4 best Forex Brokers and platforms in Slovakia – Comparison and reviews

Table of Contents

Forex trading needs investors first to find a reliable forex broker among forex brokers and scams. It is not easy and requires you to research many forex brokers. Here is a list of five of the most reliable forex brokers recommended by expert traders that accept forex traders from Slovakia.

See the list of the 4 best Forex Brokers in Slovakia:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC, SCB | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Great platform + TradingView charts + MT4 + Excellent education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 4 best forex brokers in Slovakia includes:

- Capital.com

- BlackBull Markets

- Pepperstone

- IQ Option

1. Capital.com

The trading instruments on Capital.com offered are cryptocurrencies, commodities, shares, stocks, and currencies via CFD.

It has regulations from the Cyprus Securities Exchange Commission, FCA of UK, SCB of the Bahamas, and the Australian Securities and Investment Commission. Its multiple regulations enable it to be one of the most trusted forex brokers.

Its low trading costs include low commissions, low initial deposits, and fast order processing. It offers negative balance protection and risk management tools. It also hosts trading competitions for its users and is one of the leading learning materials for trading that even has a mobile application with trading resources.

Overview

- Minimum deposit-$20 by card

- Licenses-FCA, ASIC, CySEC, SCB

- Platforms-MT4, web-trader

- Spreads from 0.8 pips on major pairs

- Support-24/5

- Free demo-yes

- Leverage-1:30

Forex spreads start at 0.8 pips, and it has no commissions. Deposits and withdrawals are free, and overnight charges apply based on the asset and leverage.

EU clients have a leverage limit of 1:30. Traders can transfer funds through bank transfer, credit/debit cards, Trustly, Sofort, ApplePay, Multibanko, Sofort, and GiroPay.

Disadvantages of Capital.com

- It has high rollover costs. Long-term traders, like trend traders, have to pay more when they keep their trading positions open.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

Since 2014 it has registered trading accounts from thousands of trading accounts. It offers trading instruments such as energies, indexes, forex, commodities, shares, and CFDs. The Financial Services Authority regulates it.

BlackBull Markets is a forex broker offering fast order processing speeds based on its ECN accounts. It has low trading costs and high leverage. Traders can access various trading platforms and support the industry-leading MT4 and MT5.

It has various trading tools and features. It also has a mobile application and a desktop version. It also offers tight spreads and low commissions, and other trading costs are low. It has integrated third-party copy trading platforms such as ZuluTrade and Myfxbook.

Overview

- Minimum deposit-$200

- License-FSA

- Platforms-MT4, MT5

- Spreads-0.0 pips

- Support-24/5

- Free demo-yes

- Leverage-1:30

Account types offered are the ECN Standard account offering an initial deposit of $200. The ECN Prime with $2000, and the ECN Institutional, has $20,000Forex spreads to start with 0.0 pips for the ECN Institutional account, while the ECN Prime has 0.1 pips and the ECN Standard offers 0.8 pips.

Commissions charged vary for the ECN Institutional account, the ECN Standard has no commissions, and the ECN Prime has $6 and $100,000. It has no inactivity costs, deposits, or withdrawals. Rollover costs vary with the size of the trading position.

Disadvantages of BlackBull Markets

It has limited learning and research materials.

Its educational resources and research materials, such as articles, courses, and webinars, are insufficient to rank it among the best in the industry, although it has an average amount.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

It was launched in 2010 and had thousands of registered accounts on its platform. It offers Shares, Indices, ETFs, forex, and commodities. The Dubai Financial Services Authority regulates it, the Australian Securities Investment Commission and the Financial Conduct Authority.

It is a forex broker that has been in the markets for almost a decade and offers a superior trading platform. It offers c Trader, MT4, and MT5 trading platforms, which offer fast order processing rates, quality trading platforms, and low trading costs.

Overview

- Minimum deposit-$200

- Licenses-ASIC, FCA

- Platform-MT4, MT5,c Trader

- Spreads-0.0 pips on the Razor account

- Support-24/5

- Free Demo-yes

- Leverage-1:400

It offers the Standard account and the Razor account having a $200 initial deposit. The Razor account offers forex spreads from 0.0 pips and the Standard account from 1.3 pips. The Razor account charges a commission of $7 per $100,000, but the Standard account has no commissions.

Traders can access rebates after being active, depending on their location. They have to qualify for some conditions to access rebates. It has a mobile app, a desktop version, and the web version to ensure its traders can access their trades from wherever they are.

Disadvantages of Pepperstone

- Limited educational content. Traders have access to limited educational materials on this forex broker. Although it has some articles and videos, They are not to the level that can compete with industry-leading brokers.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

Since 2013 when it was registered, it has had over 40 million traders using its trading platform. It offers Binary Options, commodities, Digital Options, ETFs, cryptocurrencies, and CFDs. It also has regulations from Cyprus Securities and Exchange Commission.

It is a forex broker that started by offering options trading but has ventured into other trading assets. Its proprietary trading platform has low trading costs, such as low commissions and tight forex spreads.

It has a user-friendly trading interface and a free demo account with $10,000 in virtual funds. It is also available on a mobile application, which enables its traders to monitor their open positions using their phones.

Overview

- Minimum deposit-$200

- License-CySEC, ASIC, FCA

- Platform-MT4, MT5,c Trader

- Spreads-0.0 pips on the Razor account

- Support-24/5

- Free Demo-yes

- Leverage-1:400

Account types offered include the Standard account with an initial deposit of $10 and the VIP account has a $1900 initial deposit that changes with time. Forex spreads vary with the volatility and the liquidity of the trading instrument.

It has no commissions for most of its trading instruments except cryptocurrencies, which have a commission of 2.9%. Inactive accounts for more than three months have an inactivity cost of $10, deposits and withdrawals are free, but withdrawals through bank transfers have a $31 withdrawal fee. It has rollover costs that vary from 0.1% to 0.5%.

Disadvantages of IQ Option

- It does not support MT4 and MT5. Forex trader prefers to use the MT4 and MT5 platforms as it has features that allow them to be competitive in the financial markets. Even though the IQ Option platform is efficient, traders often like to have the choice to select the trading platform they want to use.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Slovakia?

Forex trading in Slovakia started after the de-monopolization of the state banks and the development of other financial intermediaries such as financial dealers, investment firms, and stock exchange dealers. However, it crashed in late 1900 due to illiquidity and lack of transparency to investors and traders.

It recuperated when Slovakia joined the Eurozone, and trade between other European member states increased the volume of trades within the capital markets, especially the Bratislava Security Exchange (BSE).

It has been gradually growing with the economy of Slovakia, and forex traders can enjoy a wide range of trading instruments and a variety of financial investment firms. Since Slovakia is part of the EU, e regulations that apply in regulatory jurisdictions within the EU also apply in Slovakia.

The NBS is in charge of ensuring that market participants in the financial markets of Slovakia comply with the Financial Markets Act. Since Slovakia is part of the EU, regulations such as MiFID II and ESMA that cover the European Economic zones also apply.

The NBS has the mandate to establish the conditions and requirements that forex brokers and other financial dealers require to operate in Slovakia. It Issues licenses to forex brokers who want to start trading forex in Slovakia.

Market participants regulated by the NBS have to ensure they provide the information requested by the NBS as requested and agree to inspections and evaluations, which the NBS will monitor and supervise their activities.

Security for traders from Slovakia – Good to know

The NBS has ensured investor protection by establishing and implementing laws that prevent financial dealers from engaging in illegal, manipulative trading activities. It also has legislation that states the penalties for staff and companies breaching this legislation.

The NBS requires forex brokers and stock exchange dealers to communicate to their investors about changes in prices or factors affecting prices. It also conducts onsight and off-sight inspections to ensure the trading standards are per the international trading standard.

The ESMA regulations offer financial dealers guidelines, such as limited leverage for most trading instruments, the highest being forex at 1:30. It also ensures that forex brokers and stock exchange dealers provide standard trading environments for traders within the EU.

(Risk warning: 78.1% of retail CFD accounts lose money)

Is it legal to trade Forex in Slovakia?

Yes, it is legal to trade in Slovakia-listed securities and stocks. It is an active capital market in the European zone and is still growing even as the finance sector of Slovakia develops due to increased liquidity.

The capital markets are regulated by the Narodna Banka Slovenska or the bank of Slovakia (NBS). The NBS has been regulating the financial markets since 2006, according to the financial markets Supervisions act.

How to trade Forex in Slovakia – A tutorial for traders

Open account for Slovakian traders

Find a trading broker that is regulated and accepts Slovakian traders. Some factors to check include the trading instruments, trading tools, costs, forex spreads, leverage, and customer care. Also, ensure that the forex broker supports payment methods you can access.

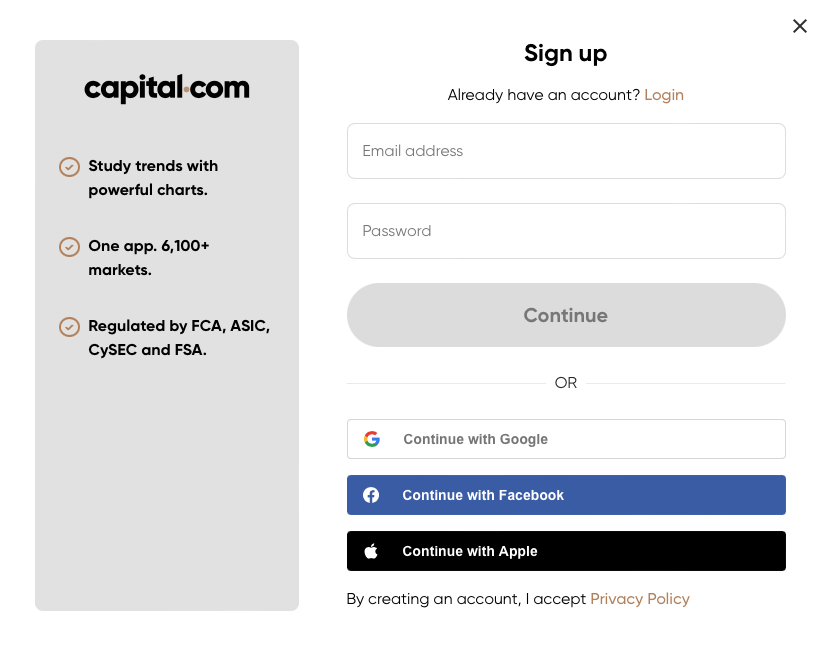

If you find a forex broker that offers convenient trading features and is regulated, opens a trading account on the forex broker using the online registration form. The online registration form requires you to submit some details according to the ESMA guidelines for registering traders.

The details include your name, email, date of birth, nationality, account type, and password you will use to access your trading account. Forex brokers must collect this information to help identify traders and limit prohibited trading activities such as money laundering and funding terrorism.

If you successfully register and verify your trading account, you need to download a trading platform that will help you access the financial markets. Forex brokers support different trading platforms which forex traders can select from.

Research the trading platforms offered and select one that you prefer. You can customize the trading features according to the trading strategy and the trading instruments you want to start trading.

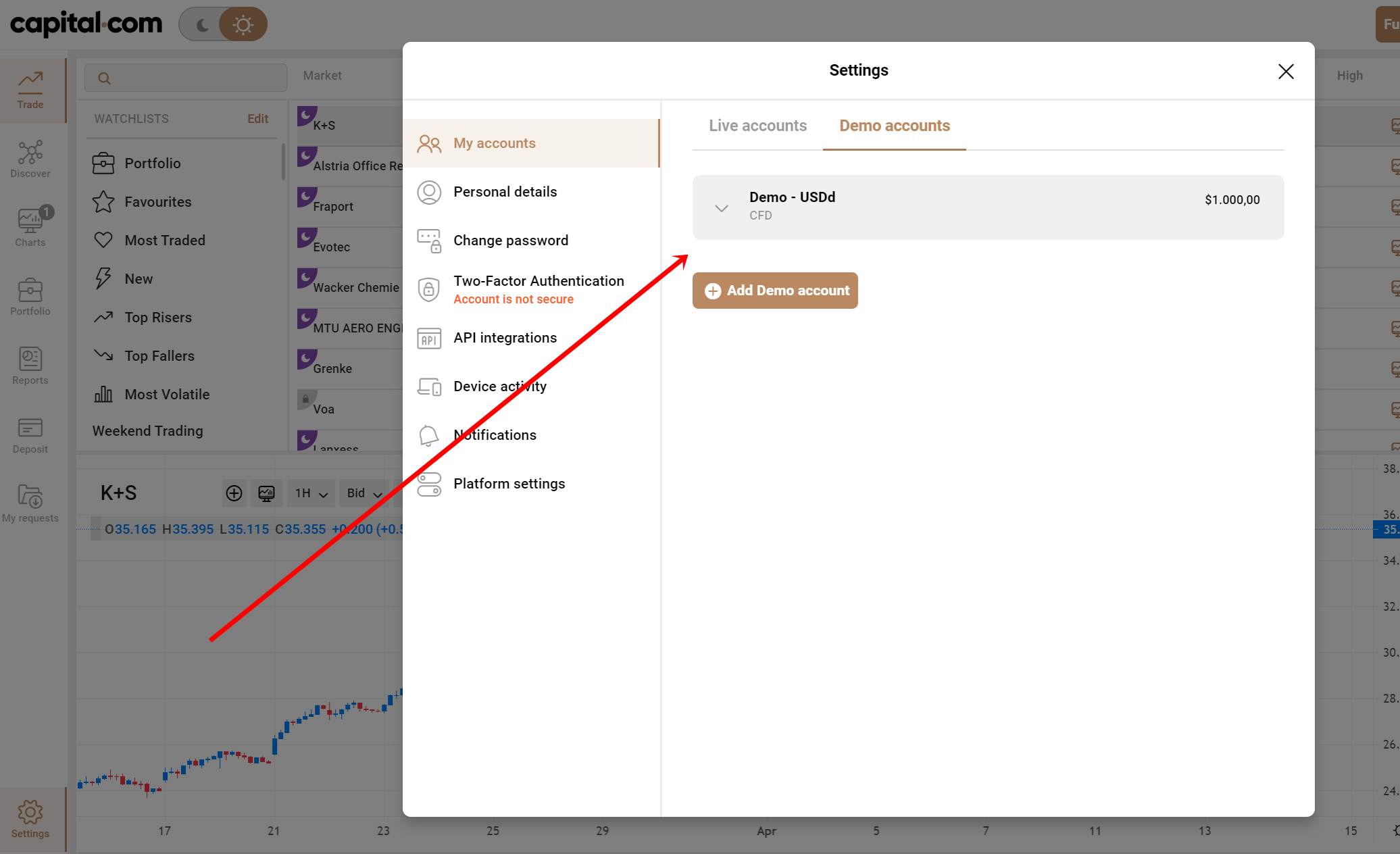

Start with a demo or real account

Seasoned traders who already know how to trade can start to trade, but new traders can start with the demo account. The demo account uses virtual funds, which forex brokers can open and close trading positions without risking their capital.

Traders use the demo account to practice their trading strategies and practice how to trade new trading instruments. Forex traders also use it to test the trading platforms and features, and new traders can use it to learn how to trade.

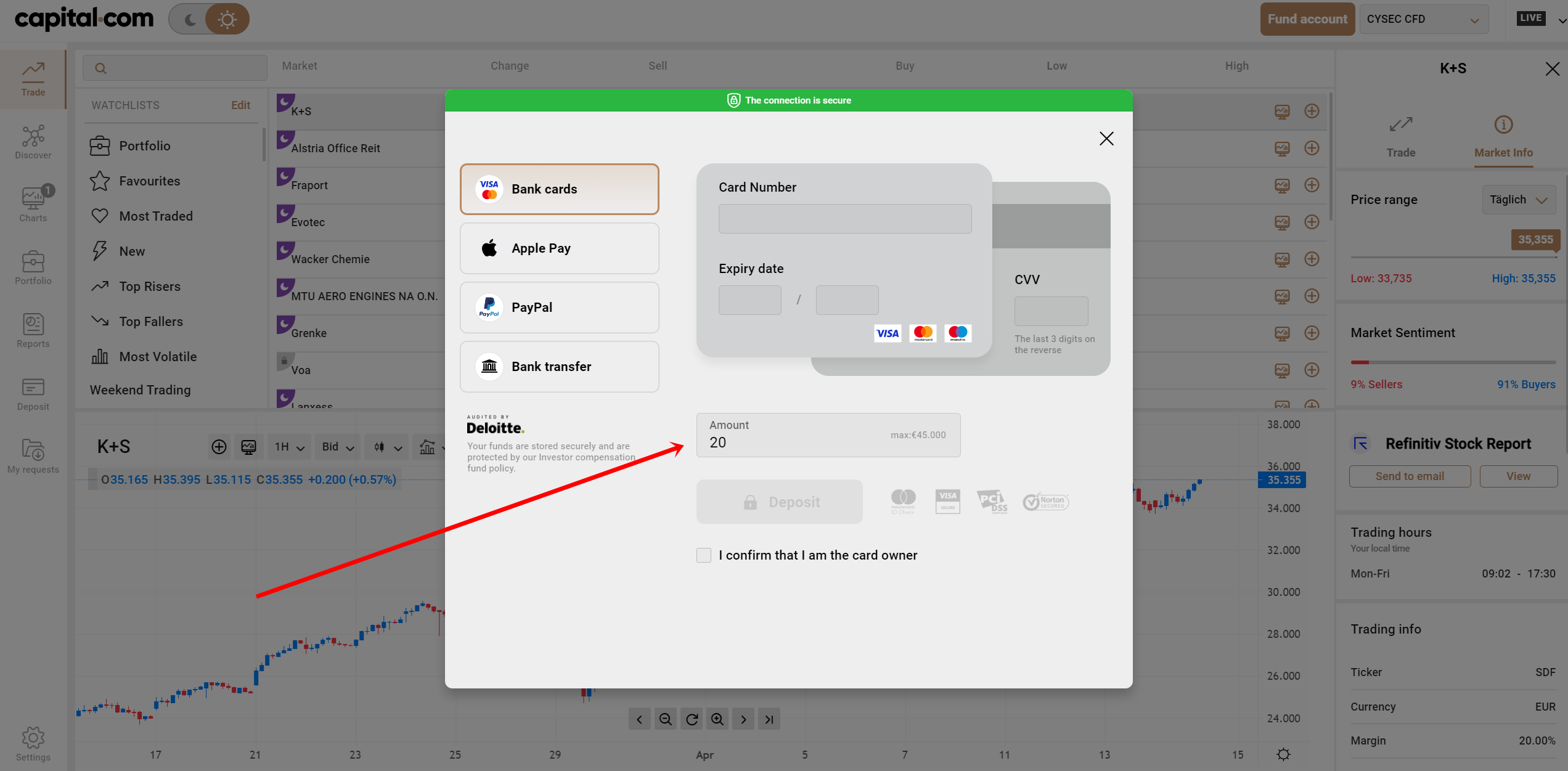

Deposit money

Deposit to your trading account by linking it with a payment method offered. International forex brokers support different payment methods that forex traders from different countries access when they want to start trading.

Ensure to select a payment method you prefer and link it with your trading account. For many forex brokers, the payment method you use to deposit is also used for withdrawals.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

Use analysis and strategies

Analysis

Forex traders should start by learning how to apply trading analysis before trading any asset. Analysis helps traders understand price movements and predict the price movements by looking at the momentum, trend, volatility, and liquidity.

Fundamental analysis involves:

- Forex traders monitor the current financial events through the economic calendars.

- News announcements from central banks.

- Political and economic status.

- New and existing trade relationships between countries.

- These factors contribute to the movement of prices of a related asset.

Many other factors influence the price action directly or indirectly, which the forex trader must monitor when conducting fundamental analysis.

Technical analysis involves forex traders applying the trading tools such as indicators and trading signals to predict price movement. The technical indicators help the trader know the momentum and strength of the trend that forex traders use to make trading decisions.

Strategies

There are many existing forex strategies that new and experienced traders apply when trading forex and other instruments. Forex brokers are still developing trading strategies to adapt to the different price patterns. Here are some of the popular use trading strategies Slovakian traders can use;

Scalping– this trading strategy requires the trader to have a forex broker with fast execution speeds and low trading costs. It works by opening and closing numerous short-term trading positions. A scalper can make trades that take thirty seconds to one minute.

Trend Trading– trend trading requires a trader to apply technical and fundamental analysis to predict trends. The trend will determine how you trade. If it is a downtrend, you can go short, and if it is an uptrend, go long. Trend trading can take more than one day, weeks, or a month and requires forex brokers with low trading costs, especially overnight charges.

Momentum trading: This trading strategy requires the trader to use momentum indicators to predict the momentum of a market. If the momentum is strong, traders can open a trading position, while if the trend is about to change, you close an open trading position.

Make profit

Before trading, ensure you have a trading strategy that offers consistent results. Practice trading first on the demo account to eliminate some mistakes you might make trading on the real account.

Apply risk management strategies and avoid making trading decisions during the trade since you might get influenced by the price movement. Practice first on the demo account to prevent making mistakes and see how you can improve your trading strategy.

Reduce the risk exposure by using risk management tools like stop loss. Make sure you understand more about the trading instrument before you start trading to increase your chances of making profits.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Slovakia

Forex trading in Slovakia has developed and has strict guidelines that market participants must comply with. Traders, therefore, have to ensure that they check the regulation of the forex broker and confirm its trading license.

Traders should also research the trading features the forex broker offers. New traders should learn to trade and practice using different strategies and instruments.

FAQ – The most asked questions about Forex Broker Slovakian :

How to invest with a forex broker in Slovakian stocks?

There are numerous trustworthy and reliable internet brokers that provide their services to customers in Slovakia. There are companies offering Slovakian stocks among them, but if you want to invest in other international markets, your options expand even more.

Can I know the top forex brokers in Slovakia?

A list of top brokers in Slovakia is collected from the market and appended below, with their services.

Capital.com – know the features offered by it.

– Minimal trading CFD fees.

– No Commission fees.

– Offers effective customer service through email and chat.

eToro

– Free trading of stocks and ETFs.

– Simple account creation.

– Trading online.

ActivTrades

– It offers a broad portfolio of products.

– Offers a wide range of research tools.

Interactive Brokers

– Minimal trading fees.

– Offers a variety of products.

– Offers a wide range of research and analytic tools.

How can someone from Slovakia open a trading account?

When opening a trading account, various variables exist, such as the platform’s usability and the minimum deposit amount. Some brokers request our identity proofs, address proofs, utility bills, and bank statements for verification purposes.

Some brokers demand a minimum deposit before they approve your trading account.

Last Updated on March 31, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)