The 5 best Forex Brokers and platforms in Tunisia

Table of Contents

For Tunisia residents who want to start trading, the most important thing is to find the top best brokers in Tunisia or brokers that accept Tunisia clients and allow them to trade in Tunisian dinar (DT). Finding reliable brokers and platforms to trade with can be rather hectic.

See the list of the best Forex Brokers in Tunisia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Tunisia is a country that exports many items varying from agriculture products to mining and petroleum products. Tunisia also derives income from manufacturing as well as from tourism. Many Tunisia citizens are interested in Forex trading; however, there is no locally regulated Forex Broker in Tunisia till this present moment.

This article gives descriptive details about the five best Forex Brokers and Platforms in Tunisia. The list of the top 5 forex brokers in Tunisia includes the following:

- Capital.com

- Blackbull Markets

- Roboforex

- Pepperstone

- IQ Option

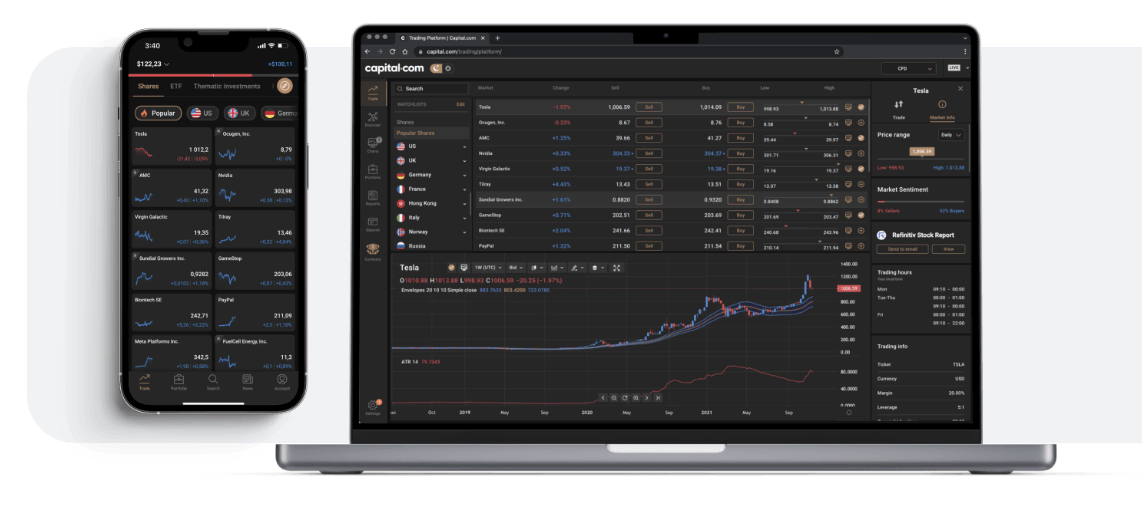

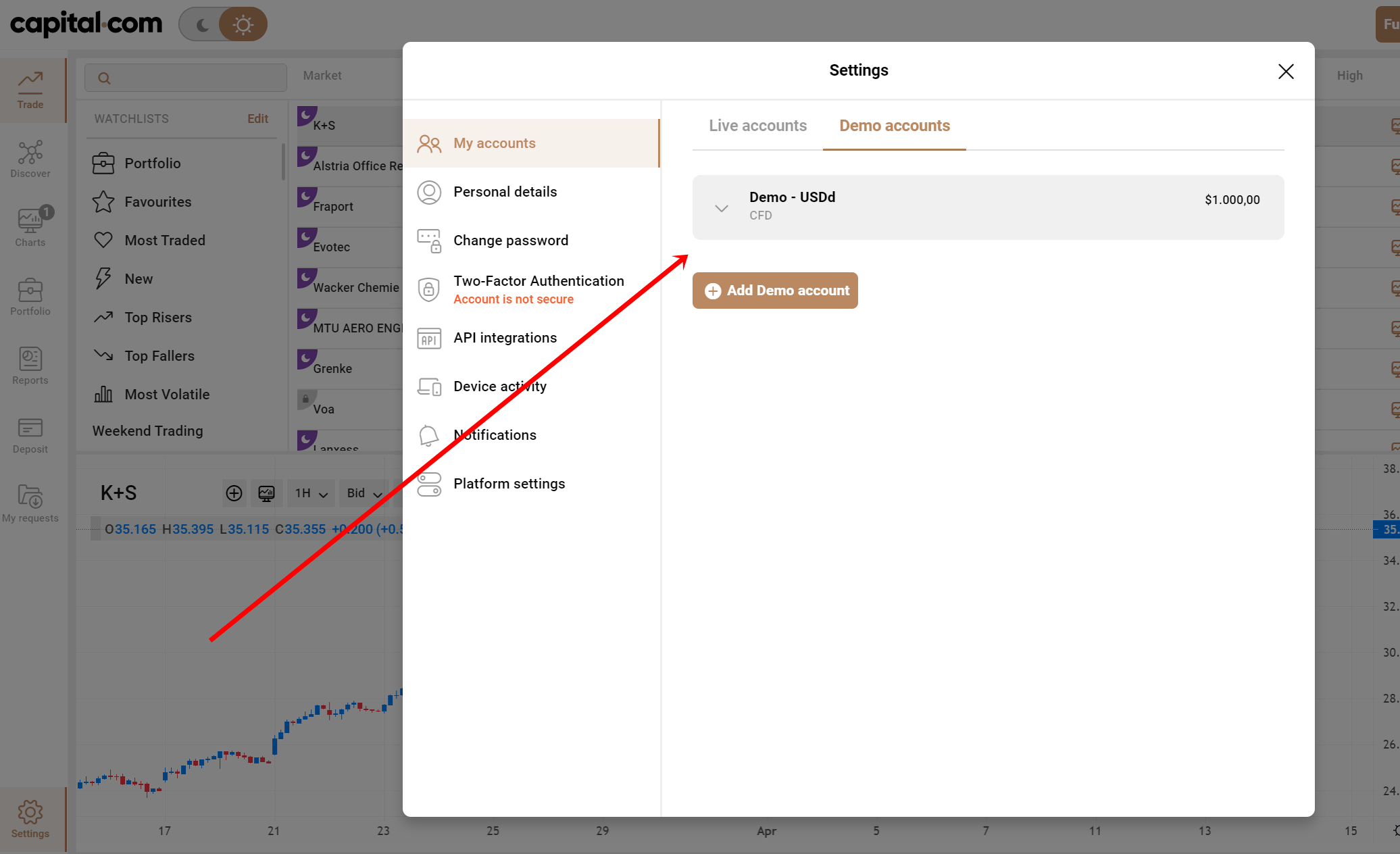

1. Capital.com

Capital.com was established in 2016. It has offices in five different countries: Cyprus, Australia, Seychelles, United Kingdom, and Gibraltar. And each is authorized and regulated locally.

As a beginner, when you trade with Capital.com, you will be provided with educational materials such as informative videos and articles. You will also undergo a 28 lecture course divided into five sessions, including a test to ensure that you understand the concept of trading on the Capital.com platform.

There is a wide range of assets to choose from as a trade on the Capital.com trading platform, assets such as indices, commodities, cryptocurrencies, foreign exchange, and stocks. As a trader on the Capital.com trading platform, you are protected by the law.

Benefits of Capital.com.

- Capital.com has low forex CFD fees.

- UK and EU Traders on Capital.com enjoy commission-free actual stock trades.

- It is easy to open an account with Capital.com

- Capital.com’s platform is user-friendly.

Drawbacks of Capital.com.

- A small number of accounts are not available for traders on the Capital.com trading platform.

- On the Capital.com trading platform, real stocks are not provided to Australian clients.

(Risk warning: 75% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a standard MetaTrader broker platform. It is a worldwide forex broker that was established in 2014. Its headquarters is located in New Zealand. BlackBull Markets is regulated by the Financial Markets Authority of New Zealand (FMA) as well as the Financial Service Authority of Seychelles (FSA); because of the authorities BlackBull is regulated by, the platform is considered safe for traders.

Assets available on Blackbull Markets include the following commodities, crucial currency pair has an,d indices. BlackBull was set up by a group of FX traders, data security professionals, and fintech developers. You can start trading metals, indices, CDFs, and energy on this platform as a beginner.

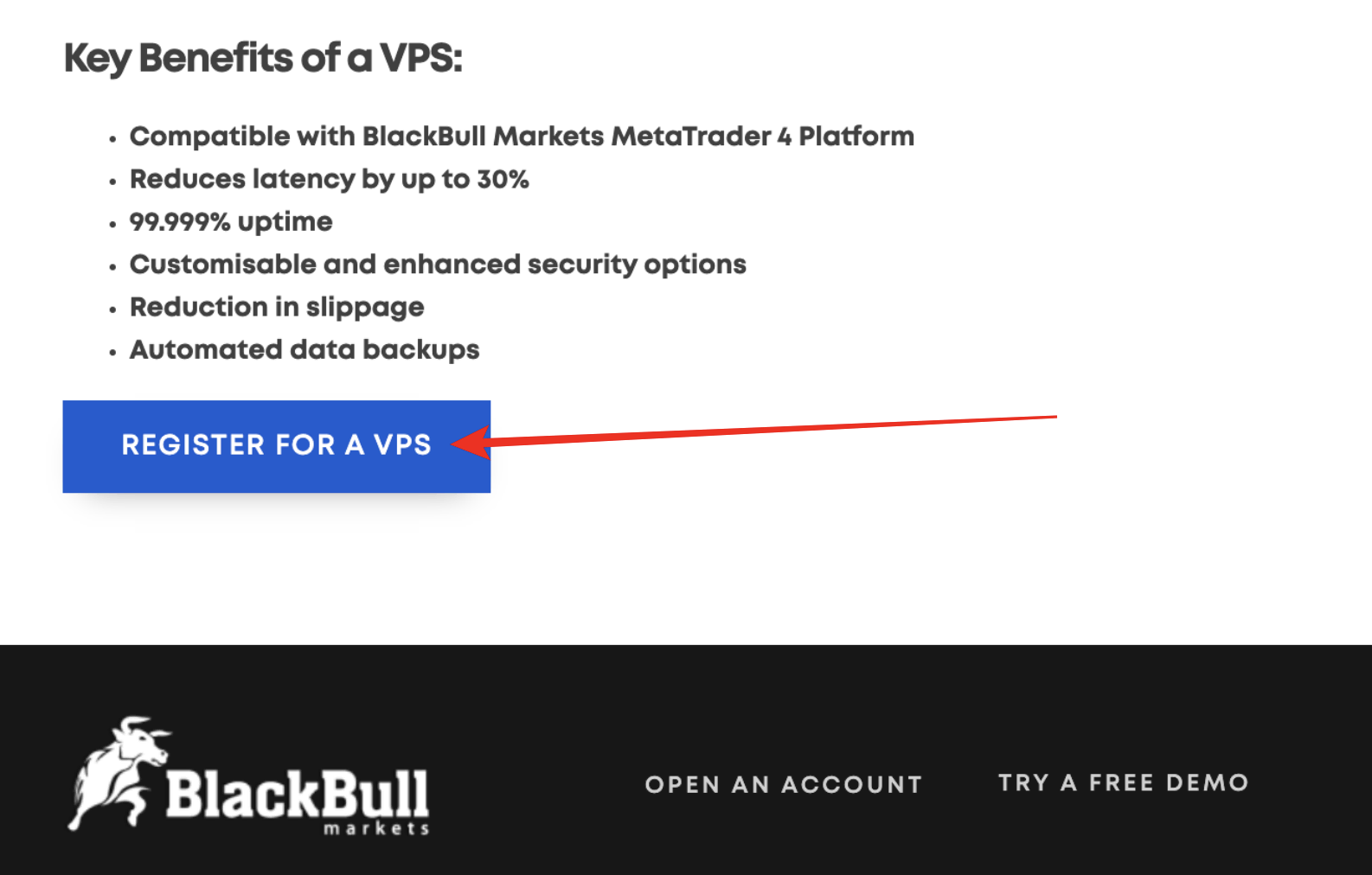

As a first-timer on the BlackBull Markets platform, you will see that you are offered an affordable price and suitable payment methods. You will also be provided free vital private servers (VPS) and API trading.

Benefits of Blackbull Markets

- BlackBull Markets has a low CFD and forex fees.

- Opening an account on BlackBull Markets is pretty straightforward.

- BlackBull Markets platform is fully digital, and it is user-friendly.

- As a trader on the BlackBull Markets platform, you will be provided with informative material such as demo accounts, educational videos, and texts to aid your trading processes.

Drawbacks of Blackbull Markets

- You will be charged a withdrawal fee.

- A high deposit amount is required for Prime Accounts.

(Risk Warning: Your capital can be at risk)

3. RoboForex

In 2019, RoboForex was established. In the Forex world, RoboForex is a leading software developer. RoboForex has over 3.5 million clients, and they are distributed in over 169 countries.

Most financial market experts consider RoboForex a trusted trading platform mainly because RoboForex has won plenty of awards during its short period of existence. RoboForex possesses an international license such as the FSC, which allows them to provide their services to clients abroad.

Advantages of RoboForex

- RoboForex provides their client with a favorable environment to trade on.

- A minimum deposit is required from you as a trader when you deposit money into your account.

- As a client abroad, you can trade on RoboForex because they have a license to provide their services abroad.

- When you withdraw, you get your money immediately. No form of delay is involved in the process.

Disadvantages of RoboForex

- Lack of cryptocurrency tools when trading.

- When you open an account on RoboForex, you have to deposit a minimum of $10 before you can start trading.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is a Forex trading platform that offers a vast loss of tradable markets, support for a series of social copy trading platforms, and high-quality research.

Pepperstone was established in 2010, and it started operations in London; afterward, it grew to offer its services to clients in the UK and Europe. Pepperstone has offices in over seven countries which include but are not limited to; London, Dubai, Limassol, Nassau, Nairobi, Düsseldorf, and Melbourne.

Pepperstone offers MetaTrader and cTrader to their clients; it provides a well-updated library of third-party tools. It also makes it easier for its clients to access the trading market.

Advantages of Pepperstone

- PepperStone has quite a large number of social trading platforms their clients can pick from to trade.

- The pricing of the PepperStone platform is relatively competitive for traders.

- Various platform add-ons are provided to clients to improve the MetaTrader experience.

Disadvantages of Pepperstone

- Pepperstone offers educational products that are of average standard.

- On the Pepperstone platform, you are provided with educational materials, but there are no assessments or tracking of your progress.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option was founded in 2013. It is one of the best trading platforms worldwide and in Tunisia. IQ Option started its operations as a binary trading platform (only for professional traders and those outside of EAA countries), but currently, the platform now provides CFDs trade.

IQ Option is a trading platform that allows you to trade in various assets. These assets include Crypto, Stocks, Commodities, ETFs, Stocks, and Indices.

On the IQ Option platform, you will find educational videos for all the trading patterns available. These videos will keep you informed about all you need to know before you start trading in a short period.

IQ Option has clients all around the whole. They have two types of accounts, namely the VIP trade account and the standard version.

Merits of IQ Option

- As a trader who wants to trade on IQ Option, opening an account is seamless.

- There are various trading assets from which traders can choose.

- Customer service is available 24 hours a day and seven days a week.

- You have access to webinars and video tutorials that will guide you on how to trade on the platform.

Demerits of IQ Options

- It takes a while when you withdraw through a bank transfer.

- You will be charged a withdrawal fee if you withdraw through a bank.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Tunisia?

The Central Bank of Tunisia published about thirty-four notes and nine circulars in 2021. Two circulars that went viral were circulars n°2021-06, posted on the 16th of September, and circular n°2021-07, issued on the 1st of September; the circulars address the revision of the scales of cereal crops credits and credits for agriculture and market gardening.

Another circular of significant contribution is that of n°2021-4 published 6th of July 2021, which mainly addressed the conditions of benefits and the management methods of the endowment line planned for refinancing. Changing the schedules of loans by banks for another purpose for SMEs helps curb the consequences of the pandemic.

Regarding risks, the Central Bank also published two circulars: the first was solely on the division, risk coverage, and monitoring of commitments in which the Central Bank requested for other banks and financial institutions to be put aside general provisions, which were referred to as collective provision, to cover up for risks to come regarding commitments requiring special monitoring.

The Central Bank passed several provisions relating to exchange transactions, currencies, interest rates, and tools that permit hedging against risks of rising and falling commodity prices.

Regarding the execution of monetary policy by the Central Bank of Tunisia, a circular published on the 8th of September 2021, circular n°2021-08, stated the means of mobilization of negotiable assets generating coupon payments accepted as collateral.

The Central Bank of Tunisia reduced the discount rate for banks to ensure proper financing of the economy and to take note of the preferential sector of export and production. This process was carried out to make the previous control measures easy and help banks satisfy the immediate credit demands requested by organizations.

Money market restructuring took place in January 1988. It helps exalt the set up of a short-term capital market, which gets to be open up to many traders, and the interest rate shows the actual value for your money.

(Risk warning: 75% of retail CFD accounts lose money)

Security for traders from Tunisia – What you should know

Majority of people that trade Forex now trade online. Traders feel the need to take control of their finances mainly because of the economic situation of not being sure of what could happen next.

As a broker, before trading on any platform, ensure that the platform is recognized internationally and sure they are being regulated by an internationally recognized controlled body. If the broker does not have an office out of Tunisia or clientele out of Tunisia, you should avoid trading on such Forex trading platforms.

Also, take note of the historical spreads given to you by brokers you intend to trade with. The spread refers to the amount you must pay to your broker every time you make a trade. Ensure you choose the broker with the minute spreads. It is also essential to note whether the broker’s customer service relations are excellent or not.

As much as you can, avoid bucket retailers. Bucket retailers are brokers that are not regulated by any regulatory body. They trade for you, stating that you will get a fixed amount, but these brokers wait for the trade price to increase to keep the difference in trade.

Is it legal to trade Forex in Tunisia?

Trading Forex in Tunisia has now become well known. The number of traders in Tunisia has increased rapidly over the last half-decade.

Worldwide, traders trade an average of USD 5.1 trillion every day. Compared to other financial sections, the gap is much.

Trading of Forex in Tunisia is allowed, and it is safe to trade Forex on any credible Forex platform in Tunisia. Forex trading is an essential part of exporting and importing; Tunisia’s economy relies solely on this.

The most important thing to do as a trader is to look out for a trusted Forex trading platform regulated by international regulatory bodies. Contrary to the misconception, Forex trading is not banned in Tunisia; you can trade on any reliable Forex platform online. A forex trader is legal in Tunisia.

How to trade Forex in Tunisia – Helpful overview

Open account for Tunisian traders

As a trader who wants to trade Forex in a country such as Tunisia, you have to open an account; to do that, you will be required to provide a valid Identity Card and proof of address. Valid identity cards can be your voter’s card, driving license, or national identity card. The evidence of residence address can be your bank statements or utility bill.

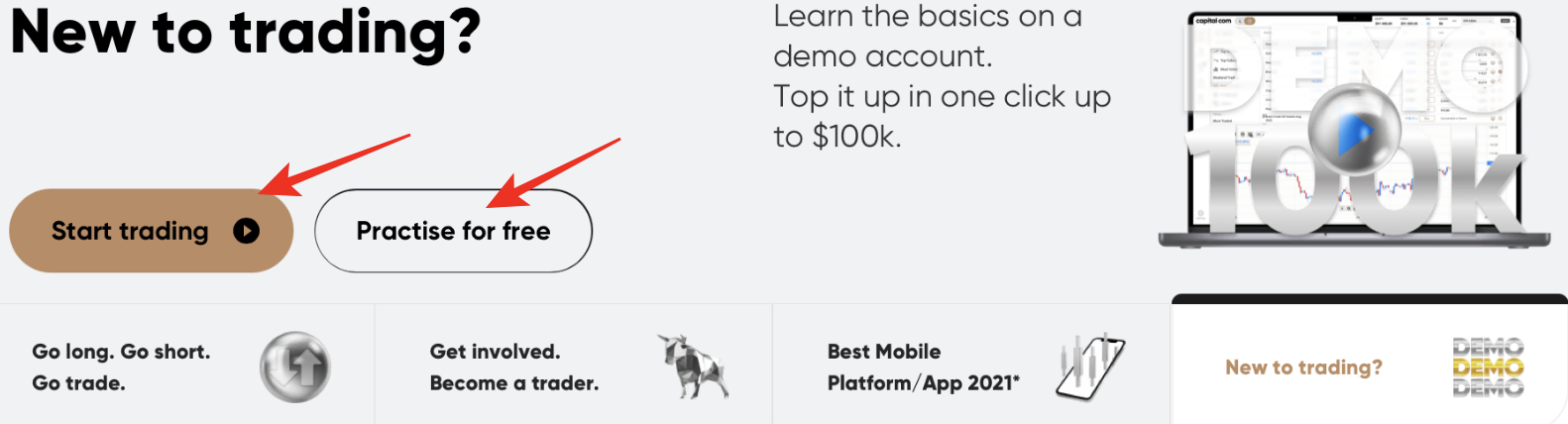

Start with a demo account or real account

Are you new to trading Forex? If you are, it will be best for you if your startup has a demo account to avoid losing your money. You should open a demo account with the broker of your choice; having a demo account will help you understand the trading platform and get you familiar with how the platform works without you losing real money.

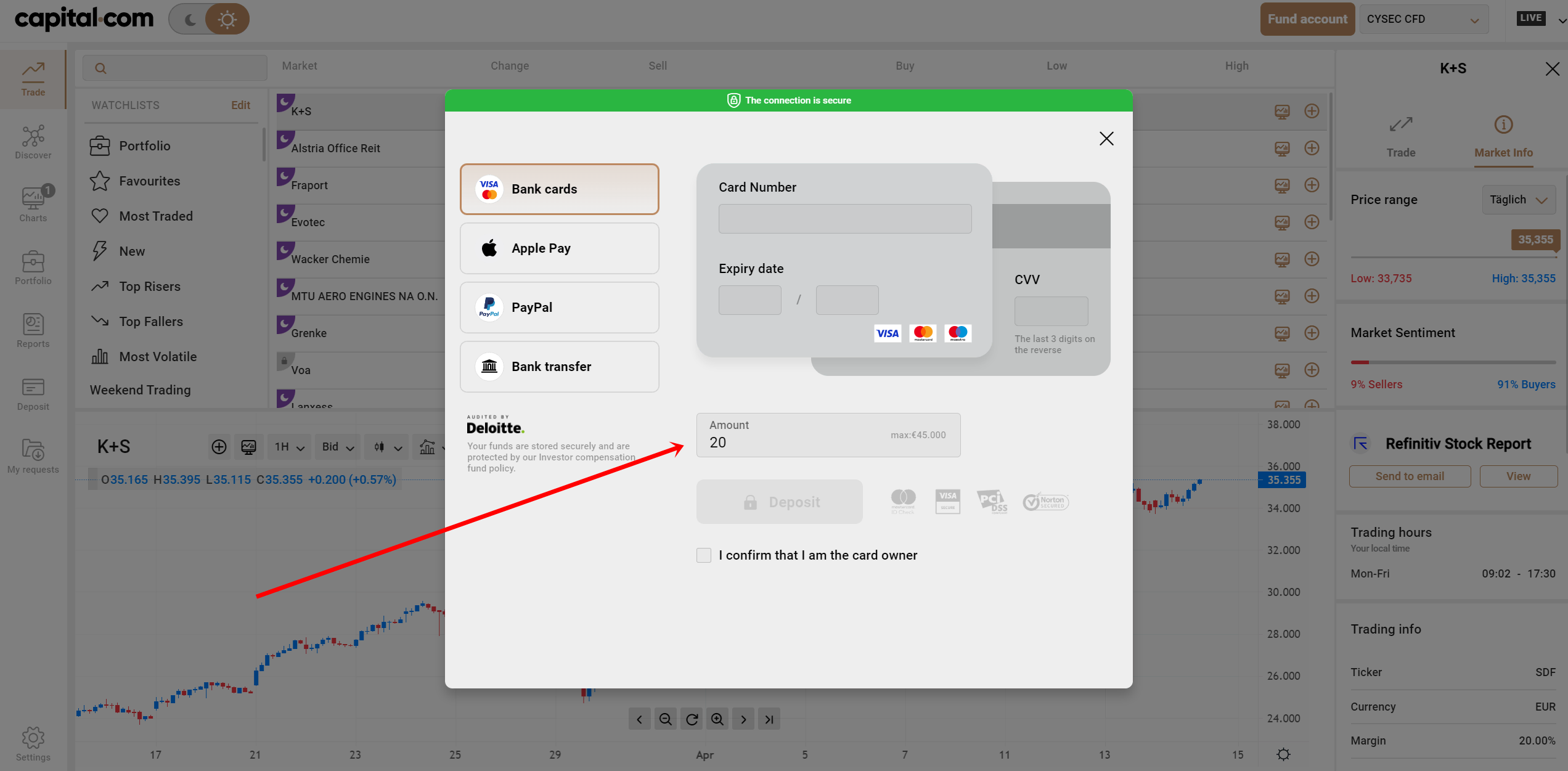

Deposit money

After you have found out which trading platform you want to trade on and opened an account, you will have to deposit money into the account to start trading. There are different ways to choose which currency you want to trade in, although the currency you will trade in is highly dependent on the trading platform you are trading on.

You can find your account through the following methods but are not limited to this list: debit cards, wire transfers, and electronic payment systems such as PayPal or Skrill. It takes one working day for you to fund your account on the majority of the trading platforms.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

As a Forex trader, there are several analyses and strategies you can use to help you choose to buy or sell at every given time. Getting familiar with these strategies will make trading easier for you. You also have to know which approach works for you and apply them judiciously.

These strategies include:

Position trading

Some traders maintain their position on the trading platform for weeks or even a year, these trading use position as a trading strategy. Position trading as a strategy is a long-time trading method; this method involves traders making a macro view of the market and accepting small market fluctuations that could affect their position.

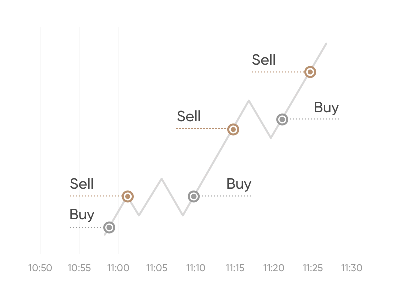

Scalping

Scalping is a strategy method that is well known among forex traders. To use this strategy as a trader, your focus will be mainly on small market movements. What this strategy entails is that you open a large number of trades to earn a small profit on each trade.

A scalping strategy helps traders maximize their earnings by putting together many small gains.

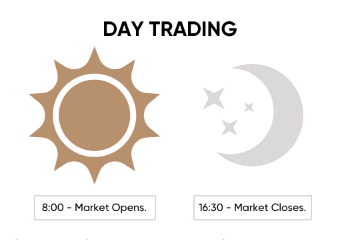

Day trading

Day trading is simply described as the process of exchanging currencies inside a single trading day. This strategy is primarily used in Forex trading even though it can be used in any other trading market.

Day trading strategy involves you opening and closing all trades in one day.

Make profit

As a Forex trader on any reputable platform, make a profit by setting up a foreign exchange contract with your broker. Before you start trading, ensure you have a plan and stick to the plan during your trading process. Also, put into consideration risk management conditions when trading.

Have at the back of your mind the amount you want to make a profit; when you have attained your goal, exit the trading platform. Take time to take stock of the process before continuing another trading process.

(Risk warning: 75% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Tunisia

As a starter in Forex trading, it is straightforward for you to get anxious when your Forex trading doesn’t go according to your plan, or in most cases, the profit is minimal compared to the amount you had in your project. Just ensure you don’t give up; learn more about the platform you are trading on, and you will get better at it.

You must understand how the Forex market works and ensure you employ new trading strategies from time to time to help you make more profit.

It is also essential to tread with caution, avoid throwing caution into the wind and be well informed about the trading market. Also, ensure a well-structured strategy that works best for you to keep making profits.

In addition, make sure you always trade on trustworthy Forex trading platforms with regulatory bodies and are also recognized internationally. When a trading platform has an international presence, you will be able to research and get reviews from traders worldwide that have traded or traded on the platform.

FAQ – The most asked questions about Forex Broker Tunisia :

Is forex trading permitted for traders in Tunisia?

Yes, forex trading is permitted for traders in Tunisia. You can enjoy trading forex in Tunisia by finding the best broker. No rules in Tunisia bar traders from trading forex. That is why several forex brokers in Tunisia offer traders the best services.

Are there any good forex brokers in Tunisia?

Yes, there are many good forex brokers in Tunisia. You only need to research before looking for one. While choosing a trading platform, a forex trader must ensure that the forex broker in Tunisia offers the following benefits.

Trading tools and technical indicators

Trading charts

Educational resources

Faster execution

Trading help

Besides, forex traders should also ensure that the forex broker is regulated. Several unregulated brokers might operate in Tunisia trading with whom can prove a challenge for traders.

How small a minimum amount does a trader in Tunisia need to begin forex trading?

Every forex broker in Tunisia has a different requirement when considering the trading of forexes. Most brokers allow you to start trading with a low investment. For instance, brokers such as IQ Option allow you to begin forex trading in Tunisia for only $10. So, $10 is the minimum investment a trader needs for forex trading.

Last Updated on April 14, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)