5 best Forex brokers that accept US clients: Platforms in comparison

Table of Contents

See the list of the 5 best Forex brokers that accept US clients:

Broker: | Review: | Accepts US-Clients: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. IG  | Yes | FCA, CySEC, ASIC | 6,000+ (70+ currency pairs) | + No hidden fees + Education section + Broker since 1974 + Multi-regulated | Live account from $0(Risk warning: Your capital can be at risk) | |

3. Forex.com  | Yes | IFSC, CySEC, ASIC | 1,000+ (55+ currency pairs) | + Supports MT5 + Great liquidity + Reliable support + Multi-Regulated | Live account from $50(Risk warning: Your capital can be at risk) | |

4. TD Ameritrade  |  (5 / 5) (5 / 5) | Yes | FCA, AFSL, FSCA | 200+ (50+ currency pairs) | + Low-cost trading + Secure and reliable + Multi-Regulated + No account minimum | Live account from $0(Risk warning: Your capital can be at risk) |

5. Oanda  |  (4.9 / 5) (4.9 / 5) | Yes | FCA, CySEC, FSCA, DFSA, SCB | 250+ (50+ currency pairs) | + Research tools + $0 minimum deposit + Low trading fees + Free demo account | Live account from $0(Risk warning: Your capital can be at risk) |

Four sessions open in the forex market, and they are some of the periods when the market is busy. One of these four sessions is the New York session in the US, and this is also one of the sessions in which forex traders are very active.

Any forex market participant would expect that the forex traders who are active in forex would come from the US since it is one f the major forex trading centers. There are few forex brokers in the US despite being a major business center for other trading commodities.

Why some Forex brokers do not accept US clients

Some forex brokers do not accept forex traders from the US because of the stringent forex policies they have to follow to operate in the US. When it comes to forex trading, forex brokers have to get licensed in a particular jurisdiction to access that market of forex traders.

There are regulatory organizations given the mandate to monitor and investigate forex brokers as they operate in an area. For example, the Financial Conduct Authority (FCA) works to regulate forex brokers around the EU.

Similarly, there are regulatory institutions in the US monitoring forex broker services. It works to ensure fairness in service provision, and forex broker follows guidelines to work in the US.

These conditions make forex brokers shy away from the US, which is why most of them do not accept US clients.

- Forex regulatory bodies for the US

- Here is a list of the institutions that regulate forex brokers operating in the US;

- National Futures Association-NFA

- Financial Industry Regulatory Authority –FINRA

- Commodities Futures Trading Commission- CFTC

- Securities and Exchange Commission- SEC

- Securities Investor Protection Corporation -SIPC

Regulations for Forex brokers in the US:

There are many regulations to prevent unjust exploitation and allow peaceful resolution of any conflict. First, there are some conditions forex brokers have to fulfill to get registered in the US.

- A forex broker must get a Retail Forex Exchange Dealer license (RFED) through a thorough verification process. It needs the forex broker to guarantee the professionalism of the employees through proper certification.

- It also requires crucial information about the company founders and objectives, the owners and operators, and the trading resources. There are also some measures to safeguard the retail investor resources, more so for those using capital less than 10 million.

- Forex brokers need a 20 million deposit requirement as a security, which is mandatory for any forex broker who wants to operate in the US.

- The maximum leverage forex brokers are 1:50 to protect retail investors who can invest without knowledge of leverage trading.

- Forex traders have to pay taxes on the majority of the revenue they get from forex trading, depending on their income status.

- They also have strict rules on hedging, which is a forex trading technique traders use on foreign currency.

- They require transparency from the forex broker about any decision and client information.

- A Physical Office in any town.

- The forex brokers agree to audits that regulators can conduct without prior knowledge.

Many policies got inducted in 2010 known as the Dod-Frank laws, intended to make the US secure from forex frauds and scams. Although these laws are viable to forex brokers, some conditions are hard to meet.

It is why forex brokers do not have forex licenses for the US and do not accept US clients. Some forex brokers meet all the requirements and can conduct their services in the US.

List of the 5 best Forex brokers that accept US forex traders:

1. IG

It is a forex broker founded in 1974, has operated for more than two decades, and has the trust of more than 150,000 clients. It has access to a range of markets such as Indices, shares, cryptocurrency, bonds, forex, commodities, and ETFs. The US clients can only access forex.

Regulation

- Commodities Futures Trading Commission in the US

- National Futures Association in the US

- Financial Conduct Authority in the UK

- Australian Securities and Investment Commission

- Japanese Financial Services Authority

- Monetary Authority of Singapore

- Swiss Financial Market Supervisory Authority

Pros and cons of IG:

Pros

- Regulation by tier-one jurisdiction regulators from the US and UK

- It has Quality educational resources

- Various payment methods

- Industry-leading trading resources

- User-friendly functionality

- Wide range of currency pairs to trade

Cons

- Limited forex trading instruments for US clients

(Risk warning: 75% of retail CFD accounts lose money)

Account types

IG has a variety of forex trading accounts for investors to choose from according to their suitability. They have a Trading, Professional, Options Trading, Turbo 24, Limited risk, Share dealing, and the Exchange account.

They also have an Islamic account for Muslim traders which follows Sharia laws. Clients can open the IG trading and the Exchange accounts which offers negative balance protection. It also has over 80n currency pairs and a variety of contracts for exchange-traded binaries.

Fees

Forex spreads start from 0.8 to 5.0 pips for most of its major and minor pairs. It has a conversion and an overnight fee for positions open overnight with leverage. The maximum forex leverage for US clients is 1:50 as per the US regulatory requirements.

IG also has an inactivity fee for inactive accounts of over a year. Forex traders who meet qualifications can access bonuses and rebates. The minimum deposit varies with the account type, but US forex traders have $250 to start trading.

IG trading features

It has a demo account that traders can use to practice forex trading or familiarize themselves with the IG trading software. It offers Meta Trader 4, ProRealTime charting software for UK clients, and the L2 dealer hat is a Direct Market Access trading platform.

These trading platforms have charting software with varying timeframes and the tick chart. They also have indicators, support copy/ share trading, and offer automated trading. It has the risk management tools like stop loss and profit-taking orders.

Forex traders can access the research via blogs and articles consisting of news, trading ideas, and forecasts. IG offers the Auto-chartist tool, that gives trading signals, daily videos, and blog updates that serve as crucial trading data for forex traders.

The educational content covers many topics, including forex trading, risk management, and trading tools. The content is presented as articles, video courses, and webinars.

IG users access the trading platform via a mobile application, a desktop and a website version, and a mobile application with educational content for traders. Their customer support team is available via live chat, email, and phone calls.

Deposit and withdrawal

Deposits and withdrawal fees depend on the type of country, but withdrawal via wire transfer is subject to withdrawal fees of $25 for Us citizens. Forex traders can use a Credit/debit card or PayPal when funding their account.

(Risk warning: 75% of retail CFD accounts lose money)

3. Forex.com

It is a forex broker founded in 2001 and has acquired several regulations from the US. Forex.com has access to commodities, ETFs, Indices, bonds, precious metals, and Forex. US forex traders can access a wide range of forex pairs to trade.

Regulation

- National Futures Association in the US

- Commodities Futures Trading Commission in the US

- Financial Conduct Authority in the UK

- Investment Industry Regulatory Organisation in Canada

- Japanese Financial Services Authority in Japan

Pros and cons of Forex.com:

Pros

- Quality trading tools

- Low trading fees

- A variety of forex pairs

- It has credibility among forex traders due to its track record of over 20 years

Cons

- Has no negative account protection for US traders

(Risk Warning: Your capital can be at risk)

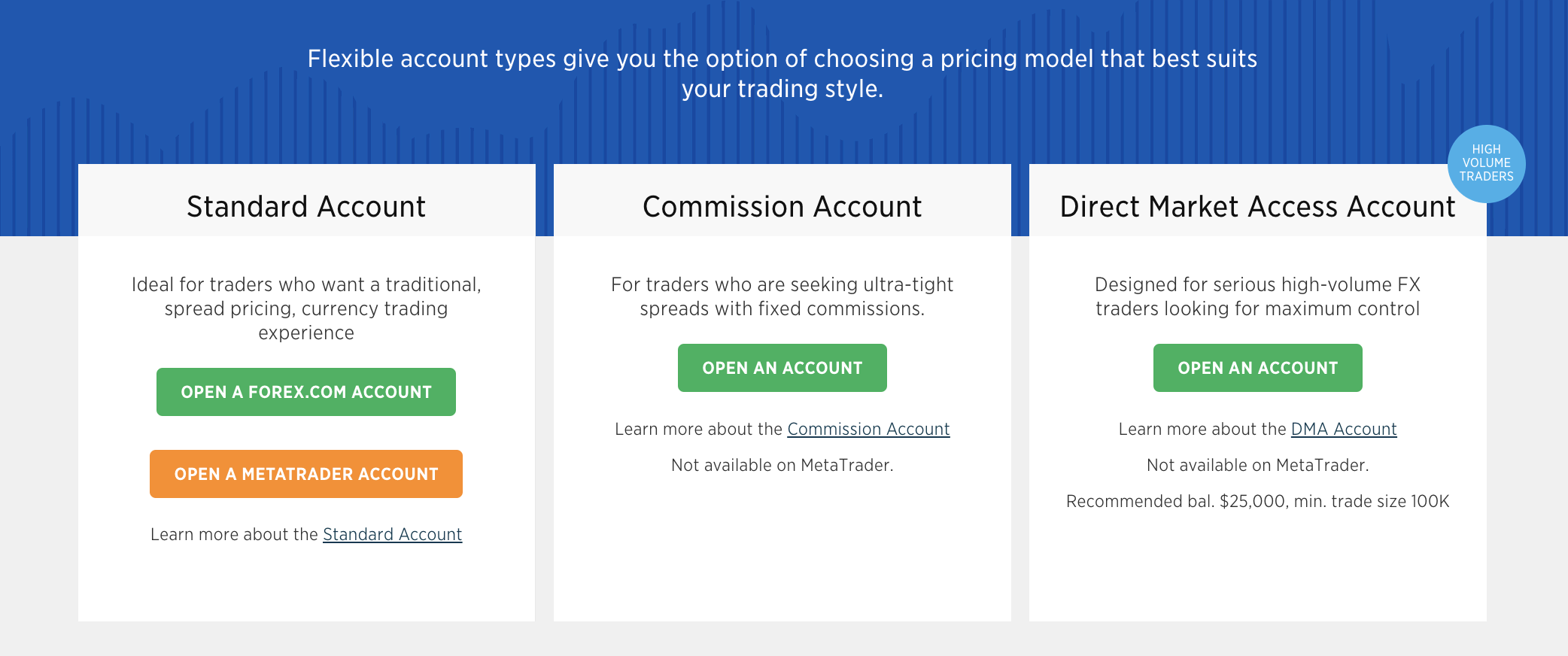

Account types

Forex.com has three types of trading accounts, the Commission, DMA, and Standard account. The Standard has low forex spreads and no commission for any trade, while the Commission account has a commission starting from $5 for each $100k traded and low forex spreads.

The Direct Market Account or the DMA is a trading account for forex traders who trade high volumes and need low spreads and high liquidity. The minimum deposit on Forex.com is $100.

Fees

Forex spreads start from as low as 0.1 on Forex.com, and commissions charged are from $50-60 for every million dollars traded. There is an overnight fee for open positions throughout the night with forex leverage, costs depend on the size of the trading position.

It has an inactivity fee of $15 for accounts without any activity for more than a year. Forex.com clients from the US can access a 1:50 leverage.

Features

Its clients can access the demo account present on the platform to look at the trading tools and research materials at Forex.com. It has integrated the Meta Trader 4, 5, and its proprietary trading platform Ninja Trader. These trading platforms come with a range of trading tools.

They have over 100 technical indicators, trading charts, and several drawing tools. Its advanced trading tools have Trading View for charting and a user-friendly interface in the mobile application, desktop, and website version.

The research materials are also available on Forex.com with Trading central, offering trading signals to traders. It has the research such that it is presented as weekly updates on videos and blogs by the analysts at Forex.com

The educational resources are comprehensive and well planned for all stages of learning, from basic level to experience level. They are in article form and teach most trading topics, and strategies traders can use in many financial markets.

Clients can contact their customer care team via live chat, email, and phone calls.

Deposits and withdrawals

It has no deposit and withdrawal fees, and they accept credit/debit cards.

(Risk Warning: Your capital can be at risk)

4. TD Ameritrade

It is a forex broker founded in 1975 and is US-based, which means it accepts US clients. Its clients can access stocks, ETFs, Forex, futures, bonds, and Mutual funds.

Regulation

- Commodities Futures Trading Commission

- Securities and Exchange Commission

- Financial Industry Regulatory Authority

- Hong Kong Securities and Futures Commission

- Monetary Authority of Singapore

Pros and cons of TD Ameritrade:

Pros

- Industry-leading forex educational resources

- User-friendly interface for the mobile, desktop, and website version

- A wide range of trading instruments for US traders

Cons

- High trading costs

(Risk Warning: Your capital can be at risk)

Account types

TD Ameritrade has many different account types, from trading to investment accounts. They include the Standard account, which you can open as an individual or a corporate. You can open an education account for investing and saving.

The IRA account is for investing towards retirement, a business, and a managed account, which they assign to clients’ account managers. These account types also have other accounts under them to suit the different needs of traders.

Fees

It has different trading fees for each trading instrument, such as ETFs and stocks are free to trade. It has an average forex spread of 1.2 when the markets open, and the contracts have a commission of $0.65. Mutual funds have a commission of $49.99.

It also has leverage. Traders have to deposit a margin of 9.5% for $10,000 and 7.75% to access funds for more than $100,000.

Features

It has a virtual method of practicing strategies using its own proprietary trading platform, Thinkorswim. It is like a demo account for trading over $100,000 in virtual money, known as paper money. Furthermore, it has two types of trading platforms that traders can enjoy Thinkorswim for trading stocks, ETFs, and forex.

Then there is the TDAmeritrade which traders can access stocks, bonds, and CFDs. These two have trading tools that forex traders require, such as advanced charting software, drawing tools, news, and technical indicators.

The two trading platforms have a mobile app and a desktop version that carries the features of the website version. Forex traders can access the trading platforms even through social media platforms like Twitter and Facebook Messenger.

TD Ameritrade has research materials for its clients through daily analysis reports, news, and content from third-party providers. Its clients are sure to get updated content daily about the financial markets. The education center hosts comprehensive trading resources arranged to ease accessibility.

It is presented through videos, tutorials, webinars, articles, and life coaching for all traders. The customer service team is also present 24/7 to solve any issue traders can have. They can get contacted through email, website, and Social Media platforms.

Deposit and withdrawals

The deposit and withdrawals are free in the US but vary in other countries. Funds transfer through credit/ debit cards, and e-wallets are unavailable. You can only deposit or withdraw using a Bank transfer, and it supports only one base currency.

(Risk Warning: Your capital can be at risk)

5. Oanda

It is a forex broker founded in 1996 that accepts US clients. Oanda offers diverse CFD trading instruments such as Stocks, Metals, Commodity, Bitcoin, bonds, and forex. CFDs trading is unavailable for US residents and can only trade forex.

Registration

Oanda has registration from tier 1 and 2 forex regulators such as;

- Commodities Futures Trading Commission in the US

- National Futures Association in the US

- Financial Conduct Authority in the UK

- Australian Securities and Investment Commission

- Investment Industry Regulatory Organization of Canada

- Japanese Financial Services Authority

Pros and cons of Oanda:

Pros

- Quality and comprehensive research materials

- Fast account registration

- It is safe to use because of regulation from several organizations

- Low trading fees

Cons

- Limited trading instruments

- No guaranteed stop loss and negative balance protection for US clients.

(Risk Warning: Your capital can be at risk)

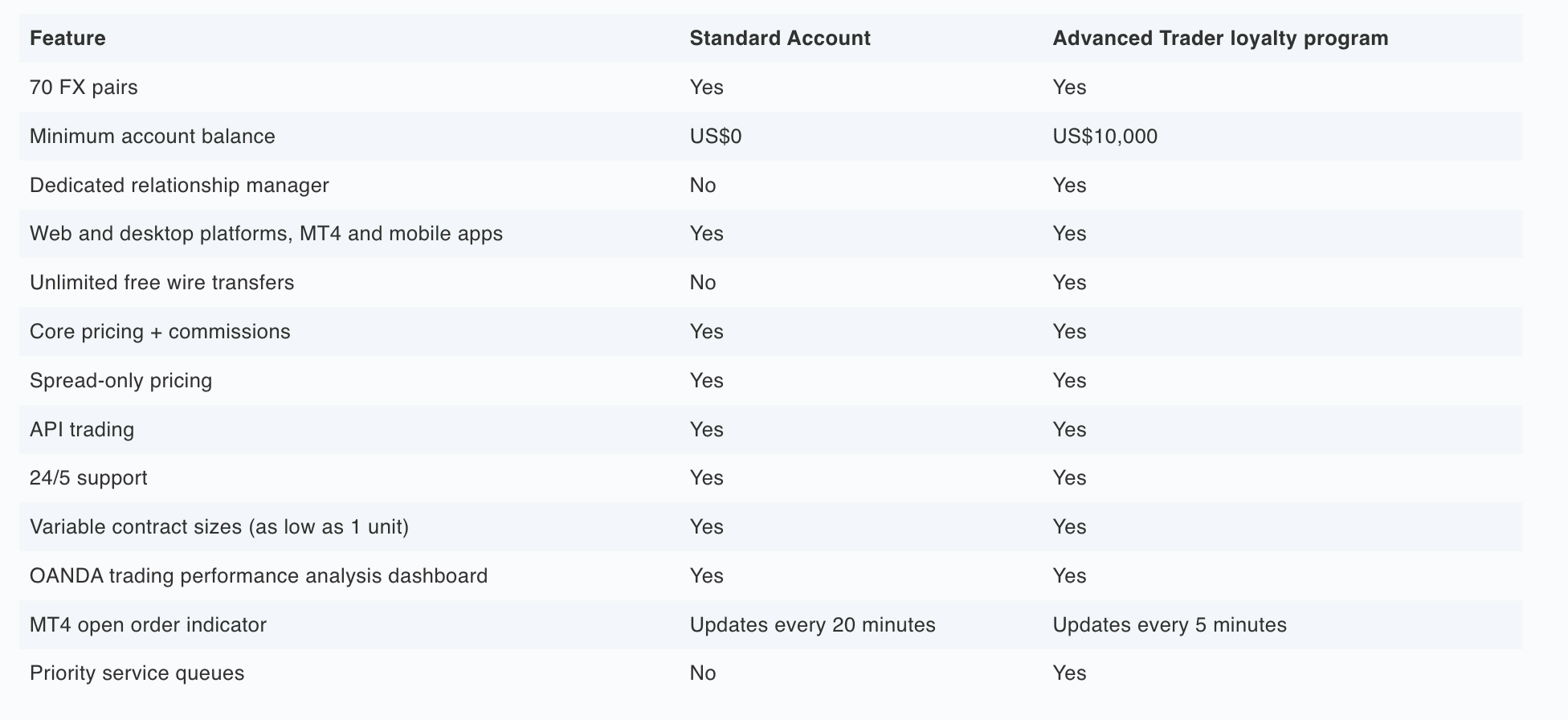

Account types

Oanda offers two types of accounts that forex traders can access different trading instruments. The Standard account has more than 20 account types available in other countries.

It has no initial deposit but has some other trading costs. There is a premium account for professional traders with a minimum deposit of $20,000.

Fees

Oanda has low trading fees, starting from the forex spreads with an average of 1.3 pips. It also has a commission of $50 charged for every 1 million dollar spread. It also has an overnight fee for trades open during the night, costs vary according to the position size.

Canada charges an inactivity fee of $10 after 12 months without any activity on a forex account. The maximum leverage US traders can access is 1:30and they can open positions as low as 0.01 micro-lots.

Features

It has a demo account for all traders, but new traders can find it very useful before registering for the live forex account. It offers the Meta Trader 4, Meta Trader 5, and its FXTrade trading platform, but Meta trader 5 is unavailable in the US.

The trading platforms have more than 50 trading tools, 30 technical indicators, several charts, and drawing tools. Oanda has webinars, forex trading articles, tutorials, and interviews to aid in research and education.

It also has third-party research and analysis from breaking news, signal analysis, and the Auto-chartist. Analysis teams give their trading research for different financial markets open. Oanda has a mobile application, a desktop, and a website version equipped with trading tools that forex traders use in any version.

They can also use the Automated trading feature present on the website version. Customer support is present 24/7 for any queries, you can contact them via email, live chat, and phone calls.

Deposit and withdrawals

Deposits are free, but you can get a withdrawal fee for bank transfers. Other payment methods are Credit/debit cards, and digital wallets such as Skrill, Neteller, Bpay, Union Pay, and others. They vary depending on the location.

(Risk Warning: Your capital can be at risk)

Conclusion – There are great brokers that accept US-clients

Forex traders in the US have few forex brokers that accept them, although most of their trading instruments are limited. But these forex brokers are the leading in the industry and safe to use because of the rules they have to follow.

Forex traders in the US must look at the different options of forex brokers and their services before choosing one. It will help them identify which forex broker matches their trading goals and objectives.

FAQ – The most asked questions about Forex Brokers that accept US clients:

Is Forex trading allowed in the US?

Yes, forex trading is allowed in the US. The strict regulations made some forex brokers reject US forex traders but more forex brokers are getting regulated in the US.

Is it safe to trade Forex in the US?

Yes, the US has the most strict rules regarding forex trading. The rules limit forex brokers from any unlawful practices to profit from their traders. Forex brokers that accept US clients need registration from the NFA and CFTC.

What is the procedure to legally trade in the USA?

To trade legally in the US, you must undergo a process. First, you must register as RFED by the financial regulatory body, CFTC. Also, before any broker accepts you as a client, register with the National Futures Association (NFA) as a Futures Commission Merchant (FCM).

Can I trade forex in the US safely?

Yes, you can use trading platforms safely in the US. They have the toughest rules regarding forex trading. It helps the clients to steer clear of any kind of fraud. In addition, the rules ensure that the brokers do not get profit from their traders through any unlawful practices. Any forex brokers who accept US clients must be registered with the NFA and CFTC. So, you can move on with Forex trading safely.

Is it a good option to rely on a Forex broker in US?

Even though foreign exchange trading is lawful, scams and corrupt individuals exist. The platform is safe to use, but you keep a sharp lookout. Make sure to have enough knowledge before indulging in the global financial markets. Yet, the forex broker is one of the safest available options. Therefore, you can try it out but be careful of scams.

Last Updated on September 30, 2024 by Andre Witzel