4 best Forex Brokers & platforms in South Africa – Comparisons and reviews

Table of Contents

Forex trading can be a pointless venture if you trade on high fees. Fortunately, many reputable low-spread brokers wish to offer you their services if you are in South Africa.

See the list of the best Forex Brokers in South Africa:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | Not regulated | Starting 0.1 pips variable & low commission | 300+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Low spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

This article aims to make it easy for you to choose. We have reviewed several brokerage platforms by investigating prices, trading environments, and general trading conditions.

We present a list of the 4 best and low-fees brokers in South Africa below:

- RoboForex

- BlackBull Markets

- Pepperstone

- IQ Option

Here’s an overview of each one’s offering:

1. RoboForex

RoboForex is an online broker that started operations in 2009. The company is headquartered in Belize and is authorized by the International Financial Service Commission (IFSC).

RoboForex is also registered with CySEC, a globally acclaimed regulatory body based in Europe. The broker is safe for South Africans.

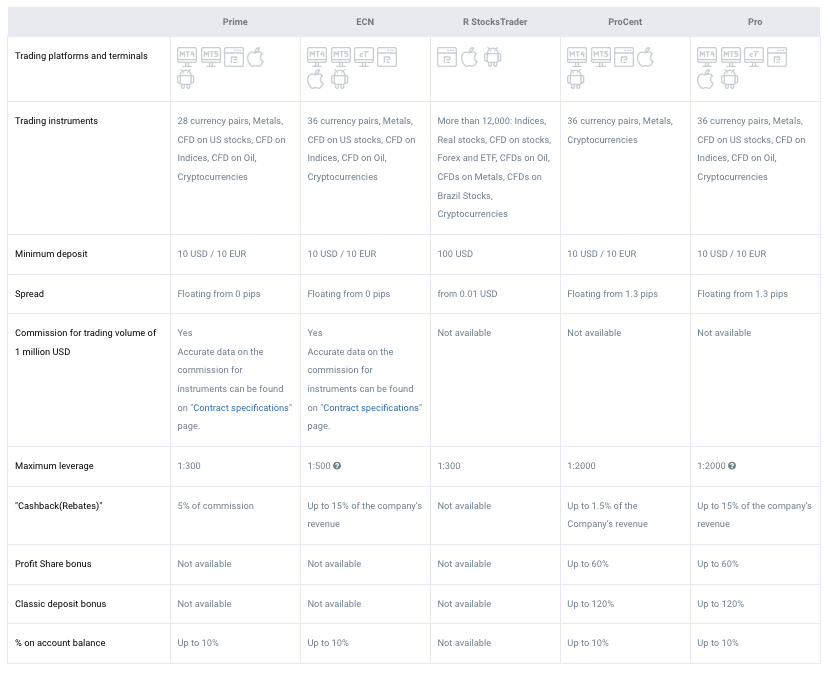

RoboForex provides access to a selection of financial instruments, including currency pairs, stocks, and CFDs, through several account types. These account types are Pro standard, Pro cent, ECN, Prime, and RStocksTrader.

A $10 minimum deposit can get you started on forex trading with RoboForex. The company’s trading costs are among the lowest, and new clients get an R500 ZAR ($30) bonus upon registering.

Trading services are available on the MT4, MT5, cTrader, and RTrader. Though commissions apply, customers get to trade on average spreads of 0.3 pips on their ECN account. The prime account is a raw spread where clients can trade with zero mark-ups during peak hours. Although, the spreads are floating.

Trading conditions with RoboForex are among the best, considering its trading platforms’ low fees, rewards, and rich features. But the broker charges withdrawal fees.

Traders can contact support anytime from Monday to Friday (24 hours). Its customer service is reachable on live chat on the website/platform, phone, or email.

(Risk Warning: Your capital can be at risk)

2. BlackBull Markets

BlackBull Markets is a global ECN forex broker that started operations in 2014. The company is based in New Zealand and registered with its authorizing body, the Financial Markets Authority (FMA).

BlackBull Markets also hold a license from the Financial Service Authority of Seychelles, FSA.

The broker offers three ECN account types on highly competitive commissions and spreads. South Africans can enjoy superfast order executions, with spreads as tight as 0.3 pips on average on the ECN account.

BlackBull Markets offer MT4 and its trading app, which are usable on mobile phones. Both trading platforms are packed with beneficial tools, including educational materials, research content, charts, indicators, etc.

Traders can access various assets, such as forex pairs, commodities, indices, energies, and CFDs. The different account types can be traded using the South African rand. Trading with the national currency helps you save costs on conversion fees.

The account types are Standard ECN, Prime ECN, and Institutional account. Traders have to fund the Standard account with a minimum of $200 to trade. The required minimum deposits for the Prime and Institutional accounts are $2000 and $20000, respectively.

Account funding and withdrawal are straightforward, with easy payment methods provided. These include MasterCard, Visa, Fasapay, Neteller, Unionpay, and Skrill. Bank transfers also work but may take longer to process payment.

BlackBull Market’s customer service is available 24 hours a day, 6 days a week, for complaints or inquiries. Traders can reach them by phone, email, or live chat. Toll-free lines are available in some countries.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone Group is an Australian-based brokerage firm established in 2010. The company is registered with several top-tier financial bodies, and its FSCA license is under processing.

These financial bodies include:

The broker is highly acclaimed and well-liked by South African forex and CFD traders.

They provide genuine ECN and STP execution in a world-class trading environment at competitive fees.

South Africans can choose from the following:

- Standard account

- Razor

The standard account is an STP one in which the broker includes the commission in the spreads. The average spread on this account is 0.7 pips. This is highly competitive as the trader does not pay any additional commission. The average on the razor account is 0.3 pips, and commission applies. But it is still within the competitive rate at $0.035 per 0.01 lot size trade.

The broker provides the MT4, MT5, and cTrader platforms for trading. Numerous useful tools are embedded, and algorithm trading is available. Pepperstone also offers social and copy trading services through Zulutrade and MyFxbook.

Southern Africans can deposit and withdraw funds easily with the several options offered. These options include credit cards, debit cards, bank transfers, Neteller, PayPal, Skrill, and Unionpay.

Withdrawals may take longer to process if you use the bank transfer method. Unfortunately, the broker charges a 3% fee when using a South African card.

Support is available all day and night (24-5) for inquiries or any issues, five days a week. They are reachable through phone, email, and live chat.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option is a global binary option and online forex broker based in Saint Vincent and the Grenadines.

Through its proprietary trading platform, IQ Option offers access to various instruments, such as currency pairs, options, indices, stocks, cryptocurrencies, and ETFs.

Traders in many parts of the world consider this broker the best for binary options trading. Its distinctively designed platform allows you to trade forex and binary options. The platform is easy to use and compatible with mobile phones.

IQ Option fees also make them an appealing choice for forex and binary options traders in South Africa. With R165 ZAR ($10), anyone can start trading with the broker. The offer is a low commission account, with spreads starting from 0.6 pips. Traders can upgrade to a VIP account by depositing $600. Several benefits come with this account, including lower spreads and a dedicated account manager.

South Africans can deposit and withdraw without hassle through the basic payment options. The bank transfer method is available through Capitec, Standard Bank, Nedbank, Absa, and FNB. Other e-wallet options are AdvCash, Investec, and PerfectMoney.

Traders can reach customer service on the platform/website by live chat, email, or phone. They’re available 24 hours from Monday to Friday.

These five brokers offer free demo accounts for customers to test their environment before beginning.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in South Africa?

South Africa is one of the economic giants of Africa, with its robust and thriving economy. The rand (ZAR) is among the top 20 actively traded currencies worldwide.

Its citizens have a high level of financial literacy and are well-informed regarding the opportunities in trading in the financial market.

For this reason, South Africa is among the countries where the foreign exchange market sees many activities. Forex and financial activities are well-regulated in the country.

The Financial Sector Conduct Authority (FSCA) oversees all forex and CFD trading activities.

Forex brokers must be authorized by this body before operating inside the country. Before rendering brokerage services to South Africans, they must meet all financial requirements and adhere strictly to the body’s policies.

Part of the FSCA’s regulations is to keep the client’s money in a separate account from the company’s. This protects traders’ funds in case of bankruptcy. South Africa has a few domestic brokerage companies. The FSCA also approves these. There are also several international brokers operating in the country.

Security for South African forex traders

Traders in South Africa have many options with the many international and local brokers available.

To be safe, South African forex traders must deal with local brokers approved by the FSCA.

If they wish to deal with international brokers OUTSIDE the country, they must choose one licensed by a well-recognized financial body.

Traders who do leverage trading must seek brokerage firms offering negative balance protection.

Is it legal to trade forex in South Africa?

Absolutely! It is legal and safe to trade forex in South Africa.

Traders must deal only with FSCA-licensed brokers inside the country. Signing up with top-tier regulated brokers outside South Africa is also permitted.

How to trade forex in South Africa? – A comprehensive overview

The basic requirement to trade forex in South Africa is signing up with a broker. Individual or retail traders cannot enter the financial markets on their own. They need an intermediary to access this market.

The forex broker is the retail trader’s link to trading in the market. The broker renders this service and takes a fee for it. Some take more fees than necessary, lowering the trader’s gains. A few others may charge a reasonable fee, but the service might be less than standard. If the broker is not regulated by a strict financial body, the offerings and trading conditions may be poor.

Some licensed brokers provide quality service at competitive prices. We have introduced some of them in this article.

Be aware of the following points when choosing a broker:

- Does the broker hold a license from an acclaimed financial body?

- Are the fees competitive or lower than average?

- Does the broker offer a free demo account for testing?

- Is customer support available round-the-clock during trading days?

- Can you deposit and withdraw funds easily with the payment methods provided?

If the answer to ALL these questions is YES, the broker checks out and might be a suitable option.

Steps to trading forex once you choose a broker:

1. Open an account for traders in South Africa

Once you choose your broker, visit the official website to begin the signup process. In South Africa, the website should automatically load your country-specific webpage. Just ensure you’re not connected to the web via VPS if you normally use it.

The create account tab should be displayed boldly on the homepage. Click on it and enter the details required. That should be an email address and your full name and phone number.

The system then sends a verification link to the email address you input. Open the message in your email and click on the link.

The email and details you provided get verified, and the complete registration page should appear to allow you to enter the rest of the required information.

The broker may also request a government-issued ID card and proof of address for KYC.

2. Start with a demo or real account

The broker should offer a free demo for testing its platform. The account would come with virtual funds of $10000 in most cases.

You can check the broker’s platform by conducting many trades with the funds. Some brokers provide the option to add more funds to this account if you use up the initial balance.

New traders should take advantage of this to get conversant with trading the forex market before going live.

It is also an opportunity to test the features available on the demo account and fully decide if the broker is suitable for you or not.

3. Deposit money

Once you have satisfactorily tested the trading platform, it is time to carry out real transactions.

For this, you need actual funds in your trading account.

The broker should provide several simple payment methods for this. The common payment options may include Visa, MasterCard, Wire transfer, Neteller, PayPal, and Skrill. Choose the one you’re most comfortable with, and deposit money in your account.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

4. Use analysis and strategies

Market analysis and a proven trading strategy are two essential elements in profitable forex trading.

The analysis is vital to give you insight into the asset and the factors influencing its price.

A workable strategy helps you enter and exit the market at the opportune points to earn profit.

The trader must effectively combine both items if they wish to trade forex successfully. We will explain some analyses and strategies below.

Important forex trading analysis:

- Technical analysis

Technical analysis involves patterns in the price charts. The trader analyzes these price patterns to identify opportunities. This analysis is widely employed in the forex sector. All trading platforms come with various tools that help the trader carry out effective technical analysis. Indicators are also embedded in these software programs to point the trader to possible opportune trading points in the price charts. Learning to use these indicators and interpret the patterns in the chart is key to successful technical analysis.

- Fundamental analysis

Forex fundamental analysis refers to analyzing the economic factors that cause the currency’s rate to rise or fall. These economic factors are the interest rate, inflation rate, GDP, the country’s political state, etc.

The trader examines these elements and understands the state of the currencies they wish to trade. They can better forecast the asset’s rise or fall after this analysis.

Both are essential to trading the forex market profitably. The trader must use these alongside a powerful strategy to succeed in a forex trading venture.

Popular trading strategies

- Range trading

The range trading approach is suitable for market conditions where the price moves within a specific range. The user can spot trading opportunities in the support and resistance zones.

- Breakout trading strategy

Trading breakouts mean finding the point where the asset price breaks away from its current direction. Anytime time frame or market condition can work with this strategy. The trader must employ technical analysis and useful indicators to predict breakouts accurately.

5. Make a profit

Combining the necessary analyses with the right strategy will have you profiting from trades soon enough.

You can then raise your capital or withdraw the profits.

The same deposit methods will apply to withdrawals. However, withdrawal takes a longer time to process.

Two days is the maximum in most cases, and it also depends on the methods used. The broker should notify you if it takes longer than necessary.

Conclusion: The best Forex Brokers are available in South Africa

Trading forex in SA is easy to start if you follow this guide. Remember that financial market instruments are complex, and trading is risky. Use the money and risk management tools and invest what you can afford to lose.

- RoboForex

- BlackBull Markets

- Pepperstone

- IQ Option

FAQ – The most asked questions about Forex Broker South Africa :

Which kind of trading is best for traders in South Africa?

Traders in South Africa can trade several kinds of underlying assets. However, the amount of profits South African traders can make depends upon their trading experience. Therefore, the trading skills of traders also matter. But learning to trade forex is easy for any trader. You can get started by choosing a broker that is reputed. Then, you can make money from the fluctuations in the currency rates.

How can a trader in South Africa signup for a trading account?

Traders in South Africa can sign up for a trading account by following a few simple steps:

1. They must choose a broker that extends the best services in South Africa.

2. They can complete the signup process by entering their details.

3. They can choose a trading account type and fund it with money.

After funding your forex trading account, you can place trades. However, don’t forget to make a technical analysis before placing your bets.

Which payment methods can a trader in South Africa use to fund his forex trading account?

Brokers that operate in South Africa, such as BlackBull Markets, Pepperstone, etc., offer many payment options to traders. For instance, traders trading forex can use their electronic wallets, debit and credit cards, bank transfers, and cryptocurrency. These payment methods offer them a choice and convenience while trading.

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)