How to answer the broker’s verification questions?

It is normal practice for brokers to request client verification when creating a new brokerage account or making substantial modifications to an existing account. These inquiries are meant to verify the account holder’s identification and ensure the account isn’t being used fraudulently.

Although these questions might sound simple, they are frequently trickier than they seem, especially if you have no idea what to expect. In this post, we’ll provide you with some pointers on how to confidently and accurately respond to the broker’s verification queries.

What are broker verification questions?

Broker verification questions are the set of questions a broker uses to verify a potential investor’s identity and financial standing. The purpose of these questions, which are frequently made as a portion of the onboarding process, is to make sure that the broker conforms with legal obligations, including anti-money laundering as well as know-your-client laws.

It is imperative to provide true and correct responses to these questions. Answers that are inaccurate or deceptive may have serious legal and financial repercussions, such as penalties, loss of investment, and sometimes even criminal prosecution. False information can also damage the broker’s reputation and raise regulatory agency red flags, which can result in more scrutiny and legal action.

Investors must, then, prepare to answer broker verification questions honestly and properly by understanding their significance and purpose. This will not only assist in safeguarding the interests of the investor but also guarantee that the broker conducts business in a lawful and morally responsible manner.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Preparation for Verification Questions

- Gather the essential information and documentation

- Examine the regulations and rules of the broker

- Familiarize yourself with frequent verification questions

Gather the essential information and documentation

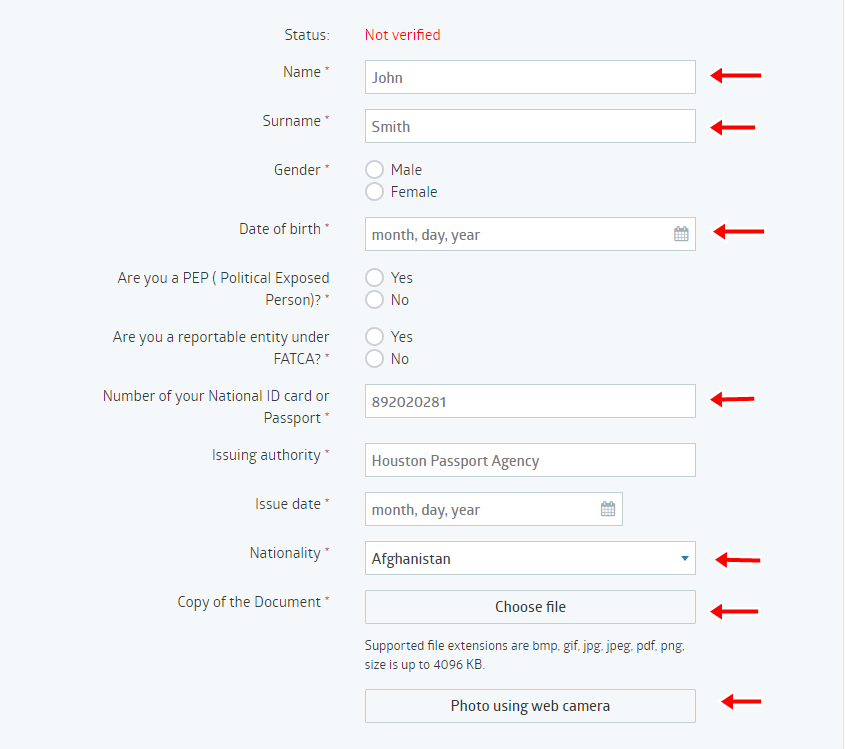

A successful verification procedure depends on careful planning. Prior to responding to broker verification inquiries, it’s crucial to compile the relevant data and paperwork. This may contain, among other things, identification documents from the government, income proof, proof of residency, and investment statements. These documents must be available and ready to go because the broker might need them for the verification process.

Examine the regulations and rules of the broker

Investors should then go over the broker’s specifications and policies to learn what data is needed and what the broker recognizes as acceptable documentation. This will enable investors to plan appropriately and steer clear of any potential snags in the verification process.

Familiarize yourself with frequent verification questions

It’s also a good idea to get acquainted with common verification questions. As a result, investors will be more confident and prepared to respond to questions with concise and clear responses.

Personal details like address, name, and date of birth as well as monetary details like profession, earnings, and net worth, are examples of typical questions. Investors might avoid misconceptions or confusion throughout the verification process by being aware of what to anticipate.

Investors may ensure the verification process is simple, straightforward, and feasible by taking the opportunity to collect information, examine the broker’s standards, and become familiar with frequent inquiries.

Tips for answering verification questions

- Give answers that are precise and brief

- Be honest and transparent

- Avoid ambiguous or general responses

- If necessary, submit supporting documentation

Give answers that are precise and brief

Each question should be addressed as clearly and directly as you can. Remain factual and avoid giving out a lot of unnecessary or lengthy information. Giving precise, concise responses will make it easier for the broker to quickly and accurately check the data.

Be honest and transparent

When it comes to responding to verification questions, honesty is always the best policy. Giving inaccurate or misleading information can have negative legal and financial repercussions. Investors must be open and truthful with regard to their information.

Avoid ambiguous or general responses

Answers to verification questions that are vague or general are not acceptable. Investors should instead offer detailed and reliable information. They ought to give an explanation if they are unable to supply the information that was asked for.

If necessary, submit supporting documentation

Brokers could ask for more proof to back up the information given. In order to prevent any disruptions in the verification process, investors should submit the relevant evidence as soon as possible. They should give an explanation if they are unable to deliver the desired documentation.

Common Verification Questions

Investors can anticipate being questioned on a variety of topics throughout the broker verification process, such as:

- Personal information

- Status and financial information

- Identity verification

Personal information

The names, addresses, dates of birth, phone numbers, and email addresses of the investors will all be required. Brokers can use this information to confirm the investor’s identity plus contact details.

Status and financial information

Investors’ employment status, as well as their job and income, will be questioned. They might also be questioned about their financial background and net worth. Brokers can evaluate an investor’s financial situation and investment knowledge using this information.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

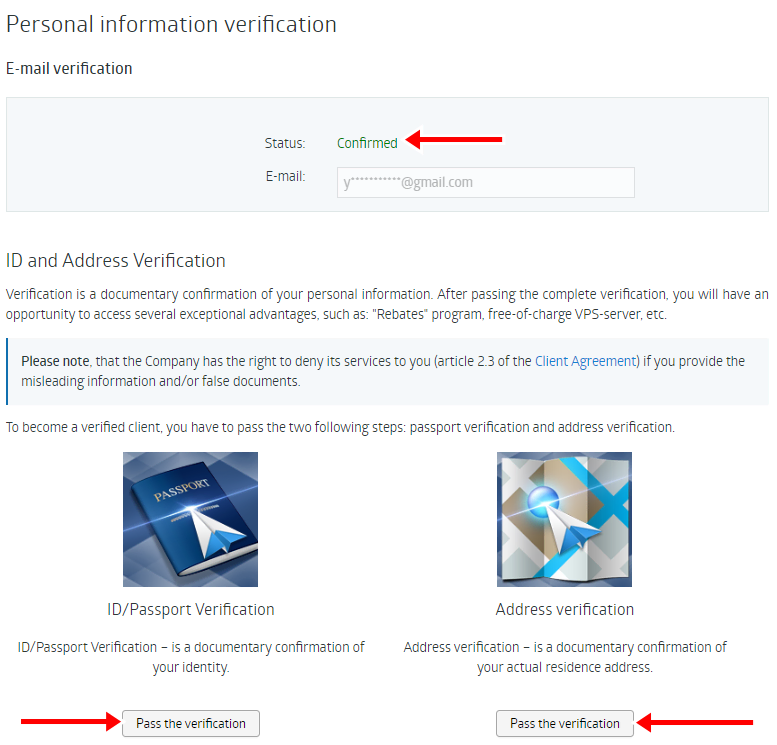

Identity verification

Investors might also be required to present official identification as well as proof of residency. Brokers can use this data to confirm an investor’s identity and make sure they are eligible to invest with the broker.

It is vital to remember that based on the broker as well as the investor’s place of residency, different questions may be asked throughout the broker verification procedure. Brokers may also ask for additional information or paperwork as part of the verification procedure.

Experienced investors should make sure they have all the information and paperwork they need to respond to broker verification inquiries in a straightforward and correct manner by getting ready in advance.

Conclusion about how to answer the broker’s verification questions

In order to maintain the security and compliance of the broker-investor relationship, broker verification questions are essential. To prevent legal and financial consequences, traders and investors ought to consider these questions carefully and provide correct and genuine responses.

Investors can make sure that the onboarding process runs smoothly and in accordance with the law by getting ready in advance, becoming familiar with typical verification questions, and giving concise and unambiguous responses.

In addition to being morally right, providing accurate and truthful responses to brokers’ verification questions is the greatest approach to safeguarding one’s capital and guaranteeing a simple and legal investment procedure.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Last Updated on June 17, 2023 by Andre Witzel