Five best Forex Brokers and platforms in Uganda – Comparison and reviews

Table of Contents

You are in the right place if you are looking for a forex broker that can offer a smooth trading process, such as low trading costs and fast order processing rates in Uganda. This article will cover some of the leading forex brokers in the industry we recommend using if you are a forex trader in Uganda.

See the list of the best Forex Brokers in Uganda:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

List of the five best Forex Brokers and trading platforms in Uganda:

1. Capital.com

Established in 2016, Capital.com has over 5 million trading accounts registered and a volume of over 530 billion traded.

Financial instruments – traders can access 6100+ assets ranging from Indices, commodities, cryptocurrencies, stocks, and shares.

Regulation – Capital.com has regulations from the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investment Commission (ASIC), and the National Bank of the Republic of Belarus (NBRB).

Account types – Capital.com has three trading account types:

- The Standard account has an initial deposit of $20

- The Plus account has a minimum deposit of $2000

- The Premier account has a minimum deposit of $10,000

Forex spreads – Capital.com has low trading costs starting with the forex spreads from 0.8 pips.

Trading costs – it has no inactivity fees, low commissions for most assets, and zero commissions for most stocks.

Leverage rates – retail traders can access leverage costs from 1:30, while professional traders can access up to 1:500.

The demo account – The demo account is free and has $10,000 worth of virtual funds.

Trading platforms – MT4 and Web Trader to access the financial markets.

Payment methods – deposits and withdrawals are free. It supports a variety of payment methods such as bank transfers, credit/debit cards, and electronic wallets such as PayPal, Sofort, Trustly, Multibanko, and Apple Pay.

Customer care – Customer support is available 24/7 in 13 languages through emails, live chat, and emails.

Pros

- Fast deposits and withdrawals

- Fast order processing rates

- Negative balance protection

- Low minimum deposits

- Low trading costs

- Regulation from tier one and two jurisdictions

Cons

- The Premier account has a high initial deposit

- Limited research tools

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a forex broker that started its operations in 2014 and has served thousands of traders in over 180+ countries, including Uganda.

Financial instruments – users can access various trading assets such as commodities, indexes, energies, shares, forex, CFDs, and metals.

Regulation – The Financial Services Authority licenses BlackBull Markets in Seychelles. The BlackBull group has registered companies in the UK and New Zealand. It also has a license to operate as a derivative issuer by the Financial Markets Authority.

Account Types – BlackBull Markets has three types of accounts traders can register:

- The ECN Standard account, where new traders can start after the demo account has a minimum deposit of $200.

- The ECN Prime account, which is designed for more experienced traders and has a minimum deposit of $2000.

- The ECN Institutional account, which is for volume or professional traders and has a minimum deposit of $20,000.

Forex spreads – forex spreads vary with the account type. The ECN Standard account starts at 0.8 pips; the ECN Prime account has forex spreads from 0.1 pips while the ECN Institutional from 0.0 pips.

Trading costs – it has an overnight fee charged according to the number of nights the position is open. There is no account maintenance and also no inactivity costs.

Leverage rates – traders can access leverage rates as high as 1:500.

A demo account – It is free for traders to practice their trading strategies or test out the trading platforms.

Trading Platforms – Traders can choose between the MT4 or MT5 trading platforms when they want to trade.

Payment methods – Deposits/withdrawals are free, and it supports different payment methods such as wire transfer, credit/debit cards, and electronic wallets such as Web Money, Skrill, Neteller, and QIWI.

Customer care – Their customer support is available 24/6 through emails, phone calls, and live chat.

Pros

- A fast account registration process

- Fast order execution rates

- Low trading costs

- Industry-standard trading tools

- High leverage rates

Cons

- Customer support is only available 24/6

- Limited educational content

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex has over 1 million forex traders registered and is available in 169 countries, including Uganda.

Financial instruments – traders can access forex, commodities, cryptocurrencies, stocks, Indices, ETFs, metals, and energies.

Regulation – It has regulation by the Financial Services Commission (IFSC) of Belize. It is a slow member of the Financial Commission, a global dispute resolution commission. RoboForex is also in category A of the compensation fund that offers protection of clients’ funds of up to 20,000 Euros.

Account types – it has five types of trading accounts:

- The Pro Cent account is the smallest and allows a smooth transition from the demo to the real account with an initial deposit of $10.

- The Pro account also has a minimum deposit of $10 with more advanced features than the pro cent.

- The prime account with a minimum deposit of $10

- The ECN account, which has an initial deposit of $10

- The R-stocks trader account is for stocks trading with an initial deposit of $100.

Fees – The Prime and ECN accounts have forex spreads from 0.0 pips, R-stocks trader has spread from 0.01 USD, while the Pro-cent and the Pro accounts start at 1.3 pips.

Trading costs – It has rollover costs. The rates depend on the trade size; it also has an inactivity fee of $10 after 12 months of inactivity.

Leverage rates – depending on the account type Pro, Pro-cent users can access up to 1:2000, Prime and Restocks traders account 1:300, while the ECN traders can get up to 1:500.

Demo account – After successfully registering a trading account, it has a free demo account.

Trading Platforms – RoboForex offers four types MetaTrader4, MetaTrader 5, c Trader, and the R Stocks Trader.

Payment methods – Deposits and withdrawals are free. It supports transfer methods such as bank wire, debit/credit cards, and digital wallets such as Union Pay, Astro pay, Skrill, Neteller, Perfect Money, NganLuong Wallet, and AdvCash.

Customer care – Customer support is available 24/7 through live chat, emails, and phone calls and supports 24 languages.

Pros

- Numerous trading accounts

- Low minimum deposits

- Fast order processing rates

- A responsive customer care team

- Low trading costs

Cons

- It is limited to a few regions

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is a forex broker that started operating in 2010 and serves thousands of traders worldwide.

Financial instruments – Its Users can access over 2000+ assets ranging from forex, commodities, shares, CFDs, ETFs, and Indices.

Regulation – Pepperstone has regulations from the Australian Securities and Investment Commission (ASIC), the Financial Conduct Authority in the UK, and the Dubai Financial Services Authority, allowing it to operate in the UAE.

Account types – it has two types of accounts, the Standard and the Razor account. Both of them have an initial deposit of $200. The Standard account has forex spreads from 1.0 pips, while the Razor account has forex spreads from 0.0 pips.

Trading costs – it has no inactivity or account maintenance costs, the standard account has no commission, but the Razor account has a commission of $7 per round turn for every $100,000 traded.

Leverage – Forex traders using both accounts can access leverage of up to 1:400.

Demo account – it has limited demo accounts that run for up to thirty days after registration.

Trading platforms – Users can choose from the three trading platforms offered, MetaTrader4, MetaTrader five, and c Trader.

Payment methods – deposits and withdrawals are free. Traders can transfer funds to and from their accounts through bank transfers, credit/debit cards, and digital wallets such as PayPal, Neteller, UnionPay, Skrill, Bpay, and POLi.

Customer support – their customer care team is available 24/5 through live chat, email, and phone calls.

Pros

- Fast execution rates

- A fast account registration process

- Industry-leading trading resources

- Low trading costs

- Wide range of trading instruments

Cons

- Limited educational materials

- Customer support is only available 24/5

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

Since its inception in 2013, IQ Option has grown to serve 40 million+ registered users and operates a volume o 20 million orders in a month.

Trading instruments – traders can access forex, stocks, commodities, indices, CFDs, cryptocurrencies, options, and ETFs.

Regulation – Its parent company has Cyprus Securities and Exchange Commission regulations.

Account types – it has two types of accounts, the Standard account with a minimum deposit of $10 and the VIP account with a minimum deposit of $1900.

Forex spreads – The forex spreads vary with the type of currency pair and the trader’s account.

Trading costs – most assets have no commissions, but cryptocurrencies have 2.9% commissions. It also has rollover costs, ranging from 0.1-0.5%, and an inactivity fee of $10 after an inactivity of 90 days.

Leverage – for traders within the European Economic Zone, the leverage rate is limited to 1:30, while other countries can access it up to 1:2000.

The demo account – It is free to use as long as you have registered an account and have virtual funds of up to $10,000 for practice trading.

Trading platforms – IQ Option has its proprietary trading platform for accessing financial markets equipped with industry-leading trading tools.

Payment methods – Deposits and withdrawals are free, and traders can use bank transfers, credit/debit cards, and digital wallets such as AdvCash, Neteller, Skrill, Perfect Money, and Online Naira.

Customer support – their customer care team is available 24/7 through live chat and email.

Pros

- Fast order processing rates

- High leverage

- Low trading costs

- A wide range of trading instruments

- Fast deposits and withdrawals

Cons

- High initial deposit for the VIP account

- Limited educational resources

(Risk warning: Your capital might be at risk.)

Is it legal to trade Forex in Uganda?

It is legal to trade forex in Uganda, and the bank of Uganda regulates the foreign exchange industry. The bank of Uganda has the mandate to ensure that forex trading is safe according to the forex exchange act of 2004.

The exchange act of 2004 has stipulated the regulations and rules that traders have to follow and the powers that the bank of Uganda has when it comes to the forex industry. The bank of Uganda is in charge of all the operations in foreign exchange.

What are the financial regulations in Uganda?

The Bank of Uganda ensures that it implements the foreign exchange act of 2004.

Some policies of the foreign exchange act include:

- Licensing any financial provider /market participant that deals in forex according to the 2004 act.

- An entity that wants to engage in foreign exchange business can obtain a trading license by paying 50 currency points. Also, one thousand currency points paid-up capital to engage in trading forex.

- Any business/ agency licensed by the bank of Uganda to transact forex must present information about the transactions they make as recommended in the forex act of 2004.

- The governor of the bank of Uganda can authorize any function to ensure that the act of 2004 about foreign exchange is implemented accordingly.

- The governor of the bank of Uganda has the mandate to ensure the proper implementation of the foreign exchange act of 2004.

- A forex trading license issued in Uganda will expire after one year, and the trader or the company needs to renew the license. The bank of Uganda also has the power to impose restrictions as it sees fair when renewing the forex trading license based on the company’s trading history or business.

- The bank of Uganda can revoke or suspend a trading license if the agency carrying out forex trading is found breaking any rules or withholding information required.

Security for Forex traders in Uganda

The bank of Uganda has the authority to regulate the securities and exchange market. Although the bank of Uganda has some laws it applies to try and regulate, a large part of the forex industry remains unregulated.

Forex traders rely on the Financial Sector Conduct Authority to regulate the financial industry. Forex traders in Uganda depend on other regulatory institutions to find reliable forex brokers they can work with since the loosely regulated foreign exchange industry in Uganda attracts forex scams.

(Risk warning: 78.1% of retail CFD accounts lose money)

How can you trade Forex in Uganda? – A quick tutorial

Find a regulated Forex Broker

Look for a forex broker regulated in Uganda or with tier one /two jurisdiction when you want to open a trading account, and you are in Uganda. Since the forex industry in Uganda is not well regulated, look for forex brokers that have regulation from other regulatory institutions that are reliable.

Many forex brokers are regulated by the FSCA, ASIC, CySEC, FCA, and many other regulatory bodies and can operate in Uganda. You can find some which expert traders in Uganda recommend from organizations of forex traders such as the Uganda Forex Bureau and Money Remittance Association (UFBMRA).

It is an organization led by members that seek to ensure fairness and transparency of financial markets in Uganda. Established in 2001, traders can join such an association to get trading knowledge from seasoned members in the forex industry who trade in Uganda.

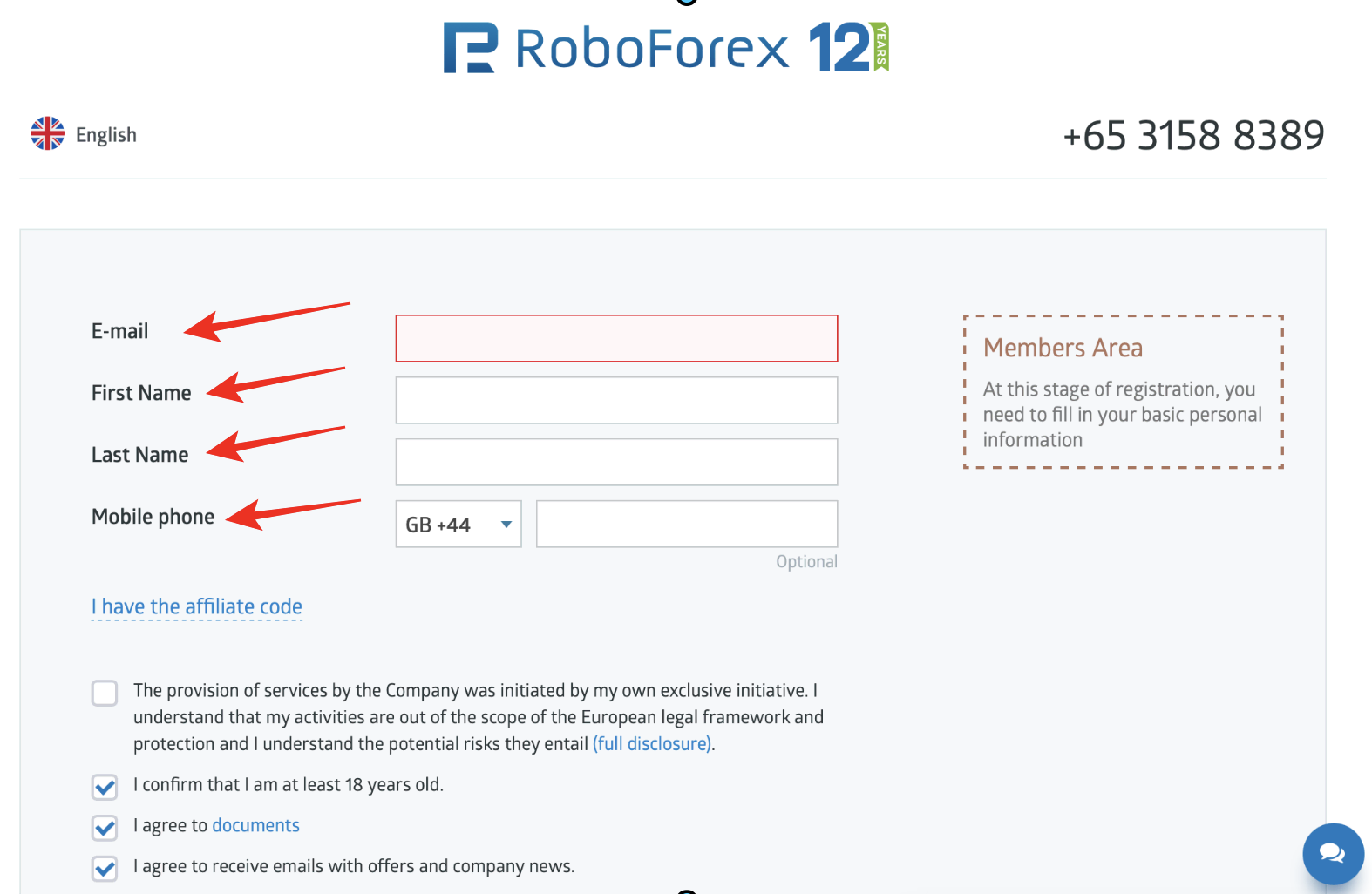

Open a trading account

You can register a trading account if you find a regulated forex broker. The registration process takes a short time and requires filling in your name, email, telephone number, date of birth, and trading background.

Start with a demo account

It is a crucial step when you want to start forex trading as it allows a new or experienced trader to understand the trading conditions. The Demo account also helps traders to practice their trading strategies in different markets before applying them with real money in the live trading account.

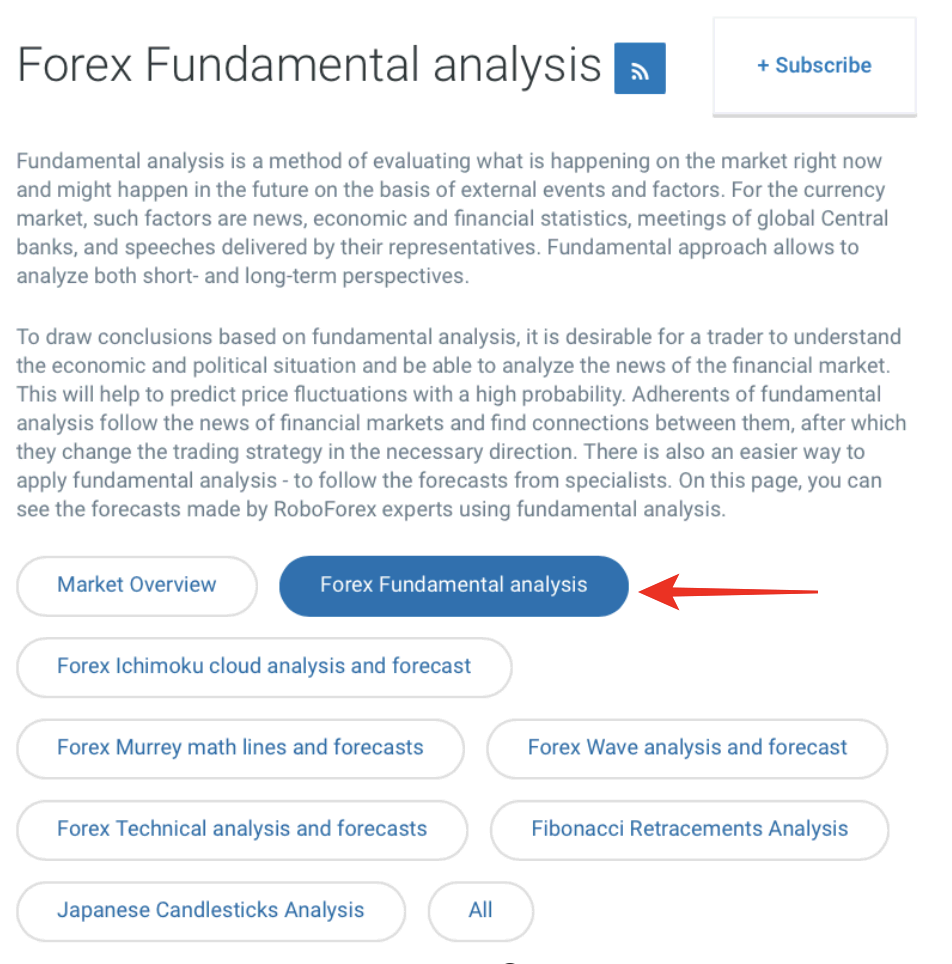

Use analysis and trading strategies

There are a variety of trading strategies that traders can apply when trading different currency pairs or trading instruments. Some examples are day trading, swing trading, trend trading, and scalping strategies. Traders can learn these trading strategies to apply when trading.

They can also learn to use technical and fundamental analysis to predict price movements and make insightful decisions. Forex brokers and other materials are available online for traders to learn how to trade by analyzing trading signals and patterns.

Make profits

Having the right mindset, applying effective trading strategies, and knowing when to enter or exit the market will ensure you can make a profit when trading any asset. Traders have to do enough trading practice to ensure that they can profit from trading financial markets.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Uganda

Forex trading in Uganda is not as popular as in many other countries, although a growing population wants to trade forex. Uganda has limited policies to regulate the growing forex industry, so most traders prefer offshore forex brokers.

Nevertheless, these forex brokers are some of the best in the industry, and they are credible. They also have advanced trading features that ensure that traders have a good experience trading forex from wherever they are.

1. Capital.com

2. BlackBull Markets

3. RoboForex

4. Pepperstone

5. IQ Option

FAQ – The most asked questions about Forex Broker Uganda :

How is Forex taxed in Uganda?

Forex traders in Uganda are responsible for paying 30% of the net income they make trading forex. For example, the net income in a financial year is the difference between the final asset prices at the beginning of the year.

Is the Ugandan shilling available in Forex?

The Ugandan Shilling is weaker compared to other currencies in forex. There is a limited number of brokers offering Ugandan Shilling for trading because the forex brokers find it hard to profit from it. Forex traders can trade the South African rand, which is an exotic currency in forex.

What are the pros of choosing the best forex brokers in Uganda?

You can avail yourself of many pros when trading with the best forex brokers in Uganda. Some of them include the following.

– They allow you to sign up with a low minimum deposit.

– The forex brokers in Uganda allow you to access the best underlying assets.

– They offer you rich customer support.

– Besides, you can always access great educational material on these platforms.

Do forex brokers in Uganda allow traders to sign up for a demo account?

Yes, a demo account is available for all traders who want to trade forex with forex brokers in Uganda. The demo account has similar features to the live trading account. Thus, you can enjoy trading on a demo account just as on a live account. Besides, brokers operating in Uganda will fund your demo account with a virtual currency of $10,000. Traders can use this demo account for 30 days without paying any charges.

How much minimum deposit is required for forex brokers in Uganda to begin trading?

To trade forex in Uganda, a trader can fund their trading account with $10. You can pick any of these five forex brokers in Uganda as they offer the best trading facilities to traders. These brokers also let you sign up with a low minimum deposit.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)