The 5 best Forex Brokers and platforms in Uruguay – Comparison and reviews

Table of Contents

The forex market is the largest and most liquid globally, with a daily trading volume of over $5 trillion. Due to its size and liquidity, it is an ideal market for traders looking to make quick profits. However, trading in the forex market can also be risky, so it is crucial to choose a broker and platform that is right for you. Below are the five best forex brokers and platforms in Uruguay.

See the list of the best Forex Brokers in Uruguay:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

- Capital.com

- Blackbull Markets

- Roboforex

- Pepperstone

- IQ Option

1. Capital.com

Capital.com is a social trading and investment platform that allows users to invest in various assets, including stocks, cryptocurrencies, and Forex. The company was founded by brothers Jason and David Gentile.

Capital.com is headquartered in London, England, and has offices in Sofia, Bulgaria, and Limassol, Cyprus. The company has a team of over 200 people and is growing rapidly.

Capital.com is a subsidiary of Boussard & Gavaudan Investment Management LLP, a global asset management firm with over €24 billion in assets under management. The company has more than 250,000 registered users and is licensed and regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

Merits of Capital.com

- A wide range of assets to invest in.

- Capital.com has an average pricing comparison to the industry at large.

- Quality educational materials are provided to traders on the Capital.com trading platform.

- Traders are offered commission-free real stocks on Capital.com.

Demerits of Capital.com

- Capital.com does not provide services to United Kingdom residents.

- There are high stock index CFD fees.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a privately owned company founded by two entrepreneurs. It provides online foreign exchange and CFD trading facilities to retail investors. The company has its registered office in the Isle of Man and is authorized and regulated by the Isle of Man Financial Services Authority (IOMFSA). The BlackBull team has many years of experience within financial services and offers its clients a wealth of knowledge and expertise. It has over two million clients in more than 130 countries.

The BlackBull Markets broker offers a wide range of products, including Forex and CFDs on stocks, indices, commodities, ETFs, and cryptocurrencies. It provides a variety of account types, each with its own set of features and benefits. They offer competitive spreads and 24/5 customer support in more than 20 languages.

Benefits of BlackBull Markets

- BlackBull Markets offers competitive spreads and high-quality execution.

- Customer support is available around the clock.

- The account opening process is swift on BlackBull Markets

- Low forex fees

The drawback of BlackBull Markets

- Blackbull Markets charge its traders’ withdrawal fee

- The research tools available on BlackBull Markets are limited.

(Risk Warning: Your capital can be at risk)

3. RoboForex

The RoboForex broker company was founded more than ten years ago. RoboForex Ltd is also registered with the Financial Conduct Authority of the United Kingdom (FCA), reference number 600475. The company provides online Forex trading services to both retail and institutional clients worldwide. RoboForex offers its clients a wide range of trading accounts.

RoboForex broker is one of the first brokers who started working with Bitcoin and helped to popularize this digital currency on the Forex market.

Merits of RoboForex

- The RoboForex trading platform is reliable and straightforward to trade on.

- You can trade on RoboForex anything of the day, and the service is available around the clock.

- You get your funds immediately when you withdraw on RoboForex.

- RoboForex provides its traders with a unique trading program such as CopyFx.

Demerits of RoboForex

- RoboForex doesn’t have cryptocurrency tools available for its traders.

- You are required to pay a minimum deposit of $10.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is an Australian online forex broker that offers services to retail and institutional traders worldwide. FXStreet has awarded the company the Best Forex Broker in Australia for three consecutive years.

Pepperstone is an Australian-based online foreign exchange (Forex) and CFD broker that offers traders access to the global financial markets. Pepperstone offers its clients a variety of trading platforms, including the MetaTrader 4, cTrader, and WebTrader platforms.

The company initially offered only forex trading but expanded its product offerings to include CFDs on stocks, indices, commodities, and cryptocurrencies. Pepperstone’s products are available to traders worldwide through its web-based platform, mobile apps, and MT4 terminal. In addition, the company offers 24/5 customer support.

Pros of Pepperstone

- RoboForex trading platform provides tight spreads and fast execution trading experience for its traders

- Pepperstone traders trade at a no commissions rate.

- Pepperstone offers its traders MetaTrader and cTrader platforms.

- Quality research materials are provided to traders on the Pepperstone trading platform.

Cons of Pepperstone

- The educational materials provided at Pepperstone are close to average.

- Assessment sections are not included in the educational materials.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a regulated binary options (only for professional traders and outside EAA countries) broker, providing trading services and facilities to retail and institutional investors. Founded in 2013, the company has since gained a strong reputation and is now one of the most popular brokers in the industry.

IQ Option offers its clients a wide range of trading products, including stocks, commodities, indices, and currencies. The company also provides a variety of trading tools and features. It also offers educational materials to help traders make informed investment decisions.

Benefits of IQ Option

- The broker offers its clients a user-friendly platform that is easy to navigate.

- The company also offers a wide range of educational materials and tools, so traders can gain in-depth knowledge about binary options (only for professional traders and outside EAA countries) trading before trading with real money.

- IQ Option doesn’t charge its traders’ withdrawal fees.

- The process of opening an account on IQ Options is easy and convenient.

The drawback of IQ Option

- MT4 and MT5 trading platforms are not available on IQ Option.

- Traders are not accepted in Canada and some other countries.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Uruguay?

The forex market is the largest and most liquid globally, with a daily trading volume of over $5 trillion. Due to its size and liquidity, it is an ideal market for traders looking to make quick profits. However, trading in the forex market can also be risky, so it is crucial to choose a broker and platform that is right for you.

Uruguay has one of the most open and liberal economies in South America. Uruguay’s financial sector is highly developed, characterized by a well-regulated banking system and a sophisticated institutional investor base. The supervision of the Uruguayan financial industry is entrusted to the National Superintendent of Banks (SUDEBAN).

Financial institutions in Uruguay include banks and other organizations that carry out financial intermediaries. The Financial institutions are expected to get authorization from SUDEBAN for legitimacy and appropriateness, with the preceding report coming from the Central Bank of Uruguay.

Uruguay has a well-developed financial system and a solid regulatory framework. The Central Bank of Uruguay is the country’s top banking and financial regulator. The Superintendencia de Instituciones del Sector Financiero (SISF) is the primary securities and insurance regulator. The Uruguayan government is keen to promote the country as a financial center and has put several incentives to attract foreign investment. These include a 10-year tax holiday for foreign investors and the ability to repatriate profits tax-free.

Uruguay has been a regional leader in financial regulation and has advocated the “follow the money” approach to combating financial crime. In 2002, Uruguay was one of the first countries to implement anti-money laundering legislation.

In more recent years, Uruguay has been at the forefront of developing measures to address the new challenges posed by digital currencies and the sharing economy. In 2017, Uruguay became one of the first countries in Latin America to regulate Bitcoin and other digital currencies.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders in Uruguay

Uruguay is one of the most crucial trading partners in Argentina. The Andean Free Trade Zone Agreement has allowed for tariff-free trade between the two countries since 2009. As a result, bilateral trade has continued to grow, reaching nearly $5 billion in 2016. This agreement has created opportunities for both countries to strengthen their economies and provide jobs for their citizens. However, this growth also brings with it new security challenges. Cybercriminals are increasingly targeting Uruguay’s financial sector with ransomware and other attacks.

Uruguay has been a popular destination for forex traders and investors lately because of its relatively stable economy and low levels of government debt. However, as with any other form of investment, there are risks associated with trading currencies, and it is vital to take steps to protect your assets.

Here are a few security tips when trading Forex in Uruguay:

1. Use a reputable and reliable forex broker.

2. Make sure your computer is protected with up-to-date antivirus software and a firewall.

3. Keep your trading account information confidential and do not share it.

Uruguay is a country that has seen a lot of growth in the Forex market recently. The country’s growth is due to the security measures that have been put into place by the Uruguayan government to protect traders and their investments.

One of the essential security measures for Forex traders in Uruguay is using two-factor authentication. The two factor-authentication requires you to enter two pieces of information. This information includes your username and password and a code that is sent to your phone) – to log in to your account.

Is it legal to trade Forex in Uruguay?

Uruguay is a country located in the southern cone of South America. The foreign exchange market, or Forex, is a decentralized global market for the trading of currencies. This market allows for the buying and selling of different currencies at predetermined rates. Is forex trading legal in Uruguay? Let’s explore.

There is no definitive answer to this question. Uruguay has some restrictions in place regarding forex trading, and there are no specific laws prohibiting it. It is crucial to ensure that you know all the relevant regulations before starting to trade. However, forex trading is not regulated by the government in Uruguay, so there is always some element of risk involved.

In general, it is advisable to seek professional legal advice before starting to trade to ensure that you are fully compliant with all the relevant laws and regulations. Also, make sure that you do adequate research about the broker. Make sure that the broker is regulated and recognized outside Uruguay.

How to trade Forex in Uruguay – Tutorial

Uruguay is a small South American country bordered by Brazil, Argentina, and the South Atlantic Ocean. The country has around 3.4 million people, and its capital city is Montevideo. Uruguay’s economy is based on services, industry, and agriculture.

Forex trading is available in Uruguay through several brokers, and the currency traded is the Uruguayan peso (UYU). The forex market in Uruguay is relatively small, with daily transactions going on.

Uruguay has several advantages when it comes to forex trading. One is that the Uruguayan peso is not as volatile as some other currencies, making it a more stable investment. Another plus is that Uruguay has a low inflation rate, making it a safe place to keep your money. Finally, Uruguay offers tax incentives for foreign investors, making this an attractive place to do business.

Open an account

Before starting trading in Uruguay, you have to open an account with Forex Trader and enjoy the security and convenience of trading online. Opening a forex account with a reliable broker will allow you to trade in any market worldwide. Getting benefit from competitive rates, tight spreads, and fast execution.

To open an account, you are required to produce two primary documents, which are your valid identification card and proof of residence (your utility bill or your bank statement)

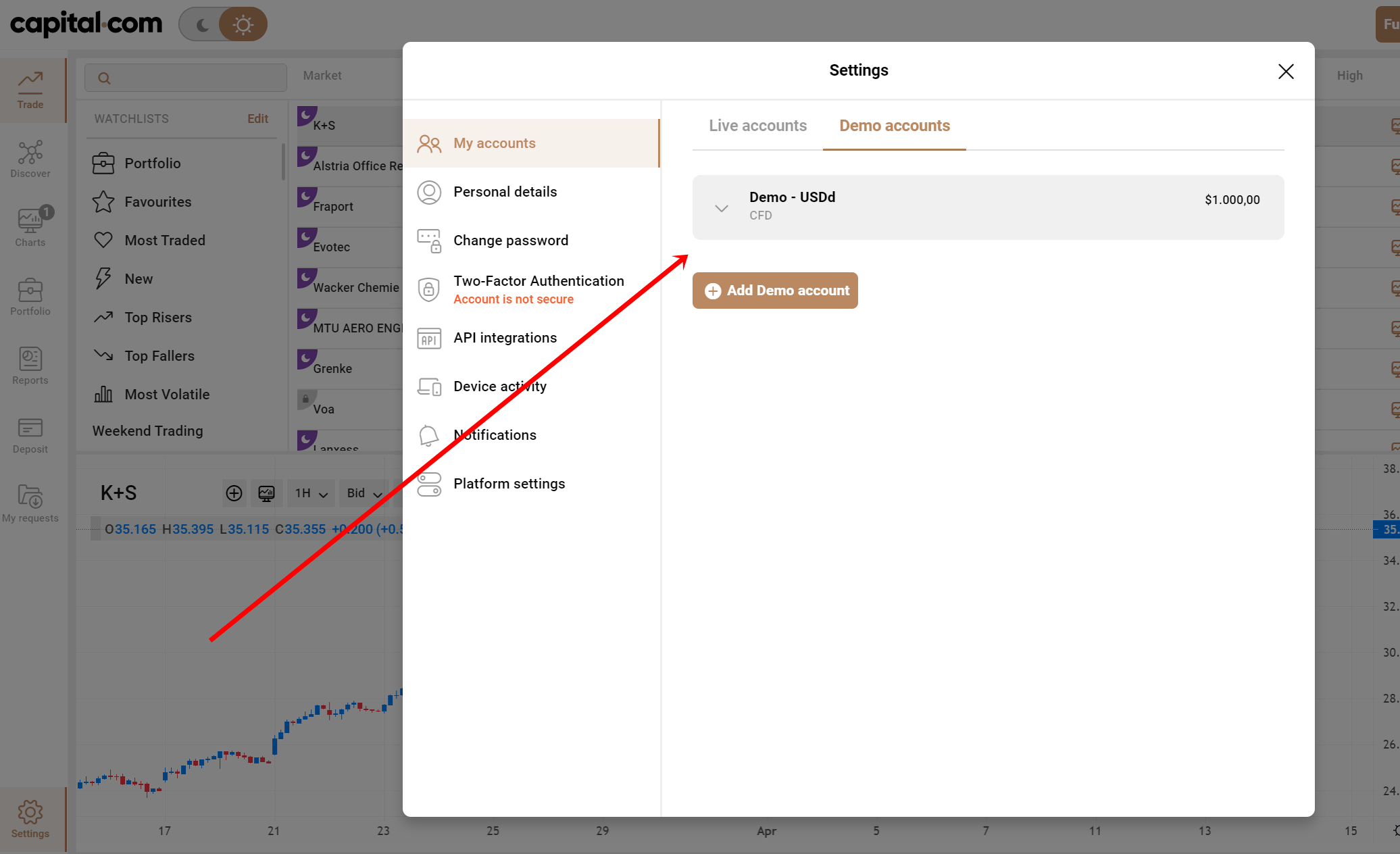

Start with a demo account or real account

When you start trading in the Forex market, you have two choices: You can either start with a demo account or a real account. Most traders choose to open a demo account to practice trading strategies and get a feel for the market before opening a real account and risking any money. A demo account allows you to trade with virtual currency to gain experience without losing money. A real account requires you to deposit money into your account to trade.

Deposit money

When you are ready to deposit money into your forex account, there are a few different ways to do this. The most common methods include wire transfers, checks, and ACH transfers. Once you have registered with a broker, they will give you specific instructions on how to send money.

To make a deposit, you will need to provide your broker with some critical information, such as your account number and the routing number for your bank. If you are depositing money via check or wire transfer, you will also need to include the amount you are depositing. It is important to note that different brokers may have different minimum deposit requirements.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

The forex market is one of the most exciting and challenging markets globally. It is constantly changing, and there are always new opportunities to explore. If you want to be successful in the forex market, you need to have a solid strategy. The most popular forex analysis and strategies will be discussed below.

Position trading

Position trading is a long-term investment strategy that aims to profit from small price movements over time. Position traders hold their investments for weeks, months, or years, often buying and selling stocks or other securities multiple times. By buying low and selling high, position traders can generate profits over time while minimizing the effects of short-term price volatility.

Scalping

Scalping is a trading strategy that attempts to take advantage of momentary changes in the market by buying and selling shares quickly and then waiting for prices to stabilize. Scalpers typically hold a position for a short time, sometimes only seconds, and then resell the stock. They are looking to make a small profit on each transaction, so they trade quantity and price. A scalper hopes to make several small profits over a day, which can add up to a significant amount if done correctly.

Day trading

Day trading is a form of active investing that attempts to take advantage of short-term price fluctuations in stocks, indices, commodities, and currencies. Rather than holding a position for months or even years, day traders aim to make anywhere from one to dozens of trades in a single day, hoping that their profits will outweigh their losses when all is said and done. Professional day traders often work out of dedicated trading floors with direct access to markets.

Make profit

Forex trading is buying and selling currencies to make a profit. It may sound simple on the surface, but it’s pretty complex and can be very risky if you don’t know what you’re doing.

If you educate yourself on the basics of forex trading and take the time to practice using a demo account, you can make a lot of money if you’re successful. There are different strategies you can use, and no single approach is guaranteed to work all the time; however, if you find a strategy that works for you and stick to it.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Uruguay

This article has reviewed the five best forex brokers and platforms in Uruguay. Forex trading can be a profitable way to invest, but it also carries a specific risk. By understanding the different brokers and platforms available in Uruguay, you can select the one that is best suited to your individual needs and goals.

FAQ – The most asked questions about Forex Broker Uruguay:

What should novices in forex trading know about indulging in the field with the help of a forex broker in Uruguay?

Novice forex traders coming with the forex broker in Uruguay in the market should look into the following points:

1. Educational courses for knowledge gain regarding the market are crucial.

2. Do check and try out the demo account feature offered by forex brokers.

3. Look at the fee structure of different account types like Gold, Bronze, Executive, etc.

4. An Islam follower can ask for an Islamic account, swap-free accounts that do not violate the Sharia law.

What fees do forex brokers in Uruguay charge?

A forex broker in Uruguay will charge the following fees. The differential between the selling and buying prices is represented by the spread. Most brokers charge spread depending on the type of trading account. Reviewing the conditions is crucial to understand them. Usually, the ECN accounts have the lowest spread.

As a novice trader, how much should I put in my account with the forex broker Uruguay?

You should put at least 50 USD in a cent account with a forex broker in Uruguay. However, if you are trading on a real account, deposit a minimum of $300- $500 for flexibility in trading.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)