How to verify your brokerage trading account?

When opening a trading account, account verification is essential for guaranteeing a secure and reliable trading experience, because it helps to verify your identity and stop fraudulent activity on the account. Along with ensuring the protection of your data, it also gives you access to several trading tools and advantages, including the ability to execute trades, make deposits and withdrawals, and check your trading history.

Your broker may have a different procedure for confirming your trading account, but it generally entails supplying specific financial and personal information and submitting pertinent documents. A step-by-step tutorial on how to confirm your broker’s trading account is provided for you in this post.

By following these steps, traders may quickly and effectively complete the verification procedure, giving them the confidence to start trading knowing that the account is secure.

Trading account verification procedure

- Gather required documentation

- Submit the required documents

- Wait for verification

1. Gather the required documentation

It’s crucial to compile all the proper documents that your broker might require before beginning the verification procedure. This often consists of identification documentation, such as a passport or national ID card, as well as financial documentation, like a bank statement or pay stub, and documentation of your place of residence, such as a utility bill or bank statement. The best way to find out what documents are needed is to ask your broker.

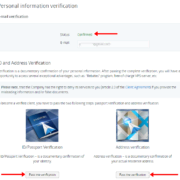

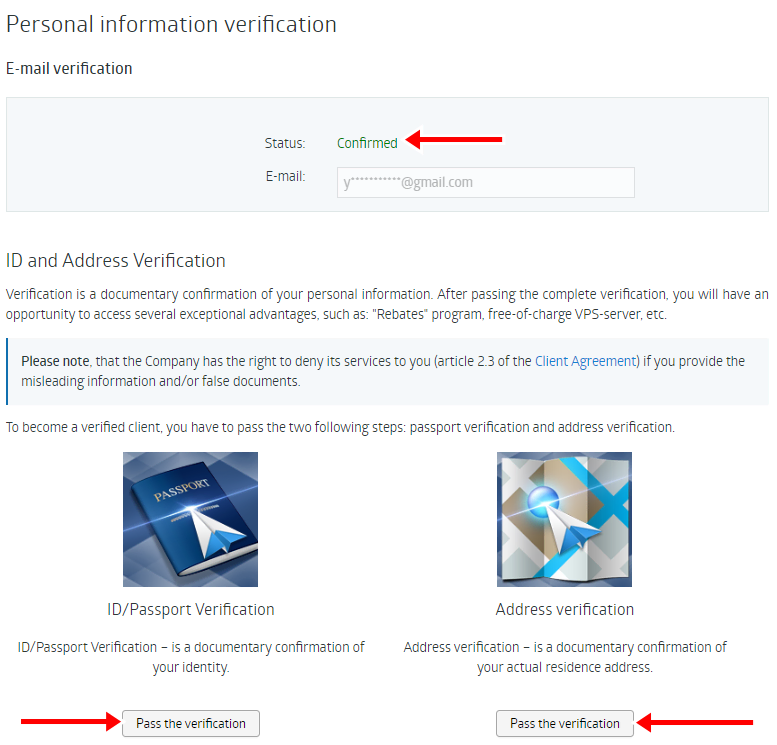

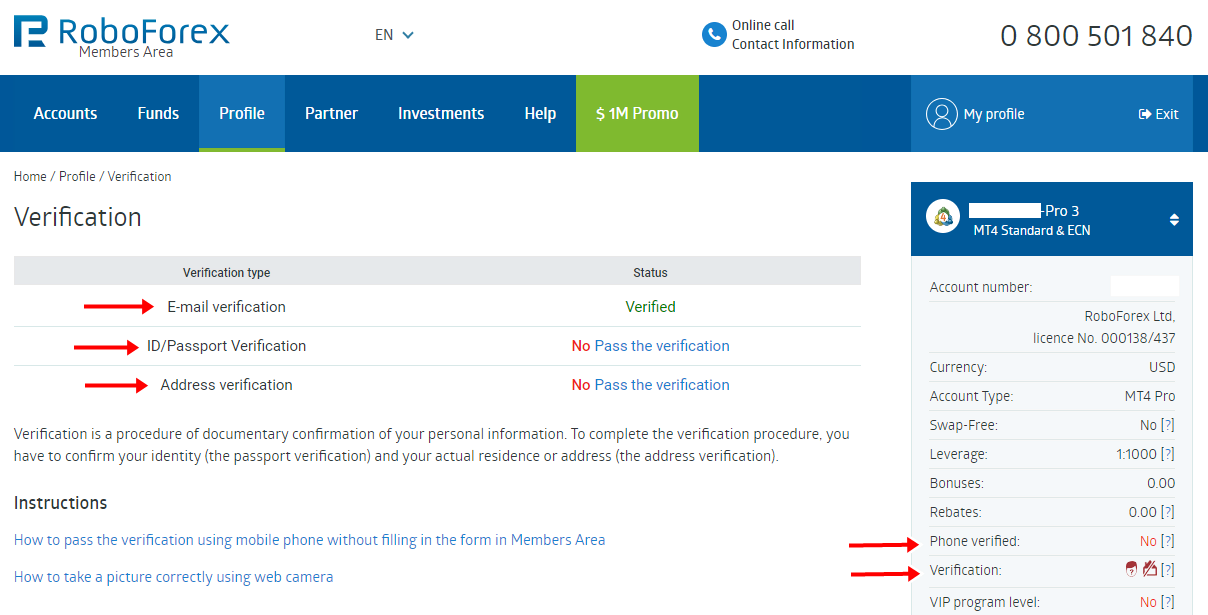

2. Submit the required documents

You can give your broker the necessary papers for verification once you have acquired all of them. Usually, you can do this by mail or online through the secure portal provided by your broker. Make care you double-check that all of the information is correct and readable before submitting your supporting material.

3. Wait for verification

The broker will examine the paperwork you have provided once you submit it to confirm your identification and trading eligibility. It can take up to a few business days to finish this process, and more paperwork or information may be needed.

It’s crucial to monitor the verification process and, if necessary, follow up with the broker. When the verification procedure is over, you will receive an acknowledgment from the broker and will be able to use all of the perks of trading using a verified account.

It’s easy to verify your trading account; just assemble the necessary paperwork, give it to the broker, and wait for confirmation. You may protect your data and gain access to all the advantages of trading by following these procedures.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Types of account verification

- Identity verification

- Address verification

Identity verification

The process of confirming a person’s identity is referred to as identity verification. Verification of personal data like name, date of birth, residence, and ID number issued by the government may fall under this category.

Address verification

Verifying an individual’s physical address is known as address verification. Verification of the street address, state, zip code, and city may be part of this. This procedure is used to confirm that the person actually resides at the specified address.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Best practices for verifying trading account

- Be honest and accurate

- Keep personal information secure

- Timely broker follow-up

Be honest and accurate

It’s crucial to be truthful and accurate when giving personal information on trading account verification forms. Giving inaccurate information may cause the verification process to take longer than expected or perhaps result in trading account rejection.

Keep personal information secure

Personal data must be protected, and sharing with unapproved third parties must be avoided. These contain private data like Social Security numbers, bank account details, and birth dates.

Timely broker follow-up

Following the submission of the verification forms, it is critical to follow up with the broker to check that the verification procedure is underway. The broker should be contacted right away to address any discrepancies or problems with the information provided.

Conclusion about how to verify your brokerage trading account

Anyone wishing to trade on the financial markets must first verify their trading account. It aids in securing your trades, safeguarding your personal information, and enabling all of trading’s advantages. You are taking a significant step toward a risk-free and secure trading experience by validating your account.

During the verification process, it’s crucial to adhere to best practices, which include providing truthful and accurate information, protecting personal information, and promptly following up with the broker. You can guarantee the security and safety of your trading experience by adhering to these best practices.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Last Updated on June 17, 2023 by Andre Witzel