The 5 best Forex Brokers & platforms in Tajikistan – Comparisons and reviews

Table of Contents

Finding the best broker with reasonable fees can be tough for a Tajik trader. There are many seemingly great brokers promising great service to Tajikistan traders.

We have reviewed many of them, testing their platforms and trading environment and comparing fees. After our test, we can recommend these five among the bests.

See the list of the best Forex Brokers in Tajikistan:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 67% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 67% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 67% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The 5 best forex brokers for Tajik traders are:

Overview of the 5 Best forex brokers in Tajikistan:

1. Capital.com

Capital.com is a globally recognized CFD and online forex broker. The company is based in the United Kingdom and has offices in Cyprus, Poland, Ukraine, Seychelles, and other parts of Europe.

Capital.com operates with licenses from well-known bodies, including:

Tajikistan customers can start forex trading with $20 on Capital.com platforms. The meta trader 4 and the broker’s app are offered. Both platforms are specifically designed to accommodate rookies and skilled traders. The platforms are user-friendly, with several charts, indicators, and other trading tools to support the user.

The broker offers among the most competitive fees with zero commission accounts and spreads as low as 0.8 pips. Deposits and withdrawals are cost-free. A dormant account does not attract fees as other brokers would charge.

The main disadvantage of Capital.com for Tajikistan traders is the lack of provision for Islamic accounts. If you seek a Sharia-compliant forex service provider, this broker may not be right for you.

(Risk warning: 67% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a trustworthy online broker with headquarters in New Zealand. The broker is authorized by its country’s Financial Markets Authority (FMA) and the Financial Service Authority of Seychelles (FSA).

BlackBull Markets allow Tajikistan traders to enter the foreign exchange market and trade various instruments. The products available are forex, CFDs, ETFs, metals, and energies.

Its trading services are available on the MetaTrader 4, MT5, and the broker’s app. These come with varieties of helpful tools for the traders. Social and copy trading is available, and an Islamic interest-free account is provided.

The broker’s account types have different fee models. These are commission-based and commission-free. Spreads on the commission-free account start from 0.8 pips, which is a good rate in the industry. The commission-based account can see spreads as low as 0.0 pip, with a $3 commission fee per lot traded.

BlackBull Markets is a great option for Tajikistan traders, except for one disadvantage. The broker requires a $200 minimum deposit to trade on its platform. This sum might be too high for people who are still testing forex trading for the first time.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is among the low-fees licensed brokers. The company is regulated by the IFSC.

RoboForex offers access to a wide range of financial market instruments at competitive fees. Traders can sign up for any of its several account types and choose from four different powerful platforms.

Its Pro standard and Pro cent accounts have the commission included in the spreads. It amounts to as little as 0.8 pips for major crosses during peak time. The ECN and prime account holders enjoy ECN executions with extremely spreads averaging 0.4 pips for majors. Although, a $2 commission per trade accrues on this account.

Tajikistan customers can join this broker’s platform with a minimum deposit of $10. Trading is conducted on the MT4, MT5, cTrader, and rTrader. The broker also offers several bonuses to reduce the trader’s expenses further.

But traders should be aware that this broker charges withdrawal fees. The service is free on other competitors’ platforms.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is an international CFD and online forex dealer founded in 2014. The broker’s home country is Australia, but they are now present in many parts of the world.

Pepperstone is authorized by several esteemed financial bodies, including ASIC, FCA, CySEC, BaFin, and DFSA. The broker is appealing for its world-class trading conditions and trustworthiness. Pricing is another one of its strong points.

Pepperstone offers two types of accounts with different fee models and remains competitive in its pricing. Spreads on its standard STP account start within the market average of 0.8 pips. Zero commission is charged on the account. The razor account is commission-based and an ECN account. Spreads can be as tight as 0.0 pip on majors during peak trading times.

The famous MT4, MT5, and cTrader are offered for trading services. All the effective trading tools are embedded. These include social, copy, and automated trading support.

Pepperstone offers a free demo like other reputable brokers. But the company only allows 30 days of access. Its competitors might allow a longer period.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is among the well-accepted broker in Tajikistan. The reason is its easy-to-use trading app and its competitive fees.

IQ Option is based in Cyprus and operates with a license from CySEC. Tajikistan traders can access these markets: binary options (Only for professional traders and outside EAA countries), digital options, forex, commodities, and indices.

A $10 minimum deposit is all you need to join this broker. But if you wish to trade on its VIP accounts, $1900 is the minimum trading amount.

Its platform, the IQ Option app, is beginner-friendly and suitable for experienced traders too. Spreads start from 0.8 pip on major currency pairs, and there’s no commission charge.

IQ Option offers Islamic accounts for those who require full Sharia-compliance trading services. A major drawback with this broker is the lack of meta trader platforms. Many traders prefer MT4 and MT5 because they are packed with valuable trading tools that might not be on other platforms.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Tajikistan?

Tajikistan is a relatively small country in Central Asia, with a little above 9 million population size.

Foreign exchange is necessary to the economy of this mountainous region due to its heavy cotton and aluminum exports.

The National Bank of Tajikistan is the head regulatory body for the country’s finance sector. Although, this sector is tiny, and people do not have that much access to foreign markets.

The Apex Bank issues and regulates the country’s currency, the Somoni (TJS). Also, it is responsible for overseeing the finance industry.

However, there is little attention on forex and CFD trading in Tajikistan. Perhaps this is because forex trading is not so popular in this nation.

But that is starting to change, especially as its economy picks up after the covid crisis. Many brokers now see a market here and are garnering to take their share of clients from the 9 million potential investors.

Security for Tajikistan traders

Considering the size of its population and the small number willing to invest in forex trading, the many options of brokers might be too confusing for a Tajik.

No known regulation protects investors and traders from fraudsters and dubious brokers.

Therefore, the individual forex trader is responsible for themselves and must ensure they choose a trusted broker to deal with.

A trusted broker is one bearing a license or two from an acclaimed financial organization. A reputable regulatory body’s approval proves that the broker is genuine and complies with the strict trading policies of the body.

Examples of acclaimed regulatory bodies are:

- Australia Securities and Investments Commission, ASIC

- Cyprus Securities and Exchange Commission, CySEC

- Financial Conduct Authority, FCA (UK)

- Commodities and Futures Trading Commission, CFTC (US)

- Financial Sector Conduct Authority, FSCA (South Africa)

- Federal Financial Supervisory Authority, BaFin (Germany)

- Dubai Financial Service Authority, DFSA

- Financial Service Authority of Seychelles, FSA

These are top-rated forex regulators and prove the broker’s legitimacy. Traders from Tajikistan may also thoroughly read a broker’s terms and conditions to see how they are protected.

Is it legal to trade Forex in Tajikistan?

Forex trading in Tajikistan is legal, apparently. There is no information about laws against forex trading. Therefore, it is legal to trade forex in Tajikistan. We should mention that forex profits fall under income tax once it reaches a certain amount. The trader should seek advice from the tax authorities regarding this to ensure they’re acting within the laws.

How to trade Forex in Tajikistan – Tutorial and overview

The trader needs to first put three things in place before starting forex.

These are:

- Internet connection

- A smartphone, tablet, or computer.

- A good broker

A dependable internet connection and a device are the first two basics. Trading is done on the internet, and a good connection is required so that the orders take effect once you click on the appropriate tab.

As we’ve mentioned, a reputable broker is the first determinant of your trading success.

Here’s what to look for when signing up with a broker:

- License

Pardon the repetition, but regulations are crucial for a broker. That’s why we reiterate this. The trader must ensure their broker holds the appropriate license. They can be safe from fraud, as their funds are secured if the broker’s business goes south.

- Fees

As we mentioned, trading costs are a vital consideration. If the broker’s fees are too high, forex trading might be a pointless endeavor. The trader makes a profit, which is mostly deducted to cover the broker’s fees. The trader must seek a broker with competitive fees, so they do not trade at a loss.

- Support

The broker’s customer support needs to be reachable at all times. No system is perfect, and the trader may encounter one or two issues, especially if they’re new. Customer service must be easily reachable for this. Therefore, the trader must look for a broker offering 24 hours support services. A multilingual service with Hungarian language support is even better and more convenient.

- Free demo

Both new and existing forex traders need to be able to test a platform before investing their funds. The broker should provide the avenue for this. One way to identify a reputable broker is through a FREE DEMO account with at least 30 days of access. The account must have sufficient funds for testing too.

- Payment method

Moving funds in and out of the trading account should be hassle-free for the trader. Therefore, the broker’s payment options must include PSPs and methods available in your location. You want to avoid problems depositing funds and withdrawing profits from the account.

Confirm your chosen broker meets all these requirements before doing business with them. You can check their official websites for information. Regulations can be verified on the regulatory bodies’ websites. Also, reading reviews and customer feedback about the broker can help you know them better.

(Risk warning: 67% of retail CFD accounts lose money)

Follow the steps below to begin trading:

1. Open account for Tajikistan trader

Many online brokers welcome Tajik traders and have prepared a specific website for them. So once you choose a broker online, visit the website to register.

Click on the signup tab, usually displayed boldly at the top or center of the page.

On the brief form that pops up, you will be required to input your name, email, and phone number. Or just your email.

After doing this, the broker sends a verification link to the mailbox. Open your inbox and click on the link to verify the email and continue the signup process.

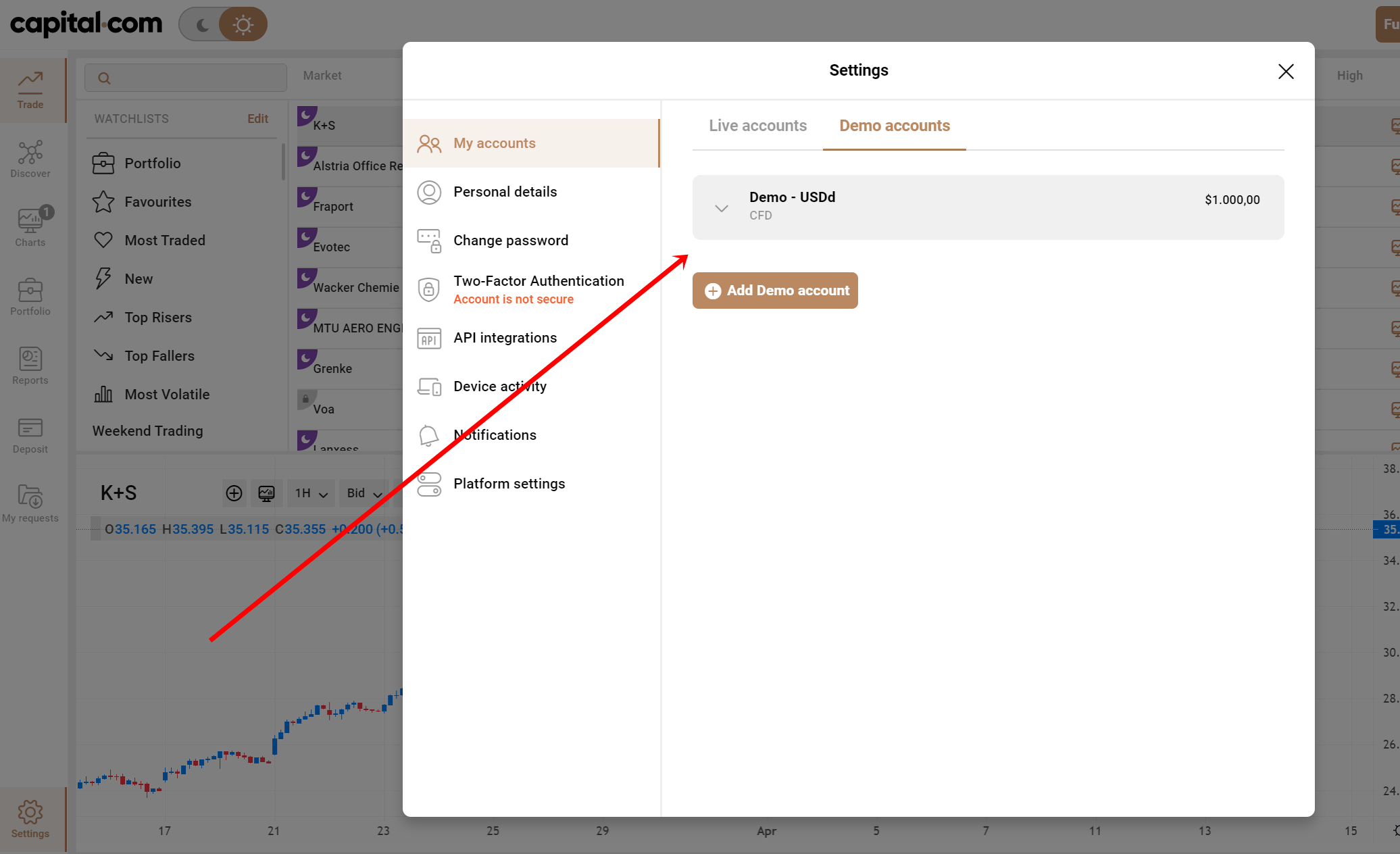

2. Start with a demo or real account

Once you complete the signup process, there’s a free demo with which you can test the broker’s platform or practice trading.

Novice traders should always use this account to practice trading before starting live transactions.

Existing and skilled traders often use the free demo to have a look-see at the broker’s trading environment. Some use it to practice new strategies before employing them in a live market environment.

3. Deposit funds to trade

After testing or practicing with a demo account, the next thing is to trade live.

You will need to deposit money for this. The broker should provide simple ways to fund forex trading accounts. Usually, support staff will help new customers with their first deposits.

The basic and simple payment methods in Tajikistan are MasterCard and bank transfers. Another local online payment service may be offered, such as Paysend.

Ensure the broker you choose offers convenient payment methods before signing up. Difficulties with funding your accounts and withdrawals can be stressful.

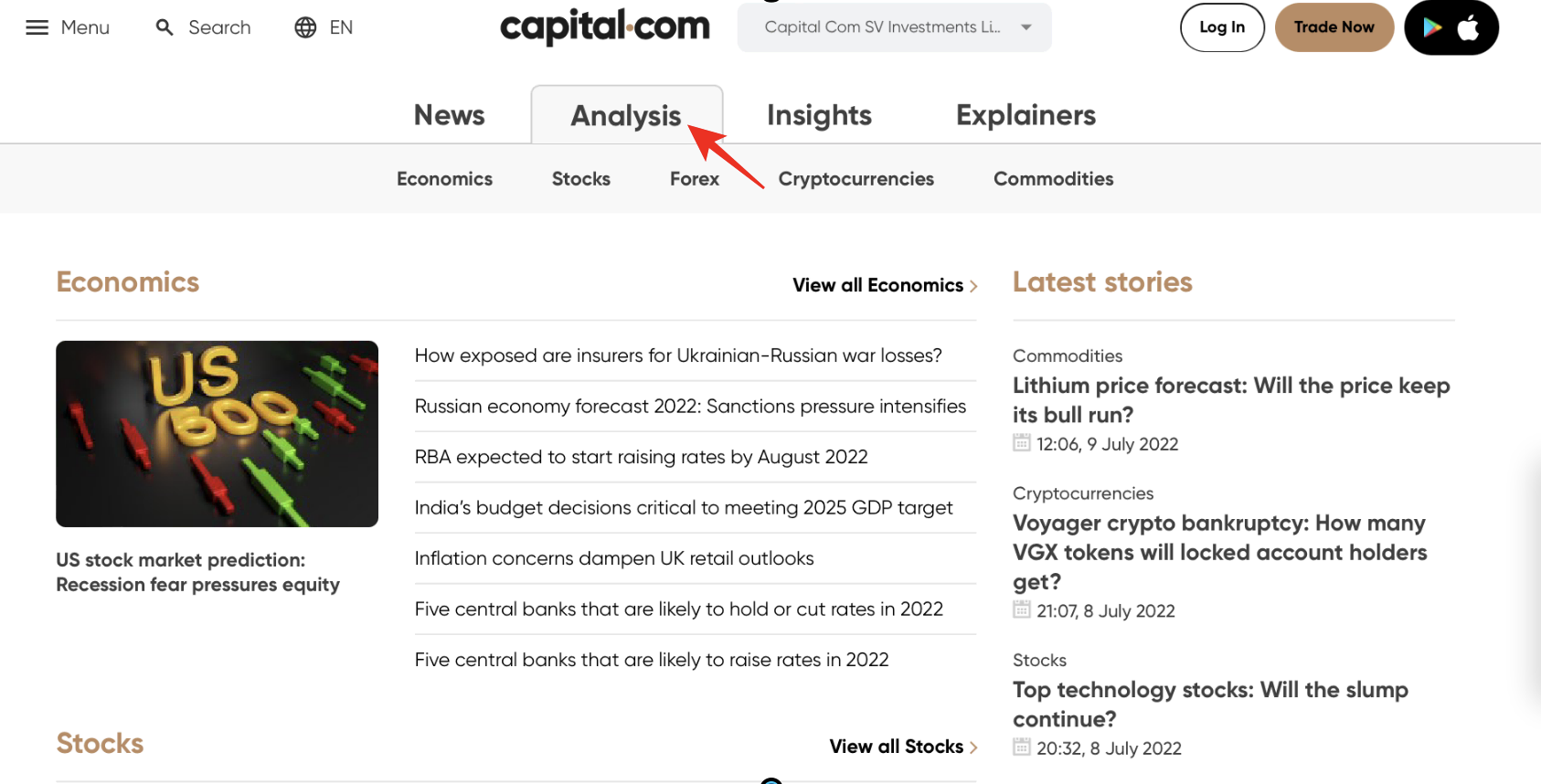

4. Use analysis and strategies

Before you begin, you must first analyze the forex pairs you wish to trade.

The analyses involve looking at fundamental factors that influence the exchange rate and examining the price chart to spot patterns in price movement.

These analyses are called:

- Fundamental analysis

- Technical analysis

Both are essential if you wish to trade profitably.

Fundamental analysis refers to inquiries about the economic factors influencing the currency’s price. These factors include the interest rate, gross domestic product (GDP), trade surplus or deficit, etc.

Technical analysis involves studying the forex price chart to find patterns in the price movements. These patterns show the best points to enter and exit trades in the market.

Successfully trading the market means blending these analyses with a winning strategy.

Here are some popular forex trading strategies:

I. Trend trading

Forex pair prices always follow a trend. The price can trend high (uptrend), low (downtrend), or in the middle (sideways). The three market conditions offer opportunities to enter and exit positions. The trader must first identify the ongoing trend to use the strategy correctly. If the market is in an uptrend, the opportunities lie in long (buy) trades. Short (sell) positions will be profitable if it is a downtrend. The trader has to look for overbought and oversold levels in a sideways market to trade profitably.

II. Range trading strategy

Another name for a ranging market condition is a sideways market. In this market condition, the asset’s price move within a certain range. The price is neither trending high nor low. Range strategy in forex is suitable for currencies that remain relatively stable. The trader needs to identify the overbought and oversold zones in this case. Then enter the appropriate trade to make a profit.

III. Carry trading strategy

Online forex trading is about speculating on currency pairs’ rise or fall. National currencies usually have their interest rates. The trader buys the higher-interest rate currency while borrowing its pair. Interest rates accrue from the higher interest rate currency when you hold the position for such trade. The broker credits your account with the interest rate.

There are numerous forex trading strategies online. Most of them are effective as long as you use them correctly. We recommend practicing your chosen strategies on a demo account before trading with them.

5. Make a profit

You should soon start seeing profit if you do the correct analysis and use a workable strategy.

The profit reflects on the trading account, and you can trade with it or withdraw it.

Withdrawal should be as easy as depositing funds in the account. Although it usually takes longer to process.

Many reputable brokers complete the request and credit the trader within 48 hours.

The processing time may also depend on the payment method. Bank transfers may take longer than online payments or debit cards.

The withdrawal option on the trading platform is usually under the FUNDS tab. Clicking on this tab brings a drop-down menu in which withdrawal should be part of the option.

Once you click on it and fill out the form, the broker receives the request and begins processing.

(Risk warning: 67% of retail CFD accounts lose money)

Final remark: The best Forex Brokers are available in Tajikistan

Tajikistan is a relatively free economic environment, and forex trading is permitted there. The customer must take care to choose the right broker. We have explained how to find one and have recommended the best ones. These brokers offer first-rate trading services at highly competitive fees. Additionally, their licenses prove their genuineness. Tajikistan traders can trade the market safely with these recommended brokers.

1. Capital.com

2. BlackBull Markets

3. RoboForex

4. Pepperstone

5. IQ Option

FAQ – The most asked questions about Forex Broker Tajikistan :

Which forex brokers in Tajikistan let traders trade with a reasonable fee?

If you wish to trade forex in Tajikistan for a reasonable fee, you can choose one broker among the five brokers we reviewed. You can sign up with one if you wish to trade for a reasonable fee. These brokers charge the lowest fees and commissions from traders. In addition, they offer you the best spreads.

Do forex traders in Tajikistan have to pay an inactivity fee?

Yes, brokers offering services to traders in Tajikistan charge an inactivity fee from traders. However, the inactivity fee might vary from broker to broker. Usually, the range of inactivity fees starts from 10 USD and can go up to a high amount. However, if you wish to ditch the inactivity fee by paying the lowest amount, you can sign up with IQ Option.

Which brokers offer the best underlying assets to traders in Tajikistan?

Several brokers in Tajikistan offer the best underlying assets to traders. However, if you want a perfect trading experience, you can sign up with BlackBull Markets or Pepperstone, as they offer many underlying assets. Thus, you can sign up with Pepperstone of BlackBull Markets if you wish to diversify your portfolio.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)