5 best Forex Brokers & platforms in the UAE – Comparisons and reviews

Table of Contents

Trading forex in the United Arab Emirates is mostly easy. The hard part is choosing the right broker, and this is why we have helped compile a brief list of the best ones below.

See the list of the best Forex Brokers in the UAE:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | Not regulated | Starting 0.1 pips variable & low commission | 300+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Low spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

5 best forex brokers in the UAE

Below is an overview of their offerings:

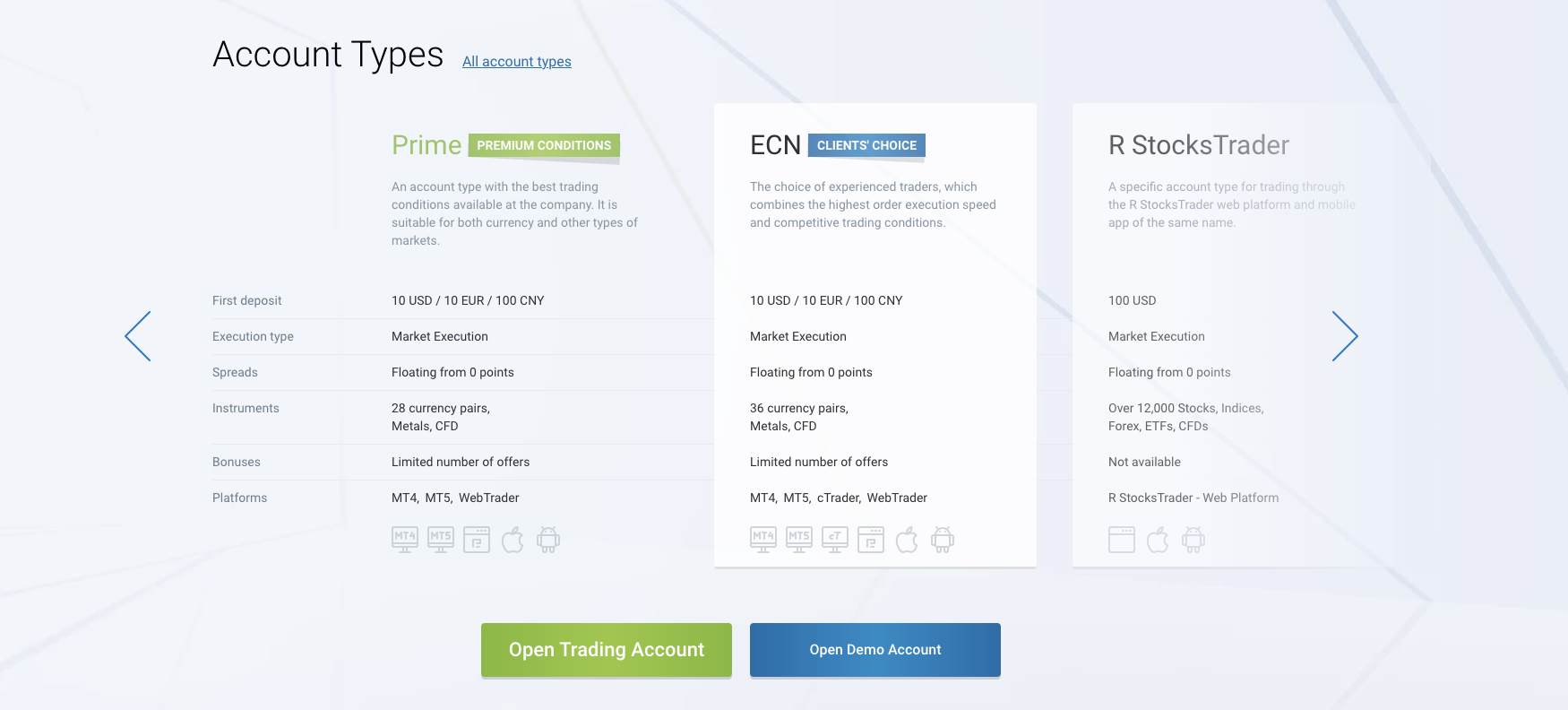

1. RoboForex

RoboForex is internationally known and boasts over 800000 active forex accounts worldwide.

Its platforms are a safe place to trade forex in the UAE. The brokerage firm holds a license from the International Financial Service Commission of Belize (IFSC).

Its head office is in Belize, but the broker has centers in other regions, including the UK, New Zealand, and Dubai.

RoboForex is a well-known low-spread broker offering quality STP Forex trade executions. Spreads start from 0.6 pips in its standard account, with no markup on the raw ECN accounts. The fees are much lower if you operate the broker’s RStocksTrader account. However, this account is ideal for skilled traders.

The broker also offers bonuses, which allows for an increased profit with low capital. Only a $20 minimum deposit is required to start trading forex. And the broker gives a $30 welcome bonus to all new customers.

The broker supports copy trading, though the minimum deposit for this may be higher.

Traders in Dubai can seek in-office support through its center at the Jumeirah Lakes Towers. But the customer is also available via phone, live chat, and email for 24-hours a day.

The demerits of trading with RoboForex

- A limited selection of market instruments

The broker does not provide variety when it comes to assets. Traders can only access about 37 forex pairs and a few hundred CFDs. Cryptocurrency is not available.

(Risk Warning: Your capital can be at risk!)

2. Capital.com

Capital.com is a reputable online forex broker based in the UK. The company was established in 2016 and is a Capital.com SV investment Ltd subsidiary.

Its branch offices are in Gibraltar, Cyprus, and Belarus. And traders from more than 183 countries, including the UAE, are welcome here. Capital.com boasts of nearly 800,000 active accounts and trades amounting to $88 billion.

The brokerage operates under licenses from internationally recognized institutions, such as the FCA and the CySEC.

The broker offers access to wide market instruments selections, such as 138 forex pairs and thousands of CFDs.

With a minimum deposit of $20, anyone can start live trades with Capital.com. And the broker allows withdrawals as low as $50. They are among the best brokers, offering low-cost trading services. Traders enjoy spreads as low as 0.6 pips on majors. There are no commission charges, zero inactivity, and withdrawal fees.

Its trading platforms contain various forex guides and rich educational materials to help traders succeed.

Newcomers can easily find their way into the forex market with this broker.

Customer service is available 24 hours a day in multiple languages, including Arabic. Traders can reach them via live chat, phone support, or email.

Cons of trading with Capital.com

- Overnight fees

The broker charges overnight fees for positions left beyond a trading day.

(Risk warning: 78.1% of retail CFD accounts lose money)

3. BlackBull Markets

BlackBull Markets is an ECN Non-dealing desk broker with its headquarters in New Zealand.

The company is a relatively new broker that started operations in 2014. But it has quickly built credibility among traders and is now among the most reputable companies in this industry.

Traders from many parts of the world, including the UAE, are welcome here.

The broker holds a license from its home country’s organization, the Financial Markets Authority. It also operates under the supervision of the Financial Service Authority of Seychelles, FSA. BlackBull Markets is also a member of the New Zealand Financial Services Complaints Limited, a dispute settlement body in its country.

With ECN and STP trade executions, the broker guarantees tight spreads and fast execution in its user-friendly and famous platforms. These are the MT4 and MT5.

Traders can choose a raw spreads account, where they enjoy zero mark-ups on currency trading. Leverage trading of up to 500:1 is available for customers who can handle the risk.

Its support service is also among the best and is available 24 hours a day. Some countries have a toll-free line through which they can call support easily. Customers can also contact them via email and live chat. They respond fast and resolve complaints for traders.

The disadvantage of BlackBull Markets

- No cryptocurrency assets

The broker offers forex and CFDs assets. Cryptocurrency is not yet available with the broker.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is among the most reliable and top-rated brokers in the industry. Any trader in the UAE who wishes to trade forex or CFD will make a great choice with Pepperstone.

The brokerage firm’s pricing is among the most competitive, and the account signup process is straightforward and quick. Customer support is exceptional.

The broker holds several licenses in multiple jurisdictions as per security and regulations. Three of these licenses are from top-tier financial bodies.

Pepperstone operates under the regulations of the following bodies:

- Australia Securities and Investments Commission, ASIC.

- Dubai Financial Service Authority, DFSA.

- Financial Conduct Authority, FCA.

- Federal Financial Supervisory Authority of Germany, BaFin.

- Cyprus Securities and Exchange Commission, CySEC.

Pepperstone offers the MetaTrader 4 and 5, plus the cTrader platforms for trading. The broker includes multiple language support and other add-ons to enrich traders’ experience. Part of the add-ons here is support for algorithm trading and several order executions.

Traders from the UAE can access over 60 forex pairs and more than 1000 CFDs here. They can choose from the Standard or Razor account. Although, the Razor account offers better trading conditions with much tighter spreads. The average spread on the Razor account is 0.16 pips, whereas the Standard account has 1.16 pips as its average. The commission is charged to the Razor account based on volume. Active traders get frequent rewards in the form of rebates.

The broker has received several awards for excellent support, quality research and education materials, and the best service. Its customer support responds on time via platform chat, phone, or email.

The drawback of trading with Pepperstone

- 1-month demo account

Pepperstone’s free demo for new users expires after 30 days. Other competitors offer 90 days of trial. Some provide lifetime access to the free demo account.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is renowned forex and binary options broker based in Saint Vincent and the Grenadines. The company has several offices in different regions, including the UAE. They are UAE customers’ first choice for binary trading.

The reason is that they provide the best software for this purpose. This software tracks real-time price moves to ensure the users’ trading decisions are based on accurate data.

Traders can access the IQ Option trading platform on computers and mobile phones. The broker offers a free demo to test forex and binary trading before starting a live trade.

IQ Option is also among the best brokers with low spreads. The average spread on major pairs here is 0.8 pips.

Traders can access over 300 assets, including currency pairs, commodities, indices, and stocks. With as low as $10, Dubai traders can sign up with the broker.

Support service is quick and responsive. Available 24 hours during market days, that’s Monday to Friday.

IQ Option is a great choice for UAE traders who invest in binary options. They stand to benefit from the broker’s competitive conversion rates, wide asset selections, mobile binary trading, and low spreads.

The disadvantage of trading with IQ Option

- MetaTrader platforms are not available.

The broker provides its proprietary web platform for trading.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in the UAE?

There are several regulatory bodies in the UAE, and forex brokers need to obtain a license from at least one to do business with their citizens.

These financial bodies are:

- The Dubai Financial Service Authority, DFSA.

- The Securities Commission Authority, SCA.

- The Abu Dhabi Global Markets, ADGM.

- The Central bank of the UAE, CBUAE.

The SCA and the Central bank are responsible for overseeing the operations of Mainland UAE companies. Citizens of the country mostly own such companies.

The DFSA and the ADGM regulate financial companies’ operations in areas considered “free financial zones.”

The country allows foreign-owned financial companies to operate in these zones.

Brokers’ requirements in the UAE are mostly the same for the different regulatory categories. But one of the few differences is brokers operating under the Central bank or SCA license must be “930 sharia-compliant”.

Those with DFSA and ADGM do not have to comply with sharia laws. Though since it’s the UAE, they all offer Islamic account services.

The SCA and Central bank clarify strictly that regulated brokers have to provide a complete Islamic account with zero interest charges. But the other brokers may include an admin charge to make up for the non-interest fee.

There is also a difference in leverage offerings. The brokers with the DFSA and ADGM licenses provide leverage up to 30:1. The same is offered in EU jurisdictions.

But the SCA and Central bank licensed brokers offer much higher leverage, up to 500:1. Some offer higher.

Therefore, if you like to trade on high leverage, seeking a Central bank or SCA-licensed broker may be wise.

Security for traders in the UAE

Remember that trading on high leverage carries great risks of loss and debt.

UAE traders should work with regulated brokers that also have any of their financial bodies’ licenses.

Traders who seek FULL Sharia-compliant brokers should look for traders holding its Central bank or the SCA license.

Is it legal to trade forex in the UAE?

Absolutely! Forex trading is legal in the United Arab Emirates.

Traders must seek brokers that hold a license from any of its regulatory bodies. That way, they are protected. It also ensures they do not deviate from the country’s financial regulations.

(Risk warning: 78.1% of retail CFD accounts lose money)

How to trade forex in the UAE – A comprehensive overview

People from the UAE who wish to start forex trading need to find an acceptable broker.

Such a broker must hold a license from any well-known financial body and one from a UAE regulatory authority.

Traders should consider brokers with competitive fees, as we explained here. A comfortable trading environment should be a major consideration before choosing a broker.

Follow these steps to trade forex in the UAE after deciding on a broker:

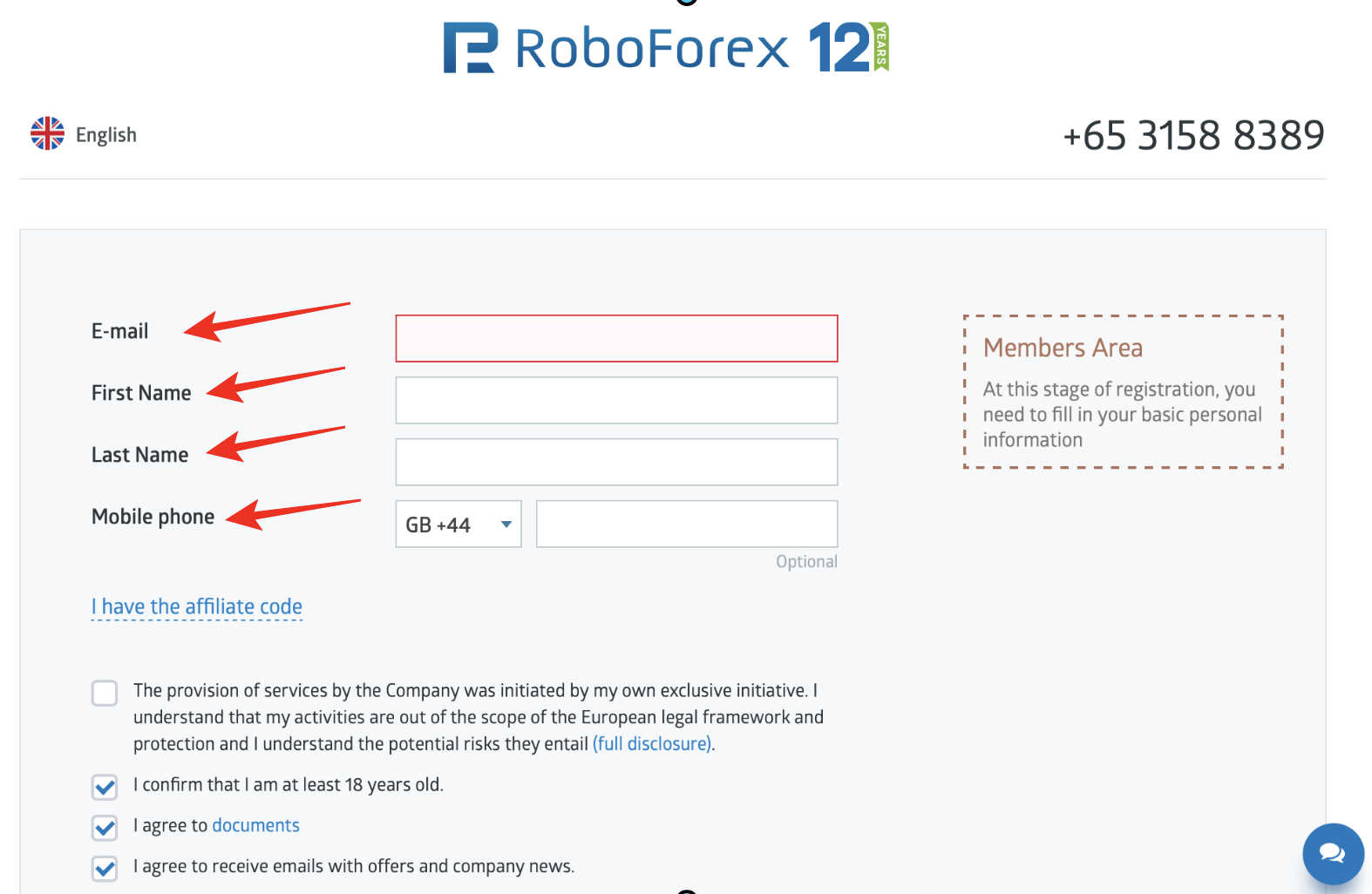

1. Open an account for UAE traders

Visit their official UAE website to fill out the registration form once you find a suitable broker.

This form should require very few details at first. Name, email, and perhaps phone number might be the requested details.

Once you enter these, you should receive an authentication link in your email. Clicking on the link verifies the detail for the broker and takes you to a page where you then complete the registration.

The broker might request an ID and proof of the address provided to sign you up fully.

It would require scanning these documents and uploading them.

Once you fulfill all these, the signup process is complete.

2. Start with a demo or “real” account

If you are new to forex, the next step is to practice trading with the broker’s free demo account.

In some cases, this account comes pre-funded, with up to $10000, although this is virtual money.

It allows one to have a feel of the market by trading with this money on the broker’s platform.

It also helps you test the broker, becoming familiar and comfortable with them before funding your account for live trades.

Many traders also use this opportunity to test different trading strategies with a broker before trading.

Some may dive straight into a live account since this gives the complete trading experience.

If you are new, we recommend starting with a demo. If you prefer to trade live, then you may start with the broker’s required minimum deposit. Then increase your capital once you become more familiar with the market environment.

3. Deposit money to trade

Once you are ready to trade for real, you need to credit the account with funds.

The broker should provide several easy options to do this. In most cases, brokers assign support staff to new customers to help them through the beginning stages of trading.

So this should be easy to do.

Expect payment options such as Bank transfers and credit or debit cards. Popular online payments should also be available, including Skrill, Paypal, Neteller, or other local online payment services.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

4. Use analysis and strategies

It is crucial to conduct some market analysis before trading. Devising one or more effective strategies is also vital. The analysis and strategies greatly determine success in forex trading.

Market analysis is of three types. They include:

- Fundamental analysis

- Technical analysis

- Sentiments analysis

Fundamental analysis involves elements such as the currency’s interest rate, the country’s economy represented by its GDP, inflation, and other economic data.

Technical analysis entails the study of patterns in the price chart to spot opportunities. Traders use these patterns to find the market’s best entry and exit points. Brokers offer several tools in trading platforms for this. But it requires practice and studies to build the skills to interpret these patterns. Technical analysis is the most popular among all three. The reason is it directly applies to actual trading.

With Sentiment analysis, traders look for the direction of market participants’ sentiments. If a good number of traders are entering LONG trades, it means the sentiment is in this direction. The trader then takes a position based on this.

These three analyses are equally important for trading. A new trader might want to be conversant with them while testing a demo. When they’re ready to trade live, they can enter the market with some confidence. And there is a good chance of winning trades.

The trader should also study some tested and trusted forex strategies. Many of these strategies exist online, though not all are effective with every currency pair.

Below, we share some common trading strategies used in forex trading:

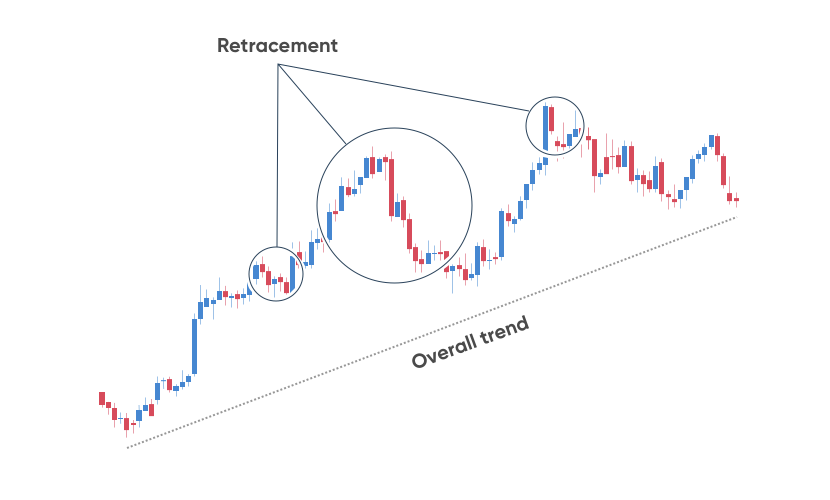

1. Trend trading

There are three types of market trends:

- Uptrend

- Downtrend

- Ranging markets.

These are all different market conditions that present different opportunities to trade. The trader must first identify which direction the market is facing before placing trades.

Uptrend condition presents an opportunity to take LONG positions. A downtrend market means the sentiments in favor of SHORT trades.

With a ranging market, traders use technical analysis to look for overbought and oversold points. These areas can be profitable trade signals for the trader.

2. News trading

Investors watch the news and place trades based on economic or political releases with this strategy. This trading is based on the idea that the market reacts to new information as it is released. The trader needs to understand participants’ reactions and predict their sentiments to succeed with this strategy.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex brokers are available in the UAE

Forex trading is easy to start in Dubai, and many people already earn from investing in this financial market.

We have made it easier to begin trading with this guide.

Choosing a licensed and reputable broker with low fees is the first task. Once you do this, you are set to partake in the market’s opportunity.

FAQ – The most asked questions about Forex Broker UAE :

How can traders in UAE simplify forex trading?

Traders in UAE can simplify forex trading once they choose the right broker. After choosing the best forex broker, a trader can assume that the hard part of trading is over. Then, they sign up for their forex trading account and research well before they place a trade. Then, they can expect their forex trading to simplify.

Which trading platform is the best for forex trading in UAE?

A trader must use the best trading software to indulge in forex trading on a professional level. You can begin trading on platforms such as MT4 and MT5. Forex traders can gain the best trading experience using these two platforms, as they allow great customization. You can customize all trading charts and indicators for your analysis using MT4 or MT5. The good thing is that UAE traders can access these two trading platforms with all five brokers.

How much minimum deposit does it take to sign up for a forex trading account in UAE?

Traders in UAE can sign up for a forex trading account beginning with only $10. Forex brokers such as IQ Option that operate in UAE allow traders to initiate trading accounts with only $10. Besides, they allow you to make initial trades with an amount equivalent to $1.

Last Updated on January 4, 2024 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)