4 best Forex Brokers in Turkey – Comparisons and reviews

Table of Contents

Are you based in Turkey and looking for a good broker with tight spreads?

See the list of the best Forex Brokers in Turkey:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | Not regulated | Starting 0.1 pips variable & low commission | 300+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Low spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

We bring you a list of 5 with the best trading conditions and the lowest spreads.

4 Best brokers in Turkey

- RoboForex

- BlackBull Markets

- Pepperstone

- IQ Option

Here’s an overview of each:

1. RoboForex

At a glance:

- Minimum deposit – $10

- License – IFSC.

- Fees – spreads start from 0.0 pip on ECN, prime, and RStocksTrader. The commission is $15/1million lot size.

- Support – available 24-5

- Payment method – Bank transfer, Neteller, Skrill, credit, and debit card.

RoboForex was established in 2009 in Belize. The broker has since become one of the industry’s most credible and reputable.

The company now boasts nearly a million active customers from around the world.

Traders enjoy ECN’s fast execution with a low minimum deposit and competitive trading costs here.

RoboForex holds a license from its home country, Belize.

Clients’ money is kept separate from the company’s. The broker also protects customers’ funds through the Financial Commission Compensation funds. This insurance scheme provides customers with up to €20000 compensation in case of eventualities.

Turkish traders can choose from the broker’s several account offerings. The accounts vary and allow newcomers, experienced, and expert traders to have a suitable option among the 5.

Traders can also choose from 4 platforms to trade on. That is the MT4, MT5, cTrader, and rTrader. These are available on Apple, Android, and Windows. This means that clients can trade on their smartphones too.

RoboForex offers several bonuses to enrich the traders’ experience further. These bonuses may not be available for withdrawal. But they offer the opportunity for increased profits.

The drawbacks of trading with RoboForex

- Currency pairs are limited

The broker only offers around 30+ forex pairs. It has a few market instruments compared to its competitors. But if the trader finds all the currencies that interest them, RoboForex is a great choice.

(Risk Warning: Your capital can be at risk)

2. BlackBull Markets

Summary:

- Minimum deposit – $200

- License – FMA, FSA.

- Fees – spreads start from 0.0 pips. The commission is $6 per round turn.

- Support – 24 hours. Mon – Fri.

- Payment method – MasterCard, Visa, Bank Wire, Neteller, Skrill.

BlackBull Markets is a New Zealand-based financial institution and forex dealer. The company was established in 2014 and has branch offices in the United Kingdom, New York, Kuala Lumpur, and Jakarta.

BlackBull operates under the regulations of its country’s body and is also registered in Seychelles. The licenses are from the Financial Markets Authority (FMA) of New Zealand and the Financial Service Authority (FSA) of Seychelles.

The broker is a trusted ECN non-dealing desk company. That means traders enjoy fast order executions and access to huge liquidity.

Its services are provided on the famous MT4 and MT5. Turkish traders can enjoy the full MetaTrader suites with all the indicators, charts, and tools.

BlackBull Markets also offer social trading on Zulutrade and MyFxbook. This service allows customers into a community of skilled forex traders, where they learn and copy effective strategies.

As a genuine ECN broker, tight spreads are guaranteed here. Customers sometimes enjoy zero spread on the raw account, and the average on the Standard account is 0.8 pips, although these accounts are commission-based.

The minimum deposit to trade with BlackBull Markets is $200 for the ECN Standard account. $2000 for the prime account.

The disadvantage of trading with BlackBull Markets:

- High minimum deposit

Other low-spread brokers require a minimum deposit between $0 and $100. Traders, especially new ones, might want to start with a small amount. $200 is comparably high, and such traders may seek other brokers with a low minimum deposit.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

At a glance:

- Minimum deposit – $0 ($200 recommended)

- License – ASIC, FCA, CySEC, BaFin

- Fees – spreads from 0.0 pip. The commission is $3 per trade.

- Support – available 24-5

- Payment method – Credit and debit card, broker-2-broker, bank wire, PayPal, Skrill, Neteller, Union pay.

Pepperstone came into the market in 2010 and had its headquarters in Australia.

The brokerage company is among the most well-respected and highly acclaimed. It is regulated in more than seven jurisdictions. Four of which are tier-1 regulators.

The broker is among the top choice for experienced forex customers, not because it is not suitable for beginners. But due to its well-known favorable trading conditions and general services.

From novice to expert, traders find an account that suits them here. Clients enjoy competitive fees with spreads starting from 0.0 pips from one of the best brokers in the industry.

Pepperstone is a flexible broker that allows different trading strategies, including hedging, scalping, and copy trading.

Its trading platforms are MT4, MT5, and cTrader. Available in different languages, including Turkish. Traders can access accounts on their smartphones or a computer. Turkish traders can access a large variety of market instruments, such as 60+ forex pairs and CFDs. The currency crosses include major and minor currencies that are paired with the Turkish lira. It provides ample opportunity to speculate on the country’s national currency.

Its research and education content is rich with valuable information for all levels of traders.

The disadvantage of trading with Pepperstone

- Traders from the US are not allowed

If you’re Turkish and based in the US, you cannot trade with Pepperstone.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Turkey?

Because of its location, Turkey plays a pivotal role in linking Europe to the Middle East.

As its varying population strives for economic growth, many of its young citizens look for different income streams.

The striving has led many of its young population to seek opportunities in the currency market. The CMB has also devised a few policies to protect Turkish forex traders.

The Capital Markets Board of Turkey (CMB) is the institution responsible for Turkey’s financial market activities. Although, brokers are not required to obtain a license to accept Turkish citizens. But brokers must seek approval in the form of authorization to trade with the Turks. The board has also added new regulations that allow Turkish traders access to only 1:10 leverage. Compared to other jurisdictions around Europe, the leverage is extremely low for forex traders. Forex brokers here must also request a minimum deposit of 50000 lire from customers. This sum is between $8000 and $9000. It is far too high for most people to afford.

Turkish forex traders must look for brokers with a tier-1 license and CMB authorization to trade safely and within their country’s laws.

They must also pay taxes on income tax on their forex profits. The tax ranges between 15% to around 35%, depending on the amount earned.

Security for traders in Turkey

All the aforementioned restrictions make forex trading a highly unattractive venture in Turkey.

But its citizens continue to trade, and brokers outside the country, not adhering to these regulations, still accept Turkish traders.

To be safe, traders from Turkey must seek reputable brokers that hold internationally recognized licenses. High-leverage traders should ensure their choice brokers offer negative balance protection. Traders must be careful to trade within the country’s regulations.

Is it legal to trade forex in Turkey?

Yes. Forex trading is legal in Turkey. Traders must seek a licensed broker that is approved by the country’s Capital Markets Board to trade safely. Turkish citizens and traders based here must adhere to the CMB minimum deposit and leverage rules to trade legally in the country.

How to trade forex in Turkey – A detailed guide

If you live in Turkey and wish to go into forex trading, you must first seek a good broker. As we mentioned, the broker must have a license and should be approved to receive Turkish clients.

We have recommended a few of the above.

Now, we will explain the ideal steps to trade forex here in Turkey:

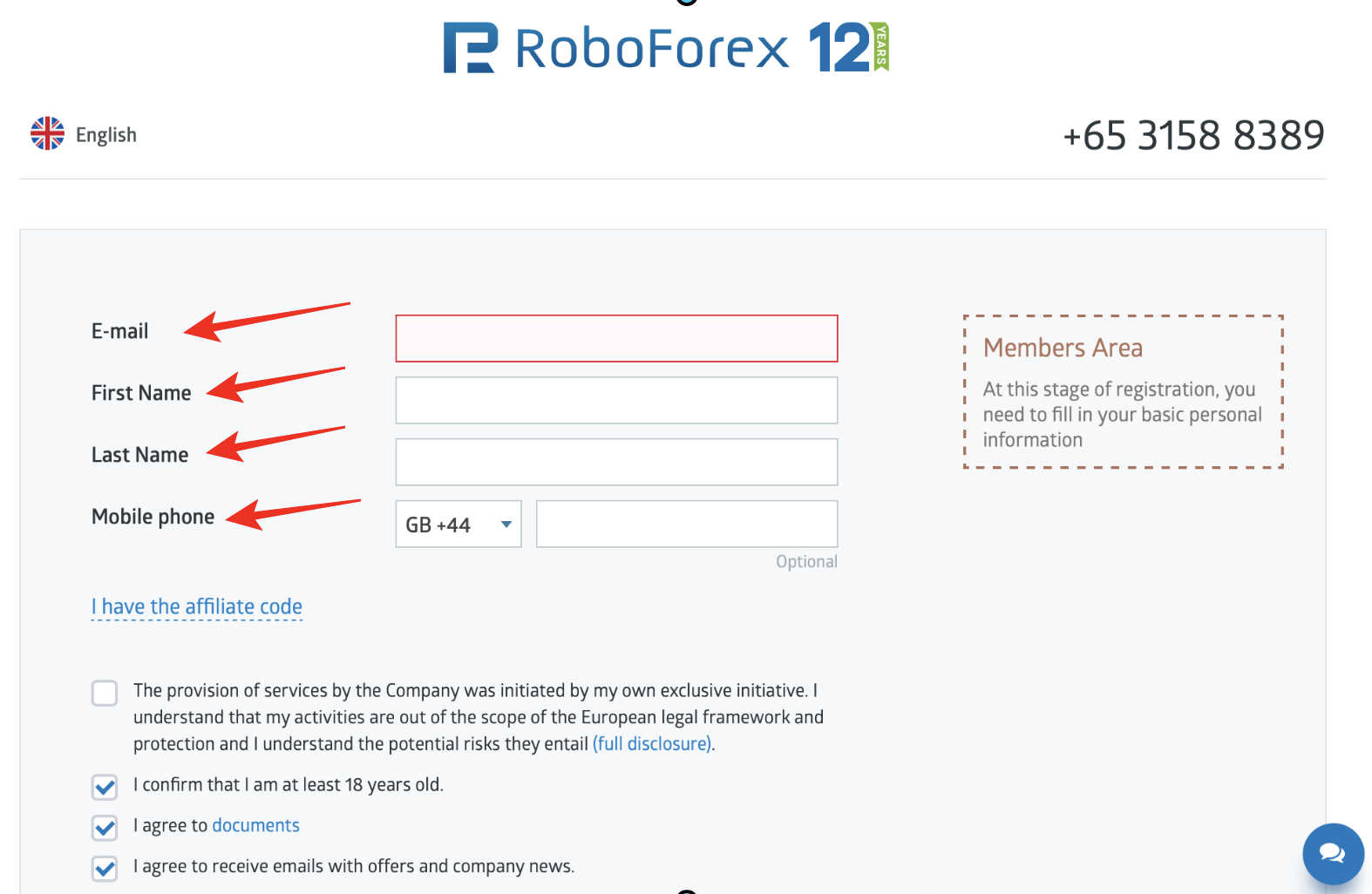

1. Open account for Turkish traders

Brokers normally have different websites for different regions. That’s because the services vary according to jurisdictions. For instance, Turkish traders can access 1:10 leverage and interest-free accounts. Whereas its neighbor Greece might be able to access 1:30 leverage. But no interest-free forex account.

That is why you must ensure you open your country-specific brokerage account. This way, you can enjoy all the services meant for Turkish traders. And you also trade within your country’s regulations.

If in doubt, contact the broker’s customer support to make sure you have the appropriate web address.

Input the required details on the site. Usually, the broker sends a verification link to your email after this. Click on the link to verify the email and complete the signup process.

The broker might request a country ID and proof of address. You can scan and upload this to fulfill the requirement and get a forex account.

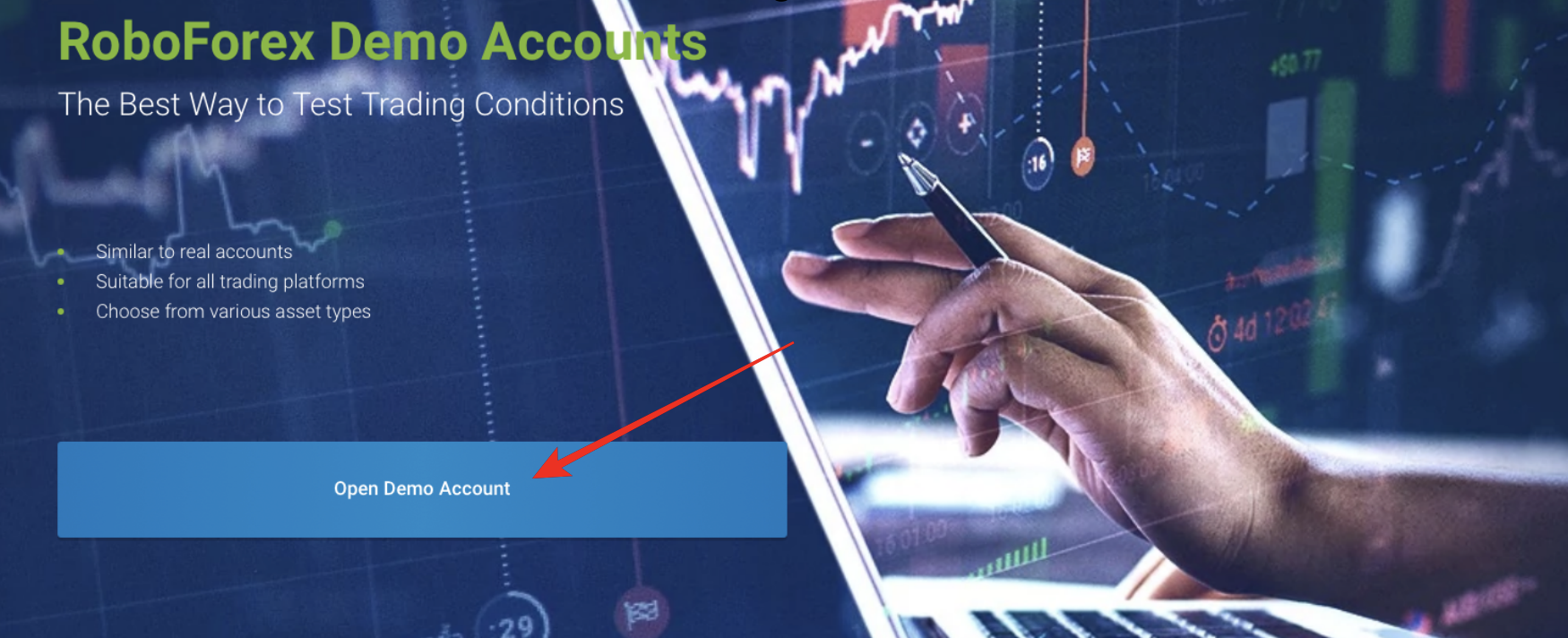

2. Start with a demo or real account

You may decide to test the broker’s platform with the free demo before trading live.

The broker credits this account with fake money for you to trade with. You can trade the market with up to $10000 virtual funds. Most forex traders practice different strategies with this account before depositing “real” money to trade live.

We always recommend the free demo for new traders. Use this until you feel comfortable, then transition to a live account.

3. Deposit money to trade

Brokers normally assign dedicated support to new customers to guide them through the first stages. This stage includes fund deposit processes.

You will have to fund the new account with at least the minimum required amount. The broker will provide different payment methods to make this process easy.

Popular payment methods are Visa, MasterCard, Bank wire, PayPal, Skrill, Neteller, and a few other online payment portals.

Third-party fees may apply. Brokers hardly charge deposit fees.

If you are testing the broker with a real account, we recommend depositing the smallest amount required for this test. That limits the financial risks for you.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use strategies and analysis

It is wise to analyze the market and research different strategies before you trade. Most Turkish forex traders stick with speculating on the lira.

Here are a few suggestions on strategies that suit the Turkish lira:

Day trading

This approach involves opening and closing trade positions within the day. The trader, in this case, conducts all their trades and closes all positions before the end of the day. It is among the most common trading strategies.

Scalping

Scalping is a form of day trading in which the goal is to profit from the smallest price movements. The trader does this by leaving positions open only for a few minutes. The profit for each trade here is tiny. But the trader conducts many trades within a few hours, and money quickly adds up to a reasonable sum.

Trading the news

Many forex traders look to news releases to make decisions. They base all their moves on information from the news. But this style requires that the trader understands how market participants respond to information. That way, they can foresee price direction and place successful trades.

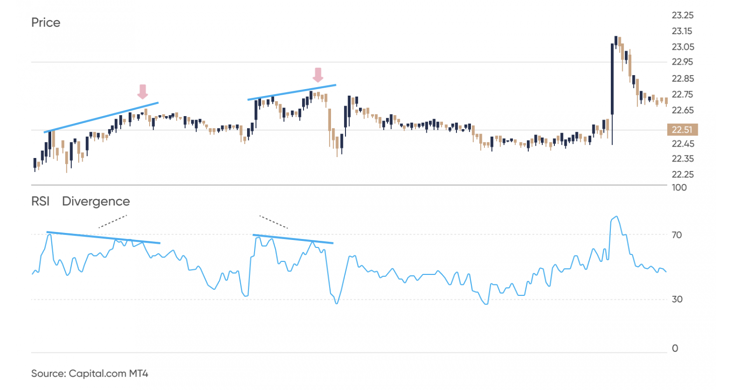

Technical analysis trading

Trading platforms come with various indicators and analyses for the traders’ use. Many forex traders use these indicators to find trading opportunities. These technical traders pay little attention to other factors unrelated to the chart indicators. To use this approach successfully, traders need to understand how to interpret charts and trade signals properly.

These are among the many strategies for trading the forex market. Many traders combine multiple strategies for strong trade signals. Others focus on one or two approaches. It’s essential that the trader fully understands the basics of the technique they choose to employ.

5. Make a profit

If you use the right approach and trade with a good broker, you will realize some profits before long.

There are many effective forex trading strategies. But they require correct use to be profitable for the trader.

If applied accurately, the trader starts to earn profit in little time.

You can withdraw the earnings or reinvest them to increase your capital and potential profit.

The same methods that you used to deposit funds should work for withdrawals.

On the broker’s trading platform, the FUND MANAGER tab should contain an option for transferring funds from the trading account.

Click on the TAB and select WITHDRAWAL. A page appears for you to enter your details and the payment information.

Once you fill out the form and click on SUBMIT, the broker receives these withdrawal requests.

The processing time to move your profits depends on the broker. But it usually takes between a few hours to a maximum of 2-days. The payment method also determines how fast or slow the funds get to you.

Once the processing is done, you should receive your profit in the selected account.

We should mention that most brokers will delay the process if the trader has not uploaded their ID for proper KYC.

Final thoughts: The best Forex Brokers are available in Turkey

Despite the harsh regulations of the Capital Markets Board, many international brokers outside the country still accept Turkish customers.

These brokers also make their services available in Turkish and Arabic. And they offer Islamic interest-free forex accounts. That is, they still welcome traders from this region with open arms.

It is up to the trader to select a globally-reputable broker having one or more internationally recognized licenses.

The brokers mentioned herein are among the best ones.

FAQ – The most asked questions about Forex Broker Turkey :

What are the best forex brokers in Turkey in?

The best forex brokers in Turkey as of are listed below.

– Roboforex -Most trusted and best broker overall.

– Interactive Brokers – Suited best for professionals and great overall.

– FOREX.com – It is an excellent platform offering all the features.

– FP Markets – It is good for MetaTrader and offers excellent pricing.

– Admiral Markets – It is a great option for MetaTrader.

– IC Markets – It is the best MetaTrader broker and offers comprehensive trading tools and strategies.

What should I check while selecting the best forex broker in Turkey in 2022?

To find the best forex broker in Turkey, you must check the following.

1. Whether the broker is well licensed and regulated.

2. Compare the fees, including spreads, commission, and withdrawal fees, with the other brokers.

3. Check about the minimum deposit required.

4. Register and create an account, and check the platform features like charting, features, usability, and customer service

How much leverage can I use for forex broker turkey?

Officially, Turkey has the lowest global maximum leverage ratio of any nation. As a result of the 2017 changes, traders from the nation are permitted to leverage their CFDs up to a maximum of 10:1. Higher leverages of up to 500:1 are frequently offered by many offshore brokers.

In our opinion, it’s best to be cautious and avoid visiting unofficial websites like this. Select a broker with a license from the CMB or, at the very least, another top regulator.

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)