How to sign up & login into a brokerage trading account?

Creating a brokerage trading account is a crucial first step if you want to invest in the stock market. For beginners, in particular, opening and logging into a brokerage trading account can be overwhelming. This ought not to be the case, however.

In this post, we will walk you through the process of opening and logging into a brokerage trading account, giving traders the information and assurance they need to begin investing.

This guide will lead you through the process, whether you’re starting a new account or signing in to an existing one, so you can start making wise investment choices and reaching your financial objectives.

Why sign up for a trading account?

The ability to purchase and sell securities like stocks, bonds, and options is provided by a specific category of financial account called a trading account. Anyone wishing to make stock market investments and benefit from prospective profits must have this instrument.

Individuals who do not have a trading account, cannot purchase or sell securities and hence cannot invest in the stock market. It is possible to register a trading account with a broker or an online trading platform, but doing so frequently necessitates providing personal data, proving your identification, and making a minimum deposit.

An individual can manage their investments and execute transactions on the stock market by having a trading account. As well as allowing access to a variety of financial services and products like buying and selling stocks, bonds, options, and more, it also gives the user access to tools like market research and analysis so they can make well-informed decisions.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Signing up for a trading account

- Step 1: Selecting a brokerage company

- Step 2: Compile all required data and paperwork

- Step 3: Complete an online application

- Step 4: Verify identity and funding methods

- Step 5: Wait for account activation

- Step 6: Fund the account

Step 1: Selecting a brokerage company

It’s crucial to pick a trustworthy brokerage company that best meets your needs and objectives when opening a trading account. Investigate various brokerage businesses and evaluate their reputations, fees, and services.

Check the firm’s regulatory status and read reviews. It’s crucial to make sure that the products and services you wish to employ in your trades are accessible.

Step 2: Compile all required data and paperwork

You will normally be required to supply certain personal information, such as your name, social security number, and financial information, including your salary and net worth, in order to open a trading account.

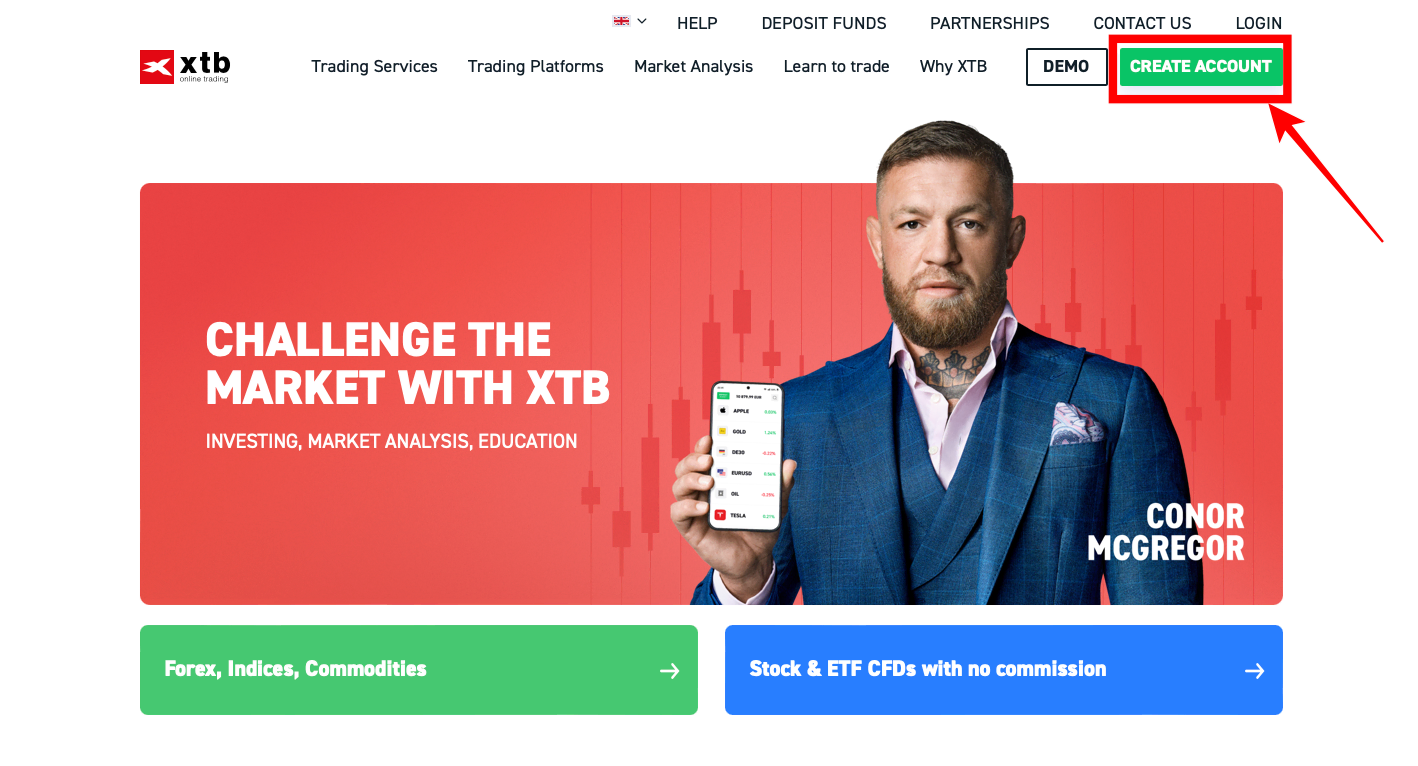

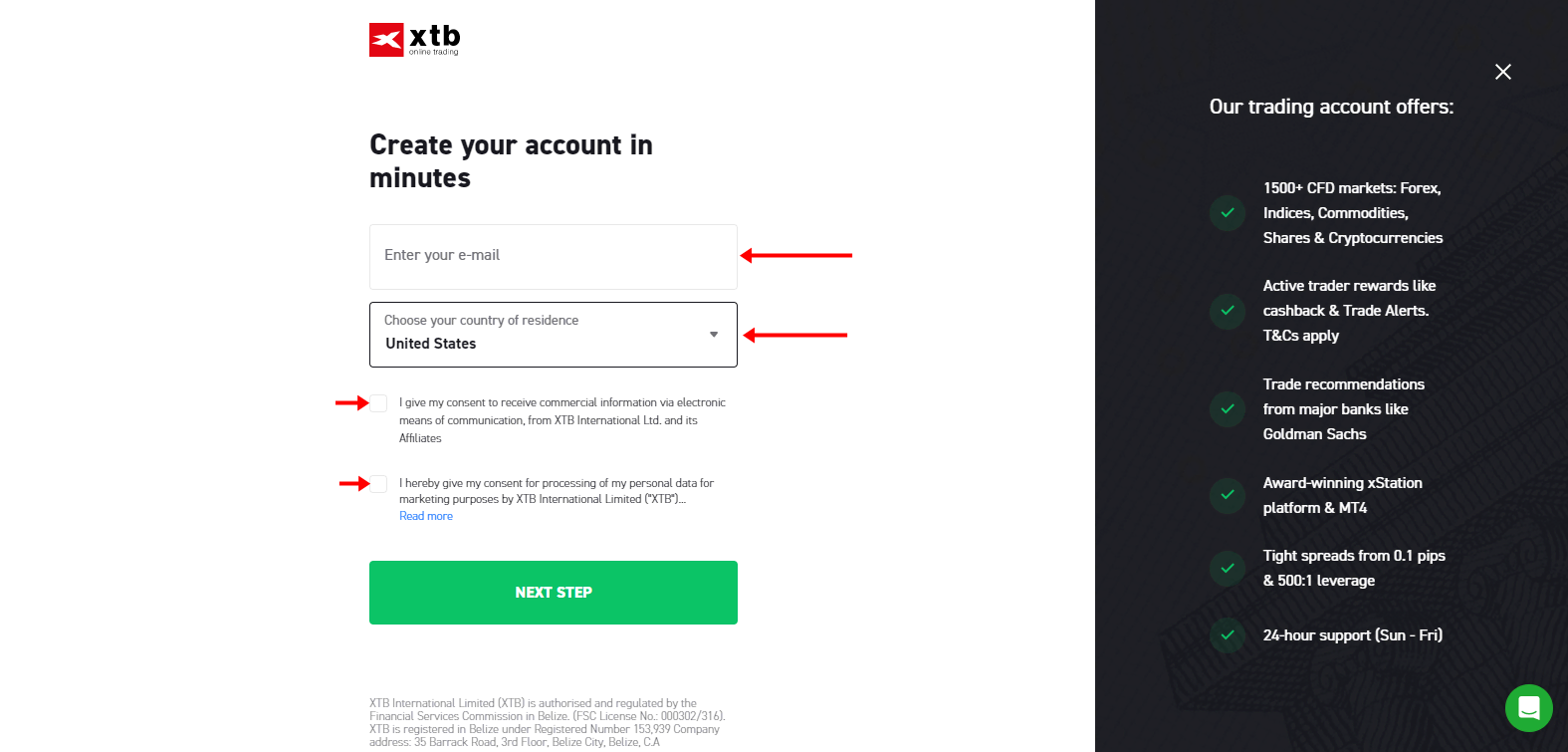

Step 3: Complete an online application

Visit the brokerage company’s website and find the page for opening an account. Put the necessary information and documents into the online form. Once finished, review and submit the application.

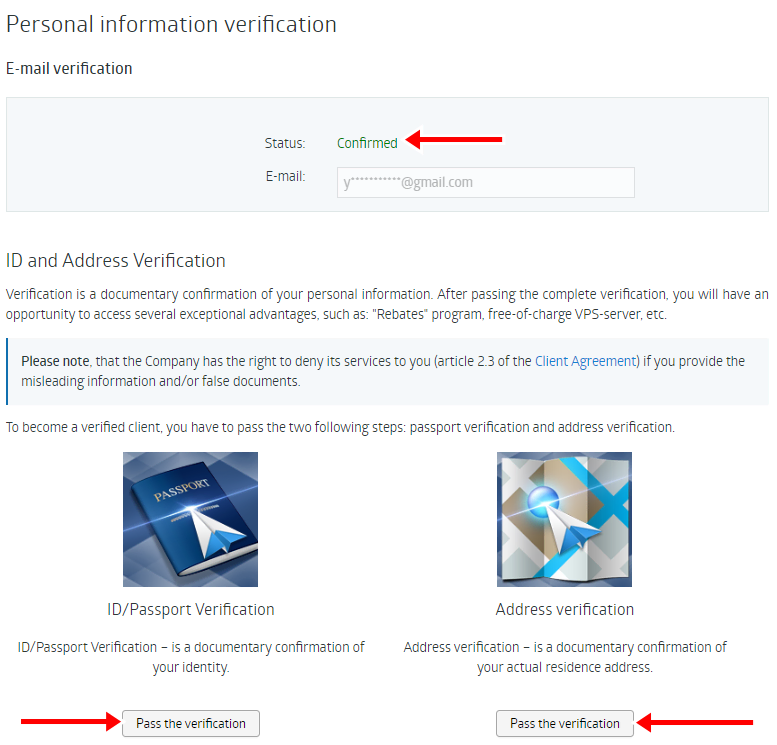

Step 4: Verify identity and funding methods

The brokerage firm will check the information supplied and might need more proof. Additionally, they will confirm the account’s funding source, such as a credit card or even a bank account.

To prevent delays in the account opening process, it’s critical to make sure the information provided is accurate and up-to-date.

Step 5: Wait for account activation

A text message or email with instructions on how to activate the account will be sent by the brokerage company when it has confirmed the accuracy of the data and documents submitted.

Step 6: Fund the account

You must fund the account in order to make trades after the account is activated. Typically, you can do this by making a money transfer from the linked bank account or by using a credit card.

Logging into a trading account

- Step 1: Browse to the login page

- Step 2: Entering login credentials

- Step 3: The account dashboard’s navigation

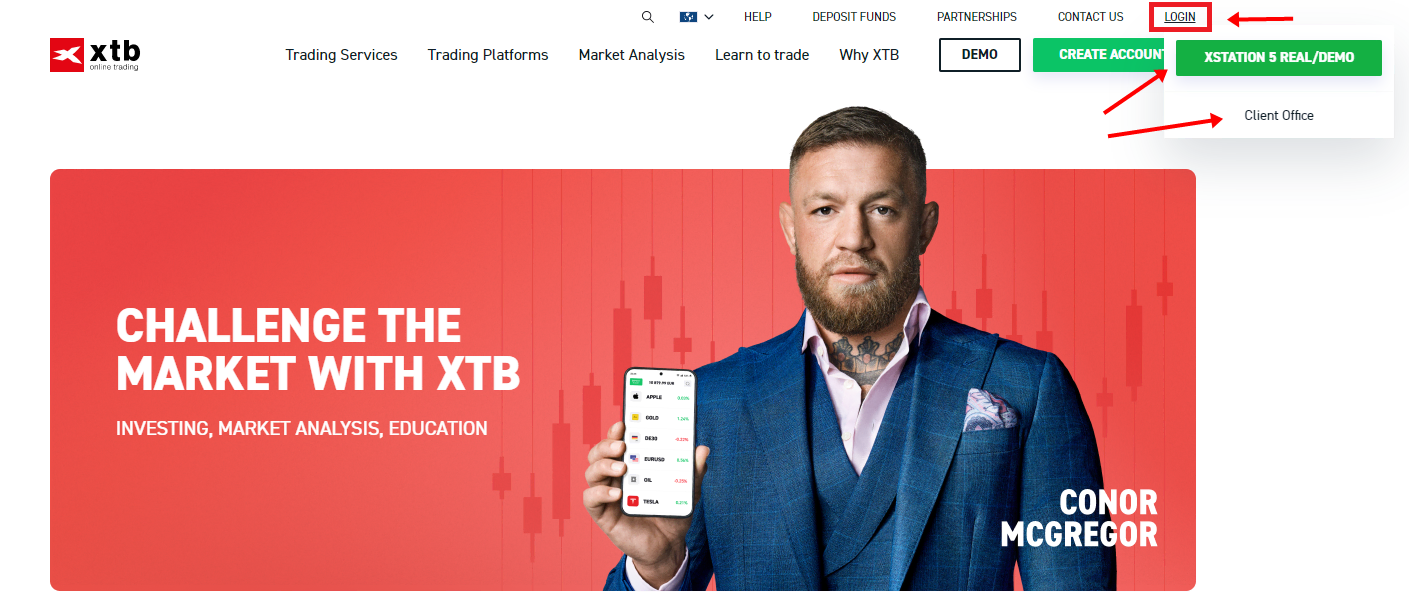

Step 1: Browse to the login page

Normally, one would enter the firm’s web URL into their web browser and click enter to view the brokerage firm’s website. Once the website has loaded, the user can search for the login page by clicking on a “login” or “sign in” link or by going to a specific page of the website where the login form is situated.

Step 2: Entering login credentials

The user will be needed to enter their registered email address and password as soon as they find the login page. Utilizing this data, the person’s identification is confirmed, and account access is granted.

The email address and password must coincide with the details provided when the account was opened; it is very important to note.

Step 3: The account dashboard’s navigation

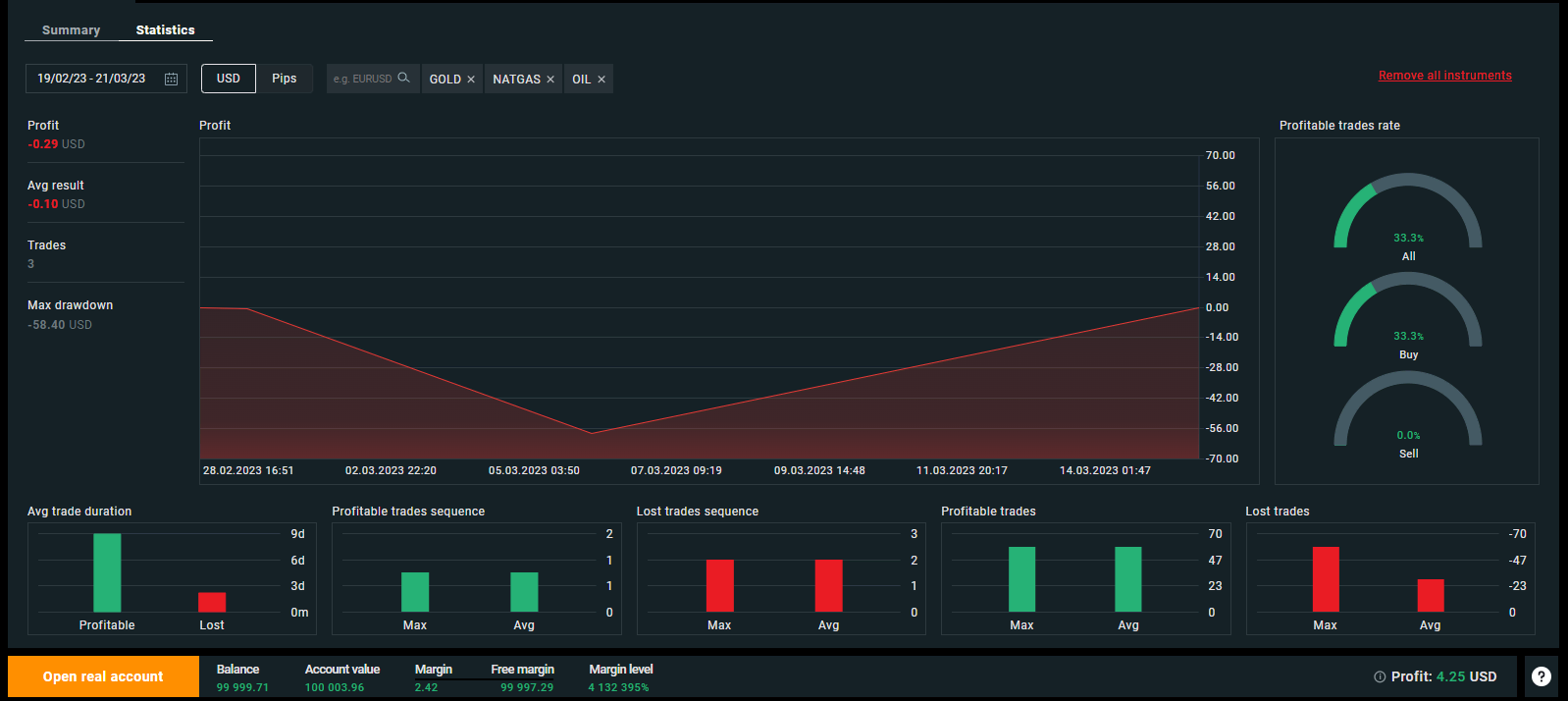

The person will be taken to their account dashboard after successfully logging in. A person can access and control all of their account information, including their account balance, recent trades, and other details, through their account dashboard, which serves as a central hub.

Additionally, the user has access to additional platform capabilities of the brokerage house through the account dashboard, including the ability to execute trades and move money.

The account dashboard, in its entirety, gives the user a thorough understanding of their account and all the resources they need to administer it.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Security and account management

Making sure an account is secure is one of the most crucial parts of operating a brokerage trading account. This entails safeguarding login information, using two-factor authentication to increase security, being aware of the brokerage firm’s rules and procedures for account management and security, as well as routinely examining account information, and keeping an eye on activities:

- Login information must be kept safe in order to prevent unwanted access to the account. Examples of such information include the user’s email address and password. To achieve this, make sure your login information is secure and unique, and don’t provide it to anybody else. In order to reduce the chance of a security breach, it’s also crucial to frequently update your password and use a separate password for each account.

- Two-factor authentication is used for increased security. A user must enter two pieces of identification, often a password and a code texted to a mobile device, in order to access an account while using two-factor authentication (2FA), an additional security measure. Even if login information is hacked, this offers an extra layer of security.

- Keeping abreast of the policies and practices the brokerage firm has in place for handling security and account management. It’s crucial to stay up to date with the policies and practices the brokerage firm has in place for handling and protecting customer accounts. This entails being aware of how to contact the brokerage firm in the event of a security breach, as well as the processes for reporting suspicious activity and the firm’s security and privacy policies.

- A regular check of account information and activity monitoring is essential. In order to effectively manage a brokerage trading account, it is crucial to regularly analyze account information and track activities. Examining trade history, keeping an eye on transactions, and checking account balances all fall under this category. The person will then be able to take the necessary action after identifying any suspicious activities, mistakes, or discrepancies. Enabling account activity notifications will also be beneficial because they can provide timely alerts for any suspicious or unusual activity.

Conclusion about how to sign up & login into a brokerage trading account

Finally, signing up for and logging into a brokerage trading account entails visiting the brokerage firm’s website, finding the login page, inputting login credentials, and accessing the account dashboard.

It’s critical to comprehend the steps involved in the process as well as the risks and requirements associated with trading. These requirements include checking the brokerage firm’s license and regulation, reading the terms and conditions, and staying up to date on the brokerage firm’s policies and processes for account management and security.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Last Updated on June 17, 2023 by Andre Witzel