The 5 best Forex Brokers in Sierra Leone – Comparisons and reviews

Table of Contents

As forex trading continues to gain fame in West Africa, including Sierra Leone, many traders still find it tough to choose a suitable broker to deal with.

See the list of the best Forex Brokers in Sierra Leone:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Sierra Leoneans looking for the right broker with excellent trading conditions and services can choose one of the following:

- Capital.com

- Blackbull Markets

- RoboForex

- Pepperstone

- IQ Option

A summary of the brokers:

1. Capital.com

Quick glance:

- Minimum deposit – $20

- Regulations – CySEC, ASIC, FCA.

- Platforms – MT4, Capital.com app.

- Spreads – 0.8 pips average, zero commission.

- Free demo – Yes

- Support – 24 hours. Mon – Fri.

- Payment method – Debit card, credit card, bank wire, Apple Pay, and SoFort.

Capital.com is a London-based forex and CFD broker that started operating in 2016.

The company is licensed by the Australian Securities and Investments Commission ASIC, Financial Conduct Authority FCA, and Cyprus Securities and Exchange Commission CySEC.

Capital.com has offices in Cyprus, Gibraltar, and Belarus, accepting customers from many parts of the world, including Sierra Leone. Its competitive fees and user-friendly platforms make it the top choice for traders of any level.

Capital.com pros:

- Top-quality educational and research materials for all traders.

- Wide selection of forex pairs and CFD assets.

- Various helpful videos for market analysis.

Capital.com cons:

- No Islamic account.

- No meta trader 5.

(Risk warning: 75% of retail CFD accounts lose money)

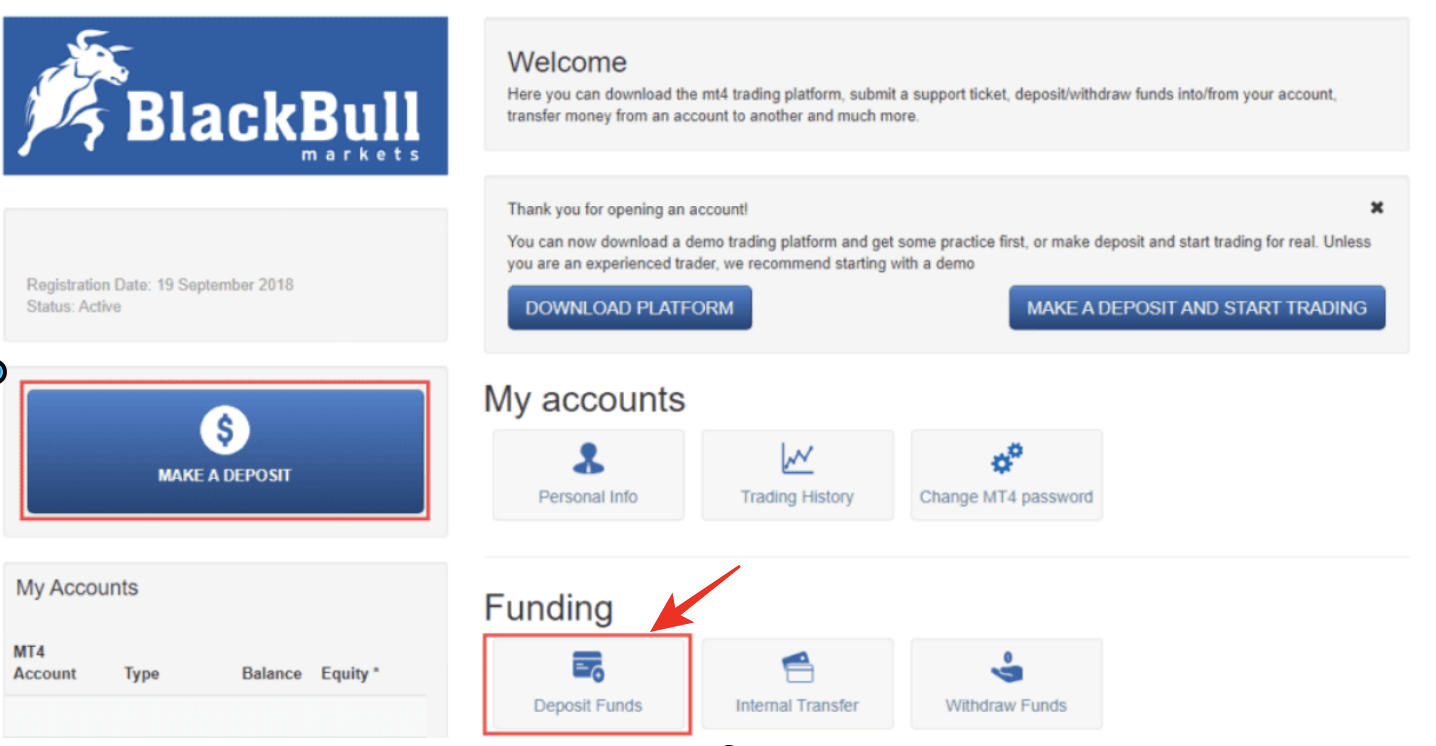

2. BlackBull Markets

Summary:

- Minimum deposit – $200

- Regulations – FMA, FSA.

- Platforms – MT4, MT5, Mobile app.

- Spreads – from 0.1 pip on raw ECN account, with $3 commission.

- Free demo – Yes

- Support – 24 hours, Monday to Saturday.

- Payment method – Fasapay, bank wire, credit card, and debit card.

Blackbull Markets is a New Zealand-based ECN broker founded in 2014. The broker operates with licenses from the Financial Markets Authority of New Zealand FMA and the Financial Service Authority of Seychelles FSA.

The company boasts of the fastest order execution and provides access to the various liquidity pools so traders can get the best deals. Its mobile app is intuitive and comes with essential tools to help traders make a profit.

Blackbull Markets pros:

- Social and copy trading is available on multiple platforms, such as Zulutrade, Tradingview, and MyFxbook.

- The complete meta trader platforms with their competitive features are provided.

- Fast ECN order executions and tight spreads.

Blackbull Markets cons:

- Higher minimum deposit

- An inactivity fee applies with this broker after 3 months of dormant account.

(Risk Warning: Your capital can be at risk)

3. RoboForex

At a glance:

- Minimum deposit – $10

- Regulations – IFSC

- Platforms – MT4, MT5, cTrader, RTrader.

- Spreads – from 0.1 pip on raw ECN account, with $2 commission.

- Free demo – Yes

- Support – 24 hours, five days a week.

- Payment method – Credit card, debit card, Advcash, Perfect Money, and bank wire.

RoboForex is a popular forex broker based in Belize, with offices in New Zealand, the United Kingdom, and Cyprus.

The broker is regulated in North America by the IFSC (International Financial Service Commission) and in Europe by the Cyprus Securities and Exchange Commission CySEC.

RoboForex’s low trading costs, bonus offers, and user-friendly platform options make them appealing to traders of all levels.

RoboForex pros:

- Low trading costs with attractive bonus packages.

- Fast withdrawal processing.

- Easy registration process.

RoboForex cons:

- Withdrawal fees apply.

- No cryptocurrency trading on its RTrader platform.

- A limited number of forex pairs (36 pairs).

(Risk Warning: Your capital can be at risk)

4. Pepperstone

At a glance:

- Minimum deposit – $0 ($200 recommended).

- Regulations – FCA, DFSA, CMA, CySEC, ASIC.

- Platforms – MT4, MT5, and cTrader.

- Spreads – from 0.1 pip on raw ECN account, with $3 commission.

- Free demo – Yes

- Support – 24 hours, Monday – Friday.

- Payment method – MasterCard, Visa, MPesa, Bank transfer, and PayPal.

Pepperstone is a global online forex and CFD dealer with headquarters in Australia. The company has other offices in the United Kingdom, the United States, Kenya, China, and Dubai.

Pepperstone holds operating licenses in the regions from the following bodies:

- ASIA

- CySEC

- CMA

- BaFin

- DFSA.

Pepperstone provides exclusive access to the Electronic Communications Network (ECN) through its high-quality trading platforms. The broker includes plugins in its platforms to support automated trading, social and copy trading, and free VPS for active customers.

Pepperstone pros:

- Multiple regulations make it one of the safest brokers.

- Advanced platforms with full support for algorithm and social trading.

- Top-rate research and education content to help traders.

Pepperstone cons:

- The free demo expires after 30 days.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

Summary:

- Minimum deposit – $10

- Regulations – CySEC

- Platforms – IQ Option app

- Spreads – 0.8 pips, with zero commission.

- Free demo – Yes

- Support – 24 hours, Weekdays.

- Payment method – MasterCard, Visa, Maestro, bank transfer, WebMoney.

IQ Option is known for binary and digital options trading on a specially designed trading platform. Other market instruments are accessible alongside the binary options, including forex pairs, indices, commodities, and ETFs.

IQ Option is based in Cyprus and operates with a license from the most famous European financial body, CySEC. The broker provides quality trading service at competitive fees and accepts traders worldwide.

IQ Option pros:

- Easy signup with only a $10 minimum deposit.

- Customizable features on its trading platform.

- Provides monthly trading reports to VIP customers to enable tracking.

IQ Option cons:

- No meta trader platforms.

- The minimum deposit required for VIP status is $1900.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Sierra Leone?

The Bank of Sierra Leone is the top financial regulatory body in the country. The body oversees all the country’s finance sectors except the Insurance industry.

Sierra Leone is among the West African countries where forex trading is picking up gradually. However, our search found no regulations relating to online forex trading by the Bank of Sierra Leone.

Online forex and CFD trading seem an unpopular activity in the country that the BSL hardly concerns itself. Perhaps this is because investments and trading in the financial market are generally low.

We should mention that in 2019, the BSL lowered the number of foreign currencies individuals and businesses are allowed to hold. Until 2020, no one was allowed to hold more than $10000 in their accounts.

The reason for the restriction was the high inflation rate caused by the shortage of the country’s currency in circulation. This regulation was directed more at businessmen and women in the country. However, at that time, Sierra Leonean traders had to conduct all their online trading within this limit. The ban was removed a little over a year later.

(Risk warning: 75% of retail CFD accounts lose money)

Security for Forex traders in Sierra Leone

Many online brokers welcome Sierra Leonean traders to use their platform. As there is no information on regulations, scammers may see opportunities here.

Traders must use only regulated brokers to be safe. Licenses are easily verifiable on regulatory bodies’ websites. We recommend Sierra Leoneans confirm their chosen broker’s license before signing up.

It is safer to trade with holders of reputable and easily-recognizable licenses. These include regulations from top-tier regions, such as:

- The United Kingdoms FCA.

- Germanys BaFin.

- Cyprus CySEC.

- Australia’s ASIC.

- New Zealand FMA.

- Seychelles FSA.

- Dubais DFSA.

Brokers holding these licenses are legit. Some brokers may also hold additional licenses issued in South Africa or Kenya. That’s the FSCA and the CMA, respectively.

Your choice of brokers should be limited to those having any of the licenses mentioned here to be safe.

Is it legal to trade Forex in Sierra Leone?

Yes, it is. There are no laws against forex trading in Sierra Leone. Therefore, Sierra Leoneans can and do trade forex and CFD with online brokers. Traders must protect themselves by dealing ONLY with licensed and trustworthy brokers.

How to trade Forex in Sierra Leone – Tutorial

Forex trading requires these basic set-ups before starting:

- Stable internet service.

- A smartphone, tablet, or laptop.

- A credible broker.

A stable connection is a must before you begin trading. Therefore the trader must ensure their service provider is the right one. Stable internet ensures that the trade opens and closes with one click, with no delays. That prevents any loss of capital or profit while trading.

A credible broker is another essential. The broker greatly determines your trading success. Poor trading service or high trading costs can lower the profit to the point that it becomes worthless to continue.

Once you find a broker, check these items to ensure they’re the right one:

- Properly regulated

Remember that the license must be recognizable and verifiable. Ensure the broker operates with a valid license from any of the bodies listed above.

- Competitive fees

The cost of trading should not take all the profits. Therefore, the broker’s spreads, commissions, and other applicable fees must not exceed the industry average. Comparing brokers’ spreads will help you see the acceptable rates.

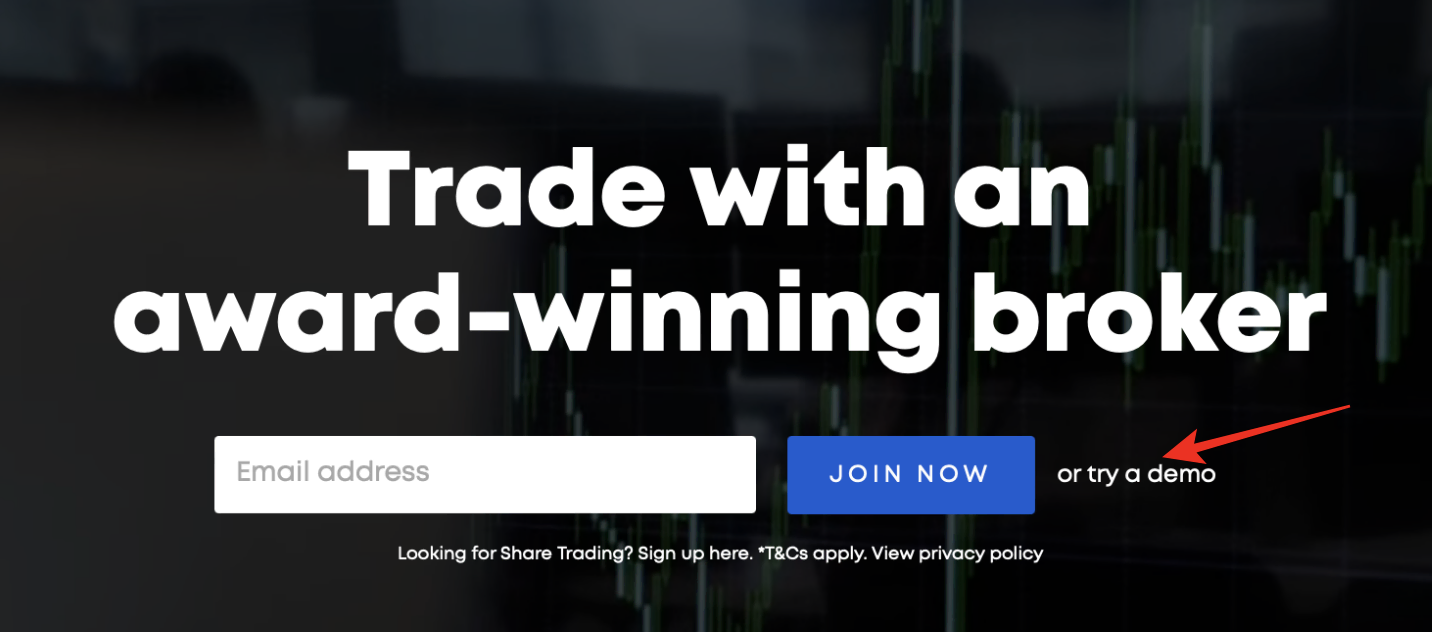

- Free demo account

A credible broker is usually proud to show potential customers their offerings. So they offer a free demo account with at least 30 days of access to let you test their platforms before trading live.

- 24 hours support service

Good brokers ensure that customer service is within reach during trading hours. That means throughout the week, all day, support must be available.

- Available payment method for easy deposits and transfer

Credible brokers make it easy for traders to deposit funds and withdraw profits from their platforms. They ensure that easy payment methods are provided in the region. The popular payment options in Sierra Leone are MasterCard, Visa, and Bank transfers. Local Mobile money options may be provided too.

Steps to trading forex:

1. Open account for Sierra Leonean traders

Enter the broker’s web address on your browser to load their page. It should take you to the website meant for Sierra Leoneans if you’re not using a proxy connection.

The create account or signup tab should be visible at the top of the page or the center. Click on this to begin the signup process.

Type in your email and any other requested information and click on create an account. The system automatically forwards a confirmation link to your mailbox.

Click on the link to verify the details you provided. Follow the rest of the instructions that appear to finish creating the account.

Be ready to send the broker a valid ID card issued by the government and proof of address.

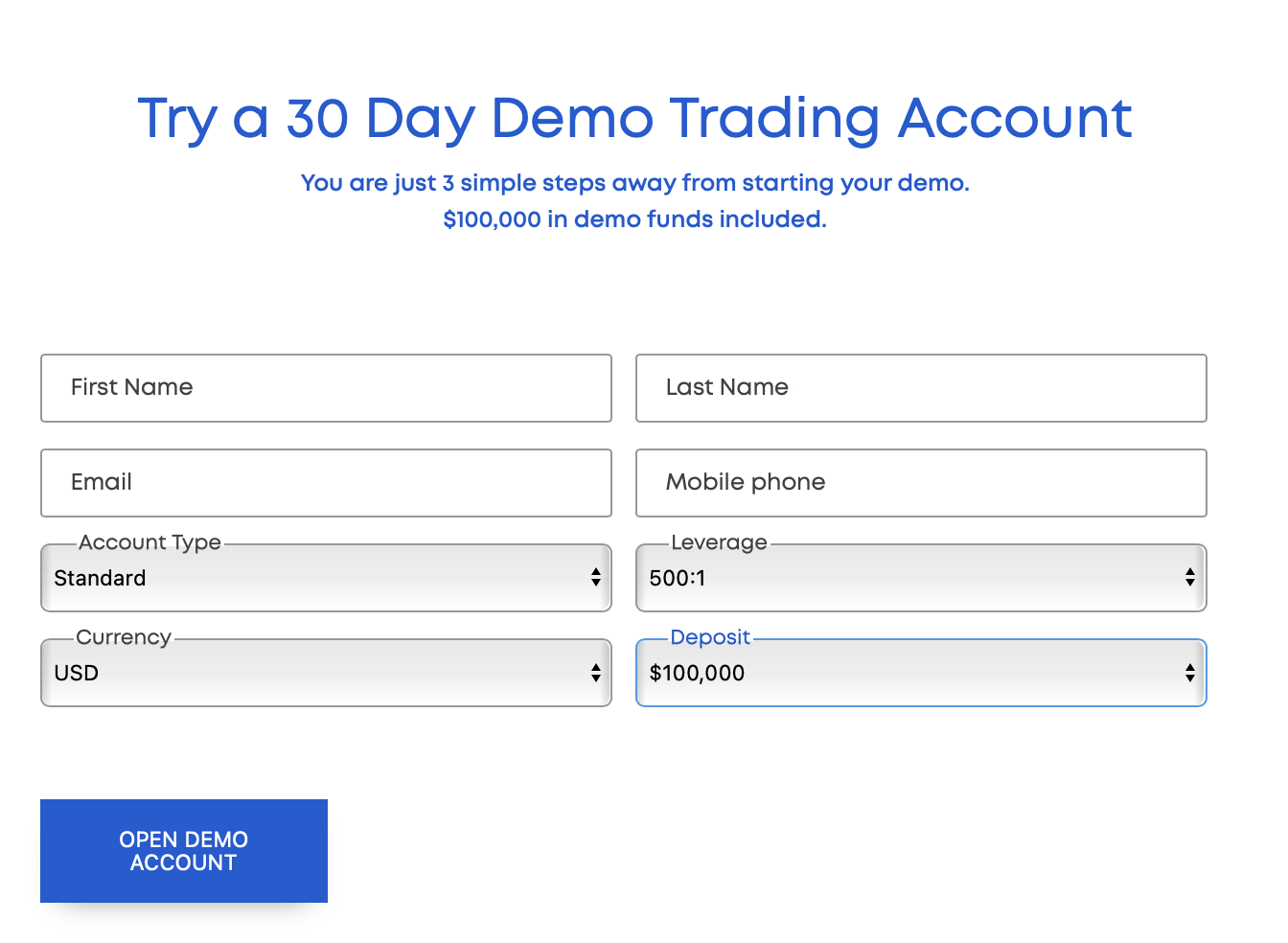

2. Start with a demo or real account

After completing the signup, you should have access to the broker’s free demo account. Some may want to skip this part, but we recommend trading with a demo account before the real one.

A demo account lets you familiarize yourself with the market environment if you’re new. Existing traders can check out a broker’s platform without financial risks. Many traders often use demo accounts to practice trading strategies.

So whether you’re a novice trader or a skilled one, demo accounts are always useful.

3. Deposit money in the Forex account

The next step after testing the demo is using the live account. To trade in a real account, you need actual cash. So you deposit money into the live account by clicking on the FUNDS tab.

Select the deposit option and choose your payment method. As we mentioned, the broker should provide several payment means that are easy to use in your location.

Choose from these and follow the instructions to transfer funds into the account. The broker may assign someone to assist, so the process should be smooth.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Before placing any trade, market analysis is a necessity. You must analyze the forex pair you wish to speculate on. The analysis gives you insight into the asset to make good trading decisions.

Market analysis also helps you choose the appropriate strategy for the currency pair that interests you. The strategy is your entry and exit approach, and your profitability directly depends on it.

Here are the 3 vital forex analyses:

- Technical analysis

- Fundamental analysis

- Sentiment analysis

Technical analysis studies forex charts to spot price patterns that show profitable opportunities. Trading platforms often have many tools to help with this analysis. The trader uses them to interpret the pattern and identify trade signals. Technical analysis is the most popular and frequently used in forex trading. The trader needs to learn the functions of the different trading tools in the platform to conduct this analysis properly.

Fundamental analysis refers to studying the factors that directly impact the exchange rates. These factors make up the nation’s economy and give a clear insight into the currency’s value. Examples of forex fundamentals to analyze are gross domestic product (GDP), inflation rate, interest rate, export, import, etc. These factors help you understand the asset’s price history and make it easy to forecast the exchange rate’s rise or fall.

Sentiment analysis means examining the market participants’ expectations. The trader does this by analyzing the price directions using technical indicators on the trading platform. The price direction can indicate the market sentiments at any given time.

After conducting these analyses, you can research different trading strategies and choose the ones best suited to the asset.

Here are a few common forex strategies:

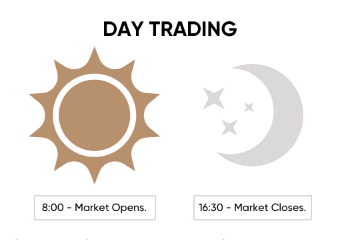

- Day trading

Day trading strategy refers to conducting trades within the same day, leaving no positions open till the next day. Many forex traders are day traders. This approach aims to lower the trading risk and costs by avoiding overnight fees and unexpected price moves. So traders may open and close one or several positions on the same day.

- Swing trading

The swing trading approach is not a short-term one like day trading. In swing trading, the traders leave their positions open for a longer period, three days, for example. Some swing traders can leave their positions open for longer than a week. The goal is to make bigger gains from the ongoing trend. So, the pips profit adds up as the trade says open.

- Positional strategy

Positional trading is a longer-term strategy. The trader must first identify a long-term trend to profit from this technique. Indicators, such as the MACD, are often used alongside other tools to determine the trend’s time length. Positional traders can hold a trade for longer than a month. Some leave positions open for up to 6 months. Before entering such transactions, the trader must be certain and should constantly monitor the trade.

5. Make profit

Mixing the right strategy with the required market analyses will result in successful trades. You will start to make a profit soon enough.

Click on the same FUNDS tab and select the withdrawal option to withdraw the profit. Fill out the request form and click on submit.

The broker receives the request and starts processing the payment. The funds should get credited to the receiving account within two days in most cases.

Sometimes, it takes longer. Other times, it takes a shorter period. It depends on the payment method and the broker.

(Risk warning: 75% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Sierra Leone

Forex trading is accessible in Sierra Leone and is safe to engage in if you choose a well-regulated dealer. Ensure the broker meets ALL the standard requirements for credibility. Dedicate time analyzing the market and learning to use the various helpful trading tools available. This guide gives you a solid start in your forex journey, and the recommended brokers are among the market’s bests ones.

FAQ – The most asked questions about Forex Broker Sierra Leone:

Which forex brokers in Sierra Leone offer traders access to TradingView?

TradingView is the best platform or software for trading forex. It allows you to make customized trades and enhances your trading experience by letting you access hundreds of underlying assets. Besides, TradingView also has a perfect way for traders to customize the indicators they use to conduct technical analysis. To access this platform with forex brokers in Sierra Leone, you can signup with one of the following.

BlackBull Markets

IQ Option

Pepperstone

Capital.com

RoboForex

How does a trader trade forex with forex brokers in Sierra Leone?

Traders in Sierra Leone can trade with forex brokers by opening a brokerage account. Traders can choose an account type for trading forex. Once done, traders are required to deposit the minimum amount needed to open an account. Then, finally, they can select the underlying forex pair they wish to trade and place the trade.

What is the minimum deposit amount forex brokers in Sierra Leone stipulate for traders?

Traders can fund their trading accounts with as much money as they want. You can begin trading with $10. Most brokers will let you fund your trading accounts with a low amount.

But you can place your forex trades starting with $1.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)