The 5 best Forex Brokers & platforms in Togo – Comparisons and reviews

Table of Contents

Forex trading is permitted in Togo and, in fact, hardly regulated. Online brokers worldwide accept Togolese traders on their platforms. Therefore, the broker options are numerous and can confuse a new trader or one who wishes to change their broker.

See the list of the best Forex Brokers in Togo:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

We have investigated several brokers and now recommend the list of the top 5 forex brokers in Togo, being among the safest and lowest-fees brokers for Togolese traders:

- Capital.com

- Blackbull Markets

- RoboForex

- Pepperstone

- IQ Option

Here is a preview of the brokers’ features:

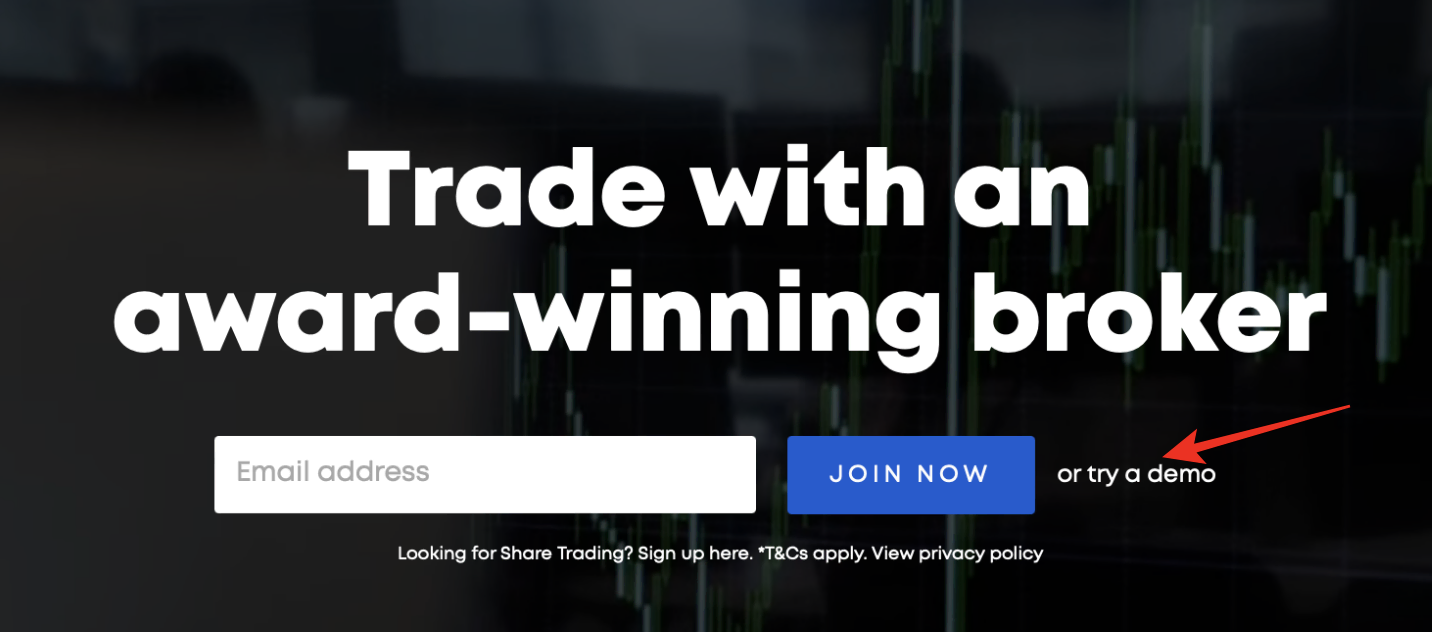

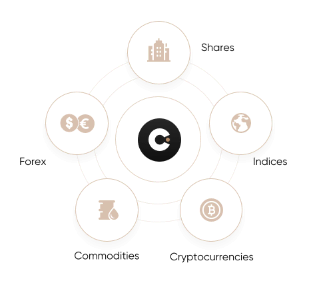

1. Capital.com

Capital.com offers access to more than 2000 markets and currently has thousands of active clients all over Africa, Asia, and Europe.

The brokerage company was founded in the United Kingdom, and they operate with licenses from its home country’s FCA, Europe’s CySEC, and Australia’s ASIC. These regulations are not the only proof of the company’s genuineness.

Capital.com started operations in 2016, not too long ago compared with its major competitors. But the company now competes with top-rated forex brokers. That is because they provide world-class trading services at competitive fees.

Togolese traders can use its proprietary platform or the MT4 to trade on its zero-commission accounts. All the account types are commission-free, and the average spreads on major pairs are 0.8 pips.

The account creation is straightforward, and the minimum deposit is $20. New traders and skilled ones get a lot of support in the form of quality education and research materials. A free demo is available, and its support service is reachable all day and night on weekdays.

Capital.com disadvantage

A major disadvantage with this broker is the lack of Islamic accounts. Muslims who want 100% sharia-compliant accounts can not use this broker.

(Risk warning: 78.1% of retail CFD accounts lose money)

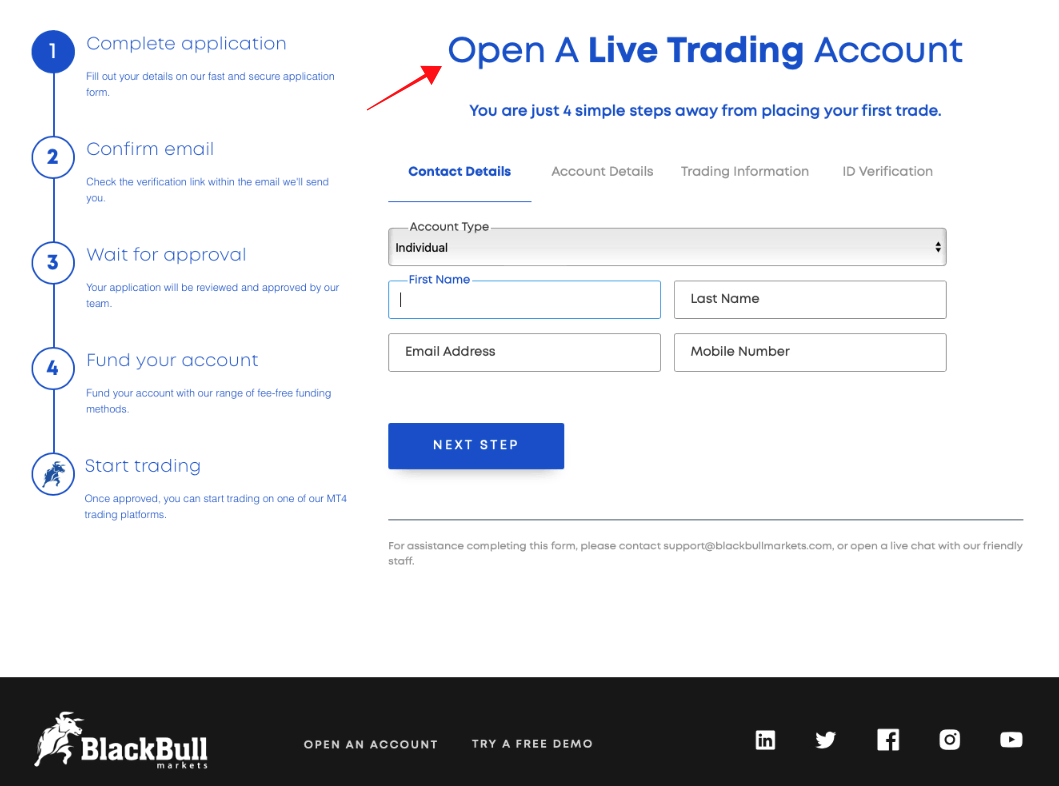

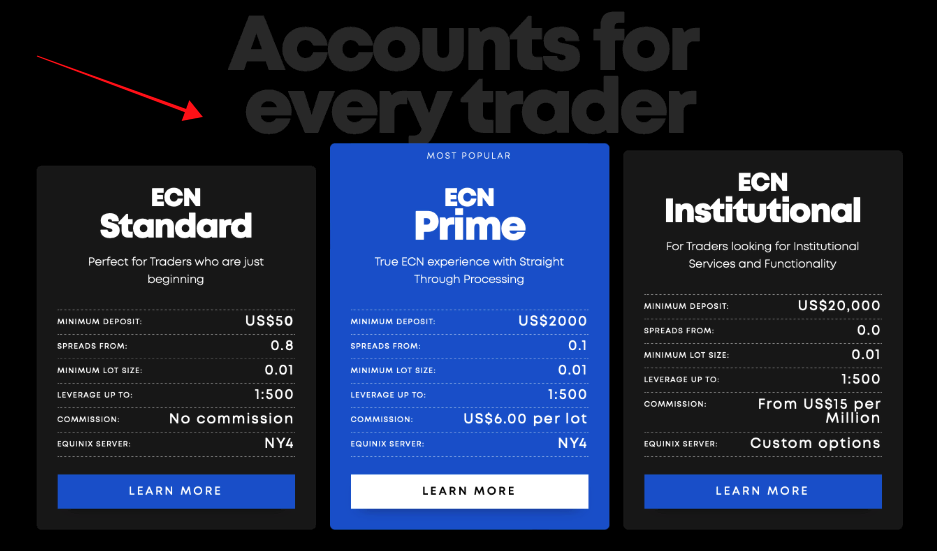

2. BlackBull Markets

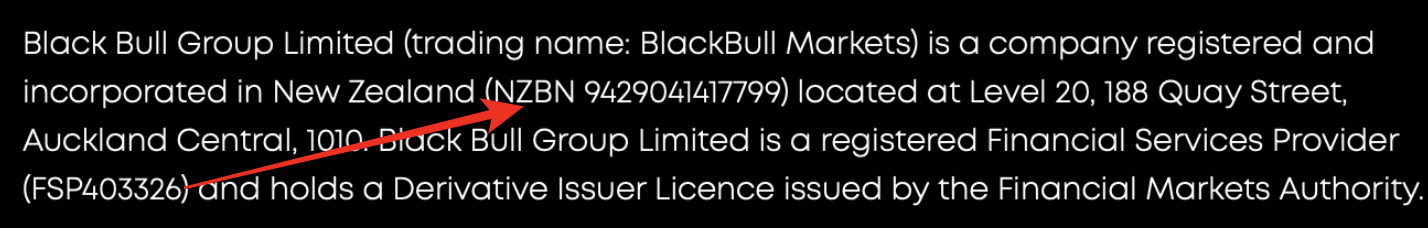

BlackBull Markets is a renowned ECN broker based in New Zealand. The company joined the industry in 2014 and has offices in New York, the United Kingdom, and Malaysia.

BlackBull Markets operate with a license from New Zealand’s regulatory authority, the FMA (Financial Market Authority). They are also registered in East Africa with the Financial Service Authority of Seychelles FSA.

The broker offers both ECN and STP account types. Togolese traders do not have to worry about conflicts of interest resulting from dealing desks. The minimum deposit required for its standard account is $200. Its raw ECN account requires $2000. But the brokers’ spreads and commissions are within the market average. The service quality and trading conditions are also impressive.

The average spread on its standard commission-free account amounts to 0.8 pips. On its raw ECN account, the floating spreads get as tight as 0.1 pip during the most active trading hours. The broker provides its services on the MT4, MT5, and its app. Mobile trading is possible, with all required trading tools included.

BlackBull Markets demerit

The minimum deposit is quite high. Togolese need 125000 CFA francs or so to trade with the broker. Its competitors allow a much lower minimum amount than this.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is one of the leading online CFD and forex trading companies. The company was founded in 2009 in Belize and now boasts more than 3 million active traders worldwide.

The brokerage is regulated in Europe by the famous CySEC, and in North America, by the IFSC (International Financial Service Commission of Belize). Traders get access to thousands of markets and can choose from several account types and platforms.

ECN and STP order executions are its mode of operation. So, traders get the best prices at competitive commission fees. Spreads on its standard account average 0.8 pips at zero commission. The MT4, MT5, cTrader, and its proprietary RTrader are available platform options. These come with various indicators to enrich your trading skills.

The broker is also known for its attractive bonus offers. New customers get $30 on its welcome bonus program. Existing traders enjoy deposit bonuses, too, depending on the amount and trading volume.

RoboForex drawback

Be prepared to pay withdrawal fees when you try to move your profit. Note that its competitors do not charge withdrawal fees.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is a renowned ECN broker headquartered in Australia and established in 2010. The company is Africa-traders-friendly and welcomes Togolese traders too.

Pepperstone is among the safest for African traders. The broker operates with several licenses from top-tier forex jurisdictions, including FCA, ASIC, CySEC, etc. The broker is also registered in East Africa with the Kenyan Capital Markets Authority (CMA) and has a physical presence in Nairobi.

Anyone can start trading on the Pepperstone platform with any amount. However, the broker recommends starting with $200. This is only a recommendation, and Togolese traders can start with a much lower amount than this.

Pepperstone has several third-party integrations in its platform to increase the user’s profitability. Social and copy trading is available through Zulutrade and MyFxbook. Autochartist is included, and automated trading is fully supported. Togolese traders can choose from the MT4, MT5, and cTrader.

Pepperstone disadvantage

The company’s free demo access is only available for 30 days. Other brokers offer longer periods to access their free demo.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a renowned binary option and forex broker based in Europe. The company is considered one of the best for binary options (only for professional traders and those outsides of EAA countries) trading due to its unique platform and low fees.

IQ Option started operating in 2010 and now has thousands of customers worldwide. The broker is regulated by Europe’s well-known, CySEC.

Access hundreds of financial instruments on its platform, including over 40 forex pairs, hundreds of CFDs, stocks, indices, commodities, and ETFs. Digital options are also offered.

With at least a $10 deposit, you can start trading with IQ Option. The broker offers its in-house trading app compatible with mobile phones for trading. Video tutorials are provided to help you learn the trade soon enough if you’re new.

There’s one standard account type, and it is upgradable to VIP if you deposit up to $1900. The broker charges zero commission on trades, and the average spread is 0.87 pips. It stays within the industry average. 24 hours customer service and free demo are also provided.

IQ Option demerit

The broker provides its service on the IQ Option app. There are no MetaTrader suites here. Many experts consider MetaTrader the best trading platform.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Togo?

Togo is among the growing economies in West African states. Since the country is heavily into exports, foreign currency exchange is necessary for its economy.

The country is a member of the African Union (AU), the United Nations (UN), and the Economic Community of West African States (ECOWAS). Its apex regulatory body, the Central Bank of West African States, is an important agent of the West African Economic and Monetary Union (WAEMU).

Togo’s Central Bank of West African States oversees its finance sector, issuing currencies and regulating the banks and other arms of the industry.

Even though Togo is among Africa’s active forex trading places, the sector is not regulated. The Central bank does not concern itself with online forex and CFD trading activities.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders in Togo – Important facts

The market records more than 150,000 active traders daily from this West African country, whose population is under 9 million.

These traders are fully responsible for themselves, their investments, and personal data.

Many online brokers try to attract traders from this region, especially since there are no laws against forex trading here.

Traders must choose their brokers carefully. Licensed brokers are safe for Togolese traders as long as a globally acclaimed financial body is the issuer.

Brokers operating with these licenses are acceptable for Togolese traders:

There are other regulatory bodies. The trader must investigate the broker’s regulation and ensure it is genuine before signing up with them.

Togolese traders who use high leverage from 30:1 should seek brokers that offer negative balance protection. It is safer for them.

Is it legal to trade Forex in Togo?

Yes. There is no law against online forex trading in Togo. Therefore, it is legal to engage in the activity. The trader should use only regulated brokers who have a good reputation in the industry.

How to trade Forex in Togo – An overview

Forex trading in Togo requires three essentials:

- Uninterrupted internet connection

- Smartphone or computer

- A licensed and reputable broker

The internet connection should be strong and stable for you to trade with ease. If the connection is unstable, you can lose profitable trades or your funds. For instance, you click on CLOSE to exit a trade. A bad connection can delay this action, possibly leading to the loss of profit you already earned.

A licensed and good broker is also important to this venture. An unregulated broker might be a scam artist posing as a forex broker. Many have lost their investments to scammers.

Here’s how to identify a good Broker:

- Verifiable license

The regulator’s name and broker’s registration number are often stated at the bottom of the broker’s webpage. You can confirm these details by visiting the regulator’s website to check their brokers’ list.

- Competitive trading costs

The broker’s spreads, commission, and other fees must be within the market average, if not below. You can compare their prices with other reputable brokers.

- Free demo account

A good broker must offer a free demo account with virtual funds to allow prospects to test their services. The free demo access must be available for at least 30 days. Many brokers offer 90 days of access to their demo accounts or more.

- Round-the-clock customer service

Legit brokers ensure customer service is available 24 hours throughout the market days. They also make support easily accessible through live chat on the website or platform, phone, email, and in some cases, social media chat.

- Easy deposit and withdrawal methods

Reputable brokers ensure they provide easy means of funding and withdrawal. Therefore, the payment methods offered must be available in your region and easy to use.

These show that the broker is a genuine one and might be suitable for you.

Follow the steps below to trade:

1. Open account for Togolese traders

Go to the broker’s webpage to create a forex account. You should be redirected to a Togo-specific site. Many brokers provide multiple language services, so you might be able to switch between English and French.

Click on the create account tab and fill out the brief form that pops up. Your email will be required, and perhaps your name and phone number. After typing in the details, press OK and check your email for the broker’s verification link.

Click on the link to confirm the details you provided and continue the signup process. You might have to scan and upload a government-issued ID card and utility bill to prove the address you gave.

The broker then processes the information and sets up a trading account.

2. Start with a demo or real account

We recommend using the free demo before trading with the broker. It helps you test the broker’s platforms and see their offering.

The demo simulates the live forex market and the broker’s user interface. Using it shows you what to expect from the broker. Newcomers can get acquainted with the forex market before starting to trade.

The account must come with enough credits to carry out several test trades. Some brokers let you request more virtual funds on this account if you exhaust the initial credits.

3. Deposit money to trade

Once satisfied with the test, you can deposit money in the account to conduct live transactions.

The FUNDING tab on the platform will have the option to do this. Clicking on the deposit option should display several payment methods you can choose.

Most brokers often assign a support rep to assist newly signed up customers. But the process should be straightforward if the payment methods are available in your region.

The funds you transfer should reflect on the account once you refresh. Usually, the account gets the credit almost immediately.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

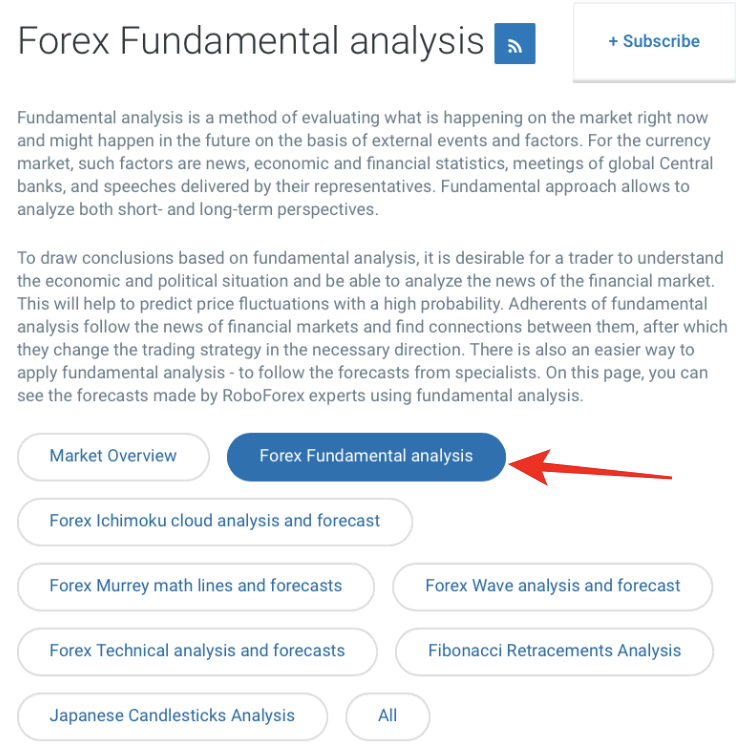

4. Use analysis and strategies

Before your first trade, it is recommended that you examine the forex pairs you wish to trade.

The way to do this market analysis. You need to analyze the currencies to understand the price movements. With this insight, you can make the best trading decisions.

Successful traders conduct 3 types of analyses before placing trades:

- Fundamental analysis

- Technical analysis

- Market sentiment

The fundamental analysis examines the country’s economic factors that affect the currency’s exchange rate. The economy determines the currency’s value. So traders must analyze the economic elements to understand the price directions and predict future price patterns. Factors to investigate include the gross domestic product (GDP), interest rate, deficit or surplus, etc.

Technical analysis is analyzing the forex pair price using the price chart. Traders examine the chart and notice patterns that indicate trading opportunities. The patterns show the current price trends and the best entry and exit points. But the trader must know how to decipher these patterns for successful technical analysis. Forex trading platforms come with various indicators and charts to improve the analysis.

Market sentiments refer to market participants’ feelings and expectations. The trader studies the price movements to analyze market sentiments. Higher demand translates to more buying, causing the price to trend high. For forex assets, a rising price indicates that the market expects the prices to keep going up. Identifying the ongoing trend helps the trader understand the market sentiment.

These analyses are crucial for successful trades and help you adopt the best strategies for your desired asset.

Since the CFA franc is illiquid and hardly paired for online forex trading, many Togolese trade popular major pairs. The EURUSD, USDZAR, GBPUSD, and other actively traded pairs offer huge opportunities for Togolese traders.

Common forex trading strategies:

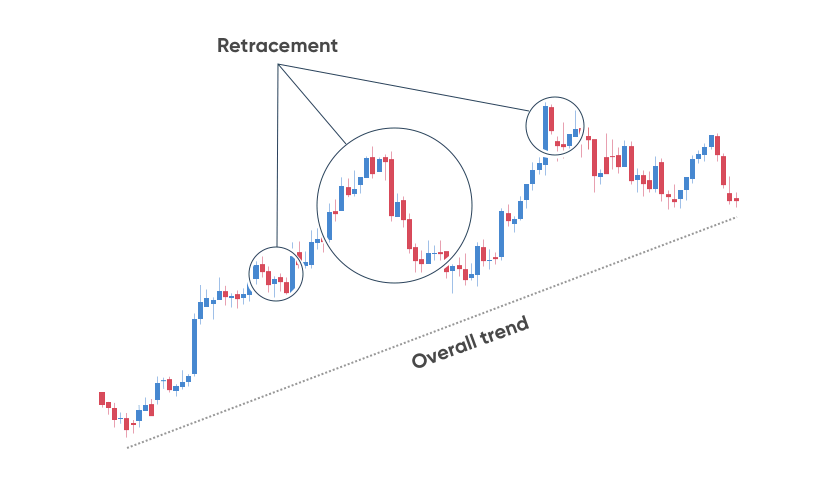

Trend trading

Trading the trend means entering and exiting positions based on the ongoing trend. A market condition can be an uptrend, downtrend, or ranging. BUY opportunities abound for the trend trader if the market is in an uptrend. A downtrend is the opposite, and a ranging market means the price is neither going up nor falling. The trader must correctly identify the condition before profiting from the strategy.

Range trading

Ranging market conditions, as we mentioned, means the asset price moves within two points. But it is neither trending up nor down. The strategy only applies to such market conditions. The trader must find the overbought and oversold points to trade profitably in this condition.

Many other effective strategies exist. The trader must research and thoroughly understand their chosen approach before using it.

5. Make profit

You should start to make a profit soon if you combine the appropriate strategy with the necessary analyses.

The profits will be in your forex account, and you can move it out or use it to trade.

Transferring funds out of the account should be as easy as depositing. Click on the same FUNDING tab and select withdrawal.

Fill out the form that appears, and the broker begins processing the request. Withdrawals take longer to reflect. On average, the money gets to you within two days.

The time length depends on the broker and the payment method. The bank wire method might take longer.

(Risk warning: 78.1% of retail CFD accounts lose money)

Final thoughts: The best Forex Brokers are available in Togo

Trading forex from Togo should be easy now with this guide. Choosing a suitable broker is key. Our recommended brokers meet the standard requirements and are certifiably safe for Togolese traders.

FAQ – The most asked questions about Forex Broker Togo :

Can you suggest trusted forex brokers in Togo?

Yes, several trusted brokers in Togo allow full-fledged forex trading to traders. You can sign up with one of these brokers and enjoy the fruits of trading. If you wish for the best forex trading experience, it is best to sign up with BlackBull Markets, Pepperstone, IQ Option, Capital.com, and RoboForex. These brokers have reputed regulating agencies overseeing their functions. You can sign up with them and enjoy trading forex with the best facilities.

Which forex brokers in Togo offer to trade with low fees and commissions?

There are not many brokers that support forex trading with low fees and commissions. You can choose one of the above five brokers if you want the best forex broker with a great trading platform. These brokers offer low trading fees. Besides, their inactivity fees id also low. When a trader signs up with any other forex broker, he might have to pay a high inactivity fee. So, these brokers are perfect for forex traders looking for brokers with low fees and commissions.

Can a trader in Togo use a demo account for forex trading?

Yes, a trader in Togo can use a demo account for forex trading. The brokers offer forex traders a free demo account for 30 days. Traders can use it for 30 days without paying any charge.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)