What is the minimum deposit to open a trading account?

Do you want to open a trading account? Wait! Before doing that, you need to know the minimum deposit amount needed to open a trading account.

Here in this post, we have discussed the minimum deposit amount charged by a trading account, its benefits, drawbacks, and more. Scroll down to have a look.

What is the minimum amount to open a trading account?

You should have a broker by your side to enter the trading market. To get access to a trading broker account, you must pay the minimum deposit amount. That means before you can start trading stocks, binary options, or forex, you are required to pay a fixed amount.

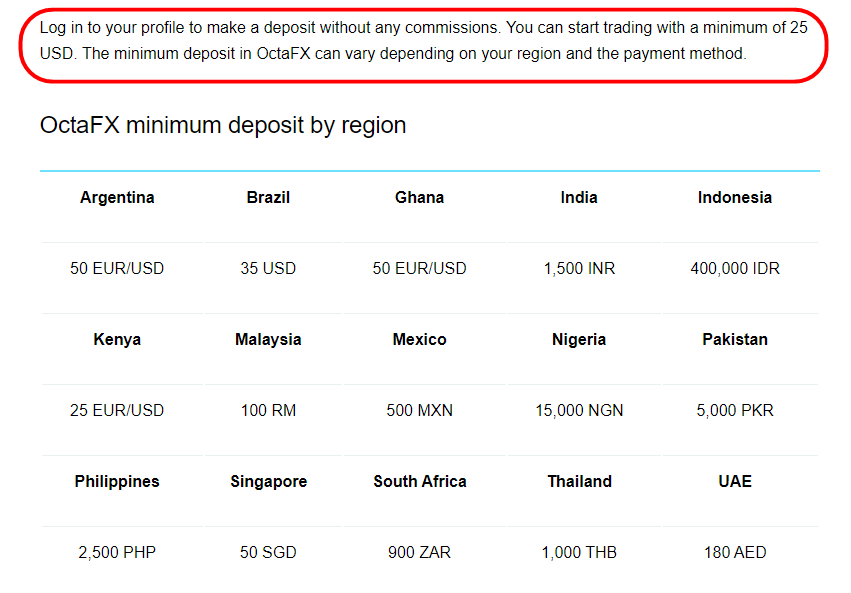

All trading accounts do not have a similar minimum deposit amount. Some platforms do not charge a single penny, but some charge a high amount to open an account.

An online trading platform works similarly to a bank. Like a bank secures your money, your trading broker protects your funds, securities, and shares. It offers you a safe environment to invest in stock without any worry.

Basically, a trading broker saves you from theft of stock and money. So, even if it does not charge a minimum deposit amount, you must pay other charges.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Pros of a broker with a minimum deposit

Here’s why you should open a trading account with a low or no minimum deposit broker:

- New traders can choose a broker with the least minimum deposit amount to start their trading journey without risking more

- You can spread your pot across various assets, from precious metals to NASDAQ

- Brokers with a low minimum deposit mostly accept smaller order sizes, which is appealing

- These brokers offer educational resources, including guides, tutorials, and tips so you can create winning strategies

Cons of a broker with low minimum deposits

Here are a few disadvantages of brokers with low minimum deposits:

- Brokers with the least minimum deposit amount can also be a scam. Why? Because sometimes, fake brokers lower the deposit amount to attract different traders

- There is a high chance that a low deposit minimum amount broker charges hidden fees. For instance, they might charge an extra amount for offering other trading services, like maintenance costs, inactivity costs, and more

Common charges to upkeep your trading account

Here’s a list of charges you need to pay to upkeep your trading account:

- Annual maintenance fees

- Account opening charges

- Custody costs

- Transaction fees

- Dematerialization fees

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

1. Annual maintenance fees

Trading brokers require their clients to pay annual maintenance fees to maintain the dematerialization. Depending on the broker, the annual maintenance fees can vary.

2. Account opening charges

Most trading accounts are free to open without any account opening charges. But trading brokers can charge an annual fee in advance.

3. Custody costs

Trading brokers charge a small custody fee to keep your shares safe in the trading account. The number of securities in your account is used to calculate the custody fee, which is billed annually.

4. Transaction fees

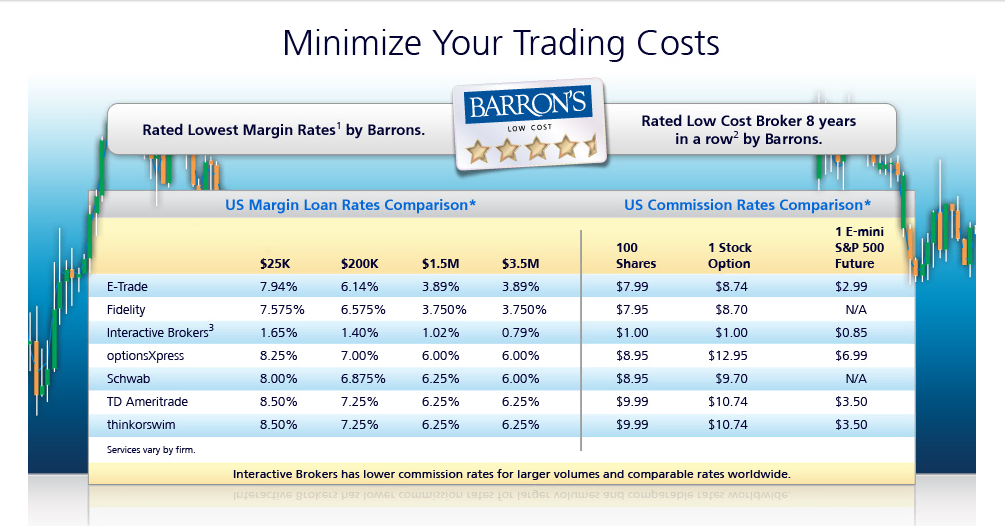

A trading broker charges a transaction fee as a commission for trading shares. If your broker charges this fee, you must pay a small amount each time you buy or sell a security.

5. Dematerialization fees

Brokers charge a dematerialization fee so you can convert physical stocks into an online form. But all account holders don’t need to pay this fee. Traders who want to convert their physical shares should pay the dematerialization fees.

Trading brokers can either charge a similar fee each month or modify the requirement. So, before registering with a trading broker, check the account fees carefully.

Online trading account opening process

Here’s how you can open a trading account:

- You first need to choose a reliable trading broker with whom you wish to start your trading career. Your trading broker will act as an intermediary between the investor and the depository

- Complete and submit the online trading account opening form. In addition, provide your address and identity. While opening the account, keep the important documents handy, like proof of address, proof of identity, income proof, and more

- Following this, sign a copy of the agreement with your online broker. You will then receive your online trading account details and a unique ID. You can use this ID to do any debt or credit

- After you get access to a dematerialization account, you can start trading stocks, shares, insurance, pension funds, and bonds

Conclusion about a minimum deposit to open a trading account

No matter if you are a new trader or have been trading for a while, you need a reliable broker on your side. But before you open an account with any trading broker, compare the minimum deposit amount to find the best deal.

Some brokers charge a high minimum deposit, while others charge a low amount. But certain brokers do not charge any minimum deposit amount. Remember that even though the broker is not charging a minimum deposit amount, you need to pay other charges and fees.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Last Updated on June 17, 2023 by Andre Witzel