The 4 best Forex Brokers & platforms in Singapore – Comparisons and reviews

Table of Contents

Trading costs can take a good chunk of your profit if you’re an active trader. Singaporean forex traders should choose a licensed broker to prevent this problem.

See the list of the best Forex Brokers in Singapore:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

Below, we recommend a few of the industry’s bests in Singapore, offering competitive prices for forex services.

- RoboForex – the best profitable Broker

- Capital.com – the best CFD broker

- BlackBull Markets – the best and fastest order Execution

- Pepperstone – the best forex broker in Singapore

Here’s a summary of the brokers:

1.RoboForex

Summary:

- Regulations – IFSC

- Minimum deposit – $10

- Spreads and fees – the average spread is 0.6 pips.

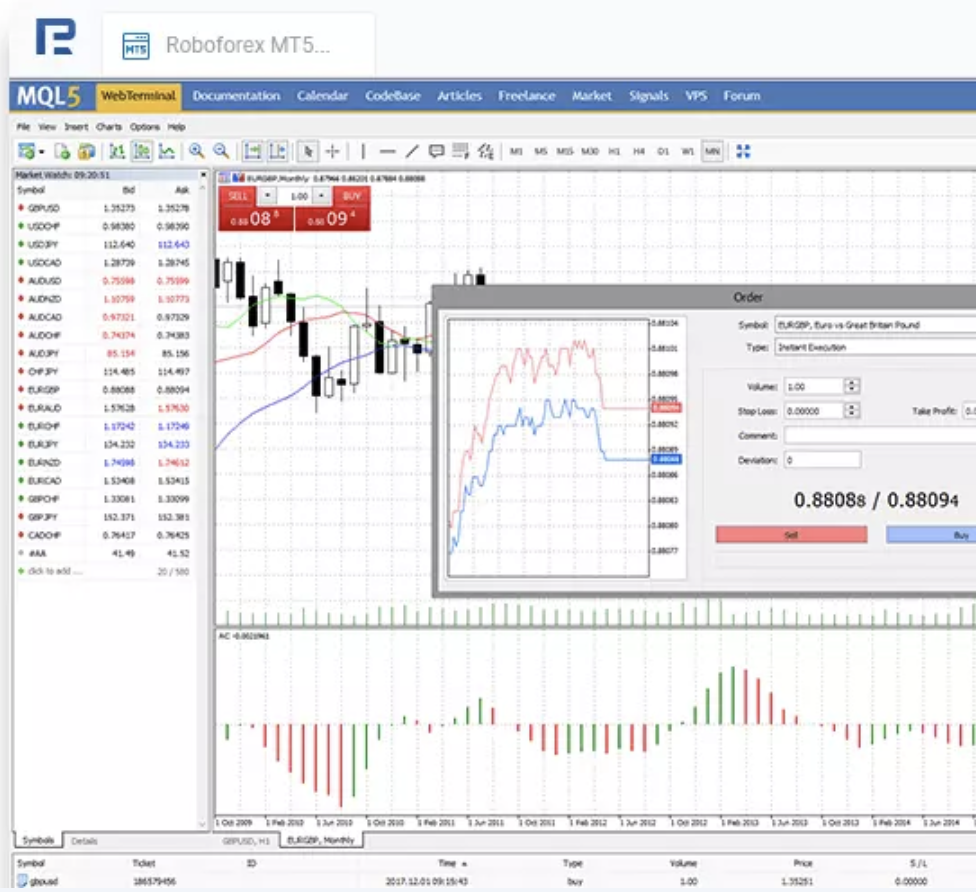

- Trading platform – MT4, MT5, cTrader, RStocksTrader.

- Payment methods – Visa, MasterCard, bank wire, Unionpay, Skrill, and Neteller.

RoboForex is a global online broker established in 2009. The broker is headquartered in Belize, and it holds a license from the International Financial Service Commission of Belize.

The brokerage firm is the most profitable for traders, with its high-quality service at superbly low fees.

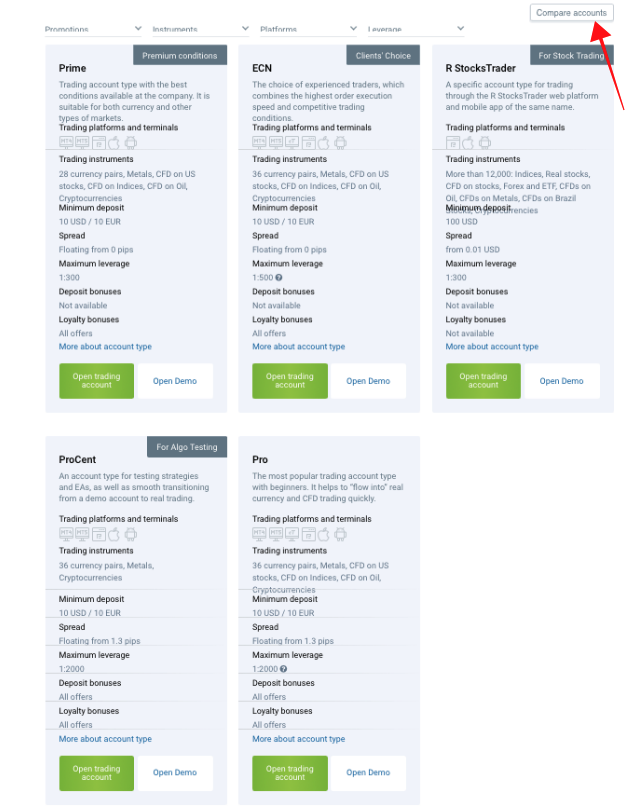

Traders in Singapore can choose from several account types, the Pro standard, Pro cent, ECN, and RStocksTrader. Trade on raw spreads with the ECN account and competitive commission.

The broker offers a welcome bonus to new customers, plus deposit bonuses and rebates to existing ones. These extra funds greatly lower the trading fees, allowing you to keep more of your profits.

Traders can use its RStocksTrader, MT4, MT5, and cTrader. Trading solutions are also available on mobile phones. All come with the necessary charts, indicators, and market information to help you trade the market successfully.

Research and education content are as competitive as other aspects of its offerings. The company provides video market analyses through the famous Claw and Horns firm. Traders’ education content is frequently updated, offering valuable data for successful trades.

Multilingual customer service is available 24/5. Support is also offered in Chinese. They are reachable on the phone, by email, and by live chat.

(Risk Warning: Your capital can be at risk)

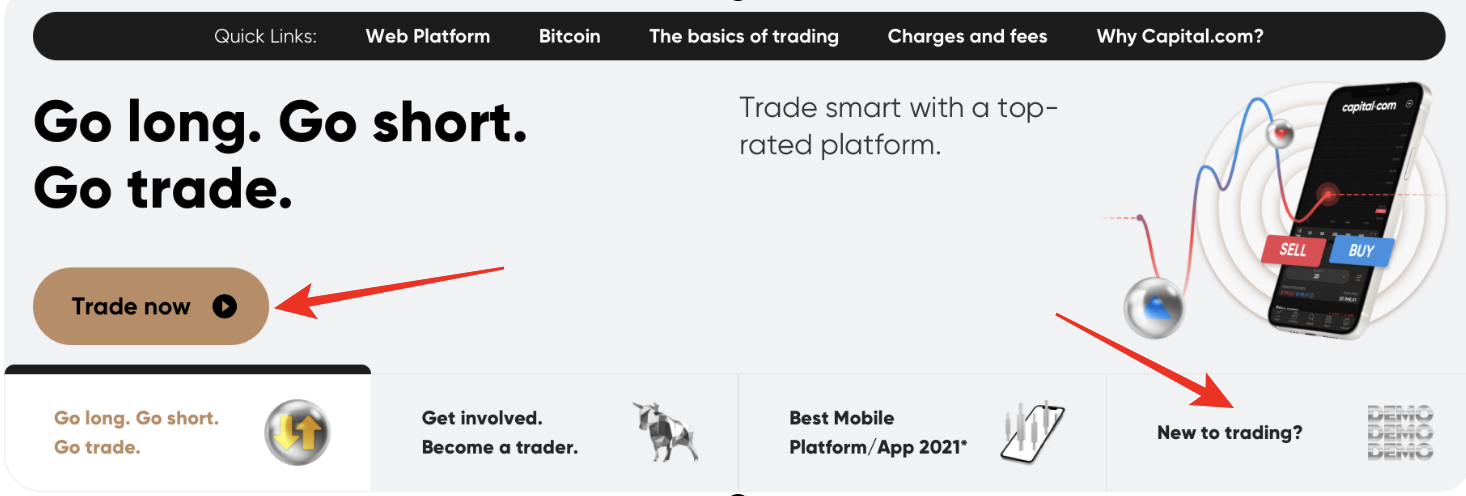

2. Capital.com

At a glance:

- Regulations – CySEC, FCA, MAS, ASIC.

- Minimum deposit – $20

- Spreads and fees – average spread is 0.6pips. Zero commission charges.

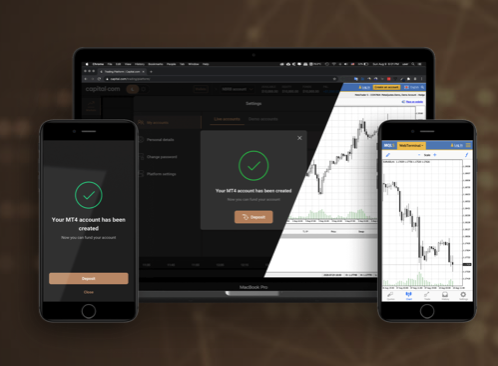

- Trading platform – MT4, Capital.com app.

- Payment methods – Credit card, debit card, bank wire, GiroPay, iDeal, Skrill, and Neteller.

Capital.com offers the best CFD trading services with over 3000 assets for traders to choose from.

Besides forex CFDs, Singapore traders can access other market instruments, such as stocks and equities.

Singaporeans can access these assets on the broker’s impressive trading platform and the MT4. Capital.com trading platforms come with a wide range of robust tools to ensure traders’ success. The broker has won several awards because of it, including the Most Transparent Broker in Europe 2019.

Capital.com offers three account types that are all commission-free. There are the Standard account, Plus, and Premier accounts. Traders can access up to 30:1 leverage and negative balance protection on all account types.

A free demo account is provided so that newly registered clients can test its trading environment. Beginners will find many helpful materials in Capital.com’s collection of educational content. Valuable information to improve trading skills is also available for skilled traders.

Customer support is available 24 hours a day from Monday to Friday. Traders can reach them via phone, web chat, or email. Singapore’s traders can seek in-person support at the Broker’s branch office.

(Risk warning: 78.1% of retail CFD accounts lose money)

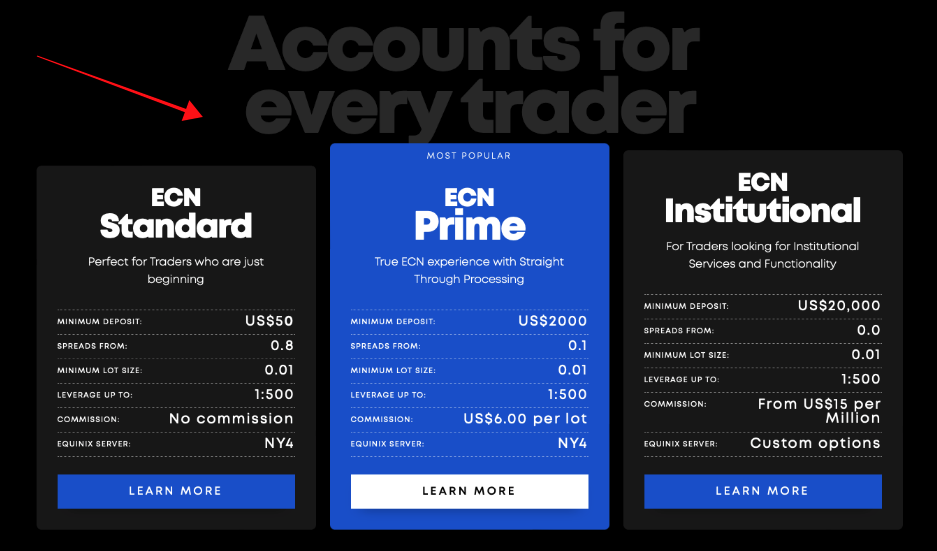

3. BlackBull Markets

Overview:

- Regulations – FMA, FSA.

- Minimum deposit – $200

- Spreads and fees – the average spread is 0.6 pips. $0.4 commission per 0.01 lot

- Trading platform – MT4, BlackBull Markets app

- Payment methods – Credit card, debit card, bank wire, Fasapay, Skrill, and Neteller.

BlackBull Markets is a reputable New Zealand-based forex and CFD broker.

The brokerage company started operations in 2014 and is registered with the Financial Markets Authority of New Zealand (FMA). BlackBull Markets also hold a license from the Financial Service Authority of Seychelles (FSA).

The broker provides genuine ECN execution on trades. They offer traders access to the largest liquidity providers, where traders can enjoy no mark-up on the Prime account. A $200 minimum deposit is required to trade on its standard ECN account. The prime account needs a $2000 minimum amount for trading.

BlackBull Markets offers the MT4 and the BlackBull Markets app for trading. Both platforms provide a first-rate trading environment and an easy-to-use interface for beginners and experienced traders.

Order executions are swift with BlackBull Markets, giving a chance for many trades and increased profits. Traders can never worry about slippages or liquidity on their platform. Mobile trading is available for traders to carry their accounts wherever they go.

The broker provides a lot of support for clients’ education with its rich offering in this area. There are video tutorials, how-to guides, and a glossary of terms for beginners to learn. The section also offers analysis, market overview, and research materials that greatly benefit advanced traders.

Quality support service is available 24 hours a day, during the Weekdays. Traders can contact them through phone, email, or live chat.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Overview:

- Regulations – CySEC, FCA, ASIC, DFSA, BaFin.

- Minimum deposit – $0 ($200 recommended).

- Spreads and fees – the average spread is 0.3 pip on the razor account. The commission is $0.04 per 0.01 lot size.

- Trading platform – MT4, MT5, cTrader.

- Payment methods – Visa, Mastercard, Bank transfer, PayPal, Skrill, and Neteller

Pepperstone is a reputable multi-award-winning ECN broker based in Australia.

The company was established in 2010 and has continued to grow since then. The company is regulated in various jurisdictions across the world, including Singapore.

Pepperstone has licenses from FCA, ASIC, CySEC, DFSA, BaFin, and other tier-2 regulatory bodies. The broker is one of the biggest and most trusted companies, providing low fees for forex services.

Singapore’s traders can choose from its two account types and trade on MT4, MT5, or cTrader. The Standard account is recommended for beginners, as the commission is included in the spreads. Spreads on the Razor account start from 0.0 pip, and commission fees apply.

Singapore’s investors can access 180 markets, including forex, commodities, index, and cryptocurrency CFDs. Customers can also trade minor and exotic currency pairs at the most competitive spreads and commissions. Traders can access up to 500:1 leverage.

The company’s world-class support service is reachable by phone, email, and live chat. They respond fast and are well-informed. Customers can rely on them to solve issues on time.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

What are the financial regulations in Singapore?

Singapore is among the countries where forex is actively traded. The Singapore dollar is a popular currency in the financial market. Forex traders, especially those from Singapore, trade this currency daily.

The Monetary Authority of Singapore (MAS) is the country’s central bank and the general overseer of its financial sector. The body regulates all financial institutions in the country, including its financial market, insurance, banking, mortgage, etc.

Brokers wishing to provide forex and CFD trading services in Singapore must obtain a license from MAS.

Like other top-rated regulated bodies, MAS requires brokers to separate customers’ funds from the company’s for safety in case of business failure.

Brokers must also reveal all their offerings to customers in terms of services and products.

MAS also provides special investment education to citizens interested in financial market investment. The goal is to pass on useful information that helps them make the best investment decisions by themselves. The educational materials help Singaporeans avoid making decisions based solely on media campaigns by brokers and other financial companies.

Security for Singapore traders

The Monetary Authority of Singapore (MAS) is among the strictest financial regulatory bodies in the world.

Like a tier-1 licensed broker, forex traders can trust a MAS-regulated broker to provide high-quality standards and fair trading services.

Traders based in Singapore should ONLY trade with tier-1 licensed brokers or MAS-regulated brokers.

That way, their protection is guaranteed, and they avoid scams.

Is it legal to trade forex in Singapore?

Yes, forex trading is legal in Singapore. Many Singaporeans are active forex traders, and many brokerage companies accept clients from the country.

(Risk warning: 78.1% of retail CFD accounts lose money)

How to trade forex in Singapore – Overview

Many Singaporeans engage in forex trading, as the market daily records large volume trades in this region.

The first and most important thing is to find a good broker if you wish to partake in forex trading opportunities.

A suitable broker, as we mentioned, is a licensed one that offers services at a reasonable price. The ones recommended in this article all offer quality service at a competitive price.

But if you want another broker, here’s what to look out for when making a choice:

- Registered with MAS or holds a tier-1 license

- Offers a free demo account.

- Inexpensive fees.

- Spreads and commissions within the average market price.

- Round-the-clock support from Monday to Friday.

- Provide common payment methods for easy deposit and withdrawal.

If you tick all these items for your desired broker, you can go ahead and register with peace of mind.

Follow the steps below to trade forex:

1. Open an account for Singapore traders

Once you decide on a broker, visit their website to register an account for a Singapore trader.

The site should automatically load your country-specific page. A ‘create account’ tab should be visible on top or at the center of the web page.

Clicking on it should bring up a form. The form will first require your name, email, and perhaps a phone number.

Input these details in the appropriate column and click on SIGNUP.

The system automatically sends a link to the email you provided. You need to click on this link to verify the email and continue the signup process.

The broker might request a government-issued ID card and a utility bill bearing your residential address.

Be prepared to scan and send this according to the broker’s instructions on the signup page.

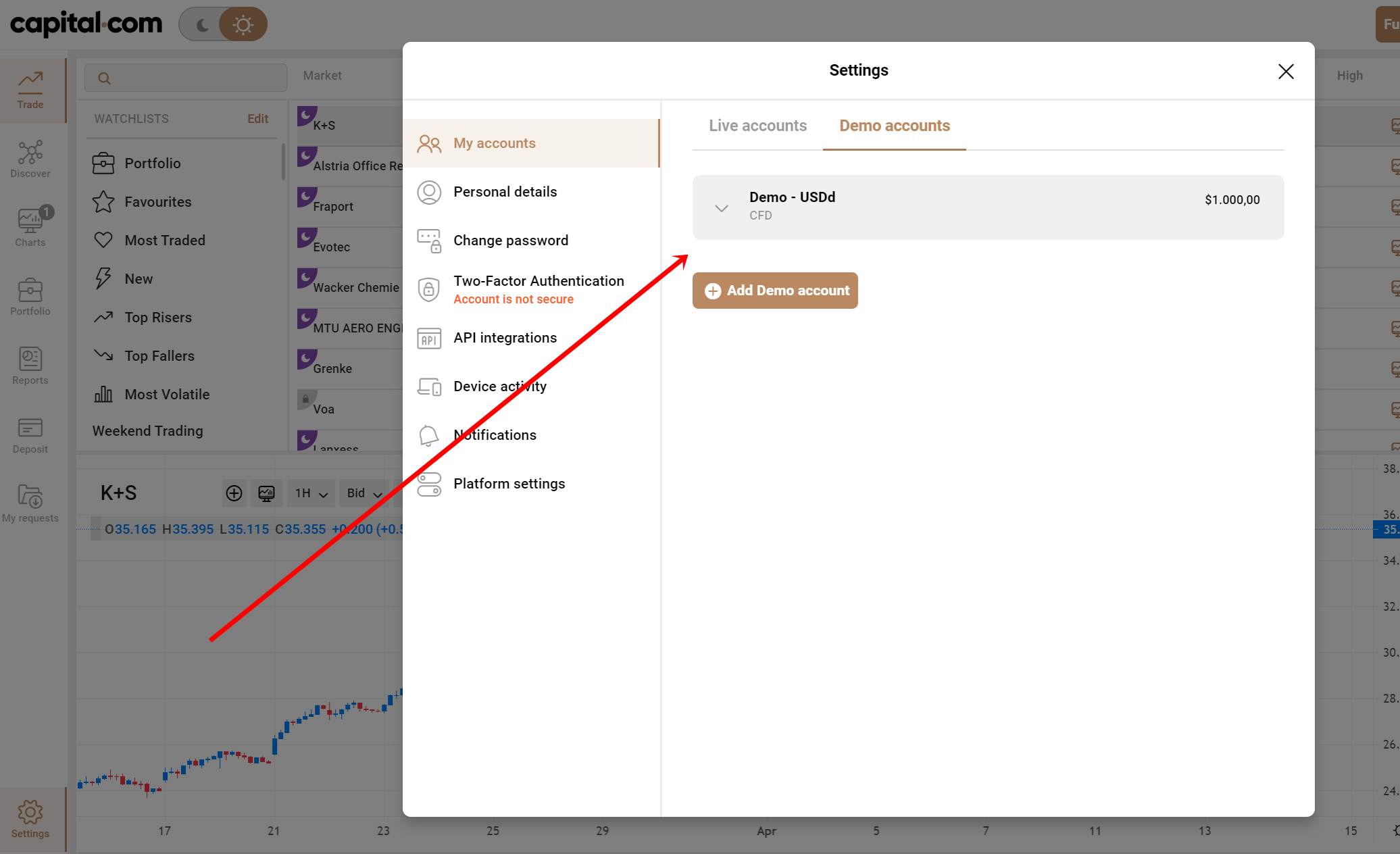

2. Start with a demo or real account

Once you finish registering, there is a free demo account with which you can practice trading.

As we mention, a free demo is one of the conditions of a good broker. Find another company if a particular broker does not offer a free demo for at least 30 days.

This trial account should come with virtual funds. Brokers usually credit it with up to $10000.

With the account, you can test the broker’s platform and ensure it’s right for you before you proceed with trading.

You can also try a new strategy on the demo before trading with it if you’ve just learned one.

A few traders usually prefer to test-trade on a real account because demos may not include all the important features and indicators.

The trader would have to fund the real account with actual money for this. We advise depositing the smallest amount required if you wish to test with a live account.

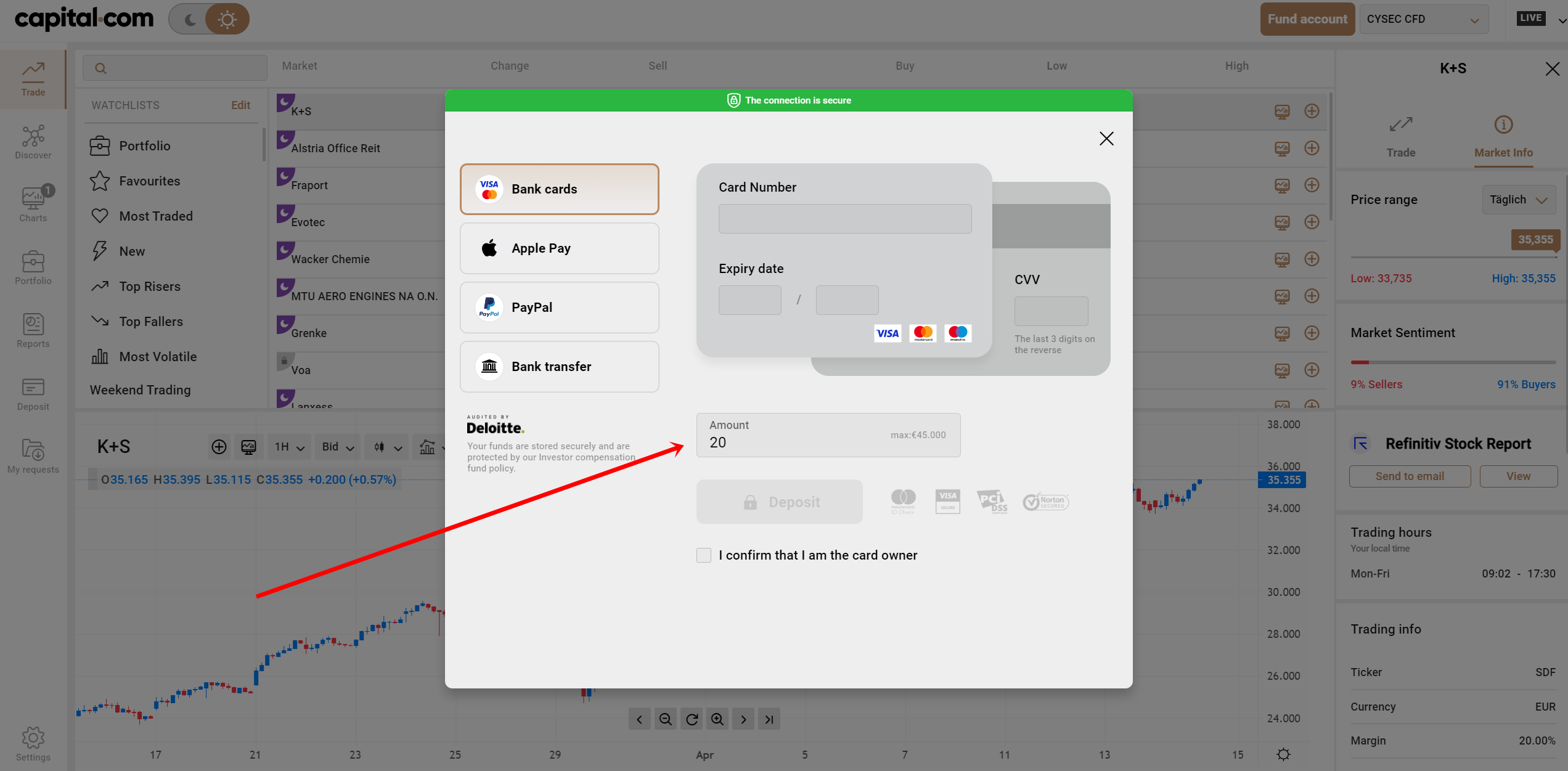

3. Deposit money to trade

The broker should provide different simple options as payment methods.

You need to deposit money in the account using any of these methods before you can trade.

The popular payment methods are Visa, MasterCard, bank transfer, PayPal, Skrill, UnionPay, and Neteller.

Funding the account should be straightforward. The broker might also assign support staff to help you through your first few trades, including the first deposit.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

4. Use analysis and strategies

Forex trading requires basic knowledge of the market instrument, its price movement, and what influences the exchange rate.

The knowledge can only be derived from analyses and studies. Through analyses, the trader understands the current condition of the asset they wish to trade. They also gain insight into factors that causes the different market conditions. The trader can then predict price movements and profitable trades.

Successful traders conduct market analyses and use a workable strategy anytime they trade the market. Profitable trading approaches let you enter and exit the market at strategic points. We will briefly discuss some popular trading strategies and analyses here.

Important forex market analyses and common strategies:

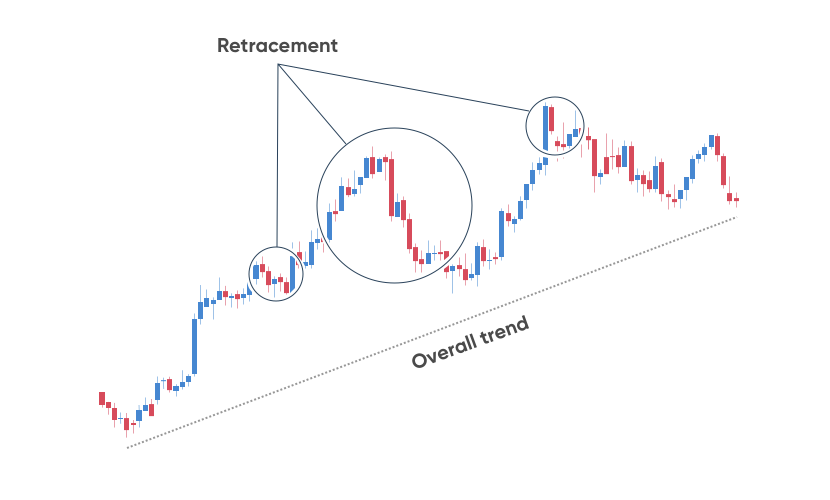

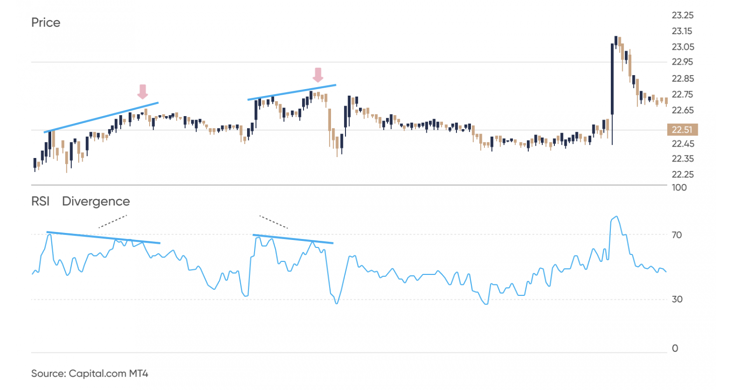

Technical analysis

Technical analysis is popularly used in forex because of its importance and effectiveness. It involves the study of patterns in the price chart to identify trade opportunities. The market always follows certain patterns during different periods. Artificial intelligence software programs have been created to show graphical representations of these patterns on the price chart. These are called indicators, and they are embedded in trading platforms. The user studies the pattern presented and identifies the best market entry points.

Fundamental analysis

Fundamental analysis means examining the fundamental factors that cause the exchange rates to move up or down. These factors are intricate in the country’s economy and include GDP, interest rate, employment rate, etc. The economic data helps you understand the asset better. You can easily predict its price rise or fall if you’re conversant with these fundamentals.

Market sentiment analysis

With market sentiment analysis, the trader studies market participants’ behavior and attempts to understand what influences buyers’ and sellers’ decisions. This analysis is slightly related to fundamental analysis in the financial market. When the market participants feel that prices will rise, they take more LONG trades. This drives the asset price high and leads the market into an uptrend.

Trading strategies:

Price action trading

Price action is a relatively simple forex strategy because it does not require complicated calculations. The trader looks at the past price of the forex and speculates. Price action trading is not based on any complex indicator. But the trader needs to learn about the candlesticks’ movement on the chart.

Economic release trading

Trading based on economic releases requires the trader to stay updated on economic data relating to the asset.

The trader enters and exits the market based on these pieces of information as they are released.

The trader must have sound knowledge of fundamental forex analysis to succeed with this strategy.

(Risk warning: 78.1% of retail CFD accounts lose money)

Concluding thought: The best Forex Brokers are available in Singapore

Singapore’s traders have many options of reputable brokers to choose from. These varied choices can make it tough to pick one. With this article, it should be simple to decide on the most suitable brokerage firm for your trading goals.

1. Capital.com

2. BlackBull Markets

3. RoboForex

4. Pepperstone

FAQ – The most asked questions about Forex Broker Singapore :

Why should traders in Singapore choose only regulated brokers?

Traders in Singapore should choose only regulated brokers because they offer you a secure trading platform. If you signup with a broker who is not answerable to any regulating agency, there is always a possibility of making losses. Furthermore, unregulated brokers make trading a hassle for you. They might make it challenging for traders to access their profits and money.

Which forex brokers in Singapore are the best for demo accounts?

Almost all brokers in Singapore offer a demo trading account to traders. However, choosing the best is crucial since forex trading involves heavy losses if a trader needs to be more careful. So, traders must choose a demo platform to make real trading fun. So, you can choose one of the following four brokers as they offer the best services.

BlackBulls Market

Pepperstone

RoboForex

Capital.com

Which payment methods can forex traders in Singapore use for trading?

Traders in Singapore can choose their desired payment method to deposit or withdraw funds. The top payment methods include the following.

Bank transfers

Cryptocurrency

Electronic wallets

Debit and credit cards

Last Updated on March 3, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)