The 4 best Forex Brokers & platforms in Venezuela – Comparison & reviews

Table of Contents

The foreign exchange market is a vast minefield with high-profit potential for buyers and sellers if done correctly but risky if not. Venezuela is a prime example of this, given its outdated currency control system, inflation problems, and embargo issues.

See the list of the best Forex Brokers in Venezuela:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

For this, it is important to rely on the best service providers that have long-term experience and expertise with forex trading in this economy.

We present this list of the best reliable forex trading brokers in Venezuela.

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

Here is a summary of the top 4 forex trading platforms and brokers operating in Venezuela.

1. BlackBull Markets

This forex broker includes both a demo account and MT4 support and supports a wide range of currencies for exchange. Based out of New Zealand, BlackBull Markets offers institutional-level benefits with forex trading, multi-market reach, and high-quality customer support services.

You can make a USD 200 minimum deposit and get less than 500:1 leverage with this forex broker. Currently, the platform supports 23,000 tradable instruments, covering types like:

- CFDs

- FX

- Equities

- Commodities

Users in Canada and the United States cannot trade in the forex market via BlackBull Markets, but other countries like Venezuela can. It falls under the authorization and licensing regulations of globally accepted boards like:

- Financial Markets Authority (for Derivative Issuer License)

- Financial Services Authority of Seychelles (FSA)

The platform performs as an ECN broker and allows access to more than 300 instruments that one can trade via MT4/WebTrader/MT5.

On BlackBull Markets, users can trade account currencies like JPY, EUR, AUD, CAD, USD, GBP, and SGP. Additionally, it accepts a wide range of payment methods like Credit Card, Bank Wire, Neteller, Fasapay, and Skrill.

Benefits of trading with BlackBull Markets:

- Supports trading with multiple countries globally, like the UK, UAE, India, Ireland, Thailand, Singapore, and other major markets

- Efficient trading and technical analysis

- Supports over 64 currency pairs

- Live support 24/7 for users

- MT4 Webtrader support is available

Drawbacks of trading with BlackBull Markets:

- The minimum deposit limit of USD 200 is higher compared to other brokers.

(Risk Warning: Your capital can be at risk)

2. RoboForex

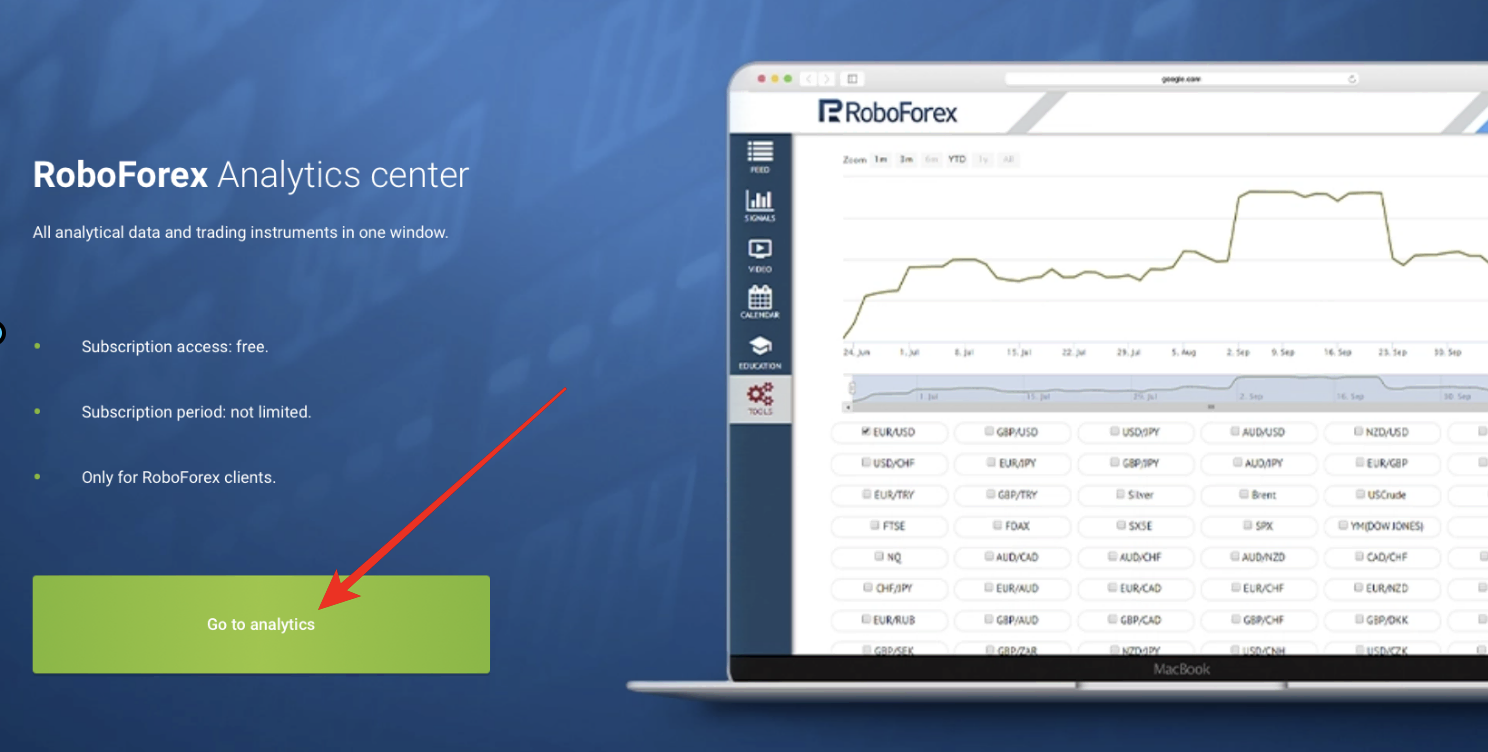

RoboForex is one of the best options for the foreign exchange market with strong order execution benefits. Buyers or sellers using this platform notice tight spreads with RoboForex, from 0 pips. This is suitable for Venezuela-based traders due to its low deposit rates.

The platform supports 8 different asset classes, including:

- Forex

- Metals

- Stocks

- Energies

- ETFs

- Cryptocurrencies

- Indices

- Soft Commodities

You can expect numerous benefits while operating through this platform. There are micro accounts that hold 0.01 lot sizes at the minimum. The broker supports multiple account currencies, namely CNY, USD, EUR, cryptocurrencies, and Gold.

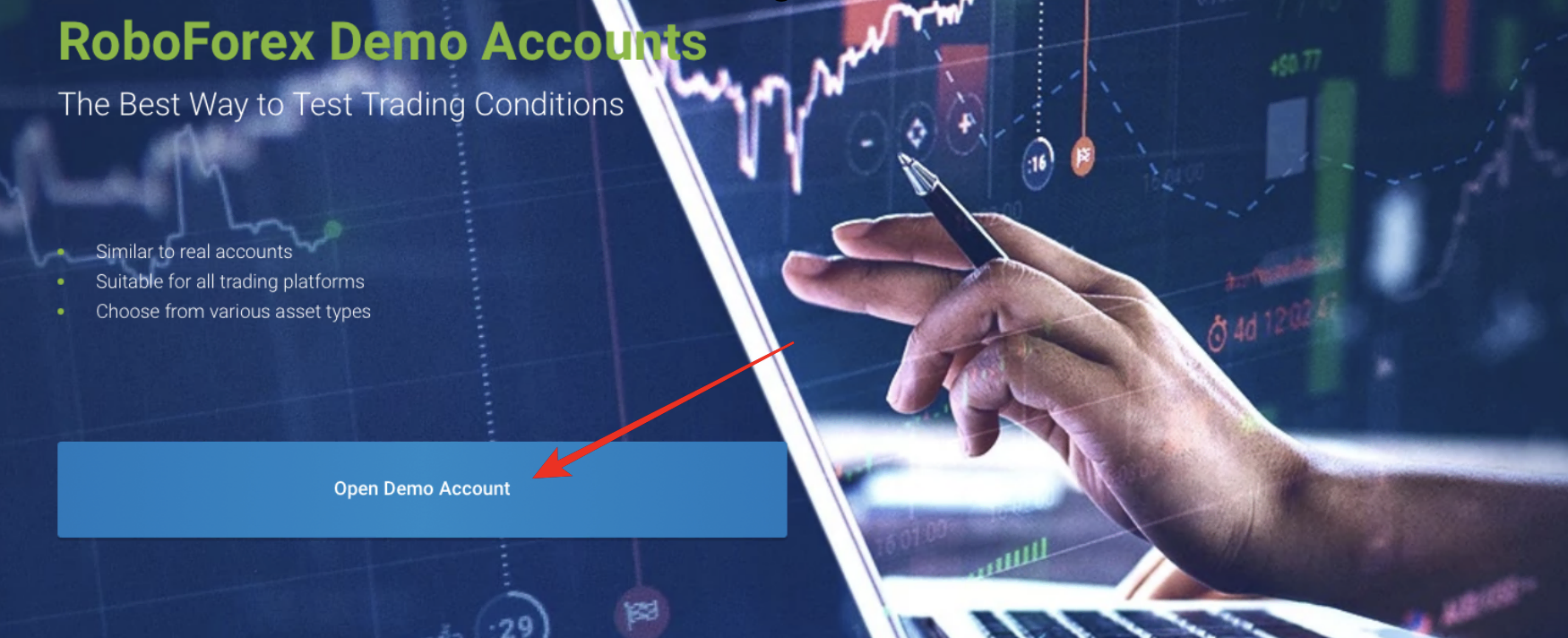

The demo account feature is available on this platform for an easier transition and learning into forex trading for the users.

- Minimum Deposit: USD 10 or 0.001₿

- Leverage: less than 2000:1

For regulations and compliance matters, the main board that the platform is registered with is:

Further, multiple payment method types are active on this platform, like AstroPay, Credit, Bank Wire, AdvCash, and Perfect Money. Leaving multiple restricted zones like South Sudan and Tahiti, users can access the markets of diverse major global markets.

Benefits of trading with RoboForex:

- Supports MetaTrader 4/MetaTrader 5

- Affiliate program available with profit sharing for 70% rate

- Seven asset classes are available

- High-level FSC-licensed security

- Multi-language support, like Chinese (Traditional/Vietnamese), Thai, Russian, Czech, Arabic, English, Italian, etc.

Drawbacks of trading with RoboForex:

- There are not many compatible market instruments or forex pairs.

- The risk is high for trading with leveraged products here.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone is currently another of the top forex brokers available in the global market. Users can make a USD 10 /€ minimum deposit and begin their trading experience without complex steps.

The platform further supports MetaTrader 4 and MetaTrader 5 trading and even offers a demo account for new users. Also, expect leverage power of 500:1 or lower.

The platform is suitable for Venezuela-based forex trading due to the low deposit limit. Legally, it falls under the jurisdiction of particular regulatory boards such as:

While using the Pepperstone trading platform, you can get access to over 1,200 instruments. These include CFD options like:

- Cryptocurrencies

- Commodities

- FX

- ETFs

- Shares, and more.

Users can expect a wide range of benefits like low costs, 24×7 customer service support, and guaranteed fast executions of the orders.

The platform supports multiple account currencies, like CAD, AUD, EUR, CHF, HKD, GBP, SGD, NZD, USD, and JPY.

Benefits of trading with Pepperstone:

- It supports markets of multiple countries like Cyprus, Bangladesh, UAE, UK, India, Indonesia, Sri Lanka, Egypt, Ireland, Nigeria, Pakistan, Singapore, Vietnam, Thailand, South Africa, Saudi Arabia, and more.

- Multi-language support like Arabic, English, Spanish, German, Polish, Italian, Thai, Polish, Vietnamese, and Traditional Chinese.

- Supported payment modes include credit card, bank wire, Fasapay, Bpay, Neteller, M-Pesa, Skrill, POLi, PayPal, and UnionPay.

- Social trading, cTrader, MT4, and MT5 support

Drawbacks of trading with Pepperstone:

- Only a minimum ECN trading of USD 10 is allowed.

- The risk potential for forex trading is high here based on the leverage power.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option is another noticeable choice among the different forex trading brokers available in the market. The service provider offers multiple intuitive platforms for IQ Option users, like:

- Windows

- Web

- macOS

- Mobile apps

It is easy to contact the customer services staff that work 24×7 for the support team for any queries. To understand the process of trading lump-sum amounts of funds, you can make use of the Practice account, available for free.

Important points about leverage and minimum deposit that you would get are:

- Minimum Deposit: USD 10

- Leverage: less than 500:1

There are different types of payment modes available for withdrawals and deposits during trading. The accepted gateways include credit card, bank wire, PayPal, Neteller, WebMoney, and Skrill.

Many account currencies like EUR, BRL, USD, TRY, RUB, MYR, IDR, and GBP, are available here.

You would access a wide range of insightful features with this platform, like historical quotes, technical analysis, and a multi-chart layout.

Additionally, there is a vast trading community on this platform, and it supports forex trading with multiple global powerhouses, except Canada, Australia, and United States.

Benefits of trading with IQ Option:

- Android and iOS app versions are available

- Minimum trade of USD 1/€ and maximum trade of USD 5,000/€

- Includes a demo account

- Around 33 different Forex pairs are supported

- Automated multi-language support, like Hindi, English, German, Bengali, Swedish, Chinese, Italian, Korean, Portuguese, Spanish, French, etc.

Drawbacks of trading with IQ Option:

- There is no app version available. You have to use the web-based option.

- There is no MT5/MT4 support.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Venezuela?

For the best forex trading brokers to function suitable in the region of Venezuela, they must abide by the regional financial regulations. They must have the authorization of the top global trading boards that are acceptable in Venezuela as well.

The trading market in Venezuela is not the strongest due to ongoing geopolitical issues and inflation problems. The official currency in the country, the VEF (Venezuelan bolivar), has been a controlled system since its inception, and not many changes have been noticed. Periodically, there have been currency devaluations, but as an exchange rate, it is relatively overvalued.

In this country, the main authority board overseeing Venezuela’s trading platforms is “Superintendencia de Bancos y Otras Instituciones Financieras”. The committee issues prudential regulations for the functioning and processes they support.

Under the prudential regulations, the Superintendencia de Bancos y Otras Instituciones Financieras board notifies about the active instructions and guidelines for compliance, technological use, legal matters, and technical accounting concerns. The regulations reach the brokers through circulars, focusing on carrying out the resolutions.

The trading platforms within Venezuela need to focus on the good financial regulations as mandated in the circulars. Additionally, it is necessary that the trading services that they offer align with those of other governmental organizations.

Users can check the validity of the financial regulation of a Venezuela-based trading platform directly through the official website of the financial regulators. The process of following the set rules for financial investment and trade can differ for specific jurisdictions. The Superintendencia de Bancos y Otras Instituciones Financieras can act on behalf of the traders in Venezuela if they feel that they are getting damaged.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Security for traders from Venezuela

Most of the forex trading platforms in Venezuela operate safely within the region while trading with another market, though issues are possible despite its strict economic condition. The financial regulators of Venezuela are responsible for security and privacy.

Here are some of the notable factors one should evaluate about the forex trading brokers to understand their level of security. Multiple European jurisdictions operate with the Venezuela forex trading brokers for financial regulation.

To verify that the platform is secure for online trading, check for the regulatory authority of Superintendencia de Bancos y Otras Instituciones Financieras.

Also, the trading platforms need to have compliance with the financial regulator-based requirements:

Furthermore, the trading platforms must hold SSL encryption protection and store all financial data in top-tier banking institutions for high-level information safety.

How to handle safe trading?

Overall, forex trading is not exceptionally risky in the context of other trading types. There are actions that the traders can take directly to help smooth out the trading risk for them. Here are the main steps to follow.

Gather regular updates:

The rates in the foreign exchange market of Venezuela often fluctuate and are high-risk-prone, especially with the ongoing global economic instabilities. Therefore, for the traders, it is critical to keep in touch with current financial news consistently, especially about the currencies.

Start your trading experience with small moves

Instead of making big plays, it is better to only begin the process with small trades.

The traders with more experience can adjust to many deals simultaneously. As a beginner, avoid doing so and grow your experience with small capital traders. Carry out the process consistently and expand your skillset first.

Practice trading multiple times

Before trying out the bigger plays, carry out multiple practice trade runs. There are demo account options in Venezuela forex trading platforms that accept Venezuelan clients, like Pepperstone.

With these accounts, you do not have to deposit any real funds; you can practice trading strategies using virtual money. After getting a better grasp of the strategies and moves in the demo account, it is suitable to shift to the real forex trading market.

Make your unique strategy:

Take the time to frame your unique trading strategy, centering on factors like your budget and principles. It would allow you to proceed with the foreign exchange transactions with the best plan that suits your skills. For this, take the time to understand your strong points first.

Do not focus on emotional moves:

You must avoid making dangerous moves in the foreign exchange trading of Venezuela based on their emotions. Stay as neutral as possible and avoid choosing trades based on personal interests/inclinations.

Instead, research the market properly.

Is it legal to trade Forex in Venezuela?

Currently, it is legal for traders to engage in foreign exchange trading in Venezuela.

The accepted platforms for forex trading are the ones under the authorized regulation of:

This verification shows that the broker is a legal practitioner in the country of Venezuela for forex trading.

Notably, in August 2018, the country’s national currency was set as “bolivar soberano” or VES. Since the legalization of forex trading in Venezuela, traders can use this currency in the forex trading market. Additionally, with a margin account for this type of trading, traders can work with minor and major currency pairs as well, like USD/EUR.

How to trade Forex in Venezuela? – Tutorial

The foreign exchange trading process can feel complex for newcomers and professional trading experts alike. However, using the right platform makes it possible to carry out this process efficiently and without any hassles.

Here are the main steps for trading on Forex effectively with high profitability potential. The process can vary slightly for specific platforms, but the main actions remain the same.

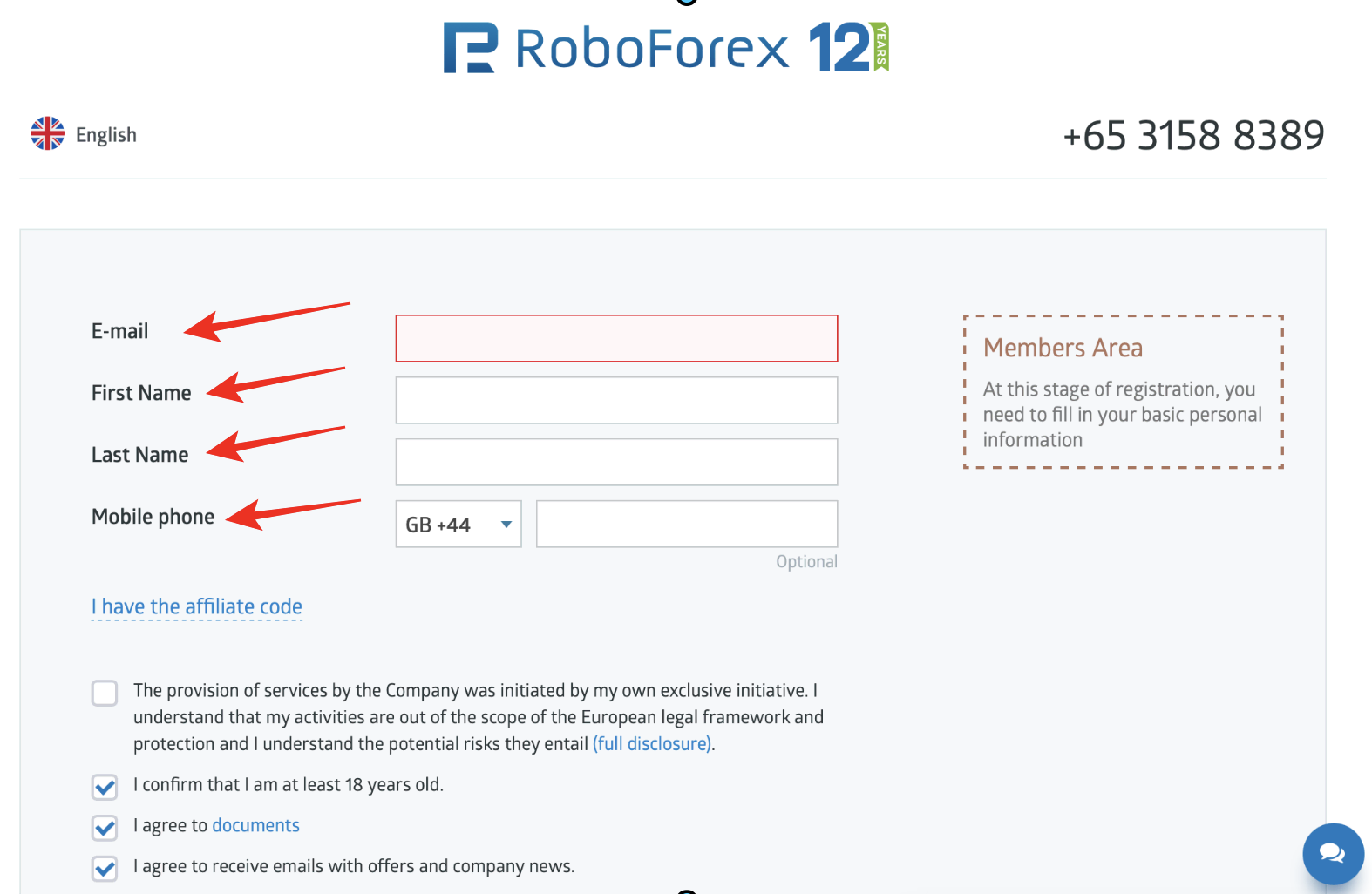

1. Open an account for Venezuela traders

Firstly, one must register for a private account on the Venezuela broker platforms. Add all the relevant information to prove your identification, adding all the necessary information like region, language, preferred currency, etc.

2. Start with a demo account or real account

Many forex trading platforms offer the demo account option to their users. This is most suitable for first-time traders to practice their forex trading strategies in a safe environment with virtual funds. Then, it is possible to shift to the real account after the suitable training completes.

You can start with the demo account or directly access the real account to begin the trading journey on the platform.

3. Deposit money

Deposit a set amount of money into the platform before beginning the trading steps. Check the minimum deposit limit and add higher than that.

4. Use analysis and strategies

Use the analysis software in the platform to check the conditions in the forex market. After that, use personalized strategies to handle the trading process.

5. Make profit

Based on the movements in the trade market, you can make profits on your trading move. Then, after crossing the minimum withdrawal limit on your account, you can take the necessary amount out.

Conclusion: The best Forex Brokers are available in Venezuela

Multiple top-grade forex trading brokers and platforms are available for high-quality exchanges across global markets to earn higher exchange rates. Since Venezuela does not have the most stable forex market, traders must handle this process to avoid excessive risks. Please choose from the best brokers in Venezuela based on their features, supported currencies, and other specifications.

Make sure to check for the platform’s legal and financial regulation verification and carry out your trading experience.

FAQ – The most asked questions about Forex Broker Venezuela:

How can I trade with a forex broker in Venezuela?

Foreign exchange trading can be intimidating to both newcomers and seasoned traders. But this process may be completed effectively and without issues, if the appropriate platform is used.

It would help if you took these primary actions to trade forex profitably and successfully. The method can vary slightly depending on the platform, but the essential steps always stay the same.

1. You should open an account for trading.

2. Start trials with a demo or real account.

3. Add funds to your account.

4. Analyze the market and learn new strategies.

5. Make profits.

6. Withdraw your earnings.

7. Start earning more with your experience.

How can I have safe trading with a forex broker in Venezuela?

Compared to other trading instruments, forex trading is often not very dangerous. The traders can take specific steps to help reduce their trading risk immediately. The key actions to take are listed below.

1. Get regular updates about the market.

2. Get experience with small moves.

3. Try trading multiple times and learn more.

4. Design your strategy.

5. Don’t move emotionally while trading.

What are the best trading and forex broker platforms in Venezuela?

Know the best trading platforms and forex brokers in Venezuela were rated as the best after thoroughly reviewing their advantages.

BlackBull Markets

Pepperstone

IQ option

RoboForex

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)