Can you withdraw money to a 3rd person from your trading account?

Numerous issues come up when managing a trading account, particularly when dealing with transactions involving third parties. One frequent query that good traders may very well have is whether it is feasible to withdraw funds from their trading account to a third party.

Due to the numerous trading platforms’ unique policies on account management and financial activities, this can be a complicated issue. In this post, we’ll examine the numerous aspects of withdrawing money from a trading account to a third party and discuss what traders should think about before executing such a transaction.

Can you withdraw money to a 3rd person from your trading account?

Based on the broker’s policies and procedures, withdrawing money from a trading account to a third party may be a possible activity. However, the capacity to withdraw money to a third party can differ amongst brokers and may be influenced by the country’s legal system in which the broker is registered.

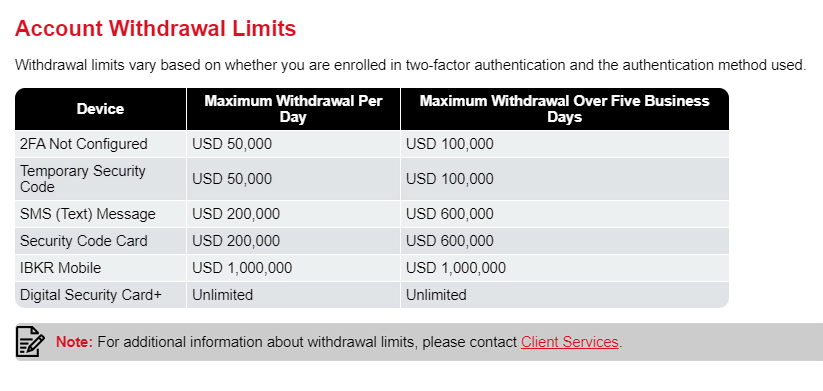

Brokers typically permit third-party withdrawals, although this almost certainly necessitates additional verification procedures to guarantee the funds are handed to the right individual. For security reasons, some brokers may impose withdrawal limitations from third parties.

Factors that affect the capacity to withdraw money to a third party

- Laws and regulations

- Trading platform policies

- Bank policies

Laws and regulations

Based on the country, different rules and laws apply to financial transactions. Money transfers to third-party accounts may be prohibited by harsh legislation in some nations but may be allowed under more flexible regulations in others. It is crucial to confirm your area’s exact rules and laws with the relevant local authorities.

Trading platform policies

It also depends on the particular trading platform you use whether you can withdraw funds from a trading account to a third party.

Withdrawals to accounts held by third parties may be permitted on some trading platforms but may be prohibited on others. It is crucial to inquire about your trading platform’s unique withdrawal rules before doing so.

Bank policies

The capacity to withdraw funds from a trading account to a third party is also influenced by banks.

Transfers to the accounts held by other parties may be prohibited by rigorous restrictions at some banks, while these policies may be more flexible at other banks. Inquiring about your bank’s specific guidelines before withdrawing to a third party is crucial.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Methods for 3rd person withdrawal from a trading account

The procedure for withdrawing funds from a trading account to a third party differs between brokers and may be influenced by the country where the broker is registered. To withdraw money to a third party, try any of these methods:

- Wire transfer

- Check

- Third-party payment service

- Direct deposit

1. Wire transfer

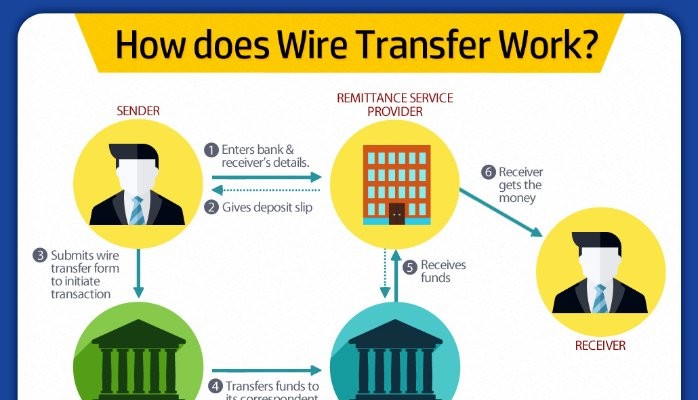

This is a frequent way of sending payments to a third party, albeit it may necessitate additional verification measures to verify the funds are transferred to the correct recipient. It’s crucial to speak with your broker about any potential fees for wire transfers.

2. Check

Some brokers may provide check withdrawals, but this is becoming less typical as more transactions are completed electronically. Due to the broker’s need to mail the check to the beneficiary, check withdrawals may take longer to process.

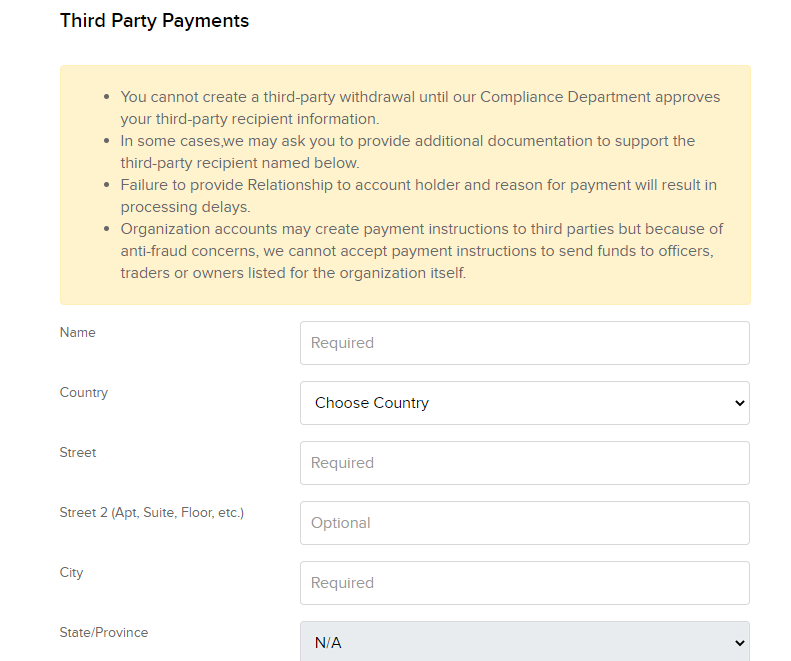

3. Third-party payment service

Some brokers could let you use a payment provider like PayPal or Venmo to withdraw money to a third party. This method can be quick and easy, but it might not be accessible in all nations and incur extra costs.

4. Direct deposit

Brokers may occasionally let you withdraw money directly to a different bank account. Further verification steps could be necessary to make sure that the cash is being transferred to the right individual and bank account when using this technique.

How to withdraw money to a 3rd person from your trading account

1. Determine eligibility

Check with your local government, trading platform, and bank to be sure the transaction is legal before withdrawing money to a third party. By doing this, you can ensure that the transaction complies with all applicable laws and rules.

2. Compile information

You must acquire the required information, such as the details of the third party’s bank account and your trading account, before withdrawing money from them. To finish the transaction, you will need to provide this data.

3. Sign into your trading account

The next step is to access your trading account. You’ll be able to access your account details and start the withdrawal procedure using this.

4. Start the process of withdrawing

Once you’ve logged in to the trading account, go to the withdrawal section and choose the third-party withdrawal option. To finish the transaction, follow the instructions provided.

5. Provide necessary information

You will be required to give the essential information, including the details of the third party’s bank account and your trading account. To move funds from the trading account to the other party’s account, utilize this information.

6. Confirm the transaction

To finish the process, confirm the transaction. It is crucial to double-check the supplied data to make sure everything is correct and truthful.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Required information

1. Details about a third party’s bank accounts

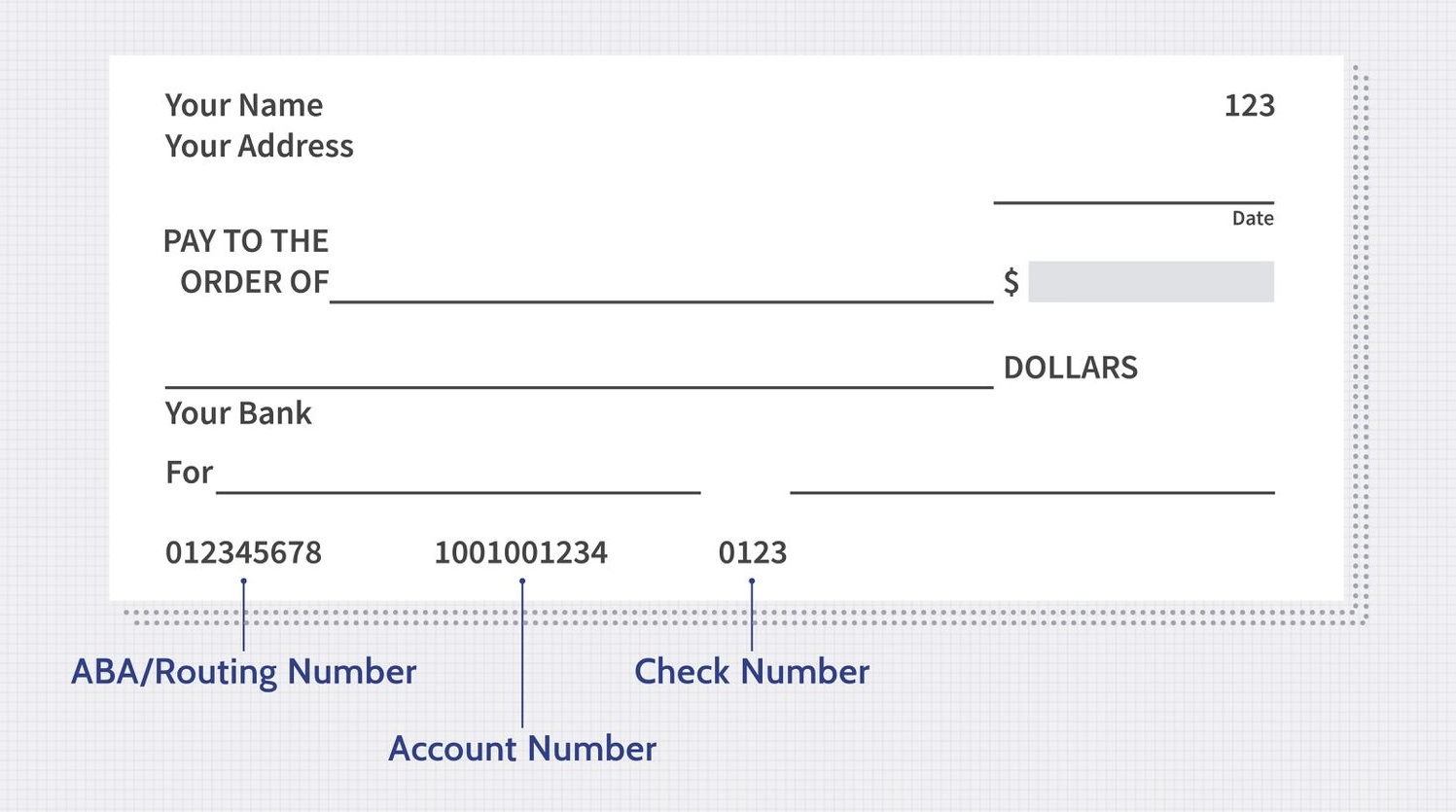

You must give the bank account details of the third person to withdraw money to them, including their name, account number, and routing number.

2. Information about trading accounts

You will also need to supply information about your trading account, such as your account number and other pertinent specifics. This data aims to identify your account and confirm your identity.

3. The withdrawal process’s time frame

The trading platform, the bank, and local rules are just a few variables that will affect how long the withdrawal procedure takes. While some trading platforms could require many days, some may complete the withdrawal in hours. Confirming the anticipated withdrawal time frame with your bank and trading platform is crucial.

Safety concerns when withdrawing money to a 3rd person

It might be quick and easy to withdraw money from your trading account to a third party, but certain security risks are involved. It is crucial to ensure that your money is safe and secure while being withdrawn. You risk losing your money or having it stolen by scammers if the transaction is not handled properly.

1. Confirm the third party’s identity

It is critical to employ safe means when sending sensitive data, such as bank account numbers and personal information. This could include secure messaging systems or encrypted email services.

2. Transmit information using secure methods

Verifying the third party’s identification is one of the most crucial steps you can take to protect the security of your money. You may achieve this by verifying their name, address, and contact details. To prove their identity, you may also wish to ask for a government-issued ID or another type of identification.

3. Verify for frauds and scams

When sending money to a third party, it’s crucial to be watchful and alert to fraud and scams. Scammers may attempt to steal your money by impersonating trustworthy organizations or duping you into giving them crucial information.

Conclusion about withdrawing money to a 3rd person from a trading account

It is possible to withdraw money from your trading account to a third party, but doing so could be constrained by rules, laws, and policies established by the trading platform and banks. This technique has benefits and drawbacks, and it’s essential to understand potential hazards.

It is crucial to protect your money when withdrawing to a third party by confirming the third party’s identification, securely sending information, and keeping an eye out for fraud and scams. To guarantee a safe and effective transaction, it is advised to carefully research your trading platform’s terms and conditions and applicable laws and regulations before moving through with a third-party withdrawal.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Last Updated on June 17, 2023 by Andre Witzel