The 5 best Forex Brokers and platforms in Thailand – Comparison and reviews

Table of Contents

The forex market has risen to become the largest financial market globally. According to a BIS estimate from 2019, the daily amount of currency exchanged is $6.6 trillion. Retail accounted for around 3.5 percent of total revenue in 2013.

See the list of the best Forex Brokers in Thailand:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

This article is for you if you are looking to start trading forex but do not know the proper steps to take or which broker to choose. Here is some vital information about the top five brokers in Thailand.

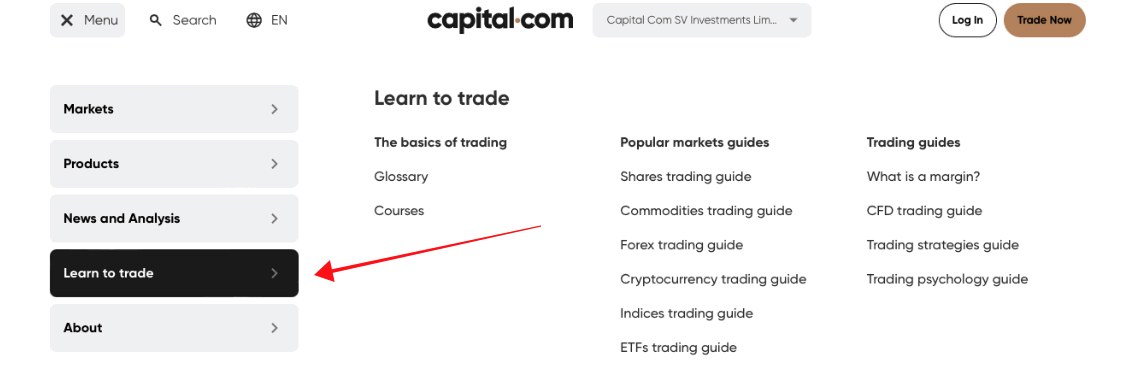

1. Capital.com

Capital.com was founded in 2016 and already has a user base of over 500,000 people. The firm is regulated by the Financial Conduct Authority (FCA) of the United Kingdom, the Australia Securities and Investment Commission (ASIC) of Australia, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the National Bank of Belarus.

Capital.com offers a thorough training program and articles, videos, and a comprehensive training curriculum for beginners. This course has 28 lectures divided into five sessions and an exam to assess your development and financial understanding.

Capital.com is one of the top brokers due to its technology platform. Traders can utilize the firm’s unique trading platform to make educated investing selections since it delivers essential data.

On Capital.com, traders may choose from an extensive range of assets to make well-informed judgments. Stocks, indices, cryptocurrencies, commodities, and foreign exchange are some of the options. Capital.com’s customers are well-protected by law, making it a well-regulated and popular trading site.

Capital.com offers CFD and Forex trading at a moderate cost. The process required to set up a new account is simple. However, the minimum deposit is high compared to other brokers, at $3000. The company provides excellent customer service, but it also answers quickly.

Merits of Capital.com

- The most competitive spreads on the market

- All the training resources, instructional apps, online courses, and trade guidelines are top-notch.

- There is a Demo account that is free and never expires.

Demerits of Capital.com

- There are a reasonable number of trading symbols, although far less than the industry’s behemoths.

- Clients from the United States are not accepted.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

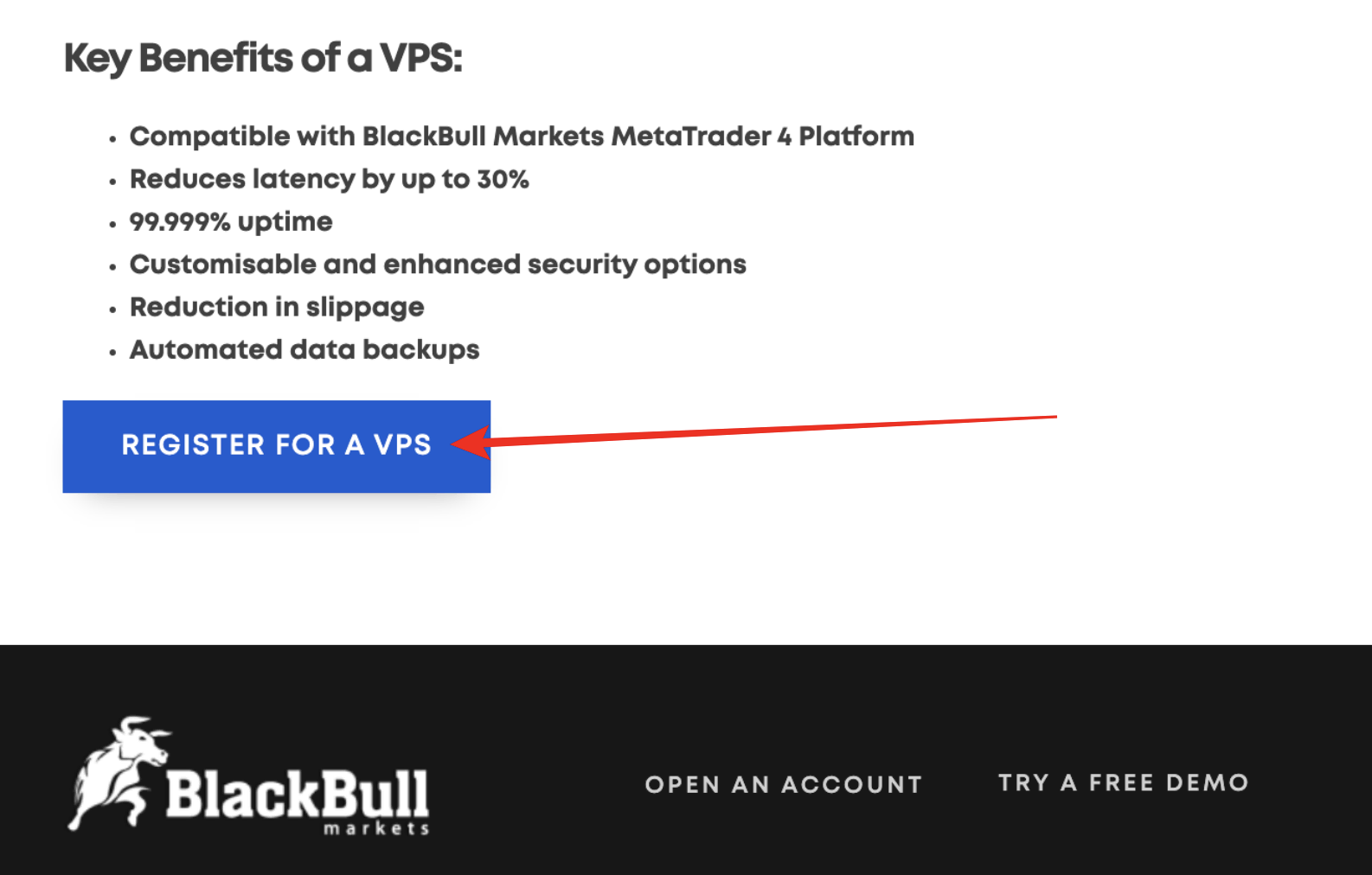

The Financial Services Provider (FSP403326) regulates Black Bull Group Limited and typically holds a Financial Markets Authority Derivative Issuer License. BlackBull Markets is the ideal platform for traders that like to trade with little assets. If you wish to trade indices, commodities, or crucial currency pairings, you must pick a broker.

A group of fintech developers, FX traders, and data security professionals founded BlackBull Markets in 2014. This platform is an excellent location to begin trading metals, commodities, indices, energy, and CFDs.

With a No-Dealing Desk (NDD) and Straight-Through Processing (STP) methodology, they are a reputable Electronic Communication Network (ECN) broker (STP). For deeper poo liquidity and greater market depth, global partners have superior liquidity providers.

When using BlackBull Markets for the first time, you’ll notice that the broker has a reasonable price structure and good transaction execution. It also offers free virtual private servers (VPS) and API trading.

The MT4 platform from BlackBull Markets connects to the Equinix NY4 server on Wall Street. It can efficiently perform transactions in 2-5 milliseconds. A trader can have various servers to trade in markets with multiple liquidity providers who offer competitive bid/ask prices, little slippage, and tight spreads.

Pros of BlackBull Markets

- BlackBull Markets accepts no fees for deposits.

- API trading and free virtual private servers (VPS) are offered.

- Traders have access to the complete MetaTrader suite, which includes MT4 and MT5

Cons of BlackBull Markets

- Customer service is not available round the clock

- Withdrawal attracts a fee to it

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex has around 800,000 customers from 170 countries. The language barrier is significantly decreased thanks to the broker’s support in 18 languages. RoboForex has made every effort to break boundaries between clients in every form.

RoboForex and Robomarkets Lte comprised the RoboForex Group, created in 2009. The former offers service worldwide, while the latter was designed for clients in the EU and EEA. The IFSC manages this organization.

RoboForex provides several options and the chance to hone your skills and compete in trading contests, which will help you improve your level and talents.

RoboForex offers trading platforms including MT4, MT5, and cTrader. Millions of traders use MT4 every year since it is a well-known, multi-functional trade site. MT5 is less standard than MT4 despite its better features. Both platforms offer top-notch trading capabilities. The cTrader is still the most used ECN platform.

The availability of minimum deposits varies by location. However, RoboForex also offers a variety of options, which helps traders get a better understanding of the trading forex using this platform.

RoboForex is working hard to ensure that its platform is a risk-free investment environment for everyone. This improves their reputation and makes them more trustworthy. Their popularity has surged to unprecedented heights in the previous several years.

Members get access to market analysis, technical analysis, expert trading analytics, and various tools in the Members section.

Advantages of RoboForex

- It provides a vast selection of software on its trading platform that is suitable for any type of trader.

- Trading fees are low, and there is a lot of leverage.

- Traders enjoy swift order execution

Disadvantages of RoboForex

- There are numerous regulatory documents that must be reviewed before working with RoboForex.

- The customer support department’s response time might be improved.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Since its start in 2010, Pepperstone Group has become a top-tier participant in the brokerage sector. It has established a top-notch and feature-rich trading platform that focuses on forex, stocks, metals, and cryptocurrencies.

Pepperstone makes market access simple, letting clients focus on the more pressing task of making a profit from market trades. Pepperstone is an excellent choice for traders who want a limited number of reduced-cost alternatives, and different types of accounts. Traders equally have access to excellent customer support.

The FCA, ASIC, CMA, BaFin, SCB, and DFSA regulate the broker. Market data and insights from Pepperstone are up-to-date according to industry standards, and they assist traders in connecting with the market and supplementing instructional resources.

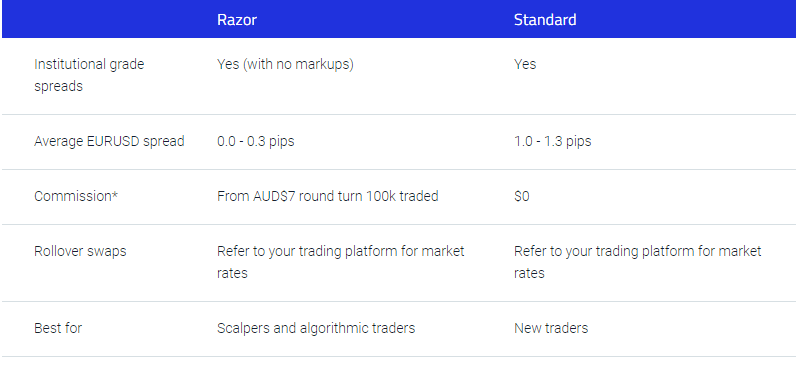

Pepperstone offers some of the most competitive commission rates in the online brokerage industry. The “Standard” account, which has minimum FX spreads starting at one pip, but no commission, and the “Razor” account, which has minimum FX spreads starting at zero pips but commission, are available to new clients.

On Pepperstone’s other instruments, the spreads are either straight or a combination of distance and commission.

Merits of Pepperstone

- There are numerous social copy trading platforms from which to choose.

- Pepperstone provides a number of platform add-ons to help you get the most out of MetaTrader.

Demerits of Pepperstone

- There are no interactive courses, progress monitoring, or instructional tests.

- Its customer service department is closed on weekends.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

Although IQ Option is not as old as most forex brokers in the binary options business, they are known for constantly updating their platforms with new binary options technologies to improve the trading experience. (Only for professional traders and outside EAA countries)

The platform offers both a desktop solution and a mobile app to aid investors in evaluating markets and benefitting from them. There is no doubt that the platform is relatively easy to use, which improves the general trading experience.

IQ Option is a multi-award-winning trading platform that has been praised and recognized by industry leaders. It offers a flexible platform that allows you to adjust anything from the chart type to the color scheme to match your specific requirements.

To assist investors on their way to prosperity, the company developed a tool called IQ Option trade patterns. This tool, which you may access through the brokers website, has the potential to have a substantial influence on the result of your investment.

IQ Option trading patterns provide video tutorials for almost every trade pattern accessible. In a short length of time, it will enlighten you on everything you need to know about employing such practices. The device is easy to identify because of its location next to the trading platform.

IQ Option is a well-known trade platform. It provides a straightforward user interface and caters to the demands of even the most discerning traders.

Pros of IQ Option

- They have a large customer care crew that works around the clock and responds in a variety of languages.

- For more receptive reactions, there are interactive webinars accessible.

- Account opening process is completely digitized

Cons of IQ Option

- Withdrawal via bank transfer takes a longer time.

- If you withdraw money from a bank, you can be charged a fee.

(Risk warning: Your capital might be at risk.)

Is it legal to trade Forex in Thailand?

In Thailand, forex trade is legal, and it is regulated by the Bank of Thailand and the Securities & Exchange Commission of Thailand, also known as the SEC. Before you, as a Thai citizen, begin engaging in forex trading, you must be well-informed about how the forex market operates. Other factors to bear in mind include; local forex trading rules and limits, accepted means of payment, and widely accessible trade sites at Thai-friendly brokerages.

In 2017, Thailand legalized forex trading, and local authorities enacted more lenient laws for financial investment products such as equities and securities. These legislative changes aim to make it easier to move money within and outside the nation and cope with the Thai baht’s strengthening (THB).

The revisions were enacted by the Bank of Thailand, the country’s leading financial institution, and went into effect in November 2019. (BOT). Thailand’s retail investors can now move cash overseas and trade in various financial assets.

If you want to trade forex in Thailand, you’ll need to work with a broker that allows Thai traders. Fortunately, this only applies to brokers. There are no forex firms that will not allow traders from this jurisdiction that I can locate. Therefore, you have your pick of the finest forex brokers in the world.

Although you may have difficulty finding a broker situated in Thailand, most forex brokers will allow traders from Thailand. If you wish to trade investors’ money, you’ll need to obtain a license.

It is an excellent time to trade forex in Thailand since the regulations and procedures allow expansion. In Europe, some governments have been cracking down on retail forex trading and have eliminated leverage, reducing it to 1:30 from 1:500.

Fortunately, Thai traders can still use the leverage of up to 1:500. I couldn’t discover any statements that mentioned that the Bank of Thailand wants to amend this regulation soon.

Financial regulations in Thailand

Thailand’s Securities and Exchange Commission (SEC) is in charge of capital and securities regulation in the Land of Smiles. Nonetheless, the central bank issued permits for business companies involved in trading operations.

The Securities and Exchange Commission (SEC) is an independent agency founded in May 1992 following the Securities and Exchange Act (B. E. 2535). (SEA). One of this entity’s main goals is to guarantee that Thailand’s capital market is fair, transparent, and efficient.

The central bank’s principal goals are to centralize Thailand’s foreign exchange sector, monitor money flows within and abound the shores of the nation, and ensure the stability of the Thai baht, the country’s official currency.

The Bank of Thailand (BOT), the country’s central financial institution, and the Thailand Securities and Exchange Commission (TSEC) now oversee Thailand’s Forex trading market (SEC)

The Apex bank restricts non-residents’ THB transactions to fulfill the last goal. Furthermore, the Bank of Thailand now gives permits to commercial banks and enterprises incorporated under specific legislation and has the authority to do business with international payment methods.

With this in mind, numerous offshore brokerages accept consumers from all over the country, while being regulated by reputable international top-tier authorities such as Cyprus Securities and Exchange Commission and the Australian Securities and Investments Commission

The government designed these financial guidelines to help keep your money and assets safe and secure. As a new broker in the forex market, there is the potential for transparency, freedom of choice when selecting a broker, and an understanding of the financial industry’s ins and outs.

The Bank of Thailand creates financial enterprises through laws, recommendations, and circulars (directions and notices). Guidelines have also been issued to banks, financial institutions, and bureau de change to encourage improved procedures.

When paired with solid regulation, these policies help the Bank of Thailand achieve its aim of a healthy and thriving financial services market.

(Risk warning: 78.1% of retail CFD accounts lose money)

How to trade Forex in Thailand – A guide for traders

Open account for Thai trader

On the forex broker’s website, you may create a new account. To open an account with some forex brokers, you must make a minimum deposit. These brokers also provide several rent account types, each with its minimum deposit and spread width.

Open a trading account for spread betting or contract for difference (CFD) trading. You may open a real or demo account to trade the price variations of currency pairings.

Start with a demo account or real account

Traders can use a demo account to replicate a natural trading environment without risking their actual money. It will assist traders in getting started with free online trading and practicing before investing real money.

On the forex broker’s website, you may create a new account. To open an account with some forex brokers, you must make a minimum deposit. These brokers also provide several account types, each with its minimum deposit and spread width.

Deposit money

After you have opened an account, you will need to deposit some money to begin trading forex. There are several ways to choose your preferred currency and fund your account. However, this depends mainly on your choice of broker. Some popular payment methods available include; Wire transfers, debit cards, and electronic payment systems like PayPal and Skrill are popular ways to fill your account.

Enter their credit card information into their forex trading accounts, and the monies will be available within one working day. Investors can utilize an existing bank account, a wire transfer, or an online check to finance their trading accounts.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Retail forex day traders employ forex analysis and strategies to determine if they should buy or sell currency pairs. These strategies are;

Position Trading

Traders who maintain their positions for a long time, from a few weeks to a few years, are using this trading approach. As a long-term trading technique, this approach requires traders to take a macro view of the market and to tolerate tiny market fluctuations that contradict their position.

Position trading is a method in which traders hold their positions for a long length of time, ranging from a few weeks to several years.

This approach demands traders to adopt a broad view of the market and withstand smaller market changes that oppose their position as a long-term trading strategy.

Scalping

Scalping is a popular forex trading method that focuses on small market movements. This strategy comprises opening many trades to earn a small profit on each one.

As a result, scalpers attempt to maximize earnings by accumulating a high number of modest gains. Holding a position for hours, days, or even weeks is the polar opposite of this strategy.

Due to the liquidity and volatility of the Forex market, scalping is quite popular. Investors seek markets where price action is continuously changing so that they can profit from modest fluctuations.

Day Trading

Day trading is the process of exchanging currencies inside a single trading day. Although day trading techniques can be used in any market, they are most typically used in the Forex market. According to this trading method, all trades should be opened and closed on the same day.

To reduce the risk, no position should be open overnight. Unlike scalpers, who are only interested in staying in markets for a few minutes, day traders monitor and manage their open trades throughout the day.

Make profit

With the help of a broker, make a foreign exchange contract. Make forex transactions according to your plan, with predetermined entry and exit locations. Remember to use risk management conditions such as a take-profit or stop-loss order when trading.

Close your shop and give it some thought. Stick to your trading plan and exit the market when your predetermined stops have been achieved. Think about how you performed, so you may improve with each trade you make.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Thailand

Forex traders, especially beginners, are prone to becoming nervous if a trade does not go their way right away or if the business makes a small profit. They want to pull the plug and walk away with smaller gains. However, it is essential to understand how the market operates and try new trading strategies to help you make significant profits.

However, you should proceed with prudence and ensure that you are well-versed in currency market fundamental and technical analysis. You should also have a well-thought-out and proven trading strategy. Learn as much as you can about risk management.

1. Capital.com

2. BlackBull Markets

3. RoboForex

4. Pepperstone

5. IQ Option

FAQ – The most asked questions about Forex Broker Thailand:

How can I locate the top forex brokers in Thailand?

Safety and accessibility should be taken into account while selecting a forex broker. It is essential that you opt for a broker who is supervised under or licensed by a renowned regulator. There are many well-known top-tier regulators like the SEC in the United States, the BaFin in Germany, and the FCA in the UK. Check to determine if the broker welcomes clients from your nation of residency as the following step.

What factors should I consider while selecting forex brokers in Thailand?

You are supposed to check or follow the below factors while selecting the best forex in Thailand.

1. Should possess a valid license and is to be regulated.

2. Compare fees like spreads, withdrawal fees, and commission fees with others.

3. Check the requirements for a minimum deposit.

4. Register and open an account and check for their services, features, availability, and understandability).

5. Availability of Thai language.

6. Check for leverages.

7. Check for THB-based accounts.

Can I know the basic regulations for FX trading in Thailand?

Market regulations are among the most crucial components of forex trading. It might keep you and your money safe, so keep a tight eye on it. The trading of foreign currencies in Thailand is governed by two separate institutions, the Securities and Exchange Commission and the Bank of Thailand (BOT).

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)