The 3 best Forex Brokers and platforms in Ukraine – Comparison and reviews

Table of Contents

Forex trading requires many things, including having a reliable forex broker. A reliable forex broker allows you to trade without worrying about getting scammed. Here is a list of reliable forex brokers offering brokerage services in Ukraine and low trading costs.

See the list of the best Forex Brokers in Ukraine:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

Four best Forex Brokers and platforms in Ukraine

1. Capital.com

Capital.com is a forex broker with over 300,000 traders since it launched in 2016.

Trading instruments – traders can access stock, indices, commodities, cryptocurrencies, and shares.

Regulation – it has regulations from the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investment Commission (ASIC).

Account types – traders can select from the three types; the Standard has an initial deposit of $20, the Plus has an initial deposit of $2000 and the Premier with $10,000.

Fees – forex spreads start from 0.8 pips.

Trading costs – it is a zero commission broker, it has no inactivity costs, and deposits and withdrawals are also free.

Leverage – it complies with ESMA regulation, so traders from the EU are limited to 1:30, but professional traders can access 1:500.

The demo account – Capital.com has an unlimited demo account with virtual funds of up to $10,000.

Trading platforms – it has integrated MT4 and web traders.

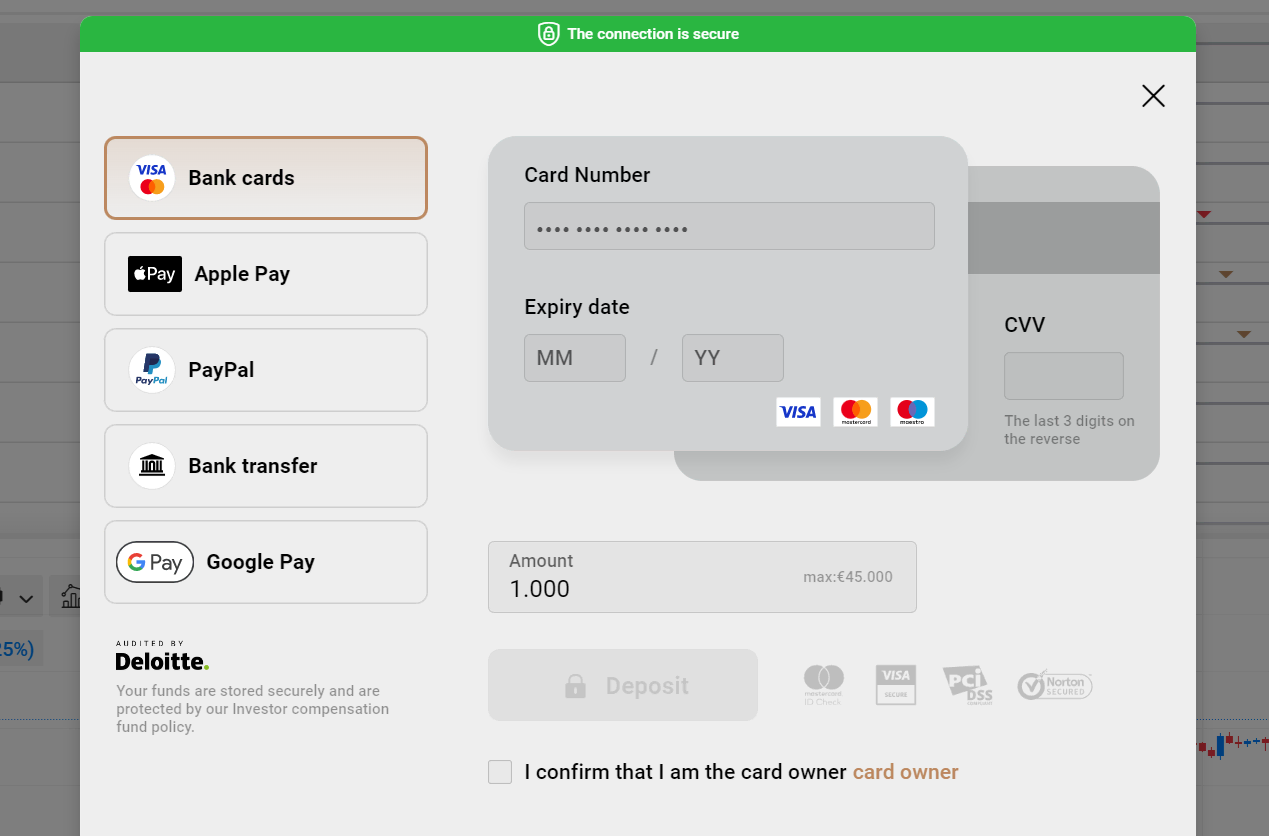

Payment methods – traders can deposit using bank transfers, debit/credit cards, and electronic wallets such as Sofort, PayPal, Multibanko, and Apple Pay.

Customer care – their customer support is available in 13 languages, and you can contact them through email, live chat, and SMS.

Pros

- Low trading costs

- Fast account registration

- It has regulations from tier one and two jurisdictions

- It offers negative balance protection

Cons

- limited research resources

- A high initial deposit for the premier account

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a forex broker serving thousands of traders since its establishment in 2014. ‘

Financial assets – it offers forex, commodities, shares, indexes, metals, CFDs, and energies.

Regulation – it has regulation from the Financial Services Authority of Seychelles.

Account types – it has three, ECN standard with an initial deposit of $200, ECN Prime has a minimum deposit of $2000, and ECN Institutional with $20,000.

Fees – forex spreads vary with the trading account; the ECN Standard starts at 0.8 pips, the CN Prime from 0.1 pips, and the ECN Institutional from 0.0 pips.

Trading costs – the ECN Institutional has a varying commission; the ECN Prime has a commission of $6 per round turn for every $100,000, while the ECN Standard is commission-free. It also has overnight costs but no inactivity fee.

Leverage – the maximum leverage is 1:500.

Demo account – traders can access its demo account, which is free as long as they register a trading account.

Trading platforms – it has integrated MT4 and MT5.

Payment methods – it supports bank transfers, debit/credit cards, and e-wallets such as WebMoney, Neteller, Skrill, and QIWI.

Customer care – customer support is present through live chat, emails, and phone calls 24/6.

Pros

- Low trading costs

- Advanced trading tools

- High leverage

- Fast account registration.

Cons

- Limited educational resources

- Customer support is only available 24/6.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone is a forex broker that started operating in 2010 with over 300k registered traders.

Financial assets – it offers forex, commodities, ETFs, indices, CFDs, and shares.

Regulation – it has regulations from Financial Conduct Authority (FCA), Dubai Financial Services Authority (DFSA), and the Australian Securities and Investment Commission (ASIC).

Account types – it offers two trading accounts: the Standard account with a minimum deposit of $200 and the Razor account with $200.

Fees – forex spreads start at 1.0 pips from the Standard account and 0.0 pips for the Razor account.

The trading costs – the standard account has no commission, but the Razor account has a commission of $7 per round turn for a volume of $100,000 traded. It has no inactivity fee, and deposits/ withdrawals are free.

Leverage – the maximum leverage offered is 1:400.

A demo account – Pepperstone has a limit of 30 after registering a trading account.

Trading platform – it has incorporated MT4, MT5, and cTrader.

Payment methods – traders can transfer funds to and from their accounts through bank transfers, credit/debit cards, and digital wallets such as Neteller, Skrill, PayPal, UnionPay, Bpay, and POLi.

Customer care – The Support team is available 24/5 through phone calls, live chat, and emails.

Pros

- Fast account registration

- Low trading costs

- Fast withdrawals and deposits

- Quality trading tools

Cons

- Limited educational resources

- The customer care team is only available 24/5

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Is it legal to trade Forex in Ukraine?

It is legal to trade securities and exchange markets in Ukraine. It had strict regulations from market participants, traders, brokers, financial advisers, or any financial agency. Due to these, few forex brokers were authorized to operate in Ukraine.

It changed in 2019 when some 40 restrictions on financial markets were removed by the national bank of Ukraine. It led to increased activity from Ukraine forex traders in the financial markets.

The official regulatory entity to ensure fairness and transparency of the Ukraine security markets is the National Commission on Securities and Stock market (NSSMC). It consists of six board members appointed by the government to oversee the execution of its function.

This committee is also answerable to the supreme council, the Verkhovna Rada. The Ukraine parliament helps with the legislation of some policies concerning the securities market.

What are the financial regulations in Ukraine?

The ministry of finance, the National bank of Ukraine (NRB), and the National Securities and Stock Market Commission (NSSMC) approved the comprehensive plan for the development of the financial industry of Ukraine.

The plan consisted of financial stability, the development of financial infrastructure, the development of microeconomic factors, and the development of financial markets. These laws also allowed the amendment of certain financial policies, such as trading activities, to take place in capital markets rather than stock exchanges.

Another policy concerned securities, forex assets, and derivatives, which had to fall under-regulated markets. The NSSMC is at the forefront of executing the rules and regulations.

Some functions that the NSSMC performs in the financial markets include:

- Licensing forex brokers and other market participants with certificates enables them to trade forex or other financial assets in Ukraine.

- It establishes the standards that market participants must adhere to regarding the financial asset and the type of license offered.

- Ensuring that services offered by financial providers such as forex brokers reach the standards of the European Union.

- Vetting the trading software of financial providers or market participants who work with forex traders in Ukraine to ensure they are safe or reach investor standards.

- Ensuring that the forex broker has adequate capital of not less than 500K hryvnias and that market participants reach the minimum limits set to undertake any activities as stipulated.

- Collecting relevant data from market participants for evaluation and monthly audits allows the NSSMC keeps track of financial activities in the exchange markets.

- Collecting information on all transactions to allow the NSSMC to track all transactions taking place in the financial markets of Ukraine.

- It also has the mandate to display all registered entities with a license to operate in Ukraine to the public.

- Monitoring financial agencies such as banks, forex brokers, credit organizations, and professional participants in the securities and exchange markets.

- Performing audits on licenses to ensure compliance with the rules against money laundering, funding terrorism, and crime.

- To investigate, report, and prevent any misconduct cases and violations of set guidelines by any market participants.

- Revoking licenses of entities found violating the rules and guidelines of the contract of regulation with the NSSMC.

- Ensuring the protection of investors by forming and executing legislation that prevents fraudulent methods that dealers and financial providers use to profit from investors.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for Ukrainian traders

Any regulatory authority must ensure that the stock exchange and securities market is safe by ensuring they have the appropriate management and control mechanisms. It also ensures that market participants comply with investor protection rights.

Some of the policies that work on investor protection include:

- Apart from forex traders and other investors in securities, other market participants, such as brokers and dealers, have to publish a website with detailed information about the services offered.

- They cannot charge any costs for consumers or investors to access information that is deemed public, according to the NSSMC.

- It monitors inquiries and complaints made by investors concerning other market entities and takes actions to investigate.

- It sanctions and revokes licenses of agencies that are investigated and found guilty of violating investor protection.

How to trade Forex in Ukraine – A quick tutorial

Connect to a stable internet

Forex trading has advanced with technology, requiring a forex trader to find a fast and stable internet to access the financial markets. Forex brokers offer their services online. Therefore, it requires fast internet to compete with other forex traders for the best prices offered.

Find a regulated forex broker that accepts Ukraine traders

Forex traders from Ukraine looking to register a trading account have to ensure they select a regulated forex broker. The advanced technology used in forex trading has also attracted scams like many other industries.

It is why traders should take precautions to find a licensed forex broker with any tier one or two jurisdictions and take an extra step to validate that the license is legitimate. You can confirm if the forex broker is regulated through the website of the regulation institution.

Register a trading account

If you have selected a forex broker, the next step is to register a trading account. Registering a trading account takes 3 to 5 minutes in most forex brokers. The forex brokers within the European Union require that traders register according to the Anti-money laundering regulations.

During registration, forex brokers must collect the client’s name, email, home address, nationality, date of birth, account type, password, employment status, and trading background. These details ensure that the forex broker has the client details for transparency.

If you successfully register and verify a trading account, you can download a trading platform that you use to enter the financial market. Forex brokers offer a variety of trading platforms that are popular in the financial markets, and others have their proprietary platforms.

Start with the demo or real account

Traders can start with the demo account to test the trading features and practice their trading strategies. Seasoned forex traders can also start with the direct account, but we recommend new traders start with the demo account to get accustomed to how trading works before risking funds on the real account.

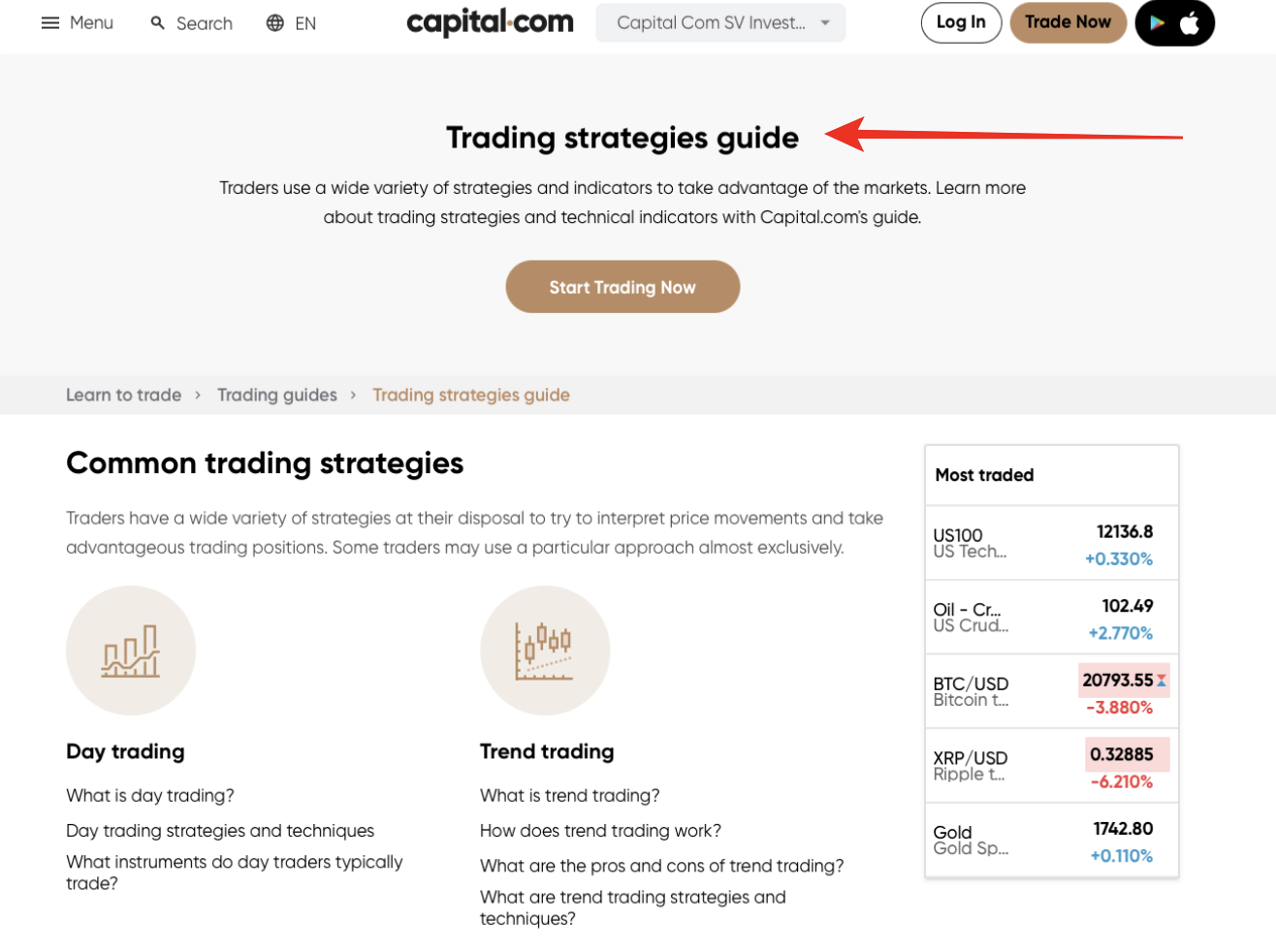

Use strategies and analysis

Trading strategies are diverse and depend on the type of trader. Long-term traders use strategies to stay in the market longer, such as trend trading or swing trading. Shorter trading strategies include day trading, scalping, or position trading.

Trading strategies consist of entry /exit methods, stop loss /take profit, and other technical tools they can apply. The analysis includes technical and fundamental evaluation of the price markets. Fundamental analysis involves monitoring any financial events and news that can cause volatility.

Technical analysis involves:

- Evaluating the history of the price action.

- Using technical tools.

- Analyzing the candlestick and price patterns.

They help a trader understand and estimate the next direction of the price action.

Deposit funds and start trading

Due to the diversification of the forex market and the advancement of technology, forex trading is now accessible even in remote regions. It means that forex brokers have to update the payment methods they support to get more clients.

They support a range of payment methods that traders select from and link to their trading accounts. Deposit your funds and start trading if you are prepared to start trading.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Ukraine

The financial markets have grown popular in Ukraine; more forex traders register trading accounts. It increases demand for regulated forex brokers, which means forex scams also target novice traders without experience.

It is why traders must ensure that the forex brokers they register under are regulated. They also need to confirm the license displayed on the broker platform to ensure true. They can do this by checking the license number on the regulatory agency’s website.

FAQ – The most asked questions about Forex Broker Ukraine:

Is the Ukrainian Hryvnia available in Forex?

Yes, it is available in forex and has the currency code UAH. You can pair it to the Euro or to the USD to trade on the varying interest rates of the two currencies. The current exchange rate of the USD/UAH is 30.2500, and of the EUR/UAH is 31.89.

Is Forex trading taxable in Ukraine?

Forex traders have to pay tax on the income they make from forex trading, whether it is a loss or a win.

How does a trader in Ukraine sign up for a forex trading account?

A trader can follow the steps below to sign up for a forex trading account in Ukraine.

Choose the forex broker operating in Ukraine.

Signup for a demo account or a live account by entering your details.

Then, choose the initial amount you wish to fund into your forex trading account

After selecting a deposit method, you can validate your payment and place your forex trade.

What is the forex demo account duration available for traders in Ukraine?

Traders in Ukraine and elsewhere can access the forex demo account for free with most forex brokers. However, the duration might vary across different forex trading platforms. Usually, most forex brokers allow traders to use the demo account free for 30 days. After this, you can extend the duration of your forex demo account by paying extra to the broker.

Which forex brokers in Ukraine offer traders the best spreads?

When considering forex spreads, few brokers in Ukraine offer competitive pricing. However, if you choose one of the below-listed forex brokers, you can enjoy trading with the best spreads.

BlackBull Markets

Capital.com

Last Updated on January 18, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)