transactions in a distinctive manner.

It is a client-oriented forex company that runs a trade commission without charge.

Capital.com is authenticated and certified by some international bureaus. Bureaus such as the UK-based FCA and many more. This platform is on the market in most nations, apart from the US and a few island nations.

Capital.com’s platform is steered in a designed manner, such that each client has an account controller assisting him in his trade. It has an easy-to-use platform where investors can utilize its products and services. Some inquiries are made to prove the investor’s identification and trading objectives.

Pros of Capital.com

- Capital.com has a couple of free fees. Free fees include withdrawal and deposit fees, sign-up fees, and inactivity fees.

- Capital.com provides low spreads.

- Capital.com ensures maximum security for its investors.

- Their services are open to iOS, Android, and desktop users.

Cons of Capital.com

- There aren’t any multi-chart tools available on this platform. Capital.com has no reward for referring a client to other platforms with referral programs.

- Its CFDs are not simple and are highly volatile.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

As a FinTech company established in Auckland, New Zealand. It takes pride in its speed and accuracy, offering traders ECN/NDD execution with deep liquidity via the MT4/MT5 trading platforms. One benefit traders experience is that their promised ECN, deep liquidity and price aggregation, and institution-level pricing for retail traders live up to the expectations.

BlackBull Markets is an essential MetaTrader broker with an expanding product lineup and compatibility for a few third-party social copy trading sites. BlackBull Markets, on the other hand, is failing to compete with the finest forex brokers due to its lack of teaching and research materials.

BlackBull Markets provides 281 tradable symbols. The platform also provides clients access to various investment products and publishes a daily series of technical and fundamental analyses for specific trading symbols. The trade-in 60 Seconds series, for example, consists of one-minute recordings that focus on a particular trading symbol.

Merits of BlackBull Markets

- Unlike many platforms, BlackBull Markets offer very low CFD fees.

- They render one of the best traders’ support services, running a 24/7 operation.

- MT4 is accessible to users of Android, iOS, and desktops.

- BlackBull markets have received a couple of outstanding awards internationally.

Demerits of BlackBull Markets

- BlackBull Markets don’t announce and offer up their forex to members of the public.

- There is a limit on the usage of their demo account, which lasts for 30 working days.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is globally prominent. It started operations in 2009. The brokerage firm is known for its services in forex trading, and it is registered with the Financial Service Commission.

They have eight liquidity providers offering over 1,200 trade instruments. They also provide access to other forex trading platforms. Furthermore, they offer customer care support that works using 11 different languages. The RoboForex customer service team is available all day long.

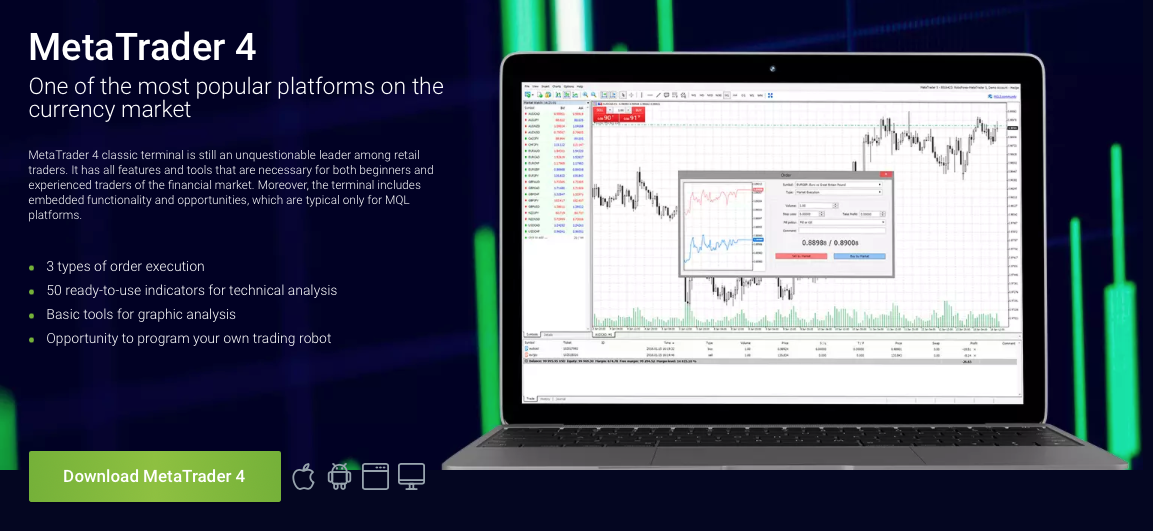

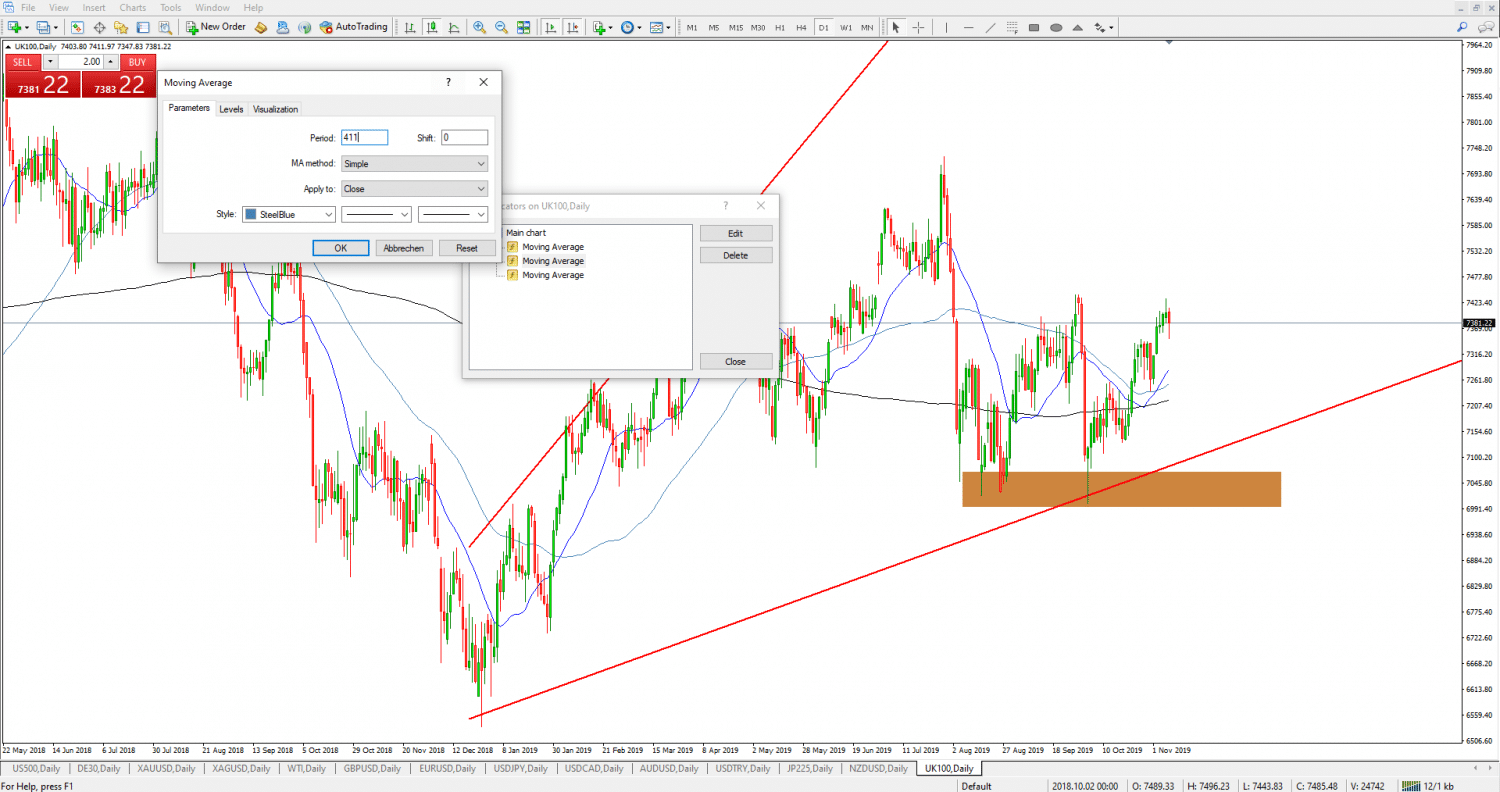

RoboForex provides trading platforms such as MT4, MT5, and cTrader. Countless traders use MT4 every year since it is a tried and proven multi-functional feature-rich trading platform. MT5 is less popular than MT4 even though it has improved features. Both platforms offer superior trading capabilities. cTrader is currently the most popular ECN platform.

Pros of RoboForex

- A €5,000,000 has been kept as insurance for civil liability. This insurance program covers errors, scams, omissions, and negligence that may result in losses.

- RoboForex has one of the fastest withdrawal services among other platforms.

- Their services are high speed and very trustworthy.

- Being one of the long-existing forex platforms gives a sense of credibility.

Cons of RoboForex

- The average commission for traders is 40%.

- Investors from the US can not access this platform.

(Risk Warning: Your capital can be at risk)

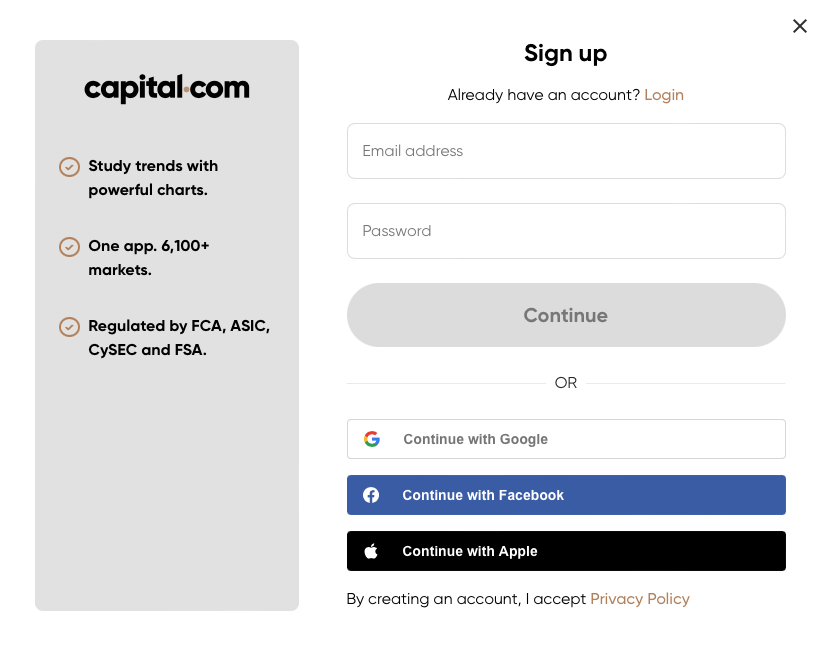

4. Pepperstone

Pepperstone is a reliable forex platform in Senegal, with more than a thousand registered investors.

The following are all globally recognized forex commissions.

The brokerage firm is well-regulated by:

Starting operations in 2010, Pepperstone has its base in different countries such as Dubai, Limassol, Nairobi, Senegal, London, and others. Investors from Belgium and the US are not given access to trade under this platform.

They offer quality products and render high-class services for different accounts. They operate a 24 working hours support from Monday to Friday, with an automated system responding in eight languages.

To open an account with them, visit their website, sign up and confirm all details provided. For training, it is advisable to register a demo account first. After you’ve become an expert, you may own a real account to earn.

Advantages of Pepperstone

- It has a speedy feedback service.

- PepperStone gives forex market gist on a daily interval.

- It operates the withdrawal process with no charge attached.

- It has platforms providing high liquidity for clients.

Disadvantages of Pepperstone

- Pepperstone’s educational products are comparable to industry standards but not as good as category leaders.

- Interactive courses, progress tracking, and instructional quizzes are not available.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

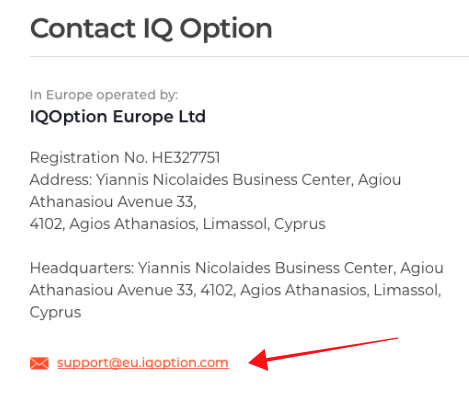

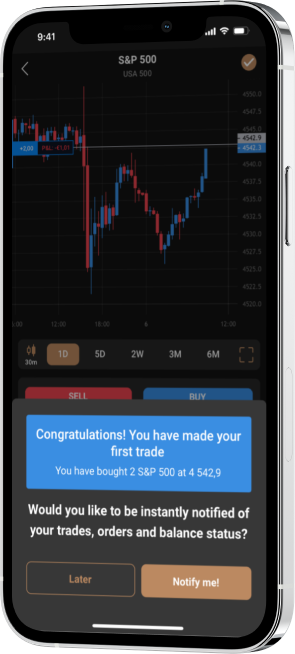

5. IQ Option

This forex platform has been existing since 2013. It is a licensed member of CySEC, EEA, and a few other commissions. Their services are available to all areas of Africa, Asia, the Middle East, and Latin America.

IQ Option is one of the best binary options (only for professional traders and those outside of EAA countries) brokers out there. The trading platform is easy to use. Traders that have been using their service for a while testify about how great the platform is.

This platform provides an account with a free commission. IQ option features a spread of 0.7 pips EUR/USD and above, and their deposit fee is $10 minimum, making it open to newbie traders. After 90 days of being inactive, you are charged €10 each month.

They have an effective communication system providing 24/7 assistance and being multilingual. You can keep in touch with them via a web platform, email, phone contact, and more.

Advantages of IQ Option

- Reliable deposit alternatives abound. The fee is $10,000 upwards.

- It has an open negotiation 24/7, even on weekends.

- Traders can customize the platform to suit their trading needs.

- With $10,000 virtual funds, you can start using their demo account.

Disadvantages of IQ Option

- The rule of withdrawal method matching deposit method is too rigid. In cases where the deposit method used isn’t available at the point of withdrawal, that becomes a problem for the client.

- The platform is designed to suit only investors operating on the shorthold.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Senegal?

The Republic of Senegal is located in West Africa and has a population of over 15 million people. The country has a fast-growing economy, with a GDP of $16.5 billion in 2016. Despite this growth, many Senegalese people still live in poverty. One way the government is trying to address this issue is by increasing financial regulation.

The banking system in Senegal is managed and controlled by the BCEAO, which is made up of 8 member countries. Guinea-Bissau, Senegal, Benin, Togo, Cote d’Ivoire, Mali, Burkina Faso, and Niger. Other bureaus have the West African Economic and Monetary Union alongside the Commission Bancaire. These are all joint unions formed to direct the affairs of financial institutions in some parts of Africa, of which Senegal is part.

The currency used is the CFA franc. This currency can be converted subsequently to Euro. WAEMU Member nations are mandated to hold 50% of their forex reserves in the French treasury. These measures automatically place the board members of the French treasury in BCEAO. This helps the IMF give their support to the Euro instead of the CFA franc.

All the 1998 restrictions on forex by the Senegalese government have been removed. Forex payments should no longer be submitted to the Finance Ministry for authorization. Senegalese commercial banks now have the right to execute these payments without approval.

Conversion of the WAEMU currency, the CFA franc, is now accessible in Senegalese banks. There are no more extended conversion limits in forex for banks. The conversion rate differs each day like the Euro – USD rate.

Foreign currencies brought into WAEMU by residents and foreigners should be deposited and sold in a Senegalese commercial bank within 30 working days of the due date.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security of traders in Senegal – Useful information

Senegal has innovative technologies that make it easy for scams and manipulative schemes to be easily detected. Senegal has put plenty of checks and balances to prevent foreign investors’ information from being breached.

Senegalese-regulated brokers reduce the risk of loss. The Senegalese traders operate by separating clients’ funds from their accounts. The country’s currency is stable and secure. Traders have nothing to worry about as the union under which Senegal belongs is well-recognized in Africa.

The Senegalese forex market is growing at high speed. Nevertheless, the stable currency is enough to lure manipulative schemes and platforms into the country. This calls for vigilance on the part of the brokers and traders in Senegal.

Therefore, forex traders should be cautious not to fall prey to these dubious dealers.

The following guidelines will help a Senegalese trader make the right decision in forex trading:

- Select a certified broker with international legal backing.

- Link your account to the certified broker and fund it.

- Select a reliable trading UI like MT4 and MT5.

- Start trading.

Is it legal to trade Forex in Senegal?

Forex trading in Senegal is permitted and duly registered with reputable unions. When trading forex, choose a licensed broker.

Forex activities in Senegal are not banned. There are a lot of globally recognized platforms offering good trading terms and conditions to interested clients. The industry is recording consistent growth. These platforms are backed up by some international agencies regulating forex activities.

How to trade Forex in Senegal – Tutorial

Referrals to the top brokerage companies in Senegal have been made. These brokers have been thoroughly explained, stating their features, the regulatory system behind them, the available trading platforms they offer, and their benefits and drawbacks.

In this session, we will be discussing how to trade forex in Senegal.

A guide is given below:

Open a Forex trading account

Firstly, you must conclude with the particular broker that is licensed and meets your needs. The top 5 brokers in Senegal have been identified above with their peculiarities.

In opening a forex account, you should consider the funds’ requirements of the broker you intend to use. Some brokers have a high deposit fee as their minimum. You must be sure you have up to that amount. Otherwise, reconsider your choice.

After this, you can open an account on the broker’s website or platform. To do this, log onto the web platform of your selected forex company, fill in your details, submit your application, verify your details, and await approval from the technical team.

Start with a demo account or real account

Most of these brokers provide demo accounts with virtual funds. These demo accounts assist you in your build-up process to become an expert in forex trading. Some platforms in their demo accounts have AI technology that exposes traders to their trading patterns.

You should note that some platform’s demo accounts last for a limited time. Whereas some last for as long as possible. So, in choosing your forex broker, you should consider this factor.

After this, you can now go ahead to open a real forex account, depositing real funds based on your broker’s fee. Here, you will be required to link your bank account to your broker. You will also be required to provide some details about yourself, confirming your identity and stating your reasons for trading.

Deposit money

The funds to be deposited depends on your selected forex company. Also, note that some forex companies have a strict rule that the deposit method must be the same as the method of withdrawal. So, before you proceed with making any payments, be sure that the option you are using will still be accessible when you want to withdraw funds.

Apart from the funds to be deposited, some platforms’ requirements stipulate that you pay a commission charge. Some brokers offer free commission, while others come with a charge. Therefore, you must be intentional and calculative when sticking to a particular forex company.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use trading strategies and analytical models

Below are some common strategies employed to trade:

- Scalping

- Trade Momentum

- Position Trading

Scalping involves a short-term kind of trade. Here, clients react almost immediately to price movements and other market factors. Scalpers are usually fast and continuously agile. Most of them are advanced traders with the prerequisite knowledge, technique, and software to give them trading hints.

Momentum traders, on the other hand, work with patterns and trends. It is like a middle-term kind of trade. Here, trading is carried out using support and limit levels. Recurrent news updates are one of the indicators for momentum traders.

Position traders deal long-term. They operate with more stable currencies. Clients here are more patient and expect high returns. They can stay on investment for years before opting out. These traders study more of a country’s economic system, analyze trading strategies, and observe the number of traders trooping in.

Make profit

To have great investment returns, you must consider the following when choosing a particular forex broker:

- The reputation of the forex company, bearing in mind the reviews they have.

- The leverage they offer. Knowing that the higher the leverage, the higher the possibility of profit or loss.

- Overnight funding charges. If high, your gain will automatically be reduced.

- The trading strategy used by the forex broker.

- The technological back-up as well as the security system of the platform.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Senegal

No forex broker offers completely challenge-free services or a direct path to failure. Your progress or regress in forex trading largely depends on the quality of your research. It also has to do with the forex broker you choose. Funds invested, leverage and risk level involved, the economic condition of the country you are trading in, and the forex regulations guiding that country.

Senegalese forex trading grows every year. But, it takes patience, the proper regulations being implemented, and other factors to ensure the growth of forex trading in this region. Therefore, investors who intend to invest in the forex trade of this country should brace up for the treasures and great benefits that lie ahead.

FAQ – The most asked questions about Forex Broker Senegal :

What are the top features that any forex broker should offer traders?

There are several top features that a trader should look for in a broker. Firstly, a trader trading in Senegal should find a reputed broker. Then, he must choose a feature-rich platform that further enhances his trading experience. A trader will enjoy the best of trading once he gains access to most forex pairs. It will also help him in trade diversification.

Is it legal for traders in Senegal to trade forex?

Yes, it is legal for traders in Senegal to trade forex. They can begin once they choose a forex broker. These days, multiple forex brokers exist in the market. You can choose one by researching well the features and other considerable factors. In essence, a trader in Senegal can trade forex without question as it is fully legal.

What are some recognized forex trading platforms in Senegal?

There is more than one recognized forex trading platform in Senegal. Some brokers include BlackBull Markets, Pepperstone, IQ Option, Capital.com, and RoboForex.

These brokers extend the most trusted services to brokers in Senegal. They enhance your trading experience and help you make money through forex trading. Besides, they also offer the best-in-class features that every forex trader dreams of. You can find a lot of charts and technical tools on this trading platform.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)