4 best Forex Brokers & platforms in Sweden – Comparison & reviews

Table of Contents

Sweden is home to a huge number of forex traders. As time goes by, the number of traders from this country continues to grow. If you’re thinking of starting your trading journey, this review of the 4 best forex brokers in Sweden is great.

See the list of the 4 best Forex Brokers in Sweden:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC, SCB, SCA | Starting 0.3 pips variable & no commissions (other fees can apply) | 3,000+ (70+ currency pairs) | + Userfriendly platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

4 best forex brokers in Sweden:

- Capital.com

- BlackBull Markets

- Pepperstone

- IQ Option

1. Capital.com

Capital.com was launched in 2016 and is based in England. Gibraltar, Seychelles, Australia, and Cyprus are among the other destinations. They are well-known for having inexpensive trading costs when it comes to FX trading.

This broker is supervised by the Australian Securities and Investments Commission, FCA in the UK, SCB of the Bahamas, and the Cyprus Securities and Exchange Commission.

Capital.com requires a minimum deposit of $20 when depositing money by credit card. But when it comes to adding funds using bank transfer, clients have to deposit at least $250.

You may choose between 4 main base currencies:

- USD

- PLN

- GBP

- EUR.

Capital.com only provides a Standard Account to its clients. To complete the account-making process, you need to provide some basic information such as your date of birth, complete name, address, and any valid ID.

The broker’s website has plenty of training classes and videos for new FX traders. It also offers a free demo account. This allows customers to access the trading platform and familiarize themselves with the different tools and market movements.

Capital.com’s trading system is accessible on mobile devices for those who want to execute their trades on the go. Customers may trade utilizing tablets or cellular phones. The trading platform is accessible in more than 25 languages.

Customer assistance is available 24 hours a day, seven days a week, and may be reached via phone, live chat on the platform, website, and email.

Summary:

- The required minimum deposit is $ 20 by credit card.

- The broker holds FCA, ASIC, SCB, SCA and CySEC licenses.

- The broker charges no commission.

- Spreads start as low as 0.6 pips.

- Payment methods accepted by the broker include Neteller, iDeal, Qiwi, Skrill, MasterCard, Visa, bank transfer, and WebMoney.

Disadvantages of trading with Capital.com

Suppose you do not submit a valid ID within 15 days of completing the registration form. In that case, the broker will terminate your account immediately. Furthermore, you may only choose between five base currencies.

(Risk warning: 75% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets, launched in 2014, is very popular in the foreign exchange trading community. Despite having its headquarters in New Zealand, it also has offices in New York, the UK, Malaysia, and Indonesia.

The Financial Services Authority of Seychelles and the Financial Markets Authority of New Zealand both regulate this broker. Many traders utilize BlackBull because of its low charges and user-friendly interface.

Clients may open either a Prime or Standard account with BlackBull Markets. The two accounts have different initial deposits, spreads, and commission rates.

A $200 deposit is required for a Standard Account, while a $2,000 deposit is required for a Prime Account. Prime Accounts may have spreads that begin at 0.01, whereas Standard Accounts can have spread as high as 0.8. Finally, whereas Standard Accounts are free of charge, Prime Account customers are charged $6 for every lot exchanged.

There are nine different basic currencies to pick from.

These currencies are among them:

- CAD

- JPY

- ZAR

- SGD

- NZD

- AUD

- GBP

- USD

- EUR

A $5 fee will be imposed when you make withdrawals from BlackBull Markets. If you withdraw the money from an offshore bank, the fee is $20.

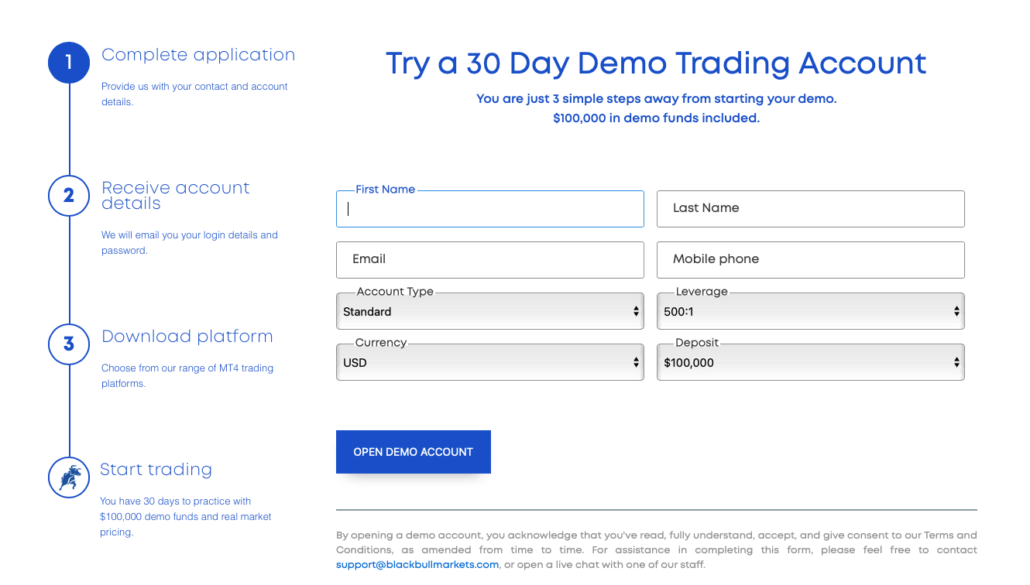

There are many informative lectures and papers on the website. A trading platform video guide is also available to help you navigate the site. A demo account is totally free to use and comes with virtual funds provided by the brokerage.

The internet trading platform also offers a mobile version, which allows you to trade from anywhere. English, Serbian, Chinese, Spanish, Uzbek, Thai, and more languages are supported.

You can reach the broker’s customer service representatives via phone, live chat, or email. However, they are not available 24 hours a day, seven days a week. It is instead only open 24/5.

Summary:

- The needed initial deposit is $200.

- The FSA and FMA license the brokerage.

- The brokerage charges a commission charge of $3.

- Spreads begin at 0.8 pips.

- Payments can be made via bank transfer, Skrill, Neteller, credit card, debit card, China Union Pay, and FasaPay.

Disadvantages of trading with BlackBull Markets

The only downside of trading with BlackBull Markets is the broker charges a fee whenever you withdraw your funds. The minimum deposit requirement for Prime accounts is also too much for most newbie traders.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

This forex brokerage was formed in Australia in 2010, and its main office can also be found there. To better serve its European clients, it established a second office in London in 2015.

The Financial Conduct Authority and the Australian Securities and Investments Commission monitor and regulate Pepperstone. A negative balance defense is also available to the majority of their clients.

Pepperstone has only one live trading account, and there is no minimum investment needed. Additionally, the broker does not impose a withdrawal fee or inactivity fee. If you are not yet ready to trade live, you may experiment with the free demo account.

The trading desk is accessible from any device. It also features a web-based system for those who do not want to install the software. It is also accessible in a number of other languages.

Customer service is only available 24 hours a day, seven days a week, through phone or live chat. The broker promises that their customer care responds quickly and effectively, so you can rest assured that your inquiries will be addressed as quickly as possible.

Summary:

- The brokerage does not require a specific minimum deposit.

- This brokerage is regulated by ASIC, the FCA, and CySEC.

- Users are charged a $3 commission fee.

- Spreads start at 0.0 pip.

- Payment methods accepted by the broker include Poli, Bpay, PayPal, Neteller, Skrill, Union Pay, debit card, credit card, and bank transfer.

Disadvantages of Trading with Pepperstone

The only disadvantage of trading with Pepperstone is customer support is only available 24/5.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option is a Cyprus-based brokerage firm that began operations in 2013 and currently services customers in over 200 countries globally. It is well-known across the globe as binary options (Only for professional traders and outside EAA countries) and forex broker, and the Cyprus Securities and Exchange Commission oversees its activities.

This brokerage has two account types to select from Standard and VIP. You need $10 to create a Standard account, and you should be able to start trading right away. To be promoted to a VIP account, you first must invest a certain amount of funds. The amount required varies depending on the broker.

The three base currencies available are EUR, GBP, and USD. The broker does not impose a withdrawal charge. When withdrawing funds through bank transfer, however, you will have to shoulder the small processing fee charged by the bank.

The free demo account has a wallet balance of $10,000 in virtual funds and may be used to explore the platform before registering for a real account. The trading platform is available on both desktop and mobile platforms and in over ten different languages.

Customer service is offered by email, live chat on the website or platform, and via phone. With over 80 employees on hand, every complaint or question will be addressed within the next few minutes.

Summary:

- This brokerage requires a minimum investment of $10.

- CySEC regulates this brokerage.

- Clients must pay a fee of $3 for each transaction.

- Spreads start at 0.6 pips.

- Payment methods accepted by the broker include Maestro, Moneybookers, Web Money, Skrill, Neteller, Cash U, debit card, credit card, and wire transfer.

Disadvantages of trading with IQ Option.

The MetaTrader platform is not available with this brokerage. Instead, you will have to trade using its own trading platform.

(Risk warning: Your capital might be at risk.)

Financial regulation in Sweden

In Sweden, Finansinspektionen, or Swedish Financial Supervisory Authority, is responsible for financial regulation. This organization was founded in 1991 and was created to control and manage the country’s financial industry’s securities, insurance, and banking sector.

The Swedish Financial Supervisory Authority is a part of the Finance Ministry and is responsible for overseeing the market and regulating and issuing permits to different financial institutions.

The organization also implements a MiFID framework because Sweden is part of the EU. MiFID or Markets in Financial Instruments Derivatives follows and implements a strict regulatory process to ensure that the brokers allowed to offer their services in their country are trustworthy and reputable.

Security for Swedish traders

When it comes to the security of your funds and personal information, you have to be very cautious when choosing a broker to partner with. After all, there are a lot of scam sites out there.

To ensure that you are trading with a trustworthy broker, they have to be regulated by well-known regulatory bodies. Additionally, check to see if they offer insurance or any other feature to shield you from threats and unwanted losses.

Also, make sure that your funds are stored in a separate account. This way, the broker cannot use your funds for their own gain. This also helps keep your funds secure from hackers or other third parties.

Is it legal to trade Forex in Sweden?

Yes, it is 100% legal to trade forex in Sweden. The Swedish Financial Supervisory Authority or Finansinspektionen oversees and allows brokers to offer their services to Swedish traders so long as the brokerage adheres to the strict rules implemented by the company.

(Risk warning: 75% of retail CFD accounts lose money)

How to trade Forex in Sweden – A quick tutorial

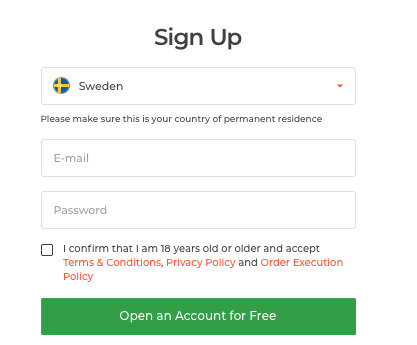

1. Open an account for Swedish traders

All the brokers listed above have fairly simple account opening procedures. The same goes for other brokers who aren’t on our list. Each brokerage has a registration form that you must complete. It will usually request your full name, phone number, email address, country of residence, and more.

After that, you must authenticate your account. Some brokers may deliver an email containing a verification link that you have to click. Others will request that you submit a legitimate government-issued ID to verify your identity. Some will even phone you to complete your live trading profile.

2. Start with a demo account or real account

Many traders want to jump in with both feet and execute a trade as soon as they open a live account. However, this may result in a very risky trade. Many pros strongly advise beginning with a demo account.

Anyone can use a demo account, which is absolutely free. It’s a terrific platform for newbies to learn about market movements and different trading strategies. Experts also use this free service to develop new tactics and refine their trading expertise.

A demo account grants you access to a simulated trading platform that mirrors live market conditions. This will help you get used to how the market works, so you are fully prepared once you start trading live.

The difference between a live and demo account is that you trade with virtual currency when using a demo account. However, whatever amount you earn on the demo account does not translate to real money.

Some brokers, however, hold trading competitions on demo accounts. Typically, the reward is real money that is transferred into your current trading account, providing you have one.

3. Deposit money

When you are ready to begin trading with genuine cash, the brokerage will invite you to top up funds to your account. Deposit methods vary per broker, but the most prevalent include bank transfer, debit or credit card, and various online wallets such as Skrill, Neteller, and PayPal.

It’s worth noting that some brokers impose a deposit fee. Before you fund your live brokerage account, take time to read the terms and conditions to avoid any problems.

4. Use analysis and strategies

We realize how tempting it is to start a transaction as soon as you put money into your account. However, doing so is very dangerous. Make time to assess the market’s behavior. By doing so, you can develop a strategy that is relevant to price movements, which might potentially convert to a considerably larger possibility of profit.

It is also critical that you research the many types of trading methods. Use the broker’s copy trading option and see how other customers execute their transactions.

The scalping approach is an example of a popular forex trading method. This is widely utilized by traders who have the luxury of monitoring the market for extended periods. This method aims to maximize earnings while reducing losses.

5. Make a profit

It might take some time for you to make a profit, but thoroughly analyze the market before executing a trade to increase your chances of gain. Also, take time to read up and implement a risk management strategy.

(Risk warning: 75% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Sweden

With the number of forex brokers available to Sweden-based traders, choosing a firm that best suits you can be a pain. In case none of the brokers mentioned above is right for you, take time to read other reviews and test the platform before deciding on a particular broker.

1. Capital.com

2. BlackBull Markets

4. Pepperstone

5. IQ Option

FAQ – The most asked questions about Forex Broker Sweden:

Is forex trading possible in Sweden?

Yes, forex trading is possible in Sweden if a trader trades with a broker who operates legally. The regulating authorities in Sweden allow traders to trade forex and other underlying assets. So, like traders elsewhere, traders in Sweden can trade forex to earn passive income.

How does a trader make money while trading forex in Sweden?

A trader would tap the opportunity of making money while trading forex by ascertaining whether the currency will rise or fall. For this, a trader can use several trading tools and technical indicators. Once they conduct a trading analysis, they can know whether the forex will rise. Thus, they can trade the currency and benefit from it when it rises.

Is a forex demo account available for traders in Sweden?

The five forex brokers that lead in offering trading services to Swedish offer the best demo account facilities to traders. Traders can use the forex demo account for free for 30 days. During these 30 days, Swedish traders can access all features that these trading platforms offer and learn to trade without using money. Traders in Sweden have the best brokers at their disposal. They can sign up with one to access the free demo account.

How can traders trade forex in Sweden?

Traders can follow a step-by-step process if they wish to trade forex in Sweden.

Find a forex broker that offers the best services to traders in forex trading.

Now, sign up for a forex demo trading account. You can also signup for a live trading account for forex trading.

Finally, you can fund your trading account and place your forex trade.

Which payment methods are available for traders in Sweden for forex trading?

Swedish traders have access to a variety of funding options for FX trading. These wide ranges of payment methods allow traders to access ease and convenience while trading forex. The payment methods include cryptocurrency, bank transfers, electronic funds, and credit and debit cards. When a trader has a wide range of payment methods at his disposal, it offers him ease and convenience of trading. For instance, you can simply select a different payment option if the first one is unsuccessful.

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)