The 5 best Forex Brokers and platforms in Zimbabwe – Comparison and reviews

Table of Contents

Forex trading may seem challenging to understand, especially for someone who just started Forex trading. Simple, Forex trading is the process of exchanging currencies. Currency trading is essential because it allows one to purchase products from home and abroad.

See the list of the best Forex Brokers in Zimbabwe:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 67% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 67% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 67% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

If you live in Zimbabwe and you want to begin your Forex journey. In that case, this article is for you because it is packed with vital information such as the top 5 brokers’ platforms you could use and other information you will find necessary before you start trading in forex.

The list of the top 5 Best Forex Brokers includes:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

Capital.com is indeed one of the international brokerage platforms that exist. They have made sure to build their offices in some countries worldwide – Cyprus, the UK, Australia, Seychelles (in East Africa), and Gibraltar. Also, in each of these countries, a regulatory body oversees their functions—CySEC in Cyprus, ASIC in Australia, FSA in Seychelles, and FCA in the UK.

Capital.com started in 2016 as a CDF trading platform. According to the previous research, over 600,000 traders worldwide are on this platform. Canada, Australia, and China are some of the platform’s country users.

New traders enjoy the benefit of courses, videos, and articles provided by Capital.com. This enables them to improve their trading skills and knowledge about the Forex market. The platform also has a demo account which both new and old traders can use if they want to get a feel of how the spread works before they jump into trading with their real account.

Capital.com’s minimum deposit is $3000 before you can then start to trade with your real account. This may be considered high compared with other available brokerage platforms.

They also have a technological platform that allows traders to have a fantastic trading experience on their platform. This remarkable technology will enable traders to be tactical in decision-making regarding trading.

Benefits of using Capital.com

- A demo account that the cash in it does not extinguish

- Traders are offered convenient spreads

- Provides traders with educative tools so they can improve in trading forex skills.

Downsides of Capital.com

- The minimum deposit starts from 3000 dollars.

- Accounts with more minor currencies are not available on Capital.com.

(Risk warning: 67% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Group Ltd is under the regulation of Financial Services Provider. It was started by a group of former professional FX traders and Fintech experts from New Zealand who wanted to create a broker’s platform of their own. BlackBull markets assets such as metals, CDF, Energy, and others.

The MetaTrader platform is one of the fastest platforms. It’s because its server is directly connected to WallStreet. Transactions can be carried out in a matter of milliseconds.

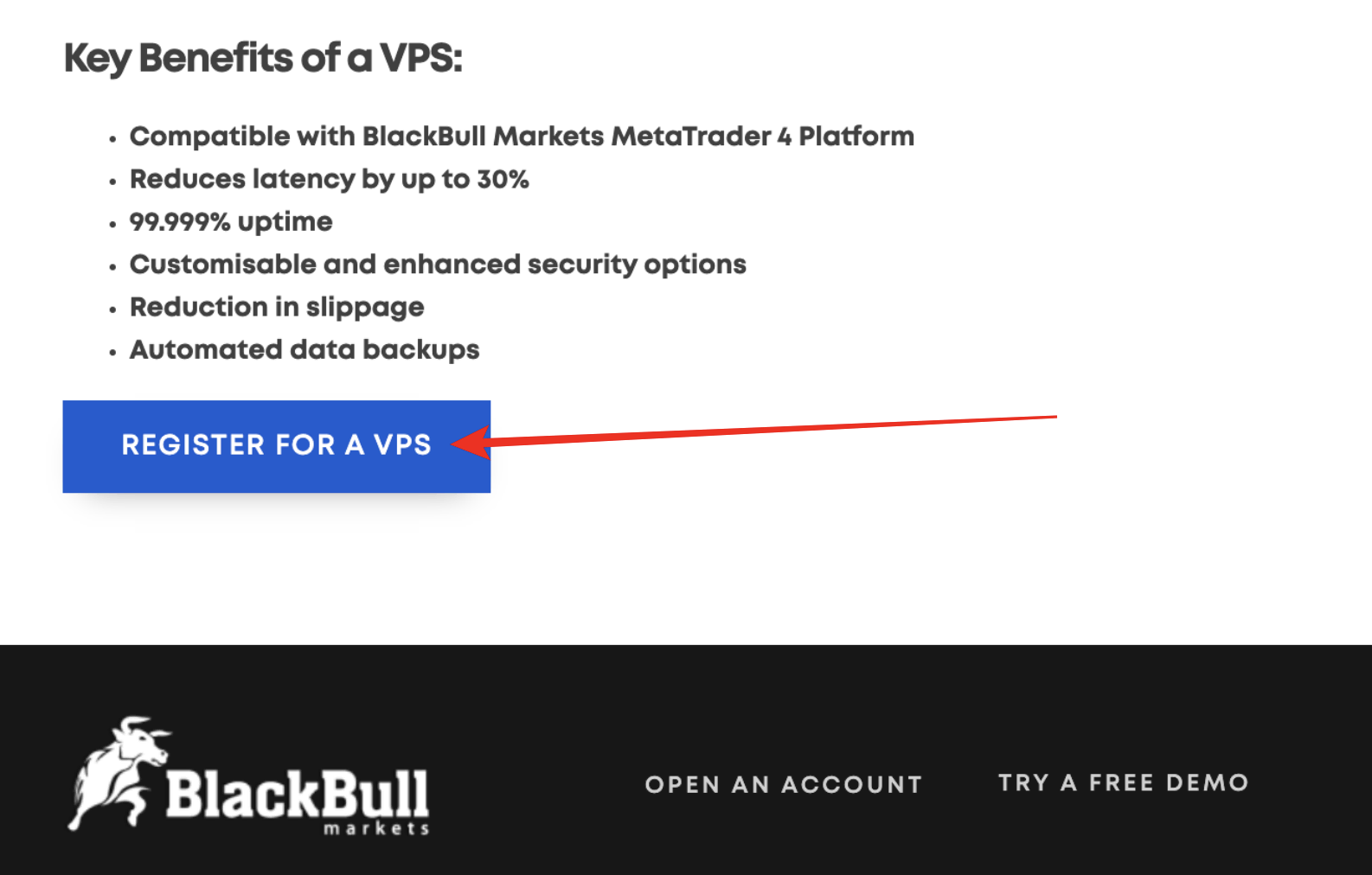

The platform also offers traders enough liquidity providers who provide a very tough price competition for the traders. The platform allows a third-party trading system through its APIs and respects the traders’ privacy by providing them with a VPS (Virtual Private Server).

BlackBull does not provide its users with the necessary reading materials and quizzes to help the traders improve and test their abilities in Forex trading. But it has good in-house market reviews that can help its traders properly analyze market strategies.

BlackBull Markets has numerous providers of liquidity from around the globe. This is so thanks to its ECN. BlackBull Markets has two accounts from which traders can select. They have a standard account that allows traders to make a deposit of 200 USD, and a prime account that allows traders to deposit any amount starting from 2000 USD. The two accounts have different price competitions and spread pip units.

Benefits of Blackbull Markets

- The web app does not need to be installed on your computer

- It has APIs and VPS on its platform

- There is also the MetaTrader platform in the broker.

- The CDFs and FX do not cost as much as other leading brokerage companies.

Drawbacks Blackbull Markets

- When you want to withdraw money, there is a fee that BlackBull will deduct

- Customer service does not work for 24 hours.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex, like some Forex brokers, provides its users with MetaTrader platforms (MT4 & 5) and cTrader. The MT4 is the most patronized because traders can perform many functions on it. While the MT5 is not popular, it is more improved than the MT4. cTrader is the most flooded platform because it offers an ECN.

It was established in Belize City, in Belize, Central America, in 2009. The platform is known to trade different assets from which traders can select. Metals, Commodities, FX, and Energy, are some of the assets that it sells.

The IFSC properly regulates the platform. The minimum amount to be deposited in your account is according to which country where you reside. Traders also get quick access to technical analysis, market approach, and professional trading analysis, all of which are necessary tools one needs to succeed as a Forex trader.

It already has a user reach of 800,000 from about 164 countries worldwide. Not to talk of the customer service language option. RoboForex’s customer support has more than 11 languages which helps them break any wall that would have stopped them from having good relations with their customers.

RoboForex is an absolutely secure platform for its traders. It is trustworthy. It’s no wonder why it has such a considerable number of users worldwide. If you want to be a Forex trader, but do not have enough capital to start, RoboForex is a great brokers’ platform for you because its minimum deposit is 10 USD, an amount which is quite affordable for anyone to start a forex trade.

Pros of RoboForex

- Traders can make transactions easily on the platform

- Withdrawal of funds from the platform is quick.

- The minimum deposit is on the low side. It starts with just $10

Cons of RoboForex

- Slow customer support system

- There are a lot of regulatory documents to go through before trading with them.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is a broker’s platform under the regulation of DFSA, BaFin, Standard Chartered Bank (SCB), FCA, and last, ASIC. The company can be well trusted because all of these platforms are international, and they make sure to regulate and control the affairs of the Forex broker platform. The broker also provides its clients with trustworthy market analysis.

The broker’s company was founded in 2010 and has climbed to greater heights since then. They have various assets from which traders can pick on their platform—Crypto, stock, and metal.

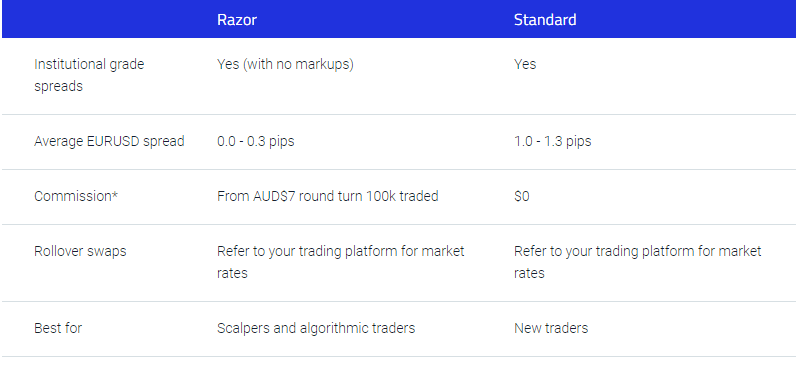

Pepperstone has two accounts available. This helps clients pick fan accounts that favor their marketing experience the most. The account has a standard account and a razor account.

Its standard account starts from one pip on the FX spread, but the traders who use this account do not have any form of commission in their trade. While the razor account, on the other hand, begins with zero pip, but the traders with this account enjoy an amount of commission in their trade.

When it comes to maximizing traders’ market experience, PepperStone is particular. They have a plug-in that helps traders have one of the best experiences. A trader can easily set up his/her account on PepperStone; it does not take a rigorous method to open your account with them.

Benefits of Pepperstone

- Razor account traders enjoy a commission from their trade.

- The platform has plug-ins that help users enjoy their trade.

- It has a lot of social copy marketing platforms.

Drawbacks of Pepperstone

- Their customer service does not work on weekends.

- There are no available interactive tutorials to take or quizzes that can help traders develop their skills.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a top brokerage firm. They offer two accounts to users: the standard account and the VIP account. They also have a demo account that does not extinguish. New traders can learn how the forex market works.

The platform has provided its traders with a well-connected environment so that traders can connect easily. The platform has forums and organizes webinars where new traders can learn a lot of expert advice from professional traders worldwide.

The broker’s platform is an award-winning one as it has several awards to prove how good it is for Forex trading. The platform is also provided with a unique tool on the website which gives traders a proper, well-informed market strategy that helps them make appropriate and careful investments.

There is also the availability of a mobile application. So traders can trade anywhere, anytime, and anyhow. This is a valuable tool for traders who go around or are always on the go.

The interface is also very intriguing because the chart can be changed from form to the chart’s color. This enables users to understand the spread on the platform correctly. They keep updating their technology to allow traders to have the best Forex trading experience.

Benefits of IQ Option

- Account opening is relatively easy using the IQ Option platform.

- Well connected environment for traders to learn from experts

- They have a considerable number of marketing instruments

Downsides of IQ Option

- If you are withdrawing your fund through a bank account, it takes longer days to drop.

- MetaTrader’s platforms are not accessible on IQ Option.

(Risk warning: Your capital might be at risk.)

Financial regulation in Zimbabwe

Zimbabwe’s multi-currency system came to a close in 2019. To prevent the instability of the past, the country restored its native currency with a new structure. The Reserve Bank of Zimbabwe will use a floating exchange rate mechanism starting in 2020. Even though the currency fluctuates, it is nothing compared to the 500 billion % inflation experienced before 2016.

Zimbabwean private forex traders now have the opportunity to participate in the world’s financial markets. Even though the Securities and Exchange Commission of Zimbabwe (SECZ) says little about private trader regulations, Zimbabwean investors can still use brokers licensed by neighboring institutions.

Zimbabwe generally has five leading agencies in charge of financial regulation and supervision.

These are:

- The Reserve Bank of Zimbabwe (RBZ)

- The Ministry of Finance

- The Deposit Protection Board

- The Securities Exchange Commission (SEC)

- The Insurance and Pensions Commission (Figure 1).

All of these perform specific functions in the financial sector of the country.

(Risk warning: 67% of retail CFD accounts lose money)

Security for traders from Zimbabwe

It is no news that the forex market is filled with many fraudsters, especially the fact that it is online and the amount of cybercrime in the country and world keeps growing. This is why the SECZ and FINSEC advise traders in Zimbabwe to market with broker’s platforms with international licenses.

Marketing with licensed Forex brokers provides means of assurance and securities for you. This is so because the broker is appropriately regulated.

Even if you wish to trade with local Zimbabwean broker platforms, carry out proper research about their policies and regulations. And they are also finding out if they are mentioned on any credible home sites or networks. Still, it would help if you traded on Forex platforms with international licensing regulatory bodies.

Is it legal to trade Forex in Zimbabwe?

Financial Security Exchange (FINSEC) received in 2016 what is called ATP, meaning Alternative Trading Platform. The sole aim of this body was to legalize or regulate the electronic method of marketing and capital making in one market and make all trade forms to be under one market.

In their facilitation of electronic trading, the body also made another means through which traders can earn a profit from which the traditional market could not perform. Forex in Zimbabwe under this act is legal in the country.

A legal act governs Forex trading online with international regulatory bodies. It advises that this is much more credible than some online tradings locally in Zimbabwe.

How to trade Forex in Zimbabwe – A comprehensive tutorial

Open an account for Zimbabwean traders

Opening an account is very easy. As long as you have picked a broker that you want. The broker will ask for some documents to legitimize your account with them. They ask for an email, your proof of identity, whether – a national ID card, a National passport, or other documents. They will also need proof of where you stay. In this place, you can provide a utility bill. And then you are set up.

Start with a demo account or real account

After providing the necessary document, you can either start by training or getting familiar with the market spread on the demo’s account. In most cases, the money does not finish and can continually be refreshed to start from the beginning. The real account is where you need to deposit money to start real live trading on the forex broker.

Deposit money

After you are ready to start trading life, you will have to deposit money into your real account. In most cases, the deposit amount varies depending on your chosen platform.

There are also different payment methods available for the deposit. So be sure to choose that which suits you most. The deposit can be through bank transfer, a USD code, and even your Master Card or VISA card.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Traders usually have a specific method or approach which they have adapted to their trading. This is what is called strategizing and analyzing. Strategizing as a forex trader helps you take careful necessary steps to understand the market.

These can come in the following forms below.

Scalping

Scalping is a method through which a trader focuses on slight market changes. These changes are always not so much. Traders usually lay down more than one trade and then aim to profit from them when they close their bid.

Day trading

This involves changing currencies in just a single day. This trading approach is not only in Forex trading, although it is more familiar in Forex trading. It means you open and close bids in a single day.

Position trading

This method involves holding a particular trade position for not just one day but weeks and, at times, even months. This method is beneficial for observing market changes for an extended period.

Make profit

In making a profit in forex, a trader must close the deal they set. You make profits by analyzing the market and chart correctly and fixing your trade right.

(Risk warning: 67% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Zimbabwe

Trading Forex is an incredible way to improve one’s living standard. Though it may seem easy, trust that it takes a lot of skimming and planning. Make sure to watch videos, attend forums, and attend webinars conducted. There is always one or two valuable pieces of information that newbie traders and even experts can grab.

Also, always trade with licensed brokers. This way, you can be sure of your investments and assets. Many traders usually fall into the hand of the wrong broker platforms. This is usually because they do not check the regulating organizations of the platforms. All the brokers mentioned in this article are well trusted and secured.

Forex trade is also a very useful tool for improving a nation’s economy and improving foreign relationships. As an individual, it’s also a good means of improving your own wealth.

FAQ – The most asked questions about Forex Broker Zimbabwe :

What are the benefits of trading forex with the best brokers in Zimbabwe?

There are several advantages of availing yourselves of the forex brokers in Zimbabwe. Faster trade executions and access to many underlying assets are benefits of signing up with the best brokers. Besides, traders can also enjoy trading with top-class features. These top-class features make any trader’s trading experience better.

Are forex brokers in Zimbabwe legal?

Yes, forex trading and the operation of brokers are legal for traders in Zimbabwe. They can sign up with the best forex brokers in Zimbabwe. The rules and regulations in this nation allow traders to trade forex with full enthusiasm. Besides, traders can access the forex pairs of the leading currencies. Whenever they tap an opportunity, they can place their forex trade. Forex brokers in Zimbabwe make it possible for traders to find the best underlying assets.

How should a trader plan his forex trading moves with the best brokers in Zimbabwe?

Traders in Zimbabwe should plan their trading moves with careful consideration. They should use the demo trading account that the forex brokers in Zimbabwe offer them. It does not involve any money and allows traders to trade. Here, they can test their trading strategies before going live with them. So, it is an easy way for traders to avoid potential losses.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)