Five best Forex Brokers and platforms in Turkmenistan – Comparison and reviews

Table of Contents

Introductions

Forex trading requires the forex trader to start by registering a trading account with a forex broker if you require a reliable forex broker that offers low trading costs and has quality trading features, select from the five recommended forex brokers.

See the list of the best Forex Brokers in Turkmenistan:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the five best forex brokers in Turkmenistan includes:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

It has over 5 million forex traders registered on its trading platform since 2016. Trading instruments offered include stocks, commodities, shares, cryptocurrencies, and indices, and have trading licenses from the FCA, CySEC, and ASIC.

Capital.com is a secure and multi-regulated broker with low trading costs and no commissions. Its user interface is powered by advanced AI technology to ensure that traders have a user-friendly and efficient platform.

It also has negative balance protection for its users and complies with investor protection rights. It has quality educational content and has the Invest mate application that offers educational resources for trading to make it easy for traders to access learning materials.

Overview

- Minimum deposit-$20

- Licenses-FCA, ASIC, CySEC

- Platforms-MT4, web-trader

- Spreads from 0.8 pips on major pairs

- Support-24/5

- Free demo-yes

- Leverage-1:30

It offers three types, Standard with an initial deposit of $10, Premier has $10,000, and Plus requires $2000. Forex spreads start at 0.8 pips, and it is a zero-commission forex broker. It has no inactivity costs, overnight costs vary with the asset, and the deposits and withdrawals are free.

It has copy trading features using third-party platforms such as MyFxbook, and ZuluTrade.Capital.com has a mobile application, desktop platform, and web version compatible with Windows and IOS.

Disadvantages of Capital.com

- It has high overnight costs. Capital.com has a higher overnight cost, especially when trading volatile pairs. Trend traders and long-term traders might find this challenging as they keep positions open during the night.

(Risk warning: 75% of retail CFD accounts lose money)

2. Pepperstone

Since 2010 when it started its operations, thousands of traders have been using its trading platform. Trading instruments offered include forex, ETFs, Indices, Commodities, and Shares. It has a trading license from the Financial Conduct Authority and Australian Securities and Investment Commission.

Pepperstone is a forex broker with multiple regulations from tier-one regulations, making it one of the trusted forex brokers. It has fast order processing rates and low trading costs. It also offers negative balance protection for traders securing their funds if a leveraged trade goes against the trader’s predictions.

It is also known to offer quality trading resources, trading tools such as technical indicators, charting tools, and risk management options. It has tight spreads and low commissions on the Razor account.

Overview

- Minimum deposit-$200

- Licenses-ASIC, FCA

- Platform-MT4, MT5,c Trader

- Spreads-0.0 pips on the Razor account

- Support-24/5

- Free Demo-yes

- Leverage-1:400

It has Razor and Standard accounts, with an initial deposit of $20. Forex spreads start from 1.0 pips for the Standard account and 0.0 pips for the Razor account. The Razor account charges $7 per $100,000, while the standard account has no commissions.

It has no inactivity costs, the overnight charges vary with the asset types, and the deposits and withdrawals are free.

Disadvantages of Pepperstone

- It has limited educational and research resources. This forex broker has industry standard trading resources but has limited learning resources. It has some materials which can be categorized as average in the industry but has room to add more educational and research resources to remain competitive with other brokers.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

3. RoboForex

It has been offering brokerage services since 2009 and has over one million traders registered since then. The trading instrument offered includes Cryptocurrencies, ETFs, forex, indices, stocks, metals, and commodities. It has a trading license from the Financial Services Commission in Belize.

RoboForex is a trading broker offering fast order processing rates, low trading costs, and low initial deposits. This forex broker also offers negative balance protection and quality trading tools, including the risk management tools like stop-loss and take-profits orders.

Forex traders looking for a high leverage broker can check the different leverage rates offered on the five accounts it offers. It also has the copyFX platform for copy trading. It is available on mobile applications, desktop, and website versions.

Overview

- Minimum deposit-$10

- License-FSC

- Platform-R-stocks trader, c Trader, MT4 and MT5

- Spreads-0.0 pips

- Support-24/7

- Free demo-yes

- Leverage-1:2000

Account types offered are the ECN, Prime, Pro, and Pro-cent have an initial deposit of $10, while the R-stocks trader requires 100 dollars. The Pro-cent and Pro account have forex spreads from 1.3 pips, the ECN and Prime from 0.0 pips, and the R-stocks trader starts at $0.01.

The ECN has commissions of $20 per $1 million; the Prime has $15 per one million, the R-stocks trader starts at $1.5, while the Pro and Pro-cent have no commissions. It has overnight charges for open positions during the night; the rates vary. For more than ten months, Accounts dormant have a $10 cost, but deposits and withdrawals are free.

Disadvantages of RoboForex

- It has limited trading cryptocurrencies. This trading broker has a variety of trading instruments traders can use, but when it comes to cryptocurrencies, it has a limited number of traders can choose from.

(Risk Warning: Your capital can be at risk)

4. BlackBull Markets

Since its establishment in 2014, it has registered thousands of traders globally. Trading instruments include shares, energies, indexes, commodities, CFDs, forex, and metals. It has a trading license from the Financial Services Authority.

It has high leverage, low trading costs, and a fast execution process if you are a forex trader looking for fast executions. It also uses the MT4 and MT5 platforms used by most forex traders because of its advanced trading tools.

Its users can access copy trading features using ZuluTrade and MyFxbook to share trading ideas with other traders. It also offers automated platforms on the MT4 and MT5 offered. It also has a mobile application that ensures traders can track their trades using their phones even as they travel.

Overview

- Minimum deposit-$200

- License-FSA

- Platforms-MT4, MT5

- Spreads-0.0 pips

- Support-24/5

- Free demo-yes

- Leverage-1:30

Account types offered are the ECN Standard with an initial deposit of $200, the ECN Plus with $2000, and the ECN Institutional with $20,000. It also has forex spreads starting from 0.8 pips for the ECN standard account, 0.1 pips for the ECN Plus account, and 0.0 pips for the ECN Institutional account.

The ECN Institutional has commissions charged depending on the volume, and the ECN Standard has no commissions, while the ECN Prime has $6 per $100,000. It has no inactivity costs. Overnight charges apply while deposits and withdrawals are free.

Disadvantages of BlackBull Markets

- It has limited educational and research resources. The trading and research materials such as articles, news, analysis, and video courses are average according to industrial standards.

(Risk Warning: Your capital can be at risk)

5. IQ Option

It has been offering its services since 2013 and has registered over 40 million traders. It has Stocks, Binary options, Cryptocurrencies, Digital options, Commodities, CFDs, and forex. Furthermore, it also has a trading license from the Cyprus Securities and Exchange Commission.

It is a trading broker with low trading costs and offers options trading. It is among the few forex brokers offering options in the financial markets. Traders can choose between digital options, binary, and FX options offered by this broker.

Besides that., it has low trading costs and low commissions for some trading instruments. It also has an industry-standard trading platform regulated by a tier-one jurisdiction that ranks it among the trusted brokers in the market.

Overview

- Minimum deposit-$10

- License-CySEC

- Platform-IQ Option trading platform

- Spreads-from 0.8 pips

- Support-24/7

- Free demo-yes

- Leverage-1:500

It offers the VIP a $1900 and above initial deposit and the Standard account with $10. Forex spreads vary with the trading instrument. Most trading instruments have no commission except for cryptocurrencies which have 2.9%.

Overnight rates range from 0.1-0.5%, and deposits/withdrawals are free. It offers Skrill, WebMoney, MoneyBookers, Neteller, Credit/debit cards, and bank transfers.

Disadvantages of IQ Option

- It has limited research materials. Forex traders can access some research resources it offers, although the resources are limited. To compete with other forex brokers at the international level, it has to offer more than the few resources available.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Turkmenistan?

The securities and stock exchange markets in Turkmenistan are still developing. They consist of the banking sector, which involves the Ashgabat stock exchange. Under the leadership of their president, the Turkmenistan government is making efforts to improve the securities and exchange markets.

It is by implementing programs to allow banks to engage in the stock exchange and urging the ministry of Finance to take the relevant measures that will ensure the development of the Ashgabat stock exchange. Forex traders based in Turkmenistan can trade forex or stocks from local banks or internationally regulated forex brokers.

The financial sector of Turkmenistan is supervised and controlled by the Ministry of Finance, which has given the central bank the authority to regulate the capital markets. Turkmenistan has legislative laws that form a scope of guidelines that financial issuers and stock exchange operators must comply with.

The Central Bank establishes the conditions that financial issuers such as brokers and professional financial advisers must meet to get a trading license or certificate for trading in Turkmenistan. It can issue licenses to the forex brokers and financial providers that meet the standards set.

It offers certificates to financial advisers who meet the required standards and have relevant experience. It also creates the procedures and laws that ensure investor protection from manipulative and fraudulent activities from brokers that are not transparent in their operations.

It has anti-money laundering regulations for registering clients that ensure transparency and fairness by having all the information about forex traders trading securities and transactions they make.

Revoking the licenses of financial issuers and market participants reported, investigated, and found guilty of breaking the regulations with enough evidence.

Security for traders from Turkmenistan

The central bank of Turkmenistan ensures investor protection rights by ensuring that forex brokers in Turkmenistan are authorized to operate within that jurisdiction. They also ensure investor funds’ protection through segregated accounts that forex brokers require.

They have strict anti-money laundering policies that ensure that forex brokers collect sufficient relevant information about the clients they register. It ensures that they know all their clients and offers transparency and fairness.

Besides that, they monitor and supervise the activities of financial issuers such as forex brokers. It helps create a safe trading environment for investors as they find market participants that engage in suspicious fraudulent actions against traders and enforce penalties.

(Risk warning: 75% of retail CFD accounts lose money)

Is it legal to trade Forex in Turkmenistan?

Yes, it is legal to purchase and sell forex in Turkmenistan. The Central Bank of Turkmenistan should establish and ensure that financial institutions comply with the regulatory functions.

Forex traders can open trading accounts using the local banks authorized by forex traders or use the regulated international forex brokers, enabling you to access various trading instruments and trading platforms.

How to trade Forex in Turkmenistan – Step-by-step tutorial

Open account for Turkmenistan traders

Find a forex broker regulated in Turkmenistan or by any of the leading forex regulators in the industry. Ensure that the forex broker also offers the trading features and instruments you want to trade. Some other features include the trading platforms, the costs, and resources.

If you settle for a forex broker that meets the requirements you want, you can open a trading account by registering on the online registration form. They will need you to give your details such as your name, email address, telephone number, nationality, physical address, account type, and password.

Forex brokers require these details to register a forex trader to comply with anti-money laundering regulations. These laws ensure the forex market in Turkmenistan is transparent and monitor suspicious accounts that may use to fund terrorist activities.

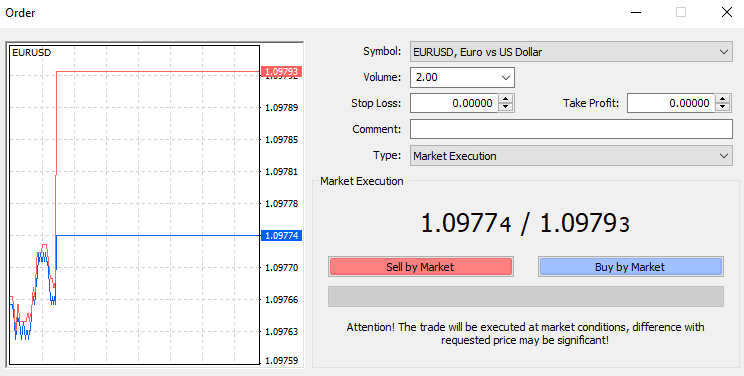

If you register a trading account with a forex broker, they will require you to download the trading platform to access the financial markets. Forex brokers work with different companies offering trading platforms, and some forex brokers have a variety of trading platforms.

Select one compatible with your forex broker and trading account and download it. Your trading broker will guide you on the process to follow. Once you have downloaded a trading platform, familiarize yourself with the interface, and you can customize it to fit your specifications.

Start with a demo or real account

You can start trading if you are a seasoned forex trader, but novice traders are recommended to start with the demo account. This account uses virtual funds and allows you to practice trading before you can apply real investments.

The demo account enables traders to learn new trading strategies and practice them, and in the process, correct any mistakes they make. It is an effective tool for new traders who are learning how to trade any instrument in forex.

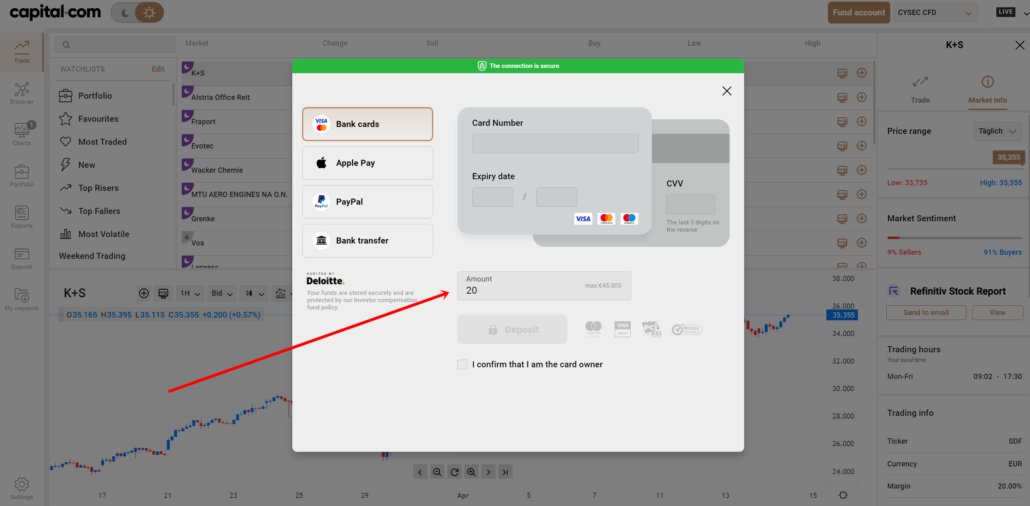

Deposit money and start trading

Once you have understood how to trade and have had enough practice, you can deposit funds into your trading account. Forex brokers support numerous trading platforms to accommodate different forex traders’ preferences.

Select a deposit or withdrawal method you are comfortable with and link with your trading account to deposit funds.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Analysis

Forex trading requires the trader to know the basics of evaluating the market to know the most profitable positions and how to enter or exit the market. It is through applying technical or fundamental analysis to gauge the market conditions.

Technical analysis involves applying technical indicators that assist the trader in analyzing the liquidity, trend, momentum, and volatility of the price action. Traders also evaluate the previous chart patterns of the asset to understand its movement under different conditions.

Fundamental analysis requires the traders to study the underlying factors that influence price action. For example, looking at financial and political events about the currency pair or trading instrument you are trading. Other factors are the GDP, interest rates of a currency, and trading patterns.

Strategies

These are the techniques you use to enter or exit the market. If you are a trader who traders for longer periods, you need long-term strategies, shorter periods require short-term strategies. Some examples of trading strategies include;

Trading a trend reversal – It is a trading strategy in which a forex trader has to know how to predict a trend reversal by applying technical and fundamental analysis. If you speculate the price movement is about to move to an uptrend, you go long and if it is about to move into a downtrend, go short.

Trading a pullback – is a trading strategy in which you identify a trend and apply trend lines or the support and resistance lines to find a pullback. The pullback is a small breakout from the trend that forex traders use to enter the market.

Trading using momentum – this trading strategy requires you to know how to apply momentum and trend indicators to know when the trend direction is strong. If the momentum is strong, you can enter the market and exit when the momentum is weak.

Make profits

You can make profits by ensuring you follow your trading strategy. Limit the leverage if the financial markets are volatile and use risk management tools to reduce the risk exposure.

Monitor the trading conditions using technical indicators during the trade. It assists in being prepared in case the market changes the trend. Practice how to enter or exit the market and find the right timing to exit the market.

(Risk warning: 75% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Turkmenistan

Finding a forex broker to use in Turkmenistan may be a difficult process which is why we recommend using international brokers. They have regulation from some leading forex regulators and offer a wide range of trading instruments.

Forex traders should learn how to apply other trading strategies. Practice how to trade to improve your chances of profits in a trade. You should also apply technical and fundamental analysis before opening any trading position.

FAQ – The most asked questions about Forex Broker Turkmenistan :

How can I locate the top forex brokers in Turkmenistan?

Safety and accessibility are the main factors when selecting a forex broker. Make sure you only choose brokers that have a top-tier regulator’s approval, such as the SEC in the US, the FCA in the UK, or BaFin in Germany, by their licenses or supervision. Check to determine if the broker welcomes clients from your nation of residency as the following step.

Check out our broker discovery tool to locate the best broker in Turkmenistan for you and save yourself hours.

Which forex brokers are the best in Turkmenistan?

After a thorough review of the trading market in terms of money, customer reviews, effective service, and many other considerable factors. Here, we are listing the top five traders to trade as the best forex broker in Turkmenistan in 2022:

Saxo Bank offers excellent trading platforms and inexpensive forex expenses.

Fusion Markets offers a great variety of currency pairs and reasonable forex fees.

Low forex CFD fees and a great account opening experience can be found at CMC Markets.

Low forex fees and a wide range of research tools are offered by Interactive Brokers.

Capital.com has a solid reputation and charges no inactivity fees.

Last Updated on March 2, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)