Is Quotex Legal in India or not? – Real review for Indian traders

Table of Contents

Introduction:

As we all know, looking for a broker that is legal in our country can be difficult. After all, these companies don’t usually have a list of countries where they are allowed to operate in. It will be up to the trader to do their research and look at different user reviews just to get the necessary information that they need.

This article will not only give you the answer to the question “Is Quotex legal in India?”, but it will also provide a review on the platform, information on the broker, and many more data that you will need before you decide that Quotex is the broker for you.

(Risk warning: Trading involves risks)

Getting to know Quotex – What is behind the platform?

This broker was founded in 2019, but it only started operating as a licensed broker in November 2020. But despite being new to the trading scene, Quotex consists of numerous developers and specialists with a lot of experience when it comes to trading.

Quotex operates under Awesomo Ltd, a Seychelles-based company. This company is a member of the IFMRRC or the International Financial Market Relations Regulation Center. Its main office can be found in Suite 1, Second Floor, Sound and Vision House, Francis Rachel Str., Victoria, Mahe, Seychelles.

Is Quotex legal in India?

The simple and straightforward answer to this question is yes, Quotex is legal in India. Traders based in India can also fully utilize all the services and features offered by this particular broker. You will read more about the platform and the credibility of the broker, as a whole, down below.

Is Quotex legal in India?

Yes, Quotex is fully legal in India!

Is Quotex safe for traders in India?

As previously mentioned, Quotex is operated by Awesomo Ltd, a company that is a member of the IFMRRC. The International Financial Market Relations Regulation Center is not an official regulator body. Instead, it is a third-party dispute resolution service. This company is responsible for the license held by Quotex so it can offer its services to clients.

The IFMRRC also acts as a second layer of defense when it comes to the clients’ funds. They implement a rule where in the event that Quotex loses its license and is unable to operate, clients will get their funds back. You can read more about this on Quotex’s website.

Quotex’s website and the platform are also protected by an SSL Certificate. This keeps your personal and bank details safe from hackers or any other unwanted third parties. It also adds credibility points to the broker since you know that Quotex is not out just to get your information or hard-earned cash.

(Risk warning: Trading involves risks)

Trading platform review for Indian traders

Unlike other brokers, Quotex uses a web-based trading platform that can be accessed from any mobile or desktop device. Clients are not required to download anything to use the trading platform. Web-based platforms are preferred by majority of traders mainly because it saves them time and space on their computers or devices.

Quotex has a wide range of tradeable assets available on its platform. You can trade any of the 27 forex pairs that include the seven major currency pairs as well as some minor pairs. If you want to trade cryptocurrencies, Ethereum and Bitcoin are available. There are also four available commodities, namely Gold, Silver, UKBrent, and USCrude. If you are looking to invest in indices, you can choose between any of the 14 available assets. Included in the indices list are the NASDAQ100 and Dow Jones.

The platform’s charts are not only easy to read but are also fully customizable. Clients can also change the template of the interface into light mode, twilight mode, or night mode to suit their preferences.

The trading signals offered by this web-based platform are highly accurate and will surely give you the information you need before you execute a trade. The platform also features high speeds to ensure that you can execute your trades accurately and swiftly.

Aside from being easy to navigate, the web trading platform comes equipped with cutting-edge trading tools as well as more than five drawing tools. Setting up trade doesn’t take much time, and it’s a fairly straightforward process. First, you will need to choose an asset you want to trade. Next, calibrate the time to your desired setting.

Once you’ve set up the time, input the amount you want to invest in your chosen asset. The last step is to pick which way the market will move. Your choices are either up or down. Now all you have to do is sit back and wait for the market to move and calibrate the settings every now and then.

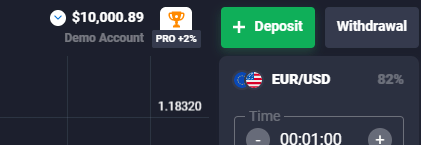

Now, if you’re just starting out or you simply want to train before you start trading with your hard-earned cash, Quotex’s trading platform allows you to practice risk-free using a demo account. Anyone is eligible to use the demo account, and it can be accessed by any web browser on any device as well.

When using the demo account, you will be trading in a simulated environment that follows live market events. When executing trades, you will be using your virtual fund of $10,000. You can use the demo account any time, but keep in mind that since you’re using a demo account, none of your profits translate to real cash.

For ease of use, the web-based trading platform can be viewed in different languages. The languages available are Vietnamese, Turkish, Polish, Russian, Italian, Tagalog, Hindi, Spanish, German, Ukrainian, Chinese, Thai, Portuguese, Malay, French, Indonesian, Arabic, Persian, and English.

Fees

The amount that Quotex will charge you depends on three things: the asset you are trading, the time you executed the trade, and market or economic events. A full breakdown of the fees involved can be found on the broker’s website or the web trading platform.

Although there may be fees when trading, Quotex does not charge its clients any commission fees. Withdrawal and deposit fees are also non-existent. However, the use of leverage is not permitted on the broker’s platform.

Offers for Indian traders

One of the main reasons why Quotex has so many clients is its deposit bonus. The bonus amount comes in tiers. This means the more you deposit, the more bonus cash you get. You can earn a bonus of up to 35%. Additionally, if your first deposit reaches $100, you get an extra 80% to help jumpstart your trading career.

Mobile Application

To date, Quotex does only have a mobile application that can be downloaded from an app store for android devices. This doesn’t mean you can’t trade on your iOS mobile devices. You can still access the web-based trading platform from your smartphone or tablet’s browser. Just makes sure that you have a stable connection before you set up or execute your trades.

(Risk warning: Trading involves risks)

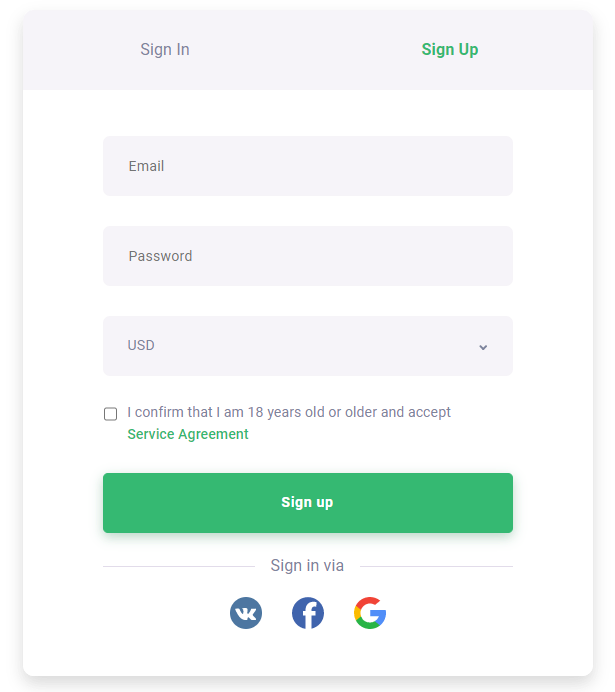

Opening a Quotex account in India

Opening a Quotex account is a fairly straightforward process. You simply need to input your email address and password. You will be asked to choose the currency you want to use as well. You can choose between VND, UAH, THB, RUB, KZT, INR, MYR, IDR, BRL, BTC, GBP, EUR, and USD.

You can also create an account by linking your Facebook or Google account. This process is much faster and easier to do.

There are three different Quotex account types. The first type is the Standard account. This was created for beginners or traders who simply want to try out the platform and invest their hard-earned cash at the same time. The minimum deposit required for standard accounts users is only $5 to $10.

The second account type is the Pro account. This is ideal for active traders who spend most of their time executing trades. The minimum deposit for the Pro account is $1,000.

The last account type is the VIP account. This is ideal for well seasoned or veteran traders. The minimum deposit amount is $5,000.

How to deposit money in India

Indian clients have the option to add funds using bank transfers, e-wallets like Perfect Money, or cryptocurrency. To deposit funds into your account, simply click on the +Deposit button found in the upper right corner of the web trading platform.

Clicking on this will take you to a window where you can select the payment method you wish to use. Click on your desired method and input the amount you want to deposit. Fill out the deposit form and send that in. Keep in mind that if you wish to deposit a large amount of money, Quotex might require you to provide additional credentials.

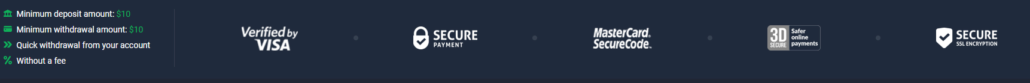

The amount will reflect on your account within one to five business days. As mentioned above, Quotex does not charge any deposit fees.

- Cryptocurrencies, Credit Cards, electronic wallets, bank transfers are available

- Minimum deposit only $10

- Minimum withdrawal $10

- No fees for you

How to withdraw money

The payment method you chose when you deposited funds will also act as your withdrawal method. Similar to depositing cash, click on the Withdrawal button found right next to the +Deposit button. Input how much you wish to withdraw and hit enter.

Additional information may also be required if you withdraw a large amount of cash. Keep in mind that the withdrawal method can take up to three business days.

(Risk warning: Trading involves risks)

Quotex customer service

Although Quotex does not have a live chat system or telephone line that you could call, you can contact their customer support representatives by opening a support ticket. You can do this on the help tab found on the web-based platform.

Quotex also has separate emails that you can contact depending on your concern. For all-around support, send an email to [email protected]. For financial queries, send an email to [email protected].

Advantages and disadvantages

Advantages:

One thing that really catches the eyes of potential customers is bonuses. This is why one of the main advantages of using Quotex is the additional funds you get when depositing funds to your account. The deposit bonus helps increase your capital which, in turn, also increases your chances of a higher gain.

Quotex’s web-based platform can be considered an advantage when it comes to most brokers. The absence of software taking up space on your device greatly helps when it comes to managing space. Also, the platform can be accessed using any browser on any device.

The web-based trading platform is also very easy to use. Compared to other broker’s platforms, Quotex’s trading platform has a simple and easy-to-understand interface. It’s great for beginners or traders who don’t know much about charts or trading platforms. The process for opening a trade is also simple and straightforward.

Quotex supports multiple payment methods for traders based in India. You can deposit funds via wire transfer, e-wallet, and every cryptocurrency. This gives the client a wide range of options to top up their accounts.

When it comes to the fees, it’s fairly low compared to what other brokers charge their clients. Quotex also doesn’t have a withdrawal or deposit fee, and the company does not charge its clients a commission fee.

The best feature, however, is Quotex’s free demo account. This is a feature that a lot of traders look for in a broker. Some would even say that the lack of a demo account is a dealbreaker for them. Anyone can use or register for a demo account on Quotex’s trading platform. Additionally, the virtual funds that come with the account are more than enough for you to practice all you want before you open up a live trade.

Disadvantages:

However, despite all the advantages, Quotex is not perfect. One of the disadvantages is the fact that you can’t use leverage when trading. This makes it a bit more difficult to make a huge profit out of your trades, but this does not make it impossible.

Also, some traders may be skeptical when it comes to this broker’s credibility. Since it is quite new, Quotex is not regulated by an official regulatory body. However, this does not necessarily mean it’s a scam. The company still holds a license issued by the IFMRRC.

Lastly, when you look at the website of other brokers, you can see a lot of offerings, including free eBooks, online courses, and webinars. Quotex does not offer any educational material to its clients. Instead, it only offers a free demo account.

Conclusion: Quotex is legal in India

Quotex is fully legal in India. There are no restrictions for Indian traders to usw Quotex. This broker is a legal business that accepts international clients. We recommend using Quotex because it gives you the opportunity to invest in the financial markets by using good conditions.

(Risk warning: Trading involves risks)

FAQ – The most asked questions about Quotex India :

Is Quotex.io a legitimate platform in India?

Yes, Quotex is a legitimate binary options broker; you can start trading with a little initial investment and use a customized trading platform without paying additional commissions.

How can you sign up for Quotex in India?

It is simple to sign up with Quotex in India. You can sign up with your contact number, name, and email ID. After that, traders may use the online platform and begin trading after creating an account on Quotex.io.

What different account kinds does Quotex India provide?

Quotex provides Demo Accounts without any risk and the need for a deposit. The Standard, Pro, and VIP account types are the other three trading account options available to traders. These accounts come with all the necessary tools to provide best-in-class trading features. A bigger reward and quicker withdrawal processing are the additional advantages of the VIP account.

How can you deposit in Quotex in India?

In addition to the standard financing methods, local deposit and withdrawal options are available in several nations, including India.

The local banks (BOI, AXIS, Union Bank, ICICI, SBI, etc.), e-wallets (UPI, Gpay, Mobikwik, Bharatpe, etc.), cryptos, credit and debit cards, and net banking are all acceptable methods for Indian traders to fund their Quotex accounts.

Last Updated on January 27, 2023 by Arkady Müller