Five best Forex Brokers and platforms in Uzbekistan – comparison and reviews

Table of Contents

Forex trading has grown in many countries, such as Uzbekistan, where forex brokers register trading accounts. You have come to the right place if you are thinking about opening a trading account as a forex trader in Uzbekistan.

See the list of the best Forex Brokers in Uzbekistan:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

List of the 5 best Forex Brokers & platforms in Uzbekistan

1. RoboForex

RoboForex started its operation in 2009 and has had one million clients.

Trading instruments – it has ETFs, indices, forex, shares, commodities, CFDs, and cryptocurrencies.

Regulation – it has regulations from the International Services Commission.

Account types – it offers four types, Pro, Pro-cent, Prime, and the ECN have an initial deposit of $10, while the R-stocks trader has $100.

Fees – forex spreads depend on the account. Pro and Pro-cent start at 1.3 pips, the ECN and Pro start from 0.0 pips, and the R-stocks trader starts at $0.01.

Trading costs – it has an inactivity fee of $10, and deposits and withdrawals are free. It also has a low commission for most of the trading instruments.

Leverage – the highest leverage is 1:2000 for the Pro and Pro-cent, the R-stocks trader and the Prime have 1:300, and the ECN has 1:500.

Demo account – the demo account is free.

The trading platforms – it has the R-stocks trader, trader, MT4, and MT5.

Payment methods – it accepts AstroPay, NganLuong, Perfect Money, AdvCash, Skrill, Neteller, bank transfer, and credit and debit cards.

Customer support – their customer support is available through phone calls, live chat, and emails.

Pros

- Fast deposits and withdrawals

- Low trading costs

- Low initial deposits

- A fast account registration process

- Numerous trading instruments

Cons

- Limited trading instruments

- It is not available in most regions

(Risk Warning: Your capital can be at risk)

2. BlackBull Markets

BlackBull Markets has been in the forex industry since 2014 and has registered thousands of forex traders.

Trading instruments – it offers commodities, indexes, metal, energies, shares, CFDs, and fore.

Regulation – it has regulation from the Financial Services Authority.

Account types – it has the ECN standard account with an initial deposit of $200, the ECN Prime has $2000, and the ECN Institutional has $20,000.

Fees – forex spreads start at 0.0 for the Institutional account, 0.1 for the Prime account, and 0.8 pips for the Standard account.

Trading costs – the Standard account has no commissions, The Prime account has commissions from$6 for $100,000, and the Institutional account has commissions depending on the volume. It has no inactivity costs while the deposits and withdrawals are free.

Leverage – the maximum leverage you can access is 1:500

Demo account – it has a free demo account

Trading platforms – it offers the MT4 and MT5 and web trader

Payment methods – it supports FasaPay, Skrill, UnionPay, Neteller, bank transfers, and credit and debit cards.

Customer support – customer care is available 24/6 through live chat, emails, and phone calls

Pros

- A fast account registration process

- Low trading costs

- Fast deposits and withdrawals

- Fast execution speeds

- Wide range of trading instruments

Cons

- Limited educational resources

- Customer support is only available 24/6

(Risk Warning: Your capital can be at risk)

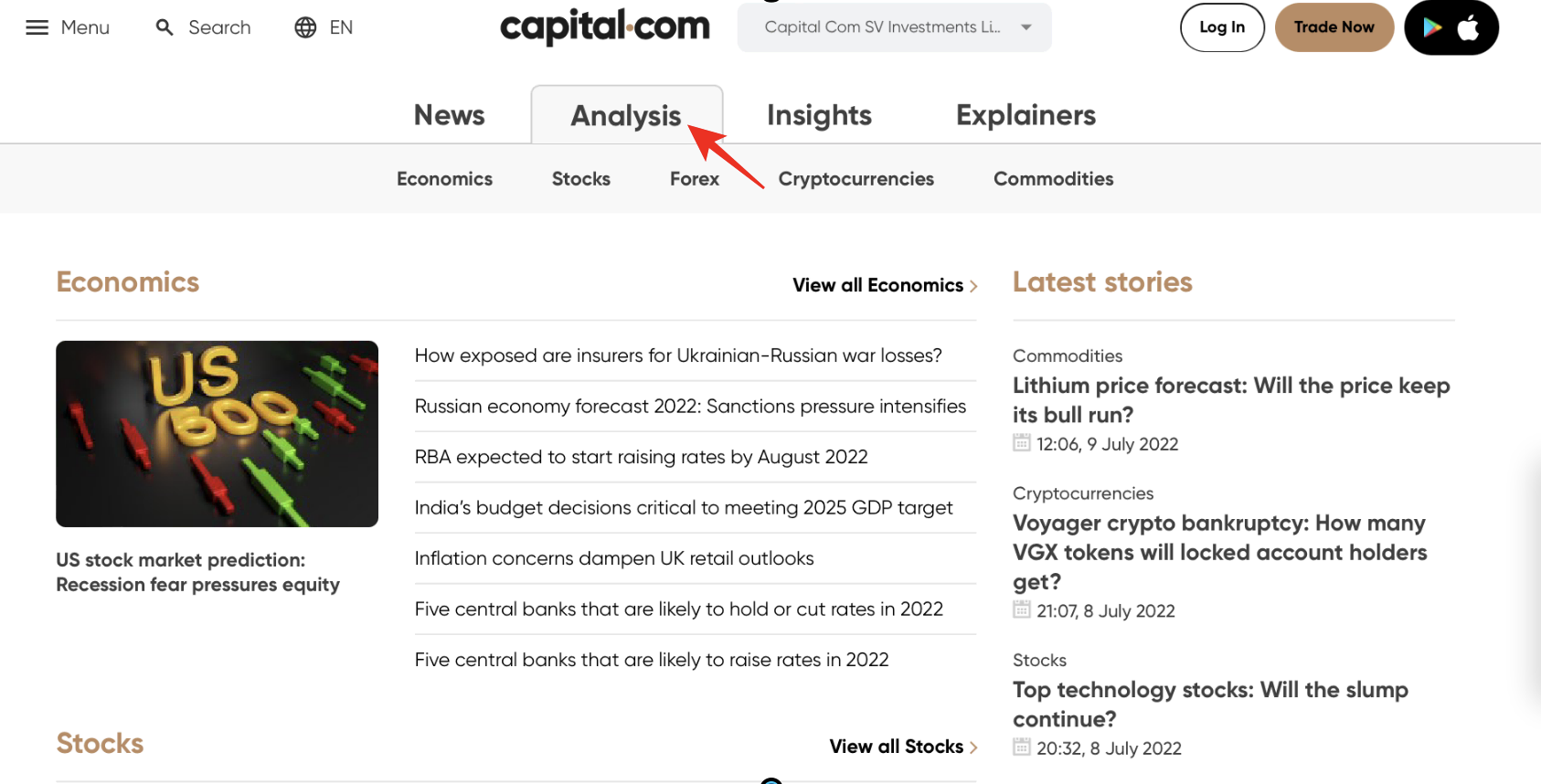

3. Capital.com

Capital.com has operated since 2016 and has registered over five million traders globally.

Trading instruments – it has access to cryptocurrencies, shares, commodities, forex, and indices.

Account types – it has three types, the Plus with an initial deposit of $2000, the Standard with $20, and the Premier, which offers $10,000.

Fees – forex spreads start at 0.8 pips.

Trading costs – It is a no-commission forex broker; it also has no inactivity costs and free deposits and withdrawals. The overnight costs depend on the leverage and position size.

Leverage – EU clients have a limit of 1:30, but professional traders and traders from other regions can access 1:500.

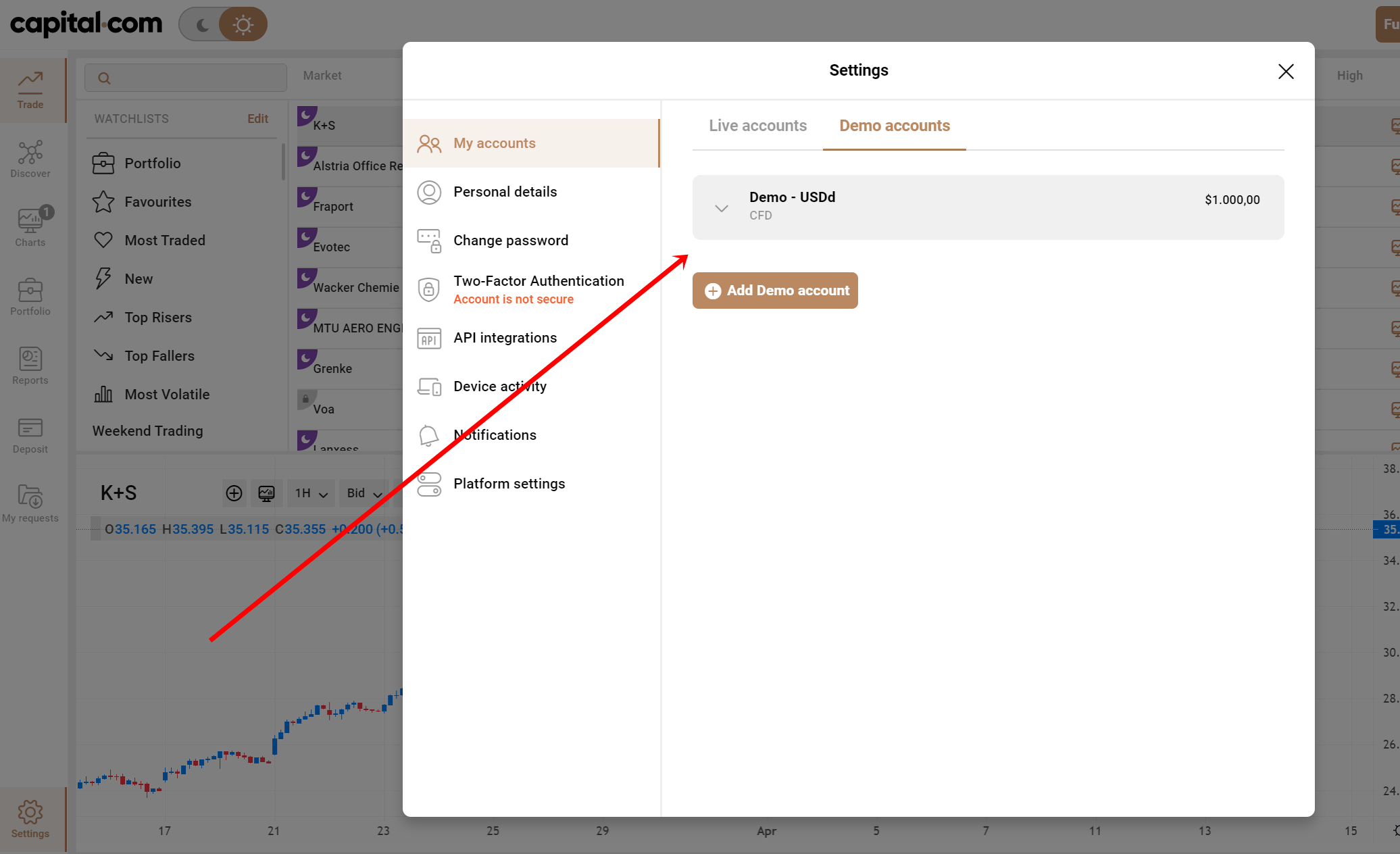

The demo account – Capital.com has a free demo account with $10,000 virtual funds.

Trading platforms – it offers the web trader and the MT4.

Payment methods – it supports GiroPay, Bank transfers, Multibanko, ApplePay, and Przelewy24. 2c2pSofort, debit and credit cards.

The customer care – customer support team is available 24/7 through live chat, emails, and phone calls.

Pros

- A fast account registration process

- Low trading costs

- Negative balance protection

- Fast deposits and withdrawals

- Wide range of payment methods.

Cons

- Limited trading instruments

- Limited educational resources

(Risk warning: 78.1% of retail CFD accounts lose money)

4. Pepperstone

Pepperstone started its operations in 2010 and has registered thousands of clients.

Trading instruments – it offers Indices, commodities, shares, ETFs, and forex.

Regulation – it has regulations from the FCA and the ASIC

Account types – traders can select from the Standard or the Razor, all having an initial deposit of $200.

Fees – the Standard account has spreads starting from 1.3 pips while the Razor account starts at 0.0 pips.

Trading costs – the razor account has a commission from $7 for $100,000. The standard account has no commissions. It has an inactivity fee of $10 and free deposits and withdrawals.

Leverage – the highest leverage is 1:400 for both accounts.

Demo account – Pepperstone has a limited demo account for 30 days with $50.00 virtual funds.

Trading platforms – it offers the cTrader, MT5, and MT4.

Payment methods – it supports Poli, PayPal, Neteller, Skrill, UnionPay, Bpay, bank transfers, and credit- / debit cards.

Customer care – customer support is available through live chat, emails, and phone calls.

Pros

- Low trading costs

- A fast account registration process

- Fast order execution rates

- Industry-standard trading resources

Cons

- Limited trading instruments

- Limited educational resources.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option has been in the industry since 2013 and has registered over 40 million clients.

Trading instruments – it offers forex, stocks, commodities, ETFs, and cryptocurrencies.

Regulation – Cyprus Securities and Exchange Commission.

Account types – it has the Standard account with an initial deposit of $10 and the VIP account with varying initial deposits.

Fees – forex spreads vary with the liquidity and the type of asset.

Trading costs – it has a commission for cryptocurrencies at 2.9% and overnight charges ranging from 0.1-0.5%. Dormant accounts for more than a month attract inactivity costs of $10.

Leverage – the maximum leverage is 1:500.

Demo account – the demo account is free and has virtual funds of $10,000.

Trading platforms – it has its proprietary trading platform.

Payment methods – it accepts bank transfers, Cash U, Neteller, Money Bookers, Skrill, and credit- / debit cards.

Customer care – their customer support team is available through email and live chat.

Pros

- Fast account registration rates

- Low trading costs

- Quick deposits and withdrawals

- Quality trading resources

Cons

- Limited trading Instruments

- Limited educational resources.

(Risk warning: Your capital might be at risk.)

Forex trading in Uzbekistan – What do you need to know?

Uzbekistan has an active forex market consisting of banks, financial dealers, retail traders, and companies. Its growth started after the government approved enterprises and stocks owned by the government to be privatized when the reign of the Soviet Union fell.

It led to the development of the Tashkent stock exchange market in the 1990s, which has grown and has more volume of traders. The government of Uzbekistan controls the shares and stocks in Uzbekistan and has established laws that it enforces to regulate capital markets.

Through the Center of Coordination and control of the securities markets, the government of Uzbekistan is a committee to manage the government’s property. The Capital Markets Developments Agency CDMA was created in 2019 to perform regulatory functions in Uzbekistan.

The state dissolved the CMDA stating the reason to reduce the amount of staff given the task to execute its functions. Its roles were delegated to the ministry of finance of Uzbekistan. The government is working on reducing its influence in the securities and exchange markets in forex to attract more investors.

Is it legal to trade Forex in Uzbekistan?

Yes, forex traders can buy and sell securities in Uzbekistan as long as they follow the guidelines to regulate the financial markets and protect investor rights. There are many forex traders in Uzbekistan, and the number has increased due to the government’s efforts.

The state of Uzbekistan has created new guidelines meant to attract more investments in the capital markets in Uzbekistan. One of the president’s functions to increase investments in forex includes removing some of the strict regulations that restrict foreign and local investors from investing in the capital markets.

What are the financial regulations in Uzbekistan?

The ministry of finance regulates the capital markets in Uzbekistan. They have made some reforms to the regulations for securities and exchange.

Guidelines market participants require to follow to trade in Uzbekistan include:

- It regulates forex participants, professional advisors, and betting firms in Uzbekistan. It gives licenses to qualified applicants who meet the standards required to operate in Uzbekistan.

- Establishes the conditions forex brokers, security issuers, and other forex dealers must meet to get a trading license or a certificate to operate.

- Ensuring all market participants with the license to trade in forex comply with the rules and regulations of forex.

- Ensuring that forex investors’ rights are protected when they trade Uzbekistan’s securities and exchange markets.

- Monitoring and supervising activities of market participants through audits, inspections, and collecting information.

- Suspend the trading license of a forex dealer or broker found guilty of breaking the guidelines according to the penalties given.

- Ensuring employees working in the forex markets have certificates that validate their qualifications to work with investors.

- Forex brokers or any financial dealers selling and buying securities on behalf of forex brokers are required to have a segregated account, one for the client funds and the company.

- They have to collect data about transactions and assets traded. The records should be kept for future reference in case a dispute emerges.

- The forex broker or an institution trading for forex traders has to carry out executions as recommended by the forex trader without interfering with the order.

- The investor whose forex broker interferes with an investor’s order without the trader’s knowledge, and loses their investments, has to compensate the forex trader.

- Financial dealers are banned from unauthorized advertising of securities aimed to lure investors into funding accounts.

Security for investors from Uzbekistan

The finance ministry ensures investor funds are secure by ensuring that forex brokers use the segregated account. Forex brokers have to disclose information about the status of an asset a client has invested in that may affect the outcome of the open position.

Ensure information it receives from forex brokers or issuers of securities is kept confidential unless required by a third party, which they have to inquire from the investor fast. Responding to reports and requests of market participants about issues affecting market participants.

Educating the public about the securities and exchange markets to get the necessary information before investing. Ensuring compensation of forex traders affected by illegal trading practices from the forex broker.

(Risk warning: 78.1% of retail CFD accounts lose money)

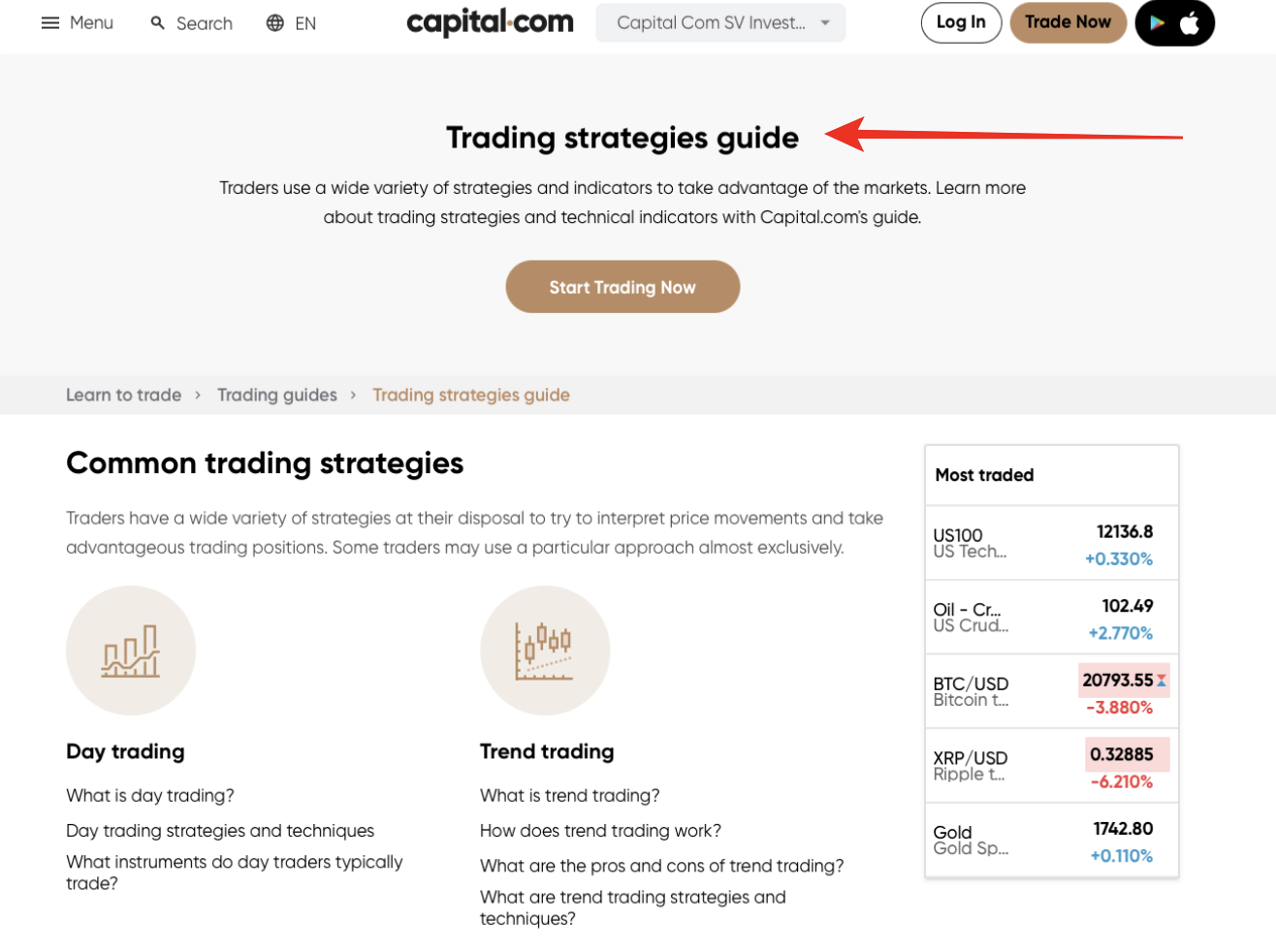

Analysis and trading strategies Uzbekistan forex traders can apply when trading

Analysis

Any trader must conduct two types of analysis of a trading instrument before opening a trading position. The analysis allows a trader to understand the current market conditions and make trading decisions based on current events.

Technical analysis requires the trader to use technical indicators to know the general direction of the price action. They can also use indicators to know liquidity, volatility, and the momentum of the market trend. Other technical analysis methods include using candlestick/ price patterns and evaluating the previous year’s price charts.

Fundamental analysis closely deals with following financial events to know when a price action will experience volatility. Traders can look at the economic calendars and financial announcements from leading financial institutions such as the central banks when they want to trade a related asset.

Trading strategies

Before trading in any financial market, traders require a trading strategy that will guide them on how they can trade an asset. Some trading strategies include:

A breakout trading strategy is applied when you want to enter a market by using trend lines or the support and resistance to find a breakout and entering when the price reverses.

Trading using momentum – requires you to apply momentum indicators to know the trend’s strength and if it is about to change, and you can open a trading position to trade the reversal.

A reversal trading strategy requires the trader to use technical and fundamental analysis to predict if the price direction is about to change and go long or short depending on the price action’s direction.

Trend trading – also relies on fundamental and technical analysis to find the direction of the price action. If the price is moving on a downtrend, you can go short, but you can go longer if it is in an uptrend.

How to trade Forex in Uzbekistan – A comprehensive overview

Find a regulated Forex Broker

Even though the Uzbekistan finance ministry puts all the necessary measures to regulate the securities markets, traders also must protect their investments by registering a trading account with a regulated forex broker.

Besides the locally regulated forex brokers, there are also offshore forex brokers regulated by reputable forex regulators such as the FCA, CySEC, CFTC, NFA, SEC, FSA, ASIC, and many other forex traders from many trading countries.

Register trading account

The account registration process is often online since many forex brokers offer their services online. The registration portal or form is on the website of the forex broker you have chosen to work with. The process is simple and fast and can take around three to five minutes.

The forex brokers will require you to give your details such as your name, email, citizenship, date of birth, account type, and the password you will use to access your trading account. You will also need to verify the information using copies of relevant documents.

Download a trading platform

Some forex brokers offer their proprietary trading platforms but most partner with companies that offer trading platforms such as the MT5 and MT4. To access the financial markets, you have to download a trading platform compatible with your forex broker.

Start with a demo account

This step is optional, but it is recommended to assist you with the experience you require before trading with real funds. The demo account uses virtual funds to help new or seasoned traders practice their trading strategies and test out new trading ideas before applying them to the real account.

Deposit funds and start trading

Forex brokers that accept forex traders from Uzbekistan support payment methods that forex traders can use to transfer funds to and from their trading accounts. Traders have to find a suitable payment method and link it with their trading account to deposit funds and start trading.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Uzbekistan

Forex trading in Uzbekistan has increased in the past years and has the potential to grow due to the interventions of the finance ministry to welcome foreign investors further. The capital markets of Uzbekistan can therefore look forward to more forex brokers accepting Uzbekistan traders.

It also means that they have to be cautious when choosing forex brokers. We recommend they register with forex brokers with reputable regulations in Uzbekistan and other offshore countries for their investments to be safe.

1. Capital.com

2. BlackBull Markets

3. RoboForex

4. Pepperstone

5. IQ Option

FAQ – The most asked questions about Forex Broker Uzbekistan:

Is trading forex possible in Uzbekistan?

Yes, the regulating authorities in Uzbekistan do not keep traders from trading forex. The traders in Uzbekistan are at par with world traders. They can trade any underlying asset that they think will fetch them profits. You can trade forex with several brokers who operate in Uzbekistan. However, one must ensure that the broker extending its services in this country is regulated before signing up for a trading account.

Which brokers in Uzbekistan are regulated?

There is not one but many brokers in Uzbekistan who are regulated. However, the services of the forex brokers also matter. So, traders wishing to trade forex should pick only such brokers who excel in offering trading services. To get the best forex trading experience, you can choose one broker among BlackBullMarkets, Pepperstone, IQ Option, RoboForex, and Capital.com.

What is the lowest minimum deposit amount for forex traders in Uzbekistan?

Forex traders in Uzbekistan can initiate trading with a minimum deposit of 10 USD. The brokers, such as IQ Option, allow traders in this country to begin trading with this low initial amount. In addition, you can place your trade on this forex trading platform with a very low amount. For instance, you can begin trading with only $1.

Is the Uzbekistan Som available in Forex?

Yes, although most forex brokers may not support it because it is a low-interest currency, it cannot yield enough profit for the forex broker. Its currency code is the UZS, and forex traders in Uzbekistan can trade it with major currencies such as the USD. The current exchange rate of the UZS/USD is 0.000090, and the UZS/EUR is 0.000084.

How is Forex taxed in Uzbekistan?

The capital laws of Uzbekistan dictate that instead of paying taxes like income tax, traders pay a 0.% of the transactions they make when selling security in forex.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)